As filed with the Securities and Exchange Commission on July 1, 2015 Registration No. 333-________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

ZIONS BANCORPORATION

(Exact name of registrant as specified in its charter)

Utah 87-0227400

(State of Incorporation) (I.R.S. Employer I.D. No.)

One South Main, 15th Floor, Salt Lake City, Utah 84133

(Address of Principal Executive Offices) (Zip Code)

Zions Bancorporation 2015 Omnibus Incentive Plan

(Full Title of Plan)

Thomas E. Laursen

ZIONS BANCORPORATION

One South Main, 11th Floor

Salt Lake City, Utah 84133

(Name and address of agent for service)

(801) 844-8503

(Telephone number, including area code, of agent for service)

Copies of all communications to:

Paul H. Shaphren

Callister Nebeker & McCullough

Zions Bank Building Suite 900

10 East South Temple

Salt Lake City, UT 84133

(801) 530-7411

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| |

Large accelerated filer ■ | Accelerated filer □ |

Non-accelerated filer □ (Do not check if a smaller reporting company) | Smaller reporting company□ |

CALCULATION OF REGISTRATION FEE

|

| | | | |

Title of securities to be registered | Amount to be registered(1) | Proposed maximum offering price per share(2) | Proposed maximum aggregate offering price(2) | Amount of registration fee |

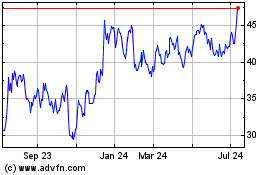

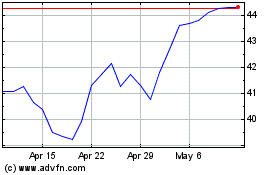

Common Stock, no par value | 9,000,000 | $32.70 | $294,300,000 | $34,197.66 |

| |

(1) | This Registration Statement covers shares of common stock, no par value (“Common Stock”), of Zions Bancorporation (the “Company”) which may be offered or sold pursuant to the Zions Bancorporation 2015 Omnibus Incentive Plan (the “Incentive Plan”). Pursuant to Rule 416, this Registration Statement shall also cover any additional shares of Common Stock that become issuable under the Incentive Plan by reason of any stock dividend, stock split, recapitalization or other similar transaction effected without the receipt of consideration that results in an increase in the number of outstanding shares of Common Stock of the Company. |

| |

(2) | This estimate is made pursuant to Rules 457(c) and 457(h)(1) under the Securities Act, solely for purposes of determining the registration fee and is based on the average of the high and low sales prices of the Common Stock as reported on the NASDAQ Stock Market on June 26, 2015. |

EXPLANATORY NOTE

This Registration Statement on Form S-8 relates to Nine Million (9,000,000) shares of common stock, no par value (the “Common Stock”), of Zions Bancorporation (the “Company”) to be issued to eligible officers, employees and directors of, and consultants and advisors to, the Company and its affiliates pursuant to the Incentive Plan. Each share of Common Stock underlying an award under the Incentive Plan will reduce the shares available for issuance under the Incentive Plan in amount equal to the issued share. Shares may be issued under the Incentive Plan from authorized but unissued shares of Common Stock or authorized and issued shares of Common Stock held in the Company’s treasury or otherwise acquired for the purposes of the Incentive Plan. Effective as of May 22, 2015, the date the Company’s shareholders approved the Incentive Plan, no new awards shall be granted under the Company’s 2005 Stock Option and Incentive Plan (the “Prior Plan”) and the remaining share authorization under the Prior Plan was cancelled, except for shares underlying outstanding awards granted under the Prior Plan.

Provisions in the Incentive Plan permit the reuse or reissuance by the Incentive Plan of shares of Common Stock underlying forfeited, terminated or canceled awards of stock-based compensation. If awards or underlying shares are tendered or withheld as payment for the exercise price, or taxes due on vesting or exercise of, of an award, the shares of Common Stock may not be reused or reissued, or otherwise be treated as available, under the Incentive Plan. Any shares of common stock delivered by the Company, any shares of common stock with respect to which awards under the Incentive Plan are made by the Company, and any shares of common stock with respect to which the Company becomes obligated to make awards, through the assumption of, or in substitution for, outstanding awards previously granted by an acquired entity, will not be counted against the shares available for awards under the Incentive Plan.

The Compensation Committee of the Company’s Board of Directors, or a subcommittee thereof, has the authority to adjust the terms of any outstanding awards and the number of shares of Common Stock issuable under the Incentive Plan for any increase or decrease in the number of issued shares of Common Stock resulting from a stock split, reverse stock split, stock dividend, recapitalization, rights offering, combination or reclassification of the common shares, or other events affecting the Company’s capitalization.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The documents containing the information specified in Part I will be sent or given to participants in the Incentive Plan, as specified by Rule 428(b)(1) of the Securities Act of 1933, as amended (the “Securities Act”). In accordance with the instructions of Part I of Form S-8, such documents will not be filed with the Securities and Exchange Commission (the “Commission”) either as part of this Registration Statement or as prospectuses or prospectus supplements pursuant to Rule 424 of the Securities Act. These documents and the documents incorporated by reference pursuant to Item 3 of Part II of this Registration Statement, taken together, constitute a prospectus as required by Section 10(a) of the Securities Act.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents that the Company has previously filed with the Commission are incorporated herein by reference in this Registration Statement:

| |

(a) | The Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014, filed on February 27, 2015; |

| |

(b) | The Company’s Current Reports on Form 8-K filed January 26, 2015; February 10, 2015; March 5, 2015; March 11, 2015; March 20, 2015; March 20, 2015; April 20, 2015; May 8, 2015; May 27, 2015; and June 1, 2015; |

| |

(c) | The Company’s Quarterly Report on Form 10-Q filed May 7, 2015; and |

| |

(d) | The description of the Company’s Common Stock contained in its Registration Statement on Form 10, and any amendment or report filed to update such description. |

In addition, all documents subsequently filed with the Commission by the Company pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, prior to the filing of a post-effective amendment hereto that indicates that all securities offered hereunder have been sold or that deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference in this Registration Statement and to be a part hereof from the date of filing of such documents; provided, however that the Company is not incorporating by reference any information in these documents or filings that is deemed “furnished” to and not filed with the Commission.

Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein or in any subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Item 4. Description of Securities

Not applicable.

Item 5. Interests of Named Experts and Counsel

Not applicable.

Item 6. Indemnification of Directors and Officers

The Restated Articles of Incorporation of the Company provide that no director of the Company will be personally liable to the Company or its shareholders for money damages for any breach of fiduciary duty by such director while acting as a director, except for liability:

| |

(1) | for any breach of the director’s duty of loyalty to Zions Bancorporation or its shareholders; |

| |

(2) | for acts of omissions not in good faith or which involve intentional misconduct or knowing violation of the law; or |

| |

(3) | for any transaction from which the director obtained an improper personal benefit. |

Part 9 of the Utah Revised Business Corporation Act contains provisions entitling directors and officers of the Company to indemnification under certain conditions from judgments, fines, amounts paid in settlement, and reasonable expenses, including attorneys’ fees, as the result of an action or proceeding in which they may be involved by reason of being or having been a director or officer of the Company. Indemnification under Utah law is generally permissible if the conduct of the director or officer was in good faith and the director or officer reasonably believed that his or her conduct was in, or not opposed to, the Company’s best interests, and, in a criminal case, that the director or officer had no reasonable cause to believe his or her conduct was unlawful. Such indemnification would not be permitted under Utah law in connection with a proceeding by or in the right of the Company in which the director or officer was adjudged liable to the Company, or in connection with any other proceeding in which the officer or director was adjudged liable on the basis that he or she obtained an improper personal benefit.

Mandatory indemnification is required under Utah law for a director or officer who is successful, on the merits or otherwise, in the defense of any proceeding, or any claim, issue or matter in a proceeding, to which he or she was a party because he or she is or was an officer or director of the Company. A court may order indemnification where mandatory under Utah law or if the court determines that the officer or director is fairly and reasonably entitled to indemnification in view of all relevant circumstances and regardless of whether the officer or director met the applicable standard of conduct or was adjudged liable to the Company or adjudged liable on the basis that he or she derived an improper personal benefit.

Payment of expenses for officers and directors is permitted in advance of a final disposition of a proceeding on certain conditions, including the furnishing of written affirmation by the officer or director of his or her good faith belief that he or she has met the applicable standard of conduct, the furnishing of a written agreement to repay the advance if the officer or director is ultimately determined not to have met the applicable standard of conduct, and a determination is made that the facts then known to the persons making the determination would not preclude indemnification under Utah law. This determination is to be made either by the Board of Directors, a committee of the Board of Directors, special counsel, or the shareholders, under conditions and procedures generally designed to assure the independence of the body making the determination.

The directors and officers of the Company are covered by policies of insurance under which they are insured, within limits and subject to limitations, against certain expenses in connection with the defense of actions, suits or proceedings, and certain liabilities which might be imposed as a result of such actions, suits or proceedings, in which they are parties by reason of being or having been directors or officers. The Company is similarly insured with respect to certain payments it might be required to make to its directors or officers under the applicable statutes and the Company’s Restated Articles of Incorporation or bylaw provisions.

Item 7. Exemption from Registration Claimed

Not applicable.

Item 8. Exhibits

|

| | |

Exhibit Number |

Description of Exhibit | |

3.1 | Restated Articles of Incorporation of Zions Bancorporation dated July 8, 2014, incorporated by reference to Exhibit 3.1 of Form 8-K/A filed on July 18, 2014.

| * |

3.2 | Restated Bylaws of Zions Bancorporation dated February 27, 2015, incorporated by reference to Exhibit 3.2 of Form 10-Q filed on May 7, 2015.

| * |

4.1 | Zions Bancorporation 2015 Omnibus Incentive Plan (filed herewith).

| |

4.2 | Form of Restricted Stock Award Agreement Subject to Holding Requirement (filed herewith).

| |

4.3 | Form of Standard Restricted Stock Award Agreement (filed herewith).

| |

4.4 | Form of Standard Restricted Stock Unit Award Agreement (filed herewith).

| |

4.5 | Form of Restricted Stock Unit Agreement Subject to Holding Requirement (filed herewith).

| |

4.6 | Form of Standard Stock Option Award Agreement (filed herewith).

| |

4.7 | Form of Standard Directors Stock Award Agreement (filed herewith).

| |

5.1 | Opinion regarding legality of securities to be offered by Callister Nebeker & McCullough (filed herewith).

| |

23.1 | Consent of Ernst & Young LLP, Independent Registered Public Accounting Firm (filed herewith).

| |

23.2 | Consent of Callister Nebeker & McCullough (included in Exhibit 5.1).

| |

* Incorporated by reference.

Item 9. Undertakings

Zions Bancorporation, the undersigned Registrant, hereby undertakes:

(1) To file, during any period in which offers or sales are being made of the securities registered hereby, a post-effective amendment to this Registration Statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the Registration Statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the Registration Statement.

Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective Registration Statement;

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the Registration Statement or any material change to such information in the Registration Statement;

Provided, however, that paragraphs (1)(i) and (1)(ii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in periodic reports filed with or furnished to the Commission by the Company pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 (the “Exchange Act”) that are incorporated by reference in the Registration Statement.

(2) That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) The Company hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Company’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the Registration Statement shall be deemed to be a new Registration Statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(5) Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Company pursuant to the foregoing provisions, or otherwise, the Company has been advised that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Company of expenses incurred or paid by a director, officer or controlling person of the Company in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Company will, unless in the opinion of its counsel the matter has been settled by the controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, Zions Bancorporation (Registrant) certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Salt Lake, State of Utah, on July 1, 2015.

ZIONS BANCORPORATION

By: /s/ Harris H. Simmons

Harris H. Simmons, Chairman of the Board and Chief Executive Officer

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities indicated on July 1, 2015.

/s/ Harris H. Simmons Chairman of the Board, Chief Executive

Harris H. Simmons Officer and Director (Principal Executive Officer)

/s/ Paul E. Burdiss Executive Vice President and Chief Financial Officer

Paul E. Burdiss (Principal Financial Officer)

/s/ Alexander J. Hume Senior Vice President and Controller

Alexander J. Hume (Principal Accounting Officer)

/s/ Jerry C. Atkin Director

Jerry C. Atkin

/s/ John C. Erickson Director

John C. Erickson

/s/ Patricia Frobes Director

Patricia Frobes

/s/ J. David Heaney Director

J. David Heaney

/s/ Vivian S. Lee Director

Vivian S. Lee

/s/ Edward F. Murphy Director

Edward F. Murphy

/s/ Roger B. Porter Director

Roger B. Porter

/s/ Stephen D. Quinn Director

Stephen D. Quinn

/s/ L. E. Simmons Director

L. E. Simmons

/s/ Shelley Thomas Williams Director

Shelley Thomas Williams

/s/ Steven C. Wheelwright Director

Steven C. Wheelwright

EXHIBIT INDEX

|

| | |

Exhibit Number |

Description of Exhibit | |

3.1 | Restated Articles of Incorporation of Zions Bancorporation dated July 8, 2014, incorporated by reference to Exhibit 3.1 of Form 8-K/A filed on July 18, 2014.

| * |

3.2 | Restated Bylaws of Zions Bancorporation dated February 27, 2015, incorporated by reference to Exhibit 3.2 of Form 10-Q filed on May 7, 2015.

| * |

4.1 | Zions Bancorporation 2015 Omnibus Incentive Plan (filed herewith).

| |

4.2 | Form of Restricted Stock Award Agreement Subject to Holding Requirement (filed herewith).

| |

4.3 | Form of Standard Restricted Stock Award Agreement (filed herewith).

| |

4.4 | Form of Standard Restricted Stock Unit Award Agreement (filed herewith).

| |

4.5 | Form of Restricted Stock Unit Agreement Subject to Holding Requirement (filed herewith).

| |

4.6 | Form of Standard Stock Option Award Agreement (filed herewith).

| |

4.7 | Form of Standard Directors Stock Award Agreement (filed herewith).

| |

5.1 | Opinion regarding legality of securities to be offered by Callister Nebeker & McCullough (filed herewith).

| |

23.1 | Consent of Ernst & Young LLP, Independent Registered Public Accounting Firm (filed herewith).

| |

23.2 | Consent of Callister Nebeker & McCullough (included in Exhibit 5.1).

| |

* Incorporated by reference.

ZIONS BANCORPORATION

2015 OMNIBUS INCENTIVE PLAN

ARTICLE I

GENERAL

The purpose of the Zions Bancorporation 2015 Omnibus Incentive Plan (the “Plan”) is to promote the long-term success of Zions Bancorporation (the “Company”) by providing an incentive for officers, employees and directors of, and consultants and advisors to, the Company and its Related Entities to acquire a proprietary interest in the success of the Company, to remain in the service of the Company and/or Related Entities, and to render superior performance during such service. If approved by shareholders of the Company, the Plan will replace the Amended and Restated Zions Bancorporation 2005 Stock Option and Incentive Plan (“Prior Plan”) for Awards granted after the Effective Date. Beginning on the Effective Date, no further awards will be made under the Prior Plan, but this Plan will not affect the terms or conditions of any awards made under the Prior Plan before the Effective Date.

| |

1.2 | Definitions of Certain Terms |

(a)“Award” means an award under the Plan as described in Section 1.5 and Article II.

(b)“Award Agreement” means a written agreement entered into between the Company and a Grantee in connection with an Award.

| |

(c) | “Board” means the Board of Directors of the Company. |

(d)“Cause” Termination of Employment by the Company for “Cause” means, with respect to a Grantee and an Award, (i) except as provided otherwise in the applicable Award Agreement or as provided in clause (ii) below, Termination of Employment of the Grantee by the Company (A) upon Grantee’s failure to substantially perform Grantee’s duties with the Company or a Related Entity (other than any such failure resulting from death or Disability), (B) upon Grantee’s failure to substantially follow and comply with the specific and lawful directives of the Board or any officer of the Company or a Related Entity to whom Grantee directly or indirectly reports, (C) upon Grantee’s commission of an act of fraud or dishonesty resulting in actual or potential economic, financial or reputational injury to the Company or a Related Entity, (D) upon Grantee’s engagement in illegal conduct, gross misconduct or an act of moral turpitude, (E) upon Grantee’s violation of any written policy, guideline, code, handbook or similar document governing the conduct of directors, officers or employees of the Company or its Related Entities, or (F) upon Grantee’s engagement in any other similar conduct or act determined by the Committee in its discretion to constitute “cause”; or (ii) in the case of directors, officers or employees who at the time of the Termination of Employment are entitled to the benefits of a change in control, employment or similar agreement entered into by the Company or a Related Entity that defines or addresses termination for cause, termination for cause as defined and/or determined pursuant to such agreement. In the event that there is more than one such agreement, the Committee shall determine which agreement shall govern.

(e)“Code” means the Internal Revenue Code of 1986, as amended.

(f)“Committee” means the Compensation Committee (including any successor thereto) of the Board and shall consist of not less than two directors. However, if (i) a member of the Compensation Committee is not an “outside director” within the meaning of Section 162(m) of the Code, is not a “non-employee director” within the meaning of Rule 16b-3 under the Exchange Act, or is not an “independent director” within the meaning of Nasdaq Market Rule 4350 (c), or (ii) the Compensation Committee otherwise in its discretion determines, then the Compensation Committee may from time to time delegate some or all of its functions under the Plan to a subcommittee composed of members of the Compensation Committee that, if relevant, meet the necessary requirements. The term “Committee” includes the Compensation Committee or any such subcommittee, to the extent of the Compensation Committee’s delegation.

(g)“Common Stock” means the common stock of the Company.

(h)“Disability” means, with respect to a Grantee and an Award, (i) except as provided in the applicable Award Agreement or as provided in clause (ii) below, “disability” as defined in the Company’s long-term disability plan in which Grantee is participating; or (ii) in the case of directors, officers or employees who at the time of the Termination of Employment are entitled to the benefits of a change in control, employment or similar agreement entered into by the Company or a Related Entity that defines or addresses termination because of disability, “disability” as defined in such agreement. In the event that there is more than one such agreement, the Committee shall determine which agreement shall govern. Notwithstanding the foregoing, (A) in the case of an Incentive Stock Option, the term “Disability” for purposes of the preceding sentence shall have the meaning given to it by Section 422 (c)(6) of the Code and (B) to the extent an Award is subject to the provisions of Section 409A of the Code and in order for compensation provided under any Award to avoid the imposition of taxes under Section 409A of the Code, then a Grantee shall be determined to have suffered a Disability only if such Grantee is “disabled” within the meaning of Section 409A of the Code.

(i)“Exchange Act” means the Securities Exchange Act of 1934, as amended.

(j)The “Fair Market Value” of a share of Common Stock on any date shall be (i) the closing sale price per share of Common Stock during normal trading hours on the national securities exchange, association or other market on which the Common Stock is principally traded for such date or the last preceding date on which there was a sale of such Common Stock on such exchange, association or market, or (ii) if the shares of Common Stock are then traded in an over-the-counter market, the average of the closing bid and asked prices for the shares of Common Stock during normal trading hours in such over-the-counter market for such date or the last preceding date on which there was a sale of such Common Stock in such market, or (iii) if the shares of Common Stock are not then listed on a national securities exchange, association or other market or traded in an over-the-counter market, such value as the Committee, in its discretion shall determine.

(k)“Good Reason” means the occurrence of one or more of the following after a Change in Control:

(i)a material reduction in the Grantee’s base salary and annual bonus opportunity, in each case, as in effect immediately before the Change in Control; or

(ii)the Company requiring the Grantee to be based at any location that is more than 50 miles from his or her regular place of employment immediately before the Change in Control, except to the extent that such change in work location results in a commute from the Grantee’s primary residence that is the same or reduced as compared to the Grantee’s commute prior to such change.

Notwithstanding the foregoing, no termination of the Grantee’s employment shall be for Good Reason unless (i) termination of the Grantee’s employment (or notice of the Grantee’s intent to terminate employment) occurs during the 24 month period following the Change in Control, and (ii) the Grantee gives the Company written notice within 90 days of the Grantee obtaining knowledge of circumstances giving rise to Good Reason (describing in reasonable detail the circumstances and the Good Reason event that has occurred) and the Company does not remedy these circumstances within 30 days of receipt of such notice. In addition, an event will not give rise to Good Reason if it is made with the Grantee’s express written consent. Further, if a Grantee is a party to an employment agreement or change in control severance agreement or plan that includes a definition of “good reason”, then Good Reason for purposes of Awards granted to such Grantee shall have the same meaning as set forth in such employment agreement or change in control severance agreement or plan. In the event that there is more than one such agreement, the Committee shall determine which agreement shall govern.

| |

(l) | “Grantee” means a person who receives an Award. |

(m)“Incentive Stock Option” means, subject to Section 2.3 (f), a stock option that is intended to qualify for special federal income tax treatment pursuant to Sections 421 and 422 of the Code (or a successor

provision thereof) and which is so designated in the applicable Award Agreement. Under no circumstances shall any stock option that is not specifically designated as an Incentive Stock Option be considered an Incentive Stock Option.

(n)“Key Persons” means then acting or prospective directors, officers and employees of the Company or of a Related Entity, and then acting or prospective consultants and advisors to the Company or a Related Entity.

(o)“Non-Employee Director” has the meaning given to it in Section 2.13(a).

(p)“Performance Goals” means the goal(s) (or combined goal(s)) determined by the Committee in its discretion to be applicable to a Grantee with respect to an Award. As determined by the Committee, the Performance Goals applicable to an Award may provide for a targeted or measured level or levels of achievement or change using one or more of the following measures: measures of efficiency (including operating efficiency, productivity ratios or other similar measures); measures of achievement of expense targets, costs reductions, working capital, cash levels or general expense ratios; asset growth; earnings per share; enterprise value, shareholder value added or value creation targets; combined net worth; debt to equity ratio; revenues, sales, net revenues or net sales measures; gross profit or operating profit measures (including before or after taxes or other similar measures); investment performance; income or operating income measures (with or without investment income or income taxes, before or after risk-adjustment, or other similar measures); cash flow; margin; net income, before or after taxes; earnings before interest, taxes, depreciation and/or amortization; return measures (including return on capital, total capital, tangible capital, expenses, tangible expenses, equity, revenue, assets, or net assets or total shareholder return or similar measures); market share measures; measures of balance sheet achievements (including debt reductions, leverage ratios or other similar measures), increase in Fair Market Value of Common Stock, regulatory rating, credit quality, and loan charge-offs. Such measures may be defined and calculated in such manner and detail as the Committee in its discretion may determine, including whether such measures shall be calculated before or after income taxes or other items, on an absolute or relative basis, as compared to one or more peer companies or a specified business index, the degree or manner in which various items shall be included or excluded from such measures, whether total assets or certain categories of assets shall be used, whether such measures shall be applied to the Company on a consolidated basis or to certain Related Parties of the Company or to certain divisions, operating units or business lines of the Company or a Related Entity, the weighting that shall be given to various measures if combined goals are used, and the periods and dates during or on which such measures shall be calculated. The Performance Goals may differ from Grantee to Grantee and from Award to Award.

(q)“Person”, whether or not capitalized, means any natural person, any corporation, partnership, limited liability company, trust or legal or contractual entity or joint undertaking and any governmental authority.

(r)“Related Entity” means any corporation, partnership, limited liability company or other entity that is an “affiliate” of the Company within the meaning of Rule 12b-2 under the Exchange Act.

(s)“Retirement” means, with respect to a Grantee and an Award, (i) except as otherwise provided in the applicable Award Agreement or as provided in clause (ii) below, the Grantee’s Termination of Employment with the Company or a Related Entity for a reason other than for Cause and that at the time of the Termination of Employment the Grantee has reached the following age with the corresponding number of years of service with the Company and/or Related Entities:

|

| |

Age | Years of Service |

55 | 10 |

56 | 9 |

57 | 8 |

58 | 7 |

59 | 6 |

60 and older | 5; |

or (ii) with respect to a Non-Employee Director, the Grantee’s Termination of Employment with the Company at the end of his or her term of office for any reason other than Cause.

(t)“Rule 16b-3” means Rule 16b-3 under the Exchange Act.

(u)Unless otherwise determined by the Committee and subject to the following two sentences, a Grantee shall be deemed to have a “Termination of Employment” upon ceasing employment with the Company or any Related Entity (or, in the case of a Grantee who is not an employee, upon ceasing association with the Company or any Related Entity as a director, consultant, advisor or otherwise). In addition, any payment or benefit due upon a termination of Grantee’s employment that represents a “deferral of compensation” within the meaning of Section 409A of the Code shall only be paid or provided to Grantee upon a “separation from service” (within the meaning of Treasury Regulation 1.409A-1(h)). Unless the Committee in its discretion determines otherwise, it shall not be considered a Termination of Employment of a Grantee if the Grantee ceases employment or association with the Company or a Related Entity but continues or immediately commences employment or association with a majority-owned Related Entity or the Company. The Committee in its discretion may determine (i) that a given termination of employment with the Company or any particular Related Entity does not constitute a Termination of Employment (including circumstances in which employment continues with another Related Entity or the Company), (ii) whether any leave of absence constitutes a Termination of Employment for purposes of the Plan, (iii) the impact, if any, of any such leave of absence on Awards theretofore made under the Plan, and (iv) when a change in a Grantee’s association with the Company or any Related Entity constitutes a Termination of Employment for purposes of the Plan. The Committee may also determine in its discretion whether a Grantee’s Termination of Employment is for Cause and the date of termination in such case. The Committee may make any such determination at anytime, whether before or after the Grantee’s Termination of Employment.

(a)The Committee. The Plan shall be administered by the Committee, which shall consist of not less than two directors.

(b)Authority. The Committee shall have the authority (i) to exercise all of the powers granted to it under the Plan, (ii) to construe, interpret and implement the Plan and any Award Agreements, (iii) to prescribe, amend and rescind rules and regulations relating to the Plan, including rules governing its own operations, (iv) to make all determinations necessary or advisable in administering the Plan (including defining and calculating Performance Goals and certifying that such Performance Goals have been met), (v) to correct any defect, supply any omission and reconcile any inconsistency in the Plan, (vi) to amend the Plan to reflect changes in applicable law or regulations, (vii) to determine whether, to what extent and under what circumstances Awards may be settled or exercised in cash, shares of Common Stock, other securities, other Awards or other property, or canceled, forfeited or suspended and the method or methods by which Awards may be settled, canceled, forfeited or suspended (including, but not limited to, canceling an Award in exchange for a cash payment (or securities with an equivalent value) equal to the difference between the Fair Market Value of a share of Common Stock on the date of grant and the Fair Market Value of a share of Common Stock on the date of cancellation, and, if no such difference exists, canceling an Award without a payment in cash or securities), and (viii) to determine whether, to what extent and under what circumstances cash, shares of Common Stock, other securities, other Awards or other property and other

amounts payable with respect to an Award shall be deferred either automatically or at the election of the holder thereof or of the Committee.

(c)Voting. Actions of the Committee shall be taken by the vote of a majority of its members. Any action may be taken by a written instrument signed by a majority of the Committee members, and action so taken shall be fully as effective as if it had been taken by a vote at a meeting.

(d)Binding determinations. The determination of the Committee on all matters relating to the Plan or any Award Agreement shall be final, binding and conclusive.

(e)Exculpation. No member of the Board or the Committee or any officer, employee or agent of the Company or any of its Related Entities (each such person a “Covered Person”) shall have any liability to any person (including, without limitation, any Grantee) for any action taken or omitted to be taken or any determination made in good faith with respect to the Plan or any Award. Each Covered Person shall be indemnified and held harmless by the Company against and from any loss, cost, liability or expense (including attorneys’ fees) that may be imposed upon or incurred by such Covered Person in connection with or resulting from any action, suit or proceeding to which such Covered Person may be a party or in which such Covered Person may be involved by reason of any action taken or omitted to be taken under the Plan and against and from any and all amounts paid by such Covered Person, with the Company’s approval, in settlement thereof, or paid by such Covered Person in satisfaction of any judgment in any such action, suit or proceeding against such Covered Person; provided that the Company shall have the right, at its own expense, to assume and defend any such action, suit or proceeding and, once the Company gives notice of its intent to assume the defense, the Company shall have sole control over such defense with counsel of the Company’s choice. The foregoing right of indemnification shall not be available to a Covered Person to the extent that a court of competent jurisdiction in a final judgment or other final adjudication, in either case, not subject to further appeal, determines that the acts or omissions of such Covered Person giving rise to the indemnification claim resulted from such Covered Person’s bad faith, fraud or willful criminal act or omission. The foregoing right of indemnification shall not be exclusive of any other rights of indemnification to which Covered Persons may be entitled under the Company’s Articles of Incorporation or Bylaws, in each case as amended from time to time, as a matter of law, or otherwise, or any other power that the Company may have to indemnify such persons or hold them harmless.

(f)Experts. In making any determination or in taking or not taking any action under this Plan, the Committee or the Board may obtain and may rely upon the advice of experts, including professional and financial advisors and consultants to the Committee or the Company. No director, officer, employee or agent of the Company shall be liable for any such action or determination taken or made or omitted in good faith reliance on such advice.

(g)Board. Notwithstanding anything to the contrary contained herein (i) until the Board shall appoint the members of the Committee, the Plan shall be administered by the Board, and (ii) the Board may, in its sole discretion, at any time and from time to time, grant Awards or resolve to administer the Plan. In either of the foregoing events, the Board shall have all of the authority and responsibility granted to the Committee herein.

| |

1.4 | Persons Eligible for Awards |

Awards under the Plan may be made to such Key Persons as the Committee shall select in its discretion.

| |

1.5 | Types of Awards under the Plan |

Awards may be made under the Plan in the form of stock options, including Incentive Stock Options and non-qualified stock options, stock appreciation rights, restricted stock, unrestricted stock, restricted stock units, performance shares, performance units, dividend equivalent units, deferred stock units and other stock-based Awards, as set forth in Article II.

| |

1.6 | Shares Available for or Subject to Awards |

(a)Total Shares Available. The total number of shares of Common Stock that may be transferred pursuant to Awards granted under the Plan shall not exceed 9,000,000 shares. Effective as of the Effective Date, no

new awards shall be granted under the Prior Plan and the remaining share authorization under the Prior Plan shall be cancelled, except for shares underlying outstanding awards granted under the Prior Plan. All of shares subject to the Plan shall be authorized for issuance pursuant to incentive stock options under Section 2.3 or for other Awards under Article II. Such shares may be authorized but unissued Common Stock or authorized and issued Common Stock held in the Company’s treasury or acquired by the Company for the purposes of the Plan. The Committee may direct that any stock certificate evidencing shares issued pursuant to the Plan shall bear a legend setting forth such restrictions on transferability as may apply to such shares pursuant to the Plan. If any Award is forfeited or otherwise terminates or is canceled without the delivery of shares of Common Stock, then the shares covered by such forfeited, terminated or canceled Award shall again become available for transfer pursuant to Awards granted or to be granted under this Plan. However, for the avoidance of doubt, if any Award or shares of Common Stock issued or issuable under Awards are tendered or withheld as payment for the exercise price of an Award or for taxes due upon vesting, exercise or settlement of an Award, the shares of Common Stock may not be reused or reissued or otherwise be treated as being available for Awards or issuance pursuant to the Plan. With respect to a stock appreciation rights, both shares of Common Stock issued pursuant to the Award and shares of Common Stock representing the exercise price of the Award shall be treated as being unavailable for other Awards or other issuances pursuant to the Plan unless the stock appreciation right is forfeited, terminated or cancelled without the delivery of shares of Common Stock. Any shares of Common Stock delivered by the Company, any shares of Common Stock with respect to which Awards are made by the Company and any shares of Common Stock with respect to which the Company becomes obligated to make Awards, through the assumption of, or in substitution for, outstanding awards previously granted by an acquired entity, shall not be counted against the shares available for Awards under this Plan.

(b)Share Counting. Each share of Common Stock underlying an Award shall be counted against the numerical limits of this Section 1.6 as one share for every share subject thereto.

(c)Adjustments. The number of shares of Common Stock covered by each outstanding Award, the kind, number or amount of shares or units available for Awards under Section 1.6 (a) or otherwise, the kind, number or amount of shares or units that may be subject to Awards to any one Grantee under Section 1.7 (b) or otherwise, the exercise price or price per share of Common Stock or units covered by each such outstanding Award and any other calculation relating to shares of Common Stock available for Awards or under outstanding Awards (including Awards under Section 2.13) shall be proportionately adjusted by the Committee in order to prevent dilution or enlargement of the benefits or potential benefits intended to be made available under the Plan (provided that no such adjustment shall be made if or to the extent that it would cause any outstanding Award to fail to comply with Section 409A of the Code), for (i) any increase or decrease in the number of issued shares of Common Stock resulting from a stock split, reverse stock split, stock dividend, recapitalization, merger, combination or reclassification of the Common Stock or similar transaction, or any other increase or decrease in the number of issued shares of Common Stock effected without receipt of consideration by the Company or to reflect any distributions to holders of Common Stock (including rights offerings) other than regular cash dividends or (ii) any other unusual or nonrecurring event affecting the Company or its financial statements or any change in applicable law, regulation or accounting principles; provided, however, that conversion of any convertible securities of the Company shall not be deemed to have been “effected without receipt of consideration.” Except as expressly provided herein, no issuance by the Company of shares of stock of any class, or securities convertible into shares of stock of any class, shall affect, and no adjustment by reason thereof shall be made with respect to, the number or price of shares of Common Stock subject to an Award. The Committee’s determinations as to the manner of effecting this Section 1.6(c) shall be conclusive and binding.

(d)Grants exceeding allotted shares. If the shares of Common Stock covered by an Award exceeds, as of the date of grant, the number of shares of Common Stock which may be issued under the Plan without additional shareholder approval, such Award shall be void with respect to such excess shares of Common Stock unless shareholder approval of an amendment sufficiently increasing the number of shares of Common Stock subject to the Plan is timely obtained in accordance with the Plan.

| |

1.7 | Regulatory Considerations |

(a)General. To the extent that the Committee determines it desirable for any Award to be given any particular tax, accounting, legal or regulatory treatment, the Award may be made by a Committee consisting of qualifying directors, subject to any necessary restrictions, conditions or other terms or otherwise in such manner as is necessary to obtain the desired treatment.

(b)Code Section 162(m) provisions. Unless and until the Committee determines that an Award to a Grantee shall not be designed to qualify as “performance-based compensation” under Section 162(m) of the Code, the following rules shall apply to Awards granted to Grantees:

(i)No Grantee shall be granted, in any fiscal year, stock options or stock appreciation rights to purchase (or obtain the benefits of the equivalent of) more than 500,000 shares of Common Stock, subject to adjustment as provided in Section 1.6(c),;

(ii)The total number of shares of Common Stock subject to Awards (other than stock options, stock appreciation rights and performance units) granted to any Grantee, in any fiscal year, may not, subject to adjustment as provided in Section 1.6(c), exceed 166,666 shares of Common Stock, provided that if any units are awarded with respect to multiple years of service, such limit shall be multiplied by such number of years (not to exceed five years);

(iii)No Grantee shall receive performance units, in any fiscal year, having a value greater than $5 million, provided that if any units are awarded with respect to multiple years of service, such limit shall be multiplied by such number of years (not to exceed five years).

(iv)No Grantee shall be granted, in any fiscal year, dividend equivalent rights with respect to more shares than the aggregate number of shares and units granted to such Grantee in such year; and

(v)For purposes of qualifying grants of Awards as “performance-based compensation” under Section 162(m) of the Code, the Committee in its discretion may set restrictions based upon the achievement of Performance Goals. The Performance Goals shall be set by the Committee on or before the latest date permissible to enable the Awards to qualify as “performance-based compensation” under Section 162(m) of the Code. In granting share Awards which are intended to qualify under Section 162(m) of the Code, the Committee shall follow any procedures determined by it from time to time to be necessary or appropriate to ensure qualification of the Award under Section 162(m) of the Code (e.g., in determining the Performance Goals).

Without consent of the Company’s shareholders, the exercise price (or equivalent) for an Award may not be reduced. This shall include, without limitation, a repricing of the Award as well as an Award exchange program whereby the Grantee agrees to cancel an existing Award in exchange for a new Award, cash or any other form of consideration.

ARTICLE II

AWARDS UNDER THE PLAN

| |

2.1 | Awards and Award Agreements |

Each Award granted under the Plan shall be evidenced by an Award Agreement which shall contain such provisions as the Committee in its discretion deems necessary or desirable. Such provisions may include restrictions on the Grantee’s right to transfer the shares of Common Stock issuable pursuant to the Award, a requirement that the Grantee become a party to an agreement restricting transfer or allowing repurchase of any shares of Common Stock acquired pursuant to the Award, a requirement that the Grantee acknowledge that such shares are acquired for investment purposes only, and a right of first refusal exercisable by the Company in the event that the Grantee wishes to transfer any such shares. The Committee may grant Awards in tandem or in connection with or independently of or in substitution for any other Award or Awards granted under this Plan or any award granted under any other plan of the Company. Payments or transfers to be made by the Company upon the grant, exercise or payment of an Award may be made in such form as the Committee shall determine, including cash, shares of Common Stock or other securities (or proceeds from the sale thereof), other Awards (by surrender or cancellation thereof or otherwise) or other property and may be made in a single payment or transfer, in installments or on a deferred basis. The Committee may determine that a Grantee shall have no rights with respect to an Award unless such Grantee accepts the Award within such period as the Committee shall specify by executing an Award Agreement in such form as the Committee shall determine and, if the Committee shall so require, makes payment to the Company in such amount as the Committee may determine. The Committee shall determine if loans (whether or not secured by shares of Common Stock) may be extended, guaranteed or arranged by the Company with respect to any Awards; provided, however, that loans to executive officers of the Company may not be extended, guaranteed or arranged by the Company in violation of Section 402 of the Sarbanes-Oxley Act of 2002, Regulation O of the Board of Governors of the Federal Reserve System or any other applicable law or regulation. Subject to the terms of the Plan, the Committee at any time, whether before or after the grant, expiration, exercise, vesting or maturity of an Award or the Termination of Employment of a Grantee, may determine in its discretion to waive or amend any term or condition of an Award, including transfer restrictions, vesting, maturity and expiration dates, and conditions for vesting, maturity or exercise.

| |

2.2 | No Rights as a Shareholder |

No Grantee of an Award (or other person having rights pursuant to such Award) shall have any of the rights of a shareholder of the Company with respect to shares subject to such Award until the transfer of such shares to such person. Except as otherwise provided in Section 1.6(c), no adjustment shall be made for dividends, distributions or other rights (whether ordinary or extraordinary, and whether in cash, securities or other property) for which the record date is prior to the date such shares are issued.

| |

2.3 | Grant of Stock Options, Stock Appreciation Rights and Additional Options |

(a)Grant of stock options. The Committee may grant stock options, including Incentive Stock Options and nonqualified stock options, to purchase shares of Common Stock from the Company, to such Key Persons, in such amounts and subject to such terms and conditions (including the attainment of Performance Goals), as the Committee shall determine in its discretion, subject to the provisions of the Plan.

(b)Grant of stock appreciation rights. The Committee may grant stock appreciation rights to such Key Persons, in such amounts and subject to such terms and conditions (including the attainment of Performance Goals), as the Committee shall determine in its discretion, subject to the provisions of the Plan. Stock appreciation rights may be granted in connection with all or any part of, or independently of, any stock option granted under the Plan. A stock appreciation right may be granted at or after the time of grant of such option.

(c)Stock appreciation rights. The Grantee of a stock appreciation right shall have the right, subject to the terms of the Plan and the applicable Award Agreement, to receive from the Company an amount equal to (i) the excess of the Fair Market Value of a share of Common Stock on the date of exercise of the stock appreciation right over (ii) the exercise price of such right as set forth in the Award Agreement (if the stock appreciation right

is granted in connection with a stock option, then the exercise price of the option), multiplied by (iii) the number of shares with respect to which the stock appreciation right is exercised. Payment to the Grantee upon exercise of a stock appreciation right shall be made in cash or in shares of Common Stock (valued at their Fair Market Value on the date of exercise of the stock appreciation right) or both, as the Committee shall determine in its discretion. Upon the exercise of a stock appreciation right granted in connection with a stock option, the number of shares subject to the option shall be correspondingly reduced by the number of shares with respect to which the stock appreciation right is exercised. Upon the exercise of a stock option in connection with which a stock appreciation right has been granted, the number of shares subject to the stock appreciation right shall be reduced correspondingly by the number of shares with respect to which the option is exercised.

(d)Exercise price. Each Award Agreement with respect to a stock option or stock appreciation right shall set forth the exercise price, which shall be determined by the Committee in its discretion; provided, however, that the exercise price shall be at least 100% of the Fair Market Value of a share of Common Stock on the date the Award is granted (except as permitted in connection with the assumption or issuance of options or stock appreciation rights in a transaction to which Section 424 (a) of the Code applies).

(e)Exercise periods. Each Award Agreement with respect to a stock option or stock appreciation right shall set forth the periods during which the Award evidenced thereby shall be exercisable, and, if applicable, the conditions which must be satisfied (including the attainment of Performance Goals) in order for the Award evidenced thereby to be exercisable, whether in whole or in part. Such periods and conditions shall be determined by the Committee in its discretion; provided, however, that no stock option or stock appreciation right shall be exercisable more than ten (10) years after the date the Award is issued.

(f)Incentive stock options. Notwithstanding Section 2.3(d) and (e), with respect to any Incentive Stock Option or stock appreciation right granted in connection with an Incentive Stock Option (i) the exercise price shall be at least 100% of the Fair Market Value of a share of Common Stock on the date the option is granted (except as permitted in connection with the assumption or issuance of options in a transaction to which Section 424(a) of the Code applies) and (ii) the exercise period shall not be for longer than ten (10) years after the date of the grant. To the extent that the aggregate Fair Market Value (determined as of the time the option is granted) of the shares of Common Stock with respect to which Incentive Stock Options and stock appreciation rights granted in connection with Incentive Stock Options granted under this Plan and all other plans of the Company are first exercisable by any Grantee during any calendar year shall exceed the maximum limit (currently, $100,000), if any, imposed from time to time under Section 422 of the Code, such options and rights shall be treated as nonqualified stock options. For purposes of this Section 2.3(f), Incentive Stock Options shall be taken into account in the order in which they were granted.

(g)Ten percent owners. Notwithstanding the provisions of Sections 2.3(d), (e) and (f), to the extent required under Section 422 of the Code, an Incentive Stock Option may not be granted under the Plan to an individual who, at the time the option is granted, owns stock possessing more than 10% of the total combined voting power of all classes of stock of his or her employer corporation or of its parent or subsidiary corporations (as such ownership may be determined for purposes of Section 422(b)(6) of the Code) unless (i) at the time such Incentive Stock Option is granted the exercise price is at least 110% of the Fair Market Value of the shares subject thereto, and (ii) the Incentive Stock Option by its terms is not exercisable after the expiration of five (5) years from the date granted.

| |

2.4 | Exercise of Stock Options and Stock Appreciation Rights |

Each stock option or stock appreciation right granted under the Plan shall be exercisable as follows:

(a)Exercise period. A stock option or stock appreciation right shall become and cease to be exercisable at such time or times as determined by the Committee.

(b)Manner of exercise. Unless the applicable Award Agreement otherwise provides, a stock option or stock appreciation right may be exercised from time to time as to all or part of the shares as to which

such Award is then exercisable (but, in any event, only for whole shares). A stock appreciation right granted in connection with an option may be exercised at any time when, and to the same extent that, the related option may be exercised. A stock option or stock appreciation right shall be exercised by written notice to the Company, on such form and in such manner as the Committee shall prescribe.

(c)Payment of exercise price. Any written notice of exercise of a stock option shall be accompanied by payment of the exercise price for the shares being purchased. Such payment shall be made (i) in cash (by certified check or as otherwise permitted by the Committee), or (ii) to the extent specified in the Award Agreement or otherwise permitted by the Committee in its discretion (A) by delivery of shares of Common Stock (which, if acquired pursuant to the exercise of a stock option or under an Award made under this Plan or any other compensatory plan of the Company, were acquired at least six (6) months prior to the option exercise date) having a Fair Market Value (determined as of the exercise date) equal to all or part of the exercise price and cash for any remaining portion of the exercise price, (B) to the extent permitted by law, by such other method as the Committee may from time to time prescribe, including a cashless exercise procedure through a broker-dealer.

(d)Delivery of shares. Promptly after receiving payment of the full exercise price, or after receiving notice of the exercise of a stock appreciation right for which payment by the Company will be made partly or entirely in shares of Common Stock, the Company shall, subject to the provisions of Section 3.3 (relating to certain restrictions), transfer to the Grantee or to such other person as may then have the right to exercise the Award, the shares of Common Stock for which the Award has been exercised and to which the Grantee is entitled. If the method of payment employed upon option exercise so requires, and if applicable law permits, a Grantee may direct the Company to deliver the shares to the Grantee’s broker-dealer.

| |

2.5 | Cancellation and Termination of Stock Options and Stock Appreciation Rights |

The Committee may, at any time prior to the occurrence of a Change of Control and in its discretion, determine that any outstanding stock options and stock appreciation rights granted under the Plan, whether or not exercisable, will be canceled and terminated and that in connection with such cancellation and termination the holder of such options (and stock appreciation rights not granted in connection with an option) may receive for each share of Common Stock subject to such Award a cash payment (or the delivery of shares of stock, other securities or a combination of cash, stock and securities equivalent to such cash payment) equal to the difference, if any, between the amount determined by the Committee to be the Fair Market Value of the shares of Common Stock and the applicable exercise price per share multiplied by the number of shares of Common Stock subject to such Award; provided that, if such product is zero or less or to the extent that the Award is not then exercisable, the stock options and stock appreciation rights will be canceled and terminated without payment therefore.

| |

2.6 | Termination of Employment |

(a)Termination of Employment by Grantee for any Reason or By the Company for Cause. Except to the extent otherwise provided in paragraphs (b), (c), (d) and (e) below or in the applicable Award Agreement, all stock options and stock appreciation rights whether or not vested and to the extent not theretofore exercised shall terminate immediately upon (i) the Grantee’s Termination of Employment at Grantee’s election for any reason or (ii) Grantee’s Termination of Employment by the Company for Cause.

(b)At election of Company or a Related Entity. Except to the extent otherwise provided in the applicable Award Agreement, upon the Termination of Employment of a Grantee at the election of the Company or a Related Entity (other than in circumstances governed by paragraph (a) above or paragraphs (c), (d) or (e) below) the Grantee may exercise any outstanding stock option or stock appreciation right on the following terms and conditions: (i) exercise may be made only to the extent that the Grantee was entitled to exercise the Award on the date of the Termination of Employment; and (ii) exercise must occur within three (3) months after the Termination of Employment but in no event after the expiration date of the Award as set forth in the Award Agreement.

(c)Retirement. Except to the extent otherwise provided in the applicable Award Agreement, upon the Termination of Employment of a Grantee by reason of the Grantee’s Retirement, the Grantee may exercise

any outstanding stock option or stock appreciation right on the following terms and conditions: (i) exercise may be made only to the extent that the Grantee was entitled to exercise the Award on the date of Retirement; (ii) exercise must occur within three (3) years after Retirement but in no event after the expiration date of the Award as set forth in the Award Agreement; and (iii) notwithstanding clause (ii) above, the option or right shall terminate on the date Grantee begins or agrees to begin employment with another company that is in the financial services industry unless such employment is specifically approved by the Committee.

(d)Disability. Except to the extent otherwise provided in the applicable Award Agreement, upon the termination of Employment of a Grantee by reason of Disability the Grantee may exercise any outstanding stock option or stock appreciation right on the following terms and conditions: (i) exercise may be made only to the extent that the Grantee was entitled to exercise the Award on the date of Termination of Employment; and (ii) exercise must occur six (6) months after the Termination of Employment but in no event after the expiration date of the Award as set forth in the Award Agreement.

(e)Death. Except to the extent otherwise provided in the applicable Award Agreement, if a Grantee dies during the period in which the Grantee’s stock options or stock appreciation rights are exercisable, whether pursuant to their terms or pursuant to paragraph (b), (c) or (d) above, any outstanding stock option or stock appreciation right shall be exercisable on the following terms and conditions: (i) exercise may be made only to the extent that the Grantee was entitled to exercise the Award on the date of death; and (ii) exercise must occur six (6) months after the date of the Grantee’s death. Any such exercise of an Award following a Grantee’s death shall be made only by the Grantee’s executor or administrator, unless the Grantee’s will specifically disposes of such Award, in which case such exercise shall be made only by the recipient of such specific disposition. If a Grantee’s executor (or administrator) or the recipient of a specific disposition under the Grantee’s will shall be entitled to exercise any Award pursuant to the preceding sentence, such executor (or administrator) or recipient shall be bound by all the terms and conditions of the Plan and the applicable Award Agreement which would have applied to the Grantee.

| |

2.7 | Grant of Restricted Stock and Unrestricted Stock |

(a)Grant of restricted stock. The Committee may grant restricted shares of Common Stock to such Key Persons, in such amounts and subject to such terms and conditions (including the attainment of Performance Goals), as the Committee shall determine in its discretion, subject to the provisions of the Plan.

(b)Grant of unrestricted stock. The Committee may grant unrestricted shares of Common Stock to such Key Persons, in such amounts and subject to such terms and conditions as the Committee shall determine in its discretion, subject to the provisions of the Plan.

(c)Rights as shareholder. The Company may issue in the Grantee’s name shares of Common Stock covered by an Award of restricted stock or unrestricted stock. Upon the issuance of such shares, the Grantee shall have the rights of a shareholder with respect to the restricted stock or unrestricted stock, subject to the transfer restrictions and the Company’s repurchase rights described in paragraphs (d) and (e) below and to such other restrictions and conditions as the Committee in its discretion may include in the applicable Award Agreement.

(d)Company to hold certificates. Unless the Committee shall otherwise determine, any certificate issued evidencing shares of restricted stock shall remain in the possession of the Company until such shares are free of any restrictions specified in the Plan or the applicable Award Agreement.

(e)Nontransferable. Shares of restricted stock may not be sold, assigned, transferred, pledged or otherwise encumbered or disposed of except as specifically provided in this Plan or the applicable Award Agreement. The Committee at the time of grant shall specify the date or dates (which may depend upon or be related to the attainment of Performance Goals) and other conditions on which the non-transferability of the restricted stock shall lapse. Unless the applicable Award Agreement provides otherwise, additional shares of Common Stock or other property distributed to the Grantee in respect of shares of restricted stock, as dividends or otherwise, shall be subject to the same restrictions applicable to such restricted stock. The Committee at any time may waive or amend the transfer restrictions or other condition of an Award of restricted stock.

(f)Termination of employment. Except to the extent otherwise provided in the applicable Award Agreement or unless otherwise determined by the Committee, in the event of the Grantee’s Termination of Employment for any reason, shares of restricted stock that remain subject to transfer restrictions as of the date of such termination shall be forfeited and canceled.

| |

2.8 | Grant of Restricted Stock Units |

(a)Grant of restricted stock units. The Committee may grant Awards of restricted stock units to such Key Persons, in such amounts and subject to such terms and conditions (including the attainment of Performance Goals), as the Committee shall determine in its discretion, subject to the provisions of the Plan.

(b)Vesting. The Committee, at the time of grant, shall specify the date or dates on which the restricted stock units shall become vested and other conditions to vesting (including the attainment of Performance Goals).

(c)Maturity dates. At the time of grant, the Committee shall specify the maturity date or dates applicable to each grant of restricted stock units, which may be determined at the election of the Grantee if the Committee so determines. Such date may be on or later than, but may not be earlier than, the vesting date or dates of the Award. On the relevant maturity date(s), the Company shall transfer to the Grantee one unrestricted, fully transferable share of Common Stock for each vested restricted stock unit scheduled to be paid out on such date and as to which all other conditions to the transfer have been fully satisfied. The Committee shall specify the purchase price, if any, to be paid by the Grantee to the Company for such shares of Common Stock.

(d)Termination of Employment. Except to the extent otherwise provided in the applicable Award Agreement or unless otherwise determined by the Committee, in the event of the Grantee’s Termination of Employment for any reason, restricted stock units that have not vested or matured shall be forfeited and canceled.

| |

2.9 | Grant of Performance Shares and Performance Units |

(a)Grant of performance shares and units. The Committee may grant performance shares in the form of actual shares of Common Stock or share units over an identical number of shares of Common Stock, to such Key Persons, in such amounts (which may depend on the extent to which Performance Goals are attained), subject to the attainment of such Performance Goals and satisfaction of such other terms and conditions (which may include the occurrence of specified dates), as the Committee shall determine in its discretion, subject to the provisions of the Plan. The Performance Goals and the length of the performance period applicable to any Award of performance shares or performance units shall be determined by the Committee. The Committee shall determine in its discretion whether performance shares granted in the form of share units shall be paid in cash, Common Stock, or a combination of cash and Common Stock.

(b)Company to hold certificates. Unless the Committee shall otherwise determine, any certificate issued evidencing performance shares shall remain in the possession of the Company until such performance shares are earned and are free of any restrictions specified in the Plan or the applicable Award Agreement.

(c)Nontransferable. Performance shares may not be sold, assigned, transferred, pledged or otherwise encumbered or disposed of except as specifically provided in this Plan or the applicable Award Agreement. The Committee at the time of grant shall specify the date or dates (which may depend upon or be related to the attainment of Performance Goals) and other conditions on which the non-transferability of the performance shares shall lapse. Unless the applicable Award Agreement provides otherwise, additional shares of Common Stock or other property distributed to the Grantee in respect of performance shares, as dividends or otherwise, shall be subject to the same restrictions applicable to such performance shares. The Committee at any time may waive or amend the transfer restrictions or other condition of an Award of performance shares.

(d)Termination of Employment. Except to the extent otherwise provided in the applicable Award Agreement or unless otherwise determined by the Committee, in the event of the Grantee’s Termination of

Employment for any reason, performance shares and performance share units that remain subject to transfer restrictions as of the date of such termination shall be forfeited and canceled.

| |

2.10 | Grant of Dividend Equivalent Rights |

The Committee may in its discretion include in the Award Agreement with respect to any Award, other than a stock option or stock appreciation right, a dividend equivalent right entitling the Grantee to receive amounts equal to the ordinary dividends that would be paid, during the time such Award is outstanding and unexercised, on the shares of Common Stock covered by such Award if such shares were then outstanding. In the event such a provision is included in an Award Agreement, the Committee shall determine whether such payments shall be made in cash, in shares of Common Stock or in another form, whether they shall be conditioned upon the exercise or vesting of, or the attainment or satisfaction of terms and conditions applicable to, the Award to which they relate, the time or times at which they shall be made, and such other terms and conditions as the Committee shall deem appropriate; provided, however, that the recipient of an Award of performance shares or performance units shall only be paid any dividends or dividend equivalent rights upon vesting of the applicable performance share or performance unit.

| |

2.11 | Deferred Stock Units. |

(a)Description. Deferred stock units shall consist of a restricted stock, restricted stock unit, performance share or performance unit Award that the Committee in its discretion permits to be paid out in installments or on a deferred basis, in accordance with rules and procedures established by the Committee. Deferred stock units shall remain subject to the claims of the Company’s general creditors until distributed to the Grantee.

(b)162(m) limits. Deferred stock units shall be subject to the annual Section 162(m) limits applicable to the underlying restricted stock, restricted stock unit, performance share or performance unit Award as forth in Section 1.7(b).

| |

2.12 | Other Stock-Based Awards |

The Committee may grant other types of stock-based Awards to such Key Persons, in such amounts and subject to such terms and conditions, as the Committee shall in its discretion determine, subject to the provisions of the Plan. Such Awards may entail the transfer of actual shares of Common Stock, or payment in cash or otherwise of amounts based on the value of shares of Common Stock.

(a)Eligibility. In order to retain and compensate voting directors of the Company who are not employees of the Company (“Non-Employee Directors”) and to strengthen the alignment of their interests with those of the shareholders of the Company, Non- Employee Directors shall be eligible to receive Awards under this Plan as determined by the Board, subject to the limits set forth in this Section 2.13.

(b)Non-Employee Director Award Limits. The aggregate value of Awards that may be granted to any one Non-Employee Director during any calendar year, solely with respect to his or her service as a Non-Employee Director, may not exceed $200,000, based on the aggregate Fair Market Value of Awards, determined as of the date of grant.

ARTICLE III

MISCELLANEOUS

| |

3.1 | Amendment of the Plan; Modification of Awards |

(a)Board authority to amend Plan. The Board in its discretion may at any time suspend, discontinue, revise or amend the Plan in any respect whatsoever, except that any such amendment (other than an amendment pursuant to paragraphs (d), (e) or (f) of this Section 3.1 or an amendment to effect an assumption or other action consistent with Section 3.7) that materially impairs the rights or materially increases the obligations of a Grantee under an outstanding Award shall be effective with respect to such Grantee and Award only with the consent of the Grantee (or, upon the Grantee’s death, the Grantee’s executor (or administrator) or the recipient of a specific disposition under the Grantee’s will). For purposes of the Plan, any action of the Board that alters or affects the tax treatment of any Award shall not be considered to materially impair any rights of any Grantee.

(b)Shareholder approval. Shareholder approval of any amendment shall be obtained to the extent necessary to comply with Section 422 of the Code (relating to Incentive Stock Options) or any other applicable law, regulation or rule (including the rules of self- regulatory organizations).