In the application of the Group's accounting policies, the

Directors are required to make judgements and estimates that can

have a significant impact on the financial statements. The most

critical accounting judgement relates to the classification of

royalty arrangements and the key sources of estimation uncertainty

relate to the calculation of certain royalty arrangement's fair

value and the key assumption used when assessing impairment of

property, plant and equipment and intangible assets. The use of

inaccurate assumptions in assessments made for any of these

estimates could result in a significant impact on financial

results. The critical accounting judgements and key sources of

estimations uncertainty are substantially the same as those

disclosed in the Group's consolidated financial statements for the

year ended December 31, 2014, which were published on March 25,

2015.

3 Changes in accounting policies and disclosures

The Condensed financial statements have been prepared under the

historical cost basis, as modified by the revaluation of coal

royalties (investment property) and certain financial

instruments.

The accounting policies applied are consistent with those

adopted and disclosed in the Group financial statements for the

year ended December 31, 2013, except for the adoption of amendments

to IAS 1, 'Financial statement presentation' regarding other

comprehensive income, IFRS 13, 'Fair Value Measurement' and IFRS 10

'Consolidated Financial Statements' and IAS 27 'Separate Financial

Statements'. These amendments have not had a material impact on the

accounting policies applied by the Group.

A number of other accounting pronouncements, principally

amendments to existing standards, issued by the IASB became

effective on January 1, 2014, and were adopted by the Group. These

pronouncements have not had a material impact on the accounting

policies applied by the Group.

The Group has not early adopted any other amendment, standard or

interpretation that has been issued but is not yet effective. It is

expected that where applicable, these standards and amendments will

be adopted on each respective effective date.

4 (Loss)/Earnings per share

Loss per ordinary share is calculated on the Group's loss after

tax of GBP47,589,000 (2013: GBP42,497,000) and the weighted average

number of shares in issue during the year of 113,075,454 (2013:

108,932,340).

Loss per ordinary share excludes the issue of shares under the

Group's JSOP, as the Employee Benefit Trust has waived its right to

receive dividends on the 925,933 ordinary 2p shares it holds as at

December 31, 2014 (December 31, 2013: 925,933).

2014 2013

GBP'000 GBP'000

Net profit attributable to shareholders

Earnings - basic (47,589) (42,497)

Earnings - diluted (47,589) (42,497)

========= =========

2014 2013

Weighted average number of shares in issue

Basic number of shares outstanding 113,075,454 108,932,340

Dilutive effect of Employee Share Option Scheme - -

------------ ------------

Diluted number of shares outstanding 113,075,454 108,932,340

============ ============

As the Group is loss making in 2014 and 2013, the Employee Share

Option Scheme is considered anti-dilutive because including it in

the diluted number of shares outstanding would decrease the loss

per share.

Due to the growing number of valuation and other non-cash

movements being recognised in the income statement, the Group

presents an adjusted earnings per share metric to better reflect

the underlying performance of the Group during the year. In

calculating the adjusted earnings per share, the weighted average

number of shares in issue remains consistent with those used in the

earnings per share calculation.

Diluted

Earnings earnings

Earnings per share per share

GBP'000 p p

Net profit attributable to shareholders

Loss - basic and diluted for the year ended December 31, 2014 (47,589) (42.09p) (42.09p)

Adjustment for:

Amortisation of royalty intangible assets 759

Gain on sale of mining and exploration interests (1,350)

Gain on disposal of coal tenures (1,409)

Impairment of mining and exploration interests 4,873

Impairment of royalty and exploration intangible assets 10,033

Impairment of royalty financial instruments 15,288

Impairment of property, plant and equipment 1,352

Revaluation of coal royalties (Kestrel) 11,822

Effective interest income on royalty financial instruments (194)

Tax effect of the adjustments above 3,577

---------

Adjusted loss - basic and diluted for the year ended December 31, 2014 (2,838) (2.51p) (2.51p)

========= ========== ==========

Diluted

Earnings earnings

Earnings per share per share

GBP'000 p p

Net profit attributable to shareholders

Loss - basic and diluted for the year ended December 31, 2013 (42,497) (39.01p) (39.01p)

Adjustment for:

Amortisation of royalty intangible assets 854

Loss on sale of mining and exploration interests 6,398

Impairment of mining and exploration interests 26,321

Impairment of royalty and exploration intangible assets 8,313

Revaluation of coal royalties (Kestrel) 13,568

Revaluation of royalty financial instruments 8,735

Effective interest income on royalty financial instruments (1,140)

Tax effect of the adjustments above (11,371)

---------

Adjusted earnings - basic and diluted for the year ended December 31, 2013 9,181 8.43p 8.43p

========= ========== ==========

5 Dividends

On February 4, 2014 an interim dividend of 4.45p per share was

paid to shareholders in respect of the year ended December 31,

2013. On August 7, 2014 a final dividend of 5.75p per share was

paid to shareholders to make a total dividend for the year of

10.20p per share. Total dividend, paid during the year were

GBP11.54m (2013: GBP11.07m).

On February 4, 2015 an interim dividend of 4.45p per share was

paid to shareholders in respect of the year ended December 31,

2014. This dividend has not been included as a liability in these

financial statements. The Directors propose that a final dividend

of 4.00p per share be paid to shareholders on August 7, 2015, to

make a total dividend for the year of 8.45p per share. This

dividend is subject to approval by shareholders at the AGM and has

not been included as a liability in these financial statements.

The proposed final dividend for 2014 is subject to shareholder

approval at the 2015 Annual General Meeting ('AGM'). The Board

proposes to pay the final dividend on August 7, 2015 to

shareholders on the Company's share register at the close of

business on June 26, 2015. The shares will be quoted ex-dividend on

the London Stock Exchange on June 25, 2015, and the Toronto Stock

Exchange on June 24, 2015. At the present time the Board has

resolved not to offer a scrip dividend alternative.

6 Coal royalties (Kestrel)

GBP'000

At January 1, 2013 170,995

Foreign currency translation (25,993)

Loss on revaluation of coal royalties (13,568)

---------

At December 31, 2013 131,434

Foreign currency translation (2,515)

Loss on revaluation of coal royalties (11,822)

---------

At December 31, 2014 117,097

=========

The Group's coal royalty entitlements comprise the Kestrel and

Crinum coal royalties, and derive from mining activity carried out

within the Group's private land area in Queensland, Australia.

Rather uniquely to this royalty, the sub-stratum land is the

property of the freeholder, including the minerals contained

within. The ownership of the land therefore entitles the Group to a

royalty, equivalent to what the State receives on areas outside the

Group's private land. This royalty is accounted for as Investment

Property in accordance with IAS 40.

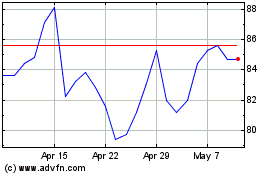

Ecora Resources (LSE:ECOR)

Historical Stock Chart

From Mar 2024 to Apr 2024

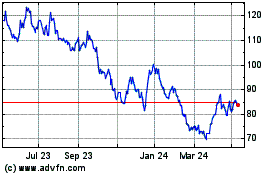

Ecora Resources (LSE:ECOR)

Historical Stock Chart

From Apr 2023 to Apr 2024