UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

______________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported) April 6, 2015 (April 6, 2015)

NATIONAL WESTERN LIFE INSURANCE COMPANY

(Exact Name of Registrant as Specified in Charter)

|

| | | | |

Colorado | | 2-17039 | | 84-0467208 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

|

| | |

850 East Anderson Lane Austin, Texas | | 78752-1602 |

(Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code (512) 836-1010

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[X] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[X] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01. Entry into a Material Definitive Agreement.

On April 6, 2015, National Western Life Insurance Company, a Colorado corporation (“NWLIC”), National Western Life Group, Inc., a Delaware corporation and wholly-owned subsidiary of NWLIC (“Newco”), and NWLIC MergerCo, Inc., a Colorado corporation and wholly-owned subsidiary of Newco (“MergerCo”), entered into an Agreement and Plan of Merger (the “Reorganization Agreement”), that provides for the merger (the “Merger”) of NWLIC with MergerCo, with NWLIC surviving the Merger as a wholly-owned subsidiary of Newco, and the conversion of each share of Class A common stock, par value $1.00 per share, of NWLIC (“NWLIC Class A Stock”) and each share of Class B common stock, par value $1.00 per share, of NWLIC (“NWLIC Class B Stock”) issued and outstanding immediately prior to the effective time of the Merger, into one duly issued, fully paid and non-assessable share of Class A common stock, par value $0.01 per share, of Newco (“Newco Class A Stock”) or Class B common stock, par value $0.01 per share, of Newco (“Newco Class B Stock”), respectively (collectively with the other transactions contemplated by the Reorganization Agreement, the “Reorganization”). In addition, each outstanding option to acquire, or SARs relating to, shares of NWLIC Class A Stock would automatically convert into an option to acquire, or SARs relating to, on the same terms and conditions, an identical number of shares of Newco Class A Stock.

Upon completion of the Reorganization, Newco, a Delaware corporation, would, in effect, replace NWLIC, a Colorado corporation, as the publicly held corporation traded on the NASDAQ Global Select Market under the symbol “NWLI”, and the holders of NWLIC Class A Stock and NWLIC Class B Stock would hold the same number of shares and same ownership percentage of Newco after the Reorganization as they held of NWLIC immediately prior to the Reorganization.

The directors of Newco immediately following the Reorganization would be the same individuals who were directors of NWLIC immediately prior to the Reorganization.

The boards of directors of NWLIC, Newco and MergerCo have unanimously approved the Reorganization Agreement and the transactions contemplated thereby. The Reorganization Agreement is subject to specified conditions, including approval by NWLIC’s shareholders at NWLIC’s Annual Meeting of Shareholders (the “Annual Meeting”), which is currently scheduled for Friday, June 19, 2015. If approved by NWLIC’s shareholders at the Annual Meeting and the other conditions set forth in the Reorganization Agreement are satisfied, it is currently expected that the Reorganization would be completed in the latter part of 2015.

The Reorganization Agreement may be terminated and the transactions contemplated thereby may be abandoned at any time prior to the effective time of the merger by action of the board of directors of NWLIC if it should determine that for any reason the completion of the transactions provided for therein would be inadvisable or not in the best interest of NWLIC or its shareholders.

The Reorganization is intended to be tax-free for NWLIC and its shareholders for U.S. federal income tax purposes.

Upon completion of the Reorganization, Newco Class A Stock would be deemed to be registered under Section 12(b) of the Securities Exchange Act of 1934, as amended, pursuant to Rule 12g-3(a) promulgated thereunder. For purposes of Rule 12g-3(a), Newco would be the successor issuer to NWLIC.

The foregoing description of the Reorganization Agreement is not complete and is qualified in its entirety by reference to the Reorganization Agreement, which is attached hereto as Exhibit 2.1 and is incorporated herein by reference.

Additional Information and Where to Find It

NWLIC and Newco have filed a registration statement on Form S-4 that includes a preliminary proxy statement/prospectus and other relevant documents in connection with the proposed Reorganization. NWLIC SHAREHOLDERS ARE URGED TO CAREFULLY READ THESE DOCUMENTS AND THE DEFINITIVE PROXY STATEMENT/PROSPECTUS, WHEN FILED AND MAILED, BECAUSE THEY CONTAIN AND WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED REORGANIZATION. Investors may obtain a free copy of the preliminary proxy statement/prospectus and other filings containing information about NWLIC, Newco and the proposed Reorganization, from the SEC at the SEC’s website at http://www.sec.gov. In addition, copies of the definitive proxy statement/prospectus (when available) and other filings containing information about NWLIC, Newco and the proposed Reorganization can be obtained without charge by directing a request to National Western Life Insurance Company, 850 East Anderson Lane, Austin, Texas 78752-1602, (telephone 512-836-1010) or accessing them on NWLIC’s corporate website at www.nationalwesternlife.com.

NWLIC, its directors, executive officers, certain other members of management and employees may be deemed to be participants in the solicitation of proxies from the shareholders of NWLIC in favor of the proposed Reorganization. Solicitations may be made by mail, email, personal interview, telephone or other electronic transmission by directors, officers and other employees of NWLIC without additional compensation.

Additional information regarding the interests of potential participants in the proxy solicitation is included in the preliminary proxy statement/prospectus and will be included in the definitive proxy statement/prospectus and other relevant documents that NWLIC and Newco have filed and intend to file with the SEC in connection with the Annual Meeting.

On April 6, 2015, NWLIC issued a press release relating to the Reorganization. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

| |

Exhibit No. | Description |

| |

2.1 | Agreement and Plan of Merger, dated April 6, 2015, among National Western Life Insurance Company, a Colorado corporation, National Western Life Group, Inc., a Delaware corporation, and NWLIC MergerCo, Inc. |

| |

99.1 | Press Release, dated April 6, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

NATIONAL WESTERN LIFE INSURANCE COMPANY

|

| | |

Date: April 6, 2015 | | |

| | |

| By: | /s/ Brian M. Pribyl |

| Name: | Brian M. Pribyl |

| Title: | Senior Vice President Chief Financial Officer and Treasurer |

EXHIBIT INDEX

|

| |

Exhibit No. | Description |

| |

2.1 | Agreement and Plan of Merger, dated April 6, 2015, among National Western Life Insurance Company, a Colorado corporation, National Western Life Group, Inc., a Delaware corporation, and NWLIC MergerCo, Inc. |

| |

99.1 | Press Release, dated April 6, 2015. |

EXHIBIT 2.1

AGREEMENT AND PLAN OF MERGER

by and among

National Western Life Insurance Company

a Colorado corporation,

National Western Life Group, Inc.

a Delaware corporation,

and

NWLIC MergerCo, Inc.

a Colorado corporation,

___________________________

Dated as of April 6, 2015

___________________________

TABLE OF CONTENTS

Page

|

| | | |

ARTICLE 1 The Merger | 2 |

|

1.1 | The Merger | 2 |

|

1.2 | Effective Time | 2 |

|

1.3 | Organizational Documents of the Surviving Company | 2 |

|

1.4 | Directors | 2 |

|

1.5 | Officers | 3 |

|

1.6 | Directors and Officers of HoldingCo | 3 |

|

1.7 | Additional Actions | 3 |

|

1.8 | Conversion of Securities | 3 |

|

1.9 | No Surrender of Certificates; Direct Registration of HoldingCo Common Stock | 4 |

|

1.10 | Stock Transfer Books | 4 |

|

1.11 | Plan of Reorganization | 5 |

|

1.12 | Successor Issuer | 5 |

|

| | |

ARTICLE 2 Actions to be Taken in Connection with the Merger | 5 |

|

2.1 | Assumption of Company Options | 5 |

|

2.2 | Assignment and Assumption of Agreements | 5 |

|

2.3 | Reservation of Shares | 5 |

|

2.4 | Registration Statement; Proxy/Prospectus | 6 |

|

2.5 | Meeting of Company Shareholders | 6 |

|

2.6 | Section 16 Matters | 6 |

|

| | |

ARTICLE 3 Conditions of Merger | 7 |

|

3.1 | Conditions Precedent | 7 |

|

| | |

ARTICLE 4 Covenants | 8 |

|

4.1 | Listing of HoldingCo Common Stock | 8 |

|

4.2 | The Plans | 8 |

|

4.3 | Insurance | 8 |

|

| | |

ARTICLE 5 Termination and Amendment | 8 |

|

5.1 | Termination | 8 |

|

5.2 | Amendment | 8 |

|

| | |

ARTICLE 6 Miscellaneous Provisions | 8 |

|

6.1 | Governing Law | 8 |

|

6.2 | Counterparts | 8 |

|

6.3 | Entire Agreement | 8 |

|

6.4 | Severability | 9 |

|

6.5 | No Third-Party Beneficiaries | 9 |

|

6.6 | Tax Matters | 9 |

|

Agreement and Plan of Merger

This AGREEMENT AND PLAN OF MERGER (this “Agreement”), dated as of April 6, 2015, is among National Western Life Insurance Company, a Colorado corporation (the “Company”), National Western Life Group, Inc., a Delaware corporation and a direct, wholly-owned subsidiary of the Company (“HoldingCo”), and NWLIC MergerCo, Inc., a Colorado corporation and a direct, wholly-owned subsidiary of HoldingCo (“MergerCo”).

Recitals

WHEREAS, as of the date hereof, the authorized capital stock of the Company consists of (i) 7,500,000 shares of Class A common stock, $1.00 par value per share (“Company Class A Common Stock”), of which approximately 3,436,166 shares are issued and outstanding, approximately 300,000 shares are reserved for issuance under the Company’s Plans (as defined below), including upon the exercise of outstanding Company Options (as hereinafter defined), and no shares are held in treasury, and (ii) 200,000 shares of Class B common stock, $1.00 par value per share (“Company Class B Common Stock” and, together with the Company Class A Common Stock, “Company Common Stock”), of which approximately 200,000 shares are issued and outstanding and no shares are held in treasury;

WHEREAS, immediately before the closing date of the transaction contemplated herein, the authorized capital stock of HoldingCo will consist of (i) 7,500,000 shares of Class A common stock, $0.01 par value per share (“HoldingCo Class A Common Stock”), of which 100 shares are issued and outstanding and no shares are held in treasury, and (ii) 200,000 shares of Class B common stock, $.01 par value per share (“HoldingCo Class B Common Stock” and, together with the Company Class A Common Stock, “HoldingCo Common Stock”), of which no shares are issued and outstanding nor held in treasury;

WHEREAS, as of the date hereof, all of the issued and outstanding common stock of MergerCo (“MergerCo Common Stock”) is held by HoldingCo;

WHEREAS, HoldingCo and MergerCo were organized for the purpose of participating in the transactions herein contemplated;

WHEREAS, the Board of Directors of each of the Company, HoldingCo and MergerCo have unanimously determined that it is advisable and in the best interests of their respective security holders to reorganize to create a new holding company structure by merging the Company with MergerCo, with the Company being the surviving entity (sometimes hereinafter referred to as the “Surviving Company”), and converting each outstanding share of Company Class A Common Stock into one (1) share of HoldingCo Class A Common Stock and each outstanding share of Company Class B Common Stock into one (1) share of HoldingCo Class B Common Stock, all in accordance with the terms of this Agreement;

WHEREAS, the Board of Directors of the Company has unanimously determined that it is advisable and in the best interests of its shareholders to reorganize the Company’s operations, such that the public company owned by its shareholders is incorporated in the State of Delaware and, accordingly, HoldingCo has been incorporated in the State of Delaware;

WHEREAS, the Boards of Directors of each of HoldingCo, the Company and MergerCo and the sole shareholder of MergerCo have adopted or approved this Agreement and the merger of the Company with MergerCo upon the terms and subject to the conditions set forth in this Agreement (the “Merger”);

WHEREAS, the Boards of Directors of each of the Company and MergerCo have declared advisable this Agreement and the Merger upon the terms and subject to the conditions set forth in this Agreement, and the Boards of Directors of each of the Company and MergerCo have unanimously determined to recommend to their respective shareholders the approval of this Agreement and the Merger, subject to the terms and conditions hereof and in accordance with the provisions of the Colorado Business Corporation Act (the “CBCA”); and

WHEREAS, the parties intend, by executing this Agreement, to adopt a plan of reorganization within the meaning of Section 368 of the Internal Revenue Code of 1986, as amended (the “Code”), and to cause the Merger to constitute an exchange of Company Common Stock for HoldingCo Common Stock governed by Section 351 of the Code, as well as a reorganization within the meaning of Section 368(a) of the Code.

NOW, THEREFORE, in consideration of the premises and the covenants and agreements contained in this Agreement, and intending to be legally bound hereby, the Company, HoldingCo and MergerCo hereby agree as follows:

ARTICLE 1

The Merger

1.1The Merger. In accordance with Section 7-111-101 of the CBCA, and subject to and upon the terms and conditions of this Agreement, the Company shall, at the Effective Time (as defined below), be merged with MergerCo, the separate corporate existence of MergerCo shall cease and the Company shall continue as the Surviving Company. At the Effective Time, the effect of the Merger shall be as provided in Sections 7-90-204 and 7-111-106(1) of the CBCA.

1.2Effective Time. The Merger shall become effective upon the filing of a Certificate of Merger with the Secretary of the State of the State of Colorado or a later date specified therein (the “Effective Time”).

1.3Organizational Documents of the Surviving Company.

(a)Immediately after the Effective Time, the articles of incorporation of the Company shall be the amended and restated articles of incorporation attached hereto as Exhibit A, until thereafter amended as provided therein and by applicable law.

(b)Immediately after the Effective Time, the bylaws of the Company shall be the amended and restated bylaws (the “Surviving Company Bylaws”) attached hereto as Exhibit B, until thereafter amended as provided therein and by applicable law.

1.4Directors. The initial directors of the Surviving Company will be Ross R. Moody, E.J. Pederson, Stephen E. Glasgow, Brian M. Pribyl, Kitty K. Nelson, and Rey Perez, and they will hold office from the Effective Time until their successors are duly elected or appointed and qualified in the manner provided in the Surviving Company Bylaws or as otherwise provided by law.

1.5Officers. The officers of the Company immediately prior to the Effective Time shall be the initial officers of the Surviving Company and will hold office from the Effective Time until their successors are duly elected or appointed and qualified in the manner provided in the Surviving Company Bylaws or as otherwise provided by law.

1.6Directors and Officers of HoldingCo. Prior to the Effective Time, the Company, in its capacity as the sole stockholder of HoldingCo, shall take or cause to be taken all such actions as are necessary to cause (i) those persons serving as the directors of the Company immediately prior to the Effective Time to be elected or appointed as the directors of HoldingCo, with the directors serving until the earlier of the next meeting of the HoldingCo stockholders at which an election of directors of such class is held and until their successors are elected or appointed (or their earlier death, disability or retirement), each such person to have the same committee memberships with HoldingCo as he or she held with the Company, to the extent such committees exist at HoldingCo, and (ii) the following executive officers of the Company immediately prior to the Effective Time to be elected or appointed as the executive officers of HoldingCo, each such person to have the same office(s) with HoldingCo as he held with the Company: (1) Robert L. Moody; (2) Ross R. Moody; (3) Brian M. Pribyl; (4) Charles D. Milos; (5) Patricia L. Scheuer; (6) Robert Sweeney; (7) Kitty K. Nelson; and (8) Rey Perez.

1.7Additional Actions. Subject to the terms of this Agreement, the parties hereto shall take all such reasonable and lawful action as may be necessary or appropriate in order to effectuate the Merger and to comply with the requirements of the CBCA. If, at any time after the Effective Time, the Surviving Company shall consider or be advised that any deeds, bills of sale, assignments, assurances or any other actions or things are necessary or desirable to vest, perfect or confirm, of record or otherwise, in the Surviving Company its right, title or interest in, to or under any of the rights, properties or assets of either of MergerCo or the Company acquired or to be acquired by the Surviving Company as a result of, or in connection with, the Merger or otherwise to carry out this Agreement, the officers of the Surviving Company shall be authorized to execute and deliver, in the name and on behalf of each of MergerCo and the Company, all such deeds, bills of sale, assignments and assurances and to take and do, in the name and on behalf of each of MergerCo and the Company or otherwise, all such other actions and things as may be necessary or desirable to vest, perfect or confirm any and all right, title and interest in, to and under such rights, properties or assets in the Surviving Company or otherwise to carry out this Agreement.

1.8Conversion of Securities. At the Effective Time, by virtue of the Merger and without any action on the part of HoldingCo, MergerCo, the Company or the holder of any of the following securities:

(a)Each share of Company Class A Common Stock issued and outstanding immediately prior to the Effective Time (other than any shares held in treasury, which shall be automatically cancelled and retired without the payment of any consideration therefor) shall be converted into one (1) duly issued, fully paid and non-assessable share of HoldingCo Class A Common Stock, and each share of Company Class B Common Stock issued and outstanding immediately prior to the Effective Time (other than any shares held in treasury, which shall be automatically cancelled and retired without the payment of any consideration therefor) shall be converted into one (1) duly issued, fully paid and non-assessable share of HoldingCo Class B Common Stock. The HoldingCo Class A Common Stock and the HoldingCo Class B Common Stock into which the Company Class

A Common Stock and Company Class B Common Stock shall be converted in accordance with this subsection (a) are referred to herein as the “Merger Consideration.”

(b)The MergerCo common stock held by HoldingCo will automatically be converted into, and thereafter represent, 100% of the common stock of the Surviving Company.

(c)Each share of HoldingCo Class A Common Stock and HoldingCo Class B Common Stock, if any, owned by the Company immediately prior to the Merger shall automatically be cancelled and retired and shall cease to exist.

(d)From and after the Effective Time, holders of certificates formerly evidencing Company Class A Common Stock and Company Class B Common Stock shall cease to have any rights as shareholders of the Company, except as provided by law; provided, however, that such holders shall have the rights set forth in Section 1.9 herein.

(e)In accordance with Section 7-113-102 of the CBCA, no appraisal rights shall be available to holders of Company Common Stock in connection with the Merger.

1.9No Surrender of Certificates; Direct Registration of HoldingCo Common Stock. At the Effective Time, (i) each outstanding share of Company Class A Common Stock (other than any shares of Company Common Stock to be cancelled in accordance with Section 1.8) shall automatically represent the same number of shares of HoldingCo Class A Common Stock without any further act or deed by the shareholders of the Company and (ii) each outstanding share of Company Class B Common Stock (other than any shares of Company Common Stock to be cancelled in accordance with Section 1.8) shall automatically represent the same number of shares of HoldingCo Class B Common Stock without any further act or deed by the shareholders of the Company. Record of ownership of HoldingCo Class A Common Stock and HoldingCo Class B Common Stock shall be kept in uncertificated, book entry form by HoldingCo’s transfer agent. Until thereafter surrendered for transfer or exchange in the ordinary course, (a) each outstanding certificate that, immediately prior to the Effective Time, evidenced Company Class A Common Stock shall, from and after the Effective Time, be deemed and treated for all corporate purposes to evidence the ownership of the same number of shares of HoldingCo Class A Common Stock and (b) each outstanding certificate that, immediately prior to the Effective Time, evidenced Company Class B Common Stock shall, from and after the Effective Time, be deemed and treated for all corporate purposes to evidence the ownership of the same number of shares of HoldingCo Class B Common Stock.

1.10Stock Transfer Books. At the Effective Time, the stock transfer books of the Company shall be closed and thereafter there shall be no further registration of transfers of shares of Company Class A Common Stock or Company Class B Common Stock theretofore outstanding on the records of the Company. From and after the Effective Time, the holders of certificates representing shares of Company Class A Common Stock and Company Class B Common Stock outstanding immediately prior to the Effective Time shall cease to have any rights with respect to such shares of Company Class A Common Stock and Company Class B Common Stock, respectively, except as otherwise provided in this Agreement or by law. On or after the Effective Time, any certificates presented to HoldingCo or its transfer agent for any reason shall solely represent the right to receive the Merger Consideration issuable in respect of the shares of Company Class A Common Stock or Class B Common Stock formerly represented by such certificates without any interest thereon.

1.11Plan of Reorganization. This Agreement is intended to constitute a “plan of reorganization” within the meaning of Treasury Regulations Section 1.368-2(g). Each party hereto shall use its commercially reasonable efforts to cause the Merger to constitute, and will not knowingly take any actions or cause any actions to be taken which could reasonably be expected to prevent the Merger from constituting, an exchange of Company Class A Common Stock for HoldingCo Class A Common Stock and an exchange of Company Class B Common Stock for HoldingCo Class B Common Stock, in each case, governed by Section 351of the Code, as well as a reorganization within the meaning of Section 368(a) of the Code.

1.12Successor Issuer. It is the intent of the parties hereto that HoldingCo be deemed a “successor issuer” of the Company in accordance with Rule 12g-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Rule 414 under the Securities Act of 1933, as amended (the “Securities Act”). At or after the Effective Time, HoldingCo shall file (i) an appropriate report on Form 8-K describing the Merger and (ii) appropriate pre-effective and/or post-effective amendments, as applicable, to any registration statements of the Company on Form S-8.

ARTICLE 2

Actions to be Taken in Connection with the Merger

2.1Assumption of Company Options. At the Effective Time, all unexercised and unexpired options to purchase Company Class A Common Stock (“Company Options”), then outstanding under the National Western Life Insurance Company 1995 Stock and Incentive Plan and the National Western Life Insurance Company 2008 Incentive Plan (collectively, the “Company Plans”), whether or not then exercisable, will be assumed by HoldingCo. Each Company Option so assumed by HoldingCo under this Agreement will continue to have, and be subject to, the same terms and conditions as set forth in the applicable Company Plan and any agreements thereunder immediately prior to the Effective Time (including, without limitation, the vesting schedule (without acceleration thereof by virtue of the Merger and the transactions contemplated hereby) and per share exercise price), except that each Company Option will be exercisable (or will become exercisable in accordance with its terms) for, or shall be denominated with reference to, that number of shares of HoldingCo Class A Common Stock equal to the number of shares of Company Class A Common Stock that were subject to such Company Option immediately prior to the Effective Time. The conversion of any Company Options that are “incentive stock options” within the meaning of Section 422 of the Code, into options to purchase HoldingCo Class A Common Stock shall be made in a manner consistent with Section 424(a) of the Code so as not to constitute a “modification” of such Company Options within the meaning of Section 424 of the Code.

2.2Assignment and Assumption of Agreements. Effective as of the Effective Time, the Company hereby assigns to HoldingCo, and HoldingCo hereby assumes and agrees to perform, all obligations of the Company pursuant to the Company Plans, each stock option agreement entered into pursuant to the Company Plans, and each outstanding Company Option granted thereunder.

2.3Reservation of Shares. On or prior to the Effective Time, HoldingCo will reserve sufficient shares of HoldingCo Class A Common Stock to provide for the issuance of HoldingCo Class A Common Stock upon exercise of the Company Options outstanding under the Company Plans.

2.4Registration Statement; Proxy/Prospectus. As promptly as practicable after the execution of this Agreement, the Company shall prepare and file with the Securities and Exchange Commission (the “SEC”) a proxy statement in preliminary form relating to the Shareholders’ Meeting (as hereinafter defined) (together with any amendments thereof or supplements thereto, the “Proxy Statement”) and HoldingCo shall prepare and file with the SEC a registration statement on Form S-4 (together with all amendments thereto, the “Registration Statement” and the prospectus contained in the Registration Statement together with the Proxy Statement, the “Proxy/Prospectus”), in which the Proxy Statement shall be included, in connection with the registration under the Securities Act of the shares of HoldingCo Class A Common Stock and HoldingCo Class B Common Stock to be issued to the shareholders of the Company as the Merger Consideration. Each of HoldingCo and the Company shall use its reasonable best efforts to cause the Registration Statement to become effective and the Proxy Statement to be cleared by the SEC as promptly as practicable, and, prior to the effective date of the Registration Statement, HoldingCo shall take all actions reasonably required under any applicable federal securities laws or state blue sky laws in connection with the issuance of shares of HoldingCo Class A Common Stock and HoldingCo Class B Common Stock pursuant to the Merger. As promptly as reasonably practicable after the Registration Statement shall have become effective and the Proxy Statement shall have been cleared by the SEC, the Company shall mail or cause to be mailed or otherwise make available in accordance with the Securities Act and the Securities Exchange Act, the Proxy/Prospectus to its shareholders; provided, however, that the parties shall consult and cooperate with each other in determining the appropriate time for mailing or otherwise making available to the Company’s shareholders the Proxy/Prospectus in light of the date set for the Shareholders’ Meeting.

2.5Meeting of Company Shareholders. The Company shall take all action necessary in accordance with the CBCA and its articles of incorporation and bylaws to call, hold and convene a meeting of its shareholders to consider the adoption of this Agreement (the “Shareholders’ Meeting”) to be held no less than ten (10) nor more than sixty (60) days following the distribution of the definitive Proxy/Prospectus to its shareholders. The Company will use its reasonable best efforts to solicit from its shareholders proxies in favor of the approval of this Agreement and the Merger. The Company may adjourn or postpone the Shareholders’ Meeting to the extent necessary to ensure that any necessary supplement or amendment to the Proxy/Prospectus is provided to its shareholders in advance of any vote on this Agreement and the Merger or, if as of the time for which the Shareholders’ Meeting is originally scheduled (as set forth in the Proxy/Prospectus) there are insufficient shares of Company Class A Common Stock and Company Class B Common Stock voting in favor of the approval of this Agreement and the Merger or represented (either in person or by proxy) to constitute a quorum necessary to conduct the business of such Shareholders’ Meeting.

2.6Section 16 Matters. Prior to the Effective Time, the Board of Directors of the Company or an appropriate committee of non-employee directors thereof (as such term is defined for purposes of Rule 16b-3 promulgated under the Exchange Act) shall adopt a resolution consistent with the interpretive guidance of the SEC so that the receipt by any officer or director of the Company who is a covered person for purposes of Section 16(a) of the Exchange Act of (i) shares of HoldingCo Class A Common Stock in exchange for shares of Company Class A Common Stock or Company Options or (ii) shares of HoldingCo Class B Common Stock in exchange for shares of Company Class B Common Stock, in each case, pursuant to this Agreement and the Merger is intended to be an exempt transaction pursuant to Section 16b-3 of the Exchange Act. Prior to the Effective Time, the Board of Directors of HoldingCo or an appropriate committee of non-employee directors (as such term is defined for purposes of Rule 16b-3 promulgated under the Exchange Act) shall adopt a

resolution consistent with the interpretive guidance of the SEC so that the receipt by any officer or director of the Company or HoldingCo who is a covered person for purposes of Section 16(a) of the Exchange Act of (a) shares of HoldingCo Class A Common Stock or options in exchange for shares of Company Class A Common Stock or Company Options or (b) shares of HoldingCo Class B Common Stock in exchange for shares of Company Class B Common Stock, in each case, pursuant to this Agreement and the Merger is intended to be an exempt transaction for purposes of Section 16b-3 of the Exchange Act.

ARTICLE 3

Conditions of Merger

3.1Conditions Precedent. The obligations of the parties to this Agreement to consummate the Merger and the transactions contemplated by this Agreement shall be subject to fulfillment by the parties hereto at or prior to the Effective Time of each of the following conditions:

(a)The Registration Statement shall have been deemed or declared effective by the SEC under the Securities Act and no stop order suspending the effectiveness of the Registration Statement shall have been issued by the SEC and no proceeding for that purpose shall have been initiated or, to the knowledge of HoldingCo or the Company, threatened by the SEC and not concluded or withdrawn. No similar proceeding with respect to the Proxy Statement shall have been initiated or, to the knowledge of HoldingCo or the Company, threatened by the SEC and not concluded or withdrawn.

(b)This Agreement and the Merger shall have been approved by the requisite vote of the shareholders of the Company in accordance with the CBCA and the articles of incorporation of the Company, as amended from time to time.

(c)The HoldingCo Class A Common Stock to be issued pursuant to the Merger shall have been approved for listing on the NASDAQ Stock Market (the “NASDAQ”) by The NASDAQ Stock Market, LLC.

(d)The Company shall have made such filings, and obtained such permits, authorizations, consents, approvals or terminations or expirations of waiting periods as are required by the corporate and insurance laws and regulations of all applicable jurisdictions.

(e)No order, statute, rule, regulation, executive order, injunction, stay, decree, judgment or restraining order that is in effect shall have been enacted, entered, promulgated or enforced by any court or governmental or regulatory authority or instrumentality that prohibits or makes illegal the consummation of the Merger or the transactions contemplated hereby.

(f)The Boards of Directors of the Company and HoldingCo shall have received a legal opinion of Sutherland Asbill & Brennan LLP in form and substance reasonably satisfactory to them to the effect that the Merger will constitute an exchange of Company Class A Common Stock for HoldingCo Class A Common Stock and an exchange of Company Class B Common Stock for HoldingCo Class B Common Stock, in each case, governed by Section 351 of the Code, as well as a reorganization within the meaning of Section 368(a) of the Code (it being understood that in rendering such opinion, Sutherland Asbill & Brennan LLP may rely upon the tax representation letter in the form agreed to by the Company, HoldingCo and Sutherland Asbill & Brennan LLP, which shall be executed and delivered by the Company and HoldingCo as a condition to rendering its opinion).

ARTICLE 4

Covenants

4.1Listing of HoldingCo Common Stock. HoldingCo will use its reasonable best efforts to obtain, at or before the Effective Time, confirmation of listing on the NASDAQ of the HoldingCo Class A Common Stock issuable pursuant to the Merger.

4.2The Plans. The Company and HoldingCo will take or cause to be taken all actions necessary or desirable in order to implement the assumption by HoldingCo pursuant to the Company Plans, and each Company Option granted thereunder, all to the extent deemed appropriate by the Company and HoldingCo and permitted under applicable law.

4.3Insurance. HoldingCo shall procure insurance or cause the execution, amendment or endorsement of the insurance policies of the Company such that, upon consummation of the Merger, HoldingCo shall have insurance coverage that is substantially identical to the insurance coverage held by the Company immediately prior to the Merger.

ARTICLE 5

Termination and Amendment

5.1Termination. This Agreement may be terminated and the Merger contemplated hereby may be abandoned at any time prior to the Effective Time by action of the Board of Directors of the Company if such Board of Directors should determine that for any reason the completion of the transactions provided for herein would be inadvisable or not in the best interest of the Company or its shareholders. In the event of such termination and abandonment, this Agreement shall become void and none of the Company, HoldingCo or MergerCo or their respective security holders, directors or officers shall have any liability with respect to such termination and abandonment.

5.2Amendment. At any time prior to the Effective Time, this Agreement may, to the extent permitted by the CBCA, be supplemented, amended or modified by the mutual consent of the parties to this Agreement.

ARTICLE 6

Miscellaneous Provisions

6.1Governing Law. This Agreement shall be governed by and construed and enforced under the laws of the State of Colorado.

6.2Counterparts. This Agreement may be executed in one or more counterparts, each of which when executed shall be deemed to be an original but all of which shall constitute one and the same agreement.

6.3Entire Agreement. This Agreement constitutes the entire agreement and supersedes all other agreements and undertakings, both written and oral, among the parties, or any of them, with respect to the subject matter hereof.

6.4Severability. The provisions of this Agreement are severable, and in the event any provision hereof is determined to be invalid or unenforceable, such invalidity or unenforceability shall not in any way affect the validity or enforceability of the remaining provisions hereof.

6.5No Third-Party Beneficiaries. Nothing contained in this Agreement is intended by the parties hereto to expand the rights and remedies of any person or entity not party hereto against any party hereto as compared to the rights and remedies which such person or entity would have had against any party hereto had the parties hereto not consummated the transactions contemplated hereby.

6.6Tax Matters. Each of the Company and HoldingCo will comply with the recordkeeping and information reporting requirements of the Code that are imposed as a result of the transactions contemplated hereby, and will provide information reporting statements to holders of Company Class A Common Stock and Company Class B Common Stock at the time and in the manner prescribed by the Code and applicable Treasury Regulations.

[Signature Page Follows]

IN WITNESS WHEREOF, the parties have caused this Agreement to be executed as of the date first written above by their respective officers thereunto duly authorized.

National Western Life Insurance Company,

a Colorado Corporation

By: /s/ Ross R. Moody

Name: Ross R. Moody

Title: President and COO

National Western Life Group, Inc.,

a Delaware Corporation

By: /s/ Ross R. Moody

Name: Ross R. Moody

Title: President and COO

NWLIC MergerCo, Inc.,

a Colorado Corporation

By: /s/ Rey Perez

Name: Rey Perez

Title: President

FOR IMMEDIATE RELEASE EXHIBIT 99.1

National Western Life Insurance Company Announces Annual Shareholders Meeting and Proposed Holding Company Reorganization

Austin, Texas, (April 6, 2015) - National Western Life Insurance Company (Nasdaq Global Select Market: NWLI) (the “Company”) today announced that it will host its Annual Meeting of Shareholders on Friday, June 19, 2015, at 9:00 a.m. local time (CST), at the Moody Gardens Hotel at Seven Hope Boulevard, Galveston, Texas 77554.

At the meeting, the Company’s shareholders will be asked, among other things, to consider and vote on a proposal to approve the reorganization (the “Reorganization”) of the company pursuant to which the present company will become a subsidiary of a newly formed Delaware corporation named National Western Life Group, Inc. (the “Holding Company”). Pending approval of the Reorganization at the Annual Meeting and effectiveness of the Reorganization, the Company’s shareholders will become stockholders of the new Holding Company. Each share of the Company’s Class A and Class B common stock outstanding at the time of the Reorganization would be converted automatically into one share of Class A and Class B common stock, respectively, in the Holding Company. The Reorganization is intended to be tax-free for the Company and its shareholders for U.S. federal income tax purposes.

Upon completion of the Reorganization, the Holding Company will replace the present company as the publicly held corporation. The Holding Company, through its subsidiaries, will continue to conduct all of the operations currently conducted by the Company and its subsidiaries, and the directors of the Company prior to the Reorganization will be the same as the directors of the Holding Company following the Reorganization.

“We expect the shares of National Western Life Group, Inc. common stock to trade under the Company’s current ticker symbol, ‘NWLI’, on the NASDAQ Global Select Market,” commented Ross R. Moody, the Company’s President and Chief Operating Officer. “We believe that implementing the holding company structure, which is how most of our public company peers are organized, will provide the Company with strategic, operational and financing flexibility, and incorporating the new Holding Company in Delaware should allow us to take advantage of the flexibility, predictability and efficiency that Delaware corporate law provides.”

If approved at the Annual Meeting, the Company expects that the Reorganization will become effective in the latter part of 2015. At the Annual Meeting, the Company’s shareholders will also be asked to elect ten directors and ratify the Company’s auditors.

About National Western Life Insurance Company

Founded in 1956, National Western Life is a stock life insurance company offering a broad portfolio of individual universal life, whole life and term insurance plans, annuity products, and investment contracts meeting the financial needs of its customers in 49 states as well as residents of various countries in Central and South America, the Caribbean, Eastern Europe, Asia, and the Pacific Rim. The Company has approximately 264 employees and 21,470 contracted independent agents, brokers, and consultants, and at December 31, 2014, maintained total assets of $11.4 billion, stockholders' equity of $1.6 billion, and life insurance in force of $23.1 billion.

Caution Regarding Forward-Looking Statements:

This press release contains statements which are or may be viewed as forward-looking within the meaning of The Private Securities Litigation Reform Act of 2005. Forward-looking statements relate to future operations, strategies, financial results or other developments, and are subject to assumptions, risks, and uncertainties. Factors that may cause actual results to differ materially from those contemplated in these forward-looking statements can be found in the Company's Form 10-K filed with the Securities and Exchange Commission. Forward-looking statements speak only as of the date the statement was made and the Company undertakes no obligation to update such forward-looking statements. There can be no assurance that other factors not currently anticipated by the Company will not materially and adversely affect our results of operations. Investors are cautioned not to place undue reliance on any forward-looking statements made by us or on our behalf.

Additional Information

The Company and the Holding Company have filed a registration statement on Form S-4 with the Securities and Exchange Commission (“SEC”) that includes a preliminary proxy statement/prospectus and other relevant documents in connection with the proposed Delaware holding company reorganization. THE COMPANY’S SHAREHOLDERS ARE URGED TO READ CAREFULLY THESE DOCUMENTS AND THE DEFINITIVE PROXY STATEMENT / PROSPECTUS, WHEN FILED AND MAILED, BECAUSE THEY CONTAIN AND WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED DELAWARE HOLDING COMPANY REORGANIZATION. Investors may obtain a free copy of the definitive proxy statement/prospectus (when available) and other filings containing information about the Company, the Holding Company and the proposed Reorganization from the SEC at the SEC’s website at www.sec.gov. In addition, copies of the definitive proxy statement/prospectus (when available) and other filings containing information about the Company, the Holding Company and the proposed reorganization can be obtained without charge by directing a request to National Western Life Insurance Company, 850 East Anderson Lane, Austin, Texas 78752-1602, (telephone 512-836-1010) or accessing them on the Company’s corporate website at www.nationalwesternlife.com.

The Company, its directors, executive officers, certain other members of management and employees may be deemed to be participants in the solicitation of proxies from the shareholders of the Company in favor of the proposed holding company reorganization. Additional information regarding the interests of potential participants in the proxy solicitation is included in the preliminary proxy statement/prospectus and will be included in the definitive proxy statement/prospectus and other relevant documents that the Company and the Holding Company have filed and intend to file with the SEC in connection with the Annual Meeting of Shareholders of the Company.

This press release is being made pursuant to and in compliance with the Securities Act of 1933, as amended, and does not constitute an offer of any securities for sale or a solicitation of an offer to buy any securities, nor shall there be any sale of the securities in any state or jurisdiction in which an offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such state or jurisdiction. Any offer of the securities will be made solely by means of a prospectus included in the registration statement and any prospectus supplement that may be issued in connection with such offering.

Investor Relations Contact:

Brian M. Pribyl - Senior Vice President, Chief Financial Officer and Treasurer

(512) 836-1010

bpribyl@nationalwesternlife.com

www.nationalwesternlife.com

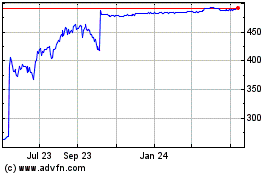

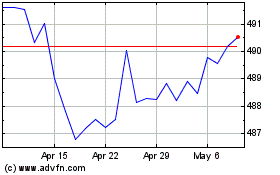

National Western Life (NASDAQ:NWLI)

Historical Stock Chart

From Mar 2024 to Apr 2024

National Western Life (NASDAQ:NWLI)

Historical Stock Chart

From Apr 2023 to Apr 2024