News Corp Earnings Boosted by Tax Benefit

November 05 2015 - 6:00PM

Dow Jones News

News Corp boosted its net income for the September quarter

because of a one-time tax benefit, but revenue fell 4% as foreign

currency fluctuations and weakness in print advertising weighed on

the media company's results.

News Corp owns The Wall Street Journal, among other

publications.

Net income from continuing operations attributable to

shareholders rose to $175 million, or 22 cents a share, from $65

million, or 15 cents a share, in the same period a year earlier,

the company said. Excluding certain items, such as a $151 million

tax benefit from the sale of the digital-educations business,

adjusted earnings were 5 cents a share.

Revenue declined to $2.01 billion from $2.11 billion a year

earlier, driven by an 11% drop in revenue at the news and

information services segment, which accounts for two-thirds of News

Corp's total revenue.

Analysts polled by Thomson Reuters had expected total revenue of

$2.09 billion in the quarter and adjusted per-share earnings of 6

cents.

"News Corp is on track in its transition to a more digital and

global future, having successfully integrated several recent

acquisitions and built a powerful platform for future growth," News

Corp Chief Executive Robert Thomson said in a news release.

Earnings before interest, taxes, depreciation and amortization

declined 15% in the period to $165 million because of declines at

the news and information services segment, higher legal costs at

News America Marketing, and declines at the book publishing

segment.

Write to Lukas I. Alpert at lukas.alpert@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 05, 2015 17:45 ET (22:45 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

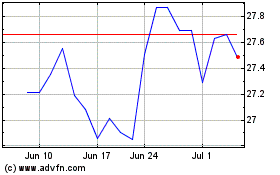

News (NASDAQ:NWSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

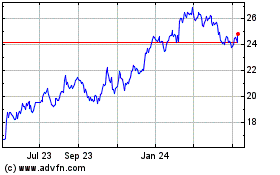

News (NASDAQ:NWSA)

Historical Stock Chart

From Apr 2023 to Apr 2024