AMCON Distributing Company (“AMCON”) (NYSE MKT:DIT), an Omaha,

Nebraska based consumer products company is pleased to announce

fully diluted earnings per share of $1.61 on net income available

to common shareholders of $1.1 million for the fiscal quarter ended

March 31, 2016.

“We continue to invest in our wholesale business to enhance our

leadership position in the Convenience Distribution Industry. We

are expanding our foodservice and technology capabilities as the

needs of our customers grow in complexity. This approach has served

to differentiate us from our competition,” said Christopher H.

Atayan, AMCON’s Chairman and Chief Executive Officer. He further

noted “We are actively seeking acquisitions that can benefit from

our extensive platform of customer service.”

Each of AMCON’s business segments reported solid quarters. The

wholesale distribution segment reported revenues of $288.9 million

and operating income before depreciation and amortization of $3.5

million for the second fiscal quarter of 2016. The retail health

food segment reported revenues of $7.5 million and operating income

before depreciation and amortization of $0.6 million for the same

period.

“Our annual spring trade show in Kansas City was well received

by our customers and vendors. This event provides momentum as we

enter our customers’ peak selling season,” said Kathleen M. Evans,

President of AMCON’s Wholesale Distribution segment.

“Our management team is focusing on a variety of initiatives

designed to enhance the operating economics of our retail stores.

We operate in a competitive environment that continues to be highly

challenging,” said Eric Hinkefent, President of AMCON’s Retail

Health Food Segment.

“We actively manage our working capital and liquidity which

provides us the ability to respond quickly to the dynamic

environments in which both of our business segments operate. This

conservative approach provides us significant flexibility to act in

the long term best interest of the many constituencies we serve,”

said Andrew C. Plummer, AMCON’s Chief Financial Officer. “We were

pleased to close the March 31, 2016 quarter with shareholders’

equity of $62.0 million and consolidated debt of $21.2

million.”

AMCON is a leading wholesale distributor of consumer products,

including beverages, candy, tobacco, groceries, foodservice, frozen

and chilled foods, and health and beauty care products with

locations in Illinois, Missouri, Nebraska, North Dakota, South

Dakota and Tennessee. AMCON also operates sixteen (16) health and

natural product retail stores in the Midwest and Florida. The

retail stores operate under the names Chamberlin's Market &

Cafe www.chamberlins.com and Akin’s Natural Foods Market

www.akins.com.

This news release contains forward-looking statements that are

subject to risks and uncertainties and which reflect management's

current beliefs and estimates of future economic circumstances,

industry conditions, Company performance and financial results. A

number of factors could affect the future results of the Company

and could cause those results to differ materially from those

expressed in the Company's forward-looking statements including,

without limitation, availability of sufficient cash resources to

conduct its business and meet its capital expenditures needs and

the other factors described under Item 1.A. of the Company’s Annual

Report on Form 10-K. Moreover, past financial performance should

not be considered a reliable indicator of future performance.

Accordingly, the Company claims the protection of the safe harbor

for forward-looking statements contained in the Private Securities

Litigation Reform Act of 1995 with respect to all such

forward-looking statements.

Visit AMCON Distributing Company's web site

at: www.amcon.com

AMCON Distributing Company and Subsidiaries

Condensed Consolidated Balance Sheets March 31, 2016 and

September 30, 2015 March

September 2016 2015 (Unaudited)

ASSETS Current assets: Cash $ 321,990 $ 219,536 Accounts

receivable, less allowance for doubtful accounts of $0.8 million at

March 2016 and $0.9 million at September 2015 29,255,947 31,866,787

Inventories, net 56,594,107 60,793,478 Deferred income taxes

1,278,006 1,553,726 Income taxes receivable — 113,238 Prepaid and

other current assets 4,080,280 2,125,908

Total current assets 91,530,330 96,672,673 Property

and equipment, net 12,465,906 12,753,145 Goodwill 6,349,827

6,349,827 Other intangible assets, net 3,908,478 4,090,978 Other

assets 296,717 317,184 $ 114,551,258

$ 120,183,807

LIABILITIES AND SHAREHOLDERS’

EQUITY Current liabilities: Accounts payable $ 16,033,216 $

17,044,726 Accrued expenses 5,860,058 7,224,963 Accrued wages,

salaries and bonuses 2,558,420 3,282,354 Income taxes payable

230,066 — Current maturities of long-term debt 357,000

351,383 Total current liabilities 25,038,760

27,903,426 Credit facility 17,609,387 20,902,207 Deferred

income taxes 3,772,620 3,696,098 Long-term debt, less current

maturities 3,204,052 3,384,319 Other long-term liabilities 30,838

34,860

Series A cumulative, Convertible Preferred

Stock, $.01 par value 100,000 shares authorized and issued, and a

total liquidation preference of $2.5 million at both March 2016 and

September 2015

2,500,000 2,500,000 Series B cumulative, Convertible Preferred

Stock, $.01 par value 80,000 shares authorized, 16,000 shares

issued and outstanding at both March 2016 and September 2015, and a

total liquidation preference of $0.4 million at both March 2016 and

September 2015 400,000 400,000 Shareholders’ equity:

Preferred stock, $.01 par value, 1,000,000 shares authorized,

116,000 shares outstanding and issued in Series A and B referred to

above — — Common stock, $.01 par value, 3,000,000 shares

authorized, 604,022 shares outstanding at March 2016 and 621,104

shares outstanding at September 2015 7,197 7,061 Additional paid-in

capital 16,697,234 15,509,199 Retained earnings 55,519,822

53,527,606 Treasury stock at cost (10,228,652 )

(7,680,969 ) Total shareholders’ equity 61,995,601

61,362,897 $ 114,551,258 $ 120,183,807

AMCON Distributing Company and Subsidiaries

Condensed Consolidated Unaudited Statements of Operations

for the three and six months ended March 31, 2016 and 2015

For the three months ended

March

For the six months ended March

2016 2015 2016 2015 Sales (including

excise taxes of $88.7 million and $87.4 million, and $186.0 million

and $184.4 million, respectively) $ 296,449,126 $ 287,443,864 $

618,457,375 $ 602,877,340 Cost of sales 278,908,888

269,710,529 581,955,233

565,617,473 Gross profit 17,540,238

17,733,335 36,502,142 37,259,867

Selling, general and administrative expenses 14,770,358 15,485,757

30,615,492 31,666,879 Depreciation and amortization 575,681

590,857 1,142,630

1,167,162 15,346,039 16,076,614

31,758,122 32,834,041 Operating income

2,194,199 1,656,721 4,744,020

4,425,826 Other expense (income):

Interest expense 161,402 194,375 373,856 431,517 Other (income),

net (35,827 ) (35,987 ) (63,082 )

(43,054 ) 125,575 158,388

310,774 388,463 Income from operations before

income tax expense 2,068,624 1,498,333 4,433,246 4,037,363 Income

tax expense 922,000 729,000

1,931,000 1,722,000 Net income 1,146,624

769,333 2,502,246 2,315,363 Preferred stock dividend requirements

(48,643 ) (48,108 ) (97,820 ) (97,285 )

Net income available to common shareholders $ 1,097,981 $

721,225 $ 2,404,426 $ 2,218,078 Basic

earnings per share available to common shareholders $ 1.81 $ 1.17 $

3.90 $ 3.61 Diluted earnings per share available to common

shareholders $ 1.61 $ 1.04 $ 3.46 $ 3.15 Basic weighted

average shares outstanding 606,080 615,822 615,768 614,173 Diluted

weighted average shares outstanding 712,547 737,180 723,317 735,599

Dividends declared and paid per common share $ 0.18 $ 0.18 $

0.64 $ 0.36

AMCON Distributing Company and

Subsidiaries Condensed Consolidated Unaudited Statements of

Cash Flows for the six months ended March 31, 2016 and

2015 2016 2015 CASH

FLOWS FROM OPERATING ACTIVITIES: Net income $ 2,502,246 $ 2,315,363

Adjustments to reconcile net income from operations to net cash

flows from operating activities: Depreciation 960,130 984,662

Amortization 182,500 182,500 (Gain) loss on sale of property and

equipment (34,482 ) 7,036 Equity-based compensation 660,203 607,661

Deferred income taxes 352,242 238,555 Provision (recovery) for

losses on doubtful accounts (67,000 ) 159,999 Provision (recovery)

for losses on inventory obsolescence 70,818 (34,189 ) Other (4,022

) (4,023 ) Changes in assets and liabilities: Accounts

receivable 2,677,840 2,279,407 Inventories 4,128,553 (21,852,218 )

Prepaid and other current assets (1,954,372 ) 1,708,944 Other

assets 20,467 111,792 Accounts payable (1,005,681 ) 200,996 Accrued

expenses and accrued wages, salaries and bonuses (1,479,465 )

(862,235 ) Income taxes payable 343,304

(1,577,138 ) Net cash flows from operating activities 7,353,281

(15,532,888 ) CASH FLOWS FROM INVESTING ACTIVITIES: Purchase

of property and equipment (692,402 ) (611,106 ) Proceeds from sales

of property and equipment 48,164 7,800

Net cash flows from investing activities (644,238 ) (603,306 )

CASH FLOWS FROM FINANCING ACTIVITIES: Net (payments)

borrowings on bank credit agreements (3,292,820 ) 16,881,883

Principal payments on long-term debt (174,650 ) (169,782 )

Repurchase of common stock (2,547,683 ) — Dividends paid on

convertible preferred stock (97,820 ) (97,285 ) Dividends on common

stock (412,210 ) (232,488 ) Withholdings on the exercise of

equity-based awards (81,406 ) (156,497 ) Net cash

flows from financing activities (6,606,589 )

16,225,831 Net change in cash 102,454 89,637

Cash, beginning of period 219,536 99,922

Cash, end of period $ 321,990 $ 189,559

Supplemental disclosure of cash flow information: Cash paid during

the period for interest $ 391,130 $ 403,758 Cash paid during the

period for income taxes 1,235,454 3,060,584 Supplemental

disclosure of non-cash information: Equipment acquisitions

classified as accounts payable 17,500 48,754 Issuance of common

stock in connection with the vesting and exercise of equity-based

awards 1,174,981 1,240,842

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160418006512/en/

AMCON Distributing CompanyChristopher H. Atayan,

402-331-3727

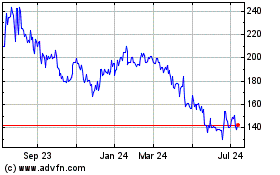

AMCON Distributing (AMEX:DIT)

Historical Stock Chart

From Mar 2024 to Apr 2024

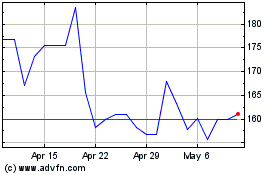

AMCON Distributing (AMEX:DIT)

Historical Stock Chart

From Apr 2023 to Apr 2024