TIDMAMS

RNS Number : 4607G

Advanced Medical Solutions Grp PLC

04 March 2015

4 March 2015

Advanced Medical Solutions Group plc

("AMS" or the "Group")

Unaudited preliminary results for the year ended 31 December

2014

Winsford, UK: Advanced Medical Solutions Group plc (AIM: AMS),

the surgical and advanced woundcare specialist company, today

announces its unaudited preliminary results for the year ended 31

December 2014.

Financial Highlights

2014 2013 Reported Growth

growth at constant

currency

(1)

--------------------------------- ----- ----- --------- -------------

Group revenue (GBP million) 63.0 59.5 6% 9%

--------------------------------- ----- ----- --------- -------------

Adjusted(2) operating margin

(%) 24.1 23.1 100bps -

--------------------------------- ----- ----- --------- -------------

Adjusted(2) profit before tax

(GBP million) 15.6 13.5 15% -

--------------------------------- ----- ----- --------- -------------

Profit before tax (GBP million) 15.2 13.1 16% -

--------------------------------- ----- ----- --------- -------------

Adjusted(2) diluted earnings

per share (p) 6.26 5.64 11% -

--------------------------------- ----- ----- --------- -------------

Diluted earnings per share

(p) 6.08 5.45 12% -

--------------------------------- ----- ----- --------- -------------

Net cash (GBP million) 17.3 5.3 226% -

--------------------------------- ----- ----- --------- -------------

-- New five year GBP30 million multi-currency revolving credit facility agreed

-- Proposed final dividend of 0.48p per share, making a total

dividend for the year of 0.70p (2013: 0.60p), up 16.7%

Business Highlights:

-- Good revenue growth across the major Business Units

o Branded Direct up 3% to GBP23.6 million (2013: GBP22.9

million), and up 6% at constant currency

o Branded Distributed up 17% to GBP10.2 million (2013: GBP8.8

million), and up 24% at constant currency

o OEM up 7% to GBP25.3 million (2013: GBP23.6 million), and up

9% at constant currency

o Bulk Materials down 7% to GBP3.9 million (2013: GBP4.2

million), and down 4% at constant currency

-- Strong performance in the US with LiquiBand(R) tissue adhesive range

o Revenues up 43% at constant currency to GBP4.1 million

o As at 31 December 2014, market share by volume increased to

19% (July 2014: 18%) in the non-hospital market and to 7% (July

2014: 6%) in the hospital segment

-- ActivHeal(R) continued to make good progress in the NHS, with

an 8% increase in revenues and increase in market share to 7%

(2013: 5%)

-- Steady progress with RESORBA(R) brands in Germany, resulting

in 4% growth at constant currency

-- Silver alginate revenues increased by 10% at constant

currency to GBP13.1 million (2013: GBP12.1 million)

-- Hernia mesh fixation device LiquiBand(R) Fix8(TM) successfully launched.

Commenting on the results, Chris Meredith, Chief Executive

Officer of AMS, said:

"2014 has been another year of good growth for AMS, with our

three largest business units all delivering solid performances

despite challenging currency conditions. We were particularly

enouraged by strong growth in the US, where the performance, range

and pricing of our LiquiBand(R) tissue adhesives is helping to

drive gains in market share, and in the UK, where the ActivHeal(R)

range continues to provide high performance, cost effective

solutions for the NHS. The successful launch of the LiquiBand(R)

Fix8(TM) hernia mesh fixation device, marking the first use of our

medical adhesives in internal applications, demonstrates our

continued commitment to investing in innovation.

"With the continuing growth in our larger business units, the

strong performance of our products and our ambitions for the Group,

we are confident that AMS is well placed to drive growth as well as

continued improvements in operational efficiencies and we remain

excited by the prospects for our future."

- End -

(1) Constant currency removes the effect of currency movements

by translating the current period's performance at the previous

period's exchange rates

(2) All items are shown before amortisation of acquired

intangible assets which, in 2014, were GBP0.4 million (2013: GBP0.4

million) as defined in the financial review

For further information, please visit www.admedsol.com or

contact:

Advanced Medical Solutions Group plc Tel: +44 (0) 1606

545508

Chris Meredith, Chief Executive Officer

Mary Tavener, Group Finance Director

Consilium Strategic Communications Tel: +44 (0) 20 3709

5700

Mary-Jane Elliott / Jonathan Birt / Matthew

Neal / Ivar Milligan

Investec Bank PLC (NOMAD & Broker) Tel: +44 (0) 20 7597

5970

Gary Clarence / Daniel Adams / Patrick

Robb

About Advanced Medical Solutions Group plc

AMS is a world-leading independent developer and manufacturer of

innovative and technologically advanced products for the global

surgical, wound care and wound closure markets, focused on quality

outcomes for patients and value for payors. AMS has a wide range of

products that include silver alginates, alginates, foams, tissue

adhesives, sutures and haemostats, which it markets under its

brands ActivHeal(R) , LiquiBand(R) and RESORBA(R) as well as

supplying under white label.

AMS's products, manufactured out of two sites in the UK, one in

the Netherlands, two in Germany and one in the Czech Republic, are

sold in more than 70 countries via a network of multinational or

regional partners and distributors, as well as via AMS's own direct

sales forces in the UK, Germany, the Czech Republic and Russia.

Established in 1991, the Company has 472 employees. For more

information please see www.admedsol.com.

Chairman's Statement

2014 was another year of good growth across the business - both

operationally and financially. AMS continues to progress as a

leading, international provider of high quality, high value

innovative and technologically advanced products for the wound care

and wound closure markets.

Operationally, the performance of LiquiBand in the US was

particularly strong and we made considerable progress towards our

goal of building a 20% market share. We also launched our

LiquiBand(R) Fix8(TM) hernia mesh fixation device for use as a

medical adhesive inside the body. This was an important development

for the Group, opening up potential new markets as we seek to

extend the application of our tissue adhesives to other internal

procedures.

Financially, we are pleased to report a 6% increase in revenue

to GBP63.0 million (2013: GBP59.5 million), representing growth of

9% on a constant currency basis and an increase in adjusted(2)

profit before tax of 15% to GBP15.6 million (2013: GBP13.5

million).

The Group continues to work on a number of significant

opportunities to drive growth resulting from existing products and

geographic markets as well as from new products in development.

The Group ended the year with net cash of GBP17.3 million (2013:

GBP5.3 million), and has taken advantage of the favourable terms

available for borrowing to put in place a five-year, unsecured, new

multi-currency, credit facility for GBP30 million. This facility is

as yet unused. AMS continues to be in robust financial health and

is well positioned to invest in internal development projects as

well as potential licensing opportunities and acquisitions in line

with the Group's strategy.

Dividend

The Board is proposing a final dividend of 0.48p per share,

making a total dividend for the year of 0.70p per share, a 16.7%

increase on 2014. If approved at the Annual General Meeting on 21

May 2015, this will be paid on 29 May 2015 to shareholders on the

register at the close of business on 7 May 2015.

People

Finally, on behalf of the Board, I would like to thank all our

employees, customers, suppliers, business partners and shareholders

for their continued support over the past year.

Peter Allen

Chairman

(2) All items are show before amortisation of acquired

intangible assets which, in 2014, were GBP0.4 million (2013: GBP0.4

million) as defined in the financial review

Chief Executive's Statement

I am pleased to report good growth across our major business

units despite foreign exchange headwinds. With more than 75 percent

of our sales outside the UK, our business is truly international

and therefore affected by currency fluctuations.

Branded Direct

The Branded Direct Business Unit reports sales of our branded

products through our own sales forces in the UK, Germany and Czech

Republic. Its revenue grew 3% to GBP23.6 million (2013: GBP22.9

million) and by 6% at constant currency.

ActivHeal(R)

ActivHeal(R) , which delivers a range of woundcare dressings

that offer significant cost savings without compromising on

clinical outcomes or patient care, continues to be a compelling

proposition for the NHS. Sales of our ActivHeal(R) range increased

by 8% to GBP6.0 million (2013: GBP5.5 million). We are encouraged

by the most recent data confirming that AMS had further increased

its market share to 7.1% (2013: 5.5%) at the end of 2014.

Encouragingly, ActivHeal(R) has had a strong start to 2015 with a

number of tender and formulary wins from new NHS Hospital Trusts

and we expect increased growth throughout the year.

LiquiBand(R)

We continue to make good progress in the UK with LiquiBand(R) .

In the Accident and Emergency Room ('A&E') sales grew 8% to

GBP2.6 million (2013: GBP2.5 million) and sales into the Operating

Room ('OR') increased 34% to GBP0.6 million (2013: GBP0.45

million).

AMS' products have been used in A&E for a number of years

and the good growth we have seen reflects the progress made by our

focused sales team in this sector. The UK surgical sales team, now

in their second year, is accessing the OR with a growing range of

products that now includes sutures and haemostats. This team will

also start selling LiquiBand(R) Fix8(TM), our hernia mesh fixation

device.

Sales of LiquiBand(R) in Germany were flat at GBP1.4 million at

a reported level, but increased by 5% at constant currency. Steady

progress is expected to continue in Germany.

RESORBA(R)

Sales of RESORBA(R) branded products in Germany and the Czech

Republic were slightly lower at GBP13.0 million (2013: GBP13.1

million) at a reported level and increased by 4% at constant

currency. Sales of haemostats increased by 12% at constant currency

to GBP3.6 million (2013: GBP3.4 million) and sales of sutures and

collagens into the dental market were unchanged at GBP3.8 million,

whilst sales of sutures into hospitals grew 2%, reversing the

decline reported in 2013.

Although the German suture market continues to be challenging

and is expected to remain so over the next year, we believe we are

well placed to benefit from the competitive pressures in the market

with our extensive range of competitively priced products. Our

German commercial operations were strengthened by the appointment

of a national sales manager in February 2015. The introduction of

the LiquiBand(R) Fix8(TM) device is also expected to support

progress in 2015, and we are reviewing the optimal way to service

the dental market in Germany, which involves mulitple call

points.

In the UK, we are actively working on a number of hospital

tenders and evaluations with the goal of becoming the main suture

supplier to those hospitals. We believe our ability to supply a

comprehensive range of top quality sutures that provide cost

savings to hospitals is compelling. Winning any one of these

current evaluations would significantly increase the presence of

our brand in the UK.

In R&D, our focus is on extending the attributes of our

collagens to meet the needs of dental practitioners and oral

surgeons. We expect to obtain approval for an enhanced collagen

cone in 2015, as well as making good progress in including new

antibiotics in our haemostats.

Branded Distributed

The Branded Distributed Business Unit reports the sales of our

brands through distributors in territories where we do not have a

national sales team.

Branded Distributed revenue was 17% higher at GBP10.2 million

(2013: GBP8.8 million) and 24% higher at constant currency. The

main contributor to this growth was LiquiBand(R) sales in the US,

which totaled GBP4.1 million and accounted for 40% of total

sales.

LiquiBand(R) in the US

Sales of LiquiBand(R) in the US increased by 36% to GBP4.1

million (2013: GBP3.0 million) and by 43% at constant currency. The

new distribution partner added at the end of 2013 performed well

throughout the year and contributed to the growth in sales

alongside existing partners. Given the high level of sales in the

second half of 2013, which included some pipeline filling at the

end of the year, our sales growth performance in 2014 was

particularly strong. The latest data for December 2014 shows our

volume market share increasing to 7%, up from 6% at July 2014, in

the US hospital sector, while our volume market share in the US

non-hospital, or alternate site, market is now estimated at 19%, up

from 18% at July 2014.

We launched our 2-octyl cyanoacrylate formulation with one of

our existing distribution partners in the second half of 2014 and

have already added additional partners since the start of 2015. A

strength of the business is the range of formulations of

cyanoacrylate on offer, including very fast setting formulations

with applicators allowing for quick, precision closure, and

film-forming formulations that provide a barrier layer over wounds

as well as closing the wound itself. With formulations that have

properties in between, we have products that can accommodate the

full spectrum of wound closing needs.

LiquiBand(R) in the EU and Rest Of the World

Elsewhere, within the EU and ROW, LiquiBand(R) sales through our

distributors continued to show good growth, with our distributors

in France and Italy continuing to perform well. Overall sales

increased by 15% to GBP1.5 million (2013: GBP1.3 million) at

reported currency and constant currency.

The regulatory approval process for LiquiBand(R) in China is

progressing, however owing to changes in the regulatory pathway, we

now expect approval later in 2015.

Hernia Mesh Fixation device - LiquiBand(R) Fix8(TM)

We received approval to market this product in Europe on 29 May

2014 and it has now been launched in the UK and Germany with our

own sales teams as well as through some European distributors who

are able to support the product.The initial response has been very

positive, with a number of surgeons keen to endorse the product. We

are also receiving valuable feedback about other possible

applications suitable for this type of device which we are

currently working on.

We do not anticipate significant sales in the first half of the

yearas surgeons are individually trained on how to use the device

and we wait to see the outcome of their surgery. Following positive

feedback, we are confident that the product will contribute to

growth in the second half of 2015 and thereafter.

RESORBA(R)

Sales of RESORBA(R) products to all export markets other than

Russia grew by 6% at reported currency to GBP2.9 million (2013:

GBP2.8 million), and by 10% at constant currency. Growth was seen

across several territories, with our French, Italian and Chinese

distributors performing strongly. Sales in Russia increased by 4%

at constant currency, but decreased 18% to GBP1.3 million (2013:

GBP1.6 million) at reported currency, reflecting the weakening

Rouble. The Russian market is unlikely to grow in the forseeable

future.

Work continues to gain approval to supply RESORBA(R) sutures and

haemostats into the US. We have received our first approval for the

sale of one type of suture for the US market and are still on

target for the remainder of the suture range to be approved in the

first half of 2015, with the expectation that we can launch the

products in the second half of 2015.

In R&D our focus is on continuing to improve the

formulations of the base monomers that are used in our adhesives as

well as extending the applications of tissue adhesives for internal

use.

OEM

The OEM Business Unit reports the sales of products that are

sold under third parties' brands.

OEM revenue increased by 7% at reported currency to GBP25.3

million (2013: GBP23.6 million) and by 9% at constant currency.

Our silver alginate ranges of dressings continued to perform

well, with sales increasing by 8% at reported currency and by 10%

at constant currency to GBP13.1 million (2013: GBP12.1 million).

Our partners continued to do well with the range of silver fibre

dressings we provide, gaining market share as well as accessing new

geographical markets. We continue to support them with regulatory

approvals and marketing data.

Sales of our foam-based dressings were flat at GBP1.8 million.

This was due to one of our partners launching a new product range

last year with sales following the typical second year post launch

sales pattern reduction. Adjusting for this, sales elsewhere were

encouraging and up 20% on a proforma basis. Our other woundcare and

skin protectant products delivered good growth and grew 9% to

GBP9.7 million (2013: GBP8.9 million), while the collagen OEM

business acquired with RESORBA(R) was flat year-on-year at GBP0.8

million, with little change expected in 2015.

In R&D, the focus is on further developing our foam range to

include both an antimicrobial and an atraumatic foam. These

products are well advanced and we expect approvals in the first

half of 2015, with a launch later this year.

Bulk Materials

The Bulk Business Unit reports sales of bulk materials to third

party convertors.

Bulk Materials revenue decreased by 7% at reported currency to

GBP3.9 million (2013: GBP4.2 million) and by 4% at constant

currency.

Rollstock foam contributed around 85% of Bulk revenue and good

growth was seen by one signficant customer that had destocked in

2013. However, sales by some newer and smaller partners were

disappointing. Until sufficient scale of revenue is achieved with

the customer base, the Bulk Materials Unit will remain vulnerable

to the ordering patterns of its partners and customers.

In R&D, the focus is on developing new foam formulations

with antimicrobials, working in conjunction with the OEM business

unit. These products are expected to be launched in 2015.

Operations

Efficiency and gross margins

We continue to strive for operational improvements by reducing

set up times, eliminating non-value added activities and increasing

outputs. These incremental efficiencies are helping to improve

gross margins acoss the Group and have helped to generate an

improvement of approximately 100 basis points in 2014, offsetting

some of the negative impact resulting from movements in currency.

We have invested in improving our converting capability in

Winsford. This equipment is still being commissioned, but we expect

to increase our operational flexibility and improve efficiency in

2015 as a result.

Capacity and resource

We have also identified the need to increase the capacity of our

collagen plant in Germany. We anticipate that GBP1.0 million of

investment is required in the plant in the second half of 2015. We

continue to invest in improving our ERP (Enterprise Resource

Planning) management and reporting systems. Following the

successful launch of our new ERP system at our Plymouth site, the

system was subsequently launched in Winsford in February 2014 and

in Etten Leur in the Netherlands in September 2014. We constantly

monitor our systems across the Group and will invest in further

improvements to systems in Germany.

Regulatory and quality assurance

With the regulatory framework gaining in complexity, we have

continued to invest in both Regulatory and Quality functions and

systems to ensure that we are able to support our partners with

winning approvals in new markets as well as obtaining approval for

our own products. We anticipate that we will continue to invest in

these areas in 2015.

R&D

The Group continues to develop new products through its R&D

teams. We are well advanced in the approval process for our

antimicrobial and atraumatic foams and, whilst external regulatory

pathways are out of our control resulting in unclear timings, we

expect to obtain several product approvals in 2015, enabling these

products to be launched thereafter.

Summary and Outlook

We delivered revenue growth of 6% (at constant currency this

would have been 9%) and significantly improved profitability and

cash generation during the year.

Our three largest business units all delivered solid performance

despite challenging currency conditions. We were particularly

encouraged by strong growth in the US, where the competitive

quality, range and pricing helped to drive gains in our market

share. The successful launch of the LiquiBand(R) Fix8(TM) hernia

mesh fixation device demonstrates our continued commitment to

investing in innovation and during the year ahead we expect further

product launches and advancements in our R&D activities.

With continuing growth across our major business units, due to

the strong performance of our products, new products progressing

well and our anticipated broadening into new geographies, we are

confident that the Group is well placed to drive growth as well as

continued improvements in efficiencies and we remain excited by the

prospects for our future.

Financial Review

Summary

Group revenue increased by 6% to GBP63.0 million (2013: GBP59.5

million). At constant currency, revenue growth would have been

9%.

Comparisons with 2013 are made on a pre-amortisation of acquired

intangible asset cost basis, as we believe that this provides a

more relevant representation of the Group's trading performance.

Amortisation of acquired intangible assets was GBP0.4 million in

the period (2013: GBP0.4 million).

To aid comparison, the Group's adjusted income statement is

summarised in Table 1 below.

Table 1 Year ended Year ended

31 Dec 2014 31 Dec 2013

Adjusted Income Statement GBP'000 GBP'000 Change

--------------------------------- --------------- -------------- -------

Revenue 63,010 59,499 6%

--------------------------------- --------------- -------------- -------

Gross profit 35,843 34,268 5%

Distribution costs (853) (744)

Administration expenses(3) (19,681) (19,679)

Other income 250 281

--------------------------------- --------------- -------------- -------

Adjusted operating profit 15,559 14,126 10%

Net finance income/(costs) 48 (582)

--------------------------------- --------------- -------------- -------

Adjusted profit before

tax 15,607 13,544 15%

Amortisation of acquired

intangibles (389) (400)

--------------------------------- --------------- -------------- -------

Profit before tax 15,218 13,144 16%

Tax (2,354) (1,778)

--------------------------------- --------------- -------------- -------

Profit for the period 12,864 11,366 13%

--------------------------------- --------------- -------------- -------

Adjusted earnings per share

- basic(4) 6.39p 5.72p 12%

Earnings per share - basic(4) 6.20p 5.52p 12%

--------------------------------- --------------- -------------- -------

Adjusted earnings per share

- diluted(3) 6.26p 5.64p 11%

Earnings per share - diluted(3) 6.08p 5.45p 12%

--------------------------------- --------------- -------------- -------

3 Administration expenses exclude amortisation of acquired intangible assets

4 See Note 7 Earnings per share for details of calculation

Revenues were negatively impacted by approximately GBP1.8

million due to the effects of currency movements in the year. This

also had an impact on Group gross margins which were reduced by 50

bps as a result. Gross margins were also negatively impacted by

sales mix effect by 120bps, however, this was partially offset by

the 100bps improvement made from operational eficiences.

Adjusted operating profit increased by 10% to GBP15.6 million

(2013: GBP14.1 million) and the adjusted operating margin increased

by 100 bps to 24.7% (2013: 23.7%). At a reported level,

administration costs were flat year on year, helped by currency

effects. Adjusting for currency, administration costs would have

increased by 5%. Within this, the Group expensed to the income

statement GBP2.1 million on R&D (2013: GBP2.2 million). Spend

as a percentage of sales reduced to 3.3% (2014: 3.7%), mainly as a

result of timing of projects.

Profit before tax for the year was 16% higher at GBP15.2 million

(2013: GBP13.1 million).

The Group's effective rate of tax for the year was 15.5% (2013:

13.5%). This is reflective of the utilisation of previously

unrecognised brought-forward tax losses in the UK, together with

patent box and R&D relief. It also reflects the impact of

blending profits and losses from different countries and the

different tax rates associated with these countries. The effective

tax rate of the Group is expected to increase as a result of the

tax losses being used up.

A reconciliation between the standard rate of taxation in the UK

and the Group's effective rate is summarised in Table 2 below.

Table 2

Taxation %

Standard taxation rate 21.50

Loss utilisation and recognition (3.61)

Impact of differential between UK and overseas tax

rate 1.70

Patent box relief (3.58)

R&D relief (1.89)

Expenses not deductible, prior year adjustments,

depreciation & share based payments 1.38

---------------------------------------------------- -------

Effective taxation rate 15.50

---------------------------------------------------- -------

Earnings (excluding amortisation of acquired intangible assets)

increased by 13% to GBP13.3 million (2013: GBP11.8 million),

resulting in a 12% increase in adjusted basic earnings per share to

6.39p (2013: 5.72p) and a 11% increase in diluted adjusted earnings

per share to 6.26p (2013: 5.64p).

Profit after tax increased by 13% to GBP12.9 million (2013:

GBP11.4 million), resulting in a 12% increase in basic earnings per

share to 6.20p (2013: 5.52p) and a 12% increase in diluted earnings

per share to 6.08p (2013: 5.45p).

The Board is proposing a final dividend of 0.48p per share, to

be paid on 29 May 2015 to shareholders on the register at the close

of business on 7 May 2015. This follows the interim dividend of

0.22p per share that was paid on 31 October 2014 and would make a

total dividend for the year of 0.70p per share (2013: 0.60p), a 17%

increase on 2013.

The operational performance of the Business Units is shown in

Table 3 below. The adjusted profit from operations and the adjusted

margin are shown after excluding amortisation of acquired

intangibles. In determining, and to aid comparison of the

operational margins of the individual Business Units, the revenue

of the Bulk Materials Business Unit sales made to other Business

Units, GBP0.7 million (2013: GBP0.8 milllion) are included.

Table 3

Operating Result by Business Unit

----------------------------------------------------------------------------------------

Year ended 31 December Branded Branded OEM Bulk Materials

2014 Direct Distributed

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------ -------- ------------- -------- ---------------

Revenue 23,610 10,247 25,275 4,580

Profit from operations 6,241 2,770 6,225 485

Amortisation of acquired

intangibles 227 135 27 -

Adjusted profit from operations(5) 6,468 2,905 6,252 485

Adjusted operating margin(5) 27.4% 28.3% 24.7% 10.6%

------------------------------------ -------- ------------- -------- ---------------

Year ended 31 December

2013

Revenue 22,918 8,785 23,629 4,933

Profit from operations 6,023 1,654 5,790 668

Amortisation of acquired

intangibles 235 130 35 -

Adjusted profit from operations(1) 6,258 1,784 5,825 668

Adjusted operating margin(1) 27.3% 20.3% 24.7% 13.5%

------------------------------------ -------- ------------- -------- ---------------

(5) excludes amortisation of intangible assets

Branded Direct

The adjusted operating margin of this Business Unit remained at

a similar level to the prior year at 27.4% (2013: 27.3%) and lower

than the position at H1 2014 (29.6%). As indicated at the half year

we are investing in sales and marketing in our increasing direct

sales teams.

Branded Distributed

The adjusted operating margin of this Business Unit increased to

28.3% (2013: 20.3%), reflecting the improved profitability from the

increase in sales in this Business Unit and in particular from

sales to the US. The growth in sales to the US mitigated the impact

in margin from sales made into Russia and continued the improvement

in margin seen at H1 2014 (18.7%).

OEM

The adjusted operating margin of this Business Unit was at a the

same level to the prior year at 24.7% (2013: 24.7%), and lower than

the margin reported at H1 2014 (27.1%). Margins are dependent on

the mix of business, which at the half year had a greater

percentage of silver alginate sales than at the full year.

Bulk Materials

The adjusted operating margin of this Business Unit decreased to

10.6% (2013: 13.5%), but improved from the position in H1 2014

(9.8%). Margins were affected by the lower volumes of production as

well as the different sales mix.

Geographic breakdown of revenues

The geographic breakdown of Group revenues in 2014 is shown in

Table 4 below:

Table 4

Geographic Breakdown of Group Revenues

----------------------------------------------------------------

GBP millions 2014 % of total 2013 % of total

------------------------ ----- ----------- ----- -----------

Europe (excluding UK &

Germany) 18.7 29.7 17.3 29.1

Germany 14.0 22.3 15.7 26.4

UK 15.3 24.3 13.2 22.2

USA 13.8 21.9 11.8 19.9

Rest of World 1.1 1.8 1.4 2.4

------------------------ ----- ----------- ----- -----------

Although nearly 52% of the Group's sales are in Europe

(excluding the UK), only around 34% of sales are denominated in

Euros. Approximately 80% of all sales to the US are denominated in

US Dollars. The Group hedges significant transaction exposure by

using forward contracts and options and aims to have 70% of its

estimated transactional exposure for the next twelve months hedged.

The foreign currency hedges put in place in 2013 mitigated the

effect of the adverse effects of currency in 2014 by around

GBP1million.

Cash Flow

Table 5 summarises the Group cash flows.

Table 5

Group Cash Flows

Year ended 31 December 2014 2013

GBP'000 GBP'000

-------------------------------------- -------- ---------

Adjusted operating profit (Table 1) 15,559 14,126

Non-cash items 2,993 2,815

-------------------------------------- -------- ---------

EBITDA 18,552 16,941

Working capital movement (104) (2,788)

-------------------------------------- -------- ---------

Net cash from operating activities 18,448 14,153

Capital expenditure and capitalised

R&D (2,406) (2,002)

Net interest received 45 (587)

Tax paid (1,876) (83)

-------------------------------------- -------- ---------

Free cash flow 14,211 11,481

Repayment of loan - (14,385)

Dividends paid (1,307) (1,111)

Proceeds from share issues 65 328

Net increase/ (decrease) in cash and

cash equivalents 12,969 (3,687)

-------------------------------------- -------- ---------

Note: EBITDA is earnings before interest, tax, depreciation,

intangible asset amortisation and share based payments

EBITDA increased by 10% to GBP18.6 million (2013: GBP16.9

million).

Working capital reduced slightly in the year but this was mainly

due to the effects of translating overseas working capital balances

held in euros into sterling. 4.2 months of supply of inventory was

held across the Group, slightly increased compared with the prior

year (2013: 4.0 months of supply). Trade debtor days remained at

the same level to the prior year at 43 (2013: 43) while trade

payable days decreased to 36 (2013: 42).

The Group generated net cash from operating activities of

GBP18.4 million (2013: GBP14.2 million) (see Table 5) and had net

cash of GBP17.3 million (2013: GBP5.3 million) at the end of the

year.

We invested GBP2.4 million in capital equipment, software and

capitalised R&D in the year (2013: GBP2.0 million). We have

invested in equipment around the Group that improves converting and

packaging as well as in business systems.

The Group generated a free cash flow of GBP14.2 million in the

year (2013: GBP11.5 million). The conversion of adjusted operating

profit into free cash flow was 91% (2013: 81%).

The Group paid its final dividend for the year ended 31 December

2013 of GBP0.85 million (2013:for the year ending 2012, GBP0.71

million) on 28 May 2014, and its interim dividend for the six

months ended 30 June 2014 of GBP0.46 million (2013: GBP0.40

million) on 31 October 2014.

In December 2014 the Group entered into a new, five-year, GBP30

million, multi-currency revolving credit facility with an accordion

option under which AMS can request up to an additional GBP20

million on the same terms. The previous facility for GBP4 million

was due to expire in 2015. The Group chose to take advantage of

favourable credit conditions to put in place a more suitable

facility to support the Group's growth ambitions. The new facility

is provided jointly by the Group's existing bankers, HSBC, as well

as The Royal Bank of Scotland PLC. It is unsecured on the assets of

the Group and has not been drawn down. This facility carries an

annual interest rate of LIBOR or EURIBOR plus a margin that varies

between 0.65% and 1.75% depending on the Group's net debt to EBITDA

ratio.

At the end of the period, the Group had net cash of GBP17.3

million (2013: GBP5.3 million). The movement in net cash from the

start of the year to net cash at the end of the year is reconciled

in Table 6 below:

Table 6

Movement in net cash GBP'000

--------------------------------- --------

Net cash as at 1 January 2014 5,257

Exchange rate impacts (946)

Free cash flow 14,211

Dividends paid (1,307)

Proceeds from share issues 65

Net cash as at 31 December 2014 17,280

--------------------------------- --------

The Group's going concern position is fully described in note

2.

CONSOLIDATED INCOME STATEMENT

(Unaudited) (Audited)

Year ended 31 December 2014 2013

Total Total

Note GBP'000 GBP'000

------------------------- ----- ------------ ----------

Revenue from continuing

operations 4 63,010 59,499

Cost of sales (27,167) (25,231)

-------------------------- ----- ------------ ----------

Gross profit 35,843 34,268

Distribution costs (853) (744)

Administration costs (20,070) (20,079)

Other income 250 281

-------------------------- ----- ------------ ----------

Profit from operations 4,5 15,170 13,726

Finance income 49 1

Finance costs (1) (583)

-------------------------- ----- ------------ ----------

Profit before taxation 15,218 13,144

Income tax 6 (2,354) (1,778)

-------------------------- ----- ------------ ----------

Profit attributable

to equity holders

of the parent 12,864 11,366

--------------------------

Earnings per share

Basic 7 6.20p 5.52p

Diluted 7 6.08p 5.45p

Adjusted diluted 7 6.26p 5.64p

-------------------------- ----- ------------ ----------

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

(Unaudited) (Audited)

Year ended 31 December 2014 2013

GBP'000 GBP'000

------------------------------------------------ ------------ ----------

Profit for the year 12,864 11,366

Items that may be reclassified subsequently

to profit and loss:

Exchange differences on translation of foreign

operations (4,200) 732

(Loss) / gain arising on cash flow hedges (1,173) 698

------------------------------------------------ ------------ ----------

Other comprehensive (expense)/income for

the year (5,373) 1,430

------------------------------------------------ ------------ ----------

Total comprehensive income for the year

attributable to equity holders of the parent 7,491 12,796

------------------------------------------------ ------------ ----------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

(Unaudited) (Audited)

At 31 December 2014 2013

GBP'000 GBP'000

---------------------------------- ------------ ----------

Assets

Non-current assets

Acquired intellectual property

rights 9,238 10,256

Software intangibles 1,835 1,662

Development costs 1,850 1,702

Goodwill 36,696 39,278

Property, plant and equipment 16,003 16,707

Deferred tax assets 1,108 1,728

Trade and other receivables 22 14

---------------------------------- ------------ ----------

66,752 71,347

Current assets

Inventories 7,532 8,042

Trade and other receivables 12,969 12,158

Current tax assets - 343

Cash and cash equivalents 17,280 5,257

---------------------------------- ------------ ----------

37,781 25,800

---------------------------------- ------------ ----------

Total assets 104,533 97,147

---------------------------------- ------------ ----------

Liabilities

Current liabilities

Trade and other payables 7,649 6,298

Current tax liabilities 584 1,220

Other taxes payable 259 260

Obligations under finance leases 2 4

------------

8,494 7,782

Non-current liabilities

Trade and other payables 472 520

Deferred tax liabilities 2,513 2,754

Obligations under finance leases 1 3

2,986 3,277

---------------------------------- ------------ ----------

Total liabilities 11,480 11,059

---------------------------------- ------------ ----------

Net assets 93,053 86,088

---------------------------------- ------------ ----------

Equity

Share capital 10,393 10,343

Share premium 32,742 32,364

Share-based payments reserve 1,563 1,326

Investment in own shares (148) (144)

Share-based payments deferred

tax reserve 278 158

Other reserve 1,531 1,531

Hedging reserve (522) 651

Translation reserve (4,867) (667)

Retained earnings 52,083 40,526

---------------------------------- ------------ ----------

Equity attributable to equity

holders of the parent 93,053 86,088

---------------------------------- ------------ ----------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Attributable to equity holders of the Group

Share Investment Share

based

Share Share based in own payments Other Hedging Translation Retained

capital premium payments shares deferred reserve reserve reserve earnings Total

tax

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------

At 1 January

2013

(audited) 10,230 31,887 1,122 (77) 180 1,531 (47) (1,399) 30,271 73,698

--------------- -------- -------- --------- ----------- --------- -------- -------- ------------ --------- --------

Consolidated

profit for

the

year to 31

Dec 2013 - - - - - - - - 11,366 11,366

Other

comprehensive

income - - - - - - 698 732 - 1,430

---------------

Total

comprehensive

income - - - - - - 698 732 11,366 12,796

--------------- -------- -------- --------- ----------- --------- -------- -------- ------------ --------- --------

Share based

payments - - 400 - (22) - - - - 378

Share options

exercised 113 477 (196) - - - - - - 394

Shares

purchased by

EBT - - - (277) - - - - - (277)

Shares sold by

EBT - - - 210 - - - - - 210

Dividends paid - - - - - - - - (1,111) (1,111)

--------------- -------- -------- --------- ----------- --------- -------- -------- ------------ --------- --------

At 31 December

2013

(audited) 10,343 32,364 1,326 (144) 158 1,531 651 (667) 40,526 86,088

--------------- -------- -------- --------- ----------- --------- -------- -------- ------------ --------- --------

Consolidated

profit for

the

year to 31

Dec 2014 - - - - - - - - 12,864 12,864

Other

comprehensive

income - - - - - - (1,173) (4,200) - (5,373)

---------------

Total

comprehensive

income

(unaudited) - - - - - - (1,173) (4,200) 12,864 7,491

--------------- -------- -------- --------- ----------- --------- -------- -------- ------------ --------- --------

Share based

payments - - 592 - 120 - - - - 712

Share options

exercised 50 378 (355) - - - - - - 73

Shares

purchased by

EBT - - - (190) - - - - - (190)

Shares sold by

EBT - - - 186 - - - - - 186

Dividends paid - - - - - - - - (1,307) (1,307)

--------------- -------- -------- --------- ----------- --------- -------- -------- ------------ --------- --------

At 31 December

2014

(unaudited) 10,393 32,742 1,563 (148) 278 1,531 (522) (4,867) 52,083 93,053

--------------- -------- -------- --------- ----------- --------- -------- -------- ------------ --------- --------

CONSOLIDATED STATEMENT OF CASH FLOWS

(Unaudited) (Audited)

Year ended 31 December 2014 2013

GBP'000 GBP'000

------------------------------------------------ ------------ ----------

Cash flows from operating activities

Profit from operations 15,170 13,726

Adjustments for:

Depreciation 1,750 1,783

Amortisation - intellectual property

rights 389 400

- development costs 331 204

- software intangibles 228 91

Impairment of development costs 92 337

Decrease / (increase) in inventories 221 (1,510)

Increase in trade and other receivables (1,623) (1,931)

Increase in trade and other payables 1,298 653

Share based payments expense 592 400

Taxation (1,876) (83)

Net cash inflow from operating activities 16,572 14,070

------------------------------------------------ ------------ ----------

Cash flows from investing activities

Purchase of software (408) (618)

Capitalised research and development (581) (612)

Purchases of property, plant and

equipment (1,478) (836)

Disposal of PPE 61 64

Interest received 50 1

Net cash used in investing activities (2,356) (2,001)

------------------------------------------------ ------------ ----------

Cash flows from financing activities

Dividends paid (1,307) (1,111)

Finance lease (4) (5)

Repayment of secured loan - (14,385)

Issue of equity shares 69 395

Shares purchased by EBT (190) (277)

Shares sold by EBT 186 210

Interest paid (1) (583)

Net cash used in financing activities (1,247) (15,756)

------------------------------------------------ ------------ ----------

Net increase / (decrease) in cash

and cash equivalents 12,969 (3,687)

Cash and cash equivalents at the

beginning of the year 5,257 8,841

Effect of foreign exchange rate changes (946) 103

Cash and cash equivalents at the

end of the year 17,280 5,257

------------------------------------------------ ------------ ----------

Notes Forming Part of the Condensed Consolidated Financial

Statements

1. Reporting entity

Advanced Medical Solutions Group plc ("the Company") is a public

limited company incorporated and domiciled in England and Wales

(registration number 2867684). The Company's registered address is

Premier Park, 33 Road One, Winsford Industrial Estate, Cheshire,

CW7 3RT.

The Company's ordinary shares are traded on the AIM market of

the London Stock Exchange plc. The consolidated financial

statements of the Company for the twelve months ended 31 December

2014 comprise the Company and its subsidiaries (together referred

to as the "Group").

The Group is primarily involved in the design, development and

manufacture of novel high performance polymers (both natural and

synthetic) for use in advanced woundcare dressings and materials,

and medical adhesives and sutures for closing and sealing tissue,

for sale into the global medical device market and dental

market.

2. Basis of preparation

These condensed unaudited consolidated financial statements have

been prepared in accordance with the accounting policies set out in

the annual report for the year ended 31 December 2013.

While the financial information included in this preliminary

announcement has been prepared in accordance with the recognition

and measurement criteria of International Financial Reporting

Standards (IFRSs), as adopted for use in the EU, this announcement

does not itself contain sufficient information to comply with

IFRSs. The Group expects to publish full financial statements that

comply with IFRSs in April 2015.

The financial information set out in the announcement does not

constitute the Group's statutory accounts for the years ended 31

December 2014 or 31 December 2013. The financial information for

the year ended 31 December 2013 is derived from the statutory

accounts for that year, which have been delivered to the Registrar

of Companies. The auditor reported on those accounts; their report

was unqualified, did not draw attention to any matters by way of

emphasis without qualifying their report and did not contain a

statement under s498 (2) or (3) Companies Act 2006. The audit of

the statutory accounts for the year ended 31 December 2014 is not

yet complete. These accounts will be finalised on the basis of the

financial information presented by the directors in this

preliminary announcement and will be delivered to the Registrar of

Companies following the Group's annual general meeting.

The financial statements have been prepared on the historical

cost basis of accounting except as disclosed in the accounting

policies set out in the annual report for the year ended 31

December 2013.

With regards to the Group's financial position, it had cash and

cash equivalents at the year end of GBP17.3 million. The Group also

has in place a five-year, unsecured, new multi-currency, credit

facility for GBP30 million which was undrawn in during 2014.

While the current economic environment is uncertain, the Group

operates in markets whose demographics are favourable, underpinned

by an increasing need for products to treat chronic and acute

wounds. Consequently, market growth is predicted. The Group has a

number of long-term contracts with customers across different

geographic regions and also with substantial financial resources,

ranging from government agencies through to global healthcare

companies.

Having taken the above into consideration the Directors have

reached a conclusion that the Group is well placed to manage its

business risks in the current economic environment. Accordingly,

they continue to adopt the going concern basis in preparing the

preliminary announcement.

The Group has not yet adopted IFRS 10 Consolidated Financial

Statements, IFRS 11 Joint Arrangements, IAS 28 Investments in

Associates and Joint Ventures (2011), IFRS 12 Disclosure of

Interests in Other Entities, IAS 27 Separate Financial Statements

(2011), IAS 32 Amendments to IFRS 7 and IAS 32, Amendments to IAS

36 Impairment of Assets, Amendments to IAS 39 Financial

Instruments: recognition and measurement, Amendments to IFRS 10,

IFRS12 and IAS 27. These have had no significant impact on this set

of financial information.

3. Accounting policies

The same accounting policies, presentations and methods of

computation are followed in the condensed set of financial

statements as applied in the Group's latest annual audited

financial statements. The annual financial statements of Advanced

Medical Solutions Group plc are prepared in accordance with

International Financial Reporting Standards as adopted by the

European Union.

4. Segment information

As referred to in the Chief Executive's Report, the Group is

organised into four business units: Branded Direct, Branded

Distributed, OEM (original equipment manufacturer) and Bulk

Materials. These business units are the basis on which the Group

reports its segment information.

Segment results, assets and liabilities include items directly

attributable to a segment as well as those that can be allocated on

a reasonable basis. Unallocated items comprise mainly investments,

and related revenue, corporate assets, head office expenses and

income tax assets. These are the measures reported to the Group's

Chief Executive for the purposes of resource allocation and

assessment of segment performance.

Business segments

Segment information about these businesses is presented

below.

Year ended Branded Branded OEM Bulk Eliminations Consolidated

31 December Direct Distributed Materials

2014

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- -------- ------------- -------- ----------- ------------- -------------

Revenue

External sales 23,610 10,247 25,275 3,878 - 63,010

Inter segment

sales 702 (702) -

---------------- -------- ------------- -------- ----------- ------------- -------------

Total revenue 23,610 10,247 25,275 4,580 (702) 63,010

---------------- -------- ------------- -------- ----------- ------------- -------------

Result

---------------- ------ ------ ------ ---- --------

Segment result 6,241 2,770 6,225 485 - 15,721

Unallocated

expenses (551)

--------

Profit from

operations 15,170

Finance income 49

Finance costs (1)

---------------- ------ ------ ------ ---- --------

Profit before

tax 15,218

Tax (2,354)

---------------- ------ ------ ------ ---- --------

Profit for the

year 12,864

---------------- ------ ------ ------ ---- --------

At 31 December 2014 Branded Branded OEM Bulk Consolidated

Direct Distributed Materials

Other Information GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ -------- ------------- -------- ----------- --------------------

Capital additions:

Software intangibles 88 11 272 37 408

Research & development 200 113 262 6 581

Property, plant and

equipment 586 179 617 96 1,478

Depreciation and

amortisation (903) (356) (1,188) (251) (2,698)

------------------------ -------- ------------- -------- ----------- --------------------

Balance sheet

Assets

Segment assets 55,456 17,207 27,200 4,462 104,325

Unallocated assets 208

------------------------ -------- ------------- -------- ----------- --------------------

Consolidated total

assets 104,553

------------------------ -------- ------------- -------- ----------- --------------------

Liabilities

Segment liabilities 5,257 2,159 3,531 533 11,480

Consolidated total

liabilities 11,480

------------------------ -------- ------------- -------- ----------- --------------------

Year ended Branded Branded OEM Bulk Eliminations Consolidated

31 December Direct Distributed Materials

2013

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- ------------- -------------- -------- ----------- ------------- -------------

Revenue

External sales 22,918 8,785 23,629 4,167 - 59,499

Inter-segment

sales 766 (766) -

---------------- ------------- -------------- -------- ----------- ------------- -------------

Total revenue 22,918 8,785 23,629 4,933 (766) 59,499

---------------- ------------- -------------- -------- ----------- ------------- -------------

Result

---------------- ------ -------------- --------- ---- --------

Segment result 6,023 1,654 5,790 668 - 14,135

Unallocated

expenses (409)

--------

Profit from

operations 13,726

Finance income 1

Finance costs (583)

---------------- ------ -------------- --------- ---- --------

Profit before

tax 13,144

Tax (1,778)

---------------- ------ -------------- --------- ---- --------

Profit for the

year 11,366

---------------- ------ -------------- --------- ---- --------

As at 31 December Branded Branded OEM Bulk Consolidated

2013 Direct Distributed Materials

Other Information GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ -------- ------------- -------- ----------- -------------

Capital additions:

Software intangibles 131 15 400 72 618

Research & development 168 70 369 5 612

Property, plant and

equipment 330 117 197 192 836

Depreciation and

amortisation (872) (310) (1,037) (259) (2,478)

------------------------ -------- ------------- -------- ----------- -------------

Balance sheet

Assets

Segment assets 54,470 15,196 23,172 4,309 97,147

------------------------ -------- ------------- -------- ----------- -------------

Consolidated total

assets 97,147

------------------------ -------- ------------- -------- ----------- -------------

Liabilities

Segment liabilities 5,629 1,675 3,156 599 11,059

------------------------ -------- ------------- -------- ----------- -------------

Consolidated total

liabilities 11,059

------------------------ -------- ------------- -------- ----------- -------------

Geographic segments

The Group operates mainly in the UK, the Netherlands, Germany,

the Czech Republic and Russia, with a sales office located in the

USA. In presenting information on the basis of geographical

segments, segment revenue is based on the geographical location of

customers. Segment assets are based on the geographical location of

the assets.

The following table provides an analysis of the Group's sales by

geographical market, irrespective of the origin of the

goods/services, based upon location of the Group's customers:

Year ended 31 December 2014 2013

GBP'000 GBP'000

------------------------------------- -------- --------

United Kingdom 15,308 13,225

Germany 14,042 15,687

Europe excluding United Kingdom and

Germany 18,747 17,331

United States of America 13,786 11,819

Rest of World 1,127 1,437

------------------------------------- -------- --------

63,010 59,499

------------------------------------- -------- --------

The following table provides an analysis of the Group's total

assets by geographical location.

As at 31 December 2014 2013

GBP'000 GBP'000

------------------------------------- -------- --------

United Kingdom 46,049 34,271

Germany 52,887 56,522

Europe excluding United Kingdom and

Germany 5,506 6,315

United States of America 91 39

------------------------------------- -------- --------

104,533 97,147

------------------------------------- -------- --------

5. Profit from operations

Year ended 31 December 2014 2013

GBP'000 GBP'000

----------------------------------------------------------- -------- --------

Profit from operations is arrived

at after charging / (crediting):

Depreciation of property, plant and

equipment 1,750 1,783

Amortisation of:

- acquired intellectual property rights 389 400

- software intangibles 228 91

- development costs 331 204

Operating lease rentals - plant and

machinery 228 235

- land and buildings 912 835

Research and development costs expensed

to the income statement 2,120 2,196

Cost of inventories recognised as

expense 26,286 24,601

Staff costs 19,342 18,241

Net foreign exchange (gain) / loss (1,029) 164

----------------------------------------------------------- -------- --------

6. Taxation

Year ended 31 December 2014 2013

GBP'000 GBP'000

--------------------------------------- -------- --------

a) Analysis of charge for the year

Current tax:

Tax on ordinary activities - current

year 1,482 1,010

Tax on ordinary activities - prior

year 194 (134)

--------------------------------------- -------- --------

1,676 876

Deferred tax:

Tax on ordinary activities - current

year 678 494

Tax on ordinary activities - prior

year - 72

Effect of reduction in UK corporation

tax rates - 336

--------------------------------------- -------- --------

678 902

--------------------------------------- -------- --------

Tax charge for the year 2,354 1,778

--------------------------------------- -------- --------

The tax assessed for the year is lower (2013: lower) than the

standard rate of corporation tax in the UK (21.5%) as explained

below:

Year ended 31 December 2014 2013

GBP'000 GBP'000

----------------------------------------- -------- --------

b) Factors affecting tax charge for

the year

Profit before taxation 15,218 13,144

Profit multiplied by the standard

rate of corporation tax in the UK

of 21.5% (2013: 23.25%) 3,272 3,056

Effects of:

Overseas tax rate versus UK corporate

tax rate 259 140

Net (income) / expenses not (taxable)

/ deductible for tax purposes and

other timing differences (26) 346

Depreciation for year less than capital

allowances (9) (72)

Patent box relief (545) (510)

Utilisation and recognition of trading

losses (550) (577)

Research and development relief (287) (439)

Share-based payments 46 (104)

Adjustments in respect of prior year

- current tax 194 (134)

Adjustments in respect of prior year

- deferred tax - 72

Taxation 2,354 1,778

----------------------------------------- -------- --------

Legislation to reduce the main rate of UK corporation tax to 21%

and 20% was passed by parliament on 2 July 2013 to take effect from

1 April 2014 and 1 April 2015 respectively. The reduction in the

main rate to 20% had been substantively enacted at the balance

sheet date and, therefore, the deferred tax assets and liabilities

are calculated in these financial statements at this rate.

In addition to the amount charged to the income statement the

Group has recognised directly in equity:

-- excess tax deductions related to share-based payments on exercised options, together with

-- changes in excess deferred tax deductions related to

share-based payments, totalling GBP120,000 deficit (2013: surplus

GBP22,000).

7. Earnings per share

The calculation of the basic and diluted earnings per share is

based on the following data:

Year ended 31 December 2014 2013

GBP'000 GBP'000

--------------------------------------- -------- --------

Earnings for the purposes of basic

and diluted earnings per share being

net profit attributable to equity

holders of the parent 12,864 11,366

Number of shares '000 '000

-------------------------------------------- -------- --------

Weighted average number of ordinary

shares for the purposes of basic earnings

per share 207,528 205,795

-------------------------------------------- -------- --------

Effect of dilutive potential ordinary

shares:

- share options, deferred share bonus,

LTIPs 3,991 2,869

-------------------------------------------- -------- --------

Weighted average number of ordinary

shares for the purposes of diluted

earnings per share 211,520 208,664

-------------------------------------------- -------- --------

GBP'000 GBP'000

------------------------------------------- -------- --------

Profit for the year attributable to

equity holders of the parent 12,864 11,366

Amortisation of acquired intangible

assets 389 400

Adjusted profit for the year attributable

to equity holders of the parent 13,253 11,766

------------------------------------------- -------- --------

Earnings per share pence pence

-------------------- ------ ------

Basic 6.20p 5.52p

Diluted 6.08p 5.45p

Adjusted basic 6.39p 5.72p

Adjusted diluted 6.26p 5.64p

-------------------- ------ ------

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR EAADDEALSEAF

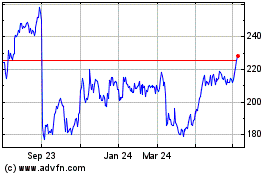

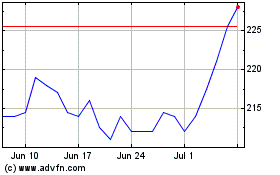

Advanced Medical Solutions (LSE:AMS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Advanced Medical Solutions (LSE:AMS)

Historical Stock Chart

From Apr 2023 to Apr 2024