TIDMAPI

RNS Number : 6710Y

API Group PLC

03 December 2014

Press Release 3 December 2014

API Group plc

("API" or the "Group")

Interim Results

API Group plc (AIM:API), a leading manufacturer of specialist

foils and packaging materials, announces its interim results for

the six months ended 30 September 2014.

Highlights

-- Revenues of GBP56.4m, compared to GBP56.9m for first half

last year; 1.6% ahead at constant exchange rates

-- Operating profits, before exceptional items, GBP2.8m (2013:

GBP3.5m)

-- No exceptional items (2013: GBP0.3m)

-- Profit before tax GBP2.3m (2013: GBP2.9m pre-exceptional,

GBP2.6m post-exceptional)

-- Underlying diluted earnings per share 2.4p (2013: 3.8p)

-- Interim dividend increased by 7% to 0.75p, reflecting confidence

in Group's cash flow and prospects

-- Laminates and Foils Europe profits unchanged. Contribution

from Holographics turnaround offset by swing into losses

at Foils Americas on significantly reduced shipments to

metallic pigment customers

-- Capital additions of GBP3.2m (2013: GBP2.0m) to increase

capacity and capability in foils

-- Net debt of GBP5.7m (2013: GBP5.6m)

Commenting on the results, Andrew Turner, Group Chief Executive

of API Group plc, said:

"The downturn in the US foils business materially impacted the

Group's results for the half year. The positives are the strong

revenue performance at Laminates and resilience at Foils Europe in

the face of sluggish markets on the Continent, as well as the

profit turnaround at Holographics.

"Against a background of tough current trading, the on-going

capital investment programme in the foils businesses is designed to

increase capacity and efficiency, extend product capabilities and

improve longer term prospects for growth."

- Ends -

For further information:

API Group plc

Andrew Turner, Group Chief Executive Tel: +44 (0) 1625

650 334

Chris Smith, Group Finance Director www.apigroup.com

Numis Securities (Broker)

James Serjeant Tel: +44 (0) 20 7260

1000

www.numis.com

Cairn Financial Advisers (Nominated Adviser)

Tony Rawlinson / Avi Robinson Tel: +44 (0) 20 7148

7900

www.cairnfin.com

Media enquiries:

Abchurch

Henry Harrison-Topham / Quincy Allan Tel: +44 (0) 20 7398

7710

quincy.allan@abchurch-group.com www.abchurch-group.com

REPORT ON THE INTERIM RESULTS

FOR THE 6 MONTH PERIOD ENDED 30 SEPTEMBER 2014

Group Income Statement

Group revenues for the six months to September 2014 were

GBP56.4m (2013: GBP56.9m), down on a reported basis by 0.9% but

ahead by 1.6% at constant exchange rates. Growth at Laminates was

offset by a decline in demand for metallic pigment products at

Foils Americas.

Gross margin, at 22.5%, was 2.6% lower than last year's first

half, due to a change in the mix of sales between the divisions and

within Laminates and lower fixed cost recovery at Foils Americas,

partly offset by reduced production and energy costs.

Selling, general and administration costs were GBP0.6m lower due

to reduced spending in Holographics, lower accruals for incentive

payments and the impact of currency translation. Pre-exceptional

operating profits for the six month period of GBP2.8m compared to

GBP3.5m at the interim stage last year, as lower costs were more

than offset by the less favourable mix of sales. Across the

divisions, operating profits at Foils Europe and Laminates were

substantively unchanged, whilst a GBP0.5m turnaround at

Holographics was more than offset by a GBP1.4m adverse swing at

Foils Americas. Central costs were lower by GBP0.2m.

Compared to the second half of last year, revenues were 2% lower

at constant FX and pre-exceptional operating profits were down by

30% due primarily to lower sales in the foils businesses,

especially Foils Americas.

No exceptional costs were incurred in the six months to 30

September 2014, compared to a charge of GBP0.3m booked last year in

connection with restructuring the UK Foils operations. As a result

of lower cash interest costs, the net finance charge was GBP0.1m

lower, at GBP0.5m, including a non-cash cost of GBP0.3m relating to

defined benefit pension liabilities. Interim profit before tax of

GBP2.3m compares to last year's pre-exceptional GBP2.9m and GBP2.6m

on a post-exceptional basis.

Tax of GBP0.4m (2013: GBP0.0m) comprised an accrual for

corporation tax in the UK and Europe of GBP0.3m (2013: GBP0.2m) and

deferred tax charge of GBP0.1m (2013: -GBP0.2m). The tax rate of

20% was inflated by the absence of further tax relief being

recognised on losses in the US. Underlying earnings per share

(diluted) amounted to 2.4p compared to 3.8p for the first half last

year.

Review of Operations

Laminates

The Group's largest division continued the strong momentum seen

in the second half of last financial year. Revenues of GBP32.3m

were 15% higher than last year's first half and were 4% ahead of

the preceding six months. There was strong demand from a number of

key tobacco customers and full loading of the new laminator as a

result of the major new supply contract which commenced last

year.

Despite higher sales, operating profits were unchanged at

GBP3.3m (2013: GBP3.3m) due to changes in the product mix and some

one-off factors impacting comparative costs and margins. The ratio

of operating profit to sales declined by 1.4% to 10.2%.

The business remains focussed on volume opportunities with

customers in the premium branded consumer goods segment and on

maximising the utilisation and effectiveness of its manufacturing

assets.

Foils Europe

Foils Europe revenues were down 4% on a constant currency basis,

at GBP13.4m. Subdued demand on the continent impacted sales in

Germany, France, Poland and Spain although this was partly offset

by further gains in Italy. The new UK supply hub performed well,

although year-on-year sales growth was constrained by a lower level

of customer activity associated with product launches and

rebranding.

The impact of lower volumes was fully compensated by a more

favourable sales mix, leaving operating profits unchanged at

GBP0.9m and operating margins of 6.4% compared to 6.3% at the

interim stage last year.

During the period, progress was made on a number of operational

improvement projects, including the installation and commissioning

of a new metalliser at Livingston and the successful roll-out of

the Group's new ERP system in France and Poland. In addition, two

important new foil grades were launched, to which the initial

customer response has been positive. The pace of change is planned

to continue in the second half with the ERP implementation at the

two UK sites and installation of the new coating line in

Livingston.

Foils Americas

As predicted at the final results stage last year and in

September's trading update, Foils Americas revenues for the six

months to 30 September 2014 were significantly impacted by a

decline in demand from customers in the metallic pigment segment.

Progress in recovering sales in the core graphics market to

compensate for the lost pigment volume was slower than expected. As

a result, divisional revenues were down by 24% on a constant

currency basis and 30% at actual FX rates to GBP8.3m.

Action was taken to reduce costs, yielding year-on-year savings

of GBP0.4m (at constant FX). Nevertheless, the unit recorded a loss

of GBP0.4m compared to an operating profit of GBP1.1m in the first

half of last year (GBP1.0m at this year's FX rates).

A new metalliser was commissioned in Lawrence towards the end of

the period which will provide enhanced capabilities relevant to

both the metallic pigment sector and the core graphics foils

market, which should benefit business development prospects over

the medium term.

Holographics

Holographics consolidated the break-even position achieved in

the final quarter of the last financial year, eliminating losses of

GBP0.5m reported for last year's first half.

Revenues were 5% lower at GBP4.3m (2013: GBP4.5m) due to reduced

orders against continuing supply agreements with security

customers, partly offset by increased volumes of decorative

holographic products supplied to sister companies within the

Group.

During the period, the division strengthened its sales and

marketing team, with key appointments from inside the security

holographics sector. A new product range was launched using optical

features originated at the Group's recently established holographic

origination centre in the Czech Republic. In addition, the

manufacturing site at Salford was accredited to the new

international security standard for security printing processes,

ISO 14298.

Cash Flow and Borrowings

Reported net cash-flow from operating activities for the six

months to September 2014 amounted to a net outflow of GBP1.6m

(2013: GBP0.6m outflow), with the year-on-year change due primarily

to lower net profits (GBP0.3m), higher income taxes paid (GBP0.2m)

and a small increase in working capital (GBP0.3m). Period-end

working capital efficiency, measured by the ratio to sales, was

consistent with September 2013 at 11.2%.

The Group is part way through a significant capital expenditure

programme primarily aimed at enhancing capacity, capability and

effectiveness of the foils businesses. Cash capital additions in

the six months to September 2014 amounted to GBP3.2m (2013:

GBP2.4m) including completing the installation of new metallisation

equipment at both Foils Americas' plant in Lawrence, Kansas and

Foils Europe's manufacturing site in Livingston, Scotland. Stage

payments were also made relating to a new coating line for

Livingston and expenditure continued on the Group's ERP

implementation which is currently being rolled out in Foils Europe.

Full year capital expenditure is expected to be close to GBP6.0m,

including second half expenditure to complete the UK coater

project.

After the reintroduction of the dividend, the final dividend

payable in respect of the year ended 31 March 2014 impacted cash

flow in the first six months of this financial year by GBP1.0m

(2013: GBP0.0m).

Group net debt at 30 September 2014 was GBP5.7m, compared to

GBP5.6m one year earlier and net cash of GBP0.2m at 31 March 2014.

The Group continues to manage its cash position closely with

gearing at the period end of 23%, unchanged from twelve months ago

and the ratio of net debt to trailing 12 month EBITDA also

unchanged at 0.6x.

The US business' existing funding with Wells Fargo expires in

April 2015 and the Group is currently in the process of arranging

new facilities.

Dividend

The Board re-introduced dividend payments at the interim stage

last year after a break of more than 10 years. In spite of the

weaker profit performance in the current financial year, the Board

remains confident about the Group's prospects and committed to an

affordable, progressive dividend policy. The interim dividend is

therefore being increased by 7.1% to 0.75 pence per share and will

be paid on 12 January 2015 to shareholders on the register as at 12

December 2014, with an ex-dividend date of 11 December 2014.

Pension Deficit

The gross deficit on UK and US defined-benefit pension plans, as

calculated under IAS19, increased by GBP2.4m to GBP15.8m compared

to the position at 31 March 2014. Above-plan returns on scheme

assets were more than offset by the impact of lower corporate bond

yields on the valuation of liabilities. The associated deferred tax

asset increased by GBP0.5m, leaving a net reported deficit of

GBP12.4m compared to GBP10.5m at March 2014. In respect of the UK

scheme, a funding ratio of 85% was down 1% on the position at 31

March 2014.

Board

As announced previously, after more than 14 years on the Board

as a non-executive director and then Chairman, Richard Wright stood

down as a director at the end of October 2014. The Board is

grateful for Richard's dedication to serving the interests of the

Group and its shareholders and especially his stewardship during

the challenges of the mid to late 2000's and the subsequent

restoration of the Group's fortunes. The search for a new Chairman

is ongoing and further announcements will be made in due

course.

Chris Smith, who has been Group Finance Director since 2008

advised the Board in July 2014 of his intention to step down,

having been selected for the position of Chief Financial Officer at

McBride plc. Chris will complete his tenure on 12 December 2014 and

the Board thanks him for his wide-ranging contribution to the

development of the Group and wishes him every success in his new

role. An announcement on the replacement Finance Director will be

made in due course. To cover the period until a permanent

appointment is made, Loraine Hughes has joined the Group as Interim

Finance Director.

Outlook

The Group has experienced tough trading conditions so far in the

second half, with the outlook for profits this financial year

slightly down on previous expectations.

Progress at Foils Europe continues to be held back by sluggish

markets on the Continent and the benefit from a slow recovery in

metallic pigment orders at Foils Americas will be partly offset by

the seasonally weaker second half in the US market for graphics

foils.

Third quarter sales at Holographics are expected to drop below

breakeven level, although there is the prospect for the shortfall

to be recovered in the final last quarter with the start-up of

shipments on two new supply contracts.

Laminates is continuing to experience strong order levels on

established supply agreements although the impact on profits is

expected to be diluted by a less favourable sales mix.

Beyond the current financial year, the recovery in US metallic

pigment volumes is expected to continue and both the US and

European foils businesses should benefit from recent new product

launches and investments in new, more efficient capacity and

additional supply capabilities.

Group Income Statement

for the six month period ended 30 September 2014

Unaudited Unaudited Audited

Six months to Six months to Year to

30 September 30 September 31 March

2014 2013 2014

Note GBP'000 GBP'000 GBP'000

--------------------------------------------------------------- ----- --------------- --------------- ----------

Revenue 2 56,374 56,897 114,712

Cost of sales (43,711) (42,621) (86,617)

--------------------------------------------------------------- ----- --------------- --------------- ----------

Gross profit 12,663 14,276 28,095

Distribution costs (1,880) (2,176) (3,952)

Administrative expenses (excluding exceptional items) (8,011) (8,645) (16,716)

--------------------------------------------------------------- ----- --------------- --------------- ----------

Operating profit before exceptional items 2 2,772 3,455 7,427

Exceptional items 3 - (300) (705)

--------------------------------------------------------------- ----- --------------- --------------- ----------

Operating profit 2,772 3,155 6,722

Net finance costs 4 (517) (567) (1,130)

--------------------------------------------------------------- ----- --------------- --------------- ----------

Profit before taxation 2,255 2,588 5,592

Tax (expense)/credit 5 (429) 20 (150)

--------------------------------------------------------------- ----- --------------- --------------- ----------

Profit for the period 1,826 2,608 5,442

--------------------------------------------------------------- ----- --------------- --------------- ----------

Earnings per share (pence)

Basic earnings per share on profit for the period 6 2.5 3.5 7.4

Underlying basic earnings per share on profit for the period 6 2.5 3.9 8.1

Diluted earnings per share on profit for the period 6 2.4 3.4 7.1

Underlying diluted earnings per share on profit for the period 6 2.4 3.8 7.8

--------------------------------------------------------------- ----- --------------- --------------- ----------

Group statement of comprehensive income

for the six months ended 30 September 2014

Unaudited

Unaudited Six months to Audited

Six months to 30 September Year to

30 September 2013 31 March 2014

2014 (restated(1) ) (restated(1) )

GBP'000 GBP'000 GBP'000

----------------------------------------------------------------- --------------- ---------------- ----------------

Profit for the period 1,826 2,608 5,442

----------------------------------------------------------------- --------------- ---------------- ----------------

Exchange differences on retranslation of foreign operations 135 (1,037) (1,442)

Change in fair value of effective cash flow hedges 527 638 863

Re-measurement (losses)/gains on defined benefit pension plans (2,690) 314 (513)

Tax on items relating to components of other comprehensive

income 398 (561) (350)

----------------------------------------------------------------- --------------- ---------------- ----------------

Other comprehensive income for the period, net of tax (1,630) (646) (1,442)

----------------------------------------------------------------- --------------- ---------------- ----------------

Total comprehensive income for the period attributable to equity

holders of the Parent 196 1,962 4,000

----------------------------------------------------------------- --------------- ---------------- ----------------

(1) Restated in accordance with IFRS 11 Joint Arrangements. See

Note 1 (c).

Group balance sheet

at 30 September 2014

Unaudited Audited

Unaudited 30 September 31 March

30 September 2013 2014

2014 (restated(1) ) (restated(1) )

Note GBP'000 GBP'000 GBP'000

------------------------------------------ ----- -------------- ---------------- ----------------

Assets

Non-current assets

Property, plant and equipment 24,050 21,413 21,776

Intangible assets - goodwill 5,602 5,631 5,626

Financial assets 78 46 -

Deferred tax assets 6,891 6,198 6,412

------------------------------------------ ----- -------------- ---------------- ----------------

36,621 33,288 33,814

------------------------------------------ ----- -------------- ---------------- ----------------

Current assets

Trade and other receivables 16,518 17,695 16,633

Inventories 13,594 12,925 12,126

Other financial assets 1,095 531 594

Cash and short-term deposits 8 6,210 1,490 8,691

------------------------------------------ ----- -------------- ---------------- ----------------

37,417 32,641 38,044

------------------------------------------ ----- -------------- ---------------- ----------------

Total assets 74,038 65,929 71,858

------------------------------------------ ----- -------------- ---------------- ----------------

Liabilities

Current liabilities

Trade and other payables 19,564 20,254 22,665

Financial liabilities 9 1,752 6,769 432

Income tax payable 755 494 635

------------------------------------------ ----- -------------- ---------------- ----------------

22,071 27,517 23,732

------------------------------------------ ----- -------------- ---------------- ----------------

Non-current liabilities

Financial liabilities 9 10,132 465 8,033

Deferred tax liabilities 405 287 306

Provisions 52 62 56

Deficit on defined benefit pension plans 10 15,777 12,733 13,364

------------------------------------------ ----- -------------- ---------------- ----------------

26,366 13,547 21,759

------------------------------------------ ----- -------------- ---------------- ----------------

Total liabilities 48,437 41,064 45,491

------------------------------------------ ----- -------------- ---------------- ----------------

Net assets 25,601 24,865 26,367

------------------------------------------ ----- -------------- ---------------- ----------------

Equity

Called up share capital 767 767 767

Share premium 7,136 7,136 7,136

Other reserves 8,822 8,816 8,818

Foreign exchange reserve (361) (91) (496)

Retained earnings 9,237 8,237 10,142

------------------------------------------ ----- -------------- ---------------- ----------------

Total shareholders' equity 25,601 24,865 26,367

------------------------------------------ ----- -------------- ---------------- ----------------

(1) Restated in accordance with IFRS 11 Joint Arrangements. See

Note 1 (c).

Group statement of changes in equity

for the six month period ended 30 September 2014

Equity Foreign Total

share Share Other exchange Retained shareholders'

capital premium reserves reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------- --------- --------- ---------- ---------- ---------- ---------------

At 1 April 2013

(restated(1) ) 767 7,136 8,816 946 5,252 22,917

Profit for the

period - - - - 2,608 2,608

Other comprehensive

income for the

period, net of

tax (restated(1)

) - - - (1,037) 391 (646)

Shares acquired

by Employee Benefit

Trust - - (32) - - (32)

Share-based payments - - - - 18 18

Transferred on

exercise of share

options - - 32 - (32) -

------------------------- --------- --------- ---------- ---------- ---------- ---------------

Balance at 30 September

2013 767 7,136 8,816 (91) 8,237 24,865

Profit for the

period - - - - 2,834 2,834

Other comprehensive

income for the

period, net of

tax (restated(1)

) - - - (405) (391) (796)

Share-based payments - - - - (18) (18)

Transferred on

exercise of LTIP - - 2 - (2) -

Dividends - - - - (518) (518)

Balance at 31 March

2014 767 7,136 8,818 (496) 10,142 26,367

Profit for the

period - - - - 1,826 1,826

Other comprehensive

income for the

period, net of

tax - - - 135 (1,765) (1,630)

Transferred on

exercise of LTIP - - 4 - (4) -

Dividends - - - - (962) (962)

------------------------- --------- --------- ---------- ---------- ---------- ---------------

Balance at 30 September

2014 767 7,136 8,822 (361) 9,237 25,601

------------------------- --------- --------- ---------- ---------- ---------- ---------------

(1) Restated in accordance with IFRS 11 Joint Arrangements. See

Note 1 (c).

Group cash flow statement

For the six month period ended 30 September 2014

Unaudited Audited

Unaudited Six months to Year to

Six months to 30 September 31 March

30 September 2013 2014

2014 (restated(1) ) (restated(1) )

Note GBP'000 GBP'000 GBP'000

---------------------------------------------------------- ----- --------------- ---------------- ----------------

Operating activities

Group profit before tax 2,255 2,588 5,592

Adjustments to reconcile Group profit before tax to net

cash flow from operating activities:

Net finance costs 517 567 1,130

Depreciation of property, plant and equipment 1,142 1,132 2,386

Profit on disposal of property, plant and equipment (2) (5) (4)

Movement in fair value foreign exchange contracts (65) (7) 44

Share-based payments - 18 -

(Increase)/decrease in inventories (1,539) (458) 221

Increase in trade and other receivables (47) (2,226) (1,271)

(Decrease)/increase in trade and other payables (2,813) (1,405) 855

Decrease in provisions (4) (4) (10)

---------------------------------------------------------- ----- --------------- ---------------- ----------------

Cash generated from operations (556) 200 8,943

Interest paid (208) (226) (396)

Pension contributions and scheme expenses paid (585) (528) (973)

Income taxes paid (227) (53) (155)

---------------------------------------------------------- ----- --------------- ---------------- ----------------

Net cash flow from operating activities (1,576) (607) 7,419

---------------------------------------------------------- ----- --------------- ---------------- ----------------

Investing activities

Interest received 1 1 2

Purchase of property, plant and equipment (3,259) (2,261) (3,748)

Investment in joint operation - (153) (251)

Sale of property, plant and equipment 4 5 4

---------------------------------------------------------- ----- --------------- ---------------- ----------------

Net cash flow used in investing activities (3,254) (2,408) (3,993)

---------------------------------------------------------- ----- --------------- ---------------- ----------------

Financing activities

Dividends paid (962) - (518)

Purchase of shares by Employee Benefit Trust - (32) (32)

New borrowings 2,645 - 12,340

Arrangement fees for new borrowings - - (183)

Repayment of borrowings (94) (1,792) (12,567)

---------------------------------------------------------- ----- --------------- ---------------- ----------------

Net cash flow from/(used in) financing activities 1,589 (1,824) (960)

---------------------------------------------------------- ----- --------------- ---------------- ----------------

(Decrease)/increase in cash and cash equivalents (3,241) (4,839) 2,466

Effect of exchange rates on cash and cash equivalents (54) (69) (103)

Cash and cash equivalents at the beginning of the period 8,459 6,096 6,096

---------------------------------------------------------- ----- --------------- ---------------- ----------------

Cash and cash equivalents at the end of the period 8 5,164 1,188 8,459

---------------------------------------------------------- ----- --------------- ---------------- ----------------

(1) Restated in accordance with IFRS 11 Joint Arrangements. See

Note 1 (c).

Notes to the interim financial statements

for the six month period ended 30 September 2014

1. Group accounting policies

(a) Corporate information

The consolidated interim financial statements of API Group plc

for the six months ended 30 September 2014 were authorised for

issue in accordance with a resolution of the Directors on 2

December 2014.

API Group plc is a public limited company incorporated and

domiciled in England and Wales. The Company's shares are traded on

the Alternative Investment Market of the London Stock Exchange.

The principal activities of the Group are the manufacture and

distribution of specialty foils, films and laminated materials.

(b) Basis of preparation

The interim consolidated financial statements of the Group for

the six months ended 30 September 2014 have been prepared in

accordance with IAS 34 Interim Financial Reporting, as adopted by

the European Union.

These interim consolidated financial statements are unaudited.

They do not constitute statutory accounts as defined in Section 435

of the Companies Act 2006 and therefore do not include all the

information and disclosures required in the annual financial

statements and should be read in conjunction with the Group's

latest annual financial statements as at 31 March 2014 which were

prepared in accordance with International Financial Reporting

Standards as adopted by the European Union. The audited annual

financial statements for the year ended 31 March 2014, which

represent the statutory accounts for that period have been filed

with the Registrar of Companies. The auditor reported on those

accounts. The audit report was unqualified, did not draw attention

to any matters by way of emphasis and did not contain a statement

under Section 498(2) or (3) of the Companies Act 2006.

UK banking facilities with HSBC extend to 31 December 2017

whilst US facilities are scheduled for renewal in April 2015. After

making appropriate enquiries, the Directors consider that there is

a reasonable expectation that the Group has adequate resources to

continue in operational existence for the foreseeable future. The

Directors therefore continue to adopt the going concern basis in

preparing these financial statements.

(c) Significant accounting policies

The accounting policies adopted in the preparation of the

interim consolidated financial statements are consistent with those

followed in the preparation of the Group's annual financial

statements for the year ended 31 March 2014, except for the

adoption of IFRS 11 Joint Arrangements with effect from 1 April

2014. Comparative figures for the six months to 30 September 2013

and the year to 31 March 2014 have been restated. The impact of

adopting IFRS 11 is described below.

IFRS 11 Joint Arrangements

The key impact of IFRS 11 is the requirement of a party to a

joint arrangement to determine the type of joint arrangement in

which it is involved by assessing its rights and obligations

arising from the agreement. IFRS 11 classifies joint arrangements

into two types - joint operations and joint ventures. IFRS 11

requires a joint operator to recognise and measure the assets and

liabilities (and recognise the related revenue and expenses) in

relation to its interest in the arrangement.

The Group has a 50% interest in a company, API Optix s.r.o.

("APIO). This joint arrangement is considered to be a joint

operation under IFRS 11 and, under the transitional requirements of

IFRS 11, the comparatives for the period ended 30 September 2013

and the year ended 31 March 2014 have been restated.

The balance sheets at 30 September 2013 and 31 March 2014 have

been restated to recognise the Group's assets and liabilities in

relation to its interest in APIO. No adjustments have been made to

the income statement for either the six months ended 30 September

2013 or the year ended 31 March 2014 as APIO operated at breakeven

and the related revenue and expenditure are not significant to the

Group. Exchange differences on retranslation of APIO's operations

have been recognised in other comprehensive income; a charge of

GBP52,000 in the year ended 31 March 2014 and a charge of GBP29,000

in the six months ended 30 September 2013. Equity shareholders'

funds have reduced by GBP41,000 at 30 September 2013 and by

GBP64,000 at 31 March 2014 for the cumulative exchange differences

on retranslation of APIO's operations.

2. Segmental information

Unaudited Unaudited Audited

Six months to Six months to Year to

30 September 30 September 31 March

2014 2013 2014

GBP'000 GBP'000 GBP'000

------------------------------------------------- --------------- ---------------- -----------

Total revenue by origin

Laminates 32,306 28,097 59,237

Foils Europe 13,410 14,380 28,580

Foils Americas 8,319 11,927 21,819

Holographics 4,269 4,505 8,888

------------------------------------------------- --------------- ---------------- -----------

58,304 58,909 118,524

------------------------------------------------- --------------- ---------------- -----------

Inter-segmental revenue

Laminates - - 13

Foils Europe 260 334 707

Foils Americas 239 312 567

Holographics 1,431 1,366 2,525

------------------------------------------------- --------------- ---------------- -----------

1,930 2,012 3,812

------------------------------------------------- --------------- ---------------- -----------

External revenue by origin

Laminates 32,306 28,097 59,224

Foils Europe 13,150 14,046 27,873

Foils Americas 8,080 11,615 21,252

Holographics 2,838 3,139 6,363

------------------------------------------------- --------------- ---------------- -----------

56,374 56,897 114,712

------------------------------------------------- --------------- ---------------- -----------

Segment result

Operating profit before exceptional items

Laminates 3,306 3,260 6,680

Foils Europe 852 901 2,130

Foils Americas (361) 1,055 1,699

Holographics (49) (548) (724)

------------------------------------------------- --------------- ---------------- -----------

Segment result 3,748 4,668 9,785

Central costs (976) (1,213) (2,358)

------------------------------------------------- --------------- ---------------- -----------

Total operating profit before exceptional items 2,772 3,455 7,427

------------------------------------------------- --------------- ---------------- -----------

3. Exceptional items

Unaudited Unaudited Audited

Six months to Six months to Year to

30 September 30 September 31 March

2014 2013 2014

GBP'000 GBP'000 GBP'000

--------------------------------------- ---------------- --------------- ----------

Restructuring of operating businesses - (300) (705)

- (300) (705)

-------------------------------------------------------- --------------- ----------

Restructuring of operating businesses in the previous year

related primarily to redundancy, severance settlements and other

costs associated with business restructuring in the Foils Europe,

Laminates and Holographics businesses.

4. Finance revenue and finance costs

Unaudited Unaudited Audited

Six months to Six months to Year to

30 September 30 September 31 March

2014 2013 2014

GBP'000 GBP'000 GBP'000

----------------------------------------------------------- --------------- --------------- ----------

Finance revenue

Interest receivable on bank and other short-term deposits 1 1 1

Other interest receivable - - 1

----------------------------------------------------------- --------------- --------------- ----------

1 1 2

----------------------------------------------------------- --------------- --------------- ----------

Finance costs

Interest payable on bank loans and overdrafts (221) (280) (533)

Other interest payable (10) (8) (41)

Finance cost in respect of defined benefit pension plans (287) (280) (558)

----------------------------------------------------------- --------------- --------------- ----------

(518) (568) (1,132)

----------------------------------------------------------- --------------- --------------- ----------

Net finance costs (517) (567) (1,130)

----------------------------------------------------------- --------------- --------------- ----------

5. Taxation

Unaudited Unaudited Audited

Six months to Six months to Year to

30 September 30 September 31 March

2014 2013 2014

GBP'000 GBP'000 GBP'000

--------------------------------------------------- --------------- --------------- ----------

Current income tax

UK corporation tax - current year charge (302) (127) (330)

UK corporation tax - adjustment to prior years - - 75

Overseas tax - current year charge (48) (54) (164)

--------------------------------------------------- --------------- --------------- ----------

(350) (181) (419)

--------------------------------------------------- --------------- --------------- ----------

Deferred tax

Origination and reversal of temporary differences (79) 237 418

Effect of change in tax rate - (36) (149)

--------------------------------------------------- --------------- --------------- ----------

(79) 201 269

--------------------------------------------------- --------------- --------------- ----------

Total (expense)/credit in the income statement (429) 20 (150)

--------------------------------------------------- --------------- --------------- ----------

6. Earnings per share

Basic earnings per share is calculated by dividing the net

profit for the period attributable to ordinary equity holders of

the Parent by the weighted average number of ordinary shares

outstanding during the period.

Diluted earnings per share is calculated by dividing the net

profit attributable to ordinary equity holders of the Parent by the

weighted average number of ordinary shares outstanding during the

period plus the weighted average number of ordinary shares that

would be issued on the conversion of all dilutive potential

ordinary shares into ordinary shares.

Earnings used to calculate adjusted basic and diluted earnings

per share exclude exceptional items, net of tax. The following

reflects the income and share data used in the basic and diluted

earnings per share computations:

Unaudited Unaudited Audited

Six months to Six months to Year to

30 September 30 September 31 March

2014 2013 2014

GBP'000 GBP'000 GBP'000

--------------------------------------------------------- --------------- --------------- ----------

Net profit attributable to equity holders of the Parent 1,826 2,608 5,442

Adjustments to arrive at underlying earnings:

Exceptional items - 300 705

Tax credit on exceptional items - - (162)

--------------------------------------------------------- --------------- --------------- ----------

Underlying earnings 1,826 2,908 5,985

--------------------------------------------------------- --------------- --------------- ----------

Unaudited Unaudited Audited

Six months to Six months to Year to

30 September 30 September 31 March

2014 2013 2014

number number number

----------------------------------------------------------------- --------------- --------------- -----------

Basic weighted average number of ordinary shares 74,021,746 73,786,981 73,892,566

Dilutive effect of employee share options and contingent shares 3,130,184 3,376,309 3,265,060

----------------------------------------------------------------- --------------- --------------- -----------

Diluted weighted average number of ordinary shares 77,151,930 77,163,290 77,157,626

----------------------------------------------------------------- --------------- --------------- -----------

The calculation of the basic weighted average number of shares

excludes the shares owned by the API Group plc No.2 Employee

Benefit Trust (30 September 2014: 2,399,009; 30 September 2013 and

31 March 2014: 2,750,000). These contingent shares are included in

the calculation of the diluted weighted average number of

shares.

Unaudited Unaudited Audited

Six months to Six months to Year to

30 September 30 September 31 March

2014 2013 2014

pence pence pence

--------------------------------------- --------------- --------------- ----------

Earnings per share

Basic earnings per share 2.5 3.5 7.4

Underlying basic earnings per share 2.5 3.9 8.1

Diluted earnings per share 2.4 3.4 7.1

Underlying diluted earnings per share 2.4 3.8 7.8

--------------------------------------- --------------- --------------- ----------

7. Dividends

An interim dividend of 0.75 pence per share (2013: 0.7 pence)

was approved by the Board on 2 December 2014, payable on 12 January

2015 to equity holders on the register at the close of business on

12 December 2014. This dividend has not been provided for in these

interim financial statements.

8. Cash and cash equivalents

Unaudited Audited

Unaudited 30 September 31 March

30 September 2013 2014

2014 (restated(1) ) (restated(1) )

GBP'000 GBP'000 GBP'000

------------------------------ -------------- ---------------- ----------------

Cash and short-term deposits 6,210 1,490 8,691

Bank overdrafts (1,046) (302) (232)

------------------------------ -------------- ---------------- ----------------

5,164 1,188 8,459

------------------------------ -------------- ---------------- ----------------

(1) Restated in accordance with IFRS 11 Joint Arrangements. See

Note 1 (c).

9. Financial liabilities

Unaudited Unaudited Audited

30 September 30 September 31 March

2014 2013 2014

GBP'000 GBP'000 GBP'000

------------------------------------------- -------------- -------------- ----------

Current

Bank overdrafts 1,046 302 232

Current instalments due on bank loans 706 6,296 187

Interest rate swaps - 4 -

Forward currency exchange contracts - 167 13

------------------------------------------- -------------- -------------- ----------

1,752 6,769 432

------------------------------------------- -------------- -------------- ----------

Non-current -

Non-current instalments due on bank loans 10,132 465 8,033

Interest rate swaps - - -

------------------------------------------- -------------- -------------- ----------

10,132 465 8,033

------------------------------------------- -------------- -------------- ----------

10. Defined benefit pension plan deficit

Unaudited Unaudited Audited

30 September 30 September 31 March

2014 2013 2014

GBP'000 GBP'000 GBP'000

---------------------------------------------------------------- -------------- -------------- ----------

United Kingdom

Fair value of scheme assets 82,558 77,231 80,011

Present value of scheme liabilities (97,459) (89,209) (92,631)

---------------------------------------------------------------- -------------- -------------- ----------

(14,901) (11,978) (12,620)

---------------------------------------------------------------- -------------- -------------- ----------

United States

Fair value of scheme assets 2,159 2,011 2,087

Present value of scheme liabilities (3,035) (2,766) (2,831)

---------------------------------------------------------------- -------------- -------------- ----------

(876) (755) (744)

---------------------------------------------------------------- -------------- -------------- ----------

Net pension liability (15,777) (12,733) (13,364)

---------------------------------------------------------------- -------------- -------------- ----------

The movements in the net pension liability are as follows:

Opening liability 13,364 13,349 13,349

Scheme expenses recognised in operating profit 266 330 675

Net cost recognised in finance costs 287 280 558

Taken to statement of comprehensive income 2,690 (314) 513

Contributions from and scheme expenses borne by employers (851) (850) (1,648)

Exchange differences 21 (62) (83)

---------------------------------------------------------------- -------------- -------------- ----------

Closing liability 15,777 12,733 13,364

---------------------------------------------------------------- -------------- -------------- ----------

The main assumptions used in valuing the present value of the scheme liabilities in the UK

are as follows:

Rate of increases in pensions in payment and deferred pensions 2.20% 2.30% 2.35%

Inflation - CPI 2.20% 2.30% 2.35%

Discount rate 4.00% 4.40% 4.40%

---------------------------------------------------------------- -------------- -------------- ----------

- Ends -

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR UGGWWPUPCGBP

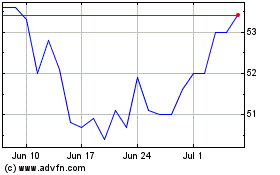

Abrdn Property Income (LSE:API)

Historical Stock Chart

From Mar 2024 to Apr 2024

Abrdn Property Income (LSE:API)

Historical Stock Chart

From Apr 2023 to Apr 2024