UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 29, 2015

TTM TECHNOLOGIES, INC.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

0-31285 |

|

91-1033443 |

| (State of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

|

|

| 1665 Scenic Avenue, Suite 250, Costa Mesa, California |

|

92626 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (714) 327-3000

N/A

(Former name or

former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Section 1 – Registrant’s Business and Operations

| Item 1.01. |

Entry into a Material Definitive Agreement Entry into a Material Definitive Agreement. |

Amendment to the Registration Rights Agreement

As described herein on this Current Report Form 8-K, on the evening of December 29, 2015 (December 30, 2015 at approximately 9:00 a.m.

Hong Kong time), TTM Technologies, Inc. (the “Company”) entered into the First Amendment to the Registration Rights Agreement, originally dated as of April 9, 2010 (the “First Amendment to the Registration Rights

Agreement”), with Mr. Tang Hsiang Chien (“Mr. Tang”) and Su Sih (BVI) Limited (Mr. Tang and Su Sih (BVI) Limited are collectively referred to as the “Principal Shareholders”). Pursuant to the First Amendment to the

Registration Rights Agreement, the Principal Shareholders will have the right to require the Company to use reasonable efforts to effect the registration of the Company’s common stock owned by them under the Securities Act of 1933, as amended,

up to such number of registrations upon demand equal to five. Previously, the Principal Shareholders had the right to demand registration up to four times. No other changes were made to the prior agreement.

The foregoing is a summary only and does not purport to be a complete description of all of the terms, provisions, covenants, and agreements

contained in the First Amendment to the Registration Rights Agreement, and is subject to and qualified in its entirety by reference to the First Amendment of the Registration Rights Agreement attached hereto as Exhibit 10.1, which is incorporated by

reference into this Item 1.01.

Amendment to the Shareholders Agreement

In addition, the Company entered into a Second Amendment to the Shareholders Agreement, originally dated as of April 9, 2010 (the

“Second Amendment to the Shareholders Agreement”), with the Principal Shareholders and two of Mr. Tang’s adult children (the “Tang Siblings”).

The Second Amendment to the Shareholder’s Agreement provides that with respect to various matters relating to, among other things,

governance of the Company; business combinations; amendments to the Company’s governing instruments; the size, composition, and qualifications of the Company’s board of directors; voting arrangements; and severance arrangements, the

Principal Shareholders and Tang Siblings will be required to bifurcate their vote as follows: (i) the Principal Shareholders, the Tang Siblings, and their affiliates may vote in their sole discretion up to 28%, up from 23% previously, of the

total voting power (the “Maximum Unrestricted Voting Percentage”), and (ii) with respect to any voting securities beneficially owned by the Principal Shareholders, Tang Siblings, and their affiliates in excess of the Maximum

Unrestricted Voting Percentage, the Principal Shareholders, Tang Siblings, and their affiliates will be required to vote such securities in direct proportion to the vote cast by the Company’s non-affiliate stockholders. The Principal

Shareholders and their affiliates may continue to vote all of their voting securities in their sole discretion with respect to (i) the election of their board nominee to the Company’s board of directors, or (ii) any amendment to the

Company’s certificate of incorporation or bylaws that would have the effect of circumventing any rights of the Principal Shareholders under the original Shareholders Agreement.

In addition, the Second Amendment to the Shareholders Agreement provides that the Principal Shareholders with respect to each of the

subsidiaries of the Company formerly owned by Meadville Holdings Limited (“Meadville”) that comprise, and operate the former Meadville Printed Circuit Board manufacturing business (the “Meadville PCB Subsidiaries”) the Principal

Shareholders and Tang Siblings are entitled to nominate directors comprising a minority of the board of directors of each such company, and the nominating and corporate governance committee of the Company’s board of directors will be entitled

to nominate the remaining members of the directors of each such company. Prior to the agreement of the Second Amendment to the Shareholder’s Agreement, the Principle Shareholders and the Tang Siblings were able to nominate the majority of the

members of the Board of Directors of the Meadville PCB Subsidiaries.

The foregoing is a summary only and does not purport to be a

complete description of all of the terms, provisions, covenants, and agreements contained in the Second Amendment to the Shareholders Agreement, and is subject to and qualified in its entirety by reference to the Shareholders Agreement attached

hereto as Exhibit 10.2, which is incorporated by reference into this Item 1.01.

Section 9 – Financial Statements and Exhibits

| Item 9.01. |

Financial Statements and Exhibits. |

See the Exhibit Index which is hereby incorporated by reference.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

TTM TECHNOLOGIES, INC. |

|

|

|

| Date: January 4, 2016 |

|

|

|

/s/ Todd. B. Schull |

|

|

|

|

By: |

|

Todd B. Schull |

|

|

|

|

|

|

Executive Vice President, Chief Financial Officer, Treasurer and Secretary |

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 10.1 |

|

The First Amendment to the Registration Rights Agreement, originally dated as of April 9, 2010, by and among Meadville Holdings Limited, MTG Investment (BVI) Limited, and TTM Technologies, Inc. |

|

|

| 10.2 |

|

The Second Amendment to the Shareholders Agreement, originally dated as of April 9, 2010, by and among Meadville Holdings Limited; Su Sih (BVI) Limited; Tang Hsiang Chien; Tang Chung Yen, Tom; Tang Ying Ming, Mai; and TTM

Technologies, Inc. |

Exhibit 10.1

FIRST AMENDMENT

TO

REISTRATION RIGHTS AGREEMENT

This FIRST AMENDMENT TO REGISTRATION RIGHTS AGREEMENT (this “Amendment”), dated as of December 29, 2015 is entered into by and among

(i) TTM Technologies, Inc., a Delaware corporation (the “Company”); (ii) Su Sih (BVI) Limited, a corporation organized under the laws of the British Virgin Islands (“SSL”); and (iii) Tang Hsiang

Chien, an individual residing at Flat 6B, 20 Fa Po Street, Yau Yat Chuen, Kowloon, Hong Kong (“Mr. Tang”).

RECITALS

A. The Company, SSL and Mr. Tang entered into that certain Registration Rights Agreement dated as of April 9, 2010 as supplemented by an Addendum

thereto dated as of September 21, 2014 (the “Original Agreement”). Capitalized terms used but not defined herein shall have the meanings ascribed to such terms in the Original Agreement.

B. The Company, SSL and Mr. Tang have agreed that the number of registrations of Registrable Securities pursuant to section 2.1 of the Original Agreement

to which the Holders are entitled following the Initial Registration Period shall be increased to the number that is equal to the difference between (x) five (5) and (y) the number of registrations of Registrable Securities pursuant

to section 2.1 of the Original Agreement effected during the Initial Registration Period.

AGREEMENT

NOW, THEREFORE, in consideration of the promises and mutual agreements set forth herein and for other good and valuable consideration, the receipt and

sufficiency of which are hereby acknowledged, the parties agree as follows:

1. Amendment to section 2.1(c) of the Original Agreement.

Section 2.1(c) of the Original Agreement shall be deleted in its entirety and shall be replaced with the following new section 2.1 (c):

“(c) The Holders shall be entitled to an aggregate of (i) not more than three (3) registrations of Registrable Securities

pursuant to this Section 2.1 during the period beginning on the Closing Date and ending on the five year anniversary of the Closing Date (the “Initial Registration Period”), and (ii) following the Initial Registration Period, the

number of registrations of Registrable Securities pursuant to this Section 2.1 equal to the difference between (x) five (5) and (y) the number of registrations of Registrable Securities pursuant to this Section 2.1 effected

during the Initial Registration Period; provided, that a registration requested pursuant to this Section 2.1 shall not be deemed to have been effected for purposes of this Section 2.1(c) unless (A) it has been declared effective by

the SEC, (B) it has remained effective for the period set forth in Section 2.4(a) and (C) the offering of Registrable Securities pursuant to such registration is not subject to any stop order, injunction or other order or requirement

of the SEC; provided, however, that in the event the Exercising Holder revokes a Demand Registration request (which revocation may only be made prior to the Company requesting acceleration of effectiveness of the registration statement) then such

Demand Registration shall count as having been effected unless the Exercising Holder pays all Registration Expenses in connection with such revoked Demand Registration within seven (7) days of written request therefor by the Company.”

2. Effectiveness. This Amendment shall be effective only on the date first written above.

3. Counterparts. This Amendment may be executed in two or more counterparts, each of which shall be deemed to be the same document.

1

4. No Other Amendments. Except as amended herein, all of the terms and conditions of the Original

Agreement shall remain in full force and effect in accordance with their terms.

5. Governing Law. This Amendment shall be governed by and

construed in accordance with the laws of the state of Delaware, without regard to its choice of law principles.

IN WITNESS WHEREOF, the

parties hereto have executed this Amendment as of the date first written above.

|

|

|

| TTM TECHNOLOGIES, INC.: |

|

|

| By: |

|

/s/ Thomas T. Edman |

| Name: |

|

Thomas T. Edman |

| Title: |

|

Chief Executive Officer and President |

|

| SU SIH (BVI) LIMITED: |

|

|

| By: |

|

/s/ Tang Chung Yen, Tom |

| Name: |

|

Tang Chung Yen, Tom |

| Title: |

|

Director |

|

| TANG HSIANG CHIEN: |

|

| /s/ Tang Hsiang Chien |

| Tang Hsiang Chien |

2

Exhibit 10.2

SECOND AMENDMENT

TO

SHAREHOLDERS AGREEMENT

This

SECOND AMENDMENT TO SHAREHOLDERS AGREEMENT (this “Amendment”), dated as of December 29, 2015 is entered into by and among (i) TTM Technologies, Inc., a Delaware corporation (the “Company”); (ii) Tang

Hsiang Chien, an individual residing at Flat 6B, 20 Fa Po Street, Yau Yat Chuen, Kowloon, Hong Kong (“Mr. Tang”), (iii) Su Sih (BVI) Limited, a corporation organized under the laws of the British Virgin Islands

(“SSL”) and now owned as to 83.4% by Mr. Tang and as to 16.6% indirectly by another member of Tang family, (iv) Tang Chung Yen, Tom, an individual residing at House 58, Sunderland, 1 Hereford Road, Kowloon Tong, Kowloon,

Hong Kong, and the son of Mr. Tang (“Tom Tang”), and (v) Tang Ying Ming, Mai, an individual residing at Flat B, 6th Floor, 20 Fa Po Street, Yau Yat Chuen, Kowloon, Hong

Kong, and the daughter of Mr. Tang (“Mai Tang” and, together with Tom Tang, the “Tang Siblings”).

RECITALS

A. The Company, Meadville

Holdings Limited, an exempted company incorporated under the laws of the Cayman Islands with limited liability (“Seller Parent”), Mr. Tang, SSL and the Tang Siblings entered into that certain Shareholders Agreement dated as of

April 9, 2010 as amended by a First Amendment dated as of September 14, 2012 (the “Original Agreement”). Seller Parent was dissolved in December 2010 and no longer exists as an entity. Capitalized terms used but not

defined herein shall have the meanings ascribed to such terms in the Original Agreement.

B. The Company, SSL, Mr. Tang and the Tang Siblings have

agreed that the constitution of the board of directors of the Asia Holdco and the Asia PCB Entities shall be changed such that the Company shall nominate the majority of the members of each of the Asia Holdco and the Asia PCB Entities.

C. The Company, SSL, Mr. Tang and the Tang Siblings have also agreed to amend the Maximum Unrestricted Voting Percentage defined in section 1.1 of the

Original Agreement from 23% to 28%.

AGREEMENT

NOW, THEREFORE, in consideration of the promises and mutual agreements set forth herein and for other good and valuable consideration, the receipt and

sufficiency of which are hereby acknowledged, the parties agree as follows:

1. Amendment to the definition of “Maximum Unrestricted Voting

Percentage” in Section 1.1 of the Original Agreement. The definition of “Maximum Unrestricted Voting Percentage” in Section 1.1 of the Original Agreement shall be deleted in its entirety and shall be replaced with

the following new definition of “Maximum Unrestricted Voting Percentage”:

“ “Maximum Unrestricted Voting

Percentage” means, on any date, with respect to the Principal Shareholders and their respective Affiliates, shares of Company Common Stock having 28% of the Total Voting Power, where such 28% is based on the percentage of total outstanding

shares of Company Common Stock owned by the Principal Shareholders as of November 27, 2015, which is approximately 28%.”

2. Amendment to

Sections 4.3 (a) - (f) of the Original Agreement. Sections 4.3 (a) - (f) of the Original Agreement shall be deleted in their entirety and shall be replaced with the following new Sections 4.3 (a) – (f):

“Section 4.3. Board Representation of Asian Holdco and Asian PCB Entities; Governance

(a) The parties hereby agree that during the Effective Period, a majority of the directors

1

constituting the board of directors of Asian Holdco shall be nominees of the Nominating and Corporate Governance Committee (the “Nominating Committee”) of the Board in consultation with

the Government Security Committee (the “GCS”) of the Board (collectively, “TTM Nominees”), and all of the other directors constituting such board shall be nominees of the Principal Shareholders (collectively, “Shareholder

Nominees”, and individually, a “Shareholder Nominee”). In furtherance thereof, on the Closing Date, the parties hereto shall take all action necessary to (i) either increase the total number of directors constituting the board of

directors of Asian Holdco or cause the removal or resignation of directors thereon so that upon such increase and such removals and resignations, as applicable, such board shall consist of a total of five directors, (ii) elect three TTM

Nominees to serve as directors on such board and (iii) elect two Shareholder Nominees to serve as directors on such board. The Principal Shareholders shall have the right, upon written notice delivered to the Company, to request that any

Shareholder Nominee be removed as a director of Asian Holdco. Upon the receipt of such notice, the Company shall cause such Shareholder Nominee to be removed as a director of the Asian Holdco.

(b) The parties hereby agree that during the Effective Period, at least a majority of the directors constituting the board of directors of each

of the Asian PCB Entities shall be TTM Nominees and all of the other directors constituting each of such boards shall be Shareholder Nominees. In furtherance thereof, on the Closing Date, the parties hereto shall use commercially reasonable efforts

to, to the extent permitted by Applicable Law and the organizational documents of the applicable Asian PCB Entity, (i) increase the total number of directors constituting the board of directors of the Asian PCB Entities or cause the removal or

resignation of directors thereon and (ii) elect (or cause to be elected) the TTM Nominees to serve as directors on such boards, which nominees shall constitute at least a majority of the directors on such boards (each a “Asian PCB

Nominee” and, collectively, the “Asian PCB Nominees”).

(c) During the Effective Period, upon the death,

resignation, retirement or removal from office of any TTM Nominee or Asian PCB Nominee, the Nominating Committee in consultation with the GSC shall be entitled promptly to nominate a replacement TTM Nominee or Asian PCB Nominee, as applicable, who

meets the qualifications of a director of Asian Holdco or the applicable Asian PCB Entity, and the parties shall to the fullest extent permitted by Applicable Law, take all action necessary to cause the election of such replacement TTM Nominee or

Asian PCB Nominee as a director of Asian Holdco or the applicable Asian PCB Entity, to the extent permitted by and subject to the requirements under Applicable Law.

(d) From and after the Closing Date, upon the death, resignation, retirement or other removal of any Shareholder Nominee from the directorship

of any Asian Holdco and Asian PCB Entities, the Principal Shareholder shall be entitled promptly to nominate a replacement Shareholder Nominee who meets the qualifications of a director of Asian Holdco or the applicable Asian PCB Entity (as the case

may be), and the parties shall use their respective commercially reasonable efforts to elect or cause the election of such replacement Shareholder Nominee as a director of Asian Holdco or the applicable Asian PCB Entity (as the case may be), to the

extent permitted by and subject to the requirements under Applicable Law.

(e) All Shareholder Nominees elected pursuant to this

Section 4.3 shall execute and deliver, and a Principal Shareholder shall obtain from all such Shareholder Nominees, an irrevocable written resignation from the board of directors of Asian Holdco, as applicable, conditioned and effective

immediately upon the Principal Shareholders and their respective Affiliates ceasing to Beneficially Own shares of Company Common Stock representing at least 9.9% of the Total Voting Power.

(f) From and after the Closing Date, if at any time the Principal Shareholders and their respective Affiliates do not Beneficially Own shares

of Company Common Stock representing at least 9.9% of the Total Voting Power, and any Shareholder Nominee shall not have otherwise resigned in accordance with Section 4.3(e), then the Principal Shareholders shall use commercially reasonable

efforts to cause all of such Shareholder Nominees to resign and vacate the board of each of Asian Holdco and the applicable Asian PCB Entities. In the event of a resignation of Shareholder Nominee pursuant to this Section 4.3(f),

the resulting vacancies shall be filled by a director recommended by the Nominating Committee in consultation with the GSC.”

2

3. Effectiveness. This Amendment shall be effective only on the date first written above.

4. Counterparts. This Amendment may be executed in two or more counterparts, each of which shall be deemed to be the same document.

5. No Other Amendments. Except as amended herein, all of the terms and conditions of the Original Agreement shall remain in full

force and effect in accordance with their terms.

6. Governing Law. This Amendment shall be governed by and construed in accordance

with the laws of the state of Delaware, without regard to its choice of law principles.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

3

IN WITNESS WHEREOF, the parties hereto have executed this Amendment as of the date first written above.

|

|

|

| TTM TECHNOLOGIES, INC.: |

|

|

| By: |

|

/s/ Thomas T. Edman |

| Name: |

|

Thomas T. Edman |

| Title: |

|

Chief Executive Officer and President |

|

| SU SIH (BVI) LIMITED: |

|

|

| By: |

|

/s/ Tang Ying Ming, Mai |

| Name: |

|

Tang Ying Ming, Mai |

| Title: |

|

Director |

|

| TANG HSIANG CHIEN: |

|

| /s/ Tang Hsiang Chien |

| Tang Hsiang Chien, individually |

|

| TANG CHUNG YEN, TOM: |

|

| /s/ Tang Chung Yen, Tom |

| Tang Chung Yen, Tom, individually |

|

| TANG YING MING, MAI: |

|

| /s/ Tang Ying Ming, Mai |

| Tang Ying Ming, Mai, individually |

[Signature Page to Second Amendment to Shareholders Agreement]

4

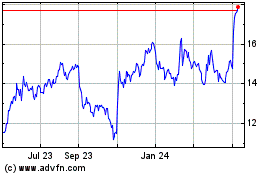

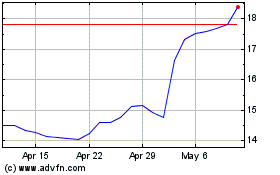

TTM Technologies (NASDAQ:TTMI)

Historical Stock Chart

From Mar 2024 to Apr 2024

TTM Technologies (NASDAQ:TTMI)

Historical Stock Chart

From Apr 2023 to Apr 2024