ADTRAN, Inc. (NASDAQ:ADTN) reported results for the third

quarter 2016. For the quarter, sales were $168,890,000 compared to

$158,078,000 for the third quarter of 2015. Net income was

$12,415,000 compared to $7,067,000 for the third quarter of 2015.

Earnings per share, assuming dilution, were $0.26 compared to $0.14

for the third quarter of 2015. Non-GAAP earnings per share were

$0.26 compared to $0.19 for the third quarter of 2015. The

reconciliation between GAAP earnings per share, diluted, and

non-GAAP earnings per share, diluted, is in the table provided.

ADTRAN Chief Executive Officer Tom Stanton stated, “Our revenue

performance for the quarter exceeded expectations with total

revenue increasing 7% over the same period last year. I am

particularly pleased to see our international business grow 42

percent over the previous quarter and 7 percent year-over-year,

driven by stronger broadband access sales in Europe. I am also

pleased with the continued growth in our services business which

increased 35 percent over the previous quarter and grew 63 percent

year-over-year as we execute on our leading market position in CAF

II and vectoring solutions and services. We continue to believe

that ADTRAN's ability to help service providers grow revenue,

reduce costs, accelerate buildout and transition to a

software-defined access network is proving to be a catalyst for

change within the industry."

The Company also announced that its Board of Directors declared

a cash dividend for the third quarter of 2016. The quarterly cash

dividend is $0.09 per common share to be paid to holders of record

at the close of business on November 3, 2016. The ex-dividend date

is November 1, 2016, and the payment date is November 17, 2016.

The Company confirmed that its third quarter conference call

will be held Wednesday, October 19, 2016, at 9:30 a.m. Central

Time. This conference call will be web cast live through

StreetEvents.com. To listen, simply visit the Investor Relations

site at www.adtran.com or www.streetevents.com approximately 10

minutes prior to the start of the call and click on the conference

call link provided.

An online replay of the conference call will be available for

seven days at www.streetevents.com. In addition, an online replay

of the conference call, as well as the text of the Company's

earnings release, will be available on the Investor Relations site

at www.adtran.com for at least 12 months following the call.

ADTRAN, Inc. is a leading global provider of networking and

communications equipment. ADTRAN’s products enable voice, data,

video and Internet communications across a variety of network

infrastructures. ADTRAN solutions are currently in use by service

providers, private enterprises, government organizations, and

millions of individual users worldwide. For more information,

please visit www.adtran.com.

For more information, contact the company at 800 9ADTRAN (800

923-8726) or via email at info@adtran.com. On the Web, visit

www.adtran.com.

This press release contains forward-looking statements which

reflect management’s best judgment based on factors currently

known. However, these statements involve risks and uncertainties,

including the successful development and market acceptance of new

products, the degree of competition in the market for such

products, the product and channel mix, component costs,

manufacturing efficiencies, and other risks detailed in our annual

report on Form 10-K for the year ended December 31, 2015. These

risks and uncertainties could cause actual results to differ

materially from those in the forward-looking statements included in

this press release.

Condensed Consolidated Balance

Sheet

(Unaudited)

(In thousands)

September 30,2016

December 31,2015

Assets Cash and cash equivalents $ 66,292 $ 84,550

Short-term investments 55,516 34,396 Accounts receivable, net

101,822 71,917 Other receivables 12,159 19,321 Income tax

receivable, net 540 - Inventory 96,034 91,533 Prepaid expenses and

other current assets 14,477 10,145 Deferred tax assets, net

17,963 18,924

Total Current Assets 364,803

330,786 Property, plant and equipment, net 78,078

73,233 Deferred tax assets, net 17,263 18,091 Goodwill 3,492 3,492

Other assets 13,548 9,276 Long-term investments 178,379

198,026

Total Assets $ 655,563

$ 632,904 Liabilities and Stockholders'

Equity Accounts payable $ 67,399 $ 48,668 Unearned revenue

15,744 16,615 Accrued expenses 16,010 12,108 Accrued wages and

benefits 16,468 12,857 Income tax payable, net -

2,395

Total Current Liabilities 115,621 92,643

Non-current unearned revenue 7,105 7,965 Other non-current

liabilities 26,740 24,236 Bonds payable 27,900 27,900

Total Liabilities 177,366 152,744

Stockholders' Equity 478,197

480,160 Total Liabilities and Stockholders'

Equity $ 655,563 $ 632,904

Consolidated Statements of

Income

(Unaudited)

(In thousands, except per share

data)

Three Months Ended Nine Months Ended

September 30, September 30, 2016

2015 2016 2015

Sales Products $ 136,277 $ 138,120 $ 398,709 $ 411,723

Services 32,613 19,958 75,086

49,328

Total Sales

168,890 158,078 473,795 461,051

Cost of Sales Products 70,988 75,969 202,905 231,739

Services 22,094 11,460 50,333

24,854

Total Cost of Sales

93,082 87,429 253,238 256,593

Gross Profit 75,808 70,649 220,557

204,458 Selling, general and administrative expenses

33,716 30,016 97,367 93,203 Research and development expenses

31,962 32,561 92,727

100,576

Operating Income 10,130

8,072 30,463 10,679 Interest and

dividend income 910 839 2,692 2,680 Interest expense (143 ) (151 )

(430 ) (448 ) Net realized investment gain 1,316 2,060 4,154 8,430

Other income (expense), net (246 ) 52 (378 ) (848 ) Gain on bargain

purchase of a business 3,550 -

3,550 -

Income before provision for

income taxes 15,517 10,872 40,051

20,493 Provision for income taxes (3,102 )

(3,805 ) (12,394 ) (7,565 )

Net

Income $ 12,415 $ 7,067

$ 27,657 $ 12,928

Weighted average shares outstanding - basic 48,470 49,862

48,839 51,682 Weighted average shares outstanding - diluted (1)

48,678 49,927 49,036 51,792 Earnings per common share -

basic $ 0.26 $ 0.14 $ 0.57 $ 0.25 Earnings per common share -

diluted (1) $ 0.26 $ 0.14 $ 0.56 $ 0.25 (1) Assumes exercise

of dilutive stock options calculated under the treasury stock

method.

Consolidated Statements of

Comprehensive Income

(Unaudited)

(In thousands)

Three Months Ended Nine Months Ended

September 30, September 30, 2016

2015 2016 2015 Net Income

$ 12,415 $ 7,067 $ 27,657 $ 12,928

Other Comprehensive Income (Loss), net of tax:

Unrealized gains (losses) on available-for-sale securities 258

(4,291 ) (162 ) (6,577 ) Defined benefit plan adjustments 36 71 103

211 Foreign currency translation 575 (1,351 )

1,202 (3,797 )

Other Comprehensive Income

(Loss), net of tax 869 (5,571

) 1,143 (10,163 )

Comprehensive Income, net of tax $

13,284 $ 1,496 $ 28,800

$ 2,765

Consolidated Statements of Cash

Flows

(Unaudited)

(In thousands)

Nine Months Ended September 30,

2016 2015 Cash flows from operating

activities: Net income $ 27,657 $ 12,928 Adjustments to

reconcile net income to net cash provided by operating activities:

Depreciation and amortization 10,260 10,765 Amortization of net

premium on available-for-sale investments 489 2,085 Net realized

gain on long-term investments (4,154 ) (8,430 ) Net loss on

disposal of property, plant and equipment 21 189 Gain on bargain

purchase of a business (3,550 ) - Stock-based compensation expense

4,601 4,788 Deferred income taxes (447 ) (2,332 ) Tax impact from

stock option exercises (16 ) (40 ) Excess tax benefits from

stock-based compensation arrangements - (3 ) Change in operating

assets and liabilities: Accounts receivable, net (29,370 ) 843

Other receivables 7,475 10,532 Inventory (683 ) (14,945 ) Prepaid

expenses and other assets (5,180 ) (1,665 ) Accounts payable 16,363

13,687 Accrued expenses and other liabilities 7,307 (3,996 ) Income

tax payable/receivable, net (2,941 ) (1,137 )

Net

cash provided by operating activities 27,832

23,269 Cash flows from

investing activities: Purchases of property, plant and

equipment (12,684 ) (7,843 ) Proceeds from disposals of property,

plant and equipment - 122 Proceeds from sales and maturities of

available-for-sale investments 141,103 189,728 Purchases of

available-for-sale investments (139,181 ) (113,227 ) Acquisition of

business (943 ) -

Net cash provided by

(used in) investing activities (11,705 )

68,780 Cash flows from financing

activities: Proceeds from stock option exercises 1,076 907

Purchases of treasury stock (22,917 ) (65,808 ) Dividend payments

(13,230 ) (13,989 ) Excess tax benefits from stock-based

compensation arrangements - 3

Net

cash used in financing activities (35,071

) (78,887 ) Net increase

(decrease) in cash and cash equivalents (18,944 ) 13,162 Effect of

exchange rate changes 686 (2,914 )

Cash and cash equivalents,

beginning of period 84,550

73,439 Cash and cash equivalents, end of

period $ 66,292 $ 83,687

Supplemental disclosure of non-cash investing

activities Purchases of property, plant and equipment included in

accounts payable $ 1,174 $ 1,303

Supplemental Information

Restructuring Expenses

(Unaudited)

(In thousands)

Restructuring expenses were recorded in

the following Consolidated Statements of Income categories for the

three and nine months ended September 30, 2016 and 2015:

Three Months Ended Nine Months Ended

September 30, September 30, 2016

2015 2016 2015

Restructuring expense included in cost of sales $

1,307 $ 9 $ 1,307

$ 107 Selling, general and

administrative expense 637 194 637 838 Research and development

expense - 712 -

2,095

Restructuring expense included in operating

expenses 637 906

637 2,933 Total

restructuring expense 1,944 915 1,944

3,040 Provision for income taxes (603 ) (357 )

(603 ) (1,186 )

Total restructuring

expense, net of tax $ 1,341 $

558 $ 1,341 $

1,854

Supplemental Information

Acquisition Related Expenses,

Amortizations and Adjustments

(Unaudited)

(In thousands)

On August 4, 2011, we closed on the

acquisition of Bluesocket, Inc., on May 4, 2012, we closed on the

acquisition of the Nokia Siemens Networks Broadband Access business

(NSN BBA), and on September 13, 2016, we closed on the acquisition

of CommScope’s active fiber business (CommScope). Acquisition

related expenses, amortizations and adjustments for the three and

nine months ended September 30, 2016 and 2015 for all three

transactions are as follows:

Three Months Ended Nine Months Ended

September 30, September 30, 2016

2015 2016 2015 Bluesocket, Inc.

acquisition Amortization of acquired intangible assets $ 158

$ 191 $ 504 $ 643 NSN BBA acquisition

Amortization of acquired intangible assets 225 231 680 701

Amortization of other purchase accounting adjustments 114 101 194

395 Acquisition related professional fees, travel and other

expenses - 20 - 61

Subtotal NSN BBA acquisition 339

352 874

1,157 CommScope acquisition Amortization of

acquired intangible assets 112 - 112 - Amortization of other

purchase accounting adjustments 84 - 84 - Acquisition related

professional fees, travel and other expenses 45

- 45 -

Subtotal

CommScope acquisition 241 -

241 -

Total acquisition related expenses, amortizations and

adjustments 738 543 1,619 1,800

Provision for income taxes (261 ) (183 ) (562

) (609 )

Total acquisition related expenses,

amortizations and adjustments, net of tax $ 477

$ 360 $ 1,057

$ 1,191

The acquisition related expenses,

amortizations and adjustments above were recorded in the following

Consolidated Statements of Income categories for the three and nine

months ended September 30, 2016 and 2015:

Three Months Ended Nine Months Ended

September 30, September 30, 2016 2015

2016 2015 Revenue (adjustments to deferred

revenue recognized in the period) $ - $ 65 $ - $ 196 Cost of goods

sold 169 7 189 52

Subtotal 169 72

189 248

Selling, general and administrative expenses 54 23 61 74 Research

and development expenses 515 448

1,369 1,478

Subtotal 569

471 1,430

1,552 Total acquisition related expenses,

amortizations and adjustments 738 543

1,619 1,800 Provision for income taxes (261 )

(183 ) (562 ) (609 )

Total

acquisition related expenses, amortizations and adjustments, net of

tax $ 477 $ 360

$ 1,057 $ 1,191

Supplemental Information

Stock-based Compensation

Expense

(Unaudited)

(In thousands)

Three Months Ended Nine Months Ended

September 30, September 30, 2016

2015 2016 2015

Stock-based compensation expense included in cost of sales

$ 88 $ 59 $

282 $ 202 Selling,

general and administrative expense 765 812 2,322 2,226 Research and

development expense 639 803

1,997 2,360

Stock-based compensation

expense included in operating expenses 1,404

1,615 4,319

4,586 Total stock-based compensation

expense 1,492 1,674 4,601 4,788 Tax

benefit for expense associated with non-qualified options

(218 ) (218 ) (643 ) (620 )

Total

stock-based compensation expense, net of tax $

1,274 $ 1,456 $

3,958 $ 4,168

Reconciliation of GAAP net income per

share, diluted, to

Non-GAAP net income per share,

diluted

(Unaudited)

Three Months Ended Nine Months Ended

September 30, September 30, 2016

2015 2016 2015 GAAP

earnings per common share – diluted $ 0.26

$ 0.14 $ 0.56 $ 0.25

Restructuring expense 0.03 0.01 0.03 0.04 Acquisition

related expenses, amortizations and adjustments 0.01 0.01 0.02 0.02

Stock-based compensation expense 0.03 0.03 0.08 0.08 Gain on

bargain purchase of a business (0.07 ) - (0.07

) -

Non-GAAP earnings per common share –

diluted $ 0.26 $ 0.19

$ 0.62 $ 0.39

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161018006792/en/

ADTRAN, Inc.Roger Shannon, 256-963-8775Senior Vice President

& CFOorInvestor Services/Assistance:Gayle Ellis,

256-963-8220Investor Services

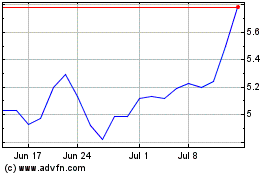

ADTRAN (NASDAQ:ADTN)

Historical Stock Chart

From Mar 2024 to Apr 2024

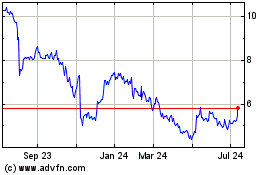

ADTRAN (NASDAQ:ADTN)

Historical Stock Chart

From Apr 2023 to Apr 2024