UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 2, 2015

Navient Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-36228 |

|

46-4054283 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

| 123 Justison Street, Wilmington, Delaware |

|

19801 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (302) 283-8000

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| ITEM 7.01 |

REGULATION FD DISCLOSURE. |

Navient Corporation (the “Company”) frequently

provides relevant information to its investors via posting to its corporate website. On November 2, 2015, a presentation entitled “2015 3rd Quarter Investor Deck” was made available

on the Company’s website at https://www.navient.com/about/investors/webcasts/. In addition, the presentation is being furnished herewith as Exhibit 99.1

The information contained in, or incorporated into, this Item 7.01, including Exhibit 99.1 attached hereto, is being furnished and shall

not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be

expressly set forth by specific reference in such filing.

| ITEM 9.01 |

Financial Statements and Exhibits. |

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1* |

|

2015 3rd Quarter Investor Deck. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

NAVIENT CORPORATION |

|

|

|

|

| Date: November 2, 2015 |

|

|

|

By: |

|

/s/ Mark L. Heleen |

|

|

|

|

|

|

Mark L. Heleen |

|

|

|

|

|

|

Executive Vice President, Chief Legal Officer and Secretary |

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1* |

|

2015 3rd Quarter Investor Deck. |

2015 3rd Quarter Investor Deck November

2, 2015 Exhibit 99.1

Forward-Looking Statements; Non-GAAP

Financial Measures The following information is current as of November 2, 2015 (unless otherwise noted) and should be read in connection with Navient Corporation’s (Navient) Annual Report on Form 10-K for the year ended December 31, 2014 (the

“2014 Form 10-K”), filed by Navient with the Securities and Exchange Commission (the “SEC”) on February 27, 2015 and subsequent reports filed by Navient with the SEC. Definitions for capitalized terms in this presentation not

defined herein can be found in our 2014 Form 10-K. This presentation contains forward-looking statements and information based on management’s current expectations as of the date of this presentation. Statements that are not historical facts,

including statements about the company’s beliefs, opinions or expectations and statements that assume or are dependent upon future events, are forward-looking statements. Forward-looking statements are subject to risks, uncertainties,

assumptions and other factors that may cause actual results to be materially different from those reflected in such forward-looking statements. These factors include, among others, the risks and uncertainties set forth in Item 1A “Risk

Factors” and elsewhere in Navient’s 2014 Form 10-K and subsequent filings with the SEC; increases in financing costs; limits on liquidity; increases in costs associated with compliance with laws and regulations; changes in accounting

standards and the impact of related changes in significant accounting estimates; any adverse outcomes in any significant litigation to which the company is a party; credit risk associated with the company’s exposure to third parties, including

counterparties to the company’s derivative transactions; risks inherent in the government contracting environment, including the possible loss of government contracts and potential civil and criminal penalties as a result of governmental

investigations or audits; and changes in the terms of student loans and the educational credit marketplace (including changes resulting from new laws and the implementation of existing laws). The company could also be affected by, among other

things: changes in its funding costs and availability; reductions to its credit ratings or the credit ratings of the United States of America; failures of its operating systems or infrastructure, or those of third-party vendors; risks related

to cybersecurity including the potential disruption of its systems or potential disclosure of confidential customer information; damage to its reputation; failures to successfully implement cost-cutting initiatives and adverse effects of such

initiatives on its business; failures or delays in the planned conversion to our servicing platform of the Wells Fargo portfolio of Federal Family Education Loan Program (“FFELP”) loans or any other FFELP or Private Education Loan

portfolio acquisitions; risks associated with restructuring initiatives; risks associated with the April 30, 2014 separation of Navient and SLM Corporation into two distinct, publicly traded companies, including failure to achieve the expected

benefits of the separation; changes in the demand for educational financing or in financing preferences of lenders, educational institutions, students and their families; changes in law and regulations with respect to the student lending business

and financial institutions generally; increased competition including from banks, other consumer lenders and other loan servicers; the creditworthiness of its customers; changes in the general interest rate environment, including the rate

relationships among relevant money-market instruments and those of its earning assets vs. its funding arrangements; changes in general economic conditions; the company’s ability to successfully effectuate any acquisitions and other strategic

initiatives; and changes in the demand for debt management services. The preparation of the company’s consolidated financial statements also requires management to make certain estimates and assumptions including estimates and assumptions

about future events. These estimates or assumptions may prove to be incorrect. All forward-looking statements contained in this presentation are qualified by these cautionary statements and are made only as of the date of this presentation. The

company does not undertake any obligation to update or revise these forward-looking statements to conform the statement to actual results or changes in its expectations. Navient reports financial results on a GAAP basis and also provides

certain core earnings performance measures. When compared to GAAP results, core earnings exclude the impact of: (1) the financial results of the consumer banking business for historical periods prior to the April 30, 2014 spin-off as well as related

restructuring and reorganization expenses incurred in connection with the spin-off, including the restructuring initiated in the second quarter of 2015; (2) unrealized, mark-to-market gains/losses on derivatives; and (3) goodwill and acquired

intangible asset amortization and impairment. Navient provides core earnings measures because this is what management uses when making management decisions regarding Navient’s performance and the allocation of corporate resources. Navient core

earnings are not defined terms within GAAP and may not be comparable to similarly titled measures reported by other companies. For additional information, see “Core Earnings — Definition and Limitations” in Navient’s third

quarter earnings release for a further discussion and a complete reconciliation between GAAP net income and core earnings.

Navient Corporation Overview

We are the leading loan management,

servicing and asset recovery company Key Businesses Highlights Asset Management FFELP Loan Portfolio Private Education Loan Portfolio $98 Billion FFELP Portfolio $27 Billion Private Education Loan Portfolio Asset Servicing FFELP Loans Private

Education Loans Department of Education Servicing Contract Guarantor Servicing Over 12 Million Borrowers Over $300 Billion of Education Loans Market leading federal default prevention – 38% better than peers Asset Recovery Education loans

Government receivables Taxes Court/Municipal Schools $26 Billion of Receivables Over 1,800 clients As of September 30, 2015

Operating Results “Core

Earnings” Basis (In millions, except per share amounts) Q3 15 Q2 15 Q3 14 Reported Core EPS $0.47 $0.40 $0.52 Net income $174 $154 $218 Operating expenses $228 $225 $195 Provision $123 $198 $140 Average student loans $127,750 $130,512

$129,915

Student Loan Market Source: Navient

estimates for total outstanding FFELP and federally-owned based on FSA Data Center, Portfolio Summary, September 30, 2014, and Federal Student Aid Annual Report, November 2014; MeasureOne, Private Student Loan Performance Report, Q3 2014; Navient

10Q filings Estimated Outstanding Student Loan Market Distribution $1.2 Trillion as of FFYE 9/30/2014 ($ in billions)

High Quality Education Loan Portfolio

Note: Financial data as of 9/30/2015 Private Education Portfolio Balance ($bn, net of allowance) $27 Avg. Loan Size $10,035 Avg. FICO at Orig. 718 % Cosigner 65% 90+ Day Delinquent 3.4% Largest holder of FFELP loans 97-98% of portfolio is government

guaranteed 78% of portfolio funded to term with securitizations Fully integrated servicing and asset recovery support operations FFELP Portfolio Largest holder of Private Education loans Seasoned portfolio with 94% of loans in repayment status

having made more than 12 payments Typically non-dischargeable in bankruptcy Balance ($bn, net of allowance) $98 % Consolidation Loans 62% % Stafford & Other 38% 90+ Day Delinquent 8.5% FFELP Portfolio Statistics Private Education Portfolio

Statistics

FFELP Loans Segment “Core

Earnings” Basis (In millions) Q3 15 Q2 15 Q3 14 Net income $70 $93 $79 Average FFELP Loans $99,367 $101,305 $98,736 FFELP Loan spread 0.90% 0.91% 1.02% Net interest margin 0.81% 0.81% 0.93% Annualized charge-off rate 0.06% 0.05% 0.08% Greater

than 90-day delinquency rate 8.5% 8.4% 7.6%

FFELP Loans Segment Credit Quality

“Core Earnings” Basis (1) Loans for customers who may still be attending school or engaging in other permitted educational activities and are not yet required to make payments on their loans, e.g., residency periods for medical students

or a grace period for bar exam preparation, as well as loans for customers who have requested and qualify for other permitted program deferments such as military, unemployment, or economic hardships. (2) Loans for customers who have used their

allowable deferment time or do not qualify for deferment, that need additional time to obtain employment or who have temporarily ceased making full payments due to hardship or other factors. (3) The period of delinquency is based on the number of

days scheduled payments are contractually past due.

Private Education Loans Segment

“Core Earnings” Basis (In millions) Q3 15 Q2 15 Q3 14 Net income $77 $22 $98 Average Private Education Loans $28,383 $29,207 $31,179 Private Education Loan spread 3.88% 3.66% 4.06% Net interest margin 3.77% 3.55% 3.96% Provision for loan

losses $117 $191 $130 Charge-offs1 $148 $179 $158 Charge-off rate1 2.3% 2.7% 2.3% Total delinquency rate 7.4% 6.8% 7.9% Greater than 90-day delinquency rate 3.4% 3.3% 3.4% Forbearance rate 4.0% 3.7% 4.4% 1 In the second quarter of 2015, the portion

of the loan amount charged off at default increased from 73 percent to 79 percent. This change resulted in a $330 million reduction to the balance of the receivable for partially charged-off loans which is not included in the charge-off disclosures

above. Including this amount the charge-offs total $509 million for the second quarter of 2015.

Private Education Loans Segment

Credit Quality “Core Earnings” Basis (1) Deferment includes customers who have returned to school or are engaged in other permitted educational activities and are not yet required to make payments on their loans, e.g., residency periods

for medical students or a grace period for bar exam preparation. (2) Loans for customers who have requested extension of grace period generally during employment transition or who have temporarily ceased making full payments due to hardship or other

factors, consistent with established loan program servicing policies and procedures. (3) The period of delinquency is based on the number of days scheduled payments are contractually past due.

Private Education Loans Segment High

Quality Portfolio Private Education Loan % of Portfolio Outstanding by Segment Private Education Loan Charge-Off1 Rate by Segment Low Risk = Smart Option, Legacy Traditional Cosigned, and Law/MBA/MED/CT/Other Moderate Risk = Legacy Traditional

Non-Cosigned Elevated Risk = Non-Traditional 1 In the second quarter of 2015, the portion of the loan amount charged off at default increased from 73 percent to 79 percent. This change resulted in a $330 million reduction to the balance of the

receivable for partially charged-off loans which is not included in the charge-off disclosures above.

Private Education Loans Segment

Credit Trends Private Education Loan Charge-Off Rate by Segment Private Education Loan Total Delinquency Rate by Segment Low Risk = Smart Option, Legacy Traditional Cosigned, and Law/MBA/MED/CT/Other Moderate Risk = Legacy Traditional Non-Cosigned

Elevated Risk = Non-Traditional Seasoned portfolio with 94% of loans in repayment status having made more than 12 payments

Private Education Loans Segment

Default Performance Historical Defaults by Payments Made The probability of default substantially diminishes as the number of payments and years of seasoning increases.

Loan Seasoning – “Core

Earnings” Basis September 30, 2015 Traditional Portfolio

Monthly Scheduled Payments Received Loan Status 0-12 payments 13-24 payments 25-36 payments 37-48 payments More than 48 payments

Total Not Yet in Repayment 2,128 Loans in Forbearance 324 19.3% 135 6.4%

135 4.2% 114 3.1% 216 1.6% 924 3.8% Loans in Repayment- Current 1,047 62.1% 1,714 81.8% 2,830 87.5% 3,331 90.6% 12,674 94.8% 21,596 89.8% Loans in Repayment- Delinq 31-60 days 85

5.0% 70 3.4% 80 2.5% 80 2.2% 189 1.4% 504 2.1% Loans in Repayment- Delinq 61-90 days 72 4.3% 52 2.5% 61 1.9% 47 1.3% 106 0.8% 338 1.4% Loans in Repayment- Delinq 90 + days

156 9.3% 125 5.9% 127 3.9% 104 2.8% 180 1.3% 692 2.9% Total Loans in

Repayment or Forbearance $ 1,684 100% $ 2,096 100% $ 3,233 100% $ 3,676 100% $ 13,365 100% $ 24,054 100% Charge-offs as a % of loans in repayment 10.5% 3.9% 2.1%

1.4% 0.7% 1.9%

Non-Traditional Portfolio Monthly

Scheduled Payments Received Loan Status 0-12 payments 13-24 payments 25-36 payments 37-48 payments More than 48 payments Total Not Yet in Repayment

207 Loans in Forbearance 55 22.5% 19 7.7% 16 5.1% 11 3.7% 21 2.1% 122 5.8% Loans in Repayment- Current 116

47.8% 166 69.1% 237 76.1% 243 82.1% 900 89.4% 1,662 79.3% Loans in Repayment- Delinq 31-60 days 16 6.8% 12 5.2% 17 5.3% 11 3.7% 29 2.9% 85 4.1% Loans in Repayment- Delinq

61-90 days 16 6.7% 11 4.7% 11 3.6% 9 3.1% 18 1.8% 65 3.1% Loans in Repayment- Delinq 90 + days 39 16.2% 32 13.3% 31 9.9% 22 7.4% 38 3.8% 162 7.7%

Total Loans in Repayment or Forbearance $ 242 100% $ 240 100% $ 312 100% $ 296 100% $ 1,006 100%

$ 2,096 100% Charge-offs as a % of loans in repayment 25.6% 11.0% 5.7% 4.5% 2.3% 6.5%

Total

Monthly Scheduled Payments Received Loan Status 0-12 payments 13-24 payments 25-36 payments 37-48 payments More than 48 payments Total Not Yet in Repayment

2,335 Loans in Forbearance 379 19.7% 154 6.6% 151 4.3% 125 3.1% 237 1.6% 1,046 4.0% Loans in

Repayment- Current 1,163 60.4% 1,880 80.5% 3,067 86.5% 3,574 90.0% 13,574 94.5% 23,258 88.9% Loans in Repayment- Delinq 31-60 days 101 5.3% 82 3.5% 97 2.8% 91 2.3% 218 1.5%

589 2.3% Loans in Repayment- Delinq 61-90 days 88 4.5% 63 2.7% 72 2.0% 56 1.4% 124 0.9% 403 1.5% Loans in Repayment- Delinq 90 + days 195 10.1% 157 6.7% 158 4.4% 126 3.2%

218 1.5% 854 3.3% Total Loans in Repayment or Forbearance $ 1,926 100% $ 2,336 100% $

3,545 100% $ 3,972 100% $ 14,371 100% $ 26,150 100% Charge-offs as a % of loans in repayment 12.6% 4.7% 2.4% 1.7% 0.8% 2.3%

Loan Seasoning – “Core

Earnings” Basis September 30, 2014 Traditional Portfolio

Monthly Scheduled Payments Received Loan Status 0-12 payments 13-24 payments 25-36 payments 37-48 payments More than 48 payments

Total Not Yet in Repayment 3,128 Loans in Forbearance 466 17.1% 183 5.3%

157 3.8% 127 3.0% 177 1.6% 1,110 4.3% Loans in Repayment- Current 1,801 66.0% 2,934 85.0% 3,649 88.7% 3,920 91.3% 10,889 95.0% 23,193 89.0% Loans in Repayment- Delinq 31-60 days

144 5.3% 111 3.2% 106 2.6% 94 2.2% 165 1.4% 620 2.4% Loans in Repayment- Delinq 61-90 days 103 3.7% 72 2.1% 67 1.6% 55 1.3% 89 0.8% 386 1.5% Loans in Repayment- Delinq 90 +

days 215 7.9% 154 4.4% 136 3.3% 96 2.2% 141 1.2% 742 2.8% Total Loans in

Repayment or Forbearance $ 2,729 100% $ 3,454 100% $ 4,115 100% $ 4,292 100% $ 11,461 100% $ 26,051 100% Charge-offs as a % of loans in repayment 8.5% 2.7% 1.7% 1.1%

0.7% 1.9%

Non-Traditional Portfolio Monthly Scheduled

Payments Received Loan Status 0-12 payments 13-24 payments 25-36 payments 37-48 payments More than 48 payments Total Not Yet in Repayment

308 Loans in Forbearance 76 20.3% 24 6.6% 17 4.9% 11 3.6% 20 2.2% 148 6.4% Loans in Repayment- Current 180 48.4% 253

71.0% 268 77.2% 256 82.7% 813 89.2% 1,770 77.0% Loans in Repayment- Delinq 31-60 days 31 8.3% 21 5.8% 19 5.5% 13 4.2% 28 3.0% 112 4.9% Loans in Repayment- Delinq 61-90 days

26 6.9% 17 4.8% 12 3.5% 10 3.2% 17 1.9% 82 3.6% Loans in Repayment- Delinq 90 + days 60 16.1% 42 11.8% 31 8.9% 20 6.3% 34 3.7% 187 8.1%

Total Loans in Repayment or Forbearance $ 373 100% $ 357 100% $ 347 100% $ 310 100% $ 912 100% $ 2,299 100%

Charge-offs as a % of loans in repayment 23.1% 8.7% 5.1% 3.6% 2.5% 7.0%

Total Monthly Scheduled

Payments Received Loan Status 0-12 payments 13-24 payments 25-36 payments 37-48 payments More than 48 payments Total Not Yet in Repayment

3,436 Loans in Forbearance 542 17.5% 207 5.4% 174 3.9% 138 3.0% 197 1.6% 1,258 4.4% Loans in Repayment- Current 1,981 63.9%

3,187 83.6% 3,917 87.8% 4,176 90.8% 11,702 94.6% 24,963 88.1% Loans in Repayment- Delinq 31-60 days 175 5.6% 132 3.5% 125 2.8% 107 2.3% 193 1.6% 732 2.6% Loans in

Repayment- Delinq 61-90 days 129 4.2% 89 2.4% 79 1.8% 65 1.4% 106 0.8% 468 1.6% Loans in Repayment- Delinq 90 + days 275 8.8% 196 5.1% 167 3.7% 116 2.5% 175 1.4% 929

3.3% Total Loans in Repayment or Forbearance $ 3,102 100% $ 3,811 100% $ 4,462 100% $ 4,602

100% $ 12,373 100% $ 28,350 100% Charge-offs as a % of loans in repayment 10.4% 3.3% 2.0% 1.3% 0.8% 2.3%

Business Services Segment

“Core Earnings” Basis (In millions) Q3 15 Q2 15 Q3 14 Net income $79 $91 $85 Federal Loans serviced ($’s in billions) $289 $281 $277 Third-Party Loan servicing revenue $47 $47 $46 Asset recovery revenue $85 $99 $65 Department of

Education accounts serviced 6.3 6.1 6.1 Contingency asset recovery receivables ($’s in billions) $25.8 $20.1 $16.0 The increase from the second quarter to the third quarter in contingency asset recovery receivables is a result of a state tax

amnesty program that will be conducted from September 15, 2015 through November 16, 2015.

Business Services Segment Federal

Loan Servicing

Business Services Segment Asset

Recovery Non Federal Student Loan Related Asset Recovery Revenues Strong business franchise Large sophisticated operating infrastructure Compliance focused Industry leading performance Total contingent collections receivables inventory of $25.8

billion Total Asset Recovery revenues of $273 million YTD1 Diverse portfolio of customers and services Focused on growing non-education related business Key Characteristics 1 As of September 30, 2015 102% Growth

Business Services Segment

Acquisition of Xtend Healthcare Leveraging Capabilities in Asset Recovery and Business Services Leverages our expertise and scale in asset recovery and business process outsourcing services. Focuses on the attractive health care payments sector -

specializes in both insurance payer billing, follow-up and account resolution as well as patient “early out” billing and processing. Serves 130 hospitals, including university-affiliated and for-profit healthcare systems. Strong history

of revenue growth from $17 million in 2010 to a projected $70 million in 2015. Navient acquired Xtend Healthcare on October 20, 2015 for $160 million. Transaction Highlights

Funding and Liquidity

2015 Capital Markets Summary

Acquired $2.9 billion1 of student loans Issued $2.8 billion of FFELP ABS Issued $1.4 billion of Private Education Loan ABS Issued $500 million of long-term unsecured debt Repurchased over $1 billion of long-term unsecured debt Returned $958 million1

to shareholders through share repurchases and dividends Maintained strong capital position 1 As of September 30, 2015

Secured Funding Navient is among the

largest issuers of ABS globally, having issued over $275 billion of Private Education and FFELP ABS transactions to date Over $97 billion of securitizations on balance sheet Additional capacity under FFELP secured facilities is over $10 billion

Maximum capacity under Private Education Loan secured facilities is $1 billion Table Source: J.P. Morgan, as of September 30, 2015 2015 YTD Issuance ($mm) 1 Ford 10,632 Auto / Floorplans 2 Santander Drive 8,350 Auto 3 Ally 7,908 Auto/ Floorplans 4

Chase 6,825 Credit Card 5 AmeriCredit/GM Financial 6,262 Auto / Floorplans 6 Hyundai 5,145 Auto 7 Mercedes 4,520 Auto / Floorplans 8 Nissan 4,354 Auto / Floorplans 9 Capital One 4,150 Credit Card 10 Toyota 4,145 Auto 11 Navient 4,144 Student Loan 12

Honda 3,745 Auto 13 CarMax 3,165 Auto 14 Onemain 2,772 Consumer 15 Dunkin’ Brands 2,600 Franchise 16 Synchrony 2,552 Credit Card 17 CNH 2,550 Equipment 18 Wendy’s 2,425 Whole Bus 19 Discover 2,425 Credit Card 20 Bank Of America 2,300

Credit Card

Recent FFELP ABS Transactions

Estimated based on a variety of assumptions concerning loan repayment behavior, as more fully described in the related prospectus, which may be obtained at https://www.navient.com/about/investors/debtasset/. Actual average life may vary

significantly from estimates. Pricing represents the yield to expected call. NAVSL 2015-3 NAVSL 2015-2 Priced: Settled: June 10, 2015 June 18, 2015 April 14, 2015 April 23, 2015 Issuance Amount: $758M $997M Collateral: US Govt. Guaranteed FFELP

Stafford, Plus and Consolidation Loans US Govt. Guaranteed FFELP Stafford and Plus Loans Prepayment Speed (1): 6% CPR Stafford / 4% CPR Consolidation 6% Constant Prepayment Rate Tranching: Class Rating (M) Amt. ($M) WAL (1) Pricing (2) Class Rating

(M) Amt. ($M) WAL (1) Pricing (2) A-1 Aaa $252 1.5 L+32 A-1 Aaa $337 1.3 L+28 A-2 Aaa $486 7.7 L+67 A-2 Aaa $157 3.3 L+42 B Aa1 $20 13.4 L+250 A-3 Aaa $476 6.4 L+57 B Aa2 $28 8.4 L+195

Recent Private Education Loan ABS

Transactions Estimated based on a variety of assumptions concerning loan repayment behavior, as more fully described in the related prospectus, which may be obtained at https://www.navient.com/about/investors/debtasset/slmsltrusts/. Actual average

life may vary significantly from estimates. Yield on fixed rate A-2 and B tranches for 2015-A were 2.67% and 4.10%, respectively. NAVSL Trust 2015-B NAVSL Trust 2015-A Priced: Settled: August 05, 2015 August 13, 2015 January 13, 2015 January 22,

2015 Issuance Amount: $700M $689M Collateral: Private Education Loans Private Education Loans Prepayment Speed(1): 4% Constant Prepayment Rate 4% Constant Prepayment Rate Tranching: Class Rating (M) Amt. ($M) WAL (1) Pricing Class Rating (M) Amt.

($M) WAL (1) Pricing (2) A-1 Aaa $174 0.7 L+80 A-1 Aaa $224 1.0 L+50 A-2 Aaa $250 3.9 L+100 A-2A Aaa $154 5.5 S+110 A-3 Aaa $276 8.8 L+180 A-2B Aaa $154 5.5 L+120 A-3 Aaa $75 8.8 L+170 B Aa3 $83 9.9 S+210

Unsecured Debt Maturities Fitch

Moody’s S&P Senior Unsecured Debt BB Ba3 BB Outlook Stable Stable Stable

Conservative Unsecured Debt Profile

December 31, 2006 December 31, 2010 September 30, 2015 Total Managed Student Loans $142.1 Billion $184.3 Billion $125.8 Billion Unsecured Debt Outstanding $48.7 Billion $20.1 Billion $15.8 Billion Tangible Equity Ratio 1.9% 2.2% 2.4% Tangible Net

Asset Ratio 1.06x 1.19x 1.25x Unsecured Debt Rating (F / M / S) A+ / A2 / A BBB- / Ba1 / BBB- BB / Ba3 / BB * Quarter ending September 30, 2015 Tangible net assets equal tangible assets less secured debt

Projected Life of Loan Cash Flows

over ~20 Years These projections are based on internal estimates and assumptions and are subject to ongoing review and modification. These projections may prove to be incorrect. Enhancing Cash Flows Education Loan Portfolio Generates Significant

Cash Flows $’s in Billions FFELP Cash Flows 9/30/15 12/31/14 Secured Residual (including O/C) $6.7 $7.3 Floor Income 2.2 1.9 Servicing 3.7 3.8 Total Secured $12.6 $13.0 Unencumbered 1.3 1.9 Total FFELP Cash Flows $13.9 $14.9 Private Credit

Cash Flows Secured Residual (including O/C) $12.9 $13.2 Servicing 1.2 1.3 Total Secured $14.1 $14.5 Unencumbered 4.9 6.8 Total Private Cash Flows $19.0 $21.3 Combined Cash Flows before Unsecured Debt $32.9 $36.2 Since 12/31/14, we have repaid $2.1B

of unsecured debt, returned $1.0 billion to shareholders through share repurchases and dividends, and acquired $2.9 billion of student loans $33 billion of estimated future cash flows over ~ 20 years Highly predictable Includes ~$11.5 billion of

overcollateralization (O/C) to be released from residuals Cash Flow Projection as of 12/31/14 $36.2 B Cash Flows Realized from Loan Portfolio (2.1) B Cash Flows from Financing Transactions (2.2) B Additional Cash Flows from Loans Acquired 0.6 B

Floor Income / Other 0.4 B Cash Flow Projection as of 9/30/15 $32.9 B

FFELP Cash Flows Highly Predictable

Total Cash Flows from Projected Excess Spread = $6.7 Billion Total Cash Flows from Projected Servicing Revenues = $3.7 Billion Assumptions No Floor Income, CPR/CDR = Stafford & Plus (3%), Consolidation (3%) These projections are based on

internal estimates and assumptions and are subject to ongoing review and modification. These projections may prove to be incorrect. *Numbers may not add due to rounding $’s in millions

Secured Cash Flow Note: Totals may

not add due to rounding *Net residual represents excess distribution, net of payments on floor contracts and receipts from basis swaps

FFELP ABS Appendix

ABS transactions are rated to timely

payment of interest and ultimate payment of principal by the legal final maturity (LFM) date Legal final maturity dates are set at issuance based on rating agency assumptions Certain ABS are experiencing extension due to slower than expected student

loan principal paydown rates from: Lower default rates Low voluntary prepayment rates following the recession Increasing percentage of borrowers enrolling in deferment, forbearance, and Income Driven Repayment (IDR) resulting in lower principal

payments and better customer performance Increased risk of ABS not paying off by their legal final maturity dates Not a credit issue; FFELP loans are 97 - 100% government guaranteed Lower prepayment speeds increases cash flow to trusts Why is this

an issue now? Moody’s and Fitch are revising cash flow assumptions used to rate FFELP ABS New criteria applied to legacy trusts result in certain ABS bonds missing full repayment by their LFM date Navient has been actively addressing the issue

since 2014 Navient’s 2015-3 transaction priced in June was structured to address extension risk Update on FFELP ABS - Legal Final Maturity

1 As of October 31, 2015 Navient is

working with the rating agencies and developing actions to support our investors and the continued investment-grade ratings status of our FFELP ABS Navient submitted formal response to Moody’s on October 19th Exercised cleanup call option on

$1.5 billion of bonds since 20141 and funded the associated loans through conduit facilities Amended 33 trusts to include 10% optional servicer purchase rights and have exercised loan repurchased rights of $449 million since 20141 Launched process

to extend the Legal Final Maturity Date on bonds in select trusts Update on FFELP ABS – Addressing Legal Final Maturity Concerns

Recent FFELP ABS Issuance

Characteristics FFELP ABS Transaction Features Collateral Characteristics Issue size of $500M to $1.5B Tranches or pass-through denominated in US$ Triple-A rated senior notes make up to 97% of issue structure Floating rate tied to 1 month LIBOR

Amortizing tranches with 1 to 15(+) year average lives Navient Solutions, Inc. is master servicer Insurance or guarantee of underlying collateral insulates bondholders from virtually any loss of principal(1) Typically non-dischargeable in bankruptcy

Offer significantly higher yields than government agency securities with comparable risk profiles (1) Principal and accrued interest on underlying FFELP loan collateral carry insurance or guarantee of 97%-100% dependent on origination year and on

meeting the servicing requirements of the U.S. Department of Education.

FFELP Loan Program Characteristics

(1) Aggregate loan limit for a Dependent Undergraduate is $31,000 Note: As of July 1, 2011 . Parameter Subsidized Stafford Unsubsidized Stafford PLUS/Grad PLUS Subsidized Consolidation Unsubsidized Consolidation Borrower Student Student Parents or

Graduate Students Student or Parents Student or Parents Needs Based Yes No No N/A N/A Federal Guarantee of Principal and Accrued Interest 97 - 100% 97 - 100% 97 - 100% 97 - 100% 97 - 100% Interest Subsidy Payments Yes No No Yes No Special Allowance

Payments (SAP) Yes Yes If cap is reached Yes Yes Repayment Term 120 months 120 months 120 months Up to 360 months Up to 360 months Aggregate Loan Limit Undergraduate: $23,000 Graduate: $65,500 Undergraduate1: $57,500 Graduate: $138,500 None None

None

Navient Stafford & PLUS Loan

Prepayments Annualized CPRs for Stafford/PLUS ABS trusts have decreased from pre-2008 levels as incentives for borrowers to consolidate have declined Higher prepayment activity in mid 2012 was related to the short term availability of the Special

Direct Consolidation Loan program Prepayments increased beginning in 2014 as we purchased assets from selected transactions to mitigate the risk that certain tranches might remain outstanding past their legal final maturity dates * Quarterly CPR

assumes School and Grace loans are not scheduled to make payments. Deferment, Forbearance and Repayment loans are scheduled to make payments.

Navient Consolidation Loan

Prepayments CPRs for Consolidation ABS trusts declined significantly following legislation effective in 2006 that prevented in-school and re-consolidation of borrowers’ loans Higher prepayment activity in mid 2012 was related to the short term

availability of the Special Direct Consolidation Loan program * Quarterly CPR assumes School and Grace loans are not scheduled to make payments. Deferment, Forbearance and Repayment loans are scheduled to make payments.

Private Education Loan ABS

Appendix

Recent Private Education Loan ABS

Issuance Characteristics Private Education Loan ABS Transaction Features Collateral Characteristics Issue size of $500M to $1.5B Triple-A rated senior notes, Single-A rated subordinated notes 20-40% Triple-A overcollateralization Amortizing tranches

with 1 to 10 year average lives Fixed rate or floating rate tied to 1 month LIBOR Complies with European risk retention (5% retention) Navient Solutions, Inc. is master servicer Collateralized by loans made to students and parents to fund college

tuition, room and board Underwritten using FICO, Custom Scorecard & judgmental criteria w/risk based pricing 60-80% with cosigners, typically a parent Many seasoned assets benefiting from proven payment history Typically non-dischargeable in

bankruptcy

Navient Private Education Loan

Programs Smart Option Undergraduate/Graduate/ Med/Law/MBA Direct-to-Consumer (DTC) Consolidation Career Training Origination Channel School School Direct-to-Consumer Lender School Typical Borrower Student Student Student College Graduates

Student Typical Co-signer Parent Parent Parent Parent Parent, Spouse Typical Loan $10k avg orig bal, 10 yr avg term, in-school payments of interest only, $25 or fully deferred $10k avg orig bal, 15 yr term, deferred payments $12k avg orig bal, 15 yr

term, deferred payments $43k avg orig bal, 15-30 year term depending on balance, immediate repayment $9k avg orig bal, up to 15 yr term, immediate payments Origination Period March 2009 to April 2014 All history through 2014 2004 through 2008 2006

through 2008 1998 through 2014 Certification and Disbursement School certified and disbursed School certified and disbursed Borrower self-certified, disbursed to borrower Proceeds to lender to pay off loans being consolidated School certified and

disbursed Borrower Underwriting FICO, custom credit score model, and judgmental underwriting Primarily FICO Primarily FICO FICO and Debt-to-Income FICO, Debt-to-Income and judgmental underwriting Borrowing Limits $200,000 $100,000 Undergraduate,

$150,000 Graduate $130,000 $400,000 Cost of attendance plus up to $6,000 for expenses Typical ABS Sec. Criteria For-Profit; FICO ≥ 670 For-Profit; FICO ≥ 670 FICO ≥ 670 For-Profit; FICO ≥ 670 FICO ≥ 670 Non-Profit; FICO

≥ 640 Non-Profit; FICO ≥ 640 Non-Profit; FICO ≥ 640 School UW No No No No Yes Historical Risk-Based Pricing L + 2% to L + 14% P-1.5% to P+7.5% P+1% to P+6.5% P - 0.5% to P + 6.5% P+0% to P+9% L+0% to L+15% L+6% to L+12% L+6.5% to

L+14% Dischargeable in Bankruptcy No No No No Yes Additional Characteristics Made to students and parents primarily through college financial aid offices to fund 2-year, 4-year and graduate school college tuition, room and board Also available on a

limited basis to students and parents to fund non-degree granting secondary education, including community college, part time, technical and trade school programs Both Title IV and non-Title IV schools (1) Made to students and parents through

college financial aid offices to fund 2-year, 4-year and graduate school college tuition, room and board Signature, Excel, Law, Med and MBA Loan brands Title IV schools only (1) Freshmen must have a co-signer with limited exceptions Co-signer

stability test (minimum 3 year repayment history) Terms and underwriting criteria similar to Undergraduate, Graduate, Med/Law/MBA with primary differences being: Marketing channel No school certification Disbursement of proceeds directly to borrower

Title IV schools only(1) Freshmen must have a co-signer with limited exceptions Co-signer stability test (minimum 3 year repayment history) Loans made to students and parents to refinance one or more private education loans Student must provide

proof of graduation in order to obtain loan Loans made to students and parents to fund non-degree granting secondary education, including community college, part time, technical, trade school and tutorial programs Both Title IV and non-Title IV

schools(1) (1) Title IV Institutions are post-secondary institutions that have a written agreement with the Secretary of Education that allows the institution to participate in any of the Title IV federal student financial assistance programs and

the National Early Intervention Scholarship and Partnership (NEISP) programs.

Navient Private Education Trusts (1)

Assumes Prime/LIBOR spread of 3.00% for all transactions.

Navient Portfolio Transition to

Seasoned Collateral Securitized collateral will continue to season as the company transitions from originations to portfolio acquisition and management Most defaults occur early in repayment; loan performance improves as loans season As of September

2015, the private securitized loan portfolio is approximately 72 months into repayment; about 72% of total expected defaults have already occurred Trust Portfolio Average Time in Repayment as of each Year

Navient Private Education Loan

Trusts – Prepayment Analysis Constant prepayment rates increased in 2007 due to the introduction of Private Education Consolidation loans, then declined following our decision to suspend our consolidation loan program in 2008

Cohort Default Triangles The

following cohort default triangles provide loan performance information for certain Private Education Loans of Navient Corporation and its consolidated subsidiaries that meet such subsidiaries’ current securitization criteria (including those

criteria listed below): Program types include Undergraduate/Graduate(1), Direct-to-Consumer (“DTC”)(2), Career Training(3) and Private Consolidation Loans FICO scores are based on the greater of the borrower and cosigner scores as of a

date near the loan application and must be at least: Undergraduate/Graduate at not-for-profit schools: ≥ 640 Undergraduate/Graduate at for-profit schools: ≥ 670 DTC loans: ≥ 670 Career Training loans: ≥ 670 Private

Consolidation loans: ≥ 640 Excludes loans made at selected schools that have historically experienced higher rates of default The cohort default triangles are not representative of the characteristics of the portfolio of Private Education

Loans of Navient Corporation and its consolidated subsidiaries as a whole or any particular securitization trust Undergraduate/Graduate loans marketed under the Signature Student Loan brand. Direct-to-Consumer Loans marketed under the Tuition Answer

brand. Career Training loans provide eligible borrowers financing at technical, trade, K-12 or tutoring schools.

Cohort Default Triangles The cohort

default triangles featured on subsequent slides are segmented by loan program type, FICO score, cosigner status, and school type Terms and calculations used in the cohort default triangles are defined below: Repayment Year – The calendar year

loans entered repayment Disbursed Principal Entering Repayment – The amount of principal entering repayment in a given year, based on disbursed principal prior to any interest capitalization Years in Repayment – Measured in years between

repayment start date and default date. Zero represents defaults that occurred prior to the start of repayment. Periodic Defaults – Defaulted principal in each Year in Repayment as a percentage of the disbursed principal entering repayment in

each Repayment Year Defaulted principal includes any interest capitalization that occurred prior to default Defaulted principal is not reduced by any amounts recovered after the loan defaulted Because the numerator includes capitalized interest

while the denominator does not, default rates are higher than if the numerator and denominator both included capitalized interest Total – The sum of Periodic Defaults across Years in Repayment for each Repayment Year

Cohort Default Triangles Note: Data

as of 9/30/15. Undergraduate/Graduate loans marketed under the Signature Student Loan brand. Periodic Defaults for the most recent two calendar Years in Repayment are for a partial year. Numerator is the amount of principal in each cohort that

defaulted in each Year in Repayment. Denominator is the amount of disbursed principal for that Repayment Year. Undergraduate/Graduate(1)

Cohort Default Triangles Note: Data

as of 9/30/15. Undergraduate/Graduate loans marketed under the Signature Student Loan brand. Periodic Defaults for the most recent two calendar Years in Repayment are for a partial year. Numerator is the amount of principal in each cohort that

defaulted in each Year in Repayment. Denominator is the amount of disbursed principal for that Repayment Year. Undergraduate/Graduate(1) Without Co-signer Undergraduate/Graduate(1) With Co-signer

Cohort Default Triangles Note: Data

as of 9/30/15. Undergraduate/Graduate loans marketed under the Signature Student Loan brand. Periodic Defaults for the most recent two calendar Years in Repayment are for a partial year. Numerator is the amount of principal in each cohort that

defaulted in each Year in Repayment. Denominator is the amount of disbursed principal for that Repayment Year. Undergraduate/Graduate(1) Non-Profit Undergraduate/Graduate(1) For-Profit

Cohort Default Triangles Note: Data

as of 9/30/15. Undergraduate/Graduate loans marketed under the Signature Student Loan brand. FICO scores are based on the greater of the borrower and co-borrower scores as of a date near the loan application. Periodic Defaults for the most recent

two calendar Years in Repayment are for a partial year. Numerator is the amount of principal in each cohort that defaulted in each Year in Repayment. Denominator is the amount of disbursed principal for that Repayment Year. Undergraduate/Graduate(1)

Loans, FICO 740-850(2) Undergraduate/Graduate(1) Loans, FICO 700-739(2)

Cohort Default Triangles Note: Data

as of 9/30/15. Undergraduate/Graduate loans marketed under the Signature Student Loan brand. FICO scores are based on the greater of the borrower and co-borrower scores as of a date near the loan application. Periodic Defaults for the most recent

two calendar Years in Repayment are for a partial year. Numerator is the amount of principal in each cohort that defaulted in each Year in Repayment. Denominator is the amount of disbursed principal for that Repayment Year. Undergraduate/Graduate(1)

Loans, FICO 670-699(2) Undergraduate/Graduate(1) Loans, FICO 640-669(2)

Cohort Default Triangles Note: Data

as of 9/30/15. Periodic Defaults for the most recent two calendar Years in Repayment are for a partial year. Numerator is the amount of principal in each cohort that defaulted in each Year in Repayment. Denominator is the amount of disbursed

principal for that Repayment Year. Private Consolidation Loans Without Co-signer Private Consolidation Loans With Co-signer

Cohort Default Triangles Note: Data

as of 9/30/15. FICO scores are based on the greater of the borrower and co-borrower scores as of a date near the loan application. Periodic Defaults for the most recent two calendar Years in Repayment are for a partial year. Numerator is the amount

of principal in each cohort that defaulted in each Year in Repayment. Denominator is the amount of disbursed principal for that Repayment Year. DTC With Co-signer, FICO ≥ 670(1) DTC Without Co-signer, FICO ≥ 670(1)

Cohort Default Triangles Note: Data

as of 9/30/15. FICO scores are based on the greater of the borrower and co-borrower scores as of a date near the loan application. Periodic Defaults for the most recent two calendar Years in Repayment are for a partial year. Numerator is the amount

of principal in each cohort that defaulted in each Year in Repayment. Denominator is the amount of disbursed principal for that Repayment Year. Career Training Loans, 670+ FICO(1)

Navient Corporation

Appendix

GAAP Results (In millions, except

per share amounts) Q3 15 Q2 15 Q3 14 Net income $237 $182 $359 EPS $0.63 $0.47 $0.85 Operating expenses $228 $225 $195 Provision $123 $198 $140 Average Student Loans $127,750 $130,512 $129,915

“Core Earnings”

adjustments to GAAP: GAAP net income $ 237 Net impact of derivative accounting (108) Net impact of goodwill and acquired intangible assets 3 Net income tax effect 42 Total “Core Earnings” adjustments to GAAP (63) “Core

Earnings” net income $174 Quarter ended September 30, 2015 ($ in millions) Differences between “Core Earnings” and GAAP

SLM / NAVI student loan trust data

(Debt/asset backed securities – SLM / NAVI Student Loan Trusts) Static pool information – detailed portfolio stratifications by trust as of the cutoff date Accrued interest factors Quarterly distribution factors Historical trust

performance – monthly charge-off, delinquency, loan status, CPR, etc. by trust Since issued CPR – monthly CPR data by trust since issuance SLM / NAVI student loan performance by trust – Issue details Current and historical monthly

distribution reports Distribution factors Current rates Prospectus for public transactions and Rule 144A transactions are available through underwriters Additional information (Webcasts and presentations) Archived and historical webcasts,

transcripts and investor presentations www.navient.com/investors www.navient.com/abs Investor Relations Website

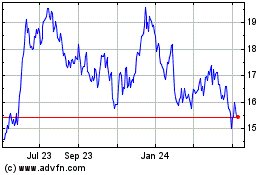

Navient (NASDAQ:NAVI)

Historical Stock Chart

From Mar 2024 to Apr 2024

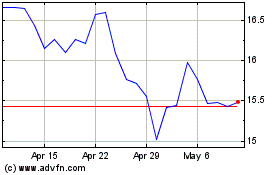

Navient (NASDAQ:NAVI)

Historical Stock Chart

From Apr 2023 to Apr 2024