Year Marks Completion of Long-Term Agreements

and Improved Cash Flow Generation

Air Transport Services Group, Inc. (Nasdaq: ATSG), the leading

provider of medium wide-body aircraft leasing, air cargo

transportation and related services, today reported consolidated

financial results for the quarter and full year ended December 31,

2014.

For the fourth quarter of 2014:

- Adjusted pre-tax earnings from

continuing operations increased 19 percent to $17.7 million. The

adjustments remove the effects of pension settlement charges,

derivative transactions, and year-earlier impairment charges. These

and other adjusted amounts referenced below are non-GAAP financial

measures, defined and reconciled to comparable GAAP results in

tables at the end of this release.

- Adjusted net earnings from continuing

operations increased 11 percent to $10.8 million, or 17 cents per

share diluted. Operating loss carryforwards for U.S. federal income

tax purposes offset much of the company’s federal tax liabilities.

ATSG does not expect to pay significant federal income taxes until

2017 at the earliest.

- Revenues were $157.9 million, slightly

higher than a year ago and up $19.5 million from the third quarter

of 2014. Excluding revenues from reimbursable expenses, revenues

decreased 3 percent compared to the fourth quarter of 2013.

Increases in revenues from additional dry leases to external

customers in 2014 offset the ending of Mideast ACMI operations for

DHL in 2013.

- Adjusted EBITDA (Earnings Before

Interest, Taxes, Depreciation and Amortization) increased by 15

percent to $50.8 million from $44.3 million a year ago. Full year

adjusted EBITDA grew by 14 percent to $179.5 million from $157.5

million in 2013.

In January, ATSG completed a multi-year commercial agreement

with DHL that calls for the extension through March 2019 of the

Boeing 767 freighter leases and operating services that ATSG has

provided in support of DHL’s U.S. network for more than a decade.

Dry leases for 13 ATSG-owned Boeing 767 freighters already leased

to DHL were extended through March 2019, and two others operating

for DHL will be converted to four year leases. ATSG’s businesses

will continue to operate and maintain those aircraft through March

2019 under an amended and restated CMI (Crew, Maintenance and

Insurance) Agreement.

Joe Hete, President and Chief Executive Officer of ATSG, said,

“ATSG’s principal businesses made significant progress in 2014, as

our leasing unit grew its portfolio of multi-year dry leases by 20

percent, to 24 aircraft, and our airlines turned in a strong

holiday season performance to cap a successful year. In the fourth

quarter, we achieved our best Adjusted EBITDA in six years, aided

by full deployment of our available aircraft. Fundamental industry

dynamics point toward an excellent year for air cargo companies in

2015, and we fully expect to benefit from these factors assuming

these trends continue.”

ATSG’s GAAP net earnings for the fourth quarter reflect a

one-time settlement option offered to certain beneficiaries of its

qualified pension plans in December 2014. The response to the offer

settled $98.7 million of pension obligations under two plans and

led to pre-tax non-cash charges of $6.7 million to continuing

operations and $5.0 million to discontinued operations in the

fourth quarter of 2014. GAAP results for 2013 include a $52.6

million pre-tax impairment charge in the fourth quarter related to

airline entity goodwill.

The one-time pension settlements, which will result in a

reduction in future pension obligations and expense volatility,

reduced net earnings from continuing operations by $0.07 per share

and from discontinued operations by $0.05 per share in 2014. The

impairment charges reduced 2013 net earnings by $0.82 per

share.

Segment Results

Cargo Aircraft Management (CAM)

CAM Fourth Quarter

Year ($ in thousands)

2014

2013 2014

2013 Revenues $ 44,852 $ 41,922 $ 166,303 $ 160,342 Pre-Tax

Earnings 14,478 16,228

53,159 66,208

Significant Developments:

- All of CAM’s $2.9 million increase in

fourth-quarter revenue came from external customers, totaling $21.2

million for the quarter. Externally leased freighters increased to

24 during 2014, from 20 at the end of 2013.

- Lower pre-tax earnings for the quarter

reflect a $2.4 million increase in depreciation costs primarily

attributable to fleet upgrades and expansion.

- At December 31, 2014, CAM owned 53

Boeing cargo aircraft in serviceable condition. CAM added four

aircraft in total during 2014, including first-quarter additions of

one 757 combi and one 767-300 freighter, and two 767-300 freighters

purchased in the third quarter from the lessor.

- In February, we executed our 25th dry

lease by placing a 767 with Cargojet, and we exercised a purchase

option to acquire our 10th 767-300 freighter. This aircraft, which

we previously leased in from a third party, will be deployed as our

26th external dry lease, as DHL has committed to take it through

March 2019.

- CAM’s earnings are expected to increase

in 2015, as growth in leasing revenues under agreements completed

over the last year exceeds increases in depreciation and other

fixed charges.

ACMI Services

ACMI Services Fourth Quarter

Year ($ in thousands)

2014 2013

2014 2013 Revenues Airline services $

95,342 $ 100,399 $ 355,678 $ 376,592 Reimbursables 21,824

16,756 84,241 67,912 Total ACMI Services

Revenues 117,166 117,155 439,919 444,504 Pre-Tax Earnings

(Loss) Excluding Charges 1,482 (3,991 ) (5,381 ) (25,601 ) Less

Impairment Charge — (52,585 ) — (52,585 ) Less Pension Settlement

Charge (6,700 ) — (6,700 ) — Pre-Tax Loss

(5,218 ) (56,576 ) (12,081 ) (78,186 )

Significant Developments:

- Total ACMI Services revenues were flat

in the fourth quarter compared to the prior year quarter, and down

$5.1 million excluding reimbursables. Increased holiday-season

flying in the fourth quarter of 2014 did not entirely offset

reductions in revenues from international operations since the

fourth quarter of 2013. Airline services revenues grew more than

$11 million from the third quarter of 2014. ACMI block hours for

the fourth quarter were down 10 percent from a year ago, but down 1

percent excluding those from Mideast operations in the prior-year

period.

- Pre-tax profitability improved sharply

for the quarter, excluding the effect of the pension settlement, as

airline operating expenses declined. Principal factors were

reductions in employee wages and benefit costs due to workforce

reductions, and lower direct operating costs, including those costs

for newer 757 combi aircraft.

- Results also reflect the reallocation

of several aircraft from the airlines' fleets to CAM. Three 767

freighters were returned to CAM during 2014 for deployment to

external dry-lease customers. Also, two of four DHL-owned 767s that

ABX Air has leased and operated for DHL in the U.S. were returned

in December 2014; the other two are expected to be returned by the

end of this month.

- As results for the ACMI Services

segment in 2015 will include the effect of higher pension expense,

changes in pricing under the DHL agreements, additional airframe

heavy maintenance checks, and other items, we anticipate 2015

pre-tax results for the segment will decline approximately $6

million from 2014.

Other Activities

Other Activities Fourth Quarter

Year ($ in thousands)

2014

2013 2014

2013 Revenues $ 36,938 $ 34,050 $ 142,294 $ 117,292 Pre-Tax

Earnings Excluding Pension Settlement Costs 2,228

3,012 11,363 12,200

Significant Developments:

- External customer revenues from all

other activities in the fourth quarter were $19.6 million, down 10

percent compared to 2013. Fourth-quarter revenues increased 5

percent for AMES, the company’s maintenance and repair business.

However, the gain was offset by higher costs, including more costs

for expanded hangar operations in Wilmington. Revenues from

management of sorting centers for the U.S. Postal Service increased

for the quarter and the full year. The company is in discussions

with the USPS about renewal of postal center contracts, some of

which would otherwise expire during 2015.

Outlook

ATSG now projects that its baseline Adjusted EBITDA from

Continuing Operations for 2015 will be approximately $180 million,

recognizing the offsetting effects of additional 767 dry leases,

higher pension expense due to lower discount rates and pricing

under its new DHL agreements, among other factors.

Capital expenditures are projected to decrease to approximately

$80 million in 2015 compared to $112.2 million in 2014.

Hete noted that "In 2014, ATSG set the stage for several years

of continued strong cash generation. New agreements with DHL that

begin in April and continue through March 2019, together with the

multi-year dry leases we have executed with other customers,

provide excellent visibility of future revenue and cash flow. We

plan to take advantage of our strong balance sheet and substantial

cash flow to grow our businesses through selected investments that

meet our ROIC hurdles. At the same time, in the second quarter, we

plan to initiate the share repurchase program that our Board

authorized last summer."

Conference Call

ATSG will host a conference call on Friday, March 6, 2015, at

10:00 a.m. Eastern time to review its financial results for the

fourth quarter of 2014. Participants should dial (888) 895-5479 and

international participants should dial (847) 619-6250 ten minutes

before the scheduled start of the call and ask for conference pass

code 38990766. The call will also be webcast live (listen-only

mode) via www.atsginc.com.

A replay of the conference call will be available by phone on

March 6, 2015, beginning at 2:00 p.m. and continuing through March

13, 2015, at (888) 843-7419 (international callers (630) 652-3042);

use pass code 38990766#. The webcast replay will remain available

via www.atsginc.com for 30 days.

About ATSG

ATSG is a leading provider of aircraft leasing and air cargo

transportation and related services to domestic and foreign air

carriers and other companies that outsource their air cargo lift

requirements. ATSG, through its leasing and airline subsidiaries,

is the world's largest owner and operator of converted Boeing 767

freighter aircraft. Through its principal subsidiaries, including

two airlines with separate and distinct U.S. FAA Part 121 Air

Carrier certificates, ATSG provides aircraft leasing, air cargo

lift, aircraft maintenance services and airport ground services.

ATSG's subsidiaries include ABX Air, Inc.; Airborne Global

Solutions, Inc.; Air Transport International, Inc.; Cargo Aircraft

Management, Inc.; and Airborne Maintenance and Engineering

Services, Inc. For more information, please see

www.atsginc.com.

Except for historical information contained herein, the matters

discussed in this release contain forward-looking statements that

involve risks and uncertainties. There are a number of important

factors that could cause Air Transport Services Group's ("ATSG's")

actual results to differ materially from those indicated by such

forward-looking statements. These factors include, but are not

limited to, changes in market demand for our assets and services,

the number and timing of deployments of our aircraft, our operating

airlines' ability to maintain on-time service and control and

reduce costs, and other factors that are contained from time to

time in ATSG's filings with the U.S. Securities and Exchange

Commission, including its Annual Report on Form 10-K and Quarterly

Reports on Form 10-Q. Readers should carefully review this release

and should not place undue reliance on ATSG's forward-looking

statements. These forward-looking statements were based on

information, plans and estimates as of the date of this release.

ATSG undertakes no obligation to update any forward-looking

statements to reflect changes in underlying assumptions or factors,

new information, future events or other changes.

AIR TRANSPORT SERVICES GROUP, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF EARNINGS(In

thousands, except per share data)

Three Months Ended Year Ended

December 31, December 31, 2014

2013 2014 2013 REVENUES $ 157,938 $

156,963 $ 589,592 $ 580,023 OPERATING EXPENSES Salaries,

wages and benefits 43,470 48,612 166,526 175,383 Maintenance,

materials and repairs 26,399 25,270 91,528 97,053 Depreciation and

amortization 29,826 25,672 108,254 91,749 Fuel 13,188 11,219 53,521

49,376 Rent 5,727 6,940 26,650 27,468 Travel 4,481 4,785 17,662

18,693 Landing and ramp 2,541 2,940 10,305 11,204 Insurance 1,417

1,750 5,304 6,216 Pension settlement 6,700 — 6,700 — Impairment of

goodwill — 52,585 — 52,585 Other operating expenses 9,904

11,197 38,617 37,111 143,653 190,970 525,067

566,838

OPERATING INCOME 14,285 (34,007 ) 64,525 13,185 OTHER INCOME

(EXPENSE) Interest income 26 18 92 74 Interest expense (3,324 )

(3,749 ) (13,937 ) (14,249 ) Net gain on derivative instruments 127

206 1,096 631 (3,171 ) (3,525 ) (12,749

) (13,544 )

EARNINGS (LOSS) FROM CONTINUING OPERATIONS BEFORE INCOME TAXES

11,114 (37,532 ) 51,776 (359 ) INCOME TAX EXPENSE (4,455 ) (5,308 )

(19,702 ) (19,266 )

EARNINGS (LOSS) FROM CONTINUING OPERATIONS 6,659

(42,840 ) 32,074 (19,625 ) EARNINGS (LOSS) FROM DISCONTINUED

OPERATIONS, NET OF TAX (2,948 ) (1 ) (2,214 ) (3 ) NET EARNINGS

(LOSS) $ 3,711 $ (42,841 ) $ 29,860 $ (19,628 )

EARNINGS (LOSS) PER SHARE - Basic Continuing operations $

0.10 $ (0.67 ) $ 0.50 $ (0.31 ) Discontinued operations (0.04 ) —

(0.04 ) — NET EARNINGS (LOSS) PER SHARE $ 0.06

$ (0.67 ) $ 0.46 $ (0.31 ) EARNINGS (LOSS) PER SHARE

- Diluted Continuing operations $ 0.10 $ (0.67 ) $ 0.49 $ (0.31 )

Discontinued operations (0.04 ) — (0.03 ) — NET

EARNINGS (LOSS) PER SHARE $ 0.06 $ (0.67 ) $ 0.46 $

(0.31 ) WEIGHTED AVERAGE SHARES Basic 64,289 64,054

64,253 63,992 Diluted 65,222 64,054

65,211 63,992

AIR TRANSPORT SERVICES GROUP, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE SHEETS(In thousands,

except share data)

December 31, December 31, 2014

2013 ASSETS CURRENT ASSETS: Cash and cash equivalents

$ 30,560 $ 31,699 Accounts receivable, net of allowance of $812 in

2014 and $717 in 2013 43,513 52,247 Inventory 10,665 9,050 Prepaid

supplies and other 11,898 9,730 Deferred income taxes 19,770 13,957

Aircraft and engines held for sale 715 2,995 TOTAL

CURRENT ASSETS 117,121 119,678 Property and equipment, net

847,268 838,172 Other assets 28,230 21,143 Pension assets, net of

obligations — 14,855 Goodwill and acquired intangibles 39,010

39,291

TOTAL ASSETS $ 1,031,629

$ 1,033,139 LIABILITIES AND

STOCKHOLDERS’ EQUITY CURRENT LIABILITIES: Accounts payable $

40,608 $ 34,818 Accrued salaries, wages and benefits 25,633 23,163

Accrued expenses 8,201 9,695 Current portion of debt obligations

24,344 23,721 Unearned revenue 12,914 8,733 TOTAL

CURRENT LIABILITIES 111,700 100,130 Long term debt 319,750

360,794 Post-retirement obligations 92,050 30,638 Other liabilities

57,647 62,740 Deferred income taxes 102,993 109,869

STOCKHOLDERS’ EQUITY: Preferred stock, 20,000,000 shares

authorized, including 75,000 Series A Junior Participating

Preferred Stock — — Common stock, par value $0.01 per share;

75,000,000 shares authorized; 64,854,950 and 64,618,305 shares

issued and outstanding in 2014 and 2013, respectively 649 646

Additional paid-in capital 526,669 524,953 Accumulated deficit

(96,953 ) (126,813 ) Accumulated other comprehensive loss (82,876 )

(29,818 ) TOTAL STOCKHOLDERS’ EQUITY 347,489 368,968

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY $

1,031,629 $ 1,033,139

AIR TRANSPORT SERVICES GROUP, INC. AND

SUBSIDIARIESPRE-TAX EARNINGS AND ADJUSTED PRE-TAX EARNINGS

SUMMARYFROM CONTINUING OPERATIONSNON-GAAP RECONCILIATION(In

thousands)

Three Months Ended Year Ended

December 31, December 31, 2014

2013 2014 2013 Revenues

CAM $ 44,852 $ 41,922 $ 166,303 $ 160,342

ACMI

Services Airline services 95,342 100,399 355,678 376,592

Reimbursables 21,824 16,756 84,241 67,912

Total ACMI Services 117,166 117,155 439,919 444,504

Other Activities 36,938 34,050 142,294

117,292

Total Revenues 198,956 193,127 748,516

722,138 Eliminate internal revenues (41,018 ) (36,164 ) (158,924 )

(142,115 )

Customer Revenues $ 157,938

$ 156,963 $ 589,592

$ 580,023 Pre-tax Earnings from

Continuing Operations CAM, inclusive of interest expense

14,478 16,228 53,159 66,208

ACMI Services 1,482 (3,991 )

(5,381 ) (25,601 )

Other Activities 2,228 3,012 11,363

12,200

Pension settlement charge (6,700 ) — (6,700 ) —

Goodwill impairment charge — (52,585 ) — (52,585 )

Net,

unallocated interest expense (501 ) (402 ) (1,761 ) (1,212 )

Net gain (loss) on derivative instruments 127 206

1,096 631

Total Pre-tax Earnings

$ 11,114 $ (37,532 ) $

51,776 $ (359 ) Adjustments

to Pre-tax Earnings Add pension settlement cost 6,700 — 6,700 —

Add goodwill impairment charge — 52,585 — 52,585 Less net (gain)

loss on derivative instruments (127 ) (206 ) (1,096 ) (631 )

Adjusted Pre-tax Earnings $ 17,687

$ 14,847 $ 57,380

$ 51,595

Adjusted Pre-tax Earnings is defined as Earnings from Continuing

Operations Before Income Taxes less derivative gains or losses,

plus a pension settlement charge and goodwill impairment charge.

Management uses Adjusted Pre-tax Earnings from Continuing

Operations to assess the performance of its operating results among

periods. Adjusted Pre-tax earnings from Continuing Operations is a

non-GAAP financial measure and should not be considered an

alternative to Earnings from Continuing Operations Before Income

Taxes or any other performance measure derived in accordance with

GAAP.

AIR TRANSPORT SERVICES GROUP, INC. AND

SUBSIDIARIESUNAUDITED ADJUSTED EARNINGS FROM CONTINUING

OPERATIONS BEFORE INTEREST, TAXES, DEPRECIATION AND

AMORTIZATIONNON-GAAP RECONCILIATION(In thousands)

Three Months Ended Year Ended

December 31, December 31, 2014

2013 2014 2013 Earnings from

Continuing Operations Before Income Taxes $ 11,114 $ (37,532 )

$ 51,776 $ (359 ) Interest Income (26 ) (18 ) (92 ) (74 ) Interest

Expense 3,324 3,749 13,937 14,249 Depreciation and Amortization

29,826 25,672 108,254 91,749

EBITDA

from Continuing Operations $ 44,238 $ (8,129 ) $ 173,875 $

105,565 Add pension settlement charge 6,700 — 6,700 — Add goodwill

impairment charge — 52,585 — 52,585 Less net (gain) loss on

derivative instruments (127 ) (206 ) (1,096 ) (631 )

Adjusted EBITDA from

Continuing Operations $ 50,811 $ 44,250 $ 179,479

$ 157,519

EBITDA and Adjusted EBITDA from Continuing Operations are

non-GAAP financial measures and should not be considered as

alternatives to Earnings from Continuing Operations Before Income

Taxes or any other performance measure derived in accordance with

GAAP.

EBITDA from Continuing Operations is defined as Earnings from

Continuing Operations Before Income Taxes plus net interest

expense, depreciation, and amortization expense. Adjusted EBITDA

from Continuing Operations is defined as EBITDA from Continuing

Operations plus a pension settlement charge and a goodwill

impairment charge and less derivative gains or losses.

Management uses EBITDA from Continuing Operations as an

indicator of the cash-generating performance of the operations of

the Company. Management uses Adjusted EBITDA from Continuing

Operations to assess the performance of its operating results among

periods. EBITDA and Adjusted EBITDA from Continuing Operations

should not be considered in isolation or as a substitute for

analysis of the Company's results as reported under GAAP, or as an

alternative measure of liquidity.

AIR TRANSPORT SERVICES GROUP, INC. AND

SUBSIDIARIESUNAUDITED ADJUSTED EARNINGSNON-GAAP

RECONCILIATION(In thousands, except per share data)

Three Months Ended Year Ended

December 31, 2014 December 31, 2014 Per

Share Per Share Earnings Basic

Diluted Earnings Basic

Diluted Earnings (loss) from continuing

operations 6,659 $ 0.10 $ 0.10 32,074 $ 0.50 $ 0.49 Effect of

pension settlement charge, net of tax 4,147 0.07 0.07

4,147 0.06 0.07

Adjusted

earnings from continuing operations 10,806 $ 0.17

$ 0.17 36,221 $ 0.56 $ 0.56

Weighted Average Shares 64,289 65,222 64,253

65,211

Three Months Ended

Year Ended December 31, 2013 December 31, 2013

Per Share Per Share Earnings Basic

Diluted Earnings Basic Diluted

Earnings (loss) from continuing operations (42,840 ) $ (0.67

) $ (0.67 ) (19,625 ) $ (0.31 ) $ (0.31 ) Effect of goodwill

impairment charge 52,585 0.82 0.82 52,585

0.83 0.82

Adjusted earnings from

continuing operations 9,745 $ 0.15 $ 0.15

32,960 $ 0.52 $ 0.51

Weighted

Average Shares 64,054 65,004 63,992 64,857

Adjusted earnings and adjusted earnings per share from

continuing operations are a non-GAAP financial measures and should

not be considered as alternatives to earnings or earnings per share

from continuing operations or any other performance measure derived

in accordance with GAAP.

Adjusted earnings from continuing operations is defined as

earnings (loss) from continuing operations plus a pension

settlement charge and goodwill impairment charge. The goodwill

impairment charge is not deductible for income tax purposes.

Management uses adjusted earnings and adjusted earnings per

share from continuing operations to assess the performance of its

operating results. Adjusted earnings from continuing operations

should not be considered in isolation or as a substitute for

analysis of the Company's results as reported under GAAP.

AIR TRANSPORT SERVICES GROUP, INC. AND

SUBSIDIARIESIN-SERVICE CARGO AIRCRAFT FLEET

Aircraft Types December 31,

December 31, December 31, 2013

2014 2015 Projected Operating

Operating Operating Total Owned Lease Total

Owned Lease Total Owned Lease B767-200 40 36 4 38 36 2 36 36 —

B767-300 8 6 2 10 9 1 10 10 — B757-200 4 4 — 4 4 — 4 4 — B757 Combi

3 3 — 4 4 — 4 4 —

Total Aircraft 55 49

6 56 53 3 54 54 —

Owned Aircraft In Serviceable Condition December

31, December 31, December 31, 2013

2014 2015 Projected ATSG airlines 29 28 27-29

External customers 20 24 25-27 Staging/Unassigned — 1 —

49

53 54

ATSG Inc.Quint O. Turner, Chief Financial Officer,

937-382-5591

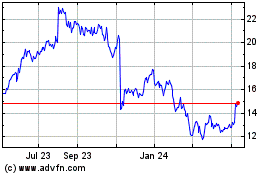

Air Transport Services (NASDAQ:ATSG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Air Transport Services (NASDAQ:ATSG)

Historical Stock Chart

From Apr 2023 to Apr 2024