UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): March 17, 2016

OMNICELL, INC.

(Exact name of registrant as specified in its charter)

|

| | | | |

Delaware | | 000-33043 | | 94-3166458 |

(State or other jurisdiction of

incorporation or organization) | | (Commission File Number) | | (IRS Employer Identification Number) |

590 East Middlefield Road

Mountain View, CA 94043

(Address of principal executive offices, including zip code)

(650) 251-6100

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 7.01 Regulation FD

On March 17, 2016, Omnicell, Inc (“Omnicell”) issued a press release announcing the non-GAAP pro forma financial information related to its acquisition of Aesynt Holding Coöperatief U.A. (“Aesynt”). The full text of the press release issued in connection with the announcement is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Form 8-K and the Exhibit attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

|

| | |

Number | | Description of Document |

99.1 | | Press release entitled "Omnicell presents the pro forma financial information related to its acquisition of Aesynt" dated March 17, 2016". |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

| | |

| OMNICELL, INC. |

| | |

Dated: March 17, 2015 | | |

| | /s/ Dan S. Johnston |

| | Dan S. Johnston |

| | Executive Vice President and Chief Legal & Administrative Officer |

EXHIBIT INDEX

|

| | |

Number | | Description of Document |

99.1 | | Press release entitled "Omnicell presents the pro forma financial information related to its acquisition of Aesynt" dated March 17, 2016". |

Exhibit 99.1

|

| | |

Contact: | | |

Peter Kuipers | | Omnicell, Inc. |

Chief Financial Officer | | 590 East Middlefield Road |

800-850-6664, ext. 6180 | | Mountain View, CA 94043 |

Peter.kuipers@omnicell.com | | |

Omnicell presents the pro forma financial information related to its acquisition of Aesynt

MOUNTAIN VIEW, Calif. -- March 17, 2016 -- Omnicell, Inc. (NASDAQ: OMCL), a leading provider of medication and supply management solutions to healthcare systems, today issued a press release presenting the pro forma financial information related to its recent acquisition of Aesynt Holding Coöperatief U.A. (“Aesynt”).

On January 6, 2016, Omnicell filed a Current Report on Form 8-K (the “Original Form 8-K”) reporting that on January 5, 2016 Omnicell closed its acquisition of Aesynt. On March 17, 2016, Omnicell filed Form 8-K/A that amended the Original Form 8-K to provide the historical financial statements of Aesynt and the pro forma financial information required by Items 9.01(a) and 9.01(b) of Form 8-K that were excluded from the Original Form 8-K in reliance on the instructions to such items. Except for the filing of the historical financial statements and pro forma financial information, the Original Form 8-K is not being amended or updated in any other manner. Details of this Form 8-K and the Form 8-K/A can be found in the investor relations section of our website and can be accessed by clicking here.

In addition to these filings, Omnicell is presenting herein the Non-GAAP reconciliation of pro forma financial information related to its recent acquisition of Aesynt as if the acquisition had occurred on January 1, 2015.

About Omnicell

Since 1992, Omnicell (NASDAQ: OMCL) has been creating innovative solutions to improve patient care, anywhere it is delivered. Omnicell is a leading supplier of comprehensive automation and business analytics software for medication and supply management across the entire health care continuum—from the acute care hospital setting, to post-acute skilled nursing and long-term care facilities, to the patient's home.

Approximately 4,000 customers worldwide use Omnicell automation and analytics solutions to increase operational efficiency, reduce medication errors, deliver actionable intelligence and improve patient safety. The recent acquisition of Aesynt adds distinct capabilities, particularly in central pharmacy and IV robotics, creating the broadest medication management product portfolio in the industry.

The Omnicell SureMed solution provides innovative medication adherence packaging to help reduce costly hospital readmissions. In addition, these solutions enable approximately 7,000 institutional and retail pharmacies worldwide to maintain high accuracy and quality standards in medication dispensing and administration while optimizing productivity and controlling costs.

For more information about Omnicell, Inc. please visit www.omnicell.com.

Forward-Looking Statements

To the extent any statements contained in this release deal with information that is not historical, these statements are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. As such, they are subject to the occurrence of many events outside Omnicell’s control and are subject to various risk factors that could cause actual results to differ materially from those expressed or implied in any forward-looking statement. Such statements include, but are not limited to Omnicell’s momentum, pipeline and new sales opportunities, profit and revenue growth, and the success of Omnicell’s strategy for growth, including differentiated products, expansion into new markets and targeted acquisitions. Risks that contribute to the uncertain nature of the forward-looking statements include our ability to take advantage of the growth opportunities in medication management across the spectrum of healthcare settings from long term care to home care, unfavorable general economic and market conditions, risks to growth and acceptance of our products and services, including competitive conversions, and to growth of the clinical automation and workflow automation market generally, the potential of increasing competition, potential regulatory changes, the ability of the company to improve sales productivity to grow product bookings, to develop new products and to acquire and successfully integrate companies. These and other risks and uncertainties are described more fully in Omnicell’s most recent filings with the Securities and Exchange Commission. Prospective investors are cautioned not to place undue reliance on forward-looking statements. All forward-looking statements contained in this press release speak only as of the date on which they were made. Omnicell undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made.

Use of Non-GAAP Financial Information

This press release contains financial measures that are not calculated in accordance with U.S. generally accepted accounting principles (GAAP). Our management evaluates and makes operating decisions using various performance measures. In addition to Omnicell’s GAAP results, we also consider non-GAAP gross profit, non-GAAP operating expenses, non-GAAP income from operations, non-GAAP net income, and non-GAAP net income per diluted share. Additionally, we calculate Adjusted EBITDA (another non-GAAP measure) by means of adjustments to GAAP Net Income. These non-GAAP results should not be considered as an alternative to gross profit, operating expenses, net income, net income per diluted share, or any other performance measure derived in accordance with GAAP. We present these non-GAAP results because we consider them to be important supplemental measures of Omnicell’s performance.

Our non-GAAP gross profit, non-GAAP operating expenses, non-GAAP net income and non-GAAP net income per diluted share are exclusive of certain items to facilitate management’s review of the comparability of Omnicell’s core operating results on a period to period basis because such items are not related to Omnicell’s ongoing core operating results as viewed by management. We define our “core operating results” as those revenues recorded in a particular period and the expenses incurred within that period that directly drive operating income in that period. Management uses these non-GAAP financial measures in making operating decisions because, in addition to meaningful supplemental information regarding operating

performance, the measures give us a better understanding of how we should invest in research and development, fund infrastructure growth and evaluate the effectiveness of marketing strategies. In calculating the these non-GAAP results, management specifically adjusted for the following excluded items:

a) Stock-based compensation expense impact of Accounting Standards Codification (ASC) 718. We recognize equity plan-related compensation expenses, which represent the fair value of all share-based payments to employees, including grants of employee stock options, as required under ASC 718, Compensation - Stock Compensation (ASC 718) as non-GAAP adjustments in each period.

b) Intangible assets amortization from business acquisitions. We excluded from our non-GAAP results the intangible assets amortization expense resulting from our past acquisitions. These non-cash charges are not considered by management to reflect the core cash-generating performance of the business and therefore are excluded from our non-GAAP results.

c) Amortization of debt issuance cost. Debt issuance cost represents costs associated with the issuance of new Term Loan and Revolving Line of Credit facilities. The cost include underwriting fees, original issue discount, ticking fee, legal fees, etc. This non-cash expense is not considered by management to reflect the core cash-generating performance of the business and therefore is excluded from our non-GAAP results.

d) Acquisition accounting impacts related to deferred revenue. In connection with our acquisition of Aesynt, business combination rules require us to account for the fair values of arrangements for which acceptance has not been obtained, and post installation support has not been provided in our purchase accounting. The non-GAAP adjustment to our sales is intended to include the full amounts of such revenues. We believe the adjustment to these revenues is useful as a measure of the ongoing performance of our business.

e) Inventory fair value adjustments. In connection with our acquisition of Aesynt, business combination rules require us to account for the fair values of inventory acquired in our purchase accounting. The non-GAAP adjustment to our Cost of Revenue is intended to include the impact of such adjustment. We believe the adjustment is useful as a measure of the ongoing performance of our business.

f) Acquisitions related expenses. We excluded from our non-GAAP results the expenses which are related to the recent acquisitions. These expenses are unrelated to our ongoing operations and we do not expect them to occur in the ordinary course of business. We believe that excluding these acquisition related expenses provides more meaningful comparisons of the financial results to our historical operations and forward looking guidance and the financial results of less acquisitive peer companies. Further, these expenses are not considered by management to reflect the core performance of the business and therefore are excluded from our non-GAAP results.

g) Gain on business combination of an equity investment. We excluded from our non-GAAP results the gain on a minority equity investment in a private company, Avantec, which was recognized in relation to the acquisition by Omnicell of the remainder of the company. This non-cash gain is not considered by management to reflect the core cash-generating performance of the business and therefore is excluded from our non-GAAP results.

Management adjusts for the above items because management believes that, in general, these items possess one or more of the following characteristics: their magnitude and timing is largely outside of Omnicell’s control; they are unrelated to the ongoing operation of the business in the ordinary course; they are unusual and we do not expect them to occur in the ordinary course of business; or they are non-operational, or non-cash expenses involving stock compensation plans.

We believe that the presentation of these non-GAAP financial measures is warranted for several reasons:

1) Such non-GAAP financial measures provide an additional analytical tool for understanding Omnicell’s financial performance by excluding the impact of items which may obscure trends in the core operating results of the business;

2) Since we have historically reported non-GAAP results to the investment community, we believe the inclusion of non-GAAP numbers provides consistency and enhances investors’ ability to compare our performance across financial reporting periods;

3) These non-GAAP financial measures are employed by Omnicell’s management in its own evaluation of performance and are utilized in financial and operational decision making processes, such as budget planning and forecasting; and

4) These non-GAAP financial measures facilitate comparisons to the operating results of other companies in our industry, which use similar financial measures to supplement their GAAP results, thus enhancing the perspective of investors who wish to utilize such comparisons in their analysis of our performance.

Set forth below are additional reasons why share-based compensation expense related to ASC 718 is excluded from our non-GAAP financial measures:

i) While share-based compensation calculated in accordance with ASC 718 constitutes an ongoing and recurring expense of Omnicell, it is not an expense that requires cash settlement by Omnicell. We therefore exclude these charges for purposes of evaluating core operating results. Thus, our non-GAAP measurements are presented exclusive of stock-based compensation expense to assist management and investors in evaluating our core operating results.

ii) We present ASC 718 share-based compensation expense in our reconciliation of non-GAAP financial measures on a pre-tax basis because the exact tax differences related to the timing and deductibility of share-based compensation, under ASC 718 are dependent upon the trading price of Omnicell’s common stock and the timing and exercise by employees of their stock options. As a result of these timing and market uncertainties the tax effect related to share-based compensation expense would be inconsistent in amount and frequency and is therefore excluded from our non-GAAP results.

Our Adjusted EBITDA calculation is defined as earnings before interest income and expense, taxes, depreciation and amortization, and non-cash expenses, including ASC 718 stock compensation expense, as well as excluding certain other non-GAAP adjustments.

As stated above, we present non-GAAP financial measures because we consider them to be important supplemental measures of performance. However, non-GAAP financial measures have limitations as an analytical tool and should not be considered in isolation or as a substitute for Omnicell’s GAAP results. In the future, we expect to incur expenses similar to certain of the non-GAAP adjustments described above and expect to continue reporting non-GAAP financial measures excluding such items. Some of the limitations in relying on non-GAAP financial measures are:

· Omnicell’s stock option and stock purchase plans are important components of incentive compensation arrangements and will be reflected as expenses in Omnicell’s GAAP results for the foreseeable future under ASC 718.

· Other companies, including companies in Omnicell’s industry, may calculate non-GAAP financial measures differently than Omnicell, limiting their usefulness as a comparative measure.

Pursuant to the requirements of SEC Regulation G, a detailed reconciliation between Omnicell’s non-GAAP and GAAP financial results is set forth in the financial tables at the end of this press release. Investors are advised to carefully review and consider this information strictly as a supplement to the GAAP results that are contained in this press release and in Omnicell’s SEC filings.

|

| | | | | | | | | | | | | | | |

OMNICELL, INC. |

UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENTS OF OPERATIONS |

(in thousands) |

| | | | | | | |

| | | | Historical | | |

| | | | Year ended | | |

| | | | December 31, 2015 | September 30, 2015 | Pro Forma | Pro Forma |

| | | | Omnicell | Aesynt | Adjustments | Combined |

| | | | | | | |

Revenues: | | | | | |

Product | | $ | 388,397 |

| $ | 105,819 |

| $ | 2,334 |

| $ | 496,550 |

|

Services and other revenues | | 96,162 |

| 84,311 |

| (8,631 | ) | 171,842 |

|

Total revenues | 484,559 |

| 190,130 |

| (6,297 | ) | 668,392 |

|

Cost of revenues: | | | | | | — |

|

Cost of product revenues | | 198,418 |

| 103,687 |

| (16,082 | ) | 286,023 |

|

Cost of services and other revenues | 38,211 |

| — |

| 34,381 |

| 72,592 |

|

Total cost of revenues | 236,629 |

| 103,687 |

| 18,299 |

| 358,615 |

|

Gross profit | | | 247,930 |

| 86,443 |

| (24,596 | ) | 309,777 |

|

Operating expenses: | | | | — |

|

Research and development | | 35,160 |

| 15,760 |

| — |

| 50,920 |

|

Selling, general and administrative | 167,581 |

| 68,300 |

| (1,531 | ) | 234,350 |

|

Gain on the equity investment | (3,443 | ) | — |

| — |

| (3,443 | ) |

| | | | 199,298 |

| 84,060 |

| (1,531 | ) | 281,827 |

|

Income from operations | | 48,632 |

| 2,383 |

| (23,065 | ) | 27,950 |

|

Interest and other income(expense), net | (2,388 | ) | (5,126 | ) | (2,503 | ) | (10,017 | ) |

Income before taxes | | | 46,244 |

| (2,743 | ) | (25,568 | ) | 17,933 |

|

Income taxes expense | 15,484 |

| 201 |

| (9,588 | ) | 6,097 |

|

Net income | | | $ | 30,760 |

| $ | (2,944 | ) | $ | (15,980 | ) | $ | 11,836 |

|

Net income per share: | | | | |

| Basic | | | $ | 0.86 |

| | — |

| $ | 0.33 |

|

| Diluted | | | $ | 0.84 |

| | — |

| $ | 0.32 |

|

Shares used in computing income per share: | | | | |

| Basic | | | 35,857 |

| | — |

| 35,857 |

|

| Diluted | | | 36,718 |

| | 523 |

| 37,241 |

|

Omnicell, Inc.

Reconciliation of Pro Forma Statement of Operations from GAAP to Non-GAAP

(Unaudited, in thousands, except per share data and percentages) |

| | | | | | | | | |

| | | | | | | Year Ended |

| | | | | | | December 31,

2015 |

| | | | | | | |

| | |

GAAP Pro forma combined net income | | $ | 11,836 |

|

Adjustments: | | |

| Share-based compensation expense | | 17,228 |

|

| Intangible assets amortization from business acquisitions | | 29,768 |

|

| Amortization of debt issuance cost | | 1,590 |

|

| Acquisition accounting impacts related to deferred revenue | | 7,984 |

|

| Inventory fair value adjustments | | 3,951 |

|

| Acquisitions related expenses | | 3,700 |

|

| Gain on business combination of an equity investment | | (3,443 | ) |

| Tax effect of the adjustments above(a) | | (14,807 | ) |

Non-GAAP Pro forma net income | | $ | 57,807 |

|

| | | | | | | |

Pro forma combined revenues | | $ | 668,392 |

|

| | Acquisition accounting impacts related to deferred revenue | | 7,984 |

|

Non-GAAP Pro forma combined revenues | | $ | 676,376 |

|

| | | |

| GAAP Pro forma gross profit | | 309,777 |

|

| GAAP Pro forma gross margin | | 46.3% |

| | Acquisition accounting impacts related to deferred revenue | | 7,984 |

|

| | Share-based compensation expense | | 2,111 |

|

| | Inventory fair value adjustments | | 3,951 |

|

| | Amortization of acquired intangibles | | 19,654 |

|

| Non-GAAP Pro forma gross profit | | $ | 343,477 |

|

| Non-GAAP Pro forma gross margin | | 50.8% |

| | |

GAAP Pro forma operating expenses | | $ | 281,827 |

|

| GAAP operating expenses % to total revenue | | 42.2% |

| Share-based compensation expense | | (15,117 | ) |

| Intangible assets amortization from business acquisitions | | (10,114 | ) |

| Acquisition related expenses | | (3,700 | ) |

| Gain on business combination of an equity investment | | 3,443 |

|

Non-GAAP Pro forma operating expenses | | $ | 256,339 |

|

| Non-GAAP Pro forma operating expenses % to total revenue | | 37.9% |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

|

| | | | | | | | | |

| | | | | | | Years Ended |

| | | | | | | December 31,

2015 |

| | | | | | | |

| | |

GAAP Pro forma income from operations | | $ | 27,949 |

|

| GAAP Pro forma operating income % to total revenue | | 4.2% |

| Share-based compensation expense | | 17,228 |

|

| Intangible assets amortization from business acquisitions | | 29,768 |

|

| Acquisition accounting impacts related to deferred revenue | | 7,984 |

|

| Inventory fair value adjustments | | 3,951 |

|

| Acquisitions related expenses | | 3,700 |

|

| Gain on business combination of an equity investment | | (3,443 | ) |

Non-GAAP Pro forma income from operations | | $ | 87,137 |

|

| Non-GAAP Pro forma operating income % to total revenue | | 12.9% |

| | | | | | | |

GAAP Pro forma Interest and other (expense), net | | $ | (10,017 | ) |

| Amortization of debt issuance cost | | 1,590 |

|

| Non-GAAP Pro forma Interest and other (expense), net | | $ | (8,427 | ) |

| | | | | | | |

| | | | | | | |

GAAP Pro forma shares - diluted | | 37,241 |

|

| | | | | | | |

GAAP Pro forma net income per share - diluted | | $ | 0.32 |

|

Adjustments: | | |

| Share-based compensation expense | | 0.46 |

|

| Intangible assets amortization from business acquisitions | | 0.80 |

|

| Amortization of debt issuance cost | | 0.04 |

|

| Acquisition accounting impacts related to deferred revenue | | 0.21 |

|

| Inventory fair value adjustments | | 0.11 |

|

| Acquisitions related expenses | | 0.10 |

|

| Gain on business combination of an equity investment | | (0.09 | ) |

| Tax effect of the adjustments above | | (0.40 | ) |

Non-GAAP Pro forma net income per share - diluted | | $ | 1.55 |

|

| | |

GAAP Pro forma net income | | $ | 11,836 |

|

Add back: | | |

| Share-based compensation expense | | 17,228 |

|

| Interest expense | | 6,428 |

|

| Depreciation and amortization expense | | 46,062 |

|

| Income tax expense | | 6,097 |

|

| Acquisition related expenses | | 3,700 |

|

| Amortization of debt issuance cost | | 1,590 |

|

| Acquisition accounting impacts related to deferred revenue | | 7,984 |

|

| Gain on business combination of an equity investment | | (3,443 | ) |

Non-GAAP adjusted Pro forma EBITDA (b) | | $ | 97,482 |

|

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

|

| | | | | | | | | |

| | | | | | | |

Aesynt stand alone Year Ended September 30, 2015 GAAP revenue | | $ | 190,130 |

|

| Acquisition accounting impacts related to deferred revenue | | 851 |

|

Aesynt stand alone year ended September 30, 2015 Non-GAAP revenue | | $ | 190,981 |

|

| | | | | | | |

Aesynt stand alone Year Ended September 30, 2015 GAAP Pro forma net income (loss) | | $ | (2,944 | ) |

Add back: | | |

| Share-based compensation expense | | 490 |

|

| Interest expense | | 4,541 |

|

| Depreciation and amortization expense | | 9,453 |

|

| Earn-out expense associated with previous acquisitions | | 7,943 |

|

| Acquisition related expenses | | 802 |

|

| Amortization of debt issuance cost | | 564 |

|

| Income tax expense | | 201 |

|

| Acquisition accounting impacts related to deferred revenue | | 851 |

|

| Inventory fair value adjustment | | 1,503 |

|

Non-GAAP adjusted Pro forma EBITDA | | $ | 23,404 |

|

____________________________________________

| |

(a) | Tax effects calculated for all adjustments except share based compensation expense, using the effective tax rate of 33%. |

| |

(b) | Defined as earnings before interest income and expense, taxes, depreciation and amortization, and non-cash expenses, including stock compensation expense, per ASC 718, as well as excluding certain non-GAAP adjustments. |

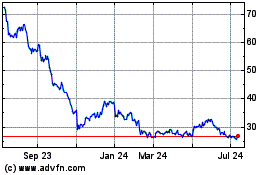

Omnicell (NASDAQ:OMCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

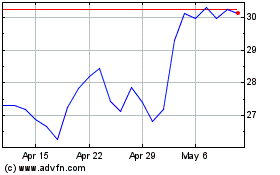

Omnicell (NASDAQ:OMCL)

Historical Stock Chart

From Apr 2023 to Apr 2024