ADR Report: ADRs Fall On China, Euro-Zone Macro Worries

March 22 2012 - 5:11PM

Dow Jones News

Shares of international companies trading in New York declined

Thursday, after renewed worries about China growth and weak data in

the euro zone weighed on markets around the world.

The Bank of New York Index of ADRs fell 0.9% to 130.45. A

preliminary purchasing managers index for China, the world's

second-largest economy, fell to a four-month low in March to 48.1,

with numbers below 50 representing a contraction. A separate

purchasing managers index for the euro zone reinforced the negative

mood, as that preliminary index also indicated further retraction

in March from the prior month.

The European index fell 1% to 119.87. European bank ADRs dropped

sharply, mirroring their performance in markets in home countries.

ING Groep NV (ING, INGA.AE) was down 3% at $8.70, Allied Irish

Banks PLC (AIBYY, ALBK.DB) fell 4.5% to $1.27, Barclays PLC (BCS,

BARC.L) declined 2.8% to $15.16 and Deutsche Bank AG (DB, DBK.XE)

was down 1.4% to $50.19.

Spanish and Italian ADRs also suffered from concerns about

Spain's fiscal outlook and the wider euro-zone economic data.

Spanish oil major Repsol YPF SA (REPYY, REP.MC) was down 3.8% at

$25.74, and Italian designer eyewear company Luxottica Group SpA

(LUX, LUX.MI) fell 2.4% to $35.18. Spain and Italy are two of the

euro-zone countries most troubled by debt.

The Asian index fell 0.5% to 128.72. The manufacturing data hurt

Chinese resource firms, with Aluminum Corp. of China Ltd. (2600.HK)

down 3.2% at $11.97. ADRs in gaming company The9 Ltd. (NCTY) were

down 5% at $7.01 after third-quarter results.

Offsetting those declines was Huaneng Power (0902.HK),

rebounding after a tumble the prior day following an earnings miss.

The rebound was likely spurred by management comments that the

power provider swung to a net profit in January and February this

year.

But the Latin American index posted the deepest decline of all

regions, sliding 1.3% to 368.78. ADRs of Brazil state-run oil

producer Petroleo Brasileiro SA (PBR) fell 2% to $26.67, as crude

futures also suffered from France energy minister comments that the

country and other industrialized nations are considering tapping

strategic oil reserves to fight higher oil prices.

-By Joan E. Solsman, Dow Jones Newswires; 212-416-2291;

joan.solsman@dowjones.com

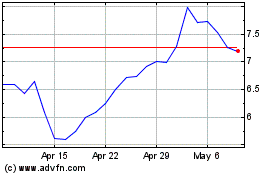

The9 (NASDAQ:NCTY)

Historical Stock Chart

From Mar 2024 to Apr 2024

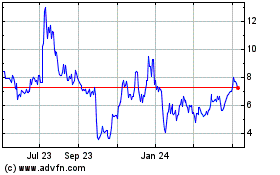

The9 (NASDAQ:NCTY)

Historical Stock Chart

From Apr 2023 to Apr 2024