AXA Profit Boosted By US Property Sales

August 03 2016 - 1:40AM

Dow Jones News

By Alexa Liautaud

PARIS--Europe's second-largest insurance company, AXA SA (CS.FR)

said Wednesday that first-half net income rose as the sale of two

real-estate properties in the U.S. helped offset costs related to

storms in Germany and floods in France.

Net income for the first six months of the year rose 4% to 3.21

billion euros ($3.6 billion) from EUR3.08 billion in the same

period last year. The figure fell below expectations, missing the

EUR3.64 billion estimate of analysts surveyed by a Dow Jones

Newswire poll.

AXA, like other insurers in Europe, has struggled with the

eurozone's record-low interest rate as it mostly relies on bond

yields to generate its profit.

In June, AXA laid out a four-year strategic plan that aims to

increase profitability by cutting costs worth EUR2.1 billion by

2020. The company seeks to achieve higher growth in select areas

such as Asia.

Revenue in the first half of the year fell 0.5% to EUR54.04

billion from EUR54.32 billion in the same period a year

earlier.

Life and savings annual premium equivalent, known as APE, was

down 2% at the end of June. APE measures new business growth for

life insurance by combining the value of payments on new regular

premium policies, and 10% of the value of payments made on

one-time, single-premium products.

The Paris-based insurance giant reported that its solvency II

ratio--a key measure of an insurance company's financial

strength--fell to 197% in the first half of 2016 down from 205% in

the same period last year.

AXA's shares have dropped 31% since the beginning of the

year.

-Write to Alexa Liautaud at alexa.liautaud@wsj.com

(END) Dow Jones Newswires

August 03, 2016 01:25 ET (05:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

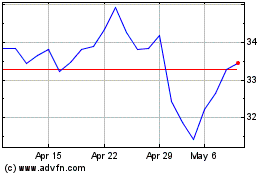

Axa (EU:CS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Axa (EU:CS)

Historical Stock Chart

From Apr 2023 to Apr 2024