ADRs End Higher; AstraZeneca Rises

November 16 2015 - 5:52PM

Dow Jones News

International stocks trading in New York closed higher on

Monday.

AstraZeneca PLC (AZN ,AZN.LN) was among the companies with ADRs

that traded actively.

The BNY Mellon index of American depositary receipts rose 1.3%

to 130.48. The European index increased 1.2% to 129.88, the Asian

index improved 1.3% to 139.94, the Latin American index rose 1.6%

to 163.61 and the emerging markets index increased 1.8% to

222.52.

AstraZeneca's ADRs rose 4.8% to $32.78 on Monday following

Friday's announcement that the drug maker's lung-cancer treatment

Tagrisso won U.S. regulatory approval after an unusually quick

development process that took just 2 1/2 years. Tagrisso,

previously known as AZD9291, is the first drug for a subset of

lung-cancer patients whose tumors have spread and developed a

treatment-resistant mutation called T790M. Another treatment for

this group of patients, rociletinib from Clovis Oncology Inc., is

being reviewed by U.S. regulators. Clovis said Monday that the Food

and Drug Administration asked for additional data on rociletinib, a

request that could delay potential approval of the treatment.

Banco Bradesco SA (BBDO, BBD, BBDC4.BR) plans to increase its

capital by 3 billion reais ($782 million) by issuing 164.8 million

new shares. The new shares will be divided almost evenly between

ordinary and preferred shares. The Brazilian lender's shareholders

will vote on the plan Dec. 17, the bank said Monday in a regulatory

filing. ADRs rose 3% to $6.29.

JD.com (JD) reported that its third-quarter revenue grew 52% to

$6.9 billion though the Chinese e-commerce company said its

quarterly net loss widened sharply from the year-earlier period,

with much of the loss stemming from higher expenses related to

JD.com's expansion of its direct sales business and increased

spending on marketing. The company expects sales for the current

quarter to increase between 47% and 51%. ADRs rose 7.7% to

$28.81.

Royal Dutch Shell PLC (RDSA, RDSA.LN) said that it is replacing

the president of its Canadian subsidiary less than a month after

abandoning a major oil sands project in the country. The moves come

at a turbulent time for the energy industry as a prolonged slump in

prices has squeezed profits, especially for high-cost operations

such as oil sands and shale oil. ADRs fell 2.6% to $49.59.

Write to Tess Stynes at tess.stynes@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 16, 2015 17:37 ET (22:37 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

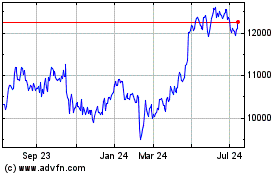

Astrazeneca (LSE:AZN)

Historical Stock Chart

From Mar 2024 to Apr 2024

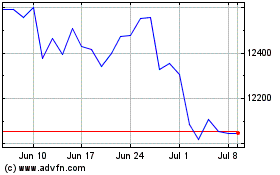

Astrazeneca (LSE:AZN)

Historical Stock Chart

From Apr 2023 to Apr 2024