The Bancorp, Inc. ("The Bancorp") (NASDAQ: TBBK), a financial

holding company, today reported financial results for first quarter

2016.

Highlights

- Net interest income increased 24% to

$20.6 million for the quarter ended March 31, 2016 compared to

$16.5 million for the quarter ended March 31, 2015.

- Loans and continuing operations loans

held for sale increased 29% to $1.43 billion at March 31, 2016

compared to $1.11 billion at March 31, 2015.

- Small Business Administration (“SBA”)

loans increased 51% to $334.4 million from $221.9 million at March

31, 2015.

- Security backed lines of credit

(“SBLOC”) increased 32% to $592.7 million from $447.6 million at

March 31, 2015.

- Direct lease financing increased 9% to

$240.7 million from $220.6 million at March 31, 2015.

- Prepaid card fee income increased 3.4%

to $13.6 million for the quarter ended March 31, 2016 from $13.1

million at March 31, 2015.

- Gross dollar volume (“GDV”) (1)

increased 15.4% to $13.5 billion for Q1 2016 from $11.7 billion for

Q1 2015.

- Assets held for sale from discontinued

operations decreased 8% from December 31, 2015 and 36% from March

31, 2015.

- The rate payable by us for average

deposits and interest bearing liabilities of $4.08 billion in Q1

2016 was 0.30% with a rate of 0.08% for $2.03 billion of average

prepaid card deposits.

- Book value per common share at March

31, 2016 of $8.35 per share. The Bancorp and its subsidiary, The

Bancorp Bank, remain well capitalized.

John Chrystal, The Bancorp’s Interim Chief Executive Officer,

said, “During the quarter, our core lending businesses continued to

drive healthy net interest income growth while non-interest income

was anchored by a 3.4% growth in prepaid card fees to $13.6

million. As anticipated, earnings were negatively impacted by

continued high regulatory look back expenses totaling $14.3 million

for the quarter. We believe that lookback expenses will be greatly

reduced after the second quarter of 2016 and minimal by year-end.

While the CMBS business has generated positive revenue each year on

an annual basis, we expect some quarter to quarter volatility.

Losses from commercial real estate loan sales affected our earnings

and resulted from volatility in secondary markets.”

The Bancorp reported a net loss of $10.9 million, or $0.29 loss

per diluted share, for the quarter ended March 31, 2016 compared to

net income of $214,000, or $0.00 net income per share, for the

quarter ended March 31, 2015. Net loss from continuing operations

for the quarter ended March 31, 2016 was $10.6 million or a loss of

$0.28 per diluted share compared to net loss from continuing

operations of $1.8 million or a loss of $0.05 per diluted share for

the quarter ended March 31, 2015. Loss from continuing operations

does not include any income which may result from the reinvestment

of the proceeds from sales of the remaining $523.6 million of

commercial and residential loans in The Bancorp’s discontinued

operations. Tier one capital to assets, tier one capital

to risk-weighted assets, total capital to risk-weighted assets

and common equity-tier 1 ratios were 6.97%, 14.35%, 14.55% and

14.35% compared to well capitalized minimums of 5%, 8%, 10% and

6.5%.

Conference Call Webcast

You may access the LIVE webcast of The Bancorp's Quarterly

Earnings Conference Call at 8:00 AM ET Friday, April 29, 2016 by

clicking on the webcast link on Bancorp's homepage at

www.thebancorp.com. Or, you may dial 877.787.4143, access code

90268500. You may listen to the replay of the webcast following the

live call on The Bancorp's investor relations website or

telephonically until Friday, May 6, 2016 by dialing 855.859.2056,

access code 90268500.

About The Bancorp

With operations in the US and Europe, The Bancorp, Inc. (NASDAQ:

TBBK) is dedicated to serving the unique needs of non-bank

financial service companies, ranging from entrepreneurial start-ups

to those on the Fortune 500. The company’s chief financial

institution, The Bancorp Bank (Member FDIC, Equal Housing Lender),

has been repeatedly recognized in the payments industry as the Top

Issuer of Prepaid Cards (US), a top merchant sponsor bank, and a

top ACH originator. Specialized lending distinctions include

National Preferred SBA Lender, a leading provider of

securities-backed lines of credit, and one of the few bank-owned

commercial leasing groups in the nation. For more information

please visit www.thebancorp.com.

Forward-Looking Statements

Statements in this earnings release regarding Bancorp’s business

which are not historical facts are "forward-looking statements"

that involve risks and uncertainties. These statements may be

identified by the use of forward-looking terminology, including but

not limited to the words “may,” “believe,” “will,” “expect,”

“look,” “anticipate,” “estimate,” “continue,” or similar words. For

further discussion of the risks and uncertainties to which these

forward-looking statements may be subject, see Bancorp’s filings

with the SEC, including the “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of

Operations” sections of those filings. These risks and

uncertainties could cause actual results to differ materially from

those projected in the forward-looking statements. The

forward-looking statements speak only as of the date of this press

release. The Bancorp does not undertake to publicly revise or

update forward-looking statements in this press release to reflect

events or circumstances that arise after the date of this

presentation, except as may be required under applicable law.

The Bancorp, Inc. Financial highlights

(unaudited) Three months ended Year ended

March 31, December 31,

Condensed income statement 2016

2015 2015 (dollars in thousands except per share data)

Net interest income $ 20,556 $ 16,514 $ 69,931

Provision for loan and lease losses - 665

2,100 Non-interest income Service fees on deposit

accounts 847 1,760 7,468 Card payment and ACH processing fees 1,267

1,253 5,731 Prepaid card fees 13,574 13,132 47,496 Gain (loss) on

sale of loans (1,433 ) 1,676 10,080 Gain on sale of investment

securities 2,026 80 14,435 Gain on sale of health savings portfolio

- - 33,531 Change in value of investment in unconsolidated entity

812 1,045 1,729 Leasing income 404 519 2,291 Debit card income (92

) 460 1,611 Affinity fees 1,094 412 3,358 Other non-interest income

189 440 5,337 Total non-interest

income 18,688 20,777 133,067 Non-interest expense Bank Secrecy Act

and lookback consulting expenses 14,315 5,744 41,444 Other

non-interest expense 40,823 35,116

152,644 Total non-interest expense 55,138

40,860 194,088 Income (loss) from continuing

operations before income tax expense (15,894 ) (4,234 ) 6,810

Income tax expense (benefit) (5,272 ) (2,427 )

1,450 Net income (loss) from continuing operations (10,622 ) (1,807

) 5,360 Net income (loss) from discontinued operations, net of tax

(290 ) 2,021 8,072 Net income (loss)

available to common shareholders $ (10,912 ) $ 214 $ 13,432

Net income (loss) per share from continuing operations -

basic $ (0.28 ) $ (0.05 ) $ 0.14 Net income (loss) per share from

discontinued operations - basic $ (0.01 ) $ 0.05 $ 0.21 Net

income (loss) per share - basic $ (0.29 ) $ - $ 0.35

Net income (loss) per share from continuing operations - diluted $

(0.28 ) $ (0.05 ) $ 0.14 Net income (loss) per share from

discontinued operations - diluted $ (0.01 ) $ 0.05 $ 0.21

Net income (loss) per share - diluted $ (0.29 ) $ - $ 0.35

Common stock shares outstanding 37,945,153 37,858,152 37,861,218

Balance sheet March 31,

December 31, September 30, March 31, 2016 2015 2015 2015 (dollars

in thousands)

Assets: Cash and cash equivalents Cash and due

from banks $ 8,542 $ 7,643 $ 4,002 $ 18,636 Interest earning

deposits at Federal Reserve Bank 757,773 1,147,519 995,441 994,400

Securities sold under agreements to resell 10,208

- 37,970 46,250 Total

cash and cash equivalents 776,523 1,155,162

1,037,413 1,059,286

Investment securities, available-for-sale, at fair value 1,252,755

1,070,098 1,316,705 1,442,665 Investment securities,

held-to-maturity 93,550 93,590 93,604 93,662 Loans held for sale,

at fair value 313,595 489,938 354,600 239,820 Loans, net of

deferred fees and costs 1,114,053 1,078,077 994,518 870,901

Allowance for loan and lease losses (4,378 ) (4,400 )

(4,194 ) (4,243 ) Loans, net 1,109,675

1,073,677 990,324 866,658

Federal Home Loan Bank & Atlantic Community Bancshares Inc

stock 1,062 1,062 1,063 1,003 Premises and equipment, net 21,692

21,631 18,893 19,158 Accrued interest receivable 9,172 9,471 11,232

11,290 Intangible assets, net 4,672 4,929 5,248 5,791 Deferred tax

asset, net 32,462 36,207 33,857 32,025 Investment in unconsolidated

entity 177,211 178,520 186,656 190,783 Assets held for sale from

discontinued operations 536,548 583,909 611,729 842,574 Other

assets 50,802 47,629 53,123

43,734 Total assets $ 4,379,719 $

4,765,823 $ 4,714,447 $ 4,848,449

Liabilities: Deposits Demand and interest checking $

3,610,003 $ 3,602,376 $ 4,002,638 $ 4,182,656 Savings and money

market 388,953 383,832 376,577 307,988 Time deposits -

428,549 - 1,400

Total deposits 3,998,956 4,414,757

4,379,215 4,492,044 Securities

sold under agreements to repurchase 671 925 1,034 7,959

Subordinated debenture 13,401 13,401 13,401 13,401 Other

liabilities 51,102 16,739 7,100

12,992 Total liabilities $ 4,064,130 $

4,445,822 $ 4,400,750 $ 4,526,396

Shareholders' equity: Common stock - authorized, 50,000,000

shares of $1.00 par value; 37,945,153 and 37,858,152 shares issued

at March 31, 2016 and 2015, respectively 37,945 37,861 37,858

37,858 Treasury stock (100,000 shares) (866 ) (866 ) (866 ) (866 )

Additional paid-in capital 301,018 300,549 299,470 298,402

Accumulated deficit (26,361 ) (15,449 ) (33,429 ) (28,029 )

Accumulated other comprehensive income (loss) 3,853

(2,094 ) 10,664 14,688 Total

shareholders' equity 315,589 320,001

313,697 322,053 Total

liabilities and shareholders' equity $ 4,379,719 $ 4,765,823

$ 4,714,447 $ 4,848,449

Average balance sheet and net interest income Three months

ended March 31, 2016 Three months ended March 31, 2015 (dollars in

thousands) Average Average Average

Average

Assets: Balance Interest Rate Balance Interest Rate

Interest-earning assets: Loans net of unearned fees and costs ** $

1,476,112 $ 15,556 4.22 % $ 1,110,804 $ 10,507 3.78 % Leases - bank

qualified* 27,798 482 6.94 % 17,555 292 6.65 % Investment

securities-taxable 1,149,101 6,532 2.27 % 1,028,718 5,060 1.97 %

Investment securities-nontaxable* 75,846 493 2.60 % 532,324 4,883

3.67 % Interest earning deposits at Federal Reserve Bank 799,398

902 0.45 % 1,096,344 622 0.23 % Federal funds sold and securities

purchased under agreement to resell 7,422 27

1.46 % 46,250 164 1.42 % Net interest earning

assets 3,535,677 23,992 2.71 % 3,831,995 21,528 2.25 %

Allowance for loan and lease losses (4,399 ) (3,640 ) Assets held

for sale from discontinued operations 588,685 5,819 3.95 % 861,685

8,536 3.96 % Other assets 299,551 278,667

$ 4,419,514 $ 4,968,707

Liabilities

and Shareholders' Equity: Deposits: Demand and interest

checking $ 3,471,909 $ 2,441 0.28 % $ 4,290,835 $ 2,606 0.24 %

Savings and money market 387,651 225 0.23 % 318,776 487 0.61 % Time

206,393 305 0.59 % 1,400

6 1.71 % Total deposits 4,065,953 2,971 0.29 % 4,611,011 3,099 0.27

% Repurchase agreements 856 - 0.00 % 13,147 9 0.27 %

Subordinated debt 13,401 124 3.70 %

13,401 95 2.84 % Total deposits and interest bearing

liabilities 4,080,210 3,095 0.30 % 4,637,559 3,203 0.28 %

Other liabilities 21,329 10,610 Total

liabilities 4,101,539 4,648,169 Shareholders' equity

317,975 320,538 $ 4,419,514 $ 4,968,707

Net interest income on tax equivalent basis* $ 26,716 $

26,861 Tax equivalent adjustment 341 1,811

Net interest income $ 26,375 $ 25,050 Net interest margin *

2.56 % 2.26 %

* Full taxable equivalent basis, using a

35% statutory tax rate.

** Includes loans held for sale.

Allowance for loan and lease losses: Three months ended Year

ended March 31, March 31, December 31, 2016 2015 2015

(dollars in thousands) Balance in the allowance for loan and

lease losses at beginning of period (1) $ 4,400 $ 3,638

$ 3,638 Loans charged-off: SBA non real estate

- 9 112 Direct lease financing 20 - 30 SBLOC - - - Other consumer

loans 12 52 1,219 Total

32 61 1,361

Recoveries: SBA non real estate - - - Direct lease financing 6 - -

Other consumer loans 4 1 23

Total 10 1 23 Net

charge-offs 22 60 1,338 Provision charged to operations -

665 2,100 Balance in

allowance for loan and lease losses at end of period $ 4,378

$ 4,243 $ 4,400 Net charge-offs/average loans 0.00 %

0.00 % 0.11 % Net charge-offs/average loans (annualized) 0.01 %

0.02 % 0.11 % Net charge-offs/average assets 0.00 % 0.00 % 0.03 %

(1) Excludes activity from assets held for sale

Loan

portfolio: March 31, December 31, September 30, March 31, 2016

2015 2015 2015 (dollars in thousands) SBA non real estate $

71,220 $ 68,887 $ 64,988 $ 62,385 SBA commercial mortgage 120,415

114,029 116,545 84,430 SBA construction 9,736

6,977 5,191 15,181 Total SBA loans

201,371 189,893 186,724 161,996 Direct lease financing 240,670

231,514 223,929 220,559 SBLOC 592,656 575,948 539,240 447,649 Other

specialty lending 48,153 48,315 12,119 1,862 Other consumer loans

21,782 23,180 23,502

30,120 1,104,632 1,068,850 985,514 862,186 Unamortized loan

fees and costs 9,421 9,227 9,004

8,715 Total loans, net of deferred loan fees and

costs $ 1,114,053 $ 1,078,077 $ 994,518 $

870,901

Small business lending portfolio: March 31,

December 31, September 30, March 31, 2016 2015 2015 2015 (dollars

in thousands) SBA loans, including deferred fees and costs

209,605 197,966 194,612 169,721 SBA loans included in HFS

124,763 109,174 86,245

52,219 Total SBA loans $ 334,368 $ 307,140 $ 280,857

$ 221,940

Capital

Ratios Tier 1 capital Tier 1 capital Total capital Common

equity to average to risk-weighted to risk-weighted tier 1 to risk

assets ratio assets ratio assets ratio weighted assets As of March

31, 2016 The Bancorp 6.97 % 14.35 % 14.55 % 14.35 % The Bancorp

Bank 6.68 % 13.75 % 13.96 % 13.75 % "Well capitalized" institution

(under FDIC regulations) 5.00 % 8.00 % 10.00 % 6.50 % As of

December 31, 2015 The Bancorp 7.17 % 14.67 % 14.88 % 14.67 % The

Bancorp Bank 6.90 % 13.98 % 14.18 % 13.98 % "Well capitalized"

institution (under FDIC regulations) 5.00 % 8.00 % 10.00 % 6.50 %

Three months ended Year ended March 31,

December 31, 2016 2015 2015

Selected operating

ratios: Return on average assets (annualized) nm 0.02 % 0.29 %

Return on average equity (annualized) nm 0.26 % 4.20 % Net interest

margin 2.56 % 2.26 % 2.37 % Book value per share $ 8.34 $ 8.53 $

8.47 March 31, December 31, September 30, March 31, 2016

2015 2015 2015

Asset quality ratios: Nonperforming loans to

total loans (2) 0.24 % 0.22 % 0.25 % 0.52 % Nonperforming assets to

total assets (2) 0.06 % 0.05 % 0.05 % 0.09 % Allowance for loan and

lease losses to total loans 0.39 % 0.41 % 0.42 % 0.49 %

Nonaccrual loans $ 1,908 $ 1,927 $ 2,157 $ 3,744 Other real estate

owned - - - -

Total nonperforming assets $ 1,908 $ 1,927 $

2,157 $ 3,744 Loans 90 days past due still

accruing interest $ 787 $ 403 $ 294 $ 769

(2) Nonperforming loan and asset ratios include

nonaccrual loans and loans 90 days past due still accruing

interest. Three months ended March 31, December 31,

September 30, March 31, 2016 2015 2015 2015 (in thousands)

Gross

dollar volume (GDV) (1)

: Prepaid card GDV $ 13,512,318

$ 9,839,782 $ 9,465,687 $ 11,712,072

(1) Gross dollar volume represents the total dollar amount

spent on prepaid and debit cards issued by The Bancorp.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160428007024/en/

The Bancorp, Inc.Andres Viroslav,

215-861-7990aviroslav@thebancorp.com

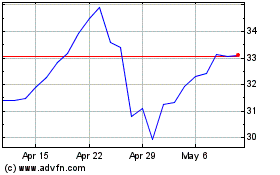

Bancorp (NASDAQ:TBBK)

Historical Stock Chart

From Mar 2024 to Apr 2024

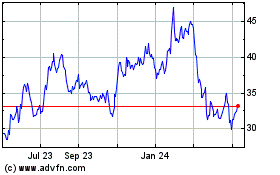

Bancorp (NASDAQ:TBBK)

Historical Stock Chart

From Apr 2023 to Apr 2024