TIDMASC

RNS Number : 7507T

ASOS PLC

17 October 2017

17 October 2017

ASOS plc

Global Online Fashion Destination

Final Results for the year to 31 August 2017

Summary financial results

Year to Year to CCY(3)

GBPm(1) 31 August 31 August Change Change

2017 2016(2)

---------------------------------- ----------- ----------- --------- --------

Group revenues(4) 1,923.6 1,444.9 33% 27%

Retail sales 1,876.5 1,403.7 34% 27%

UK retail sales 698.2 603.8 16% 16%

International retail sales 1,178.3 799.9 47% 36%

Gross profit 958.3 722.2 33%

Retail gross margin 48.6% 48.5% 10bps

Gross margin 49.8% 50.0% (20bps)

Continuing profit before tax and

exceptional items(5) 80.0 63.7 26%

Profit before tax 80.0 32.7 145%

Diluted earnings per share from

continuing operations only(5) 76.6p 61.8p 24%

Diluted earnings per share 76.6p 29.3p 161%

Cash and cash equivalents 160.3 173.3 (8%)

---------------------------------- ----------- ----------- --------- --------

(1) All numbers subject to rounding throughout this document,

(2) Restated to remove the results of the discontinued operation in

China, (3) Constant currency is calculated to take account of

hedged rate movements on hedged sales and spot rate movements on

unhedged sales, (4) Includes retail sales, delivery receipts and

third party revenues, (5) For the year to 31 August 2016, figures

exclude one-off legal settlement costs of GBP20.9m and losses from

discontinued operations of GBP10.1m.

Results summary

-- Retail sales grew strongly at +34% on a reported basis and +27% on a constant currency basis

-- Solid UK growth of +16% and a strong international

performance at +47% (constant currency +36%) aided by the

reinvestment of the FX tailwind

-- Retail gross margin up 10bps on prior year despite material price investment

-- Continued strong customer engagement with active customers(6)

+24%, average basket value +2% and average order frequency(7)

+5%

-- Total orders shipped 49.6m, +30% year on year

-- Transition to Eurohub 2 phase one is complete, US warehouse plans progressing well

-- Strong cash position of GBP160.3m supporting growth and enabling business investment

Guidance and medium term outlook

-- Increased FY18 reported sales guidance of c.25-30%

-- FY18 EBIT margin stable at c.4%, in line with market consensus

-- Accelerated capex expected to be GBP200-GBP220m in FY18 given strong business momentum

-- Medium term reported sales growth guidance remains unchanged

at c.20-25% p.a. with a c.4% EBIT margin

Nick Beighton, CEO, commented:

"It's been a great year for ASOS, with continued growth in sales

and profits. Our international performance was excellent, as we

reinvested FX tailwinds and benefitted from our continually

improving customer proposition. In a competitive UK market, we

achieved strong full price performance whilst further increasing

market share.

At the same time, we ramped up our investment in building the

increasingly strong and differentiated ASOS proposition. Our new

agile technology platform is allowing us to accelerate our pace of

innovation with great benefits for our customers, including new

payment methods and additional language sites to come. The

investments we are making will see us add 1,000 new heads and will

lay the foundations for a c.60% increase in unit capacity and

c.GBP4 billion of net sales.

The new financial year shows continuing momentum in the

business. The potential for our company remains huge. We are

confident we are positioning ASOS to be the world's number one

destination for fashion loving twentysomethings"

(6) Defined as having shopped in the last twelve months as at 31

August 2017, (7) Calculated as last twelve months' total orders

divided by active customers

Investor and analyst meeting:

There will be a meeting for analysts that will take place at

9.30am today, 17 October 2017, at Numis Securities, 10 Paternoster

Row, London EC4M 7LT. Photo ID and security checks will be required

so please ensure prompt arrival. A webcast of the meeting will be

available both live and following the meeting at www.asosplc.com.

Please register your attendance in advance with Guy Scarborough at

Instinctif Partners on either 020 7457 2047 or

guy.scarborough@instinctif.com.

For further information:

ASOS plc Tel: 020

Nick Beighton, Chief Executive 7756 1000

Officer

Helen Ashton, Chief Financial

Officer

Greg Feehely, Director of

Investor Relations

Website: www.asosplc.com/investors

Instinctif Partners Tel: 020

Matthew Smallwood / Guy Scarborough 7457 2020

JPMorgan Cazenove Tel: 020

Michael Wentworth-Stanley 7742 4000

/ Caroline Thomlinson/ Bill

Hutchings

Numis Securities Tel: 020

Alex Ham / Luke Bordewich 7260 1000

Forward looking statements:

This announcement may include statements that are, or may be

deemed to be, "forward-looking statements" (including words such as

"believe", "expect", "estimate", "intend", "anticipate" and words

of similar meaning). By their nature, forward-looking statements

involve risk and uncertainty since they relate to future events and

circumstances, and actual results may, and often do, differ

materially from any forward-looking statements. Any forward-looking

statements in this announcement reflect management's view with

respect to future events as at the date of this announcement. Save

as required by applicable law, the Company undertakes no obligation

to publicly revise any forward-looking statements in this

announcement, whether following any change in its expectations or

to reflect events or circumstances after the date of this

announcement.

Background note

ASOS is a global fashion destination for 20-somethings, selling

cutting-edge fashion and offering a wide variety of fashion-related

content, making ASOS.com the hub of a thriving fashion community.

ASOS sells over 85,000 branded and own-label products through

localised mobile and web experiences, delivering from fulfilment

centres in the UK, US and Europe to almost every country in the

world.

ASOS tailors the mix of own-label, global and local brands sold

through each of eight local language websites: UK, US, France,

Germany, Spain, Italy, Australia and Russia.

ASOS's websites attracted 135.7m visits during August 2017

(August 2016: 117.5m) and as at 31 August 2017 had 15.4m active

customers(1) (31 August 2016: 12.4m), of which 5.2m were located in

the UK and 10.2m were located in international territories (31

August 2016: 4.7m in the UK and 7.7m internationally).

(1) Defined as having shopped in the last twelve months as at 31

August 2017

ASOS plc ("the Group")

Global Online Fashion Destination

Final Results for the year to 31 August 2017

Business review

ASOS is delighted to report record sales and profit for the year

to 31 August 2017 in line to marginally ahead of expectations. The

Group retail sales growth of 34% to GBP1,876.5m (2016: GBP1,403.7m)

was once again driven by strong product, proposition improvements

and further price investments across major markets. As previously

noted, the continuing FX tailwind enabled reinvestment at a faster

rate than initially planned.

Retail gross margin increased by 10bps to 48.6% (2016: 48.5%) as

price investments in the US, Europe and some RoW territories were

offset by a higher full price mix. Delivery receipts grew 18% aided

by higher next-day delivery usage and the expansion of Premier

globally.

Continuing profit before tax and exceptional items grew by 26%

to GBP80.0m (2016: GBP63.7m).

The successful rollout of ASOS's new technology platform

delivers micro-service architecture with fully native mobile

experience in android and iOS apps and a vastly improved all new

checkout. The platform allows for significantly greater transaction

volume at enhanced levels of stability. A critical benefit of the

new platform is the increased ability to deliver technical change

and innovation at pace; the number of technology releases this year

surpassed expectations at 1,300 vs. 490 in the prior year. The

coming year will see a further acceleration in velocity, delivering

many more customer enhancements, new payment methods, new language

sites and stronger customer engagement.

ASOS continued to increase capacity and efficiency at Barnsley,

successfully transitioned to phase 1 of the new Eurohub 2

fulfilment centre with ongoing work to further double its capacity

and automate its operations. In August, ASOS signed a lease for a

new fulfilment centre in the US, which is expected to be

operational by Autumn 2018. The investments ASOS is making across

logistics will lay the foundations for a c.60% increase in unit

capacity and c.GBP4 billion of net sales per annum.

Our global potential

ASOS continues to see considerable opportunity across key

markets. The global apparel market continues to undergo significant

channel shift, with growth online outstripping the overall market.

Online penetration will continue to increase and ASOS is well

placed to capitalise on this shift in customer behaviour.

In the UK, the online apparel market has grown at more than

twice the rate of the overall apparel market across the last five

years. ASOS's consistent double-digit sales growth has continued to

surpass growth in the online apparel market in all of our key

territories.

ASOS's market share of online sales remains modest particularly

in international markets. ASOS will continue to invest to grow the

business at pace to take advantage of the global opportunity.

Our unique product

Creating and curating the most relevant product for fashion

loving 20-somethings

ASOS offers customers the greatest, most relevant choice of

fashion at the right price whatever their shape, size or style. The

ASOS Brand is positioned alongside a curated edit of the best third

party brands, sourced from across the globe. Sales of ASOS Brand

account for c.41% of sales. Newness is important to our customers

and is a key differentiator of the ASOS offering. Each week c.5,000

new styles are launched with c.85,000 products in stock at any one

point in time.

The brand portfolio continues to evolve. Almost 200 new brands

were introduced during the year whilst a similar number were edited

out. The combination of ASOS Brand and exclusive collaborations

with brands leads to c.60% of ASOS product only being available to

customers through the ASOS sites, an additional point of

differentiation.

Building on last year's launch, ASOS is accelerating its

activewear offering, with football and golf ranges now accompanying

a greater choice of true sports performance wear including gym, run

and yoga. The ASOS 4505 activewear range will launch in 2018 along

with range extensions into snow and surf.

Last month ASOS relaunched 'Face + Body', which establishes ASOS

as a destination for all things face, body, skin and hair. Initial

reaction has been very positive in a market that is predicted to be

worth GBP450bn p.a. globally by 2020.

ASOS's longstanding 'Fashion with Integrity' initiative

encompasses nine principal aspects of ethical trading. This

initiative is ambitious and is driving behaviour across the

business. This covers fundamental human rights and ASOS has

published a statement on modern slavery, become a signatory to the

UN's Women's empowerment Principles and recently signed a global

framework agreement with IndustriALL, the world's largest trade

union organisation representing 50 million workers in the retail

sector. Publication of ASOS's full factory list for the first time

also improved transparency of the supply chain.

'Fashion with Integrity' ultimately aims to ensure that the

production of our products causes no negative impact on the

environment. ASOS joined the Sustainable Apparel Coalition, giving

ASOS insights into environmental management systems across water

and chemical management. The Group reached 70% full traceability

across the viscose supply chain, allowing ASOS to identify risk

hotspots associated with certain viscose producers. ASOS signed the

Cotton Communique with the Clarence House International

Sustainability Unit, committing to 100% sustainably sourced cotton

by 2025 and are on track to hit a sustainable cotton target of 70%

for 2017. ASOS also signed the Commitment to a Circular Fashion

System (Global Fashion Agenda, Copenhagen) to support the

transition to a 'circular business'.

ASOS views its commitment to 'Fashion with Integrity' as a

critical investment in the future of the business. Our twenty

something customers care deeply about ethical and environmental

issues as does ASOS.

Our best in class proposition

Offering a friction-free experience at every stage of the

journey

Brand experience

Significant investments during the year have driven strong

engagement levels across ASOS's customer base. Site visits

increased by 24% year-on-year; average order frequency improved by

5%; average basket value increased by 2% alongside a 20bps

improvement in conversion. Active customers are now at 15.4m,

representing a 24% increase since last year. ASOS continues to

invest in and evolve its UK loyalty programme which is successfully

driving increased purchase frequency and reduced rates of

churn.

ASOS is continually striving for new ways to engage with its

customer demographic, such as a focus on students with a calendar

of acquisition and engagement activity aimed at growing penetration

of this global population. ASOS's 'hero' campaign successfully

reached students on campus and online in the UK, USA, France,

Germany, Australia and Italy. The student discount proposition was

extended into eight new markets with plans to further develop this

programme during the current year.

ASOS maintained investment in relevant, emerging content formats

like cross-channel video. Our videos were viewed more than 66

million times, a doubling on the prior year. ASOS continues to

experiment with pioneering advertising trials across key

international markets, on the platforms that matter most to fashion

loving 20-somethings. This activity is already driving heightened

engagement across multiple territories.

ASOS is continually finding fresh ways to engage with both new

and existing audiences, including two initiatives, "Fashion

Discovery" and "ASOS Supports Talent". "Fashion Discovery" is an

annual competition to discover and nurture the freshest UK fashion

talent. "ASOS Supports Talent" helps up-and-coming creatives to

realise an important, culturally significant project by giving them

funding, mentoring and a platform to showcase their skills.

Delivery & returns

ASOS continually enhances delivery and returns options,

maintaining a best-in-class customer proposition with over 200

improvements implemented over the last twelve months.

ASOS's Click & Collect delivery proposition has now been

expanded globally. UK total coverage increased to 9,000 locations

with an improved Next Day order cut-off of 7pm, whilst Click &

Collect launched into Italy and the United States in September,

giving an additional 11,000 collection points across those two

territories.

During the year, improvements were also made to Next Day and

Standard Delivery propositions. Internationally, ASOS now offers

tracked Standard Delivery services to a total of 61 countries

across the world, and within the UK, Saturday was added as a

Standard Delivery promise. Next Day Delivery weekend ordering

cut-off has been extended to 8pm in the UK and a Saturday order cut

off for Monday delivery has been introduced into a number of key

European territories, giving the customer an extra 24 hours for

Monday delivery.

For the year ahead, an Evening Next Day Delivery service will be

launched into Germany's major cities whilst ASOS Instant, ASOS's

same day delivery service, has just launched in London, with

further UK cities to follow. Nominated Day Delivery will also be

launched throughout the EU, allowing customers to select their

preferred delivery date. There will be continued expansion of Click

& Collect points globally, targeting the UK, France, Germany,

Netherlands, Sweden and Australia.

Customer care

A key differentiator for ASOS is providing best in class service

for customers throughout their entire ASOS experience. ASOS offers

customer support 24/7 365 days a year across email, live chat,

social media and telephony in nine languages. ASOS continues to

maintain strong service levels, responding to all emails within one

hour, all social media communications from customers within 15

minutes and all live chats or telephony calls within 30

seconds.

ASOS recently moved to a new 80,000 square feet Customer Care

site in Leavesden, North Watford and are on track to complete the

site during the first half of the new financial year. This

investment in infrastructure and technical capability cost GBP11m

and supports the ever growing customer base and allows in-sourcing

of all Customer Care operations, improving the quality of the

service and also reducing cost.

Warehousing

Investment in our site in Barnsley continues, with a fifth

packing module currently being commissioned. Live testing is now

underway and it will be fully operational for the start of the peak

trading period. This will provide additional capacity for Black

Friday volumes as well as supporting future growth. Planning

permission for a small office extension has been granted and

building works will commence in the next few weeks.

Eurohub 2, our warehouse in Berlin, was opened at the beginning

of March and has quickly grown its volumes, now fulfilling c.95% of

all EU orders. The local stockholding is now over 7.5m units and

will grow to around 9m units in readiness for peak trading this

year. The Phase 2 extension of Eurohub 2, which will double the

square footage of the fulfilment centre, is on track with first

deliveries of automation equipment expected shortly. The first

phase of Automation is expected to go live by the end of 2018.

In addition to the existing US operation in Ohio, ASOS signed a

lease for an existing 1 million square foot building located near

Atlanta, Georgia. Fit out commences shortly and the facility is

expected to be operational by Autumn 2018.

Technology

During the year, ASOS significantly ramped up the pace of both

technology investment and implementation. At the start of the year

ASOS completed the roll out of a new digital platform across all

territories. This new platform is the backbone of the ASOS customer

experience on both sites and apps. The new platform delivers

micro-service architecture with fully native mobile experience in

android and iOS apps and a vastly improved, all new checkout. The

new platform handled record volumes of transactions during peak

trading period, which at one point reached 33 orders per

second.

A critical benefit of this new platform is the enhanced ability

to deliver technological change and innovation at pace. During the

year, ASOS developed and rolled out over 1,300 individual releases

across the platform compared to 490 in the previous year. The pace

of change has exceeded expectations, demonstrating the flexibility

of the new platform and the power of ASOS's growing engineering

teams. During the year, ASOS added 120 engineers and technologists

and plans to add a further c.200 over the next 12 months as

velocity and momentum continue to accelerate.

During the first half of the year, ASOS completed the

development of the global fulfilment software changes and

technology required to open the Eurohub 2 fulfilment centre. This

new fulfilment software was a major change, controlling which

country sites have access to which stock pools, enabling further

improvement of the delivery proposition for each of these

countries. During the second half of the year this fulfilment logic

was used to point the German, French, Spanish and Italian sites at

the Eurohub stock pool. Improved conversion aided by better local

inventory availability was achieved as a result.

Throughout the year ASOS delivered new capabilities for

customers. Within the last six months these have included rolling

out ApplePay globally; a fully rebuilt and refreshed My Account

section on sites and apps; extension of product recommendation

algorithms to international sites; a size and fit recommendation

tool, and a new image search capability (Style Match) within the

iOS app. The migration of content management to a cloud based

solution has also delivered a richer and more efficient editorial

experience as well as delivering content to customers quicker.

ASOS has just developed and rolled out fully refreshed site

navigation and search as well as category and brand list pages.

These will improve how customers search, browse and explore

products to support conversion and will further improve page

download speeds globally. Looking forward, ASOS is continuing to

leverage machine learning and experiment with augmented reality, in

addition to progressing with a 'Customer Privacy Programme',

focussed on delivering an open and transparent way for customers to

manage their privacy needs, ahead of regulation that comes into

effect in 2018.

Good progress has been made with major transformation programmes

including the new end-to-end merchandising and planning system,

Truly Global Retail (TGR) and a new finance system, both of which

will support the ability to buy, sell and account for stock in

multiple locations and currencies. The first output from these

programmes has already been seen, with a new clearance optimisation

tool deployed to the first wave of categories, in readiness for

summer sale period. The new people and finance systems are expected

to go live in the first half of 2018.

ASOS will continue to evolve and innovate. Currently ASOS has 7

country specific websites. For the first time in 4 years, ASOS will

add new local foreign sites, up to 13 by the end of FY18,

ultimately giving the potential to cover all of ASOS's 200+

markets. Additionally ASOS will extend its premier proposition to

new countries, further personalising customers' experience across

sites and apps, improving the returns and refund experience,

extending the student proposition to new countries and offering

online gift vouchers to international customers.

Finally, to further drive global growth, ASOS will also launch

additional payment methods, new language sites and delivery

propositions.

Power of our people

Supporting our customers, our team and our partners to realise

their potential

ASOS works hard to protect its special culture where colleagues

feel valued, respected, enjoy their work, understand that they make

a real difference each day and also have some fun along the way.

ASOS aims to lead the way as a diverse, inclusive and inspiring

place to work which attracts the very best talent. Being true to

the ASOS values of being Authentic, Brave and Creative is at the

heart of how the business works.

Everyone who works for ASOS is central to the Group's success.

As at 31 August 2017, ASOS employed 3,579 people with the majority

based at our headquarters in Camden, North London and the Customer

Care site in Leavesden, with smaller teams in Paris, Birmingham,

Berlin, New York and Sydney. In FY18 ASOS plans to add a further

1,000 people to its team to support its accelerating pace of

growth.

Attracting talent and investing in our people

Attracting, developing and retaining the best talent that will

thrive in ASOS's fast-paced environment remains a number one

priority. Over the past twelve months, ASOS has strengthened the

senior team in critical areas with key appointments and promotions

in Technology, Finance, People Experience Team, Supply Chain,

Content and Engagement, Brand Experience and Legal. More widely

across the business, apprenticeships and internships remain

important ways of attracting and developing talent and ASOS

continues to build partnerships with a variety of universities and

colleges.

Once the best talent has been brought on board, the focus is on

developing and retaining people by offering opportunities that

match both their professional and personal aspirations. ASOS has a

robust learning offer to support its people through their journey

at ASOS, offering them support to achieve professional

qualifications, as well as role and departmental-specific training

in a variety of coaching, classroom, psychometric, informal and

social learning opportunities specific to the ASOS culture.

Investment

ASOS's investment in technology and logistics is delivering

great results and is key to sustaining the strong growth momentum

within the business. ASOS anticipates capital expenditure in FY18

to be between GBP200-GBP220m compared to the GBP168m invested

during the year just ended, the second year of accelerated capex.

As always, this investment will be funded from internally generated

cash alongside existing robust cash balances. Whilst the group is

likely to be free cash flow negative post capex in FY18, we expect

the group to return to positive free cash flow post capex from FY19

onwards.

This accelerated spend will include substantial investments into

the warehouse portfolio including further optimisation of Barnsley,

automating and extending Eurohub 2 and fitting out the US site.

These investments will lay the foundation for c.60% more unit

capacity and c.GBP4 billion of net sales per annum.

Additionally ASOS will complete the implementation of a number

of transformational technology programmes including the new retail

and planning system, TGR along with the finance and people systems.

The extension and refit of the head office in Camden will continue,

increasing space from 180,000 ft(2) to 243,000 ft(2) which, when

combined with the very latest technology, will provide sufficient

flexibility to accommodate future headcount growth.

The rollout of ASOS's new technology platform has enabled

deployment of enhancements to the customer experience at ever

greater velocity. The number of technology releases this year and

the positive customer impact it has generated has surpassed

expectations and ASOS will continue to accelerate investment in

this area over the coming year, delivering many more customer

enhancements, new payment methods, new language sites and stronger

customer engagement.

Outlook

The new financial year has started well. Our increased sales

guidance is 25-30% for FY18 inclusive of a modest FX tailwind, with

EBIT margins stable at c.4% in line with market consensus. Medium

term reported sales guidance of c.20%-25% is unchanged. ASOS

expects EBIT margins to remain at a similar level into the medium

term, with operating leverage in payroll and distribution offset by

ongoing investment in technology and warehousing infrastructure to

support continued growth. We are confident we are positioning ASOS

to be the world's number one destination for fashion loving

twenty-somethings.

Nick Beighton Helen Ashton

Chief Executive Officer Chief Financial Officer

Financial review

Revenue

Year to 31 August

2017 Group International

GBPm total UK US EU RoW total

---------------------- -------- ------ ------ ------ ------- --------------

Retail sales 1,876.5 698.2 261.6 544.1 372.6 1,178.3

Growth 34% 16% 46% 45% 52% 47%

Growth at constant

exchange rate 27% 16% 31% 34% 42% 36%

Delivery receipts 40.8 16.1 6.3 10.8 7.6 24.7

Growth 18% 5% 15% 48% 19% 29%

Third party revenues 6.3 6.0 0.2 0.1 - 0.3

Growth (6%) (6%) 100% - (100%) -

Total revenues 1,923.6 720.3 268.1 555.0 380.2 1,203.3

Growth 33% 15% 45% 45% 51% 47%

Growth at constant

exchange rate 27% 15% 30% 34% 41% 36%

---------------------- -------- ------ ------ ------ ------- --------------

The Group generated retail sales growth of 34% during the year,

with UK growth of 16% and strong international growth of 47% (36%

constant currency). This result was driven by investments in price

and proposition. International retail sales accounted for 63%

(2016: 57%) of total retail sales.

UK retail sales grew by 16% a solid performance in a more

promotional market. The A-List loyalty scheme which annualised

during the year, continued to aid increases in conversion and

average order frequency. ASOS retained its first place position for

unique visitors to apparel retailers in the 15-34 age range

(Comscore, August 2017).

US retail sales grew by 46% (31% in constant currency) driven by

price investments and the annualisation of improved delivery

propositions coupled with key promotional events, which increased

conversion and average basket value metrics.

EU retail sales grew by 45% (34% in constant currency) aided by

the introduction of free returns across the whole of the EU,

alongside prior year price investments annualising.

RoW retail sales grew significantly at 52% (42% constant

currency), augmented by further price and proposition investments.

Russia and Israel were the stand out performers, achieving triple

digit sales growth of over 200% and 150% respectively.

Delivery receipts increased by 18% which lagged retail sales

growth as customers increasingly took advantage of more extensive

free shipping options. The number of premier customers increased by

55%.

Customer engagement

ASOS has seen a significant increase in active customers(1) ,

finishing the financial year with 15.4m, up 24% compared to last

year. Engaging content and investments in the technology platform

have helped drive this growth as well as a 24% increase in the

number of visits. The compelling nature of the ASOS proposition

drove increases in average basket value of 2%, conversion(2)

increased by 20bps and average order frequency(3) increased by

5%.

Year to Year to Change

31 August 31 August

2017 2016

--------------------------------- ----------- ----------- --------

Active customers(1) (m) 15.4 12.4 24%

Average basket value (including

VAT) GBP72.24 GBP70.84 2%

Average units per basket 2.87 2.82 2%

Average selling price

per unit (including VAT) GBP25.16 GBP25.09 -

Average order frequency(3) 3.22 3.08 5%

Total orders (m) 49.6 38.3 30%

Total visits (m) 1,669.0 1,348.7 24%

Conversion(2) 3.0% 2.8% +20bps

Mobile device visits 70.3% 65.5% +480bps

Net Promoter Score as

at 31 August 2017(4) 66 63 5%

--------------------------------- ----------- ----------- --------

(1) Defined as having shopped during the last twelve months as

at 31 August 2017

(2) Calculated as total orders divided by total visits

(3) Calculated as last twelve months' total orders divided by

active customers

(4) Net Promoter Score is based on a customer pulse survey

Gross profitability

Year to 31 August

2017 Group International

total UK US EU RoW Total

--------------------- -------- ------- ------ --------- --------------

Gross profit (GBPm) 958.3 330.6 164.6 262.6 200.5 627.7

Growth 33% 12% 47% 46% 47% 47%

Retail gross margin 48.6% 44.2% 60.4% 46.3% 51.8% 51.1%

Growth 10bps (100bps) 110bps 30bps (90bps) 10bps

Gross margin 49.8% 45.9% 61.4% 47.3% 52.7% 52.2%

Growth (20bps) (120bps) 80bps 30bps (120bps) -

--------------------- -------- --------- ------- ------ --------- --------------

Group retail gross margin increased by 10bps to 48.6% compared

to last year (2016: 48.5%) due to an improved markdown position

through both increased full price mix and shallower depths on

clearance activity. This benefit, coupled with the net FX tailwind,

offset price investments and a continued shift into branded sales.

Gross margin (including delivery receipts and third-party revenues)

decreased by 20bps to 49.8% (2016: 50.0%) as faster free delivery

options became more appealing to customers.

Operating expenses

The Group increased its investment in operating resources by 33%

to GBP878.7m, with the total operating costs to revenue ratio

increasing by 10bps to 45.7% (2016: 45.6%).

Year to Year to

31 August % of 31 August % of

GBPm 2017 sales 2016(1) sales Change

Distribution costs (299.2) 15.6% (216.0) 14.9% (39%)

Payroll and staff

costs(2) (162.8) 8.5% (132.6) 9.2% (23%)

Warehousing (168.5) 8.8% (114.3) 7.9% (47%)

Marketing (86.8) 4.5% (76.6) 5.3% (13%)

Production (6.8) 0.3% (6.3) 0.4% (8%)

Technology costs (35.1) 1.8% (24.5) 1.7% (43%)

Other operating

costs (77.2) 4.0% (57.3) 4.0% (35%)

Depreciation and

amortisation (42.3) 2.2% (31.6) 2.2% (34%)

-------------------- ----------- ------- ----------- ------- -------

Total operating

costs (878.7) 45.7% (659.2) 45.6% (33%)

-------------------- ----------- ------- ----------- ------- -------

(1) All numbers have been restated to remove the results of the

discontinued operation in China

(2) Inclusive of non-cash share-based payment charges

Distribution costs increased by 70bps to 15.6% of revenue,

driven by investment into free return propositions, particularly in

the RoW and EU, along with an improved standard delivery service

and premier launches.

Payroll and staff costs decreased by 70bps to 8.5% of sales as a

result of cost leveraging. Headcount has increased 34% (2017:

3,579; 2016(3) : 2,664). Non-cash share-based payment charges

amounted to GBP7.6m (2016: GBP4.5m) relating to a third grant to

senior management under the Long-Term Incentive Scheme during the

year and Save As You Earn scheme to all employees.

Warehousing costs increased by 90bps to 8.8% of revenue due to

ramp up and increased fulfilment mix from Eurohub 2 which is

currently a more manual operation, partly offset by efficiencies

achieved at Barnsley from automation investments.

Marketing costs decreased by 80bps to 4.5% of sales as a result

of digital marketing efficiencies and a higher return on

advertising spend, alongside a redistribution of spend towards

customer propositions such as A-List and student discounts.

Other operating costs remained flat at 4.0% of revenue.

Depreciation and amortisation remained flat at 2.2% of revenue

as a consequence of the strong sales growth versus prior year

together with a significant element of capital expenditure being in

relation to projects, which go live in the next financial year.

(3) Restated to remove the headcount relating to discontinued

operations in China

Exceptional items

No exceptional items have been identified for the year to 31

August 2017.

In the comparative period to 31 August 2016, the Group settled

trademark infringement disputes with high-performance cycle wear

manufacturer Assos of Switzerland GmbH, and German menswear

retailer Anson's Herrenhaus KG. This resulted in a one-off

exceptional legal settlement cost of GBP20.9m (including associated

legal fees) representing full, final and global settlement of all

outstanding litigation.

Discontinued operations

No discontinued operations have occurred for the year to 31

August 2017.

In the comparative period to 31 August 2016, the Group

discontinued its in-country China operation, which incurred an

operating loss before tax of GBP3.6m up to the point of closure and

one-off exceptional closure costs before tax of GBP6.5m, of which

GBP4.4m was non-cash relating principally to the impairment of

fixed assets.

Income statement

The Group generated continuing profit before tax and exceptional

items of GBP80.0m, up 26% compared to last year, lower than sales

growth due to gross margin investment of 20bps and a 10bps

investment in operating costs.

Year to 31 August

2016

Year to Before Exceptional After

31 August exceptional items exceptional

GBPm 2017 items items

--------------------------- ----------- ------------- ------------ -------------

CONTINUING OPERATIONS

--------------------------- ----------- ------------- ------------ -------------

Revenue 1,923.6 1,444.9 - 1,444.9

Cost of sales (965.3) (722.7) - (722.7)

--------------------------- ----------- ------------- ------------ -------------

Gross profit 958.3 722.2 - 722.2

Distribution expenses (299.2) (216.0) - (216.0)

Administrative expenses (579.5) (443.2) (20.9) (464.1)

Operating profit 79.6 63.0 (20.9) 42.1

Net finance income 0.4 0.7 - 0.7

Profit before tax 80.0 63.7 (20.9) 42.8

Income tax expense (15.9) (12.3) 4.2 (8.1)

--------------------------- ----------- ------------- ------------ -------------

Profit after tax from

continuing operations 64.1 51.4 (16.7) 34.7

--------------------------- ----------- ------------- ------------ -------------

Effective tax rate 19.9% 19.3% (20.1%) 18.9%

DISCONTINUED OPERATIONS

--------------------------- ----------- ------------- ------------ -------------

Loss before tax from

discontinued operations - (3.6) (6.5) (10.1)

Tax from discontinued

operations - 0.3 (0.5) (0.2)

--------------------------- ----------- ------------- ------------ -------------

Loss after tax from

discontinued operations - (3.3) (7.0) (10.3)

--------------------------- ----------- ------------- ------------ -------------

GROUP RESULTS

--------------------------- ----------- ------------- ------------ -------------

Group profit before

tax 80.0 60.1 (27.4) 32.7

Income tax expense (15.9) (12.0) 3.7 (8.3)

--------------------------- ----------- ------------- ------------ -------------

Group profit after

tax 64.1 48.1 (23.7) 24.4

--------------------------- ----------- ------------- ------------ -------------

Effective tax rate 19.9% 20.0% (13.5%) 25.2%

Taxation

The effective tax rate from continuing operations before

exceptional items increased by 60bps to 19.9% (2016: 19.3%). This

arose mainly from the deferred tax prior year adjustment in respect

of losses in China and to an increase in expenses not deductible

for tax purposes. The effective tax rate from continuing operations

after exceptional items increased by 100bps to 19.9% (2016:

18.9%).

Going forward, ASOS expects the effective tax rate to be

approximately 100bps higher than the prevailing rate of UK

corporation tax due to permanently disallowable items.

Earnings per share

Basic and diluted earnings per share from continuing operations

before exceptional items increased by 25% and 24% to 77.2p and

76.6p respectively (2016: 61.9p and 61.8p). This was driven by the

increase in continuing profit before tax during the year.

Statement of financial position

The Group continues to enjoy a healthy financial position

including a closing cash balance of GBP160.3m (2016:

GBP173.3m).

The reduction in cash includes the payment of last year's

GBP20.2m legal settlement (excluding legal fees) in relation to

trademark infringement disputes with Assos of Switzerland GmbH and

Anson's Herrenhaus KG.

Net assets increased by GBP86.7m to GBP287.1m during the year

(2016: GBP200.4m) due to the increase in capital expenditure and

inventory. The closing stock position was up 25% versus last year

to ensure good stock availability to meet customer demand for the

new season. In addition, there was a reduction of GBP12.8m in the

fair value of the net liability position of outstanding forward

contracts since 31 August 2016. This was due to hedges which were

entered into pre-Brexit at adverse rates, settling during the

period. The summary statement of financial position is shown

below:

At At

GBPm 31 August 2017 31 August 2016

-------------------------------------- ---------------- ----------------

Goodwill and other intangible assets 178.0 113.5

Property, plant and equipment 137.4 77.2

Derivative financial assets 1.3 -

Deferred tax asset 9.2 13.3

-------------------------------------- ---------------- ----------------

Non-current assets 325.9 204.0

-------------------------------------- ---------------- ----------------

Inventories 323.3 257.7

Net current payables (452.1) (355.7)

Cash and cash equivalents 160.3 173.3

Derivative financial liabilities (64.5) (76.0)

Current tax liability (5.8) (2.9)

Net assets 287.1 200.4

-------------------------------------- ---------------- ----------------

Statement of cash flows

The Group's cash balance decreased by GBP13.0m to GBP160.3m

during the year (2016: GBP173.3m) as capital expenditure of

GBP161.5m was partly offset by a cash inflow from operating

activities of GBP145.9m. The working capital inflow is

predominately made up of higher stock, which reflects the higher

level of sales expected for the new season compared to the prior

year, offset by a movement in trade payables comprising higher

trade payables caused by the timing of payments. The prior year

balance includes the accrual for the trademark infringement legal

settlement of GBP20.2m, which was settled after the year-end. The

summary statement of cash flows is shown below.

GBPm Year to 31 August 2017 Year to 31 August 2016

------------------------------------------------------- ----------------------- -----------------------

Operating profit from continuing operations 79.6 42.1

Loss before tax from discontinued operations - (10.1)

------------------------------------------------------- ----------------------- -----------------------

Operating profit 79.6 32.0

Depreciation and amortisation 42.3 31.7

Losses on disposal of assets - continuing 0.5 0.8

Losses on disposal of assets - discontinuing - 4.3

Working capital 24.1 69.1

Share-based payments charge 7.6 4.5

Other non-cash items (0.6) (1.7)

Tax paid (7.6) (10.0)

Cash inflow from operating activities 145.9 130.7

Capital expenditure (161.5) (79.2)

Net finance income received 0.5 0.7

Net cash inflow relating to Employee Benefit Trust(1) 1.8 0.7

Total cash (outflow)/inflow (13.3) 52.9

Opening cash and cash equivalents 173.3 119.2

Effect of exchange rates on cash and cash equivalents 0.3 1.2

------------------------------------------------------- ----------------------- -----------------------

Closing cash and cash equivalents 160.3 173.3

------------------------------------------------------- ----------------------- -----------------------

(1) Employee Benefit Trust and Capita Trust

Fixed asset additions

Year to Year to

31 August 31 August

GBPm 2017 2016(2)

----------------------------- ----------- -----------

Technology 104.8 60.1

Warehouse 49.5 24.4

Office fixtures and fit out 13.2 2.5

Total 167.5 87.0

----------------------------- ----------- -----------

(2) All numbers have been restated to remove the results of the

discontinued operations in China

ASOS continues to invest in warehousing and technology

infrastructure to support future growth ambitions. The majority of

technology spend related to the replatforming programme, the new

global fulfilment programme and TGR programme including an

end-to-end retail merchandising system with supporting finance

system, whilst warehousing spend related to the build-out of

Eurohub 2 and further automation in Barnsley. The office fixtures

and fit out spend related to the new customer care site at

Leavesden and the continued extension and fit out of the Head

Office in Camden.

Consolidated Statement of Total Comprehensive Income

For the year to 31 August 2017

Year to 31 August

2016

Year Before Exceptional After

to 31 exceptional items exceptional

August items (Note items

2017 3)

GBPm GBPm GBPm GBPm

CONTINUING OPERATIONS

----------------------------------- -------- ------------- ------------ -------------

Revenue 1,923.6 1,444.9 - 1,444.9

Cost of sales (965.3) (722.7) - (722.7)

----------------------------------- -------- ------------- ------------ -------------

Gross profit 958.3 722.2 - 722.2

Distribution expenses (299.2) (216.0) - (216.0)

Administrative expenses (579.5) (443.2) (20.9) (464.1)

Operating profit 79.6 63.0 (20.9) 42.1

Net finance income 0.4 0.7 - 0.7

Profit before tax 80.0 63.7 (20.9) 42.8

Income tax expense (15.9) (12.3) 4.2 (8.1)

----------------------------------- -------- ------------- ------------ -------------

Profit from continuing

operations 64.1 51.4 (16.7) 34.7

----------------------------------- -------- ------------- ------------ -------------

Loss before tax from discontinued

operations - (3.6) (6.5) (10.1)

Tax from discontinued

operations - 0.3 (0.5) (0.2)

----------------------------------- -------- ------------- ------------ -------------

Loss after tax from discontinued

operations - (3.3) (7.0) (10.3)

----------------------------------- -------- ------------- ------------ -------------

Profit for the year attributable

to owners of the parent

company 64.1 48.1 (23.7) 24.4

----------------------------------- -------- ------------- ------------ -------------

Net translation movements

offset in reserves (0.3) (1.4) - (1.4)

Net fair value gains/(losses)

on derivative financial

assets 15.8 (82.3) - (82.3)

Income tax relating to

these items (3.3) 16.2 - 16.2

----------------------------------- -------- ------------- ------------ -------------

Other comprehensive income/(loss)

for the year(1) 12.2 (67.5) - (67.5)

----------------------------------- -------- ------------- ------------ -------------

Total comprehensive income/(loss)

for the year attributable

to owners of the parent

company 76.3 (19.4) (23.7) (43.1)

----------------------------------- -------- ------------- ------------ -------------

Basic earnings per share

(Note 4)

From continuing operations 77.2p 61.9p (20.1p) 41.8p

From discontinued operations - (3.9p) (8.5p) (12.4p)

----------------------------------- -------- ------------- ------------ -------------

Total 77.2p 58.0p (28.6p) 29.4p

----------------------------------- -------- ------------- ------------ -------------

Diluted earnings per share

(Note 4)

From continuing operations 76.6p 61.8p (20.1p) 41.7p

From discontinued operations - (4.0p) (8.4p) (12.4p)

----------------------------------- -------- ------------- ------------ -------------

Total 76.6p 57.8p (28.5p) 29.3p

----------------------------------- -------- ------------- ------------ -------------

(1) All items of other comprehensive income may be reclassified

to profit or loss

Consolidated Statement of Changes in EquitY

For the year to 31 August 2017

Employee

Called Benefit

up share Share Retained Trust Hedging Translation Total

capital premium earnings(1) reserve(2) reserve reserve equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm

At 1 September

2016 2.9 6.9 254.7 (2.6) (60.0) (1.5) 200.4

Profit for the

year - - 64.1 - - - 64.1

Other comprehensive

income/(loss)

for the year - - - - 12.5 (0.3) 12.2

---------- ----------- ------------- ------------ --------- ------------ --------

Total comprehensive

income/(loss)

for the year - - 64.1 - 12.5 (0.3) 76.3

Net cash received

on exercise of

shares from EBT(2) - - - 1.8 - - 1.8

Transfer of shares

from EBT(2) on

exercise - - (0.2) 0.2 - - -

Share-based payments

charge - - 7.6 - - - 7.6

Deferred tax

on share options - - 1.0 - - - 1.0

Balance as at

31 August 2017 2.9 6.9 327.2 (0.6) (47.5) (1.8) 287.1

========== =========== ============= ============ ========= ============ ========

Employee

Called Benefit

up share Share Retained Trust Hedging Translation Total

capital premium earnings(1) reserve(2) reserve reserve equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm

At 1 September

2015 2.9 6.9 225.1 (3.6) 6.3 (0.3) 237.3

Profit for the

year - - 24.4 - - - 24.4

Other comprehensive

(loss) for the

year - - - - (66.3) (1.2) (67.5)

---------- ----------- ------------- ------------ --------- ------------ --------

Total comprehensive

income/(loss)

for the year - - 24.4 - (66.3) (1.2) (43.1)

Net cash received

on exercise of

shares from EBT(2) - - - 0.7 - - 0.7

Transfer of shares

from EBT(2) on

exercise - - (0.3) 0.3 - - -

Share-based payments

charge - - 5.0 - - - 5.0

Deferred tax

on share options - - 0.5 - - - 0.5

Balance as at

31 August 2016 2.9 6.9 254.7 (2.6) (60.0) (1.5) 200.4

========== =========== ============= ============ ========= ============ ========

(1) Retained earnings includes the share-based payments

reserve

(2) Employee Benefit Trust and Capita Trust

Consolidated Statement of Financial PositioN

At 31 August 2017

At At

31 August 31 August

2017 2016

GBPm GBPm

Non-current assets

Goodwill 1.1 1.1

Other intangible assets 176.9 112.4

Property, plant and equipment 137.4 77.2

Derivative financial 1.3 -

assets

Deferred tax asset 9.2 13.3

----------- -------------------

325.9 204.0

----------- -------------------

Current assets

Inventories 323.3 257.7

Trade and other receivables 28.6 15.0

Derivative financial 2.3 -

assets

Cash and cash equivalents 160.3 173.3

514.5 446.0

----------- -------------------

Current liabilities

Trade and other payables (480.7) (370.7)

Derivative financial

liabilities (57.7) (55.0)

Current tax liability (5.8) (2.9)

(544.2) (428.6)

----------- -------------------

Net current (liabilities)/assets (29.7) 17.4

Non-current liabilities

Derivative financial

liabilities (9.1) (21.0)

(9.1) (21.0)

----------- -------------------

Net assets 287.1 200.4

=========== ===================

Equity attributable to

owners of the parent

Called up share capital 2.9 2.9

Share premium 6.9 6.9

Employee Benefit Trust

reserve (0.6) (2.6)

Hedging reserve (47.5) (60.0)

Translation reserve (1.8) (1.5)

Retained earnings 327.2 254.7

----------- -------------------

Total equity 287.1 200.4

=========== ===================

Consolidated Statement of Cash Flows

For the year to 31 August 2017

Year to Year to

31 31

August August

2017 2016

GBPm GBPm

Operating profit from continuing

operations 79.6 42.1

Loss before tax from discontinued

operations - (10.1)

-------- -------------------

Operating profit 79.6 32.0

Adjusted for:

Depreciation of property, plant

and equipment 13.7 10.5

Amortisation of other intangible

assets 28.6 21.2

Loss on disposal of non-current

assets from continuing operations 0.5 0.8

Loss on disposal of non-current

assets from discontinued operations - 4.3

Increase in inventories (65.6) (63.8)

(Increase)/decrease in trade

and other receivables (13.6) 4.2

Increase in trade and other

payables 103.3 128.7

Share based payments charge 7.6 4.5

Other non-cash items (0.6) (1.7)

Income tax paid (7.6) (10.0)

-------- -------------------

Net cash generated from operating

activities 145.9 130.7

Investing activities

Payments to acquire other intangible

assets (89.5) (55.7)

Payments to acquire property,

plant and equipment (72.0) (23.5)

Finance income 0.5 0.8

Net cash used in investing activities (161.0) (78.4)

Financing activities

Net cash inflow relating to

EBT(1) 1.8 0.7

Finance expense - (0.1)

-------- -------------------

Net cash generated in financing

activities 1.8 0.6

Net (decrease)/increase in cash

and cash equivalents (13.3) 52.9

======== ===================

Opening cash and cash equivalents 173.3 119.2

Effect of exchange rates on

cash and cash equivalents 0.3 1.2

-------- -------------------

Closing cash and cash equivalents 160.3 173.3

======== ===================

(1) Employee Benefit Trust and Capita Trust

Notes to the financial information

For the year to 31 August 2017

1. Preparation of the consolidated financial information

a) General information

ASOS Plc ('the Company') and its subsidiaries (together, 'the

Group') is a global fashion retailer. The Group sells products

across the world and has websites targeting the UK, US, Australia,

France, Germany, Spain, Italy and Russia. The Company is a public

limited company which is listed on the Alternative Investment

Market (AIM) and is incorporated and domiciled in the UK. The

address of its registered office is Greater London House, Hampstead

Road, London, NW1 7FB.

b) Basis of preparation

The condensed consolidated financial information for the year to

31 August 2017 has been prepared in accordance with the recognition

and measurement criteria of International Financial Reporting

Standards ("IFRS") as adopted for use in the European Union and

with those parts of the Companies Act 2006 applicable to companies

reporting under IFRS. The accounting policies adopted for the year

to 31 August 2017 are consistent with those adopted and disclosed

in the Group financial statements for the year to 31 August

2016.

The financial information contained within this preliminary

announcement for the years to 31 August 2017 and 31 August 2016

does not comprise statutory financial statements within the meaning

of section 434 of the Companies Act 2006. Statutory accounts for

the year to 31 August 2016 have been filed with the Registrar of

Companies and those for the year to 31 August 2017 will be filed

following the Company's annual general meeting. The auditors'

report on the statutory accounts for each of the years to 31 August

2017 and 31 August 2016 is unqualified, does not draw attention to

any matters by way of emphasis, and does not contain any statement

under section 498 of the Companies Act 2006.

Going concern and viability

The Directors have reviewed current performance and cash flow

forecasts, and are satisfied that the Group's forecasts and

projections, taking account of potential changes in trading

performance, show that the Group will be able to operate within the

level of its current facilities for the foreseeable future. The

Directors have therefore continued to adopt the going concern basis

in preparing the Group's financial statements.

The Directors have also assessed the Group's prospects and

viability over a three-year period to 31 August 2020. This

three-year assessment period was selected as it corresponds with

the Board's strategic planning horizon as well as the time period

over which senior management are remunerated via long-term

incentive plans.

In making this assessment, the Directors took account of the

Group's current financial position, annual budget, three-year plan

forecasts and sensitivity testing. The Directors also considered a

number of other factors, including the Group business model, its

strategy, risks and uncertainties and internal control

effectiveness. Whilst the principal risks and uncertainties could

impact future performance, none of them are considered likely,

individually or collectively, to affect the viability of the

business during the three-year assessment period. The Group is

operationally strong with a robust balance sheet and cash position,

and has a track record of delivering profitable and sustainable

growth, which is expected to continue.

Based on this assessment, there is a reasonable expectation that

the Group will continue in operation and meet all its liabilities

as they fall due during the period up to 31 August 2020.

Changes to accounting standards

The accounting policies applied are consistent with those

adopted and disclosed in the Group financial statements for the

year to 31 August 2016. Various new accounting standards and

amendments were issued during the year, none of which have an

impact on the current year.

The following accounting standards are in issue but not yet

effective and have not been adopted by the Group:

-- IFRS 9 'Financial Instruments' replaces IAS 39 'Financial

Instruments Recognition and Measurement'. The standard is effective

for accounting periods beginning on or after 1 January 2018. The

Group has completed an assessment of IFRS 9 and it is expected that

adoption will not have a material impact on the results or

financial position of the Group.

-- IFRS 15 'Revenue from Contracts with Customers' replaces IAS

18 'Revenue'. This standard is effective for accounting periods

beginning on or after 1 January 2018. The Group has completed an

assessment of IFRS 15 and it is expected that adoption will not

have a material impact on the results or financial position of the

Group.

-- IFRS 16 'Leases' is effective for periods beginning on or

after 1 January 2019. Early adoption is permitted if IFRS 15 has

also been adopted. The standard will require lease liabilities and

the right of use assets for leases to be recognised on the

Statement of Financial Position. The Group has completed an

assessment of IFRS 16. The net impact on the income statement

between the old and the new leasing standards is immaterial, and a

recognition of leased assets and liabilities will be presented on

the balance sheet.

2. Segmental analysis

IFRS 8 'Operating Segments' requires operating segments to be

determined based on the Group's internal reporting to the Chief

Operating Decision Maker. The Chief Operating Decision Maker has

been determined to be the Executive Board who receive information

on the basis of the Group's operations in key geographical

territories, based on the Group's management and internal reporting

structure. The Executive Board assesses the performance of each

segment based on revenue and gross profit after distribution

expenses, which excludes administrative expenses.

Year to 31 August 2017

UK US EU RoW Total

GBPm GBPm GBPm GBPm GBPm

Retail sales 698.2 261.6 544.1 372.6 1,876.5

Delivery receipts 16.1 6.3 10.8 7.6 40.8

Third party revenues 6.0 0.2 0.1 - 6.3

Total revenue 720.3 268.1 555.0 380.2 1,923.6

Cost of sales (389.7) (103.5) (292.4) (179.7) (965.3)

-------- -------- -------- -------- ------------

Gross profit 330.6 164.6 262.6 200.5 958.3

Distribution expenses (81.9) (69.2) (89.8) (58.3) (299.2)

-------- -------- -------- -------- ------------

Segment result 248.7 95.4 172.8 142.2 659.1

Administrative expenses (579.5)

Operating profit from

continuing operations 79.6

Finance income 0.4

------------

Profit before tax 80.0

============

Year to 31 August 2016

UK US EU RoW Total

GBPm(1) GBPm(1) GBPm(1) GBPm(1) GBPm(1)

Retail sales 603.8 179.2 374.9 245.8 1,403.7

Delivery receipts 15.3 5.5 7.3 6.4 34.5

Third party revenues 6.4 0.1 0.1 0.1 6.7

Internal revenues - - - 3.0 3.0

-------- -------- -------- -------- ------------

Total segment revenue 625.5 184.8 382.3 255.3 1,447.9

Eliminations - - - (3.0) (3.0)

-------- -------- -------- -------- ------------

Total revenue 625.5 184.8 382.3 252.3 1,444.9

Cost of sales (331.0) (72.9) (202.5) (116.3) (722.7)

-------- -------- -------- -------- ------------

Gross profit 294.5 111.9 179.8 136.0 722.2

Distribution expenses (72.8) (46.8) (54.2) (42.2) (216.0)

-------- -------- -------- -------- ------------

Segment result 221.7 65.1 125.6 93.8 506.2

Administrative expenses (443.2)

Exceptional items (Note

3) (20.9)

Operating profit from

continuing operations 42.1

Finance income 0.7

------------

Profit before tax from

continuing operations 42.8

Loss before tax from

discontinued operations (10.1)

------------

Profit before tax 32.7

============

Due to the nature of its activities, the Group is not reliant on

any individual major customers. No analysis of the assets and

liabilities of each operating segment is provided to the Chief

Operating Decision Maker in the monthly management accounts.

Therefore no measure of segments assets or liabilities is disclosed

in this note. The total amount of non-current assets located in the

EU is GBP46.1m (2016: GBP9.1m).

(1) All numbers have been restated to remove the results of the

discontinued operation in China

3. Exceptional items

Year to Year to

31 August 31

2017 August

2016

GBPm GBPm

Legal settlement - 20.9

Exceptional items - 20.9

=========== ========

No exceptional items have been identified for the year to 31

August 2017.

In the comparative period to 31 August 2016, the Group settled

its trademark infringement disputes with high-performance cycle

wear manufacturer Assos of Switzerland GmbH, and German menswear

retailer Anson's Herrenhaus KG. This resulted in a one-off

exceptional legal settlement cost of GBP20.9m (including associated

legal fees) representing full, final and global settlement of all

outstanding litigation.

4. Earnings per share

Basic earnings per share is calculated by dividing the profit

attributable to the owners of the parent company by the weighted

average number of ordinary shares in issue during the year. Own

shares held by the Employee Benefit Trust and Capita Trust are

eliminated from the weighted average number of ordinary shares.

Diluted earnings per share is calculated by dividing the profit

attributable to the owners of the parent company by the weighted

average number of ordinary shares in issue during the period,

adjusted for the effects of potentially dilutive share options.

Year to Year to

31 August 31

2017 August

2016

No. of No. of

shares shares

Weighted average share capital

Weighted average shares in

issue for basic earnings

per share 82,996,217 82,972,285

Weighted average effect of

dilutive options 712,861 224,372

----------- -----------

Weighted average shares in

issue for diluted earnings

per share 83,709,078 83,196,657

=========== ===========

Earnings attributable to owners of

the parent company (GBPm)

From continuing operations 64.1 34.7

From discontinued operations - (10.3)

---------------- ----------------

64.1 24.4

================ ================

Basic earnings per share:

From continued operations 77.2p 41.8p

From discontinued operations - (12.4p)

---------------- ----------------

Basic earnings per share from all

operations: 77.2p 29.4p

================ ================

Diluted earnings per share:

From continued operations 76.6p 41.7p

From discontinued operations - (12.4p)

-------------- ----------------

Diluted earnings per share

from all operations: 76.6p 29.3p

============== ================

5. Reconciliation of cash and cash equivalents

Year to Year to

31 August 31 August

2017 2016

GBPm GBPm

Net movement in cash and

cash equivalents (13.3) 52.9

Opening cash and cash equivalents 173.3 119.2

Effect of exchange rates

on cash and cash equivalents 0.3 1.2

----------- -----------

Closing cash and cash equivalents 160.3 173.3

=========== ===========

The Group has in place a GBP20.0m revolving loan credit facility

available until October 2018, none of which has been drawn down at

the year end.

6. Contingent liabilities

From time to time, the Group is subject to various legal

proceedings and claims that arise in the ordinary course of

business, which due to the fast-growing nature of the Group and its

ecommerce base, may concern the Group's brand and trading name or

its product designs. All such cases brought against the Group are

robustly defended and a liability is recorded only when it is

probable that the case will result in a future economic outflow

which can be reliably measured.

At 31 August 2017, there were no other pending claims or

proceedings against the Group which were expected to have a

material adverse effect on its liquidity or operations. The Group

had contingent liabilities of GBP19.1m (2016: GBP7.3m) in relation

to supplier standby letters of credit, rent deposit deeds and other

bank guarantees. The likelihood of a cash outflow in relation to

these contingent liabilities is considered to be low.

7. Financial instruments

There are no changes to the categories of financial instruments

held by the Group.

Year to Year to

31 August 31

2017 August

2016

GBPm GBPm

Financial assets

Derivative assets used for hedging 3.6

at fair value -

Loans and receivables(1) 176.3 179.0

Financial liabilities

Derivative liabilities used for

hedging at fair value (66.8) (76.0)

Amortised cost(2) (474.2) (364.9)

=========== ========

(1) Loans and receivables include trade and other receivables

and cash and cash equivalents, and excludes prepayments

(2) Included in financial liabilities at amortised cost are

trade payables, accruals and other payables

The Group operates internationally and is therefore exposed to

foreign currency transaction risk, primarily on sales denominated

in US dollars, Euros and Australian dollars. The Group's policy is

to mitigate foreign currency transaction exposures where possible

and the Group uses financial instruments in the form of forward

foreign exchange contracts to hedge future highly probable foreign

currency cash flows.

These forward foreign exchange contracts are classified above as

derivative financial liabilities and are classified as Level 2

financial instruments under IFRS 13, "Fair Value Measurement." They

have been fair valued at 31 August 2017 with reference to forward

exchange rates that are quoted in an active market, with the

resulting value discounted back to present value. All forward

foreign exchange contracts were assessed to be highly effective

during the period to 31 August 2017 and a net unrealised gain of

GBP15.8m (2016: loss of GBP82.3m) was recognised in equity. All

derivative financial liabilities at 31 August 2017 mature within

two years based on the related contractual arrangements.

8. Related parties

The Group's related party transactions are with the Employee

Benefit Trust, Capita Trust, key management personnel and other

related parties. There have been no material changes to the Group's

related party transactions during the year to 31 August 2017.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR UNAKRBAARAAA

(END) Dow Jones Newswires

October 17, 2017 02:00 ET (06:00 GMT)

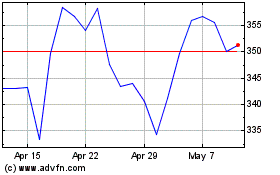

Asos (LSE:ASC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Asos (LSE:ASC)

Historical Stock Chart

From Apr 2023 to Apr 2024