Shareholder pressure Tuesday claimed its most high-profile

victim in Aviva PLC's (AV.LN) Andrew Moss--and while experts

predict that the wave of protest will continue, some say that

investor action could backfire and leave companies rudderless.

Over the past few weeks, investors in Europe have ramped up

pressure against a raft of companies, calling for cuts in what they

perceive as excessive executive pay in the light of poor

performance. Remuneration packages at Barclays PLC (BCS), UBS AG

(UBS) and Credit Suisse (CS), among others, have been attacked with

significant "no" votes in recent annual meetings.

However, Aviva became the fourth FTSE 100 company ever to have

its remuneration report rejected, and Tuesday the British insurance

group said that Chief Executive Moss, whose GBP2.69 million pay

packet was also rejected in the non-binding vote, would stand down

with immediate effect.

Moss' departure follows that of Trinity Mirror PLC's (TNI.LN)

chief executive, Sly Bailey, and David Brennan at U.K. drug giant

AstraZeneca PLC (AZN.LN), all three quitting as investor anger

centers on executive pay perceived as excessive in the light of

company underperformance.

Unlike Bailey and Brennan though, Moss' exit is immediate and,

despite interim appointments, could leave a void at the insurer at

a time when insurers are struggling to meet new capital

requirements and as the euro-zone crisis sees little signs of

abating. If shareholders continue to vent, triggering immediate

exits, other companies could be left headless, and shareholders

should be aware of the consequences of their actions, experts

say.

"Shareholders don't want to see companies without a leader," a

spokesman for the Association of British Insurers said. The

group--whose members, through their investments, control about 12%

of the U.K. stock market--flags matters that shareholders should

consider, although it doesn't directly give vote

recommendations.

The fact that shareholders could be left in a worse position

than previously was even raised by the U.K. Shareholders

Association, a champion of shareholder rights.

"There is a risk that if shareholders attack the board or a CEO

on pay or any other matter that he quits," Roger Lawson of the

group said. "And the increase in shareholder pressure could trigger

more immediate exits."

Market reaction reflected concern over the break in leadership

at Aviva, with shares closing the day virtually flat at 303 pence

after having risen as high as 320 pence, or nearly 6%, immediately

after the announcement of Moss' resignation.

Advisory shareholder group Pensions Investment Research

Consultants, or PIRC, said it specifically advises companies to

have succession plans in place in the event that top executives are

forced out.

"Shareholders and companies alike know the risks and

consequences that can follow if investors are unhappy," said PIRC's

Tom Powdrill. "Having no plans in place can only exacerbate the

situation."

Still, most observers see increased shareholder participation as

a good development.

One of the top 10 investors in Aviva said his firm has taken

heed from former City Minister Paul Myners, who said investors

should be more active in their relationships with the companies

they invest in. "Lord Myners was rightly against absentee

shareholders," the investor said.

"The previous government seemed to have an agenda of fairness,

and we agree that we need to see that in executive remuneration,

and putting pressure as institutional shareholders to top

management [is important]," the investor added.

Despite the calls for active engagement, the level of

shareholder voting has remained steady over the past five to 10

years, according to Capita Registrars, the U.K.'s largest provider

of share registration services.

"Capita data shows there has been no increase in shareholder

voting, but there should be, and we think there now will be, not to

force CEOs out of their jobs, but to help shape the future of the

companies shareholders invest in a positive way," Capita CEO

Charles Cryer said.

The apparent rise in shareholder voting at recent AGMs is likely

limited to specific cases where there has been strong publicity, a

lot of controversy and talk about excessive pay, a Capita

representative added.

Investors in U.K. companies are set to have their ammunition

boosted under a government proposal to give investors binding votes

on corporate pay policies. If implemented the plan, proposed by

business secretary Vince Cable, will refer to remuneration payable

in the future--the recent nonbinding votes have been on last year's

pay.

The U.K. government won't be releasing any specific details

regarding executive pay in the Queen's speech when she opens

Parliament on Wednesday and sets out the government's legislative

plans, but the issue is set to be mentioned.

Meanwhile, in France, where shareholders cannot currently vote

during AGM's on executive pay, the law is set to change shortly

with the introduction of legislation, said Didier Cornardeau, who

runs an association that represents shareholders.

In Germany, spokesman Juergen Kurz from the retail investor

association DSW said Tuesday that investors' influence on the

management board's remuneration policy at AGMs in Germany isn't as

large as in the U.K. as say-on-pay votes aren't that established

yet and as executive payments aren't at the top level of British

counterparts.

"The say-on-pay vote has been introduced in Germany over the

last about three years," he said, adding that, although single

investors have uttered concerns over management payments in some

cases, the majority of the shareholders have voted in favor of it

at past AGMs.

U.K.-based investor Hermes, for instance, criticized Deutsche

Bank AG (DBK.XE) on a number of issues, including succession

planning for the outgoing chief executive, failure to take concerns

regarding remuneration policy into account, and its approach to

sustainability and reputation issues. In a counterproposal to the

AGM agenda, Hermes asked shareholders not to approve the

supervisory board's performance.

VW AG (VOW.XE) Chief Executive Martin Winterkorn has recently

triggered public furor for having earned about EUR17 million in

2011, making the company's work council to think about a limit for

executive payments.

But bosses in the U.K. will likely remain under pressure and

several others could join the likes of Moss, Bailey and Brennan.

Even where company performance is relatively strong shareholders

are flexing their muscles.

On Tuesday, U.K. bookmaker William Hill PLC's (WMH.LN) CEO Ralph

Topping narrowly missed a rejection of a resolution that he receive

a GBP1.2 million "retention bonus." Just under 50% of shareholders

opposed the resolution which also includes an 8.3% pay rise.

Bosses at U.K. consumer goods giant Unilever PLC (ULVR.LN) and

utility Centrica PLC (CNA.LN) face investor votes at upcoming

meetings this week. Meanwhile, Man Group PLC's (EMG.LN) CEO Peter

Clarke who avoided a shareholder revolt despite much criticism at

the company's AGM, could yet come under more pressure if shares

continue to fall at the hedge fund group which has lost 66% of its

value over the year.

Meanwhile, Moss doesn't leave empty-handed. Aviva said in a

separate statement late Tuesday that Moss will receive around

GBP1.75 million, which includes a 12-month salary, contribution to

his pension, a lump-sum settlement, and 75% of the shares awarded

to him in 2009.

-By Marietta Cauchi, Dow Jones Newswires; +44 207 842 9241;

marietta.cauchi@dowjones.com

(Vladimir Guevarra and Max Colchester in London and Eyk Henning

in Frankfurt contributed to this article. )

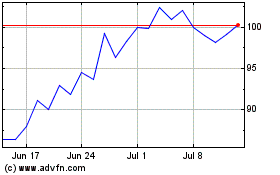

Reach (LSE:RCH)

Historical Stock Chart

From Mar 2024 to Apr 2024

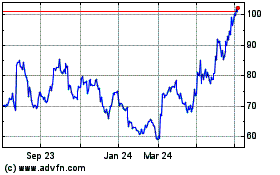

Reach (LSE:RCH)

Historical Stock Chart

From Apr 2023 to Apr 2024