The Bancorp, Inc. ("Bancorp") (NASDAQ: TBBK), a financial

holding company, today reported financial results for third quarter

2014.

Bancorp reported net income from continuing operations of $1.5

million for third quarter 2014 compared to net income of $2.2

million from continuing operations in third quarter 2013, and

respective diluted earnings per share of $.04 and $.06. Pretax

income from continuing operations amounted to $1.5 million for

third quarter 2014, and reflected $2.7 million of Bank Secrecy Act

and look back consulting expenses. Income from continuing

operations does not include any income which would result upon the

reinvestment of the proceeds of the planned sale of $1.2 billion of

commercial loans as explained in the chief executive officer’s

comments below. As a result of discontinued operations in third

quarter 2014, Bancorp recorded a loss of $16.8 million or $.45

diluted loss per share for that period, compared to net income of

$4.8 million or $.13 diluted earnings per share in third quarter

2013.

Financial Highlights

Discontinued Operations:

- Bancorp has decided to discontinue its

commercial lending operations. The loans which constitute that

portfolio are in the process of disposition. This represents a

strategic continuation of the shift to a focus on Bancorp’s

specialty lending including small fleet leasing, security backed

lines of credit (“SBLOC”), CMBS origination and SBA lending. The

discontinuance resulted in a charge to earnings of $18.3 million,

net of tax.

Continuing Operations:

- 44% increase in net interest income to

$15.4 million compared to $10.7 million in third quarter 2013.

- 21% increase in prepaid card fees to

$12.3 million compared to $10.2 million in third quarter 2013.

- 33% increase in card processing and ACH

fees to $1.4 million.

- Increases over prior year targeted loan

balances: SBA lending 65%, SBLOC 44%, Leasing 14%.Loans in

continuing operations and loans held for sale totaled $1.0 billion

at September 30, 2014.

- Tax equivalent yield on earning assets

increased to 2.65% compared to 2.19% in third quarter 2013.

- Tier one capital to assets, tier one

capital to risk assets and total capital to risk assets were

8.10%, 12.95% and 13.11% , compared to well capitalized minimums of

5%, 6% and 10%.

Betsy Z. Cohen, Bancorp’s Chief Executive Officer, said, “As

part of our strategic evaluation of the asset composition of the

bank, we have decided to replace our commercial lending with a

greater emphasis on the specialty lending segments which we have

been describing over the last 12 months - small fleet leasing,

security backed lines of credit and SBA lending. As a result of our

greater emphasis on these targeted specialty lending segments, they

have experienced substantial 12 month over 12 month growth rates as

follows: SBA 65%, SBLOC (Security Backed Lines of

Credit) 44% and leasing 14%. At September 30, 2014,

the total outstanding for these continuing lines and the

CMBS loans held for sale, on which we also earn a spread, exceeded

one billion dollars. Our decision was based upon our expectation

that the specialty lending segments will provide better risk

adjusted yields, greater granularity compared to various types of

commercial lending and, thus, a more predictable earnings stream.

During the transition of our commercial lending operation to our

targeted specialty lending operations, we expect that, on an

interim basis, our investment securities portfolio will expand.

"In connection with the discontinuance of our commercial loan

portfolio and the resulting charge to earnings, an independent

third party expert has provided a fair value analysis of the

commercial loan portfolio for purposes of reflecting discontinued

assets on our balance sheet. This analysis resulted in a valuation

of the approximate $1.2 billion discontinued portfolio, and the

related valuation adjustment and the operations of this segment are

reflected in the quarterly loss of $16.8 million. This

valuation is an estimate only, based on current circumstances and

the actual sales price could be significantly greater or lesser

than the estimate, which could materially affect results of

operations in future quarters. We have commenced the process of

seeking buyers for our commercial loan portfolio. The income and

other financial statements segregate discontinued operations from

continuing operations. While continuing operations exclude interest

income on the commercial loan portfolio, that line item does not

include any income from reinvestment of proceeds from the sale of

the commercial loan portfolio. Based upon the current interest rate

environment, our investment advisor has modeled portfolio

reinvestment at a 1.75% yield; however, that yield could be

materially more or less at the actual time of reinvestment, as a

result of the then-current interest rate environment, the sectors

in which we invest or other economic factors. Book value at

September 30, 2014 amounted to $9.45 compared to $9.39 at September

30, 2013. The Bank remains well capitalized.”

Financial Results

Bancorp reported net income from continuing operations of $1.5

million for third quarter 2014 compared to net income of $2.2

million from continuing operations in third quarter 2013, and

respective diluted earnings per share of $.04 and $.06. After

discontinued operations, Bancorp reported net loss to common

shareholders for the three months ended September 30, 2014 of $16.8

million, or loss per share of $0.45, based on 37,708,862 weighted

average shares outstanding, compared to net income available to

common shareholders of $4.8 million, or diluted earnings per share

of $0.13, based on 38,283,317 weighted average diluted shares

outstanding, for the three months ended September 30, 2013. The

$16.8 million loss reflected a 51% effective income tax benefit

based upon an estimated annualized tax rate. That tax rate exceeds

the 35% statutory tax rate primarily due to the impact of tax

exempt municipal bond interest.

Conference Call Webcast

You may access the LIVE webcast of Bancorp's Quarterly Earnings

Conference Call at 8:00 AM EDT Friday, October 31, 2014 by clicking

on the webcast link on Bancorp's homepage at www.thebancorp.com.

Or, you may dial 877.280.4962, access code 69319357. You may listen

to the replay of the webcast following the live call on Bancorp's

investor relations website or telephonically until Friday, November

7, 2014 by dialing 888.286.8010, access code 19205886.

About Bancorp

The Bancorp, Inc. is a financial holding company that operates

The Bancorp Bank, an FDIC-insured commercial bank that delivers a

full array of financial services both directly and through

private-label affinity programs.

Forward-Looking Statements

Statements in this earnings release regarding The Bancorp,

Inc.’s business which are not historical facts are "forward-looking

statements" that involve risks and uncertainties. These statements

may be identified by the use of forward-looking terminology,

including but not limited to the words “may,” “believe,” “will,”

“expect,” “look,” “anticipate,” “estimate,” “continue,” or similar

words. For further discussion of the risks and uncertainties to

which these forward-looking statements may be subject, see The

Bancorp, Inc.’s filings with the SEC, including the “Risk Factors”

sections of The Bancorp Inc.’s filings. These risks and

uncertainties could cause actual results to differ materially from

those projected in the forward-looking statements. The

forward-looking statements speak only as of the date of this

presentation. The Bancorp, Inc. does not undertake to publicly

revise or update forward-looking statements in this presentation to

reflect events or circumstances that arise after the date of this

presentation, except as may be required under applicable law.

The Bancorp, Inc. Financial highlights

(unaudited) Three months ended Nine months

ended September 30, September 30, 2014 2013 2014 2013

(dollars in thousands except per share data)

Condensed income

statement Net interest income $ 15,380 $ 10,676 $ 44,118

$ 29,370 Provision for loan and lease losses

965 379 3,420 461

Non-interest income Service fees on deposit accounts 1,640 1,238

4,146 3,296 Card payment and ACH processing fees 1,369 1,027 3,989

2,940 Prepaid card fees 12,307 10,177 38,673 33,682 Gain on sale of

loans 2,772 4,739 13,468 12,665 Gain (loss) on sales of investment

securities (35 ) 42 365 785 Other than temporary impairment of

investment securities - - - (20 ) Leasing income 840 624 2,236

1,853 Debit card income 414 158 1,296 555 Affinity fees 649 722

1,851 2,428 Other non-interest income 299 449

1,217 1,936 Total non-interest income

20,255 19,176 67,241 60,120 Non-interest expense Bank Secrecy Act

and lookback consulting expenses 2,749 - 4,918 - Other non-interest

expense 30,386 26,384 93,437

74,686 Total non-interest expense 33,135

26,384 98,355 74,686

Income from continuing operations before income tax expense 1,535

3,089 9,584 14,343 Income tax expense 45 935

282 4,344 Net income from continuing

operations 1,490 2,154 9,302 9,999

Net income (loss) from discontinued

operations, net of tax

(18,295 ) 2,634 (25,471 ) 7,787

Net income (loss) available to common shareholders $ (16,805 ) $

4,788 $ (16,169 ) $ 17,786 Net income per share from

continuing operations - basic $ 0.04 $ 0.06 $ 0.25 $

0.27 Net income (loss) per share from discontinued

operations - basic $ (0.49 ) $ 0.07 $ (0.68 ) $ 0.21 Net

income (loss) per share - basic $ (0.45 ) $ 0.13 $ (0.43 ) $ 0.48

Net income per share from continuing operations -

diluted $ 0.04 $ 0.06 $ 0.25 $ 0.26 Net income

(loss) per share from discontinued operations - diluted $ (0.49 ) $

0.07 $ (0.68 ) $ 0.21 Net income (loss) per share - diluted

$ (0.45 ) $ 0.13 $ (0.43 ) $ 0.47 Weighted average shares -

basic 37,708,862 37,440,838 37,698,759 37,359,230 Weighted average

shares - diluted 37,708,862 38,283,317 37,698,759 37,978,108

Balance sheet September 30, June

30, December 31, September 30, 2014 2014 2013 2013 (dollars in

thousands)

Assets: Cash and cash equivalents Cash and due

from banks $ 9,913 $ 13,288 $ 31,890 $ 30,056 Interest earning

deposits at Federal Reserve Bank 430,117 441,422 1,196,515 657,618

Securities sold under agreements to resell 55,450

15,906 7,544 40,811 Total

cash and cash equivalents 495,480 470,616

1,235,949 728,485

Investment securities, available-for-sale, at fair value 1,442,049

1,459,626 1,253,117 1,083,154 Investment securities,

held-to-maturity 96,951 97,130 97,205 97,459 Loans held for sale,

at fair value 136,115 154,474 69,904 25,557 Loans, net of deferred

fees and costs 866,765 812,164 655,320 636,038 Allowance for loan

and lease losses (4,390 ) (4,082 ) (2,164 )

(2,516 ) Loans, net 862,375 808,082

653,156 633,522 Federal Home

Loan Bank & Atlantic Central Bankers Bank stock 3,409 3,409

3,209 3,209 Premises and equipment, net 17,536 16,236 15,659 14,252

Accrued interest receivable 11,272 10,692 8,747 8,157 Intangible

assets, net 6,573 6,988 7,612 6,253 Other real estate owned 725 - -

- Deferred tax asset, net 41,601 24,606 30,415 26,434 Assets held

for sale 1,143,380 1,227,215 1,299,914 1,345,530 Other assets

39,046 36,089 31,178

28,271 Total assets $ 4,296,512 $ 4,315,163

$ 4,706,065 $ 4,000,283

Liabilities: Deposits Demand and interest checking $

3,412,593 $ 3,424,719 $ 3,585,241 $ 2,923,591 Savings and money

market 241,518 226,085 434,834 407,179 Time deposits 24 24 142 142

Time deposits, $100,000 and over - -

100 101 Total deposits 3,654,135

3,650,828 4,020,317

3,331,013 Securities sold under agreements to

repurchase 21,496 17,481 21,221 22,057 Accrued interest payable - -

- 73 Subordinated debenture 13,401 13,401 13,401 13,401 Liabilities

held for sale 227,898 231,587 253,203 238,614 Other liabilities

23,194 29,371 38,319

41,792 Total liabilities $ 3,940,124 $

3,942,668 $ 4,346,461 $ 3,646,950

Shareholders' equity: Common stock - authorized, 50,000,000

shares of $1.00 par value; 37,808,862 and 37,720,945 shares issued

at September 30, 2014 and 2013, respectively 37,809 37,809 37,721

37,721 Treasury stock (100,000 shares) (866 ) (866 ) (866 ) (866 )

Additional paid-in capital 297,122 296,523 294,576 292,715 Retained

earnings 10,955 27,763 27,615 20,291 Accumulated other

comprehensive income 11,368 11,266

558 3,472 Total shareholders' equity

356,388 372,495 359,604

353,333 Total liabilities and shareholders'

equity $ 4,296,512 $ 4,315,163 $ 4,706,065 $

4,000,283

Average balance sheet and

net interest income Three months ended September 30, 2014 Three

months ended September 30, 2013 (dollars in thousands) Average

Average Average Average

Assets:

Balance Interest Rate Balance Interest Rate Interest-earning

assets: Loans net of unearned fees and costs ** $ 907,691 $ 9,032

3.98 % $ 658,139 $ 7,058 4.29 % Leases - bank qualified* 16,706 218

5.22 % 17,894 260 5.81 % Investment securities-taxable 1,029,544

5,311 2.06 % 837,700 4,057 1.94 % Investment securities-nontaxable*

526,393 4,858 3.69 % 297,301 2,040 2.74 % Interest earning deposits

at Federal Reserve Bank 477,609 285 0.24 % 702,492 438 0.25 %

Federal funds sold/securities purchased under agreement to resell

31,153 105 1.35 % 44,289

157 1.42 % Net interest earning assets 2,989,096 19,809 2.65 %

2,557,815 14,010 2.19 % Allowance for loan and lease losses

(8,473 ) (4,850 ) Assets held for sale 1,227,796 12,689 4.13 %

1,355,442 13,618 4.02 % Other assets 85,541

76,321 $ 4,293,960 $ 3,984,728

Liabilities and Shareholders' Equity: Deposits: Demand and

interest checking $ 3,389,692 $ 2,233 0.26 % $ 2,881,927 $ 1,999

0.28 % Savings and money market

221,604

290 0.52 %

352,831

402 0.46 % Total deposits 3,611,296 2,523 0.28

% 3,234,758 2,401 0.30 % Repurchase agreements 18,396 13

0.28 % 19,771 13 0.26 % Subordinated debt 13,401

116 3.46 % 13,401 115 3.43 % Total

deposits and interest bearing liabilities 3,643,093 2,652 0.29 %

3,267,930 2,529 0.31 % Liabilities held for sale 272,220 112

0.16 % 369,576 177 0.19 % Other liabilities 14,585

2,896 Total liabilities 3,929,898 3,640,402

Shareholders' equity 364,062 344,326 $

4,293,960 $ 3,984,728 Net interest income on tax

equivalent basis* $ 29,734 $ 24,922 Tax equivalent

adjustment 1,776 805 Net interest income $

27,958 $ 24,117 Net interest margin * 2.81 % 2.53 % * Full

taxable equivalent basis using a 35% statutory tax rate. **

Includes loans held for sale.

Average

balance sheet and net interest income Nine months ended

September 30, 2014 Nine months ended September 30, 2013 (dollars in

thousands) Average Average Average

Average

Assets: Balance Interest Rate Balance Interest Rate

Interest-earning assets: Loans net of unearned fees and costs ** $

858,829 $ 25,977 4.03 % $ 611,251 $ 20,025 4.37 % Leases - bank

qualified* 17,756 708 5.32 % 15,376 668 5.79 % Investment

securities-taxable 1,037,344 15,804 2.03 % 785,973 11,345 1.92 %

Investment securities-nontaxable* 459,508 12,613 3.66 % 210,678

4,499 2.85 % Interest earning deposits at Federal Reserve Bank

793,560 1,460 0.25 % 960,220 1,781 0.25 % Federal funds

sold/securities purchased under agreement to resell 28,612

296 1.38 % 32,897 279 1.13 % Net

interest-earning assets 3,195,609 56,858 2.37 % 2,616,395 38,597

1.97 % Allowance for loan and lease losses (3,492 ) (2,359 )

Assets held for sale 1,285,922 38,732 4.02 % 1,350,838 41,615 4.11

% Other assets 96,627 75,955 $

4,574,666 $ 4,040,829

Liabilities and

Shareholders' Equity: Deposits: Demand and interest checking $

3,569,670 $ 6,721 0.25 % $ 2,933,218 $ 5,725 0.26 % Savings and

money market

271,621

976 0.48 %

349,437

1,222 0.47 % Total deposits 3,841,291 7,697 0.27 %

3,282,655 6,947 0.28 % Short-term borrowings 7 - 0.00 % - -

0.00 % Repurchase agreements 17,262 37 0.29 % 17,545 39 0.30 %

Subordinated debt 13,401 344 3.42 %

13,401 433 4.31 % Total deposits and interest bearing

liabilities 3,871,961 8,078 0.28 % 3,313,601 7,419 0.30 %

Liabilities held for sale 308,465 410 0.18 % 375,131 605 0.22 %

Other liabilities 16,839 7,963 Total

liabilities 4,197,265 3,696,695 Shareholders' equity

377,401 344,134 $ 4,574,666 $ 4,040,829

Net interest income on tax equivalent basis* 87,102

72,188 Tax equivalent adjustment 4,662

1,808 Net interest income $ 82,440 $ 70,380 Net interest

margin * 2.59 % 2.41 % * Fully taxable equivalent basis

using a 35% statutory tax rate ** Includes loans held for sale.

Allowance for loan and lease

losses: Nine months ended Year ended September 30,

September 30, December 31, 2014 2013 2013 (dollars in thousands)

Balance in the allowance for loan and lease losses at

beginning of period (1)

$ 2,163

$ 2,381 $

2,381 Loans charged-off: SBA non real

estate, student loan commercial and commercial mortgage 42 2 44 SBA

construction - - - Direct lease financing 323 - 30 SBLOC and other

consumer loans

846

354 446 Total

1,211 356

520 Recoveries: SBA non real estate,

student loan commercial and commercial mortgage - - - SBA

construction - - - Direct lease financing - 8 8 SBLOC and other

consumer loans

18 22

53 Total

18

30 61

Net charge-offs 1,193 326 459 Provision charged to operations

3,420 461

241 Balance in allowance for loan

and lease losses at end of period

$ 4,390

$ 2,516 $

2,163 Net charge-offs/average loans 0.14 % 0.05

% 0.07 % Net charge-offs/average loans (annualized) 0.18 % 0.07 %

0.07 % Net charge-offs/average assets 0.03 % 0.01 % 0.01 % (1)

Excludes activity from assets held for sale

Loan

portfolio: September 30, June 30, December 31, September 30,

2014 2014 2013 2013 (dollars in thousands) SBA non real

estate and student loan commercial $ 96,079 $ 97,445 $ 53,391 $

59,325 SBA commercial mortgage 95,492 90,316 75,666 62,911 SBA

construction 16,472 9,936 51

- Total commercial loans 208,043 197,697 129,108

122,236 Direct lease financing 201,825 185,877 175,610 177,797

SBLOC and other consumer loans 448,497 420,421

345,703 331,697 858,365 803,995 650,421

631,730 Unamortized loan fees and costs 8,400

8,169 4,899 4,308 Total loans, net of

deferred loan fees and costs $ 866,765 $ 812,164 $

655,320 $ 636,038

(1) Security backed lines of credit

Capital Ratios Tier 1 capital Tier 1

capital Total capital to average assets to risk-weighted assets to

risk-weighted assets As of September 30, 2014 Bancorp 8.10 % 12.95

% 13.11 % The Bancorp Bank 7.51 % 12.03 % 12.19 % "Well

capitalized" institution (under FDIC regulations) 5.00 % 6.00 %

10.00 % As of December 31, 2013 Bancorp 8.58 % 14.57 % 15.83

% The Bancorp Bank 6.72 % 11.40 % 12.66 % "Well capitalized"

institution (under FDIC regulations) 5.00 % 6.00 % 10.00 %

Three months ended Nine months ended September 30,

September 30, 2014 2013 2014 2013

Selected

operating ratios: Return on average assets (annualized) nm 0.48

% nm 0.59 % Return on average equity (annualized) nm 5.52 % nm 6.91

% Net interest margin 2.81 % 2.53 % 2.59 % 2.41 % Book value per

share $ 9.45 $ 9.39 $ 9.45 $ 9.39 September 30, June 30,

December 31, September 30, 2014 2014 2013 2013

Asset quality

ratios: Nonperforming loans to total loans (1) 0.55 % 0.43 %

0.25 % 0.28 % Nonperforming assets to total assets (1) 0.13 % 0.08

% 0.03 % 0.05 % Allowance for loan and lease losses to total loans

0.51 % 0.50 % 0.33 % 0.40 % Nonaccrual loans $ 4,495 $ 3,413

$ 1,524 $ 1,602 Other real estate owned 725 -

- - Total nonperforming assets $

5,220 $ 3,413 $ 1,524 $ 1,602

Loans 90 days past due still accruing interest $ 264 $ 119

$ 110 $ 204 Three months ended

September 30, June 30, December 31, September 30, 2014 2014 2013

2013

Gross dollar volume (GDV): Prepaid card GDV $ 9,323,312

$ 10,025,213 $ 7,720,554 $ 7,178,533

(1) Nonperforming loan and asset ratios include nonaccrual

loans and loans 90 days past due still accruing interest.

The Bancorp, Inc.Andres Viroslav,

215-861-7990aviroslav@thebancorp.com

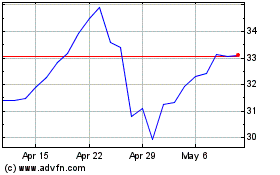

Bancorp (NASDAQ:TBBK)

Historical Stock Chart

From Mar 2024 to Apr 2024

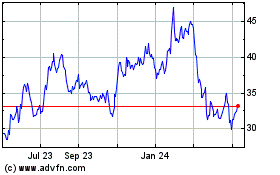

Bancorp (NASDAQ:TBBK)

Historical Stock Chart

From Apr 2023 to Apr 2024