Current Report Filing (8-k)

December 13 2016 - 5:17PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 13, 2016

RED ROBIN GOURMET BURGERS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-34851

|

|

84-1573084

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

6312 S. Fiddler’s Green Circle, Suite 200N

Greenwood Village, Colorado

|

|

80111

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code:

(303) 846-6000

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01.

Entry into a Material Definitive Agreement

The information set forth under Item 5.02 of this Form 8-K is incorporated herein by reference.

Item 5.02.

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

(c)

Appointment of Guy Constant as Executive Vice President and Chief Financial Officer

On December 13, 2016, Red Robin Gourmet Burgers, Inc. (the “Company”) announced it has hired Guy J. Constant, age 52, to serve as Executive Vice President and Chief Financial Officer, effective as of December 14, 2016 (the “Effective Date”).

Prior to joining the Company, Mr. Constant served as Chief Financial Officer, Executive Vice President of Finance, and Treasurer of Rent-A-Center, Inc. from June 2014 until December 2016. Mr. Constant served as the Chief Financial Officer and Executive Vice President of Brinker International Inc. from September 2010 to March 2014 and also served as its Principal Accounting Officer. He served as the President of Global Business Development of Brinker International, Inc., from January 2013 to March 2014. He served as Senior Vice President of Finance from May 2008 to September 2010 and Vice President of Strategic Planning and Analysis and Investor Relations from September 2005 to May 2008 and Senior Director of Compensation from November 2004 to September 2005. Prior to Brinker, he spent nine years at AMR Corporation, the parent of American Airlines, in various marketing, finance, and human resources positions of increasing scope and responsibility. He earned his Bachelor of Arts in Economics and Political Science from the University of Manitoba and a Master of Business Administration from the University of Western Ontario.

Mr. Constant is not and has not been involved in any related party transactions with the Company and does not have any family relationships with any other director, executive officer, or any persons nominated for such positions.

In connection with his appointment as Executive Vice President and Chief Financial Officer of the Company, the Company entered into an Employment Agreement with Mr. Constant dated as of December 13, 2016 (the “Employment Agreement”). Pursuant to the terms of the Employment Agreement, Mr. Constant will serve as Executive Vice President and Chief Financial Officer of the Company for an indefinite period of time until his employment is terminated in accordance with its terms. The Employment Agreement provides, among other things, for the following:

·

an annual base salary of $500,000, subject to adjustment from time to time as determined by the Board’s Compensation Committee;

2

·

a sign-on bonus of $200,000, subject to a pro-rated clawback if Mr. Constant’s employment with the Company terminates less than 24 full months after the Effective Date;

·

a target annual bonus of 70% of base salary, based on the satisfaction of certain performance targets to be determined by the Compensation Committee, with the target percentage subject to adjustment beginning in fiscal 2018;

·

sign-on equity awards consisting of (x) a stock option with a Black-Scholes grant date fair value of $400,000, (y) restricted stock units (“RSUs”) with a grant date fair value of $200,000, and (z) performance stock units (“PSUs”) representing that number of shares of the Company’s common stock (at target) equal to $400,000 divided by the closing price of the Company’s common stock on January 3, 2017 (such PSU grant will be subject to approval of the Company’s new equity incentive plan at the shareholder meeting in fiscal year 2017). The stock option and RSUs will be granted on January 3, 2017, and each award will vest over four years in substantially equal annual installments on the anniversaries of the date of grant, subject to continued employment through each such vesting date. The PSUs will be granted in the first quarter of 2017 and will cliff-vest at the end of a three-year performance cycle, generally subject to Mr. Constant’s continued employment through the applicable vesting date, with the number of awards to be issued to be determined based on achievement of EBITDA and ROIC threshold, target, or maximum objectives. Specific EBITDA and ROIC targets will be approved by the Compensation Committee of the Board in the first quarter of fiscal year 2017;

·

annual long-term incentive awards as may be approved by the Compensation Committee of the Board from time to time. Beginning with the 2018 fiscal year, the Company agreed to grant Mr. Constant a long-term incentive award with a target grant date value equal to 150% of his base salary; and

·

certain other benefits, including an annual car allowance and the right to participate in all savings, retirement, medical, welfare, and insurance plans and programs to the same extent as other senior executive employees of the Company.

Upon either Mr. Constant’s termination by the Company without cause, or by Mr. Constant for good reason (each term as defined in the Employment Agreement), Mr. Constant will receive, among other things, a severance payment equal to his annual base salary then in effect. This amount would be paid in a lump sum in cash within 60 days after the effective date of such termination. The Employment Agreement contains confidentiality, non-compete, and non-interference covenants from Mr. Constant, including a 12-month covenant not to compete with the Company and its subsidiaries (i) in a burger focused restaurant business in the United States, the Canadian provinces of

3

Alberta and British Columbia, or any other country where the Company conducts business as of the date Mr. Constant’s employment terminates or (ii) with certain casual dining and brew-centric restaurant concepts specified in the Employment Agreement or their successors.

The foregoing summary of the material terms of the Employment Agreement is qualified by reference to the full Employment Agreement, a copy of which is expected to be filed with the Company’s annual report on Form 10-K for fiscal year 2016.

Item 7.01.

Regulation FD

On December 13, 2016, the Company issued a press release announcing the appointment of Mr. Constant as the Company’s new Executive Vice President and Chief Financial Officer. A copy of this press release is furnished herewith as Exhibit 99.1 and is incorporated herein by reference to this Item 7.01.

The information set forth in this Item 7.01 including the information set forth in Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01.

Financial Statements and Exhibits

Exhibits.

99.1 Red Robin Gourmet Burgers, Inc. Press Release dated December 13, 2016.

4

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

RED ROBIN GOURMET BURGERS, INC.

|

|

|

|

|

|

|

|

|

|

Date: December 13, 2016

|

By:

|

/s/ Michael L. Kaplan

|

|

|

Name:

|

Michael L. Kaplan

|

|

|

Title:

|

Senior Vice President and Chief Legal Officer

|

5

EXHIBIT INDEX

99.1 Red Robin Gourmet Burgers, Inc. Press Release dated December 13, 2016.

6

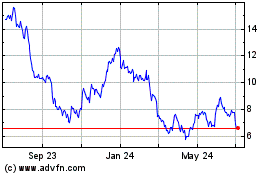

Red Robin Gourmet Burgers (NASDAQ:RRGB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Red Robin Gourmet Burgers (NASDAQ:RRGB)

Historical Stock Chart

From Apr 2023 to Apr 2024