LBO Firms Consider Retailers, Vie With Activists And Rivals

February 16 2011 - 4:14PM

Dow Jones News

Retailers that survived the recession have become beacons of

stability, at least for leveraged-buyout firms that have lots of

money on hand and are under pressure to put it to work.

Family Dollar Inc. (FDO) is the latest retailer to capture

attention, with activist investor Nelson Peltz's Trian Group

offering $55 to $60 a share for the deep discounter, with the $60

representing a 36% premium over Tuesday's closing price and valuing

the deal at $7.6 billion.

"I think there is still upside to the stock, even at these

prices," according to Mark Giambrone, a portfolio manager with

Texas-based asset manager Barrow, Hanley, Mewhinney & Strauss.

Giambrone said he doesn't "see any reason" for his firm, which has

more than $50 billion in assets under management, to sell the

roughly 2.25 million Family Dollar shares--about 1.8% of the

deep-discount chain--that filings show it owned at the end of last

year.

Giambrone said the Peltz bid could bring other bidders to the

table, and he thinks larger rival Dollar General Corp. (DG) is a

"very intriguing" possibility, one that "makes tremendous sense."

He said such a tie-up would depend on whether there would be

antitrust concerns and if controlling Dollar General holder KKR

& Co. is so inclined.

LBO firms are setting their sights on the retail industry with

gusto, looking for the kinds of companies that most fit their

takeout criteria--relatively stable cash flow and manageable debt,

plus steady to growing operations that have room for

improvement.

These investors typically have time horizons of a few years,

during which they hope to improve the company and bring it public

again for a handsome profit, ideally in much the same way KKR has

done with Dollar General. KKR took Dollar General private in a 2007

LBO and reintroduced it to the public markets just over two years

later.

LBO firms are also looking at retailers that, like Family

Dollar, don't have poison pills that can hamper a takeover, don't

have a lot of insider holdings and whose shares are relatively

depressed.

"A number of retailers right now fit the criteria," said Colin

McGranahan, retail analyst at Sanford Bernstein.

Patrick McKeever, retail analyst at MKM Partners, said Big Lots

Inc. (BIG), 99 Cents Only Stores (NDN) and Fred's Inc. (FRED) could

also be targets, "and this latest development gives me greater

conviction."

LBO firms have been gravitating to lower-end retailers in many

cases because the shares of the companies are depressed compared

with their higher-end peers, whose customers seem to have come out

of the recession ready to spend, while lower income consumers are

still struggling.

"I think it's selective retail," said BHMS's Giambrone,

specifically retailers who have "a lot of cash," and "strong

balance sheets." Giambrone anticipates the wave of mergers to

continue across all markets, not just retail, and will be fueled by

acquisitive public companies as well as LBO shops, who are being

lured back to the game by easier and cheaper access to debt

markets.

Retailers already in the process of being taken private include

J. Crew Group Inc. (JCG), with TPG Capital LP and Leonard Green

& Partners preparing their $3 billion purchase of the preppy

clothing retailer. Jo-Ann Stores Inc. (JAS) agreed to be taken

private by Leonard Green for about $1.6 billion less than two

months ago. Leonard Green is also said to be considering a bid for

BJ's Wholesale Club Inc. (BJ), which said earlier this month that

it would explore options that include a sale of the warehouse

chain.

Joining BJ's in the group that seems to be angling for a

private-equity suitor is A.C. Moore Arts & Crafts Inc. (ACMR),

which on Tuesday said it is exploring strategic alternatives

including a sale, and indicated it has received third-party

expressions of interest. Close-out retailer Big Lots hired Goldman

Sachs Group Inc. (GS) to look into the possibility of a sale as

well as other options, according to reports last week. Bookseller

Barnes & Noble Inc. (BKS), under pressure from an activist

investor, last summer began exploring a sale of the company, though

Wednesday's bankruptcy filing by smaller rival Borders Group Inc.

(BGP) might alter the bookstore landscape.

-By Karen Talley, Dow Jones Newswires; 212-416-2196;

karen.talley@dowjones.com; and Maxwell Murphy, Dow Jones Newswires;

212-416-2171; maxwell.murphy@dowjones.com

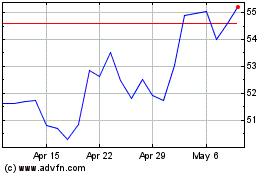

Northeast Bank (NASDAQ:NBN)

Historical Stock Chart

From Mar 2024 to Apr 2024

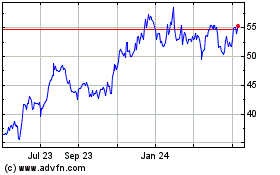

Northeast Bank (NASDAQ:NBN)

Historical Stock Chart

From Apr 2023 to Apr 2024