Q2 Revenue $9.9 Million, Up 168% Year-Over-Year;

Led by Media Placement Revenue of $8.3 Million, Up 285%

Year-Over-Year

SITO Mobile Ltd. (NASDAQ:SITO), a leading mobile engagement

platform, today announced its results for the second quarter

ended June 30, 2016.

Second Quarter 2016 Business Highlights

- TOTAL REVENUE: was $9.9 million, an increase

of 168% year-over-year.

- MEDIA PLACEMENT REVENUE: (SITO Mobile’s

programmatic advertising revenue) was $8.3 million, an increase of

285% year-over-year and 71% sequentially.

- GROSS PROFIT: was $5.4 million (55% gross

margin) in Q2 2016, up from $1.8 million (51% gross margin) in Q2

2015. (Please refer to the supplemental schedule below for

calculation of Gross Profit and Gross Margin).

- ADJUSTED EBITDA: was $1.8 million for

the quarter, up from $0.1 million in Q1 and ($0.2) million in Q2 of

2015. (See attached schedule for reconciliation of Adjusted

EBITDA to GAAP)

- NET INCOME: was $0.7 million, which

equates to $0.04 earnings per share on total shares outstanding of

17.4 million.

“In the Second quarter, we produced early indications of the

kind of consistent, solid revenue growth we’re expecting as we work

towards becoming a dominant player in location-based mobile

advertising,” said Jerry Hug, CEO of SITO Mobile. “The overall

market for mobile advertising is already measured in $10’s of

billions and is growing rapidly. Mobile Media is uniquely

equipped to handle location-based ad campaigns and SITO Mobile is

emerging as a leading player in this $18 billion segment of the

mobile advertising market. SITO Mobile is creating higher levels of

mobile consumer engagement – resulting in more clients, more

campaigns and larger campaign spending commitments, as the largest

global advertisers shift significant advertising dollars to mobile.

On this foundation, we look forward to producing meaningful revenue

growth for the balance of 2016 and beyond.”

Commenting on SITO’s new Board Member, Hug added, “We’re excited

to welcome Brent Rosenthal to our Board of Directors. Brent

is an accomplished investor and business professional with an

outstanding 20+ year track record of creating shareholder value in

cable, telecom, mobile, Out-of-Home and information

companies. Most recently, he spearheaded an investment in

Rentrak Corporation (NASDAQ:RENT) where he served on the Board of

Directors from 2008 – 2016, including as the Non-Executive Chairman

from 2011 – 2016. He worked closely with management to pivot

the Company which led to a dramatic increase in market

capitalization, culminating in a merger with comScore

(NASDAQ:SCOR). Brent’s business acumen, professional network

and extensive public company Board experience will be invaluable to

our team.”

Conference call information: Date: Monday,

August 15, 2016 Time: 4:30 P.M. Eastern Time (ET) Dial in Number

for U.S. & Canadian Callers: 877-407-8293 Dial in Number for

International Callers (Outside U.S. & Canada): 201-689-8349

Participating on the call will be SITO Mobile's Chief Executive

Officer Jerry Hug and Chief Financial Officer Kurt Streams. To join

the live conference call, please dial into the above referenced

telephone numbers five to ten minutes prior to the scheduled

conference call time.

A replay will be available for 2 weeks starting on August 15,

2016 at approximately 8:00 P.M. ET. To access the replay, please

dial 877-660-6853 in the U.S. and 201-612-7415 for international

callers. The conference ID# is 13642293.

About SITO Mobile Ltd.

SITO Mobile provides a mobile engagement platform that enables

brands to increase awareness, loyalty, and ultimately sales. For

more information, visit www.sitomobile.com.

Forward-Looking Statements

This press release contains "forward-looking statements" within

the meaning of the safe harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995. Forward-looking

statements are neither historical facts nor assurances of future

performance. Instead, they are based only on our current beliefs,

expectations and assumptions regarding the future of our business,

future plans and strategies, projections, anticipated events and

trends, the economy and other future conditions. Because

forward-looking statements relate to the future, they are subject

to inherent uncertainties, risks and changes in circumstances that

are difficult to predict and many of which are outside of our

control. Our actual results and financial condition may differ

materially from those indicated in the forward-looking statements.

Therefore, you should not rely on any of these forward-looking

statements. Important factors that could cause our actual results

and financial condition to differ materially from those indicated

in the forward-looking statements include, among others, sales

growth, our reliance on brand owners and wireless carriers, the

possible need for additional capital as well as other risks

identified in our filings with the SEC. Any forward-looking

statement made by us in this press release is based only on

information currently available to us and speaks only as of the

date on which it is made. We undertake no obligation to publicly

update any forward-looking statement, whether written or oral, that

may be made from time to time, whether as a result of new

information, future developments or otherwise.

[FINANCIAL TABLES TO FOLLOW]

SITO Mobile, Ltd. UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

| |

|

For the Three Months Ended |

|

|

For the Six Months Ended |

|

|

|

|

June 30, |

|

|

June 30, |

|

|

|

|

2016 |

|

|

2015 |

|

|

2016 |

|

|

2015 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

| Media

placement |

|

$ |

8,297,880 |

|

|

$ |

2,154,030 |

|

|

$ |

13,159,380 |

|

|

$ |

3,781,530 |

|

| Wireless

applications |

|

|

1,454,428 |

|

|

|

1,387,313 |

|

|

|

2,945,078 |

|

|

|

3,391,629 |

|

| Licensing

and royalties |

|

|

125,946 |

|

|

|

139,535 |

|

|

|

261,365 |

|

|

|

274,539 |

|

| Total

revenue |

|

|

9,878,254 |

|

|

|

3,680,878 |

|

|

|

16,365,823 |

|

|

|

7,447,698 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Costs and

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of

revenue |

|

|

4,430,522 |

|

|

|

1,807,237 |

|

|

|

7,487,118 |

|

|

|

3,423,210 |

|

| Sales and

marketing |

|

|

2,662,886 |

|

|

|

905,285 |

|

|

|

4,762,905 |

|

|

|

1,781,574 |

|

| General

and administrative |

|

|

1,454,056 |

|

|

|

1,474,156 |

|

|

|

3,351,324 |

|

|

|

2,638,908 |

|

|

Depreciation and amortization |

|

|

160,444 |

|

|

|

77,361 |

|

|

|

324,804 |

|

|

|

145,442 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total costs and expenses |

|

|

8,707,908 |

|

|

|

4,264,039 |

|

|

|

15,926,151 |

|

|

|

7,989,134 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) from operations |

|

|

1,170,346 |

|

|

|

(583,161 |

) |

|

|

439,672 |

|

|

|

(541,436 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other Income

(Expense) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest

income |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

54,323 |

|

| Interest

expense |

|

|

(445,091 |

) |

|

|

(454,199 |

) |

|

|

(885,113 |

) |

|

|

(888,758 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) before income taxes |

|

|

725,255 |

|

|

|

(1,037,360 |

) |

|

|

(445,441 |

) |

|

|

(1,375,871 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Provision

for income taxes |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

725,255 |

|

|

$ |

(1,037,360 |

) |

|

$ |

(445,441 |

) |

|

$ |

(1,375,871 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings (loss) per share |

|

$ |

0.04 |

|

|

$ |

(0.07 |

) |

|

$ |

(0.02 |

) |

|

$ |

(0.09 |

) |

|

Basic weighted average shares outstanding |

|

|

17,355,478 |

|

|

|

15,404,817 |

|

|

|

17,288,445 |

|

|

|

15,385,645 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings (loss) per share |

|

$ |

0.04 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

Diluted weighted average shares outstanding |

|

|

19,831,509 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Financial Measures

This press release uses Adjusted EBITDA, a non-GAAP financial

measure. Adjusted EBITDA should not be considered a replacement

for, and should be read together with, the most comparable GAAP

financial measure, which is Operating Profit (Loss). A

reconciliation of Adjusted EBITDA to Operating Profit (Loss) is

included herein.

To supplement our financial results and guidance presented in

accordance with U.S. generally accepted accounting principles

(GAAP), the Company uses certain non-GAAP financial measures in

this press release, including EBITDA. The Company believes that

non-GAAP financial measures are helpful in understanding its past

financial performance and potential future results, particularly in

light of the effect of various acquisition transactions effected by

the Company. Non-GAAP financial measures are not meant to be

considered in isolation or as a substitute for or superior to

comparable GAAP measures and should be read in conjunction with the

consolidated financial statements prepared in accordance with

GAAP.

Management excludes stock based compensation expense because

they believe that the non-GAAP financial measures excluding this

item provide meaningful supplemental information regarding

operational performance. In particular, because of varying

available valuation methodologies, subjective assumptions and the

variety of award types that companies can use under FASB ASC 718,

we believe that providing non-GAAP financial measures that exclude

this expense allows investors to make more meaningful comparisons

between our operating results and those of other companies.

Accordingly, management believes that excluding this expense

provides investors and management with greater visibility to the

underlying performance of our business operations, facilitates

comparison of our results with other periods, and may also

facilitate comparison with the results of other companies in our

industry. Management uses Adjusted EBITDA in managing and

analyzing its business and financial condition. Management believes

that the presentation of non-GAAP financial measures provides

investors greater transparency into ongoing results of operations

allowing investors to better compare the Company's results from

period to period.

| |

|

For the Three Months Ended June

30, |

|

For the Six Months Ended June 30, |

| |

|

2016 |

|

|

2015 |

|

|

|

2016 |

|

|

|

2015 |

|

| |

|

|

|

|

|

|

|

|

| Net Income

(Loss) |

|

725,255 |

|

|

(1,037,360 |

) |

|

|

(445,441 |

) |

|

|

(1,375,871 |

) |

| Adjustments to

reconcile net income (loss) to EBITDA: |

|

|

|

|

|

|

|

|

| Depreciation and

amortization expense included in costs and expenses: |

|

|

|

|

|

|

|

|

| Amortization

included in cost of revenue |

|

271,198 |

|

|

175,001 |

|

|

|

523,693 |

|

|

|

326,412 |

|

|

Depreciation and other amortization |

|

160,444 |

|

|

77,361 |

|

|

|

324,804 |

|

|

|

145,442 |

|

| Total depreciation and

amortization expense |

|

431,642 |

|

|

252,362 |

|

|

|

848,497 |

|

|

|

471,854 |

|

| |

|

|

|

|

|

|

|

|

| Interest Income |

|

|

|

|

|

|

|

|

54,323 |

|

| Interest expense |

|

445,091 |

|

|

454,199 |

|

|

|

885,113 |

|

|

|

888,758 |

|

| Provision for income

taxes |

|

- |

|

|

- |

|

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

EBITDA |

|

1,601,988 |

|

|

(330,799 |

) |

|

|

1,288,169 |

|

|

|

39,064 |

|

| |

|

|

|

|

|

|

|

|

| Adjustments to

reconcile EBITDA: |

|

|

|

|

|

|

|

|

| Stock based

compensation expense included in costs and expenses: |

|

|

|

|

|

|

|

|

| Sales and marketing |

|

75,327 |

|

|

22,808 |

|

|

|

149,361 |

|

|

|

45,923 |

|

|

General and administrative |

|

110,604 |

|

|

124,491 |

|

|

|

410,072 |

|

|

|

251,342 |

|

| Total stock based

compensation expense |

|

185,931 |

|

|

147,299 |

|

|

|

559,433 |

|

|

|

297,265 |

|

| |

|

|

|

|

|

|

|

|

| Adjusted

EBITDA |

|

1,787,919 |

|

|

(183,500 |

) |

|

|

1,847,602 |

|

|

|

336,329 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SITO Mobile, Ltd.CONDENSED CONSOLIDATED

BALANCE SHEETS

| |

|

June 30, |

|

|

December 31, |

|

| |

|

2016 |

|

|

2015 |

|

| |

|

(Unaudited) |

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

| Cash and

cash equivalents |

|

$ |

1,682,785 |

|

|

$ |

2,615,184 |

|

| Accounts

receivable, net |

|

|

8,819,725 |

|

|

|

6,167,816 |

|

| Other

prepaid expenses |

|

|

91,055 |

|

|

|

123,692 |

|

|

|

|

|

|

|

|

|

|

|

|

Total current assets |

|

|

10,593,565 |

|

|

|

8,906,692 |

|

|

|

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

|

492,010 |

|

|

|

585,356 |

|

|

|

|

|

|

|

|

|

|

|

|

Other assets |

|

|

|

|

|

|

|

|

|

Capitalized software development costs, net |

|

|

1,846,330 |

|

|

|

1,600,813 |

|

|

Intangible assets: |

|

|

|

|

|

|

|

|

|

Patents |

|

|

406,546 |

|

|

|

445,473 |

|

| Patent

applications cost |

|

|

928,969 |

|

|

|

897,087 |

|

| Other

intangible assets, net |

|

|

1,574,507 |

|

|

|

1,714,477 |

|

|

Goodwill |

|

|

6,444,225 |

|

|

|

6,444,225 |

|

| Deferred

loan costs, net |

|

|

56,520 |

|

|

|

78,116 |

|

| Other

assets including security deposits |

|

|

108,938 |

|

|

|

84,829 |

|

|

|

|

|

|

|

|

|

|

|

|

Total other assets |

|

|

11,366,035 |

|

|

|

11,265,020 |

|

|

|

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

22,451,610 |

|

|

$ |

20,757,068 |

|

| |

|

|

|

|

|

|

|

|

CONDENSED CONSOLIDATED BALANCE SHEETS

| |

|

June 30, |

|

|

December 31, |

|

| |

|

2016 |

|

|

2015 |

|

| |

|

(Unaudited) |

|

|

|

|

| |

|

|

|

|

|

|

| Liabilities and

Stockholders' Equity |

|

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

|

| Accounts

payable |

|

$ |

6,837,561 |

|

|

$ |

4,828,600 |

|

| Accrued

expenses |

|

|

1,795,234 |

|

|

|

1,277,896 |

|

| Deferred

revenue |

|

|

563,976 |

|

|

|

532,909 |

|

| Current

obligations under capital lease |

|

|

3,320 |

|

|

|

11,699 |

|

| Note

payable, net - current portion |

|

|

2,068,450 |

|

|

|

3,984,219 |

|

|

|

|

|

|

|

|

|

|

|

|

Total current liabilities |

|

|

11,268,541 |

|

|

|

10,635,323 |

|

|

|

|

|

|

|

|

|

|

|

|

Long-term liabilities |

|

|

|

|

|

|

|

|

|

Obligations under capital lease |

|

|

4,510 |

|

|

|

6,201 |

|

| Note

payable |

|

|

5,315,989 |

|

|

|

4,934,966 |

|

|

|

|

|

|

|

|

|

|

|

|

Total long-term liabilities |

|

|

5,320,499 |

|

|

|

4,941,167 |

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities |

|

|

16,589,040 |

|

|

|

15,576,490 |

|

|

|

|

|

|

|

|

|

|

|

|

Commitments and contingencies - See notes 17 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' Equity |

|

|

|

|

|

|

|

|

| Preferred

stock, $.0001 par value, 5,000,000 shares

authorized; none outstanding |

|

|

- |

|

|

|

- |

|

| Common

stock, $.001 par value; 100,000,000 shares

authorized, 17,357,520 shares issued and outstanding as of

June 30, 2016 and $.001 par value; 300,000,000 shares

authorized, 17,157,520 shares issued and outstanding as of

December 31, 2015 |

|

|

17,3576 |

|

|

|

17,156 |

|

|

Additional paid-in capital |

|

|

145,665,480 |

|

|

|

144,538,247 |

|

|

Accumulated deficit |

|

|

(139,820,266 |

) |

|

|

(139,374,825 |

) |

|

|

|

|

|

|

|

|

|

|

|

Total stockholders' equity |

|

|

5,862,570 |

|

|

|

5,180,578 |

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders'

equity |

|

$ |

22,451,610 |

|

|

$ |

20,757,068 |

|

| |

|

|

|

|

|

|

|

|

SITO Mobile, Ltd.UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

| |

|

For the Three Months Ended |

|

|

|

|

June 30, |

|

|

|

|

2016 |

|

|

2015 |

|

| |

|

|

|

|

|

|

| Cash Flows from

Operating Activities |

|

|

|

|

|

|

| Net

income (loss) |

|

$ |

725,255 |

|

|

$ |

(1,037,364 |

) |

|

Adjustments to reconcile net income (loss) to net cash provided by

(used in) operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation expense |

|

|

43,263 |

|

|

|

35,419 |

|

|

Amortization expense - software development costs |

|

|

271,199 |

|

|

|

175,001 |

|

|

Amortization expense - patents |

|

|

49,431 |

|

|

|

43,645 |

|

|

Amortization expense - discount of debt |

|

|

198,910 |

|

|

|

152,585 |

|

|

Amortization expense - deferred costs |

|

|

9,432 |

|

|

|

13,334 |

|

|

Amortization expense - intangible assets |

|

|

67,750 |

|

|

|

- |

|

| Provision

for bad debt |

|

|

95,005 |

|

|

|

- |

|

| Loss on

disposition of assets |

|

|

- |

|

|

|

- |

|

| Stock

based compensation |

|

|

185,931 |

|

|

|

147,299 |

|

| Changes

in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

(Increase) in accounts receivable, net |

|

|

(2,675,931 |

) |

|

|

(794,502 |

) |

| Decrease

(increase) in prepaid expenses |

|

|

42,649 |

|

|

|

(134,211 |

) |

|

(Increase) decrease in other assets |

|

|

(10,794 |

) |

|

|

(250 |

|

| Increase

(decrease) in accounts payable |

|

|

2,375,634 |

|

|

|

(1,032,077 |

) |

| Increase

(decrease) in accrued expenses |

|

|

234,611 |

|

|

|

129,690 |

) |

|

Increase in deferred revenue |

|

|

249,054 |

|

|

|

308,669 |

|

| Increase

in accrued interest |

|

|

60,474 |

|

|

|

83,513 |

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) operating

activities |

|

|

921,873 |

|

|

|

(1,909,249 |

) |

| |

|

|

|

|

|

|

|

|

| Cash Flows from

Investing Activities |

|

|

|

|

|

|

|

|

| Patents

and patent applications costs |

|

|

(41,449 |

) |

|

|

(74,148 |

) |

| Purchase

of property and equipment |

|

|

(9,852 |

) |

|

|

(225,000 |

) |

|

Capitalized software development costs |

|

|

(342,673 |

) |

|

|

(340,350 |

) |

| |

|

|

|

|

|

|

|

|

|

Net cash used in investing activities |

|

$ |

(393,974 |

) |

|

$ |

(639,498 |

) |

| |

|

|

|

|

|

|

|

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS

| |

|

For the Three Months Ended |

|

|

|

|

June 30, |

|

|

|

|

2016 |

|

|

2015 |

|

| Cash Flows from

Financing Activities |

|

|

|

|

|

|

|

Repayments on related party loans |

|

|

- |

|

|

|

525,000 |

|

| Principal

reduction on obligation under capital lease |

|

|

(3,564 |

) |

|

|

(4,911 |

) |

| Principal

reduction on repayment of debt |

|

|

(525,000 |

) |

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

Net cash (used in) provided by financing

activities |

|

|

(528,564 |

) |

|

|

520,089 |

|

|

|

|

|

|

|

|

|

|

|

|

Net decrease in cash and cash equivalents

|

|

|

(665 |

) |

|

|

(2,028,658 |

) |

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents - beginning of period

|

|

|

1,683,450 |

|

|

|

4,815,907 |

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents - ending of period

|

|

$ |

1,682,785 |

|

|

$ |

2,787,249 |

|

| |

|

|

|

|

|

|

|

|

| Supplemental

Information: |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Interest

expense paid |

|

$ |

115,812 |

|

|

$ |

204,685 |

|

| Income

taxes paid |

|

$ |

17,729 |

|

|

$ |

4,600 |

|

| SITO Mobile, Ltd. |

| Supplemental Schedule |

| Amounts in thousands except

percentages |

| |

June 30, 2015 |

|

September 30, 2015 |

|

December 31, 2015 |

|

Fiscal Year 2015 |

|

March 31, 2016 |

|

June 30, 2016 |

| |

Reported |

|

Adjusted |

|

Reported |

|

Adjusted |

|

Reported |

|

Reported |

|

Adjusted |

|

Reported |

|

Reported |

|

Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Media

placement |

|

2,154 |

|

|

|

2,154 |

|

|

|

3,023 |

|

|

|

3,023 |

|

|

|

5,345 |

|

|

|

12,150 |

|

|

|

12,150 |

|

|

|

4,862 |

|

|

|

8,298 |

|

| Wireless

Applications |

|

1,387 |

|

|

|

1,387 |

|

|

|

1,347 |

|

|

|

1,347 |

|

|

|

1,622 |

|

|

|

6,360 |

|

|

|

6,360 |

|

|

|

1,491 |

|

|

|

1,454 |

|

| Licensing

and royalties |

|

140 |

|

|

|

140 |

|

|

|

144 |

|

|

|

144 |

|

|

|

245 |

|

|

|

664 |

|

|

|

664 |

|

|

|

135 |

|

|

|

126 |

|

|

Total Revenue |

|

3,681 |

|

|

|

3,681 |

|

|

|

4,514 |

|

|

|

4,514 |

|

|

|

7,212 |

|

|

|

19,174 |

|

|

|

19,174 |

|

|

|

6,488 |

|

|

|

9,878 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of

Revenue |

|

1,445 |

|

|

|

1,807 |

|

|

|

1,513 |

|

|

|

2,164 |

|

|

|

3,449 |

|

|

|

7,987 |

|

|

|

9,064 |

|

|

|

3,057 |

|

|

|

4,431 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross

Profit |

|

2,236 |

|

|

|

1,874 |

|

|

|

3,001 |

|

|

|

2,350 |

|

|

|

3,763 |

|

|

|

11,187 |

|

|

|

10,110 |

|

|

|

3,431 |

|

|

|

5,448 |

|

|

Gross Margin |

|

61 |

% |

|

|

51 |

% |

|

|

66 |

% |

|

|

52 |

% |

|

|

52 |

% |

|

|

58 |

% |

|

|

53 |

% |

|

|

53 |

% |

|

|

55 |

% |

| Operating

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| General and

administrative |

|

1,459 |

|

|

|

1,474 |

|

|

|

2,241 |

|

|

|

2,254 |

|

|

|

1,584 |

|

|

|

6,439 |

|

|

|

6,476 |

|

|

|

1,897 |

|

|

|

1,454 |

|

| Sales &

marketing |

|

1,268 |

|

|

|

906 |

|

|

|

1,849 |

|

|

|

1,198 |

|

|

|

1,877 |

|

|

|

5,906 |

|

|

|

4,829 |

|

|

|

2,100 |

|

|

|

2,663 |

|

| Research and

development |

|

15 |

|

|

|

- |

|

|

|

13 |

|

|

|

- |

|

|

|

0 |

|

|

|

37 |

|

|

|

- |

|

|

|

0 |

|

|

|

0 |

|

| Loss on

impairment of long-lived asset |

|

- |

|

|

|

- |

|

|

|

831 |

|

|

|

831 |

|

|

|

0 |

|

|

|

831 |

|

|

|

831 |

|

|

|

0 |

|

|

|

0 |

|

| Depreciation

& amortization |

|

77 |

|

|

|

77 |

|

|

|

209 |

|

|

|

209 |

|

|

|

219 |

|

|

|

573 |

|

|

|

573 |

|

|

|

164 |

|

|

|

160 |

|

| Total Operating

Expenses |

|

2,819 |

|

|

|

2,457 |

|

|

|

5,143 |

|

|

|

4,492 |

|

|

|

3,680 |

|

|

|

13,786 |

|

|

|

12,709 |

|

|

|

4,161 |

|

|

|

4,276 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (Loss) from

Operations |

|

(583 |

) |

|

|

(583 |

) |

|

|

(2,142 |

) |

|

|

(2,142 |

) |

|

|

83 |

|

|

|

(2,599 |

) |

|

|

(2,599 |

) |

|

|

(730 |

) |

|

|

1,171 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note: Certain reclassifications have been made to conform the

fiscal 2015 quarterly amounts to the fiscal 2016 classifications

for comparative purposes. The Company is reporting a vendor cost in

cost or revenue that had been previously reported in sales and

marketing expense and is reporting research and development cost in

general and administrative expense. The changes are only expense

reclassifications and do not affect revenue, total costs and

revenues, income (loss) from operations, net income or any balance

sheet accounts. Amounts affected by the reclassification are shown

in bold in the table above.

Contact:

Investor Relations:

Joseph Wilkinson

SVP Investor Relations

Joseph.Wilkinson@sitomobile.com

Media Relations:

Alexandra Levy

Silicon Alley Media

alex@siliconalley-media.com

RELATED LINKS

http://www.sitomobile.com

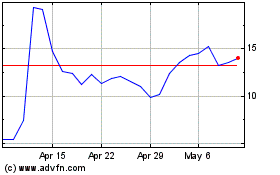

Rent the Runway (NASDAQ:RENT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rent the Runway (NASDAQ:RENT)

Historical Stock Chart

From Apr 2023 to Apr 2024