UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 11, 2016

Trimble Navigation Limited

(Exact name of registrant as specified in its charter)

|

California

|

|

001-14845

|

|

94-2802192

|

| |

|

|

|

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

I.D. No.)

|

935 Stewart Drive, Sunnyvale, California, 94085

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (408) 481-8000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

o

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

|

o

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

|

o

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

|

o

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 8.01. Other Events.

As previously reported, the Company has reached agreement on a settlement in connection with a class action complaint challenging the change of control provisions in the Company’s credit agreement with JP Morgan Chase Bank. Under the proposed settlement, there would be no payments to individual stockholders, but the Company would be required to amend the change of control provisions in the Company’s credit agreement. On February 11, 2016, the Company published the notice of hearing and proposed class action settlement attached as Exhibit 99.1 to this Form 8-K, giving notice of a hearing to be held on June 10, 2016 with respect to whether the provisional class certification should be made final, and whether the proposed settlement is fair, reasonable and adequate and should be finally approved, and at which the court will consider plaintiff counsel’s application for an award of fees and expenses. The case is captioned Rachel Thompson, On Behalf of Herself and All Others Similarly Situated v. Trimble Navigation Limited, Steven W. Berglund, John B. Goodrich, Merit E. Janow, Ulf Johansson, Mark S. Peek, Nickolas W. Vande Steeg, Ron Nersesian, and JPMorgan Chase Bank, Case No. 1-15-cv-27798.

Item 9.01 Financial Statements and Exhibits.

|

(d)

|

|

Exhibits

|

| |

|

|

|

|

| |

|

99.1

|

|

Notice of Hearing and Proposed Class Action Settlement (Rachel Thompson, On Behalf of Herself and All Others Similarly Situated v. Trimble Navigation Limited, Steven W. Berglund, John B. Goodrich, Merit E. Janow, Ulf Johansson, Mark S. Peek, Nickolas W. Vande Steeg, Ron Nersesian, and JPMorgan Chase Bank, Case No. 1-15-cv-277983)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

TRIMBLE NAVIGATION LIMITED

|

| |

a California corporation

|

| |

|

|

Dated: February 11, 2016

|

By:

|

/s/ James A Kirkland

|

| |

|

James A. Kirkland

|

| |

|

Vice President and General Counsel

|

Exhibit Index

|

Exhibit Number

|

|

Description

|

|

99.1

|

|

Notice of Hearing and Proposed Class Action Settlement (Rachel Thompson, On Behalf of Herself and All Others Similarly Situated v. Trimble Navigation Limited, Steven W. Berglund, John B. Goodrich, Merit E. Janow, Ulf Johansson, Mark S. Peek, Nickolas W. Vande Steeg, Ron Nersesian, and JPMorgan Chase Bank, Case No. 1-15-cv-277983)

|

Exhibit 99.1

|

KESSLER TOPAZ

MELTZER & CHECK, LLP

Eric L. Zagar (Bar No. 260519)

280 King of Prussia Road

Radnor, PA 19087

Telephone: (610) 667-7706

Facsimile: (267) 948-2512

ezagar@ktmc.com

-and-

Eli R. Greenstein (Bar No. 217945)

One Sansome Street, Suite 1850

San Francisco, CA 94104

Phone: (415) 400-3000

Fax: (415) 400-3001

egreenstein@ktmc.com

Attorneys for Plaintiff Rachel Thompson

|

|

SUPERIOR COURT OF THE STATE OF CALIFORNIA

CITY AND COUNTY OF SANTA CLARA

|

RACHEL THOMPSON, ON BEHALF OF HERSELF AND ALL OTHERS SIMILARLY SITUATED,

Plaintiff,

v.

TRIMBLE NAVIGATION LIMITED, STEVEN W. BERGLUND, JOHN B. GOODRICH, MERIT E. JANOW, ULF JOHANSSON, MARK S. PEEK, NICKOLAS W. VANDE STEEG, RON NERSESIAN, AND JPMORGAN CHASE BANK,

Defendants.

|

CLASS ACTION

NOTICE OF HEARING AND PROPOSED

CLASS ACTION SETTLEMENT

Judge: Hon. Peter H. Kirwan

Dept.: 1 (Complex Civil Litigation)

Complaint Filed: March 12, 2015

|

TO: ALL PERSONS AND ENTITIES THAT HELD TRIMBLE NAVIGATION LIMITED (“TRIMBLE” OR THE “COMPANY”) COMMON STOCK AS OF NOVEMBER 24, 2014.

PLEASE NOTE THAT THIS ACTION IS A NON-MONETARY SETTLEMENT AND NO INDIVIDUAL STOCKHOLDER HAS THE RIGHT TO BE COMPENSATED AS A RESULT OF THIS SETTLEMENT.

PLEASE READ THIS NOTICE CAREFULLY AND IN ITS ENTIRETY. YOUR RIGHTS MAY BE AFFECTED. THIS NOTICE IS NOT ANY EXPRESSION OF ANY OPINION BY THE COURT AS TO THE MERITS OF ANY CLAIMS OR DEFENSES IN THE ABOVE-CAPTIONED LAWSUIT. THE STATEMENTS IN THIS NOTICE ARE NOT FINDINGS OF THE COURT.

YOU ARE HEREBY NOTIFIED, pursuant to an Order of the Superior Court of the State of California for the City and County of Santa Clara (the “Court”), that a proposed Settlement1 has been reached as to claims asserted in a Class Action pending before the Court, captioned Rachel Thompson, On Behalf of Herself and All Others Similarly Situated v. Trimble Navigation Limited, Steven W. Berglund, John B. Goodrich, Merit E. Janow, Ulf Johansson, Mark S. Peek, Nickolas W. Vande Steeg, Ron Nersesian, and JPMorgan Chase Bank, Case No. 1-15-cv-277983 (the “Action”). The terms of the Settlement are summarized in this Notice and fully set forth in the Stipulation of Settlement dated as of October 6, 2015 (the “Stipulation”).

The Settlement will fully resolve the Action upon entry of an Order and Final Judgment by the Court and forever release, relinquish, and discharge the Released Claims against the Released Defendant Parties and any and all claims (including Unknown Claims) arising out of, relating to, or in connection with, the defense, settlement or resolution of the Action against the Released Defendant Parties. The Order and Final Judgment shall also fully, finally, and forever release, relinquish and discharge Plaintiff and Plaintiff’s Counsel from all claims arising out of, relating to, or in connection with, the institution, prosecution, assertion, settlement or resolution of the Action or the Released Claims (including Unknown

____________________

|

1

|

Except as otherwise expressly provided herein, all capitalized terms contained herein shall have the same meanings and/or definitions as set forth in the Stipulation of Settlement.

|

Claims). For a more detailed statement of the matters involved in the Action, the Settlement and the terms discussed in this Notice, the Stipulation may be inspected at the Office of the Clerk, Superior Court of the State of California for the City and County of Santa Clara, 191 North First Street, San Jose, California 95113-1090, during regular business hours of each business day. The Settlement will result in changes to the Company’s credit agreements, not in payment to individuals.

I. BACKGROUND OF THE ACTION

On November 24, 2014, Trimble entered into a credit agreement with JPMorgan Chase Bank (“JPMorgan”) that provided for a five-year, $1.0 billion revolving loan facility (with a $50 million letter of credit sub-facility) maturing on November 24, 2019 (the “Agreement”). Under Section 1.01 of the Agreement, “Change of Control” is defined as, inter alia, “an event or series of events by which . . . during any period of 12 consecutive months, the majority of the board of directors of the Company fails to consist of Continuing Directors.” Under Section 1.01 of the Agreement, “Continuing Directors” means:

with respect to any Person as of any date of determination, any member of the board of directors of such Person who (a) was a member of such board of directors on the Closing Date, or (b) was nominated for election or elected to such board of directors with the approval of a majority of the Continuing Directors who were members of such board at the time of such nomination or election (other than any person whose initial nomination or election occurred as a result of an actual or threatened solicitation of proxies or consents for the election or removal of one or more members), in each case either by specific vote or by approval of a proxy statement issued by the Company on behalf of its entire board of directors in which such individual is named as a nominee for director.

(Emphasis added).

Under subsection (k) of Section 8.01 of the Agreement, a “Change of Control” constitutes a “Default”, and under Section 8.02 if a “Default” occurs:

the Administrative Agent may, and at the request of the Required Lenders shall, terminate or suspend the obligations of the Lenders to make Loans hereunder and the obligation of the Issuing Banks to issue Letters of Credit hereunder, or declare the Obligations to be due and payable, or both, whereupon the Obligations shall become immediately due and payable, without presentment, demand, protest or notice of any kind, all of which the Borrowers expressly waive.

On March 12, 2015, Plaintiff Rachel Thompson (“Plaintiff”) filed in the Superior Court of the State of California for the City and County of Santa Clara a Class Action Complaint that asserted claims

on behalf of herself and a putative class of Trimble stockholders (the “Complaint”). The Complaint alleged, inter alia, that (i) defendants Steven W. Berglund, John B. Goodrich, Merit E. Janow, Ulf Johansson, Mark S. Peek, Nickolas W. Vande Steeg, and Ron Nersesian (collectively, the “Individual Defendants”) wrongfully agreed to provisions in the Agreement that trigger the lenders’ right to accelerate the debt if there is an election of a majority of directors whose initial nomination arose from an actual or threatened proxy contest (the “Dead Hand Proxy Put”); (ii) the Individual Defendants breached their fiduciary duties of loyalty and care when they did not obtain “extraordinarily valuable economic benefits” in exchange for agreeing to the Dead Hand Proxy Put provision as part of the Agreement; and (iii) JPMorgan aided and abetted said breach of fiduciary duties. Plaintiff sought, among other things, a permanent injunction barring enforcement of the Dead Hand Proxy Put provision.

On April 21, 2015, the Court determined the case to be “complex” within the meaning of California Rules of Court 3.400 and stayed discovery.

Commencing in or about May 2015, counsel for the respective parties began arm’s length negotiations regarding a possible resolution of the Action. Thereafter, counsel for the parties reached an agreement to resolve the Action on the terms set forth herein.

II. PLAINTIFF’S CLAIMS AND BENEFITS OF THE SETTLEMENT

Plaintiff and her counsel have concluded that the terms and conditions of the Stipulation are fair, reasonable and adequate to Plaintiff and the other members of the Class. Based on Plaintiff’s direct oversight of the prosecution of this matter, and with the advice of its counsel, Plaintiff has agreed to settle and release all of the claims raised in the Action pursuant to the terms and provisions of the Stipulation, after considering (i) the substantial benefits provided under the proposed Settlement; and (ii) the uncertain outcome and risk of any litigation, especially in complex actions such as the Action, as well as the difficulties and delays inherent in such litigation. Plaintiff and her counsel are also mindful of the inherent problems of proof and possible defenses to the claims asserted in the Action. Based on their evaluation, Plaintiff and her counsel have determined that the Settlement set forth in the Stipulation is in the best interests of the Class. Plaintiff’s Counsel believes that the Settlement set forth in the Stipulation confers substantial benefits upon the Class. Plaintiff’s Counsel bases this conclusion upon, inter alia,

their extensive investigation during the development, prosecution and settlement of the Action, which included, inter alia, inspecting, reviewing and analyzing information regarding the Company, including, but not limited to, the Company’s filings with the Securities and Exchange Commission (“SEC”), and researching the applicable law with respect to the claims asserted in the Action and the potential defenses thereto.

III. INDIVIDUAL DEFENDANTS’ DENIALS OF WRONGDOING AND LIABILITY

Each Defendant expressly denies any wrongdoing or liability with respect to all claims asserted in the Action, including that they have committed any violations of law, that they have acted improperly in any way, or that they have any liability or owe any damages or relief of any kind to Plaintiff or any other member or the Class. Defendants are entering into the Stipulation solely because they consider it desirable that the Action be settled and released, on the merits and with prejudice, in order to, among other things, (a) eliminate the burden, inconvenience, expense, risk and distraction of further litigation; and (b) terminate all the claims that were or could have been asserted against the Defendants in the Action.

IV. THE SETTLEMENT HEARING

The Settlement Hearing will be held before the Honorable Peter H. Kirwan on June 10, 2016 at 9:00 a.m. in Department 1 of the Court, located at 191 North First Street, San Jose, California 95113-1090, to: (i) determine whether the provisional class action certification should be made final; (ii) determine whether the Settlement should be finally approved by the Court as fair, reasonable, and adequate; (iii) determine whether an Order and Final Judgment should be entered pursuant to the Stipulation; (iv) consider Plaintiff’s Counsel’s application for an award of attorneys’ fees and expenses; and (v) rule on such other matters as the Court may deem appropriate. The Settlement Hearing may be continued by the Court at the Settlement Hearing or at any adjourned session thereof without further notice.

V. THE SETTLEMENT

The terms and conditions of the Settlement are set forth in the Stipulation described above. The following is only a summary of its terms.

The Settling Parties have conducted arms-length negotiations over an extended period of time and have reached an agreement in good faith to settle the Action. In consideration of the full settlement and the release of the Released Claims against Defendants and the other Released Defendant Parties, Defendants agree to the following:

(a) Within 30 days of the Settlement becoming Final, Defendants shall eliminate the Dead Hand Proxy Put provision by amending the Agreement’s definition of “Continuing Directors” to delete the following language:

(other than any person whose initial nomination or election occurred as a result of an actual or threatened solicitation of proxies or consents for the election or removal of one or more members)

(b) JPMorgan shall not charge Trimble a fee for amending the Agreement as set forth in paragraph (a) above. Except as explicitly set forth in paragraph (a) above, the Settlement shall not alter or affect the Agreement in any way.

VI. RELEASE AND DISCHARGE

In connection with the Court’s approval of the Settlement and upon the Effective Date, Plaintiff and each member of the Class shall be deemed to have, and by operation of the Order and Final Judgment shall have, fully, finally, and forever released, relinquished and discharged the Released Claims against the Released Defendant Parties and any and all claims (including Unknown Claims) arising out of, relating to, or in connection with, the defense, settlement, or resolution of the Action against the Released Defendant Parties.

Upon the Effective Date each of the Released Defendant Parties and each member of the Class shall be deemed to have, and by operation of the Order and Final Judgment shall have, fully, finally, and forever released, relinquished and discharged Plaintiff and Plaintiff’s Counsel from all claims arising out of, relating to, or in connection with, the institution, prosecution, assertion, settlement, or resolution of the Action or the Released Claims (including Unknown Claims).

“Released Claims” means any claims, demands, rights, actions, causes of action, liabilities, damages, losses, obligations, judgments, duties, suits, costs, expenses, matters, and issues known or unknown, including Unknown Claims, contingent or absolute, suspected or unsuspected, disclosed or undisclosed, liquidated or unliquidated, matured or unmatured, accrued or unaccrued, apparent or unapparent, whether state, federal, or foreign, common law, statutory, or regulatory, including, without limitation, claims under the federal securities laws, that have been or could have been asserted in any court, tribunal or proceeding by Plaintiff and/or any Trimble stockholder, either on his, her or its own behalf or on behalf of Trimble, against any Released Defendant Parties that are based upon, arise out of, or relate to the allegations in the Complaint and/or the settlement of the Action, except that Released Claims do not include claims to enforce the Settlement.

“Unknown Claims” means any claims which any of the Settling Parties do not know or suspect to exist in his, her or its favor at the time of the release, and which, if known by him, her or it, might have affected his, her or its decision (i) to enter into the Stipulation, (ii) to agree to the releases contemplated therein or (iii) not object to the Settlement. With respect to any and all Released Claims, the Settling Parties stipulate and agree that, upon the Effective Date, each of the Settling Parties shall expressly waive, and each member of the Class by operation of the Judgment shall have expressly waived, the provisions, rights, and benefits of California Civil Code section 1542, or any law of the United States or any state of the United States or territory of the United States, or principle of common law, which is similar, comparable, or equivalent to California Civil Code section 1542, which provides:

A GENERAL RELEASE DOES NOT EXTEND TO CLAIMS WHICH THE CREDITOR DOES NOT KNOW OR SUSPECT TO EXIST IN HIS OR HER FAVOR AT THE TIME OF EXECUTING THE RELEASE, WHICH IF KNOWN BY HIM OR HER MUST HAVE MATERIALLY AFFECTED HIS OR HER SETTLEMENT WITH THE DEBTOR.

The Settling Parties acknowledge, and each member of the Class by operation of the Order and Final Judgment shall be deemed to have acknowledged, that they may hereafter discover facts in addition to or different from those which they now know or believe to be true with respect to the subject matter of the Released Claims, but, upon the effective date of the Settlement, the Settling Parties shall expressly settle and release, and each member of the Class shall be deemed to have, and by operation of the Order and

Final Judgment shall have, fully, finally, and forever settled and released, any and all Released Claims, known or unknown, suspected or unsuspected, contingent or non-contingent, whether or not concealed or hidden, which now exist, or heretofore have existed upon any theory of law or equity now existing or coming into existence in the future, including, but not limited to, conduct which is negligent, intentional, with or without malice, or a breach of any duty, law or rule, without regard to the subsequent discovery or existence of such different or additional facts. The Settling Parties acknowledge, and each member of the Class shall be deemed by operation of the Order and Final Judgment to have acknowledged, that the foregoing waiver and the inclusion of “Unknown Claims” in the definition of “Released Claims” was separately bargained for and was a material element of the Settlement of which this release is a part and was relied upon by each and all of the Defendants in entering into the Stipulation.

The Court has not made (and will not make) any determination as to the merits of any claims or defenses in the Action. This notice does not imply that any Individual Defendant would be found liable or that relief would be awarded if the Action were not being settled. Nothing herein shall in any way impair or restrict the rights of any Party to enforce the terms of the Stipulation.

VII. PLAINTIFF’S COUNSEL’S FEES AND EXPENSES

Plaintiff’s Counsel intends to seek an award of fees and expenses, in the aggregate, of not more than $250,000 (the “Fees and Expenses”). Defendants agree not to oppose an award of fees and expenses, in the aggregate, that does not exceed such amount, which amount will be payable by the Company, its successors in interest, and/or its insurers. Any order or proceeding relating to the Fees and Expenses, or any appeal from any order relating thereto or reversal or modification thereof, shall not operate to terminate or cancel the Stipulation, or affect or delay the finality of the Order and Final Judgment approving the Stipulation and the Settlement as set forth herein.

VIII. THE RIGHT TO OBJECT AND/OR BE HEARD AT THE HEARING

Any person who objects to the Settlement, the Order and Final Judgment to be entered in the Action, and/or Plaintiff’s Counsel’s application for attorneys’ fees and expenses, or who otherwise wishes to be heard, may appear in person or by counsel at the Settlement Hearing and present evidence or argument that may be proper and relevant.

IX. CONDITIONS OF SETTLEMENT

The Settlement is conditioned upon the occurrence of certain events described in the Stipulation. Those events include the occurrence of the Effective Date, which means the first date by which all of the following events and conditions have been met and have occurred:

(a) The conditional certification of the Action as a non-opt-out class action on behalf of a Class;

(b) The approval by the Court of a release of the Released Defendant Parties and the entry by the Court of the Order and Final Judgment; and

(c) The Order and Final Judgment has become Final.

X. EXAMINATION OF PAPERS AND INQUIRIES

This notice contains only a summary of the terms of the Settlement. For a more detailed statement of the matters involved in the Action, there is additional information concerning the Settlement available in the Stipulation, which may be inspected at the Office of the Clerk, Superior Court of the State of California for the City and County of Santa Clara, 191 North First Street, San Jose, California 95113-1090, during regular business hours of each business day.

Clerk of the Court

Superior Court of California

City and County of Santa Clara

191 North First Street

San Jose, CA 95113-1090

Telephone: (408) 882-2100

PLEASE DO NOT TELEPHONE THE COURT OR TRIMBLE

REGARDING THIS NOTICE

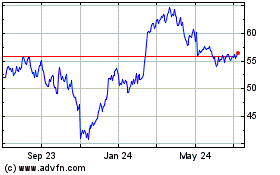

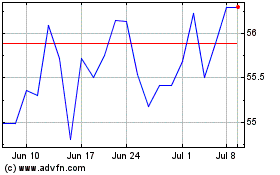

Trimble (NASDAQ:TRMB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Trimble (NASDAQ:TRMB)

Historical Stock Chart

From Apr 2023 to Apr 2024