UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 4, 2016

NUVASIVE, INC.

(Exact

name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

000-50744 |

|

33-0768598 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification Number) |

7475 Lusk Boulevard, San Diego, California 92121

(Address of principal executive offices) (Zip Code)

(858) 909-1800

(Registrant’s telephone number, including area code)

n/a

(Former name or

former address, if changed since last report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 1.01 |

Entry into a Material Definitive Agreement. |

On January 4, 2016 (the

“Agreement Date”), NuVasive, Inc., a Delaware corporation (the “Company”) entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Magneto Acquisition

Corporation, a Delaware corporation (“Merger Sub”) and wholly-owned subsidiary of the Company, Ellipse Technologies, Inc., a Delaware corporation (“Ellipse”), and Fortis Advisors LLC, a Delaware

limited liability corporation, in its capacity as the equityholders’ representative (the “Equityholders’ Representative”). The Merger Agreement provides that, at the effective time of the merger (the

“Closing”), upon the terms and subject to the conditions set forth in the Merger Agreement, Merger Sub will merge with and into Ellipse, with Ellipse continuing as the surviving entity and a wholly-owned subsidiary of the

Company (the “Merger”). The Merger Agreement and the transactions contemplated thereby have been approved by the Board of Directors of both the Company and Ellipse, as well as the requisite stockholders of Ellipse.

Subject to the terms and conditions of the Merger Agreement, the Company has agreed to pay to the holders of Ellipse equity and promissory

notes convertible into Ellipse equity (collectively, the “Ellipse Security Holders”) an upfront cash payment of $380.0 million at the Closing and a potential milestone payment of $30.0 million payable in 2017 related to the

achievement of specific revenue targets (collectively, the “Merger Consideration”). The Company expects to fund the Merger Consideration with existing cash on hand. The Merger Consideration payable to Ellipse Security Holders

will be subject to working capital, net debt and transaction expense adjustments as set forth in the Merger Agreement. At the Closing, $1.0 million of the aggregate Merger Consideration will be contributed into an escrow fund to secure the Ellipse

Security Holders’ payment obligations, if any, with respect to such working capital, net debt and transaction expense adjustments. In addition, at the Closing, $38.0 million of the aggregate Merger Consideration will be contributed to an escrow

fund to secure the Ellipse Security Holders’ obligations to indemnify the Company for a period of 15 months following the Closing for certain matters, including breaches of representations and warranties and covenants included in the Merger

Agreement.

The Merger Agreement contains customary representations, warranties and covenants of the parties, including, among other

things, that during the period from the Agreement Date until the earlier of the termination of the Merger Agreement or the Closing, Ellipse agrees (a) to carry on its business in the ordinary course; (b) to use commercially reasonable

efforts to preserve its present business organizations, keep available the services of key employees and preserve its relationships with customers, suppliers and others having business dealings with it; and (c) not to solicit, initiate or

knowingly encourage any inquires or proposals that constitute a proposal or offer for a merger, consolidation, asset acquisition or similar business combinations involving Ellipse.

The Merger Agreement also contains standard conditions to Closing, including, among other things:

| |

• |

|

receipt of required regulatory approvals; |

| |

• |

|

the representations and warranties of Ellipse being true and correct at the Closing subject to the terms of the Merger Agreement; |

| |

• |

|

the absence of a material adverse effect on Ellipse; and |

| |

• |

|

certain employees of Ellipse being employed by the Company as of the Closing. |

The Merger

Agreement provides for limited termination rights, including but not limited to, by the mutual consent of the Company and Ellipse; upon certain breaches of representations, warranties, covenants or agreements; and in the event the Merger has not

been consummated by a mutually agreed upon date between the parties.

The foregoing description of the Merger Agreement and the

transactions contemplated thereby is not complete and is subject to and qualified in its entirety by reference to the Merger Agreement, a copy of which will be filed as an exhibit to the Company’s Annual Report on Form 10-K for the fiscal year

ended December 31, 2015, or if the Closing of the Merger has occurred prior to the filing of the Company’s Annual Report on Form 10-K, as an exhibit to the Current Report on Form 8-K filed by the Company to announce the Closing of the

Merger.

On January 5, 2016, the Company and Ellipse issued a joint press

release announcing the execution of the Merger Agreement. A copy of the joint press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

On January 5, 2016, the Company and Ellipse will hold a conference call at 5:00 p.m. ET / 2:00 p.m. PT to discuss the details of

transaction. The slide presentation for the conference call is furnished as Exhibit 99.2 to this report. The dial-in numbers for the conference call are 1-877-407-9039 for domestic callers and 1-201-689-8470 for international callers. A live webcast

of the conference call will be available online from the Investor Relations page of the Company’s website at www.nuvasive.com. After the live webcast, the call will remain available on NuVasive’s website through February 5,

2016. In addition, a telephone replay of the call will be available until January 12, 2016. The replay dial-in numbers are 1-877-870-5176 for domestic callers and 1-858-384-5517 for international callers, using pin number: 13627758.

This Current Report on Form 8-K includes forward-looking statements that are not a description

of historical facts and that involve risks, uncertainties, assumptions and other factors which, if they do not materialize or prove correct, could cause NuVasive’s results to differ materially from historical results or those expressed or

implied by such forward-looking statements. Forward-looking statements include, but are not limited to, statements about the timing of the anticipated acquisition, the funding of the anticipated acquisition, the potential benefits, synergies and

cost savings of the anticipated acquisition, including the expected impact on future financial and operating results, and post-acquisition plans and intentions. The forward-looking statements contained herein are based on the current expectations

and assumptions of NuVasive and not on historical facts. The following important factors, among others, could cause actual results to differ materially from those set forth in the forward-looking statements: the satisfaction of conditions to closing

the agreement, including the risk that the required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the acquisition; the loss

of key employees; the risk that the businesses will not be integrated successfully; unexpected variations in market growth and demand for the combined company’s products and technologies; and the risk that benefits and synergies from the

acquisition may not be fully realized or may take longer to realize than expected. Additional risks and uncertainties that may affect future results are described in NuVasive’s news releases and periodic filings with the Securities and Exchange

Commission. NuVasive’s public filings with the Securities and Exchange Commission are available at www.sec.gov. NuVasive assumes no obligation to update any forward-looking statement to reflect events or circumstances arising after the date on

which it was made.

| Item 9.01 |

Financial Statements and Exhibits. |

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Joint press release issued by NuVasive, Inc. and Ellipse Technologies, Inc. on January 5, 2016. |

|

|

| 99.2 |

|

Slide presentation dated January 5, 2016.* |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

| NUVASIVE, INC. |

|

|

| By: |

|

/s/ Jason D. Hanson |

|

|

Jason D. Hanson |

|

|

Executive Vice President, Strategy, Corporate

Development and General Counsel |

Date: January 5, 2016

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Joint press release issued by NuVasive, Inc. and Ellipse Technologies, Inc. on January 5, 2016. |

|

|

| 99.2 |

|

Slide presentation dated January 5, 2016.* |

Exhibit 99.1

NEWS RELEASE

Investor/Media Contact:

Stacy Roughan

NuVasive, Inc.

1-858-909-1812

sroughan@nuvasive.com

NUVASIVE TO ACQUIRE ELLIPSE TECHNOLOGIES

Reflects NuVasive’s Focus on Transformative Spine Solutions, Reinforces Leadership Position with the

Addition of Fast-Growing Complex Deformity Franchise

Expected to Accelerate the Company’s Revenue Growth and be Accretive to

Non-GAAP Diluted Earnings Per Share within First 12 Months

Investor Conference Call to be Held at 5:00 p.m. ET Today

SAN DIEGO, CA and ALISO VIEJO, CA – January 5, 2016 – NuVasive, Inc. (NASDAQ: NUVA), a leading medical device company focused on

transforming spine surgery with minimally disruptive, procedurally-integrated solutions, and Ellipse Technologies, Inc. (“Ellipse”), a privately held medical technology company focused on revolutionizing procedural solutions for complex

skeletal deformity, today announced that the Boards of Directors of both companies have unanimously approved a definitive agreement under which NuVasive will acquire Ellipse for a $380 million upfront cash payment and a potential $30 million

milestone payable in 2017 related to the achievement of specific revenue targets. NuVasive expects the acquisition to accelerate its revenue growth toward the high-single digit range and to be slightly accretive to the Company’s non-GAAP

diluted earnings per share within the first 12 months and significantly accretive thereafter. NuVasive also expects the transaction to support its five-year, double-digit return on invested capital goal, consistent with the Company’s previously

stated acquisition criteria.

The acquisition builds on NuVasive’s reputation as the leading technology provider for spine procedure solutions by

adding a highly regarded, disruptive technology platform. Ellipse’s magnetic growing rod technology is currently receiving rapid adoption in the pediatric deformity and orthopedic markets, providing for new growth opportunities beyond

NuVasive’s current portfolio of winning solutions that address adult degenerative and deformity spinal conditions.

1

Ellipse is the developer and marketer of a novel platform of magnetically adjustable implant systems based on its

MAGnetic External Control, or MAGEC®, technology. Ellipse’s novel and proprietary implants are adjustable at the time of implantation and are distracted non-invasively over the course of

treatment to accommodate the changing clinical needs of patients as they heal, grow or age. Ellipse’s MAGEC technology enables physicians to customize therapy for patients in a non-invasive manner, reducing the need for further repeat surgical

procedures, and providing meaningful improvements in patient clinical outcomes and quality of life while generating cost savings to the healthcare system.

“Ellipse’s revolutionary technology, which has been enthusiastically received by surgeons, has the potential to become the standard of care for

spine and orthopedic patients. It is in NuVasive’s sweet-spot of game-changing innovation, bolstering our leadership in spine and providing new growth opportunities in the U.S. and around the world,” said Gregory T. Lucier, NuVasive’s

Chairman and Chief Executive Officer. “NuVasive remains committed to adult deformity through our Integrated Global Alignment (iGA™) platform, and the acquisition of Ellipse will aggressively insert NuVasive into early onset and idiopathic

scoliosis, an important and attractive part of the spinal deformity market for NuVasive where we have tremendous opportunities for accelerated growth. Additionally, this investment expands NuVasive’s footprint into new niche markets with highly

differentiated technology that – when coupled with our market-making expertise – will be strategically applied in other spine and orthopedic applications, including degenerative spine disease, trauma and knee osteoarthritis. Ellipse’s

robust product pipeline also enhances internal development and licensing opportunities for NuVasive, including areas where we look to assemble with our iGA™ and neuromonitoring expertise. We are very excited to welcome Ellipse’s talented

team to NuVasive and look forward to realizing the many operational and financial benefits this transaction creates.”

Edmund J. Roschak, President

and Chief Executive Officer of Ellipse Technologies, said, “Ellipse has made enormous strides since our founding ten years ago. Joining forces with NuVasive not only validates the promise of our technology, but provides us with the scale and

resources necessary to realize our full potential, to the benefit of our surgeon customers and their patients, faster than we could achieve on our own. Additionally, NuVasive’s longstanding commitment to developing market-leading, less invasive

technological solutions represents a tremendous cultural fit. Innovation, a passion for excellence and improved clinical outcomes have all been hallmarks of Ellipse, and ones that I know will continue as part of NuVasive. We look forward to joining

with NuVasive to continue to help improve patient lives.”

Founded in 2005, Ellipse has commercialized two highly differentiated and rapidly adopted

product families: the MAGEC-EOS spinal bracing and distraction system for treatment of early onset scoliosis and the PRECICE® limb lengthening system, or PRECICE LLD, for treatment of limb

length discrepancy. These products have been used to treat more than 5,000 patients worldwide. The global addressable market opportunity for Ellipse’s currently commercialized products was approximately $1.2 billion as of the end of 2014 based

on data from Life Science Intelligence, Inc. In addition, Ellipse’s product candidates that leverage the MAGEC® technology platform addressed a significant global opportunity of more than

690,000 annual procedures based on this data. For 2015, Ellipse had revenues of approximately $40 million compared to approximately $26 million in 2014, representing 54% year-over-year growth. Ellipse’s products are marketed and sold in the

U.S. and 29 other countries. Revenues outside of the U.S. represented approximately 45% of Ellipse’s revenues in 2014 and approximately 37% of revenues for 2015. For 2016, Ellipse’s revenues are expected to be approximately $60 million on

a pro forma basis as the company continues its exceptional growth trajectory.

2

The transaction is expected to close by the end of February 2016, subject to customary closing conditions and

regulatory approvals. NuVasive expects to fund the acquisition with existing cash on hand.

After the closing of the transaction, NuVasive plans to

maintain a Design Center of Excellence in Aliso Viejo, California, where Ellipse is headquartered. Mr. Roschak will join NuVasive as a member of the NuVasive executive leadership team reporting directly to Mr. Lucier.

Advisors

Goldman, Sachs & Co. is serving

as exclusive financial advisor to NuVasive and DLA Piper is serving as its legal counsel. Piper Jaffray is serving as exclusive financial advisor to Ellipse and Latham & Watkins is serving as its legal counsel.

Investor Conference Call

NuVasive will hold a

conference call today at 5:00 p.m. ET / 2:00 p.m. PT to discuss the details of transaction. The dial-in numbers are 1-877-407-9039 for domestic callers and 1-201-689-8470 for international callers. A live webcast of the conference call will be

available online from the Investor Relations page of the Company’s website at www.nuvasive.com.

After the live webcast, the call will remain

available on NuVasive’s website through February 5, 2016. In addition, a telephone replay of the call will be available until January 12, 2016. The replay dial-in numbers are 1-877-870-5176 for domestic callers and 1-858-384-5517 for

international callers, using pin number: 13627758.

About NuVasive

NuVasive is an innovative global medical device company that is transforming spine surgery with minimally disruptive surgical products and

procedurally-integrated solutions for the spine. NuVasive has emerged from a small startup to become the #3 player in the $9 billion global spine market and remains focused on market share-taking strategies as the Company continues on its path to

become the industry’s leading spine company. NuVasive offers a comprehensive spine portfolio of more than 90 unique products developed to improve spine surgery and patient outcomes. The Company’s principal procedural solution is its

Maximum Access Surgery, or MAS®, platform for lateral spine fusion. MAS was designed to provide safe, reproducible, and clinically proven outcomes, and is a highly differentiated solution with

fully integrated neuromonitoring, customizable exposure, and a broad offering of application-specific implants and fixation devices designed to address a variety of pathologies.

About Ellipse Technologies

Ellipse Technologies,

Inc. is a privately held medical device company located in Aliso Viejo, California. The company is dedicated to the design, development, and commercialization of its evolving proprietary

MAGEC® technology platform for spinal and orthopedic applications. The MAGEC® technology platform enables precisely controlled,

non-invasive postoperative adjustment of spinal and orthopedic implants allowing surgeons to better address a range of clinical needs. Ellipse develops products to significantly improve clinical outcomes in a variety of orthopedic applications

through its collaboration with surgeon thought leaders. For more information, visit www.ellipse-tech.com.

3

Forward-Looking Statements

NuVasive cautions you that statements included in this news release that are not a description of historical facts are forward-looking statements that involve

risks, uncertainties, assumptions and other factors which, if they do not materialize or prove correct, could cause NuVasive’s results to differ materially from historical results or those expressed or implied by such forward-looking

statements. Forward-looking statements include, but are not limited to, statements about the timing of the anticipated acquisition, the funding of the anticipated acquisition, the potential benefits, synergies and cost savings of the anticipated

acquisition, including the expected impact on future financial and operating results, and post-acquisition plans and intentions. The forward-looking statements contained herein are based on the current expectations and assumptions of NuVasive and

not on historical facts. The following important factors, among others, could cause actual results to differ materially from those set forth in the forward-looking statements: the satisfaction of conditions to closing the agreement, including the

risk that the required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the acquisition; the loss of key employees; the risk

that the businesses will not be integrated successfully; unexpected variations in market growth and demand for the combined company’s products and technologies; and the risk that benefits and synergies from the acquisition may not be fully

realized or may take longer to realize than expected. Additional risks and uncertainties that may affect future results are described in NuVasive’s news releases and periodic filings with the Securities and Exchange Commission. NuVasive’s

public filings with the Securities and Exchange Commission are available at www.sec.gov. NuVasive assumes no obligation to update any forward-looking statement to reflect events or circumstances arising after the date on which it was made.

# # #

4

NuVasive, Inc. Acquisition of Ellipse

Technologies, Inc. January 5, 2016 Exhibit 99.2

Safe Harbor Statements NuVasive, Inc.

(“NuVasive,” “NUVA” or the “Company”) cautions you that statements included in this presentation that are not a description of historical facts are forward-looking statements that involve risks, uncertainties,

assumptions and other factors which, if they do not materialize or prove correct, could cause the Company's results to differ materially from historical results or those expressed or implied by such forward-looking statements. Forward-looking

statements include, but are not limited to, statements about the timing of the anticipated acquisition, the funding of the anticipated acquisition, the potential benefits, synergies and cost savings of the anticipated acquisition, including the

expected impact on future financial and operating results, and post-acquisition plans and intentions. The forward-looking statements contained herein are based on the current expectations and assumptions of NuVasive and not on historical facts. The

following important factors, among others, could cause actual results to differ materially from those set forth in the forward-looking statements: the satisfaction of conditions to closing the agreement, including the risk that the required

regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the acquisition; the loss of key employees; the risk that the businesses will

not be integrated successfully; unexpected variations in market growth and demand for the combined company’s products and technologies; and the risk that benefits and synergies from the acquisition may not be fully realized or may take longer

to realize than expected. Additional risks and uncertainties that may affect future results are described in NuVasive's news releases and periodic filings with the Securities and Exchange Commission. NuVasive's public filings with the Securities and

Exchange Commission are available at www.sec.gov. NuVasive assumes no obligation to update any forward-looking statement to reflect events or circumstances arising after the date on which it was made. Management also uses certain non-GAAP financial

measures in this presentation which constitute “non-GAAP financial measures” as defined by the Securities and Exchange Commission. Management uses these non-GAAP financial measures to enable it to further and more consistently analyze

the period-to-period financial performance of its core business operations. Management believes that providing investors with these non-GAAP measures gives them additional information to enable them to assess, in the same way management assesses,

the Company’s current and future continuing operations. These non-GAAP measures are not in accordance with, or an alternative for, GAAP, and may be different from non-GAAP measures used by other companies. Reconciliations of the non-GAAP

financial measures to the comparable GAAP financial measures can be found on the Investor Relations section of the Company’s website. Forward-looking information and non-GAAP measures

Ellipse at a Glance Committed to

innovation, passion for improved clinical outcomes Business Description Privately held medical technology company focused on revolutionizing procedural solutions for complex skeletal deformity Developer and marketer of disruptive, magnetically

adjustable implant systems for use in spine and niche orthopedic surgery Founded in 2005 and headquartered in Aliso Viejo, CA (~120 employees) Core Products & Solutions Products based on the MAGnetic External Control (“MAGEC”)

technology platform and consist of two commercial product families: MAGEC-EOS spinal bracing and distraction system for treatment of early onset scoliosis (“EOS”) PRECICE limb lengthening system for treatment of limb length discrepancy

Key features of revolutionary technology platform Minimally invasive implantation with precise, non-invasive incremental adjustments via External Remote Controller (“ERC”) Reduces need for repeat surgeries and creates meaningful

improvements in patient quality of life, while generating cost savings to healthcare system Substantial reduction in complication rates as a result of avoided surgeries, offering a strong value proposition and gaining rapid surgeon adoption Market

Opportunity Accelerate Ellipse’s go-to-market strategy Pull through opportunities through utilization of NuVasive’s product line in combination with MAGEC offering Creates new market opportunities for other applications of technology

Accelerates NuVasive’s transition

from spine implant company to spine solutions company, offering broad range of integrated capabilities to deliver improved clinical and economic outcomes for patients and hospitals Complementary offerings to NuVasive that further diversify revenue

mix and present new and large market opportunities for growth Builds on entry into adult deformity market with Integrated Global Alignment (iGA™) platform and aggressively inserts NuVasive into early onset and idiopathic adolescent scoliosis

applications for non-elective procedures – an important and attractive part of the spinal deformity market with tremendous opportunities for accelerated growth Expands NuVasive’s footprint into new spine and niche orthopedic markets with

highly differentiated technology that can be broadened to additional areas like degenerative spine disease, and through partnership in trauma and knee osteoarthritis Robust product pipeline enhances internal development and licensing opportunities,

particularly through integration of NuVasive’s iGA platform and neuromonitoring expertise Accelerates revenue and earnings growth – enhancing NuVasive’s longer-term stated revenue target and non-GAAP EPS performance targets, while

supporting five-year, double-digit ROIC goal Strategic Rationale Reinforces NuVasive’s focus on transformative spine solutions

Transaction Overview $380mm acquisition

with $30mm potential milestone payment, financed with cash on hand Revenue Accelerates revenue growth toward the high single-digit range New applications of existing technology represent further upside opportunity Synergies Near-term annual

operating cost synergies of ~$5mm identified, with even greater ability longer term to leverage NuVasive’s existing infrastructure Non-GAAP EPS Accretive to NuVasive’s non-GAAP EPS – slightly within first 12 months and

significantly thereafter ROIC Supports NuVasive’s five-year, double-digit return on invested capital goal Balance Sheet & Cash Flow Maintains balance sheet flexibility and NuVasive’s attractive financial profile Strengthens

NuVasive’s cash flow generation over near term $380mm upfront +$30mm in a potential milestone payable in 2017 related to achievement of specific revenue targets Closing expected by end of February 2016, subject to customary closing conditions

and regulatory approvals

Value Proposition Ellipse’s

technology rapidly becoming standard of care in spine and orthopedics Builds on NuVasive’s reputation as leading technology provider and innovator for integrated spine procedure solutions Integrate highly regarded, differentiated and

disruptive magnetic growing rod technology platform with NuVasive product offerings Accelerate new product opportunities based on existing and future Ellipse technology programs Integrate and optimize R&D programs across multiple application

areas outside of core NuVasive spine channel Gains direct entry point for NuVasive in key markets Capture pediatric deformity opportunity with magnetic rod technology enhanced through integration of leading iGA alignment capabilities Penetrate new

niche orthopedic markets with highly differentiated technology applied to trauma and knee osteoarthritis Exploit expansive technology platform to develop additional applications for further utility Expands International presence immediately with

opportunities for greater penetration globally Ellipse’s commercialized products currently marketed and sold in the U.S. and 29 other countries globally

Ellipse’s Attractive Growth

Profile U.S. dollar amounts in millions, except surgeon count Revenues by Region Revenues by Product U.S. Surgeon Adoption >425% CAGR 2016 revenues expected to be ~$60 million on pro forma basis; Go forward gross margins to range in low to mid

~70%

New, Large Market Opportunities $1.2

billion* current addressable market opportunity Highly scalable business with growth prospects both geographically and in addressable segments Proprietary Technology Non-invasively adjustable implants expected to have significant economic benefits

over current implant technologies Favorable reimbursement across current products Robust IP portfolio with unique material engineering and design ‘know-how’ Focused on Revolutionizing Surgery Addressing sizable market opportunities with

proprietary technology Ellipse Remote Control Intervention NuVasive once again redefining MIS surgery * Source: Life Science Intelligence, Inc.

MAGEC Eliminates lengthening surgeries

Fewer complications More frequent adjustment to accommodate growth Improved patient outcomes and quality of life ~$570mm* global market opportunity Rapid training cycle: same initial procedure as traditional rods Single implant: fewer trays, less

instrumentation Additional applications for further utility Before After Proprietary MAGEC-EOS system developed using MAGEC technology to treat children suffering from EOS Expandable spinal rods coupled with ERC allow for periodic, non-invasive

adjustment of the implant Clear opportunity for application in idiopathic adolescent scoliosis, as well as adult spinal deformity and degeneration cases Paradigm shift in the treatment of early onset scoliosis Revolutionary Therapy Highly Scalable

Product *Ellipse Technologies estimates

Proprietary PRECICE LLD system

developed using MAGEC technology to treat limb length discrepancies Non-invasive, adjustable intramedullary nail coupled with ERC Designed to internally lengthen the long bones of leg with precision and control, and without need for external

fixation Innovative technique with rapidly growing clinical paper support and significant benefits over traditional procedures ~$700mm* global market opportunity Pre-programmed for at-home use Improved socioeconomic benefits PRECICE Traditional

Lengthening PRECICE Innovative limb lengthening system *Ellipse Technologies estimates PRECICE Revolutionizes Approach

Reinforces focus on transformative

spine solutions to improve patient outcomes Extends position as global spine leader with comprehensive approach to fast-growing complex deformity market Provides new innovation platforms to strategically address broader spine and niche orthopedic

applications Immediately expands International presence with opportunities for greater penetration globally Accelerates stated revenue growth to high single-digit Slightly accretive to non-GAAP EPS in first 12 months and significantly thereafter

Supports five-year, double-digit return on invested capital goal Summary Extending leadership in MIS with market-making, category leading technology

Questions & Answers

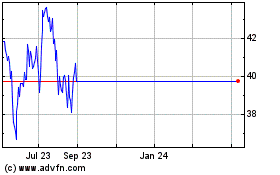

Nuvasive (NASDAQ:NUVA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nuvasive (NASDAQ:NUVA)

Historical Stock Chart

From Apr 2023 to Apr 2024