TIDMASC

RNS Number : 0706J

ASOS PLC

01 April 2015

1 April 2015

ASOS plc

Global Online Fashion Destination

Interim Results for the six months ended 28 February 2015

Summary results

Six months Six months Change

GBP'000 to 28 February to 28 February

2015 2014

-------------------------------------- --------------------------- --------------------------- --------------------

Group revenues(1) 550,474 481,726 14%

Retail sales 536,429 472,319 14%

UK retail sales 231,370 182,040 27%

International retail sales 305,059 290,279 5%

Gross profit 265,199 243,087 9%

Retail gross margin 46.8% 49.5% (270bps)

Gross margin 48.2% 50.5% (230bps)

Profit before tax(2) 18,044 20,097 (10%)

Diluted earnings per share 17.6p 18.5p (5%)

Cash and cash equivalents 64,891 36,914 76%

-------------------------------------- --------------------------- --------------------------- --------------------

(1) Includes retail sales, delivery receipts and third party

revenues

(2) For the six months to 28 February 2015, profit before tax

includes business interruption reimbursements of GBP6.3m in respect

of a warehouse fire in the prior financial year

Highlights

-- Retail sales up 14% (UK retail sales up 27%, International retail sales up 5%)

-- 9.3 million active customers(3) at 28 February 2015, up 13% on prior year

-- Retail gross margin down 270bps

-- Profit before tax(2) of GBP18.0m (2014: GBP20.1m)

-- Cash and cash equivalents of GBP64.9m (31 August 2014: GBP74.3m)

-- Zonal pricing capability deployed and Barnsley automation landed

-- New CIO and People Director appointed

(3) Defined as having shopped in the last twelve months

Nick Robertson, CEO, commented:

"Trading for the six months ended 28 February 2015 included a

record Christmas season, with total sales increasing by +14%. UK

growth remained strong with sales up +27% and International sales

up +5% (+10% on a constant currency basis). Our customer engagement

remains high, with growth in visits, average order frequency,

average basket size and conversion all improving. Our active

customers(3) grew by 13%, exceeding the 9m mark for the first

time.

The successful launch of our zonal pricing capability and

planned investment in our international prices resulted in a gross

margin decrease of 230bps during the period, which together with

increased investment in building our global distribution capacity,

has reduced half year profit before tax by 10% to GBP18.0m.

With our continued investment in our international price

competitiveness gaining traction, momentum in the business is

building. This gives us confidence in the outlook for the second

half and that full year profit and margin will be in line with

expectations."

Investor and Analyst Meeting

There will be a meeting for analysts that will take place at

9.30am today, 1 April 2015, at Greater London House, Hampstead

Road, London, NW1 7FB. A webcast of the meeting will be available

both live and following the meeting at www.asosplc.com. Please

register your attendance in advance with Instinctif Partners using

the details below.

For further information:

ASOS plc Tel: 020 7756 1000

Nick Robertson, Chief Executive Officer

Nick Beighton, Chief Operating Officer /

Chief Financial Officer

Greg Feehely, Head of Investor Relations

Website: www.asosplc.com/investors

Instinctif Partners Tel: 020 7457 2020

Matthew Smallwood / Justine Warren / Guy

Scarborough

JPMorgan Cazenove Tel: 020 7742 4000

Luke Bordewich

Numis Securities Tel: 020 7260 1000

Alex Ham

Background note

ASOS is a global fashion destination for 20-somethings. We sell

cutting-edge 'fast fashion' and offer a wide variety of

fashion-related content, making ASOS.com the hub of a thriving

fashion community. We sell over 75,000 branded and own-brand

products through localised mobile and web experiences, delivering

from our fulfilment centres in the UK, US, Europe and China to

almost every country in the world.

We tailor the mix of own-label, global and local brands sold

through each of our nine local language websites: UK, US, France,

Germany, Spain, Italy, Australia, Russia and China.

ASOS's websites attracted 88 million visits during February 2015

(February 2014: 71 million) and as at 28 February 2015 had 9.3

million active customers(1) (28 February 2014: 8.2 million), of

which 3.7 million were located in the UK and 5.6 million were

located in our international territories (28 February 2014: 3.2

million in the UK and 5.0 million internationally).

(1) Defined as having shopped in the last twelve months

www.asos.com

www.us.asos.com

www.asos.de

www.asos.fr

www.asos.com/au

www.asos.it

www.asos.es

www.asos.com/ru

www.asos.cn

m.asos.com

marketplace.asos.com

ASOS plc ("the Company")

Global Online Fashion Destination

Interim Results for the six months ended 28 February 2015

Business Review

The Group has delivered retail sales growth of 14% to GBP536.4m

(2014: GBP472.3m) during the six months ended 28 February 2015,

with encouraging momentum in our international markets following

our planned price investments and launch of our zonal pricing

solution. The impact of this international price investment on

gross margins, plus increased warehousing costs as we build our

global warehousing capability, resulted in a decline of 10% in

profit before tax to GBP18.0m (2014: GBP20.1m). We remain confident

in our outlook for the remainder of the year and our investments in

warehouse and technology remain on track.

Our fashion

Our product offer continues to be focused around three key

pillars; extensive, appropriate fashion at great value for money

for our global fashion conscious 20-something customer. We stock

over 75,000 lines across more than 750 brands, including our

exclusive in-house ASOS label. Our portfolio of third party brands

is constantly reviewed to ensure that it includes the most relevant

and sought after brands for our customer. With this in mind, over

the last six months we have added 150 new brands, including

Abercrombie & Fitch, Adidas, Ellesse, Reebok, Sisley, Only

& Sons and Liquor & Poker, and removed 180 brands.

Our ranges cater for seasonal events and trends. We have seen

our menswear customer become more focused on trend items, with

particular success in longline tops, black denim, trainers and

Chelsea boots. In Womenswear, key items for the season have

included playsuits and jumpsuits, shirts, trainers, oversized coats

and scarves. Christmas and Black Friday remain the major events of

the season; we offer a comprehensive range of going out and

occasion wear product for these events. In addition we increased

our gifting range with a more extensive selection of beauty, men's

grooming, novelty gifts and also more traditional items such as

nightwear. In addition, events such as Halloween and Valentine's

Day are becoming increasingly important to our customer and we have

responded by adding specific ranges for these celebrations.

Our wide range of sizes continues to be an important element of

our offer. We stock sizes 2 to 30 in Womenswear & XXXS to XXXL

in Menswear, as well as an assortment of leg lengths, waist and

shoes sizes. We have continued to add to this with an increased

range of Fuller Bust Lingerie and Swimwear, as well as the addition

of wide fit shoes. We also continue to extend the offer on our

specialist ranges: Plus Size, Petite, Tall and Maternity. As well

as broadening our own-label range, we have added to our third party

brands in this area; Chi Chi Plus, Jarlo Tall and John Zack Petite

are amongst a number of brand additions this season.

Our price proposition remains core to our offer. In recent

seasons we have added a range of value brands such as New Look,

Monki and Weekday that cater for our customers on a more limited

budget, whilst also ensuring that our own-label range is

competitively priced. However, a good spread of price points that

remain great value for money is also important to our customers. We

have therefore refocused our "top end" offer and streamlined our

portfolio of third party premium brands to those that remain

accessible to our 20-something customer, such as Ted Baker, Reiss,

Whistles and new additions Gestuz and Supertrash. We have also

relaunched ASOS White, our premium own label, and introduced a

range of ASOS "Red Carpet" evening dresses. Both of these ranges

have stretched the price architecture within our own-label

portfolio and have been well received by customers.

Another key element of our price proposition is our ability to

differentially price brands by market, which became possible during

the period following the launch of our zonal pricing capability.

This capability allows brands that were previously uncompetitively

priced in local currency to be priced in line with the local

market. We have affected 50 brands across Australia, the US,

France, Germany, Italy and Spain during the season and initial

results have been encouraging. We plan to add further brands over

the next six months as international price competitiveness

continues to be a key objective for us.

Operations

Technology

We remain committed to investing a total of GBP75m in our

technology by the end of the next financial year, and have made

significant progress during the last six months. We rolled out our

zonal pricing functionality in Australia, France, Germany, Spain,

Italy and the US during the period, enabling us to offer more

competitive local pricing and to sell brands which were previously

restricted in these territories.

We also launched localised versions of our Android and iOS apps

in France, Germany and the US during the period, and in Italy,

Spain and Russia during March 2015. Traffic from mobile devices now

represents over 50% of all traffic and in response to this we

launched our first mobile-only promotions during the period and

continue to improve the speed and stability of all our apps. We

will further expand our international mobile offering during the

next six months with the launch of a localised app in China.

We continue to invest in our underlying platforms and

behind-the-scenes technology in order to support our global

expansion and deliver the best customer experience. Our website

replatforming continues; we successfully reengineered our order

processing platforms to support peak volumes and we are focused on

developing our new checkout function to launch on mobile during the

next six months.

We have recently commenced our global fulfilment programme,

which will optimise our global stock management capabilities and

provide greater flexibility to move stock efficiently around our

global warehousing network. During the period, we delivered a new

warehouse control system to support our automation in Barnsley, as

well as developing stock monitoring capabilities within our Eurohub

fulfilment centre in Germany. This global fulfilment programme is a

key step in our journey to becoming a truly global retailer.

Customer Experience

Our customer engagement remains high, with growth in visits,

average order frequency, average basket size and conversion. Active

customers grew by 13% over last year, surpassing the 9m mark for

the first time.

We recently introduced our 'social sign-in' functionality across

all our websites and apps, enabling customers to sign in using

their Facebook, Twitter and Google+ details, simplifying the

customer journey from browsing to buying product. Our personalised

product recommendations function has also been launched across our

mobile apps, and will be rolled out to our websites over the next

six months. To improve our international customer experience, we

recently added our upgraded search facility to our Spanish,

Italian, Australian and Russian websites.

Uptake of our ASOS Premier membership in the UK, US, France,

Germany and Australia continues to grow, with total members up

nearly 70% on last year.

Global expansion

Our principal international objective this period has been to

restore our price competitiveness, following a period of adverse

exchange rate movements.

During the first six months of the year we have reduced local

currency prices for our Australian, New Zealand and Eurozone

customers, and initial customer response is encouraging, with

increased sales growth in these territories as well as increases in

our Comscore rankings in France, Italy and Spain (Comscore,

February 2015). We will continue to focus on our product and

pricing offer in existing strategic markets before expanding into

new markets, but expect to launch new European websites within the

next year.

We have invested a further GBP3.1m (2014: GBP3.7m) in our China

operation during the period and are pleased with our progress in

this territory.

Delivery and returns

Expanding our delivery and returns solutions remains central to

achieving our goal of providing a best-in-class customer

proposition across our strategic markets and we have continued to

enhance our offer during the last six months.

In the UK, we extended our Saturday evening next-day delivery

cut-off from 8pm to midnight and our Sunday next-day delivery

cut-off from 2pm to 5pm, as well as introducing an estimated

delivery date at checkout for standard orders.

Internationally, following the introduction of our next-day

delivery service in France and Germany, we extended this offer to

customers in Spain, Italy, Denmark, Sweden and the Netherlands

during the period. We plan to further extend our next-day delivery

service into Belgium, Ireland and Northern Ireland by the end of

this financial year. We have also added new mid-tier services in

Korea and Singapore, which have at least halved delivery lead times

in each of these territories compared with our standard service.

Over the next six months, we are planning to add similar mid-tier

services in Russia, Hong Kong, Taiwan and Japan.

We have also extended return options during the period, with the

launch of returns via Doddle stores, home collection returns and

InPost LockerBoxes in the UK. Internationally, we introduced

labelless returns in France, the Netherlands, Belgium and

Luxembourg as well as launching a three month free returns trial in

the Netherlands.

We continue to focus on developing our Pick-Up-Drop-Off ('PUDO')

network, which allows customers to collect and return their orders

from a variety of convenient locations. Customers in France, Spain,

Belgium, Luxembourg, and soon Germany, benefit from a

delivery-to-store option at over 28,000 locations and in the UK we

launched a click-and-collect trial with Boots stores in North

London. We continue to seek further PUDO solutions in all our key

strategic territories.

Warehousing

Our warehousing activities continue to increase, with total

order processing up 14% year on year, including our biggest ever

peak trading volumes during November 2014, reaching a record 2m

parcel despatches in one week.

At Barnsley, our mechanised picking solution was launched at the

start of this financial year and whilst this has involved some

short-term disruption to our logistic activities during the period,

it is now beginning to deliver operational benefits. By the end of

February, the vast majority of orders were being batch picked and

we are targeting a per-person picking capability of 200 units per

hour by the end of the financial year. Labour cost per unit for our

UK warehouses has also increased by 7% to 81p (2014: 76p) as a

result of the short-term disruption but we expect this to decrease

over the remainder of the year, and continue to target a

medium-term UK labour cost per unit of 50p.

We exited our off-site storage facility at Lister Hills during

February following the go-live of our two high bay mini-loads

earlier in the period, which double our Barnsley on-site storage

capacity. Our new warehouse control system now automatically

retrieves stock as required from the mini-loads to maintain stock

levels in the main pick-face area of the warehouse, increasing

efficiency and our stock management capabilities.

We received a further, and final, GBP6.3m insurance

reimbursement during the period following a fire in this warehouse

in June 2014. This has been reinvested in our international pricing

proposition.

We continue to develop our international warehousing

infrastructure, particularly in Europe, and during the second half

of the year will focus on increasing stock levels in our German

Eurohub, to allow us to continue to improve Eurozone delivery lead

times and further extend delivery cut-off times. The Eurohub

currently despatches 24% of total EU orders, principally to

Germany, France, Spain, Sweden and the Netherlands, and we expect

this to increase to 35% by the year end. Our returns processing

centre in Swiebodzin already processes nearly all returns from the

Eurozone, improving refund processing times.

Our warehouse in the US continues to develop and consistently

fulfils over 25% of US orders. We will turn our focus back to our

US fulfilment during the next financial year in order to further

drive local fulfilment in this territory.

People

During the period, our team grew by 281 to 1,822 employees at 28

February 2015. In addition, the Board have made a number of

appointments, strengthening the senior management team of the

Group.

We will be joined by Clifford Cohen, who has been appointed as

Group Chief Information Officer and will join the Group in May.

Clifford is a senior IT professional with an extensive background

in commercial technology leadership, programme delivery and

operations. Most recently, Clifford spent seven years with Marks

and Spencer in a variety of IT related roles including retail,

multi-channel and ultimately as Interim Group Chief Information

Officer. Prior to Marks and Spencer, Clifford spent eight years

with Accenture where he led IT teams on supply chain for Dixons

Stores, re-platforming for Sainsbury's and Merchandising and Supply

Chain for New Look.

In March, we were joined by Peter Collyer, our new People

Director, who brings exceptional experience to ASOS. He is a senior

human resource executive having worked for world class,

international, consumer facing corporations. Most recently he ran

Global HR for Claire's Stores Inc., the Chicago based retailer with

3,600 stores across 44 countries, specialising in beauty products,

jewellery and accessories for younger women. Prior to that, Peter

spent over ten years with The Walt Disney Company in a number of

people roles, ranging from the Disney Stores, Disney consumer

products and Disney global retail. Amongst his other jobs, Peter

spent four years with fashion retailer Oasis Stores.

Our search for a new Group Chief Financial Officer is now at an

advanced stage and we will update the market in due course.

These appointments all bring highly relevant experience to ASOS

from some of the world's largest international companies at a time

when ASOS is putting in place the capabilities to support the next,

significant leg in its growth story.

Financial review

Revenue

Six months to 28 February

2015 Group International

GBP'000 total UK US EU RoW total

-------- -------- ------- -------- -------- --------------

Retail sales 536,429 231,370 54,528 136,228 114,303 305,059

Growth 14% 27% 17% 7% (1%) 5%

Growth at constant

exchange rate 17% 27% 14% 14% 5% 10%

Delivery receipts 11,768 5,440 1,554 2,214 2,560 6,328

Growth 56% 60% 86% 40% 49% 53%

Third party revenues 2,277 2,277 - - - -

Growth 22% 22% - - - -

Total revenues 550,474 239,087 56,082 138,442 116,863 311,387

Growth 14% 28% 18% 7% (1%) 6%

-------- -------- ------- -------- -------- --------------

The Group generated retail sales growth of 14% during the

period, with growth of 27% in the UK and 5% in our international

markets (10% at constant exchange rates), where we have started to

see improvements following our price investments. As a result,

international retail sales now account for 57% (2014: 61%) of total

retail sales.

Retail sales in the UK increased by 27%, driven by a strong peak

Christmas trading period and continuous improvements to our

market-leading proposition in this territory. We retained our first

place position for unique visitors to apparel retailers in the

15-34 age range (Comscore, February 2015).

US retail sales have grown by 17% (constant currency growth 14%)

following further expansion of our range of locally relevant

brands, a strong full price sales mix, and uptake of our premier

membership scheme.

The EU has been impacted by adverse currency movements during

the last six months, with sales growth of 7% (constant currency

growth 14%). Following improvements to our delivery proposition in

key European countries and investment in our prices across the

Eurozone, sales momentum has started to recover in recent months.

Growth is particularly encouraging in France, where customers are

responding well to our localised promotions following the launch of

our zonal pricing functionality in this territory.

Our Rest of World segment also continues to be affected by

adverse currency movements with reported sales down 1% on prior

year, although sales in this territory were up 5% on a constant

currency basis. Our price investments in Australia and New Zealand

have been well received and recent visits growth is encouraging. We

comfortably retained our first place Comscore position in

Australia. Sales in Russia have continued to suffer due to

macro-economic factors and adverse exchange rates in this

territory. Our ASOS China operation had a strong Christmas trading

period and we continue to focus on increasing brand awareness and

our market share in this territory.

Delivery receipts increased by 56% driven by the introduction of

global minimum free-delivery spend thresholds in late 2014, a wider

range of paid delivery options and uptake in our premier membership

scheme.

Third party revenues, which mainly comprise advertising revenues

from the website and the ASOS magazine, increased by 22% as we

undertook larger campaigns than in the prior period.

Customer engagement

We have continued to attract new customers and had 9.3m active

customers(1) at 28 February 2015, an increase of 13% since the

comparative period. Average basket value increased by 7%, driven by

an 8% increase in average units per basket as customers responded

well to our ongoing proposition improvements, including our free

international express delivery offers above a minimum spend

threshold.

Conversion(2) increased by 10bps and average order frequency

increased by 6%, reflecting the compelling nature of our

proposition.

Six months Six months Change

to 28 February to 28 February

2015 2014

------------------------------------------- ---------------- ---------------- -------

Active customers(1) ('000) 9,268 8,173 13%

Average basket value (including VAT) GBP67.12 GBP62.67 7%

Average units per basket 2.72 2.52 8%

Average selling price per unit (including

VAT) GBP24.70 GBP24.85 (1%)

Total orders ('000) 14,087 12,321 14%

Total visits ('000) 523,665 469,107 12%

------------------------------------------- ---------------- ---------------- -------

(1) As at 28 February, defined as having shopped during the last

twelve months

(2) Calculated as total orders divided by total visits

Gross profitability

Six months to 28

February 2015 Group International

total UK US EU RoW total

--------- --------- ------- --------- --------- --------------

Gross profit (GBP'000) 265,199 107,042 32,738 67,272 58,147 158,157

Growth 9% 23% 19% 2% (7%) 1%

Retail gross margin 46.8% 42.9% 57.2% 47.8% 48.6% 49.8%

Growth (270bps) (210bps) 30bps (260bps) (390bps) (250bps)

Gross margin 48.2% 44.8% 58.4% 48.6% 49.8% 50.8%

Growth (230bps) (170bps) 70bps (240bps) (340bps) (220bps)

--------- --------- ------- --------- --------- --------------

Retail gross margin decreased by 270bps compared with last year,

to 46.8% (2014: 49.5%). This was driven by our price investments in

the Eurozone and Rest of World territories to ensure we continue to

offer our customers compelling local currency prices, as well as

increased return rates, principally in the UK and Germany. This was

offset by an improvement in our full-price sales mix, particularly

in the US. Gross margin (including third-party revenues and

delivery receipts) decreased by 230bps to 48.2% (2014: 50.5%).

Operating expenses

The Group increased its investment in operating resources by 14%

to GBP253.5m during the period, as we have continued to invest in

our warehousing and IT infrastructure as well as our customer

proposition. Total operating costs to sales ratio improved by 30bps

over the same period.

Six months Six months

to 28 February to 28 February

GBP'000 2015 2014 Change

----------------------------------- ---------------- ----------------- -------

Distribution costs (78,771) (72,944) (8%)

Payroll and staff costs (50,316) (44,194) (14%)

Warehousing (50,064) (34,724) (44%)

Marketing (26,442) (31,505) 16%

Production (2,438) (2,383) (2%)

Technology costs (9,643) (7,315) (32%)

Other operating costs (25,493) (22,547) (13%)

Depreciation and amortisation (10,374) (7,494) (38%)

----------------------------------- ---------------- ----------------- -------

Total operating costs (253,541) (223,106) (14%)

Operating cost ratio (% of sales) 46.0% 46.3% 30bps

----------------------------------- ---------------- ----------------- -------

Distribution costs decreased by 80bps to 14.3% of sales despite

an increase in total orders of 14% during the period, due to the

continued high proportion of lower cost UK shipments, a decrease in

EU distribution costs as we increase the number of shipments from

our Eurohub, and negotiation of more favourable carrier rates.

Staff costs decreased by 10bps to 9.1% of sales as headcount

increases were offset by restructuring of management share

incentive awards since the prior year.

Warehousing costs increased by 190bps to 9.1% of sales

principally as a result of one-off short-term additional running

costs at our Barnsley warehouse following the launch of our

automation technology during the first half of the year, as well as

increasing investment in our global warehousing infrastructure,

particularly in Europe.

Marketing costs have decreased by 170bps to 4.8% of sales as

spend on international marketing campaigns was limited during the

period whilst we focus on restoring the price competiveness of our

products. Our digital marketing activities have however continued

in order to drive awareness and grow our market share.

IT costs increased by 30bps to 1.8% of sales as a result of

increased traffic across our expanded range of global

platforms.

Other operating costs have decreased by 10bps to 4.6% of sales

due to a continued focus on controlling costs related to travel and

entertaining.

Depreciation has increased by 30bps to 1.9% of sales following

our recent accelerated investment in our warehouse and IT

infrastructure, particularly in our mechanised picking

solution.

We incurred operating costs of GBP3.1m (2014: GBP3.7m) related

to our activities in China during the period. These related largely

to warehousing and staff costs.

Net other income

We received final business interruption insurance reimbursements

during the period of GBP6.3m as a result of a fire in our Barnsley

warehouse in June 2014. This amount is included within a separate

line item titled 'net other income' in the Income Statement, and

has been reinvested in our international pricing proposition during

the period. Total business interruption receipts resulting from the

fire are GBP9.3m.

GBP'000 Six months Six months Year to

to to 31 August

28 February 28 February 2014

2015 2014

Stock loss and other incremental costs - - (8,486)

Insurance reimbursements 6,299 - 11,536

Total 6,299 - 3,050

------------------------------------------------ ------------- ------------- -----------

Income statement

The Group generated profit before tax of GBP18.0m, down 10% on

last year (2014: GBP20.1m) due to the decline in gross margin as a

result of international price investments, plus additional

operating expenses related to investments in our warehousing

infrastructure.

Six months Six months

to 28 February to 28 February

GBP'000 2015 2014 Change

------------------------- ---------------- ----------------- -------

Revenue 550,474 481,726 14%

Cost of sales (285,275) (238,639)

------------------------- ---------------- ----------------- -------

Gross profit 265,199 243,087 9%

Distribution expenses (78,771) (72,944) (8%)

Administrative expenses (174,770) (150,162) (16%)

Net other income 6,299 -

Operating profit 17,957 19,981 (10%)

Net finance income 87 116

Profit before tax 18,044 20,097 (10%)

Income tax expense (3,735) (4,796)

------------------------- ---------------- ----------------- -------

Profit after tax 14,309 15,301 (6%)

------------------------- ---------------- ----------------- -------

Taxation

The effective tax rate decreased by 320bps to 20.7% (2014:

23.9%), principally due to a reduction in the prevailing rate of UK

corporation tax and prior year permanently disallowable charges in

respect of the ASOS Long-Term Incentive Plan, which have not been

repeated during 2015. Going forward, we expect the effective tax

rate to be approximately 100bps higher than the prevailing rate of

UK corporation tax due to permanently disallowable items.

Earnings per share

Basic earnings per share decreased by 5% to 17.6p (2014: 18.6p)

and diluted earnings per share decreased by 5% to 17.6p (2014:

18.5p), both driven by the decline in profit after tax during the

period.

Statement of financial position

The Group continues to enjoy a robust financial position

including a strong cash balance. Net assets increased by GBP25.6m

to GBP218.7m during the period (31 August 2014: GBP193.0m), driven

principally by the Group's profit after tax. The Group's cash

position decreased by GBP9.4m to GBP64.9m (31 August 2014:

GBP74.3m).

The summary statement of financial position is shown below.

At At

28 February 31 August

GBP'000 2015 2014

-------------------------------------- ------------- -----------

Goodwill and other intangible assets 70,449 63,901

Property, plant and equipment 61,167 55,400

Non-current assets 131,616 119,301

-------------------------------------- ------------- -----------

Inventories 161,571 161,480

Net current payables (149,231) (165,154)

Cash and cash equivalents 64,891 74,340

Derivative financial assets 12,338 2,240

Current tax (liability)/asset (1,397) 2,217

Deferred tax liability (1,138) (1,393)

-------------------------------------- ------------- -----------

Net assets 218,650 193,031

-------------------------------------- ------------- -----------

Statement of cash flows

The Group's cash balance decreased by GBP9.4m to GBP64.9m during

the period (31 August 2014: GBP74.3m) as operating profit of

GBP18.0m was offset by capital expenditure of GBP27.0m. The summary

statement of cash flows is shown below.

Six months to Six months to

28 February 28 February

GBP'000 2015 2014

-------------------------------------------------------------- -------------- ---------------

Operating profit 17,957 19,981

Depreciation and amortisation 10,374 7,494

Losses on disposal of assets 52 93

Working capital (12,174) (27,492)

Share-based payments charge 1,082 2,527

Other non-cash items 269 (75)

Tax paid (145) (2,346)

Cash inflow from operating activities 17,415 182

Capital expenditure (26,961) (34,259)

Proceeds from issue of ordinary shares - 563

Net cash inflow/(outflow) relating to Employee Benefit Trust 38 (632)

Acquisition of subsidiary - 182

Net finance income received 61 82

Total cash outflow (9,447) (33,882)

-------------------------------------------------------------- -------------- ---------------

Opening cash and cash equivalents 74,340 71,139

Effect of exchange rates on cash and cash equivalents (2) (343)

-------------------------------------------------------------- -------------- ---------------

Closing cash and cash equivalents 64,891 36,914

-------------------------------------------------------------- -------------- ---------------

Cash generated from operating profit increased by GBP17.2m in

comparison to the prior period, principally due to a reduction in

working capital outflow as a result of tight stock management and

final business interruption insurance reimbursements relating to

the warehouse fire. This cash inflow from operating activities was

offset by total capital expenditure of GBP27.0m on our warehouse

and technology infrastructure during the period.

Fixed asset additions

Six months Six months

to to

28 February 28 February

GBP'000 2015 2014

----------------------------- ------------- --------------

IT 14,407 16,101

Office fixtures and fit-out 667 2,753

Warehouse 8,504 16,497

Total 23,578 35,351

----------------------------- ------------- --------------

We continue to invest in our warehousing and IT infrastructure

to support our future annual sales target of GBP2.5bn. The majority

of our warehousing spend related to our automation technology at

Barnsley while our IT spend related to our continuing

behind-the-scenes work to move from our legacy platforms to a new

truly global and scalable platform.

Outlook

Our recent investment in international prices has generated

increasing momentum in visits and sales, and we expect this to

continue during the second half of the year. We are confident of

our outlook for the remainder of the financial year and expect

profit before tax for the year to be in line with market

expectations. We are pleased with progress in our investments in

our warehousing and IT infrastructure, and we continue to focus on

building capacity to reach our next staging post of GBP2.5bn

sales.

Nick Robertson Nick Beighton

Chief Executive Officer Chief Operating Officer

CONDENSED UNAUDITED Consolidated Statement of Total

Comprehensive Income

For the six months ended 28 February 2015

Six months Six months Year to 31

to 28 February to 28 February August 2014

2015 2014

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Revenue 550,474 481,726 975,470

Cost of sales (285,275) (238,639) (490,463)

---------------- ---------------- ---------------

Gross profit 265,199 243,087 485,007

Distribution expenses (78,771) (72,944) (147,303)

Administrative expenses (174,770) (150,162) (294,108)

------------------------------------------- ---------------- ---------------- ---------------

Warehouse fire: stock loss

and other incremental costs - - (8,486)

Warehouse fire: insurance reimbursements 6,299 - 11,536

------------------------------------------- ---------------- ---------------- ---------------

Net other income (Note 4) 6,299 - 3,050

Operating profit 17,957 19,981 46,646

Finance income 145 168 312

Finance expense (58) (52) (57)

---------------- ---------------- ---------------

Profit before tax 18,044 20,097 46,901

Income tax expense (3,735) (4,796) (10,313)

---------------- ---------------- ---------------

Profit for the period 14,309 15,301 36,588

================ ================ ===============

Net translation movements offset

in reserves (134) (120) (176)

Net fair value gain on derivative

financial assets 10,098 1,193 2,015

---------------- ---------------- ---------------

Other comprehensive income

for the period(1) 9,964 1,073 1,839

---------------- ---------------- ---------------

Total comprehensive income 24,273 16,374 38,427

================ ================ ===============

Profit/(loss) attributable

to:

Owners of the parent company 14,578 15,407 36,950

Non-controlling interest (269) (106) (362)

---------------- ---------------- ---------------

14,309 15,301 36,588

================ ================ ===============

Total comprehensive income/(loss)

attributable to:

Owners of the parent 24,542 16,480 38,789

Non-controlling interest (269) (106) (362)

---------------- ---------------- ---------------

24,273 16,374 38,427

================ ================ ===============

Earnings per share (Note 5)

Basic 17.6p 18.6p 44.6p

Diluted 17.6p 18.5p 44.5p

================ ================ ===============

(1) All items of other comprehensive income may be reclassified

to profit or loss. Net fair value gains on derivative financial

assets will be reclassified from other comprehensive income to

profit or loss during the next twelve months.

CONDENSED UNAUDITED Consolidated Statement of Changes in

Equity

For the six months ended 28 February 2015

Equity

Employee attributable

Called Benefit to owners

up share Share Retained Trust Hedging Translation of the Non-controlling Total

capital premium earnings(1) reserve reserve reserve parent interest equity

(unaudited) (unaudited) (unaudited) (unaudited) (unaudited) (unaudited) (unaudited) (unaudited) (unaudited)

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 September

2014 2,920 6,901 186,927 (5,330) 2,240 (221) 193,437 (406) 193,031

Net cash

received

on exercise

of shares

from

EBT(2) - - - 38 - - 38 - 38

Transfer of

shares from

EBT(2) on

exercise - - (108) 108 - - - - -

Share-based

payments

charge - - 1,082 - - - 1,082 - 1,082

Profit/(loss)

for the

period - - 14,578 - - - 14,578 (269) 14,309

Other

comprehensive

income/(loss)

for the

period - - - - 10,098 (134) 9,964 - 9,964

Deferred tax

on share

options - - 111 - - - 111 - 111

Current tax

on items

taken

directly to

equity - - 115 - - - 115 - 115

At 28 February

2015 2,920 6,901 202,705 (5,184) 12,338 (355) 219,325 (675) 218,650

============ ============ ============ ============ ============ ============ ============= ================ ============

Employee Equity

Called up Benefit attributable

share Share Retained Trust Hedging Translation to owners of Non-controlling Total

capital premium earnings(1) reserve reserve reserve the parent interest equity

(unaudited) (unaudited) (unaudited) (unaudited) (unaudited) (unaudited) (unaudited) (unaudited) (unaudited)

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 September

2013 2,890 6,368 152,133 (1,770) 225 (45) 159,801 (2) 159,799

Shares

allotted in

the period 30 533 - - - - 563 - 563

Purchase of

shares by

EBT(2) - - - (632) - - (632) - (632)

Transfer of

shares from

EBT(2) on

exercise - - (59) 59 - - - - -

Share based

payments

charge - - 2,527 - - - 2,527 - 2,527

Profit/(loss)

for the

period - - 15,407 - - - 15,407 (106) 15,301

Other

comprehensive

income/(loss)

for the

period - - - - 1,193 (120) 1,073 - 1,073

Acquisition of

subsidiary - - (535) - - - (535) (42) (577)

Deferred tax

on share

options - - (7,284) - - - (7,284) - (7,284)

Current tax on

items taken

directly to

equity - - 2,643 - - - 2,643 - 2,643

At 28 February

2014 2,920 6,901 164,832 (2,343) 1,418 (165) 173,563 (150) 173,413

============ ============ ============ ============ ============ ============ ============= ================ ============

Employee Equity

Called up Benefit attributable

share Share Retained Trust Hedging Translation to owners of Non-controlling Total

capital premium earnings(1) reserve reserve reserve the parent interest equity

(audited) (audited) (audited) (audited) (audited) (audited) (audited) (audited) (audited)

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 September

2013 2,890 6,368 152,133 (1,770) 225 (45) 159,801 (2) 159,799

Shares

allotted in

the period 30 533 - - - - 563 - 563

Purchase of

shares by

EBT(2) - - - (3,914) - - (3,914) - (3,914)

Transfer of

shares from

EBT(2) on

exercise - - (354) 354 - - - - -

Share based

payments

credit - - (2,813) - - - (2,813) - (2,813)

Profit/(loss)

for the

period - - 36,950 - - - 36,950 (362) 36,588

Other

comprehensive

income/(loss)

for the

period - - - - 2,015 (176) 1,839 - 1,839

Acquisition of

subsidiary - - - - - - - (42) (42)

Deferred tax

on share

options - - (8,730) - - - (8,730) - (8,730)

Current tax on

items taken

directly to

equity - - 9,741 - - - 9,741 - 9,741

Balance as at

31 August

2014 2,920 6,901 186,927 (5,330) 2,240 (221) 193,437 (406) 193,031

========== ========== ============ ========== ========== ============ ============= ================ ==========

(1) Retained earnings includes the share-based payments

reserve

(2) Employee Benefit Trust and Capita Trust

CONDENSED UNAUDITED Consolidated Statement of Financial

PositioN

At 28 February 2015

At At At

28 February 28 February 31 August

2015 2014 2014

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Non-current assets

Goodwill 1,060 1,325 1,325

Other intangible assets 69,389 50,280 62,576

Property, plant and equipment 61,167 46,141 55,400

Deferred tax asset - 1,127 -

------------- ------------- -----------

131,616 98,873 119,301

------------- ------------- -----------

Current assets

Inventories 161,571 154,640 161,480

Trade and other receivables 18,589 19,110 20,385

Derivative financial assets

(Note 8) 12,338 1,418 2,240

Current tax asset - - 2,217

Cash and cash equivalents (Note

6) 64,891 36,914 74,340

-------------

257,389 212,082 260,662

------------- ------------- -----------

Current liabilities

Trade and other payables (167,820) (135,201) (185,539)

Current tax liability (1,397) (1,806) -

------------- ------------- -----------

(169,217) (137,007) (185,539)

------------- ------------- -----------

Net current assets 88,172 75,075 75,123

-------------

Non-current liabilities

------------- ------------- -----------

Deferred tax liability (1,138) (535) (1,393)

------------- ------------- -----------

Net assets 218,650 173,413 193,031

============= ============= ===========

Equity attributable to owners

of the parent

Called up share capital 2,920 2,920 2,920

Share premium 6,901 6,901 6,901

Employee Benefit Trust reserve (5,184) (2,343) (5,330)

Hedging reserve 12,338 1,418 2,240

Translation reserve (355) (165) (221)

Retained earnings 202,705 164,832 186,927

-------------

219,325 173,563 193,437

------------- ------------- -----------

Non-controlling interests (675) (150) (406)

Total equity 218,650 173,413 193,031

============= ============= ===========

CONDENSED UNAUDITED Consolidated Statement of Cash Flows

For the six months ended 28 February 2015

Six months Six months Year to 31

to 28 February to 28 February August 2014

2015 2014

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Operating profit 17,957 19,981 46,646

Adjusted for:

Depreciation of property, plant

and equipment 3,673 3,044 5,860

Amortisation of other intangible

assets 6,701 4,450 9,501

Loss on disposal of non-current

assets 52 93 150

Decrease/(increase) in inventories 111 (11,499) (18,352)

Decrease/(increase) in trade and

other receivables 1,808 (821) (1,844)

(Increase)/decrease in trade and

other payables (14,093) (15,172) 33,522

Share-based payments charge/(credit) 1,082 2,527 (2,813)

Other non-cash items 269 (75) (297)

Income tax paid (145) (2,346) (3,714)

---------------- ---------------- -------------

Net cash generated from operating

activities 17,415 182 68,659

Investing activities

Payments to acquire other intangible

assets (15,213) (16,636) (32,627)

Payments to acquire property,

plant and equipment (11,748) (17,623) (29,750)

Finance income 123 146 296

Acquisition of subsidiary, net

of cash acquired - 182 182

---------------- ----------------

Net cash used in investing activities (26,838) (33,931) (61,899)

Financing activities

Proceeds from issue of ordinary

shares - 563 563

Net cash inflow/(outflow) relating

to Employee Benefit Trust 38 (632) (3,914)

Finance expense (62) (64) (65)

---------------- ---------------- -------------

Net cash used in financing activities (24) (133) (3,416)

Net (decrease)/increase in cash

and cash equivalents (9,447) (33,882) 3,344

================ ================ =============

Opening cash and cash equivalents 74,340 71,139 71,139

Effect of exchange rates on cash

and cash equivalents (2) (343) (143)

---------------- ---------------- -------------

Closing cash and cash equivalents 64,891 36,914 74,340

---------------- ---------------- -------------

Notes to the CONDENSED UNAUDITED financial information

For the six months ended 28 February 2015

1. Preparation of the condensed unaudited consolidated financial

information

a) Basis of preparation

The interim financial statements for the six months ended 28

February 2015 have been prepared in accordance with IAS 34,

"Interim Financial Reporting" as adopted by the European Union. The

interim financial information should be read in conjunction with

the Group's Annual Report and Accounts for the year ended 31 August

2014, which has been prepared in accordance with IFRSs as adopted

by the European Union.

The interim consolidated financial information contained in this

report has been reviewed, not audited, and does not constitute

statutory accounts within the meaning of section 434 of the

Companies Act 2006. The Annual Report and Accounts for the year

ended 31 August 2014 has been filed with the Registrar of

Companies. The auditors' report on those accounts was unqualified,

did not include a reference to any matters to which the auditors

drew attention by way of emphasis without qualifying the report and

did not contain statements under s498(2) or s498(3) of the

Companies Act 2006.

The Group's business activities together with the factors that

are likely to affect its future developments, performance and

position are set out in the Business Review. The Business Review

describes the Group's financial position, cash flows and borrowing

facilities.

The interim financial statements were approved by the Board of

Directors on 31 March 2015.

Going concern

The Directors have reviewed current performance and forecasts,

combined with expenditure commitments, including capital

expenditure. After making enquiries, the Directors have a

reasonable expectation that the Group has adequate financial

resources to continue its current operations, including contractual

and commercial commitments for the foreseeable future. For this

reason, they have continued to adopt the going concern basis in

preparing the interim financial statements.

Statement of Directors' responsibilities

The Directors confirm that, to the best of their knowledge, this

condensed set of consolidated financial statements have been

prepared in accordance with IAS 34 "Interim Financial Reporting" as

adopted by the European Union, and that the interim management

report includes a fair review of the information required.

Accounting policies

The interim financial statements have been prepared in

accordance with the accounting policies set out in the Annual

Report and Accounts for the year ended 31 August 2014. Various new

accounting standards and amendments were issued during the period,

none of which have had or are expected to have any significant

impact on the Group, and none of which have been adopted early.

Taxes on income in the interim periods are accrued using the tax

rate that would be applicable to the expected total annual

earnings.

2. Principal risks and uncertainties

The Board considers the principal risks and uncertainties which

could impact the Group over the remaining six months of the

financial year to 31 August 2015 to be unchanged from those set out

in the Annual Report and Accounts for the year ended 31 August

2014, summarised as follows:

- Market risks, including maintaining our market position and

fashionability, failure to meet customer demand and meet the needs

of changing customer tastes

- Technological risk, including robustness and sufficiency of IT

systems and infrastructure, and failure to adopt technological

innovations

- Financial risks, including exposure to changes in interest and foreign exchange rates

- Supply chain risks, including interruption to supply of core

category products and disruption to delivery services or

warehousing activities

- Brand and reputational risks

- Reliance on key personnel

These are set out in detail on pages 16 to 18 of the Group's

Annual Report and Accounts for the year ended 31 August 2014, a

copy of which is available on the Group's website, www.asosplc.com.

Information on financial risk management is also detailed on pages

69 to 70 of the Annual Report.

3. Segmental analysis

IFRS 8 'Operating Segments' requires operating segments to be

determined based on the Group's internal reporting to the Chief

Operating Decision Maker. The Chief Operating Decision Maker has

been determined to be the Executive Board and has determined that

the primary segmental reporting format of the Group is geographical

by customer location, based on the Group's management and internal

reporting structure.

The Executive Board assesses the performance of each segment

based on revenue and gross profit after distribution expenses,

which excludes administrative expenses.

Six months to 28 February 2015 (unaudited)

UK US EU RoW Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Retail sales 231,370 54,528 136,228 114,303 536,429

Delivery receipts 5,440 1,554 2,214 2,560 11,768

Third party

revenues 2,277 - - - 2,277

Internal revenues 376 - - 1,309 1,685

---------------- ---------------- ---------------- ---------------- ----------------

Total segment

revenue 239,463 56,082 138,442 118,172 552,159

Eliminations (376) - - (1,309) (1,685)

---------------- ---------------- ---------------- ---------------- ----------------

Total revenue 239,087 56,082 138,442 116,863 550,474

Cost of sales (132,045) (23,344) (71,170) (58,716) (285,275)

---------------- ---------------- ---------------- ---------------- ----------------

Gross profit 107,042 32,738 67,272 58,147 265,199

Distribution

expenses (25,050) (17,239) (18,092) (18,390) (78,771)

---------------- ---------------- ---------------- ---------------- ----------------

Segment result 81,992 15,499 49,180 39,757 186,428

Administrative

expenses (174,770)

Net other income 6,299

Operating profit 17,957

Finance income 145

Finance expense (58)

----------------

Profit before tax 18,044

================

Internal revenues relate largely to sale of stock by ASOS.com to

ASOS (Shanghai) Commerce Co. Limited.

Six months to 28 February 2014 (unaudited)

UK US EU RoW Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Retail sales 182,040 46,749 127,626 115,904 472,319

Delivery

receipts 3,410 835 1,582 1,717 7,544

Third party

revenues 1,863 - - - 1,863

Internal

revenues - - - 400 400

Total segment

revenue 187,313 47,584 129,208 118,021 482,126

Eliminations - - - (400) (400)

------------------ ----------------- ----------------- ----------------- ------------------

Total revenue 187,313 47,584 129,208 117,621 481,726

Cost of sales (100,182) (20,131) (63,325) (55,001) (238,639)

------------------ ----------------- ----------------- ----------------- ------------------

Gross profit 87,131 27,453 65,883 62,620 243,087

Distribution

expenses (17,896) (15,100) (17,784) (22,164) (72,944)

------------------ ----------------- ----------------- ----------------- ------------------

Segment result 69,235 12,353 48,099 40,456 170,143

Administrative

expenses (150,162)

------------------

Operating

profit 19,981

Finance income 168

Finance expense (52)

------------------

Profit before

tax 20,097

==================

Year to 31 August 2014 (audited)

UK US EU RoW Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Retail sales 372,241 92,311 256,385 234,358 955,295

Delivery receipts 7,412 1,773 3,162 3,604 15,951

Third party

revenues 4,224 - - - 4,224

Internal revenues 111 - - 7,654 7,765

---------------- ---------------- ---------------- ---------------- ----------------

Total segment

revenue 383,988 94,084 259,547 245,616 983,235

Eliminations (111) - - (7,654) (7,765)

---------------- ---------------- ---------------- ---------------- ----------------

Total revenue 383,877 94,084 259,547 237,962 975,470

Cost of sales (207,853) (40,137) (126,460) (116,013) (490,463)

---------------- ---------------- ---------------- ---------------- ----------------

Gross profit 176,024 53,947 133,087 121,949 485,007

Distribution

expenses (39,618) (28,804) (37,062) (41,819) (147,303)

---------------- ---------------- ---------------- ---------------- ----------------

Segment result 136,406 25,143 96,025 80,130 337,704

Administrative

expenses (294,108)

Net other income 3,050

Operating profit 46,646

Finance income 312

Finance expense (57)

----------------

Profit before tax 46,901

================

Due to the nature of its activities, the Group is not reliant on

any individual major customers.

No analysis of the assets and liabilities of each operating

segment is provided to the Chief Operating Decision Maker in the

monthly management accounts therefore no measure of segments assets

or liabilities is disclosed in this note.

There are no material non-current assets located outside the

UK.

4. Net other income

Net other income recognised during the six months ended 28

February 2015 relates to final business interruption reimbursements

as a result of the fire in our main distribution hub in June 2014.

Amounts recognised during the year to 31 August 2014 related to

insurance reimbursements related to stock loss and other

incremental costs plus a portion of business interruption

losses.

Six months Six months Year to

to 28 February to 28 February 31 August

2015 2014 2014

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Stock loss and other incremental

costs - - (8,486)

Insurance reimbursements 6,299 - 11,536

----------------

Total 6,299 - 3,050

================ ================ ===========

At 31 August 2014, the Group disclosed a contingent asset in

relation to these expected final business interruption

reimbursements. This contingent asset no longer exists as at 28

February 2015 as a result of the reimbursements received above.

5. Earnings per share

Basic earnings per share is calculated by dividing the profit

attributable to the owners of the parent company by the weighted

average number of ordinary shares in issue during the year. Own

shares held by the Employee Benefit Trust and Capita Trust are

eliminated from the weighted average number of ordinary shares.

Diluted earnings per share is calculated by dividing the profit

attributable to the owners of the parent company by the weighted

average number of ordinary shares in issue during the period,

adjusted for the effects of potentially dilutive share options.

Six months Six months Year to

to 28 February to 28 February 31 August

2015 2014 2014

(unaudited) (unaudited) (audited)

No. of shares No. of shares No. of shares

Weighted average share capital

Weighted average shares in issue

for basic earnings per share 82,921,082 82,707,823 82,845,587

Weighted average effect of dilutive

options 64,978 442,819 279,864

---------------- ---------------- --------------

Weighted average shares in issue

for diluted earnings per share 82,986,060 83,150,642 83,125,451

================ ================ ==============

Six months Six months Year to 31

to 28 February to 28 February August

2015 2014 2014

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Earnings

Underlying earnings attributable

to owners of the parent 14,578 15,407 36,950

================ ================

Six months Six months Year to 31

to 28 February to 28 February August

2015 2014 2014

(unaudited) (unaudited) (audited)

Pence Pence Pence

Earnings per share

Basic earnings per share 17.6 18.6 44.6

Diluted earnings per share 17.6 18.5 44.5

================ ================ ==============

6. Reconciliation of cash and cash equivalents

Six months Six months Year to 31

to 28 February to 28 February August

2015 2014 2014

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Net movement in cash and cash equivalents (9,447) (33,882) 3,344

Opening cash and cash equivalents 74,340 71,139 71,139

Effect of exchange rates on cash

and cash equivalents (2) (343) (143)

---------------- ---------------- -----------

Closing cash and cash equivalents 64,891 36,914 74,340

================ ================ ===========

The Group has a GBP20m revolving loan credit facility which

includes an ancillary GBP10m guaranteed overdraft facility and

which is available until July 2015. We expect to renegotiate this

loan facility during the second half of the year.

7. Capital expenditure and commitments

During the period, the Group acquired property, plant and

equipment of GBP9.7m and intangible assets of GBP13.9m. Disposals

were immaterial. At the period end capital commitments contracted,

but not provided for by the Group, amounted to GBP2.6m.

8. Financial instruments

There are no changes to the categories of financial instruments

held by the Group.

Six months Six months Year to 31

to 28 February to 28 February August

2015 2014 2014

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Financial assets

Loans and receivables(1) 75,595 48,349 86,058

Derivative financial assets 12,338 1,418 2,240

================ ================ ===========

Financial liabilities

Amortised cost(2) (165,152) (133,015) (181,481)

================ ================ ===========

(1) Loans and receivables include trade and other receivables

and cash and cash equivalents, and excludes prepayments.

(2) Included in financial liabilities at amortised cost are

trade payables, accruals and other payables.

The Group operates internationally and is therefore exposed to

foreign currency transaction risk, primarily on sales denominated

in US dollars, Euros and Australian dollars. The Group's policy is

to mitigate foreign currency transaction exposures where possible

and the Group uses financial instruments in the form of forward

foreign exchange contracts to hedge future highly probable foreign

currency cash flows.

These forward foreign exchange contracts are classified above as

derivative financial assets and are classified as Level 2 financial

instruments under IFRS 13, "Fair Value Measurement." They have been

fair valued at 28 February 2015 with reference to spot exchange

rates that are quoted in an active market. All forward foreign

exchange contracts were assessed to be highly effective during the

period to 28 February 2015 and a net unrealised gain of

GBP10,098,000 (2014: GBP1,193,000) was recognised in equity. All

derivative financial assets at 28 February 2015 mature within one

year based on the related contractual arrangements.

9. Related Parties

The Group's related parties are the Employee Benefit Trust,

Capita Trust and key management personnel. There have been no

material changes to the Group's related party transactions during

the six months to 28 February 2015.

Independent review report to ASOS PLC

Introduction

We have been engaged by the Company to review the interim

results for the six months ended 28 February 2015, which comprises

the condensed consolidated statement of total comprehensive income,

condensed consolidated statement of financial position, condensed

consolidated statement of changes in equity, condensed consolidated

cash flow statement and related notes. We have read the other

information contained in the half-yearly financial report and

considered whether it contains any apparent misstatements or

material inconsistencies with the information in the condensed set

of financial statements.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and

has been approved by, the directors. The directors are responsible

for preparing the half-yearly financial report in accordance with

the AIM Rules for Companies which require that the financial

information must be presented and prepared in a form consistent

with that which will be adopted in the company's annual financial

statements.

As disclosed in Note 1, the annual financial statements of the

group are prepared in accordance with IFRSs as adopted by the

European Union. The condensed set of financial statements included

in this half-yearly financial report has been prepared in

accordance with the International Accounting Standard 34, "Interim

Financial Reporting", as adopted by the European Union.

Our responsibility

Our responsibility is to express to the company a conclusion on

the condensed set of financial statements in the half-yearly

financial report based on our review. This report, including the

conclusion, has been prepared for and only for the company for the

purpose of the AIM Rules for Companies and for no other purpose. We

do not, in producing this report, accept or assume responsibility

for any other purpose or to any other person to whom this report is

shown or into whose hands it may come save where expressly agreed

by our prior consent in writing.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, 'Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity' issued by the Auditing Practices Board for use in

the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK and Ireland) and consequently does not enable us to

obtain assurance that we would become aware of all significant

matters that might be identified in an audit. Accordingly, we do

not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 28

February 2015 is not prepared, in all material respects, in

accordance with International Accounting Standard 34 as adopted by

the European Union and the AIM Rules for Companies.

The condensed interim financial statements for the period ended

28 February 2014 forming the corresponding figures of the condensed

interim financial statements for the period ended 28 February 2015

have not been reviewed.

PricewaterhouseCoopers LLP

Chartered Accountants

31 March 2015

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR SDSFMFFISEFD

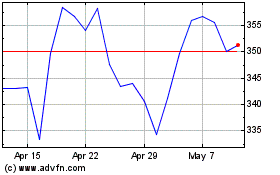

Asos (LSE:ASC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Asos (LSE:ASC)

Historical Stock Chart

From Apr 2023 to Apr 2024