UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 27, 2016

VERTEX PHARMACEUTICALS INCORPORATED

(Exact name of registrant as specified in its charter)

|

| | |

MASSACHUSETTS (State or other jurisdiction of incorporation) | 000-19319 (Commission File Number) | 04-3039129 (IRS Employer Identification No.) |

50 Northern Avenue

Boston, Massachusetts 02210

(Address of principal executive offices) (Zip Code)

(617) 341-6100

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition.

On January 27, 2016, we issued a press release in which we reported our consolidated financial results for the three and twelve months ended December 31, 2015. A copy of that press release is attached to this Current Report on Form 8-K as Exhibit 99.1 and is incorporated herein by reference.

The information set forth in Exhibit 99.1 shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

Exhibit Description of Document

99.1 Press Release, dated January 27, 2016

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| |

| VERTEX PHARMACEUTICALS INCORPORATED |

| (Registrant) |

| |

Date: January 27, 2016 | /s/ Michael J. LaCascia |

| Michael J. LaCascia Senior Vice President and General Counsel |

| |

Vertex Reports Full-Year and Fourth Quarter 2015 Financial Results

-Full-year 2015 total non-GAAP revenues of $1.01 billion, including net product revenues of $351 million for ORKAMBI® (lumacaftor/ivacaftor) and $632 million for KALYDECO® (ivacaftor) in cystic fibrosis-

-Vertex reiterates 2016 financial guidance for KALYDECO net product revenues of $670 to $690 million and for non-GAAP operating expenses of $1.18 to $1.23 billion-

-Phase 3 study of ORKAMBI in children ages 6 to 11 meets primary endpoint and supports planned supplemental New Drug Application in the second quarter of 2016; Approximately 2,400 children ages 6 to 11 would be eligible for treatment with ORKAMBI in the U.S.-

BOSTON -- Vertex Pharmaceuticals Incorporated (Nasdaq: VRTX) today reported consolidated financial results for the quarter ended December 31, 2015. Vertex also reiterated its financial guidance for total 2016 KALYDECO® (ivacaftor) net revenues and non-GAAP operating expenses. Key financial results include:

|

| | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | | | Twelve Months Ended December 31, | | |

| 2015 | | 2014 | | % Change | | 2015 | | 2014 | | % Change |

| (in millions, except per share and percentage data) |

ORKAMBI product revenues, net | $ | 220 |

| | $ | — |

| | N/A |

| | $ | 351 |

| | $ | — |

| | N/A |

|

KALYDECO product revenues, net | $ | 181 |

| | $ | 124 |

| | 45 | % | | $ | 632 |

| | $ | 464 |

| | 36 | % |

GAAP net loss | $ | (76 | ) | | $ | (177 | ) | | (57 | )% | | $ | (558 | ) | | $ | (739 | ) | | (24 | )% |

GAAP net loss per share | $ | (0.31 | ) | | $ | (0.74 | ) | | (58 | )% | | $ | (2.31 | ) | | $ | (3.14 | ) | | (26 | )% |

Non-GAAP net income (loss) | $ | 43 |

| | $ | (132 | ) | | N/A |

| | $ | (268 | ) | | $ | (511 | ) | | (48 | )% |

Non-GAAP net income (loss) per share | $ | 0.17 |

| | $ | (0.55 | ) | | N/A |

| | $ | (1.11 | ) | | $ | (2.17 | ) | | (49 | )% |

"Entering 2016, Vertex is in a strong financial position to support continued investment in our business to create future medicines for serious diseases and value for our shareholders," said Jeffrey Leiden, M.D., Ph.D., Chairman, President and Chief Executive Officer of Vertex. "We look forward to multiple important milestones over the coming year that will mark continued progress toward our goal of discovering and developing potential new medicines for all people with CF."

On January 10, 2016, Vertex provided a comprehensive update on its development programs in cystic fibrosis (CF) and other serious diseases. The company today provided the following updates and highlighted upcoming milestones:

Phase 3 Data Support Submission of Supplemental New Drug Application for ORKAMBI in Children Ages 6 to 11 with Two Copies of the F508del Mutation in the U.S.

Vertex recently completed a Phase 3 clinical study that was conducted to support the potential approval of ORKAMBI for children with CF as young as six years of age with two copies of the F508del mutation in the U.S. Children in the study received a twice-daily fixed-dose combination of lumacaftor (200mg) and ivacaftor (250mg) for six months. The study enrolled 58 children ages 6 to 11 with two copies of the F508del mutation, and the primary endpoint of the study was safety. The study did not include a placebo control arm. Secondary and exploratory endpoints evaluated the effect on multiple efficacy endpoints including forced expiratory volume in one second (FEV1), lung clearance index and others.

The study met its primary safety endpoint, and safety data from the study showed that the combination was generally well-tolerated. The most common adverse events were cough, headache, infective pulmonary exacerbation, nasal congestion, abdominal pain, increased sputum and elevated liver enzymes. Two patients (3.4%) discontinued treatment because of adverse events.

Based on these data, Vertex plans to submit a supplemental New Drug Application (sNDA) to the U.S. Food and Drug Administration (FDA) in the second quarter of 2016. There are approximately 2,400 children ages 6-11 who have two copies of the F508del mutation in the U.S.

In addition to meeting its primary safety endpoint, the study showed a 2.5 percentage point improvement in FEV1 (p=0.067), a secondary endpoint, and a -0.88 improvement in lung clearance index (p=0.0018), which was an exploratory endpoint. Improvements in secondary endpoints of body mass index, the respiratory domain of the CF questionnaire-revised (CFQ-R) and sweat chloride were also observed in the study.

To support approval in the European Union, a six-month Phase 3 efficacy study is ongoing to evaluate lumacaftor/ivacaftor in approximately 200 children. The primary endpoint of this study is the absolute change in lung clearance index. There are approximately 3,400 children ages 6-11 who have two copies of the F508del mutation in the European Union.

Supplemental New Drug Application in Residual Function Mutations

The FDA set a target review date of February 7, 2016 for its decision regarding a supplemental New Drug Application for the use of KALYDECO in people ages two and older with one of 23 residual function mutations. The sNDA was based on preclinical data for ivacaftor in certain residual function mutations, the established clinical profile of KALYDECO and on previously reported data from an exploratory Phase 2a

study. Eight of the 23 mutations proposed for approval in the sNDA were represented in the Phase 2a study. More than 1,500 people with CF in the U.S. ages two and older have the mutations represented in the sNDA.

Approval of ORKAMBI in Canada

On January 26, Vertex announced that announced that Health Canada approved ORKAMBI for use in people ages 12 and older with two copies of the F508del mutation. It is only indicated for these patients, who can be identified with a genetic test. Of the approximately 4,000 people in Canada with CF, approximately 1,500 are ages 12 and older and have two copies of the F508del mutation. Health Canada approval is the first step in the process for securing funding through Canada's public drug programs for a new medicine. Once a new medicine receive approval from Health Canada, it enters the Canadian Agency for Drugs and Technologies (CADTH) Common Drug Review (CDR) process. Following its review, CADTH will send a recommendation to participating public drug programs, and participating jurisdictions may then proceed to reimbursement discussions with the manufacturer through the Pan-Canadian Pharmaceutical Alliance (pCPA). When an agreement has been reached between the manufacturer and the pCPA, each province and territory determines how the new medicine will be funded.

Fourth Quarter 2015 Financial Highlights

Revenues:

| |

• | Net Product Revenues from ORKAMBI were $219.9 million. As of December 31, 2015, more than 4,500 people with CF had started treatment with ORKAMBI. |

| |

• | Net Product Revenues from KALYDECO were $180.7 million compared to $124.4 million for the fourth quarter of 2014. |

Expenses:

| |

• | Total combined non-GAAP cost of product revenues and royalty expenses (COR) were $64.2 million, compared to $13.2 million for the fourth quarter of 2014. GAAP COR expenses were $64.4 million, compared to $14.0 million for the fourth quarter of 2014. Fourth quarter 2015 COR expenses included a $13.9 million sales milestone earned by Cystic Fibrosis Foundation Therapeutics, Inc. |

| |

• | Non-GAAP research and development (R&D) expenses were $203.8 million compared to $175.7 million for the fourth quarter of 2014. The increased R&D expenses for the fourth quarter of 2015 were primarily the result of increased costs related to the pivotal Phase 3 program for VX-661 in combination with ivacaftor, which includes four Phase 3 studies in more than 1,000 patients. GAAP R&D expenses were $310.4 million compared to $201.5 million for the fourth quarter of 2014. |

| |

• | Non-GAAP sales, general and administrative (SG&A) expenses were $78.1 million compared to $60.4 million for the fourth quarter of 2014. The increased SG&A expenses were primarily the result of increased investment in global commercial support for the planned launch of ORKAMBI. GAAP SG&A expenses were $97.1 million compared to $78.5 million for the fourth quarter of 2014. |

Net Income (Loss) Attributable to Vertex:

| |

• | Non-GAAP net income was $42.7 million, or $0.17 per diluted share, compared to a non-GAAP net loss of $131.8 million, or $0.55 per diluted share, for the fourth quarter of 2014. The net income was the result of ORKAMBI product revenues and increased KALYDECO product revenues, partially offset by increased operating expenses. The GAAP net loss was $75.5 million, or $0.31 per diluted share, compared to Vertex's fourth quarter 2014 GAAP net loss of $176.7 million, or $0.74 per diluted share. |

Full Year 2015 Financial Highlights

Revenues:

| |

• | Net Product Revenues from ORKAMBI were $350.7 million. |

| |

• | Net Product Revenues from KALYDECO were $631.7 million compared to $463.8 million for the full year 2014. |

Expenses:

| |

• | Total combined non-GAAP cost of product revenues and royalty expenses (COR) were $124.9 million, compared to $45.0 million for the full year 2014. GAAP COR expenses were $125.5 million compared to $61.0 million for the full year 2014. |

| |

• | Non-GAAP research and development (R&D) expenses were $764.4 million compared to $694.2 million for the full year 2014. The increased R&D expenses for the full year 2015 were primarily the result of increased costs related to the pivotal Phase 3 program for VX-661 in combination with ivacaftor, which includes four Phase 3 studies in more than 1,000 patients. GAAP R&D expenses were $996.2 million compared to $855.5 million for the full year 2014. |

| |

• | Non-GAAP sales, general and administrative (SG&A) expenses were $295.4 million compared to $225.6 million for the full year 2014. This increased SG&A expenses were primarily the result of increased investment in global commercial support for the planned launch of ORKAMBI. GAAP SG&A expenses were $377.1 million compared to $305.4 million for the full year 2014. |

Net Loss Attributable to Vertex:

| |

• | Non-GAAP net loss was $268.3 million, or $1.11 per diluted share, compared to a non-GAAP net loss of $511.2 million, or $2.17 per diluted share, for the full year 2014. The decreased net loss was the result of the first half year of ORKAMBI product revenues and increased KALYDECO product revenues, partially offset by increased operating expenses. The GAAP net loss was $558.1 million, or $2.31 per diluted share, compared to Vertex's full year 2014 GAAP net loss of $738.6 million, or $3.14 per diluted share. |

Cash Position:

| |

• | As of December 31, 2015, Vertex had $1.04 billion in cash, cash equivalents and marketable securities compared to $1.39 billion in cash, cash equivalents and marketable securities as of December 31, 2014. |

| |

• | As of December 31, 2015, Vertex had $300 million outstanding from a credit agreement that provides for a secured loan of up to $500 million. |

2016 Financial Guidance:

Vertex today reiterated its 2016 net product revenue guidance for KALYDECO and guidance for non-GAAP operating expenses, excluding cost of revenues. The company also today provided financial guidance for the non-GAAP R&D and SG&A components of non-GAAP operating expenses. The financial guidance is summarized below, together with information regarding the company's expectation for providing ORKAMBI net revenue guidance in 2016, as previously discussed on January 10, 2016:

| |

• | KALYDECO: As announced on January 10, 2016, Vertex anticipates total 2016 KALYDECO net product revenues of $670 to $690 million, which exclude any revenues related to the potential approval of KALYDECO for people in the U.S. who have residual function mutations. Anticipated 2016 KALYDECO net revenues reflect the expectation for approximately 200 patients with a gating mutation to enroll in a Phase 3 clinical study of VX-661 in combination with ivacaftor who would otherwise receive KALYDECO, which will thus reduce 2016 KALYDECO revenues. |

| |

• | ORKAMBI: The company expects to provide net product revenue guidance for ORKAMBI during 2016 after gaining additional information on the launch of ORKAMBI in the U.S., including: |

| |

◦ | The total proportion of the 8,500 eligible patients who begin treatment with ORKAMBI in 2016. |

| |

◦ | The rate at which patients initiate treatment in 2016. |

| |

◦ | The proportion of initiated patients who remain on treatment. |

| |

◦ | The compliance rate for patients who remain on treatment. |

As of December 31, more than 4,500 people had begun treatment with ORKAMBI in the U.S. since the approval of the medicine in July 2015. Vertex expects the vast majority of eligible patients in the U.S. will begin treatment by the end of 2016.

Vertex expects to recognize revenues from sales of ORKAMBI in the U.S. and Germany in 2016. In Germany, there are approximately 2,500 people with CF ages 12 and older with two copies of the F508del mutation. The company does not anticipate any other significant revenues from other countries in 2016.

| |

• | Operating Expenses, Excluding Cost of Revenues (Combined Non-GAAP R&D and SG&A Expenses): Vertex expects that its combined non-GAAP R&D and SG&A expenses in 2016 will be in the range of $1.18 to $1.23 billion. The increase as compared to 2015 is primarily a result of expanded development efforts related to the pivotal Phase 3 development program for VX-661 in combination with ivacaftor and for multiple Phase 1 and 2 studies of Vertex's early-stage and mid-stage pipeline of potential CF medicines and anticipated costs to support the launch of ORKAMBI in new global markets. The components of Vertex's non-GAAP operating expenses include: |

| |

◦ | Non-GAAP R&D Expenses: Vertex expects that full-year 2016 non-GAAP R&D expenses will be in the range of $850 to $880 million. The development component of 2016 non-GAAP R&D expenses is expected to increase as compared to 2015 primarily as a result of the ongoing pivotal Phase 3 program for VX-661 and other ongoing and planned Phase 1 and Phase 2 studies in CF. |

| |

◦ | Non-GAAP SG&A Expenses: Vertex expects that full-year 2016 non-GAAP SG&A expenses will be in the range of $330 to $350 million. The expected increase in SG&A is a result of ongoing investment in the company's commercial infrastructure to support the global launch of ORKAMBI in new markets. |

Vertex's expected non-GAAP R&D and SG&A expenses exclude stock-based compensation expense and certain other expenses.

Non-GAAP Financial Measures

In this press release, Vertex's financial results and financial guidance are provided in accordance with accounting principles generally accepted in the United States (GAAP) and using certain non-GAAP financial measures. In particular, non-GAAP financial results exclude stock-based compensation expense, costs and credits related to the relocation of the company's corporate headquarters including a one-time 2014 cash payment related to a lease agreement, hepatitis C-related revenues and costs, $75.0 million payment related to our collaboration with CRISPR Therapeutics AG and other adjustments. These results are provided as a complement to results provided in accordance with GAAP because management believes these non-GAAP

financial measures help indicate underlying trends in the company's business, are important in comparing current results with prior period results and provide additional information regarding the company's financial position. Management also uses these non-GAAP financial measures to establish budgets and operational goals that are communicated internally and externally and to manage the company's business and to evaluate its performance. A reconciliation of the GAAP financial results to non-GAAP financial results is included in the attached financial information.

Vertex Pharmaceuticals Incorporated

Fourth Quarter Results

Consolidated Statements of Operations Data

(in thousands, except per share amounts)

(unaudited)

|

| | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2015 | | 2014 | | 2015 | | 2014 |

Revenues: | | | | | | | |

Product revenues, net | $ | 406,550 |

| | $ | 124,942 |

| | $ | 1,000,324 |

| | $ | 487,821 |

|

Royalty revenues | 6,331 |

| | 8,785 |

| | 23,959 |

| | 40,919 |

|

Collaborative revenues | 5,054 |

| | 10,829 |

| | 8,053 |

| | 51,675 |

|

Total revenues | 417,935 |

| | 144,556 |

| | 1,032,336 |

| | 580,415 |

|

Costs and expenses: | | | | | | | |

Cost of product revenues | 63,122 |

| | 11,290 |

| | 118,181 |

| | 39,725 |

|

Royalty expenses | 1,293 |

| | 2,737 |

| | 7,361 |

| | 21,262 |

|

Research and development expenses | 310,429 |

| | 201,463 |

| | 996,170 |

| | 855,506 |

|

Sales, general and administrative expenses | 97,054 |

| | 78,527 |

| | 377,080 |

| | 305,409 |

|

Restructuring expenses | 1,524 |

| | 4,164 |

| | 2,206 |

| | 50,925 |

|

Total costs and expenses | 473,422 |

| | 298,181 |

| | 1,500,998 |

| | 1,272,827 |

|

Loss from operations | (55,487 | ) | | (153,625 | ) | | (468,662 | ) | | (692,412 | ) |

Interest expense, net | (20,654 | ) | | (21,177 | ) | | (84,206 | ) | | (72,863 | ) |

Other (expenses) income, net | (1,688 | ) | | (3,792 | ) | | (6,713 | ) | | 30,400 |

|

Loss from continuing operations before provision for income taxes | (77,829 | ) | | (178,594 | ) | | (559,581 | ) | | (734,875 | ) |

(Benefit from) provision for income taxes | (1,379 | ) | | 2,043 |

| | 30,381 |

| | 6,958 |

|

Loss from continuing operations | (76,450 | ) | | (180,637 | ) | | (589,962 | ) | | (741,833 | ) |

Loss from discontinued operations, net of tax | — |

| | (209 | ) | | — |

| | (912 | ) |

Net loss | (76,450 | ) | | (180,846 | ) | | (589,962 | ) | | (742,745 | ) |

Loss attributable to noncontrolling interest | 938 |

| | 4,190 |

| | 31,847 |

| | 4,190 |

|

Net loss attributable to Vertex | $ | (75,512 | ) | | $ | (176,656 | ) | | $ | (558,115 | ) | | $ | (738,555 | ) |

| | | | | | | |

Amounts attributable to Vertex: | | | | | | | |

Loss from continuing operations | $ | (75,512 | ) | | $ | (176,447 | ) | | $ | (558,115 | ) | | $ | (737,643 | ) |

Loss from discontinued operations | — |

| | (209 | ) | | — |

| | (912 | ) |

Net loss attributable to Vertex | $ | (75,512 | ) | | $ | (176,656 | ) | | $ | (558,115 | ) | | $ | (738,555 | ) |

| | | | | | | |

Amounts per share attributable to Vertex common shareholders: | | | | | | | |

Net loss from continuing operations: | | | | | | | |

Basic and diluted | $ | (0.31 | ) | | $ | (0.74 | ) | | $ | (2.31 | ) | | $ | (3.14 | ) |

Net loss from discontinued operations:

| | | | | | | |

Basic and diluted | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

|

Net loss: | | | | | | | |

Basic and diluted | $ | (0.31 | ) | | $ | (0.74 | ) | | $ | (2.31 | ) | | $ | (3.14 | ) |

Shares used in per share calculations: | | | | | | | |

Basic and diluted | 242,987 |

| | 238,272 |

| | 241,312 |

| | 235,307 |

|

Reconciliation of GAAP to Non-GAAP Net Loss

Fourth Quarter Results

(in thousands, except per share amounts)

(unaudited)

|

| | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2015 | | 2014 | | 2015 | | 2014 |

GAAP loss attributable to Vertex | $ | (75,512 | ) | | $ | (176,656 | ) | | $ | (558,115 | ) | | $ | (738,555 | ) |

Stock-based compensation expense | 45,439 |

| | 42,381 |

| | 231,817 |

| | 177,542 |

|

Real estate restructuring costs and income (Note 1) | 454 |

| | 3,660 |

| | (1,748 | ) | | 40,963 |

|

HCV related revenues and costs (Note 2) | (5,510 | ) | | (1,920 | ) | | (23,716 | ) | | 2,245 |

|

Other adjustments (Note 3) | 77,786 |

| | 703 |

| | 83,424 |

| | 6,587 |

|

Non-GAAP net income (loss) attributable to Vertex (Note 5) | $ | 42,657 |

| | $ | (131,832 | ) | | $ | (268,338 | ) | | $ | (511,218 | ) |

|

| | | | | | |

Amounts per diluted share attributable to Vertex common shareholders: | | | | | | | |

GAAP | $ | (0.31 | ) | | $ | (0.74 | ) | | $ | (2.31 | ) | | $ | (3.14 | ) |

Non-GAAP | $ | 0.17 |

| | $ | (0.55 | ) | | $ | (1.11 | ) | | $ | (2.17 | ) |

Shares used in diluted per share calculations: | | | | | | | |

GAAP | 242,987 |

| | 238,272 |

| | 241,312 |

| | 235,307 |

|

Non-GAAP | 246,635 |

| | 238,272 |

| | 241,312 |

| | 235,307 |

|

Reconciliation of GAAP to Non-GAAP Revenues and Expenses

Fourth Quarter Results

(in thousands)

(unaudited)

|

| | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2015 | | 2014 | | 2015 | | 2014 |

GAAP total revenues | $ | 417,935 |

| | $ | 144,556 |

| | $ | 1,032,336 |

| | $ | 580,415 |

|

HCV related revenues (Note 2) | (6,071 | ) | | (3,968 | ) | | (21,449 | ) | | (44,626 | ) |

Other adjustments (Note 3) | (1,509 | ) | | — |

| | (2,888 | ) | | — |

|

Non-GAAP total revenues | $ | 410,355 |

| | $ | 140,588 |

| | $ | 1,007,999 |

| | $ | 535,789 |

|

| | | | | | | |

| | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2015 | | 2014 | | 2015 | | 2014 |

GAAP cost of product revenues and royalty expenses | $ | 64,415 |

| | $ | 14,027 |

| | $ | 125,542 |

| | $ | 60,987 |

|

HCV related costs (Note 2) | (209 | ) | | (801 | ) | | (631 | ) | | (16,036 | ) |

Non-GAAP cost of product revenues and royalty expenses | $ | 64,206 |

| | $ | 13,226 |

| | $ | 124,911 |

| | $ | 44,951 |

|

| | | | | | | |

GAAP research and development expenses | $ | 310,429 |

| | $ | 201,463 |

| | $ | 996,170 |

| | $ | 855,506 |

|

Stock-based compensation expense | (28,696 | ) | | (25,714 | ) | | (153,245 | ) | | (116,998 | ) |

Real estate restructuring costs (Note 1) | — |

| | — |

| | — |

| | (25,094 | ) |

HCV related costs (Note 2) | (213 | ) | | (159 | ) | | 493 |

| | (14,993 | ) |

Other adjustments (Note 3) | (77,762 | ) | | 100 |

| | (78,984 | ) | | (4,229 | ) |

Non-GAAP research and development expenses | $ | 203,758 |

| | $ | 175,690 |

| | $ | 764,434 |

| | $ | 694,192 |

|

| | | | | | | |

GAAP sales, general and administrative expenses | $ | 97,054 |

| | $ | 78,527 |

| | $ | 377,080 |

| | $ | 305,409 |

|

Stock-based compensation expense | (16,743 | ) | | (16,667 | ) | | (78,572 | ) | | (60,544 | ) |

Real estate restructuring costs (Note 1) | — |

| | (122 | ) | | — |

| | (4,645 | ) |

HCV related costs (Note 2) | — |

| | (879 | ) | | 2,807 |

| | (14,095 | ) |

Other adjustments (Note 3) | (2,176 | ) | | (491 | ) | | (5,892 | ) | | (491 | ) |

Non-GAAP sales, general and administrative expenses | $ | 78,135 |

| | $ | 60,368 |

| | $ | 295,423 |

| | $ | 225,634 |

|

| | | | | | | |

Combined non-GAAP R&D and SG&A expenses | $ | 281,893 |

| | $ | 236,058 |

| | $ | 1,059,857 |

| | $ | 919,826 |

|

| | | | | | | |

| | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2015 | | 2014 | | 2015 | | 2014 |

GAAP interest expense, net and other expense, net | $ | (22,342 | ) | | $ | (24,969 | ) | | $ | (90,919 | ) | | $ | (42,463 | ) |

Real estate restructuring income (Note 1) | — |

| | — |

| | — |

| | (36,685 | ) |

Non-GAAP interest expense, net and other expense, net | $ | (22,342 | ) | | $ | (24,969 | ) | | $ | (90,919 | ) | | $ | (79,148 | ) |

| | | | | | | |

GAAP (benefit from) provision for income taxes | $ | (1,379 | ) | | $ | 2,043 |

| | $ | 30,381 |

| | $ | 6,958 |

|

Other adjustments (Note 3) | 636 |

| | (3,876 | ) | | (29,731 | ) | | (3,876 | ) |

Non-GAAP (benefit from) provision for income taxes | $ | (743 | ) | | $ | (1,833 | ) | | $ | 650 |

| | $ | 3,082 |

|

Condensed Consolidated Balance Sheets Data

(in thousands)

(unaudited)

|

| | | | | | | |

| December 31, 2015 | | December 31, 2014 |

Assets | | | |

Cash, cash equivalents and marketable securities | $ | 1,042,462 |

| | $ | 1,387,106 |

|

Restricted cash and cash equivalents (VIE) (Note 4) | 78,910 |

| | 8,418 |

|

Accounts receivable, net | 177,639 |

| | 75,964 |

|

Inventories | 56,083 |

| | 30,848 |

|

Property and equipment, net | 697,715 |

| | 715,812 |

|

Intangible assets and goodwill | 334,724 |

| | 68,915 |

|

Other assets | 109,512 |

| | 47,616 |

|

Total assets | $ | 2,497,045 |

| | $ | 2,334,679 |

|

| | | |

Liabilities and Shareholders' Equity | | | |

Other liabilities | $ | 431,944 |

| | $ | 307,023 |

|

Deferred tax liability | 110,439 |

| | 15,044 |

|

Accrued restructuring expense | 15,358 |

| | 45,855 |

|

Deferred revenues | 26,010 |

| | 45,276 |

|

Capital leases | 52,124 |

| | 57,099 |

|

Fan Pier lease obligation | 473,043 |

| | 473,424 |

|

Senior secured term loan | 295,447 |

| | 294,775 |

|

Shareholders' equity | 1,092,680 |

| | 1,096,183 |

|

Total liabilities and shareholders' equity | $ | 2,497,045 |

| | $ | 2,334,679 |

|

| | | |

Common shares outstanding | 246,307 |

| | 241,764 |

|

Note 1: In the three and twelve months ended December 31, 2015, "Real estate restructuring costs and income" consisted of restructuring charges and credits, respectively, related to the company's relocation from Cambridge to Boston, Massachusetts. In the three and twelve months ended December 31, 2014, "Real estate restructuring costs and income" consisted of (i) transition costs related to the company's relocation that were recorded as R&D and SG&A, (ii) restructuring charges related to this relocation and (iii) credits recorded to other (expense) income, net to record the effect of the one-time cash payment received related to a lease agreement in the second quarter of 2014.

Note 2: In the three and twelve months ended December 31, 2015 and 2014, "HCV related revenues and costs" included in the company's loss from continuing operations consisted of:

|

| | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2015 | | 2014 | | 2015 | | 2014 |

| (in millions) |

Net product revenues from Incivek | $ | 6.0 |

| | $ | 0.6 |

| | $ | 18.0 |

| | $ | 24.1 |

|

Royalty revenues from Incivo | (0.2 | ) | | 0.6 |

| | 1.5 |

| | 13.5 |

|

HCV collaborative revenues | 0.3 |

| | 2.8 |

| | 1.9 |

| | 7.1 |

|

COR expenses | (0.2 | ) | | (0.8 | ) | | (0.6 | ) | | (16.0 | ) |

R&D and SG&A credits (including pharma fee) | (0.2 | ) | | (1.0 | ) | | 3.3 |

| | (29.1 | ) |

Restructuring expenses | (0.1 | ) | | — |

| | (0.4 | ) | | (0.8 | ) |

Note 3: In the three and twelve months ended December 31, 2015, "Other adjustments" was primarily attributable to a $75.0 million payment related to our collaboration with CRISPR Therapeutics AG that was recorded as R&D expense, as well as activity related to two variable interest entities ("VIEs") that are not associated with the company's collaborations with our collaborators. In each of the three and twelve months ended December 31, 2014, "Other adjustments" was primarily attributable to development cost associated with VX-509.

Note 4: The company consolidates the financial statements of two of its collaborators as VIEs as of December 31, 2015 and consolidated a single VIE as of December 31, 2014. These VIEs are consolidated because Vertex has licensed the rights to develop the company's collaborators' most significant intellectual property assets. The company's interest and obligations with respect to these VIEs' assets and liabilities are limited to those accorded to the company in its collaboration agreements with these collaborators. Restricted cash and cash equivalents (VIE) reflects the VIEs’ cash and cash equivalents, which Vertex does not have any interest in and which will not be used to fund the collaboration. Each reporting period Vertex estimates the fair value of the contingent milestone payments and royalties payable by Vertex to these collaborators. Any increase in the fair value of these contingent milestone and royalty payments results in a decrease in net income attributable to Vertex (or an increase in net loss attributable to Vertex) on a dollar-for-dollar basis. The fair value of contingent milestone and royalty payments is evaluated each quarter and any change in the fair value is reflected in the Company's statement of operations.

Note 5: In each of the three and twelve months ended December 31, 2015 and 2014, the company excludes from its non-GAAP loss attributable to Vertex restructuring expense (income). In addition, in the three and twelve months ended December 31, 2014 discontinued operations related to the effect of the company's relationship with Alios are excluded from its non-GAAP loss attributable to Vertex.

U.S. INDICATION AND IMPORTANT SAFETY INFORMATION FOR ORKAMBI® (lumacaftor/ivacaftor) TABLETS

ORKAMBI is a combination of lumacaftor and ivacaftor indicated for the treatment of cystic fibrosis (CF) in patients age 12 years and older who are homozygous for the F508del mutation in the CFTR gene. The efficacy and safety of ORKAMBI have not been established in patients with CF other than those homozygous for the F508del mutation.

Worsening of liver function, including hepatic encephalopathy, in patients with advanced liver disease has been reported in some patients with CF while receiving ORKAMBI.

Serious adverse reactions related to elevated transaminases have been reported in patients with CF receiving ORKAMBI and, in some instances, associated with concomitant elevations in total serum bilirubin.

Respiratory events (e.g., chest discomfort, shortness of breath, and chest tightness) were observed more commonly in patients during initiation of ORKAMBI compared to those who received placebo. Clinical experience in patients with percent predicted FEV1 < 40 is limited, and additional monitoring of these patients is recommended during initiation of therapy.

Co-administration of ORKAMBI with sensitive CYP3A substrates or CYP3A substrates with a narrow therapeutic index is not recommended as ORKAMBI may reduce their effectiveness. ORKAMBI may substantially decrease hormonal contraceptive exposure, reducing their effectiveness and increasing the incidence of menstruation-associated adverse reactions. Co-administration with strong CYP3A inducers is not recommended as they may reduce the therapeutic effectiveness of ORKAMBI.

Abnormalities of the eye lens (cataracts) have been reported in pediatric patients treated with ivacaftor, a component of ORKAMBI.

The most common adverse reactions associated with ORKAMBI include shortness of breath, sore throat, nausea, diarrhea, upper respiratory tract infection, fatigue, chest tightness, increased blood creatinine phosphokinase, rash, flatulence, runny nose, and influenza.

U.S. INDICATION AND IMPORTANT SAFETY INFORMATION FOR KALYDECO® (ivacaftor)

KALYDECO is a cystic fibrosis transmembrane conductance regulatory (CFTR) potentiator indicated for the treatment of cystic fibrosis (CF) in patients age 2 years and older who have one of the following mutations in the CFTR gene: G551D, G1244E, G1349D, G178R, G551S, S1251N, S1255P, S549N, S549R or R117H.

KALYDECO is not effective in patients with CF with 2 copies of the F508del mutation (F508del/F508del) in the CFTR gene. The safety and efficacy of KALYDECO in children with CF younger than 2 years of age have not been studied. The use of KALYDECO in children under the age of 2 years is not recommended.

High liver enzymes (transaminases; ALT and AST) have been reported in patients with CF receiving KALYDECO.

Use of KALYDECO with medicines that are strong CYP3A inducers substantially decreases exposure of KALYDECO and may diminish effectiveness. Therefore, co-administration is not recommended. The dose

of KALYDECO must be adjusted when used concomitantly with strong and moderate CYP3A inhibitors or when used in patients with moderate or severe hepatic disease.

Cases of non-congenital lens opacities/cataracts have been reported in pediatric patients treated with KALYDECO.

The most common side effects associated with KALYDECO include headache; upper respiratory tract infection (common cold), including sore throat, nasal or sinus congestion, and runny nose; stomach (abdominal) pain; diarrhea; rash; nausea; and dizziness.

Please see the full prescribing information for KALYDECO.

About Vertex

Vertex is a global biotechnology company that aims to discover, develop and commercialize innovative medicines so people with serious diseases can lead better lives. In addition to our clinical development programs focused on cystic fibrosis, Vertex has more than a dozen ongoing research programs aimed at other serious and life-threatening diseases.

Founded in 1989 in Cambridge, Mass., Vertex today has research and development sites and commercial offices in the United States, Europe, Canada and Australia. For six years in a row, Science magazine has named Vertex one of its Top Employers in the life sciences. For additional information and the latest updates from the company, please visit www.vrtx.com.

Special Note Regarding Forward-looking Statements

This press release contains forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995, including, without limitation, Dr. Leiden's statements in the second paragraph of the press release, the information provided in the section captioned "2016 Financial Guidance” and statements regarding (i) the sNDA for ORKAMBI for the treatment of patients six to eleven years of age who are homozygous for the F508del mutation and the ongoing Phase 3 study in this same patient population and (ii) the target date for the FDA to review the sNDA for the use of KALYDECO in patients ages two and older with one of 23 residual function mutations. While Vertex believes the forward-looking statements contained in this press release are accurate, these forward-looking statements represent the company's beliefs only as of the date of this press release and there are a number of factors that could cause actual events or results to differ materially from those indicated by such forward-looking statements. Those risks and uncertainties include, among other things, that the company's expectations regarding its 2016 revenues and expenses may be incorrect (including because one or more of the company's assumptions underlying its expectations may not be realized), that data from the company's development programs may not support registration or further development of its compounds due to safety, efficacy or other reasons, and other risks listed under Risk Factors in Vertex's annual report and quarterly reports filed with the Securities and Exchange Commission and available through the company's website at www.vrtx.com. Vertex disclaims any obligation to update the information contained in this press release as new information becomes available.

Conference Call and Webcast

The company will host a conference call and webcast today at 5:00 p.m. ET. To access the call, please dial (866) 501-1537 (U.S.) or +1 (720) 545-0001 (International). The conference call will be webcast live and a link to the webcast can be accessed through Vertex's website at www.vrtx.com in the "Investors" section under "Events and Presentations." To ensure a timely connection, it is recommended that users register at

least 15 minutes prior to the scheduled webcast. An archived webcast will be available on the company's website.

(VRTX-GEN)

Vertex Contacts:

Investors:

Michael Partridge, 617-341-6108

or

Eric Rojas, 617-961-7205

or

Zach Barber, 617-341-6470

Media:

617-341-6992

mediainfo@vrtx.com

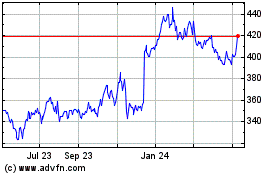

Vertex Pharmaceuticals (NASDAQ:VRTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

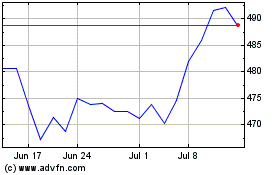

Vertex Pharmaceuticals (NASDAQ:VRTX)

Historical Stock Chart

From Apr 2023 to Apr 2024