Additional Proxy Soliciting Materials (definitive) (defa14a)

July 29 2015 - 5:30PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

|

| | |

| | |

Filed by the Registrant þ | | Filed by a Party other than the Registrant o |

| | |

Check the appropriate box: | | |

|

| | |

o | | Preliminary Proxy Statement |

| | |

o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

o

| | Definitive Proxy Statement |

| | |

þ

| | Definitive Additional Materials |

| | |

o | | Soliciting Material Pursuant to §240.14a-12 |

ACCRETIVE HEALTH, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if Other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

| | |

þ | | No fee required. |

| | |

o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

| | |

(1) | | Title of each class of securities to which transaction applies: |

| | |

(2) | | Aggregate number of securities to which transaction applies: |

| | |

(3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

(4) | | Proposed maximum aggregate value of transaction: |

| | |

(5) | | Total fee paid: |

|

| | |

o | | Fee paid previously with preliminary materials. |

| | |

o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

| | |

(1) | | Amount Previously Paid: |

| | |

(2) | | Form, Schedule or Registration Statement No.: |

| | |

(3) | | Filing Party: |

| | |

(4) | | Date Filed: |

On July 29, 2015, Accretive Health, Inc. filed a Current Report on Form 8-K including the following disclosure:

ITEM 5.02 DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS

(e)

On July 27, 2015, the Board of Directors of the Company (the “Board”) approved a targeted retention program (the “Retention Bonus Program”) for certain of the Company’s key employees, including its named executive officers, and critical members of its management team (the “Key Employees”) and enhanced change of control severance arrangements (the “Enhanced Change of Control Severance Program”) for the Key Employees of the Company. The Board and the Compensation Committee of the Board (the “Compensation Committee”) determined that it is appropriate and in the best interest of the Company and its stockholders to adopt the Retention Bonus Program and the Enhanced Change of Control Severance Program in order to preserve the value of the Company by retaining the Company’s Key Employees during the Company’s announced strategic alternative review by Goldman Sachs and Co. on behalf of the Board. The Retention Bonus Program and Enhanced Change of Control Severance Program are also intended to mitigate any uncertainty regarding future employment resulting from Ascension Health’s (“Ascension”) unsolicited proposal to acquire the Company or other strategic alternatives that the Board may elect to pursue. In connection with its adoption of the Retention Bonus Program and the Enhanced Change of Control Severance Program, the Board and the Compensation Committee consulted with Company management and the Company’s legal advisors and independent compensation consultant to review and evaluate the terms of the programs.

Each Key Employee participant in the Retention Bonus Program is eligible to receive a retention bonus in an amount described below, fifty percent of which is payable upon the closing of a “change of control” type transaction involving the Company and the remaining fifty percent of which is payable ninety days following the closing of the change of control. These payments are subject to the Key Employee’s continued employment through the payment date or, solely with respect to the second portion of the retention bonus, termination of the Key Employee’s employment without “cause,” due to the Key Employee’s death or disability or by the Key Employee for “good reason” following the closing of the change of control, but prior to the payment of the second portion of the bonus. Dr. Rizk and Messrs. Csapo and Flanagan will be eligible for retention bonuses equal to two times the sum of their respective base salaries and target bonuses (with aggregate retention bonuses of $3,000,000, $1,692,000 and $2,380,000, respectively) and other Key Employee participants in the Retention Bonus Program will be eligible for aggregate retention bonuses based upon a percentage of the applicable employee’s base salary, and in certain cases, target bonus.

The Enhanced Change of Control Severance Program provides that Key Employees whose employment is terminated by the successor to the Company without cause or by the employees for good reason (a “Qualifying Termination”), in each case, during the 24 month (or, with respect to certain Key Employees, the 12 month) period following a “change of control” (the “Protected Period”), will be entitled to lump sum cash severance payments in amounts based on a percentage of the Key Employee’s base salary and, in certain cases, target bonus (with Dr. Rizk and Messrs. Csapo and Flanagan being entitled to such payments in an amount equal to two times the sum of their respective base salaries and target bonuses). Assuming a Qualifying Termination of their respective employment on July 28, 2015 (and assuming a change of control had occurred), the aggregate severance payments to which Dr. Rizk and Messrs. Csapo and Flanagan would be entitled under the Enhanced Severance Program are $3,000,000, $1,692,000 and $2,380,000, respectively. Dr. Rizk’s cash severance entitlement under the Enhanced Severance Program is the same as under his current offer letter with the Company, except that severance under the Enhanced Severance Program will be payable in a lump sum, rather than installments.

The Company intends to enter into letter agreements with participants in the Retention Bonus Program and the Enhanced Change of Control Severance Program, including Dr. Rizk and Messrs. Csapo and Flanagan, to effectuate the foregoing.

On July 23, 2015, the Compensation Committee approved the grant of cash bonuses to those participants in the Company’s 2014 annual cash incentive bonus plan who received all or a portion of their 2014 annual incentive

award in the form of restricted shares of the Company’s common stock (the “2014 Bonus Plan RSA Grantees”), including each of the Company’s named executive officers, Dr. Rizk and Messrs. Csapo and Flanagan. The Compensation Committee determined that it was appropriate to grant these bonuses to mitigate the effect of the significant decrease in the Company’s stock price following the grant and the associated reduction in the overall value of the 2014 annual incentive awards granted to 2014 Bonus Plan RSA Grantees as a result of the Company’s disclosure on July 16, 2015 of the unsolicited takeover offer for the Company by Ascension. These bonuses will be paid to 2014 Bonus Plan RSA Grantees on the first or second regularly scheduled payroll date following the Company’s scheduled second quarter earnings release on August 5, 2015 and will be equal to (i) $5.38 (which was the Company’s per share closing trading price on the date that the Company determined the number of restricted shares to be granted to 2014 Bonus Plan RSA Grantees), minus the trading price per share of the Company’s common stock as of the close of trading on the second business day following the earnings release, multiplied by (ii) the number of restricted shares granted to the applicable 2014 Bonus Plan RSA Grantee (which were 78,067, 34,944 and 132,714 for Dr. Rizk, and Messrs. Csapo and Flanagan, respectively).

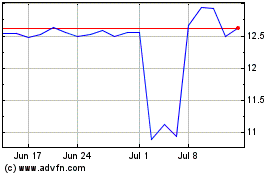

R1 RCM (NASDAQ:RCM)

Historical Stock Chart

From Mar 2024 to Apr 2024

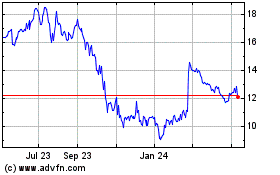

R1 RCM (NASDAQ:RCM)

Historical Stock Chart

From Apr 2023 to Apr 2024