SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of

the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

|

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

☒

|

Definitive Proxy Statement

|

|

|

|

|

☐

|

Definitive Additional Materials

|

|

|

|

|

☐

|

Soliciting Material Pursuant to § 240.14a-12

|

PCTEL, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

(5)

|

Total fee paid:

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing Party:

|

|

|

(4)

|

Date Filed:

|

NOTICE

OF ANNUAL MEETING OF STOCKHOLDERS

|

|

Tuesday, June 14, 2016

4:30 p.m.

|

|

|

To

Our Stockholders:

The

2016 annual meeting of stockholders of PCTEL, Inc., a Delaware corporation, will be held on Tuesday, June 14, 2016 at 4:30 p.m.

local time at Millennium Broadway Hotel, 145 West 44th Street, New York, New York 10036 for the following purposes:

|

|

1.

|

The

election of the two Class II director nominees named in the proxy statement to serve

as directors for three-year terms that will expire at the 2019 annual meeting of stockholders;

|

|

|

2.

|

A

non-binding advisory vote to approve the Company’s named executive officer compensation;

|

|

|

3.

|

The

ratification of the appointment of Grant Thornton LLP as the Company’s independent

registered public accounting firm for the fiscal year ending December 31, 2016; and

|

|

|

4.

|

The

transaction of such other business as may properly come before the meeting or any adjournment

or postponement thereof.

|

The

foregoing items of business are more fully described in the proxy statement accompanying this notice. Only stockholders of record

at the close of business on April 20, 2016 are entitled to notice of and to vote at the meeting.

Pursuant

to the rules promulgated by the Securities and Exchange Commission, we have elected to provide access to our proxy materials over

the Internet. Accordingly, we will mail, on or about May 4, 2016, a Notice of Internet Availability of Proxy Materials to our

stockholders of record and beneficial owners at the close of business on April 20, 2016. On the date of mailing of the Notice

of Internet Availability of Proxy Materials, all stockholders and beneficial owners will have the ability to access all of the

proxy materials on a website referred to in the Notice of Internet Availability of Proxy Materials. These proxy materials will

be available free of charge.

Your

participation in the annual meeting is important. You can vote by telephone, Internet or, if you request that proxy materials

be mailed to you, by completing and signing the proxy card enclosed with those materials and returning it in the envelope provided.

If you wish to attend the meeting in person, you must bring evidence of your ownership as of April 20, 2016, or a valid proxy

showing that you are representing a shareholder.

All

stockholders are cordially invited to attend the meeting in person. However, to assure your representation at the meeting, you

are urged to deliver your proxy by telephone or the Internet or to mark, sign, date and return the proxy card as promptly as possible.

Any stockholder attending the meeting may vote in person, even if he or she has previously returned a proxy.

|

|

Sincerely,

|

|

|

|

|

|

|

|

|

MARTIN H. SINGER

|

|

|

Chief Executive Officer and

Chairman of the Board of Directors

|

Bloomingdale,

IL

May

4, 2016

|

|

|

YOUR VOTE IS IMPORTANT.

|

|

|

PLEASE SUBMIT YOUR PROXY AS PROMPTLY AS POSSIBLE

BY FOLLOWING THE INSTRUCTIONS LOCATED ON

THE NOTICE OF INTERNET

AVAILABILITY OF PROXY MATERIALS OR THE PROXY CARD.

|

|

|

|

Important

Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be held on June 14, 2016: The Proxy Statement

and Annual Report to Stockholders for the fiscal year ended December 31, 2015 are available electronically free of charge

at

http://www.proxyvote.com

.

|

|

|

PCTEL,

INC.

471

Brighton Drive

Bloomingdale,

Illinois 60108

PROXY STATEMENT FOR THE

2016

ANNUAL MEETING OF STOCKHOLDERS

|

GENERAL

INFORMATION

The

Board of Directors of PCTEL, Inc. is soliciting proxies for the 2016 annual meeting of stockholders. This proxy statement contains

important information for you to consider when deciding how to vote on the matters brought before the meeting. Please read it

carefully.

Our

Board of Directors has set April 20, 2016 as the record date for the meeting. Stockholders of record at the close of business

on April 20, 2016 are entitled to vote at and attend the meeting, with each share entitled to one vote. There were 17,264,586

shares of our common stock outstanding on the record date. On the record date, the closing price of our common stock on the NASDAQ

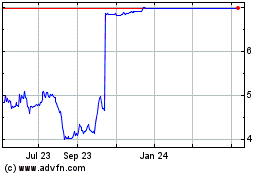

Select Global Market was $4.65 per share.

This

proxy statement is made available on or about May 4, 2016 to stockholders entitled to vote at the meeting.

In this proxy statement:

|

|

•

|

“We,”

“Company” and “PCTEL” each means PCTEL, Inc.

|

|

|

•

|

If

you hold shares in “street name,” it means that your shares are held in an account at a brokerage firm, bank, broker

dealer or other similar organization and record ownership is not in your name.

|

|

|

•

|

“SEC”

means the Securities and Exchange Commission.

|

|

|

•

|

“Beneficial

ownership” of stock is defined under various SEC rules in different ways for different

purposes, but it generally means that, although you (or the person or entity in question)

do not hold the shares of record in your name, you do have investment or voting control,

and/or an economic or “pecuniary” interest, in the shares through an agreement,

relationship or the like.

|

QUESTIONS

AND ANSWERS

|

|

Q:

|

When

and where is the stockholder meeting?

|

|

|

A:

|

Our

annual meeting of stockholders is being held on Tuesday, June 14, 2016 at 4:30 p.m. local time at Millennium Broadway Hotel, located

at 145 West 44th Street, New York, New York 10036.

|

|

|

Q:

|

Why

did I receive a “Notice Regarding the Availability of Proxy Materials”?

|

|

|

A:

|

We

are furnishing proxy materials to our stockholders primarily via the Internet, instead

of mailing printed copies of those materials to each stockholder. By doing so, we save

costs and reduce the environmental impact of our annual meeting. On or about May 4, 2016,

we mailed a Notice Regarding the Availability of Proxy Materials (the “Notice of

Availability”) to certain of our stockholders. The Notice of Availability contains

instructions on how to access our proxy materials and vote online or how to vote in person

or by mail. The Notice of Availability also contains a control number that you will need

to vote your shares.

|

|

|

Q:

|

How

do I request paper copies of the proxy materials?

|

|

|

A:

|

You

may request, free of charge, paper copies of the proxy materials for the annual meeting

by following the instructions listed on the Notice of Availability. In addition, we will

provide you, free of charge, a copy of our Annual Report on Form 10-K,

upon written request sent to PCTEL, Inc., 471 Brighton Drive, Bloomingdale, Illinois 60108, Attention: John W. Schoen, Corporate

Secretary.

|

|

|

Q:

|

What

information is included in this proxy statement?

|

|

|

A:

|

This

proxy statement describes issues on which we would like you, as a stockholder, to vote.

It also gives you information on these issues so that you can make an informed decision.

This proxy statement also outlines the means by which you can vote your shares.

|

|

|

A:

|

The

Board is requesting your proxy. Giving your proxy means that you authorize the persons

named as proxies therein (Martin H. Singer and John W. Schoen) to vote your shares at

the annual meeting in the manner you specify in your proxy (or to exercise their discretion

as described herein). If you hold your shares as a record holder and submit a proxy but

do not specify how to vote on a proposal, the persons named as proxies will vote your

shares in accordance with the Board’s recommendations. The Board has recommended

that stockholders vote FOR the election of each of the director nominees listed in Proposal

#1, FOR the non-binding, advisory vote to approve our named executive officer compensation

in Proposal #2;

and FOR ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal

year ending December 31, 2016 in Proposal #3. Giving your proxy also means that you authorize the persons named as proxies to

vote on any other matter properly presented at the annual meeting in such manner as they determine. We are not aware of any other

matters to be presented at the annual meeting as of the date of this proxy statement.

|

|

|

Q:

|

What

is the difference between holding shares as a beneficial owner in street name and as a stockholder of record?

|

|

|

A:

|

If

your shares are held in street name through a broker, bank, trustee or other nominee,

you are considered the beneficial owner of shares held in street name. As the beneficial

owner, you have the right to direct your broker, bank, trustee or other nominee how to

vote your shares.

|

|

|

|

If your shares are registered directly in your name, you are

considered to be a stockholder of record with respect to those shares. As a stockholder of record, you have the right to

grant your voting proxy directly to the Company or to a third party, or to vote in person at the annual meeting.

|

|

|

A:

|

You

are being asked to vote on the following proposals:

|

|

|

•

|

The

election of the two Class II director nominees named in this proxy statement to serve

as directors for three-year terms that will expire at the 2019 annual meeting of stockholders

(Proposal #1);

|

|

|

•

|

A

non-binding advisory vote to approve the Company’s named executive officer compensation (Proposal #2); and

|

|

|

•

|

The

ratification of the appointment of Grant Thornton LLP as the Company’s independent

registered public accounting firm for the fiscal year ending December 31, 2016 (Proposal

#3).

|

|

|

A:

|

If

you are a stockholder of record, you may vote by proxy or in person at the annual meeting.

If you received a paper copy of the proxy materials by mail, you may vote your shares

by proxy by doing any one of the following: (1) by voting online at the Internet site

address listed on your proxy card; (2) calling the toll-free number listed on your proxy

card; or (3) mailing your signed and dated proxy card in the self-addressed envelope

provided. If you received only the Notice of Availability by mail, you may vote your

shares online at the Internet site address listed on your Notice of Availability or in

person at the annual meeting. You may also request a paper copy of our proxy materials

by following the procedures outlined above or in the Notice of Availability. Even if

you plan to attend the annual meeting, we recommend that you vote by proxy prior to the

annual meeting. You can always change your vote as described below.

|

|

|

|

If you hold your shares in street name, you should follow the

voting instructions provided to you by the organization that holds your shares. If you hold your shares in street name and

plan to attend the annual meeting and vote in person, you must bring a legal proxy from the stockholder of record indicating

that you were the beneficial owner of the shares on the record date in order to vote in person.

|

|

|

Q:

|

What

does it mean if I receive more than one Notice of Availability or set of proxy materials?

|

|

|

A:

|

You

may receive more than one Notice of Availability or more than one paper copy of the proxy materials, depending on how you hold

your shares. For example, if you hold your shares in more than one brokerage account, you may receive a separate Notice of Availability

or a separate set of proxy materials for each brokerage account in which you hold your shares. To vote all of your shares by proxy,

you must vote at the Internet site address listed on the Notice of Availability or your proxy card, call the toll-free number

listed on your proxy card, or sign, date and return each proxy card that you receive.

|

|

|

Q:

|

What

if I change my mind after I return my proxy?

|

|

|

A:

|

You

may revoke your proxy (that is, cancel it) and change your vote at any time prior to

the voting at the annual meeting by providing written notice to our Corporate Secretary

at the following address: 471 Brighton Drive, Bloomingdale, Illinois 60108,

Attention: John W. Schoen, Corporate Secretary.

You may also do this by:

|

|

|

•

|

Signing

and returning another proxy card with a later date;

|

|

|

•

|

Voting

in person at the meeting; or

|

|

|

•

|

Voting

via the Internet or by telephone on a date after the date on your proxy (your latest proxy is counted).

|

|

|

Q:

|

What

is a “broker non-vote”?

|

|

|

A:

|

Under

the rules that govern brokers who have record ownership of shares that are held in “street

name” for their clients (who are the beneficial owners of the shares), brokers

have the discretion to vote such shares on routine matters (such as the ratification

of the appointment of our independent registered public accounting firm, Proposal #3),

but not on non-routine matters (such as the election of directors (Proposal #1) and the

non-binding advisory vote to approve the Company’s named executive officer compensation

(Proposal #2)) without specific instructions from their clients. The vote with respect

to any non-routine matter is referred to as a “broker non-vote.” Thus, because

the proposals to be acted upon at the meeting consist of both routine and non-routine

matters, the broker may turn in a proxy card for uninstructed shares that vote FOR the

routine matter, but expressly states that the broker is NOT voting on the non-routine

matters. A broker non-vote may also occur with respect to routine matters if the broker

expressly instructs on the proxy card that it is not voting on a certain matter.

|

|

|

Q:

|

How

are broker non-votes counted?

|

|

|

A:

|

Broker

non-votes are counted for the purpose of determining the presence or absence of a quorum,

but are not counted for determining the number of votes cast for or against a proposal,

whether such proposal is a routine or non-routine matter.

|

|

|

Q:

|

Will

my shares be voted if I do not submit a proxy?

|

|

|

A:

|

Stockholders

of record —

If you are a stockholder of record and you do not cast your vote,

no votes will be cast on your behalf on any of the items of business at the annual meeting.

|

|

|

|

Beneficial owners —

If you hold your shares in

street name, it is critical that you cast your vote if you want it to count in the election of directors (Proposal #1) and

the advisory vote to approve the Company’s named executive officer compensation (Proposal #2), both of which are

considered “non-routine” matters. If you do not provide the organization that holds your shares with specific

voting instructions, under the rules of the NASDAQ Select Global Market (“NASDAQ”), the organization that holds

your shares cannot vote on non-routine matters. This is generally referred to as a “broker non-vote.”

The organization that holds your shares will, however, continue to have discretion to vote any uninstructed shares on the

ratification of the appointment of our independent registered public accounting firm (Proposal #3), which is considered a

“routine” matter.

|

|

|

Q:

|

How

do I attend the Annual Meeting?

|

|

|

A:

|

The

2016 annual meeting of stockholders will be held on Tuesday, June 14, 2016, at Millennium Broadway Hotel, 145 West 44th Street,

New York, New York 10036 at 4:30 p.m. local time.

|

|

|

Q:

|

How

many votes can be cast at the meeting?

|

|

|

A:

|

As

of the record date, 17,264,586 shares of PCTEL common stock were outstanding. Each outstanding

share of common stock entitles the holder of such share to one vote on all matters covered

in this proxy statement. Therefore, there are a maximum of 17,264,586 votes that may

be cast at the meeting.

|

|

|

A:

|

A

“quorum” is the number of shares that must be present, in person or by proxy,

in order for business to be transacted at the meeting. The required quorum for the annual

meeting is a majority of the shares outstanding on the record date. There must be a quorum

present for the meeting to be held. All completed and signed proxy cards, Internet votes,

telephone votes and votes cast by those stockholders who attend the annual meeting in

person, whether representing a vote FOR, AGAINST, ABSTAIN, or a broker non-vote, will

be counted toward the quorum.

|

|

|

Q:

|

What

is the required vote for each of the proposals to pass?

|

|

|

A:

|

Election

of the two director nominees under Proposal #1 requires the affirmative vote of the holders

of a plurality of the common stock present, represented and entitled to vote at the annual

meeting. Broker non-votes and proxies marked WITHHOLD AUTHORITY will not be counted toward

the election of directors or toward the election of individual nominees and, thus, will

have no effect other than that they will be counted for establishing a quorum.

|

|

|

|

The proposal to approve the resolution regarding the

Company’s named executive officer compensation under Proposal #2 requires the affirmative vote of the holders of a

majority of the common stock present, represented and entitled to vote at the annual meeting. Stockholders may vote FOR,

AGAINST or ABSTAIN on Proposal #2. Broker non-votes will not be counted for the purposes of determining whether Proposal #2

has been approved. Abstentions will be counted as present and entitled to vote for purposes of Proposal #2 and,

therefore, will have the same effect as a vote against Proposal #2.

|

|

|

|

The ratification of the appointment of Grant Thornton LLP as our

independent registered public accounting firm under Proposal #3 requires the affirmative vote of the holders of a majority of

the common stock present, represented and entitled to vote at the annual meeting. Stockholders may vote FOR, AGAINST or

ABSTAIN on Proposal #4. Abstentions will be counted as present and entitled to vote for purposes of Proposal #3 and,

therefore, will have the same effect as a vote against Proposal #3.

|

|

|

Q:

|

Who

is soliciting my vote?

|

|

|

A:

|

PCTEL

is making this proxy solicitation and will bear the entire cost of it, including the

preparation, assembly, printing, posting and mailing of proxy materials. PCTEL may reimburse

brokerage firms and other custodians for their reasonable out-of-pocket expenses for

forwarding these proxy materials to you. PCTEL expects Broadridge Financial Solutions,

Inc. to tabulate the proxies and to act as the inspector of the election. In addition

to this solicitation, proxies may be solicited by the Company’s directors, officers

and other employees by telephone, the Internet or fax, in person or otherwise. None of

these persons will receive any additional compensation for assisting in the solicitation.

|

Deadline

for Receipt of Stockholder Proposals and Nominations for 2017 Annual Meeting of Stockholders

Stockholders

are entitled to present proposals for action and director nominations at the 2017 annual meeting of stockholders only if they

comply with applicable requirements of the proxy rules established by the SEC and the applicable provisions of our bylaws. Stockholders

must ensure that such proposals and nominations are received by our Corporate Secretary at the following address: 471 Brighton

Drive, Bloomingdale, Illinois 60108, Attention: John W. Schoen, Corporate Secretary, on or prior to the deadline for receiving

such proposals and nominations.

Proposals

for the 2017 annual meeting of stockholders that are intended to be considered for inclusion in the proxy statement and form of

proxy relating to such meeting must be received no later than January 4, 2017, and must comply with the procedures of Rule 14a-8

under the Securities Exchange Act of 1934 (the “Exchange Act”) and the provisions of our bylaws.

If

a stockholder intends to submit a proposal or director nomination for consideration at our 2017 annual meeting of stockholders

outside the procedures of Rule 14a-8 under the Exchange Act, the stockholder must comply with the requirements of our bylaws.

We are not currently required to include such a proposal or nomination in the proxy statement and form of proxy relating to such

meeting. Our bylaws contain an advance notice provision that requires stockholders to submit a written notice containing certain

information not less than 120 days prior to the date of our proxy statement for the previous year’s annual meeting of stockholders.

For purposes of the 2017 annual meeting of stockholders, this means that such proposals or nominations must also be received by

January 4, 2017. A copy of the relevant bylaw provision is available upon written request to our Corporate Secretary at the address

provided above.

Discretionary

Voting Authority

The

accompanying proxy card grants the proxy holders discretionary authority to vote on any business raised at the annual

meeting. If you fail to comply with the advance notice provisions set forth above in submitting a proposal or nomination for

the 2017 annual meeting of stockholders, the proxy holders will be allowed to use their discretionary voting authority if

such a proposal or nomination is raised at that meeting.

SUMMARY

OF PROPOSALS

The

Board of Directors has included three proposals on the agenda for our 2016 annual meeting of stockholders. The following is a

brief summary of the matters to be considered and voted upon by the stockholders.

Proposal

#1

: Election of Directors

The

Company has a classified Board of Directors. Each director serves a three-year term. The first proposal on the agenda for the

annual meeting is the election of two Class II directors to serve until the 2019 annual meeting of stockholders. The Board of

Directors has nominated Gina Haspilaire and M. Jay Sinder to serve as the Class II directors. Additional information about the

election of directors and a biography of each nominee begins on page 6.

The

Board of Directors recommends a vote “FOR” each of the two nominees.

Proposal #2

: Advisory Vote to Approve

the Company’s Named Executive Officer Compensation

The

Company is providing its stockholders with the opportunity to cast a non-binding advisory vote on the Company’s proposed

compensation for its named executive officers, as described in this proxy statement, in accordance with SEC rules. The Company’s

overall philosophy is to offer competitive compensation opportunities that enable the Company to attract, motivate and retain

highly experienced executive officers who will provide leadership for the Company’s success and enhance stockholder value.

The Company believes that its compensation for named executive officers, which includes short-term and long-term elements, fulfills

this goal and is closely aligned with the long-term interests of its stockholders. More information about this proposal begins

on page 10.

The

Board of Directors recommends a vote “FOR” approval of the Company’s

Named

Executive Officer Compensation.

Proposal

#3

: Ratification of the appointment of the Independent Registered Public Accounting Firm

The

third proposal on the agenda for the annual meeting is the ratification of the appointment of Grant Thornton LLP as the Company’s

independent registered public accounting firm for the fiscal year ending December 31, 2016. More information about this proposal

begins on page 11.

The

Board of Directors recommends a vote “FOR” the ratification of the appointment

of Grant Thornton LLP as the independent

registered public accounting firm.

Other

Matters

Other

than the proposals listed above, the Board of Directors does not currently intend to present any other matters to be voted on

at the meeting. The Board of Directors is not currently aware of any other matters that will be presented by others for action

at the meeting. However, if other matters are properly presented at the meeting and you have signed and returned your proxy card

or voted on the Internet or by telephone, the proxies will have discretion to vote your shares on these matters to the extent

authorized under the Exchange Act.

PROPOSAL

#1

ELECTION

OF DIRECTORS

Classification

of Board of Directors

PCTEL

has a classified Board of Directors, currently consisting of three classes. At each annual meeting of stockholders, one

class of directors is elected for a term of three years to succeed those directors whose terms expire on the annual meeting

date. There are currently three Class I directors whose terms will expire at the 2018 annual stockholder meeting, two Class

II directors whose terms are expiring at this 2016 stockholder annual meeting, and three Class III directors whose terms are

expiring at the 2017 annual stockholder meeting. In order to create continuity on the Board of Directors in anticipation of a

planned retirement at this 2016 annual meeting of Carl Thomsen, who has served as a Class II director since 2001, in November

2015 the number of directors was expanded to eight and the Board of Directors appointed Ms. Gina Haspilaire as the third

Class I director. The Board has nominated Ms. Haspilaire to fill the Class II vacancy. The result of her nomination is to

change Ms. Haspilaire from a Class I director to a Class II director, to reduce the number of directors from eight to seven,

and to return the configuration of the Board to two directors in Classes I and II and three directors in Class III. The

nominees for Class II directors are indicated in the section “Nominees” immediately below.

Nominees

On

the recommendation of the Board of Directors, the nominees for election at the 2016 annual meeting of stockholders as Class II

directors are Gina Haspilaire and M. Jay Sinder whose biographies are set forth in “Directors and Nominees” below.

If elected, each of the nominees will continue as a director until the expiration of the term at the annual meeting of stockholders

in 2019.

The

proxy holders may not vote the proxies for a greater number of persons than the number of nominees named. Unless otherwise instructed,

the proxy holders will vote the proxies received by them for the two Class II director nominees. In the event that either of the

nominees is unable or declines to serve as a director at the time of the annual meeting, the proxies will be voted for any nominee

who shall be designated by the present Board of Directors to fill the vacancy. We are not aware of any nominee who will be unable

or will decline to serve as a director.

Vote

Required and Board of Director’s Recommendation

If

a quorum is present and voting, the two nominees receiving the highest number of votes will be elected to the Board of

Directors. Abstentions and “broker non-votes” are not counted in the election of directors.

The

Board of Directors has approved the director nominees and recommends

that

stockholders vote “FOR” the election of each of the director nominees listed above.

Directors

and Nominees

The

following table sets forth certain information regarding the current directors and director nominees to be elected at the 2016

annual meeting of stockholders:

|

Name

|

|

Age

|

|

Position with PCTEL

|

|

Since

|

|

Class I directors whose terms will expire at the 2018 annual meeting of stockholders:

|

|

|

|

|

|

|

|

Cindy K. Andreotti

|

|

60

|

|

Director

|

|

2013

|

|

Brian J. Jackman

|

|

75

|

|

Director

|

|

2002

|

|

|

|

|

|

|

|

|

|

Class II director nominees to be elected at the 2016 annual meeting of stockholders whose terms will expire at the 2019 annual meeting of stockholders:

|

|

|

|

|

|

|

|

Gina Haspilaire

|

|

53

|

|

Director/Nominee

|

|

2015

|

|

M. Jay Sinder

|

|

49

|

|

Director/Nominee

|

|

2014

|

|

|

|

|

|

|

|

|

|

Class III director nominees whose terms will expire at the 2017 annual meeting of stockholders:

|

|

|

|

|

|

|

|

Steven D. Levy

|

|

59

|

|

Director

|

|

2006

|

|

Giacomo Marini

|

|

64

|

|

Director

|

|

1996

|

|

Martin H. Singer

|

|

64

|

|

Chief Executive Officer,

Chairman of the Board

|

|

1999

|

Class

I Directors

Ms.

Andreotti

became a director in 2013. She is the President and Chief Executive Officer of The Andreotti Group LLC, a strategic

business advisory firm serving domestic and global enterprise clients, private equity and institutional firms and international

investment groups. Prior to launching The Andreotti Group in 2005, Ms. Andreotti enjoyed a 26-year career in the telecommunications

industry (12 years with AT&T Inc. and 14 years with MCI Telecommunications Inc.). While at MCI, Ms. Andreotti managed a $14

billion operation. In her last leadership role at MCI, she served as President, Enterprise Markets, which included the Global

Accounts Segment, Government Markets, the Conferencing Business Unit and MCI Solutions (the managed services division of MCI).

Before joining MCI, Ms. Andreotti managed national accounts at AT&T, most notably Dayton-Hudson Corporation (currently Target

Corporation). She delivered the first-touch sensitive personal digital assistants or PDAs with related back office systems and

network into Dayton Hudson’s retail operation. Ms. Andreotti has served as Vice Chairman of the Japan American Society since

2007, a member of the Board of Trustees for the Americans in Wartime Museum since 2010, a member of the Board of Directors for

the Community Foundation for Northern Virginia since November 2014, and a Senior Advisor and Executive Coach for WJM Associates,

Inc. since 2009. Ms. Andreotti is also a past member of the Board of Directors for DiaXsys Inc., where she served on the Audit

and Compensation Committees between 2011 and 2014, and a past member of the Board of Directors for APAC Customer Services, Inc.,

where she served as chair of the Compensation Committee and served on the Audit and Nominating and Corporate Governance Committees

between 2005 and 2011. She also served on the Audit Committee of the Board of Directors of Rivermine Software Inc. between 2006

and 2011. Ms. Andreotti earned a Bachelor of Arts degree in Business Administration and Women in Management from the College of

St. Catherine. She has also attended executive management training at the Aspen Institute, the Menninger Foundation and the Stanford

School of Business Executive Leadership Program. Ms. Andreotti’s industry experience in telecommunications sales, marketing,

operations and management qualify her to serve on the Company’s Board of Directors.

Mr.

Jackman

has been a director since February 2002. He is currently the President of The Jackman Group, Inc., a management consulting

company that he formed in 2005. In September 2001, Mr. Jackman retired from Tellabs Inc., a communications company he had been

with since 1982. Mr. Jackman served as President, Global Systems and Technology, and Executive Vice President of Tellabs since

1998 and as President of Tellabs Operations from 1993 to 1998. Between 1965 and 1982, Mr. Jackman held various management positions

in sales and marketing for IBM. Commencing in January 2003, he joined the Board of Directors of Open Text, Inc., an enterprise

content management solutions company, where he currently serves on the Compensation Committee. Commencing in January 2005 through

December 2010, Mr. Jackman served on the Board of Directors of Keithley Instruments Inc., a test and measurement equipment company.

In total, Mr. Jackman has served on the boards of eight companies in the technology sector. In addition, Mr. Jackman served on

the Board of Trustees of Gannon University in Erie, Pennsylvania from May 2001 to May

2010.

Mr. Jackman holds a Bachelor of Arts degree in English Literature from Gannon University and a Master’s degree in Business

Administration from Pennsylvania State University. Mr. Jackman’s specific experience with a test and measurement equipment

company as well as his extensive experience in sales, marketing and management functions with telecommunications and high tech

companies, and his current and prior service on the board of directors of other companies, make him qualified to serve on the

Company’s Board of Directors and as the Lead Independent Director.

Class

II Directors/Nominees

Ms.

Haspilaire

was appointed to serve as a Class I member of the Board of Directors in November 2015, and has been nominated for

election at the 2016 Annual Meeting of Shareholders to serve as a Class II member of the Board of Directors. Since January 2015,

she has served as Chief Human Resources Officer of Reliance Communications Ltd. (Enterprise) and Global Cloud Xchange, a global

data communications service provider, and is responsible for human resources, corporate affairs and facilities management. Prior

to that, she was Vice President of Sales for the Americas at Henkel Adhesive Technologies, a division of Henkel AG & Co. KGaA

and a leading solution provider for adhesives, sealants and functional coatings worldwide. Between 2002 and 2013, she served as

Vice President and Managing Director at Pacnet Limited, a global telecommunications service provider. Ms. Haspilaire has more

than 25 years of experience in general management, global strategy, business development, investor relations, sales and marketing,

human resources and customer service. She has held executive and leadership positions at Heidrick & Struggles and AT&T.

Since 1999, she has served as an Advisory Board Member for PearlNet, Inc. Between 2011 and 2013, she also served on the Service

Provider Advisory Board of Telx. Also, since 2010 she has been a Board Member and Chair of NANOG (North American Network Operators

Group) Development Team. In 2011, Ms. Haspilaire served on the Advisory Board of SoHo Colo. She earned a Master’s degree

in Business Administration from Columbia University and a Bachelor of Science degree in Mathematics/Computer Science from St.

John’s University in New York. Ms. Haspilaire’s telecommunications experience in sales, marketing and management functions

with extensive operational experience and industry contacts qualify her to serve on the Company’s Board of Directors.

Mr.

Sinder

has been a director since December 2014. Mr. Sinder is a telecommunications industry veteran with executive and financial

experience at both public and private companies. Since July 2015, he has served as Chief Financial Officer of ByteGrid Holdings

LLC, a data center and managed services company. Since September 2013, he has served as a member of the Board of Directors of

Contec, LTD, a cable set-top box repair company based in New York, and since December 2015, as a member of the Board of Directors

and the Audit and Compensation Committees of Impact Telecom, Inc., a national telecommunications company. Between 2014 and 2015,

Mr. Sinder served on the Board of Directors of TNCI Operating Company, LLC, a national telecommunications company based in California,

which merged with Impact Telecom in December 2015. From 2012 to 2013, he served as Chief Executive Officer of CoreLink Data Centers

LLC. Prior to his promotion to Chief Executive Officer, Mr. Sinder was Chief Financial Officer of CoreLink from 2010 to 2012.

Mr. Sinder also served as Chief Financial Officer at Hostway Corporation from 2009 to 2010 and at Hu-Friedy Mfg. Co., Inc. from

2005 to 2008. From 1998 to 2004, he served at Focal Communications Corporation in a variety of executive and financial positions,

including Chief Financial Officer, Treasurer, and Vice President, Corporate Development. Prior to joining Focal, Mr. Sinder held

finance positions at Ameritech, MCI Communications, Telephone and Data Systems and IBM. Mr. Sinder holds a Bachelor of Science

degree from the University of Michigan and a Master’s degree in Business Administration from the University of Chicago.

Mr. Sinder’s financial knowledge and expertise and his experience serving in a variety of executive and financial positions

at various corporations, including as Chief Executive Officer, Chief Financial Officer and Treasurer, make him qualified to serve

on the Company’s Board of Directors and Audit Committee.

Class

III Directors

Mr.

Levy

has been a director since March 2006. He served as a Managing Director and Global Head of Communications Technology Research

at Lehman Brothers from July 1998 until September 2005. Before joining Lehman Brothers, Mr. Levy was a Director of Telecommunications

Research at Salomon Brothers from March 1997 to July 1998, a Managing Director and Head of the Communications Research Team at

Oppenheimer & Co. from July 1994 to March 1997, and a senior communications analyst at Hambrecht & Quist from July 1986

to July 1994. As a securities analyst for almost 20 years, Mr. Levy became proficient in analyzing business strategies and financial

results, having evaluated well over 100 companies. In November 2015, Mr. Levy joined the Board of Directors of Edison Properties,

a privately and closely held real estate company. He is also currently a member of the Board of Directors and the Audit Committee

and chairs both the Compensation and Governance Committee of Allot Communications, a data communications provider for carriers,

and also a member of the Board of Directors of privately held GENBAND Inc., an innovator of IP Infrastructure. From January 2007

to February 2010, he served on the Board of Directors of Zhone Technologies, Inc., a broadband technology company, and commencing

September 2005 as a board member of Tut Systems, Inc., a technology company providing advanced content processing and distribution

products and system integration services, prior to its March 2007 acquisition by Motorola, Inc. In total, Mr. Levy has served

on six boards of directors and has been a member of the audit committee of each company. Mr. Levy holds a Master’s degree

in Business Administration and a Bachelor of Science degree in Materials Engineering from Rensselaer Polytechnic Institute. Mr.

Levy provides a unique perspective to Company’s Board of Directors, its Compensation Committee, and to its Nominating and

Governance Committee which he chairs, as a result of his investment banking experience related to the telecommunications industry

and his analytical skills. The Company benefits from his knowledge of financial markets, business strategies and competitive data

analysis.

Mr.

Marini

has been a director since October 1996. Mr. Marini has been Chairman and Chief Executive Officer of Neato Robotics,

a home robots company, since February 2013. He is also the founder and Managing Director of Noventi Ventures, a Silicon Valley-based

early stage technology venture capital firm begun in March 2002. Mr. Marini also served as interim Chief Executive Officer of

FutureTel, a digital video capture company, and as President and Chief Executive Officer of No Hands Software, an electronic publishing

software company. Prior to this, Mr. Marini was the co-founder, Executive Vice President and Chief Operating Officer of Logitech

International SA, a computer peripherals company. Previously, he held technical and management positions with Olivetti and IBM.

Mr. Marini has extensive and broad executive operating experience. At Neato he leads a fast growing company with complex technology

products and a broad worldwide sales network. At Logitech he managed engineering, operations and finance as the company grew from

inception to over $200M in annual revenues, effected an initial public offering and expanded manufacturing and development in

North America, Asia and Europe and sales presence in over 30 countries worldwide. At FutureTel (1998-1999) and No Hands Software

(1993-1994) he managed rapid product development, decisive restructuring, new markets and product entries. Over the last 15 years

he has also been managing venture capital investments in technology companies. This activity entails evaluating business plans,

making investment decisions, assisting management in the formulation and execution of operating and strategic plans involving

all facets of company operations. It also includes continuous evaluation of the performance of management teams, directing management

changes and helping in recruiting executives for portfolio companies. Further, it requires the identification, evaluation and

execution of exit strategies, such as acquisitions by other companies or initial public offerings. He has directed investments

in over 15 companies, some of which have been acquired by market leaders such as BEA Systems, Cisco, HP and Symantec. He currently

serves on the Board of Trustees of the University of California at Davis

Foundation

and on the boards of Neato Robotics, Inc. since December 2006 and Velomat S.r.l since April 2012. Other past board service included

Ecrio Inc. from March 1999 through December 2015; TES S.p.A. from September 1994 to January 2012; Minerva Networks, Inc. from

May 2003 through March 2013; Aurora Algae, Inc. from January 2007 to August 2012; Cosmo Industrie S.p.A. from December 2007 to

December 2011; Windspire Energy, Inc. beginning December 2008 through March 2012; and Lumenergi, Inc. beginning February 2008

to May 2013. Mr. Marini holds a Computer Science “Laurea” degree from the University of Pisa, Italy. Overall, Mr.

Marini brings experience with a wide variety of company situations both as a general management executive and as active board

member and investor. These qualifications provide a solid basis for serving as a director, and member of the Audit Committee of

a technology company, dealing with issues of growth, product and marketing strategy, international expansion and merger and acquisition

activities.

Dr.

Singer

has served as the Company’s Chief Executive Officer and Chairman of the Board since October 2001. From

February 2001 until October 2001, he served as the Company’s non-executive Chairman of the Board, and he has been a

director of the Company since August 1999. From December 1997 to August 2000, Dr. Singer served as President and Chief

Executive Officer of SAFCO Technologies, Inc., a wireless communications company acquired by Agilent Technologies in August,

2000. Prior to SAFCO Technologies, Dr. Singer served as Vice President within the Cellular Infrastructure Group of Motorola,

a communications equipment company. He also held senior management and technical positions at Tellabs, AT&T and Bell

Labs. Dr. Singer holds a Bachelor of Arts degree in Psychology from the University of Michigan and a Master of Arts degree

and Ph.D. in Experimental Psychology from Vanderbilt University. He served on the Standing Advisory Group for the Public

Company Accounting Oversight Board and on the Advisory Board for the MMM program at Kellogg School of Business. From March

2009 until September 2010, he served on the Board of Directors of Westell Technologies, Inc., a leading provider of broadband

products, gateways and conferencing services, and was Chair of Westell’s Compensation Committee. In 2006, Dr. Singer

was appointed to the Board of Directors of ISCO International, a provider of spectrum conditioning solutions to wireless and

cellular providers worldwide, where he also chaired the Compensation Committee until he left the board in 2007. In 2012, he

was elected to the Board of Directors of Multiband Corporation, and served as Chair of the Compensation Committee until the

sale of Multiband in 2013. Dr. Singer is a member of the Economic Club of Chicago and now serves on the University of

Illinois at Chicago (UIC) College of Engineering’s Advisory Board. Dr. Singer has nine patents in

telecommunications and has written several essays on the telecommunications industry. He provides expertise in business

strategy, intellectual property, strategic alliances and communications technology.

PROPOSAL

#2

ADVISORY

VOTE TO APPROVE THE COMPANY’S

NAMED

EXECUTIVE OFFICER COMPENSATION

As

required by Section 14A of the Exchange Act and related SEC rules, the Board of Directors is requesting that the stockholders

approve, on a non-binding, advisory basis, the following resolution relative to the compensation of the Company’s named

executive officers:

“RESOLVED,

that the stockholders hereby APPROVE the compensation of the Company’s named executive officers, as disclosed pursuant to

the compensation rules of the SEC, including the Compensation Discussion and Analysis, the compensation tables and related narrative

discussion disclosed in this proxy statement.”

The

compensation of the Company’s named executive officers is described in the Compensation Discussion and Analysis section

of this proxy statement, including the compensation tables that accompany the narrative. The overall objectives of the executive

compensation program is to provide incentives to motivate the Company’s executive officers and key managers to perform to

the best of their abilities and to closely align their interests with those of the Company’s stockholders, with the objective

of enhancing stockholder value and promoting long-term, sustainable growth. The long-term incentives are also designed to retain

executive talent. A portion of each named executive officer’s overall compensation is performance-based and tied to the

achievement of defined goals. Payments for both short-term incentives and long-term incentives will be made in restricted stock.

The

proposal to approve the compensation of the Company’s named executive officers requires the affirmative vote of the holders

of a majority of the shares of common stock present, represented and entitled to vote at the annual meeting. Accordingly, broker

non-votes will not be relevant to the outcome. Abstentions will be counted as being present and entitled to vote for purposes

of Proposal #2 and, therefore, will have the same effect as a vote against Proposal #2. Because this vote is advisory, it will

not be binding on the Compensation Committee or the Board of Directors. However, the Board of Directors and the Compensation Committee

will carefully evaluate the voting results and take them into account when considering future executive compensation matters.

The

Board of Directors recommends a vote “FOR” approval of the Company’s

named

executive officer compensation, as disclosed in this proxy statement.

PROPOSAL

#3

RATIFICATION

OF APPOINTMENT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

The

Audit Committee has appointed Grant Thornton LLP, an independent registered public accounting firm, to audit the Company’s

financial statements for the fiscal year ending December 31, 2016. This appointment is being presented to the stockholders for

ratification at the 2016 annual meeting of stockholders.

Before

selecting Grant Thornton LLP as the independent registered public accounting firm for the Company for fiscal year

2016,

the Audit Committee carefully considered the firm’s qualifications as independent auditors. This included a review of the

qualifications of the engagement team, the quality control procedures the firm has established and its reputation for integrity

and competence in the fields of accounting and auditing. The Audit Committee’s review also included matters required to

be considered under the SEC’s rules on auditor independence, including the nature and extent of non-audit services, to ensure

that Grant Thornton LLP’s independence will not be impaired. Grant Thornton LLP has been conducting independent audits of

the Company’s financial statements since May 2006. Representatives of Grant Thornton LLP are expected to be available by

telephone at the 2016 annual meeting of stockholders to answer appropriate questions from stockholders.

Summary

of Fees

The

following table summarizes the aggregate fees billed to the Company by Grant Thornton LLP for the Company’s 2014 and 2015

fiscal years:

|

Type

of Fees

|

|

Fiscal

Year 2015

($)

|

|

|

Fiscal

Year 2014

($)

|

|

|

Audit Fees

(1)

|

|

|

829,758

|

|

|

|

682,618

|

|

|

Audit-Related Fees

(2)

|

|

|

283,193

|

|

|

|

216,818

|

|

|

All

Other Fees

(3)

|

|

|

4,900

|

|

|

|

5,000

|

|

|

Total Fees

|

|

|

1,117,851

|

|

|

|

904,436

|

|

|

|

(1)

|

Audit

Fees —

These are fees for professional services for fiscal years 2015 and 2014.

The professional services provided included auditing the Company’s annual financial

statements and internal controls, reviewing the Company’s quarterly financial statements

and other services that are normally provided in connection with statutory and regulatory

filings or engagements.

|

|

|

(2)

|

Audit-Related

Fees —

These are fees for assurance and related services that are reasonably

related to the performance of the audit or review of the Company’s financial statements

that are not reported as “Audit Fees” above. For fiscal year 2015 and 2014,

these fees included due diligence and consultations related to mergers and acquisitions

and auditing the Company’s 401(k) and profit sharing plan.

|

|

|

(3)

|

All

Other Fees —

These are fees for permissible services that do not fall within

the above categories.

|

Pre-Approval

of Independent Auditor Services and Fees

The

Audit Committee reviewed and pre-approved all audit and non-audit fees for services provided to the Company by Grant Thornton

LLP and has determined that the firm’s provision of such services to the Company during fiscal year 2015 is compatible with

and did not impair Grant Thornton LLP’s independence. It is the practice of the Audit Committee to consider and approve

in advance all auditing and non-auditing services provided to the Company by the independent registered public accounting firm

in accordance with the applicable requirements of the SEC.

Vote

Required and Recommendation

Stockholder

ratification of the selection of Grant Thornton LLP as the independent registered public accounting firm for the Company is not

required by the Company’s bylaws or other applicable legal requirement. However, the Board of Directors is submitting the

selection of Grant Thornton LLP to the stockholders for ratification as a matter of good corporate practice. The affirmative vote

of the holders of a majority of the shares of common stock present, represented and entitled to vote at the annual meeting, will

constitute ratification of the appointment of Grant Thornton LLP as the Company’s independent registered public accounting

firm under Proposal #3. Abstentions will be counted as present and entitled to vote for purposes of Proposal #3 and, therefore,

will have the same effect as a vote against Proposal #3. Notwithstanding the selection by the Audit Committee of Grant Thornton

LLP or stockholder ratification of that selection, the Audit Committee may direct the appointment of a new independent registered

public accounting firm at any time during the year if the Audit Committee determines that such a change would be in the best interest

of the Company and the stockholders. If the selection of Grant Thornton LLP is not approved at the annual meeting, the Audit Committee

will investigate the reason for the rejection and reconsider the appointment.

The

Board of Directors recommends that stockholders vote “FOR” the ratification

of

Grant Thornton LLP as the Company’s independent registered public accounting firm.

CORPORATE

GOVERNANCE

Board

and Committee Meetings

The

Board of Directors currently has an Audit Committee, a Compensation Committee and a Nominating and Governance Committee. The members

of each of the committees are listed in the table below. Each member of the Audit Committee, the Compensation Committee and the

Nominating and Governance Committee meets the applicable SEC and NASDAQ Global Select Market (“NASDAQ”) independence

requirements. The Board of Directors has determined that each of Mr. Thomsen and Mr. Sinder qualifies as an “audit committee

financial expert” as defined under the rules and regulations of the SEC, and that all members of the Audit Committee meet

the NASDAQ financial literacy requirements. The Board of Directors held a total of eight meetings during fiscal 2015, including

one meeting of the subcommittee formed to consider the acquisition of Nexgen Wireless, Inc. During 2015, each of the directors,

other than Ms. Haspilaire who became a director in November 2015, attended at least 75% of the total number of meetings of the

Board of Directors and any committee on which such director served.

|

|

|

|

|

|

|

|

|

|

|

|

Committee

|

|

Members During Fiscal

2015

|

|

Committee

Functions

|

|

Date Current Written

Charter Adopted

|

|

Meetings

Held in

Fiscal 2015

|

|

|

|

|

|

|

|

|

|

|

|

Audit

|

|

Carl A. Thomsen (Chair)

Giacomo Marini

M. Jay Sinder

|

|

•

|

Selects the independent auditors

|

|

Originally adopted

August 1999; last

amended September 2010

|

|

10

|

|

|

|

•

|

Oversees the internal financial reporting and accounting controls

|

|

|

|

|

|

•

|

Consults with and reviews the services provided by independent

auditors

|

|

|

|

|

|

•

|

Identifies high-risk behaviors that potentially imperil the underlying

value of the Company

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation

|

|

Brian J. Jackman (Chair)

Cindy K. Andreotti

Gina Haspilaire

Steven D. Levy

|

|

•

|

Reviews and makes recommendations to the Board of Directors regarding

the compensation and benefits of the Chief Executive Officer

|

|

Originally adopted

August 1999; last

amended March 2013

|

|

8

|

|

|

|

•

|

Reviews and approves compensation and benefits of the named executive

officers other than the Chief Executive Officer and reviews compensation and benefits of the other executive

officers and key managers

|

|

|

|

|

|

•

|

Establishes and reviews general policies relating to the compensation

and benefits of the employees

|

|

|

|

|

|

•

|

Balances the portion of executive compensation tied to achievement

of performance goals with managing overall enterprise risk

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nominating and

Governance

|

|

Steven D. Levy (Chair)

Cindy K. Andreotti

Brian J. Jackman

|

|

•

|

Assists the Board of Directors in identifying

and selecting prospective director nominees for the annual meeting of stockholders

|

|

Originally adopted

February 2004; last

amended September 2013

|

|

4

|

|

|

|

•

|

Reviews and makes recommendations on matters

regarding corporate governance, composition of the Board of Directors, evaluation and nominations, committees of the Board

of Directors and conflicts of interest

|

|

|

|

|

|

•

|

Oversees and coordinates the risk management

activities of the Company

|

|

|

|

|

|

•

|

Establishes, maintains and improves corporate

governance guidelines

|

|

|

A

copy of the charter for each of the committees of the Board of Directors is available on our website located at http://investor.pctel.com/documentsdisplay.cfm.

The meetings indicated in the chart above include a joint meeting of the members of the Audit Committee and Compensation Committee

in November 2015.

Board

Leadership Structure

The

members of the Board of Directors believe that their familiarity with the Company, their insight into the industries in which

the Company is engaged, and their knowledge of the challenges and opportunities arising in this evolving economy place the Board

of Directors in the best position to determine the optimal leadership structure for the Company. The Board of Directors has determined

that combining the roles of Chairman of the Board and Chief Executive Officer is the optimal structure for the Company at this

time. Mr. Singer, who currently fills both roles, commenced his involvement with the Company as a Director on the Company’s

Board in 1999, became the non-executive Chairman of the Board in February 2001, and subsequently became the Chief Executive Officer

in October 2001. The Board of Directors believes that the stockholders are best served by Mr. Singer fulfilling both roles, thereby

unifying the leadership and direction of the Board with the management of the Company, and enabling the Company to move decisively

to meet challenges and maximize opportunities for growth. The Board of Directors maintains independent and effective oversight

of the Company’s business through the strong leadership provided by the Lead Independent Director (as defined in the immediately

succeeding paragraph) and the Board committees, and through the composition of the Board, with all directors other than the Chairman

being independent directors.

Mr.

Jackman is currently the lead independent director of the Board of Directors (“Lead Independent Director”). As Lead

Independent Director, his principal responsibilities are (i) working with the Chairman and Chief Executive Officer and the other

members of the Board of Directors to set the agenda for each meeting of the Board of Directors, (ii) serving as a liaison for

communications between the Board of Directors and the Chief Executive Officer, (iii) acting as the chair for executive sessions

held at regularly scheduled meetings of the Board of Directors, and (iv) consulting with the General Counsel regarding communications

received from the stockholders.

Independence

The

Board of Directors has determined that the non-employee directors are “independent directors” based on the NASDAQ

and SEC standards for independence. Only independent directors may serve on the Audit, Compensation and Nominating and Governance

Committees. In determining the independence of the directors, the Board of Directors affirmatively determines whether a non-employee

director has a relationship that would interfere with that director’s exercise of independent judgment in carrying out the

responsibilities of being a director. In coming to that decision, the Board of Directors is informed of the NASDAQ and SEC rules

that disqualify a person from being considered as independent, considers the responses to an annual questionnaire from each director,

and reviews the applicable standards with each member of the Board of Directors.

Risk

Management

While

the executive officers of the Company are responsible for the day-to-day management of the material risks facing the Company,

the Board of Directors, as a whole and through its committees, has responsibility for the oversight of risk management. In its

oversight role, the Board of Directors has the responsibility to determine whether the risk management processes designed and

implemented by management are adequate and functioning as designed. The involvement of the full Board of Directors in setting

the Company’s business strategy at least annually is a key part of its oversight of risk management, its assessment of management’s

risk appetite, and its determination of what constitutes an appropriate level of risk for the Company. The Board of Directors

has assigned to the Nominating and Governance Committee the responsibility of working with Company management to identify, assess,

and quantify risks facing the Company in order to create meaningful but cost-effective strategies to manage the Company’s

most significant risks. The Nominating and Governance Committee updates the full Board of Directors semiannually at Board meetings

regarding its efforts to manage enterprise risks and reports extensively on these efforts at the joint annual meeting of the Audit

and Compensation Committees. The Board also regularly receives updates from management regarding certain of the significant risks

facing the Company, including litigation and various operating risks.

In

addition to the Nominating and Governance Committee’s overall enterprise risk management efforts, each committee of the

Board of Directors oversees certain aspects of enterprise risk management. For example, the Audit Committee is responsible for

overseeing risk management of financial matters, financial reporting, the audit process, the adequacy of internal controls over

financial reporting, and disclosure controls and procedures. The Compensation Committee oversees risks related to the compensation

policies and practices. In its oversight, the Compensation Committee examines whether the compensation practice is consistent

with the Compensation Committee’s responsibilities (as set forth in “Compensation Discussion and Analysis —

Overiew and Responsibilities of the Compensation Committee”) and its philosophy (as set forth in “Compensation Discussion

and Analysis — Compensation Philosophy”) and is aligned with the Company’s goals and risk tolerance. In evaluating

the compensation policies and practices, the Compensation Committee seeks advice and data regarding the Company’s peer group

from its independent compensation consultant. In addition to its role in working with management in the overall enterprise risk

mitigation efforts, the Nominating and Governance Committee oversees governance related risks, such as board independence and

conflicts of interest, as well as management and director succession planning. The committees report their findings to the full

Board of Directors.

At

its most recent joint meeting of the Audit and Compensation Committees, the members of both Committees reviewed risks applicable

to the Company, focusing on (i) the results of the enterprise risk survey in which Board members, executives, and key managers

participated, which identified the participants’ view of the most significant risks that the Company faces, and (ii) the

results of a security audit performed by a third party, which identified key areas for the Company to focus its efforts relating

to cybersecurity. Management discussed with the joint committees cost-effective steps that will improve security and mitigate

identified risks. The NEOs (as identified in “Compensation Discussion and Analysis—Named Executive Officers”)

and certain other executive officers attend Board of Directors and committee meetings as needed, and are available to address

any questions or concerns raised by the Board on risk management-related matters.

Director

Nomination Process

Stockholder

Recommendation and Nominations

. It is the policy of the Nominating and Governance Committee to consider director candidates

recommended by the stockholders holding on the date of submission of such recommendation at least 1% of the then-outstanding shares

of PCTEL common stock continuously for at least 12 months prior to such date.

Stockholders

desiring to recommend a candidate for election to the Board of Directors should send their recommendation in writing to the

attention of the Corporate Secretary, at the Company’s office located at 471 Brighton Drive, Bloomingdale, Illinois

60108. This written recommendation must include the information and materials required by the bylaws as well as the

candidate’s name, home and business contact information, detailed biographical data, relevant qualifications, a signed

letter from the candidate confirming willingness to serve, information regarding any relationships between the candidate and

the Company within the last three years and evidence of the required ownership of PCTEL common stock by the recommending

stockholder. A copy of the Company’s bylaws is available upon written request to the Corporate Secretary at the address

provided above. For a description of the advance notice provision of the Company’s bylaws, see “Deadline for

Receipt of Stockholder Proposals and Nominations for 2017 Annual Meeting of Stockholders” immediately following the

“Questions and Answers” section above. Additional information regarding stockholder recommendations for director

candidates is set forth in the document entitled “Policies and Procedures for Director Candidates” available at

http://investor.pctel.com/documentsdisplay.cfm.

Identifying

and Evaluating Nominees for Director

. The Nominating and Governance Committee uses the following procedures for

identifying and evaluating any individual recommended or offered for nomination to the Board of Directors:

|

|

•

|

The

Committee considers candidates recommended by stockholders in the same manner as candidates

recommended by other sources; and

|

|

|

|

|

|

|

•

|

The

Committee considers the following factors in its evaluation of candidates:

|

|

|

|

-

|

The

current size and composition of the Board of Directors;

|

|

|

|

|

|

|

|

|

-

|

The

needs of the Board of Directors and its committees;

|

|

|

|

|

|

|

|

|

-

|

The

candidate’s judgment, independence, character, integrity, age, education, area

of expertise, knowledge of the telecommunications industry, experience with businesses

and other organizations of comparable size, diversity, length of service and potential

conflicts of interests;

|

|

|

|

|

|

|

|

|

-

|

Skills

which are complementary to those of the existing members of the Board of Directors; and

|

|

|

|

|

|

|

|

|

-

|

Other

factors that the Committee considers appropriate.

|

Diversity

In

addition to the qualifications set forth above, in evaluating the suitability of candidates for the Board of Directors, the Nominating

and Governance Committee considers the diversity of the candidates, and of the Board of Directors as a whole, based on factors

such as business background, experience and potential contributions to the Board of Directors, in addition to balancing the gender,

ethnicity and racial composition of its members. The Nominating and Governance Committee seeks to ensure that the Board of Directors

is comprised of individuals with experience in industries that are complementary to the Company’s business and individuals

with financial and accounting experience in order to bring diverse business experience, knowledge and perspectives to the Board

of Directors.

Compensation

of Directors

Cash

and Stock Compensation

. The non-employee directors received an annual cash retainer of $25,000 and shares of common stock

with value equivalent to $35,000 covering the period from the 2015 annual meeting until this 2016 annual meeting. (Commencing

with this 2016 annual meeting, in addition to the annual cash retainer, the non-employee directors will receive shares of common

stock with value equivalent to $55,000.) The non-employee directors also received $1,500 per Board meeting attended (unless the

Board meeting was conducted by teleconference, in which case directors received $1,000 for each telephonic meeting in which they

participated) and $1,000 per committee meeting attended. In addition, the non-employee directors received the following additional

shares of common stock:

|

|

•

|

the

chair of the Audit Committee received shares of common stock with value equivalent to $10,000;

|

|

|

•

|

the

chair of the Compensation Committee received shares of common stock with value equivalent to $10,000;

|

|

|

•

|

the

chair of the Nominating and Governance Committee received shares of common stock with value equivalent to $7,000;

|

|

|

•

|

each other non-employee member of any

of the foregoing committees received shares of common stock with value

equivalent to $5,000; and

|

|

|

•

|

the

Lead Independent Director received shares of common stock with value equivalent to $10,000.

|

All

the grants of common stock to the non-employee directors, as described above, were awarded on the date of the annual meeting (

i.e.

,

June 10, 2015) and vest immediately. The number of shares granted was based on the total dollar value divided by the closing price

of PCTEL common stock as presented by NASDAQ on the date of grant.

In

addition to the above-referenced grants, new non-employee directors receive a one-time grant of restricted shares equivalent to

$50,000 based upon the closing price of PCTEL common stock as presented by NASDAQ as of the first date of service, which vests

in equal annual installments over three years.

Reimbursements

.

Each of the non-employee directors is reimbursed for all reasonable out-of-pocket expenses incurred in connection with his or

her service on the Board of Directors.

Non-Employee

Directors’ Compensation for the Fiscal Year Ended December 31, 2015

|

Name

|

|

Fees