Fears Of A Slower US Recovery Hit Regional Bank Stocks

March 15 2011 - 2:16PM

Dow Jones News

The impact of the Japanese natural and nuclear disasters on the

world economy damped investors' enthusiasm Tuesday for the stocks

of U.S. banks.

Shares of regional banks were falling Tuesday, reflecting a

growing concern among investors that demand for new loans may not

improve revenue as much as some on Wall Street are hoping. Though

some analysts argue that banks' improved capital will still allow

them to raise dividends or buy back stock.

The disruptions to the world's third-largest economy, and their

potential ripple effect on a U.S. recovery, follow rising oil

prices and political upheaval in north Africa and the Middle East.

"Anything hurting the U.S. recovery puts pressure on bank stocks,"

said Peter Winter, an analyst with BMO Capital Markets.

Comerica Inc. (CMA) was among the worst performers in the

regional bank group, falling 2.3% in recent trading, to $37.43. The

Dallas bank is mainly a commercial lender, a type of lending

dependent on growing businesses.

PNC Financial Services Group Inc. (PNC) was off 1.6%, to $61.54;

and Zions Bancorporation (ZION) fell 2%, to $22.63; while they are

two very different banks, both are thought to be able to derive

much of their future revenue from the economic recovery in the

U.S.

Midwestern commercial lenders Fifth Third Bancorp (FITB) and

KeyCorp (KEY) fell more than 4% before the market opened and were

recently down around 2%.

Consumer lenders like Capital One Financial Corp. (COF) and

Astoria Financial Corp. (AF) are doing better; Capital One was up

2.6%, to $50.74, after reporting shrinking monthly delinquencies on

credit card loans, and Astoria is off 0.4%, to $13.73.

"The fear meter definitely swung hard in one direction" Tuesday

morning, said Terry J. McEvoy, an analyst with Oppenheimer &

Co. "Investors are taking money off the table until it is clearer

what this means for loan growth" and credit quality.

Bankers have said in recent months that demand from businesses

for new loans picked up in December, giving investors hope the

economic recovery would soon impact bank earnings--one reason why

bank stocks rose. The KBW bank index was up more than 6% from

January to mid-February, when concerns about the political upheaval

in North Africa and the Middle East damped economic growth

expectations. On Tuesday, the index fell 1.6%, compared to a 1.7%

decline of the Standard & Poor's 500 Index.

But loan demand has remained timid. "Even excluding Japan, it

looks that the economic recovery is slower than thought," said

Joseph Fenech of Sandler O'Neill & Partners. A slower economic

recovery could mean the improvement in delinquent loans will also

slow.

In addition, momentum trading moves like the one that hit the

market Tuesday morning usually have a big impact on bank stocks.

"Regional bank betas are pretty high following the financial

crisis," said Frederick Cannon, the chief equity strategist at

Keefe, Bruyette & Woods Inc. Beta refers to the tendency for

certain stocks to move more or less than the stock market in

general; high beta stocks tend to move up and down more than broad

market indices.

Large banks are also falling Tuesday, with Citigroup Inc. (C)

and Bank of America Corp. (BAC) down 2.5%, and 2.2%, respectively,

to $4.42 and $13.92. However, Wells Fargo & Co. (WFC), also a

big commercial lender but best known for its retail banking

business, was off only 0.7%, to $31.88.

So analysts argue the sell-off in bank stocks, tied simply to a

slower--or perhaps even stalled--recovery, is overdone. Banks have

sufficient capital to increase their dividends and buy back their

shares, and acquisitions will pick up, Fenech said, giving

investors reason to continue to invest in banks.

-By Matthias Rieker, Dow Jones Newswires; 212-416-2471;

matthias.rieker@dowjones.com

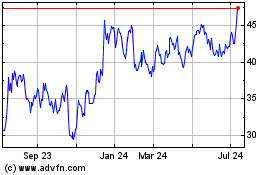

Zions Bancorporation NA (NASDAQ:ZION)

Historical Stock Chart

From Mar 2024 to Apr 2024

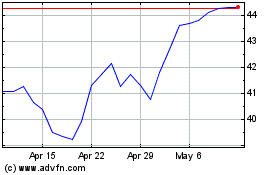

Zions Bancorporation NA (NASDAQ:ZION)

Historical Stock Chart

From Apr 2023 to Apr 2024