FORM

6-K

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a–16 OR 15d–16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2015

Commission File Number: 001-33178

MELCO CROWN ENTERTAINMENT LIMITED

36th Floor, The Centrium

60 Wyndham Street

Central

Hong Kong

(Address of principal executive offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20–F or Form 40–F. Form

20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the

Commission pursuant to Rule 12g3–2(b) under the Securities Exchange Act of

1934. Yes ¨ No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3–2(b): 82– N/A

MELCO CROWN ENTERTAINMENT LIMITED

Form 6–K

TABLE OF

CONTENTS

Signature

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

| MELCO CROWN ENTERTAINMENT LIMITED |

|

|

| By: |

|

/s/ Geoffrey Davis |

| Name: |

|

Geoffrey Davis, CFA |

| Title: |

|

Chief Financial Officer |

Date: May 7, 2015

3

EXHIBIT INDEX

|

|

|

|

|

| Exhibit No. |

|

|

|

Description |

|

|

|

| Exhibit 99.1 |

|

|

|

Unaudited Results for The First Quarter of 2015, dated May 7, 2015 |

Exhibit 99.1

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no

representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement.

Melco Crown Entertainment Limited

(Incorporated in the Cayman Islands with limited liability)

(SEHK Stock Code: 6883)

UNAUDITED RESULTS FOR THE FIRST QUARTER OF 2015

This announcement is issued pursuant to Rule 13.09 of the Rules Governing the Listing of the Securities of

The Stock Exchange of Hong Kong Limited.

Melco Crown Entertainment Limited (“Melco Crown Entertainment”

or “the Company” or “we”) (SEHK: 6883) (NASDAQ: MPEL), a developer, owner and operator of casino gaming and entertainment resort facilities in Asia, today released its unaudited financial results for the first

quarter of 2015, as part of its regular earnings disclosure practices for the Company’s American depository shares (“ADSs”), which are listed on the NASDAQ Global Select Market in the United States.

These unaudited results have been prepared in accordance with the United States Generally Accepted

Accounting Principles (“U.S. GAAP”) which differ in certain respects from the International Financial Reporting Standards (“IFRS”).

Net revenue for the first quarter of 2015 was US$1,054.3 million, representing a decrease of approximately 22% from US$1,357.3 million for the comparable

period in 2014. The decline in net revenue was primarily attributable to lower group-wide rolling chip revenues and mass market table games revenues.

Adjusted property EBITDA(1) was US$253.3 million for the first quarter of 2015, as compared to Adjusted

property EBITDA of US$387.5 million in the first quarter of 2014. The 35% year-over-year decline in Adjusted property EBITDA was attributable to lower group-wide rolling chip volumes and rolling chip win rate, together with a lower contribution from

the mass market table games segment.

On a U.S. GAAP basis, net income attributable to Melco Crown Entertainment for the first quarter of 2015 was US$60.6

million, or US$0.11 per ADS, compared with net income attributable to Melco Crown Entertainment of US$239.5 million, or US$0.44 per ADS, in the first quarter of 2014. The net loss attributable to noncontrolling interests during the first quarter of

2015 of US$36.8 million related to Studio City and City of Dreams Manila.

1

Mr. Lawrence Ho, Co-Chairman and Chief Executive Officer of Melco Crown Entertainment, commented, “I am

pleased to report a solid operating and financial performance for Melco Crown Entertainment in what continues to be a challenging period for Macau.

“While the demand environment in Macau remains challenging, we are firmly committed to maximizing customer experience and loyalty by leveraging our

premium hotel rooms, food and beverage amenities and entertainment attractions. We are also firmly committed to maintaining a strict discipline on player reinvestment and operating costs, as demonstrated by our Macau Property EBITDA margins which

remained flat sequentially despite declining revenues.

“With a market-leading array of premium non-gaming amenities, Melco Crown Entertainment once

again received more Forbes-5 star awards than any other company in Macau. We believe this highlights City of Dreams and Altira’s unique appeal to the most discerning and sophisticated customers in Macau.

“We have always strived to offer visitors a multi-faceted experience and have consistently supported the Macau Government’s long term vision for

Macau as a world-class leisure and tourism destination. Our support and commitment are highlighted by the diverse non-gaming amenities we offer, including our award winning The House of Dancing Water show which required an investment of over US$300

million to design and produce and has been viewed by over 3.2 million guests, Club Cubic, Macau’s only cabaret show, Taboo, and our SOHO food and beverage and entertainment precinct.

“Studio City, which remains on budget and on schedule, signifies our Company’s continued commitment to the diversification of Macau and it

highlights our ability to bring unique, market-leading attractions to Macau. Studio City will provide a diverse and exciting mix of entertainment in Macau, including a Warner Bros. Batman-themed motion ride, a 40,000-square-foot family entertainment

center, Asia’s highest Ferris wheel, a TV production studio, a 5,000-seat multi-purpose live entertainment center, a live magic show precinct and Pacha nightclub.

“Studio City is conveniently located on Cotai and is directly adjacent to the Lotus Bridge immigration point connecting Hengqin Island and a future

station-point for the Macau Light Rapid Transit. We believe that Studio City with its Hollywood-inspired design and exciting attractions will attract new customers and visitors to Macau.

“We remain firm believers in Macau’s long term positioning as the leading leisure and tourism destination in the region. We believe that

Macau’s unique geographical position, the Macau and Central Government’s forward-thinking and expansive infrastructure and development plan, and the diversification of the city’s leisure and tourism offering all together provide a

sustainable long term growth model. We look forward to continuing our leadership role as a provider of unique and world-class entertainment attractions and non-gaming amenities in Macau and our support for the long term vision for Macau.

2

“City of Dreams Manila continues to build on its early success, with its mass market gaming operations and

non-gaming attractions delivering robust growth since its opening in December 2014. We believe that this growth, together with the junket business that is anticipated to develop over the coming months, positions the property to realize its potential

as the leading integrated resort in the Philippines.

“City of Dreams Manila represents an important milestone for Melco Crown Entertainment as we

embark on our plans to become the leading gaming, leisure and entertainment company in Asia. We are proud to be the first integrated resort operator in Entertainment City to be awarded a regular license from the Philippines government. We believe

the Philippines offers a unique opportunity to participate in the expected strong consumer-led growth in Asia and we look forward to contributing to the expansion of the Philippines as a leading, multi-faceted tourist destination in the

region.”

Community Support and Investment

As

an employer of choice with a strong and deep heritage in Macau, we have always maintained a steadfast commitment to the long term development of our employees and support of the local community. This is highlighted by the following initiatives we

have recently instituted or expanded:

| |

• |

|

We recently announced the “Foundation Acceleration Program”, a new management development program for our local employees. It aims to enhance preparedness for management responsibilities through a

structured program. |

| |

• |

|

In 2009, we established Macau’s first “In-house Learning Academy”, offering over 200 courses each year to all our employees who are wanting to expand their education and widen their career path.

These programs will now be offered to employees of local business and SMEs as a commitment to developing a longer term sustainable economic model in Macau. |

| |

• |

|

Our “Back-to-School” program, which started in 2010 in partnership with the Department of Education, is Macau’s first and only in-house high school diploma program giving our employees a chance to

complete high school education. |

| |

• |

|

Our “Dare to Dream” series, which began in 2012, offered Macau youths a once-in-a-lifetime opportunity to study with international maestros including Franco Dragone, the creator of The House of Dancing

Water show, legendary piano master Yundi Li, and Dame Zaha Hadid, the world-renowned architect. |

City of Dreams First Quarter Results

For the quarter ended March 31, 2015, net revenue at City of Dreams was US$805.9 million compared to US$1,074.0 million in the first quarter of

2014. City of Dreams generated Adjusted EBITDA of US$235.8 million in the first quarter of 2015, representing a decrease of 31% compared to US$341.4 million in the comparable period of 2014. The decline in Adjusted EBITDA was primarily a result

of lower rolling chip revenues and mass market table games revenues.

Rolling chip volume totaled US$13.5 billion for the first quarter of 2015 versus

US$24.6 billion in the first quarter of 2014. The rolling chip win rate was 3.2% in the first quarter of 2015 versus 3.0% in the first quarter of 2014. The expected rolling chip win rate range is 2.7%–3.0%.

Mass market table games drop decreased to US$1,199.0 million compared with US$1,299.1 million in the first quarter of 2014. The mass market table games hold

percentage was 35.9% in the first quarter of 2015 compared to 37.5% in the first quarter of 2014.

Gaming machine handle for the first quarter of 2015 was

US$1,242.0 million, compared with US$1,489.7 million in the first quarter of 2014.

Total non-gaming revenue at City of Dreams in the first quarter of

2015 was US$66.7 million, compared with US$70.6 million in the first quarter of 2014.

Altira Macau First Quarter Results

For the quarter ended March 31, 2015, net revenue at Altira Macau was US$148.7 million compared to US$229.8 million in the first quarter of 2014. Altira

Macau generated Adjusted EBITDA of US$6.8 million in the first quarter of 2015 compared with Adjusted EBITDA of US$34.8 million in the first quarter of 2014. The year-over-year decrease in Adjusted EBITDA was primarily a result of lower rolling chip

revenues.

Rolling chip volume totaled US$7.4 billion in the first quarter of 2015 versus US$10.1 billion in the first quarter of 2014. The rolling chip

win rate was 2.5% in the first quarter of 2015 versus 2.9% in the first quarter of 2014. The expected rolling chip win rate range is 2.7%–3.0%.

3

In the mass market table games segment, drop totaled US$159.3 million in the first quarter of 2015, a decrease

from US$203.8 million generated in the comparable period in 2014. The mass market table games hold percentage was 17.2% in the first quarter of 2015 compared with 13.3% in the first quarter of 2014.

Gaming machine handle for the first quarter of 2015 was US$7.2 million.

Total non-gaming revenue at Altira Macau in the first quarter of 2015 was US$8.5 million compared with US$9.4 million in the first quarter of 2014.

Mocha Clubs First Quarter Results

Net revenue from Mocha

Clubs totaled US$34.9 million in the first quarter of 2015 as compared to US$39.5 million in the first quarter of 2014. Mocha Clubs generated US$8.3 million of Adjusted EBITDA in the first quarter of 2015 compared with US$11.3 million in

the same period in 2014.

The number of gaming machines in operation at Mocha Clubs averaged approximately 1,200 in the first quarter of 2015, compared to

approximately 1,400 in the comparable period in 2014. The reduction in gaming machines reported by Mocha Clubs was primarily due to the closure of one club in mid-2014 and the transfer of the reporting of one club to Altira Macau in 2015, partially

offset by the opening of a new Mocha club in mid-2014. The net win per gaming machine per day was US$316 in both quarters ended March 31, 2015 and 2014.

City of Dreams Manila First Quarter Results

City of

Dreams Manila started operations on December 14, 2014 with its grand opening on February 2, 2015. For the first quarter of 2015, net revenue at City of Dreams Manila was US$52.7 million. City of Dreams Manila generated Adjusted EBITDA of

US$2.9 million in the first quarter of 2015.

Rolling chip volume totaled US$185.5 million for the first quarter of 2015. The rolling chip win rate

was negative 0.8% in the first quarter of 2015.

Mass market table games drop was US$101.8 million and the mass market table games hold percentage was

25.2% in the first quarter of 2015.

Gaming machine handle for the first quarter of 2015 was US$385.7 million.

Total non-gaming revenue at City of Dreams Manila in the first quarter of 2015 was US$20.2 million.

4

Other Factors Affecting Earnings

Total net non-operating expenses for the first quarter of 2015 were US$35.8 million, which mainly included interest income of US$1.8 million and interest

expenses, net of capitalized interest, of US$27.0 million and other finance costs of US$12.4 million. We recorded US$36.2 million of capitalized interest during the first quarter of 2015, primarily relating to Studio City, City of Dreams Manila and

the fifth hotel tower at City of Dreams. The year-on-year decrease of US$5.5 million in net non-operating expenses was primarily due to higher capitalized interest in the current quarter, partially offset by higher interest expenses resulted from

the drawdown of the Studio City US$1.3 billion term loan facility.

Depreciation and amortization costs of US$110.7 million were recorded in the first

quarter of 2015, of which US$14.3 million was related to the amortization of our gaming subconcession and US$16.1 million was related to the amortization of land use rights.

Financial Position and Capital Expenditure

Total cash

and bank balances as of March 31, 2015 totaled US$3.2 billion, including US$0.1 billion of bank deposits with original maturity over three months and US$1.6 billion of restricted cash, primarily related to Studio City. Total debt at the end of

the first quarter of 2015 was US$3.8 billion.

Capital expenditures for the first quarter of 2015 were US$456.2 million, which predominantly related to

Studio City and City of Dreams Manila, as well as various projects at City of Dreams, including the fifth hotel tower.

The shareholders and potential

investors of Melco Crown Entertainment are advised not to place undue reliance on the unaudited earnings and financial information of the Company for the first quarter of 2015 and are reminded that such financial information presented herein have

been prepared in accordance with U.S. GAAP which may differ in certain respects from IFRS and has not been audited. Consequently, the shareholders and potential investors of the Company are advised to exercise caution in dealing in the securities of

the Company.

5

Conference Call Information

Melco Crown Entertainment will hold a conference call to discuss its first quarter 2015 financial results on Thursday, May 7, 2015 at 8:30 a.m. Eastern

Time (8:30 p.m. Hong Kong Time). To join the conference call, please use the dial-in details below:

|

|

|

| US Toll Free |

|

1 866 519 4004 |

| US Toll/International |

|

1 845 675 0437 |

| HK Toll |

|

852 3018 6771 |

| HK Toll Free |

|

800 906 601 |

| UK Toll Free |

|

080 823 46646 |

| Australia Toll Free |

|

1 800 457 076 |

| Philippines Toll Free |

|

1 800 165 10607 |

|

|

| Passcode |

|

MPEL |

An audio webcast will also be available at www.melco-crown.com.

To access the replay, please use the dial-in details below:

|

|

|

| US Toll Free |

|

1 855 452 5696 |

| US Toll/International |

|

1 646 254 3697 |

| HK Toll Free |

|

800 963 117 |

| Philippines Toll Free |

|

1 800 161 20166 |

|

|

| Conference ID |

|

27003361 |

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities

Litigation Reform Act of 1995. The Company may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission (the “SEC”), in its annual report to shareholders, in press

releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including statements about the Company’s beliefs and expectations, are

forward-looking statements. Forward-looking statements involve inherent risks and uncertainties, and a number of factors could cause actual results to differ materially from those contained in any forward-looking statement. These factors include,

but are not limited to, (i) growth of the gaming market and visitation in Macau and the Philippines, (ii) capital and credit market volatility, (iii) local and global economic conditions, (iv) our anticipated growth strategies,

and (v) our future business development, results of operations and financial condition. In some cases, forward-looking statements can be identified by words or phrases such as “may”, “will”, “expect”,

“anticipate”, “target”, “aim”, “estimate”, “intend”, “plan”, “believe”, “potential”, “continue”, “is/ are likely to” or other similar expressions.

Further information regarding these and other risks, uncertainties or factors is included in the Company’s filings with the SEC. All information provided in this announcement is as of the date of this announcement, and the Company undertakes no

duty to update such information, except as required under applicable law.

6

Non-GAAP Financial Measures

| (1) |

“Adjusted EBITDA” is earnings before interest, taxes, depreciation, amortization, pre-opening costs, development costs, property charges and others, share-based compensation, payments to the Philippine parties

under the cooperative arrangement (the “Philippine Parties”), land rent to Belle Corporation, gain on disposal of assets held for sale and other non-operating income and expenses. “Adjusted property EBITDA” is earnings

before interest, taxes, depreciation, amortization, pre-opening costs, development costs, property charges and others, share-based compensation, payments to the Philippine Parties, land rent to Belle Corporation, gain on disposal of assets held for

sale, corporate and others expenses and other non-operating income and expenses. Adjusted EBITDA and adjusted property EBITDA are presented exclusively as a supplemental disclosure because management believes that they are widely used to measure the

performance, and as a basis for valuation, of gaming companies. Management uses adjusted EBITDA and adjusted property EBITDA as measures of the operating performance of its segments and to compare the operating performance of its properties with

those of its competitors. The Company also presents adjusted EBITDA and adjusted property EBITDA because they are used by some investors as ways to measure a company’s ability to incur and service debt, make capital expenditures, and meet

working capital requirements. Gaming companies have historically reported adjusted EBITDA and adjusted property EBITDA as supplements to financial measures in accordance with U.S. GAAP. However, adjusted EBITDA and adjusted property EBITDA should

not be considered as alternatives to operating income as indicators of the Company’s performance, as alternatives to cash flows from operating activities as measures of liquidity, or as alternatives to any other measure determined in accordance

with U.S. GAAP. Unlike net income, adjusted EBITDA and adjusted property EBITDA do not include depreciation and amortization or interest expense and therefore do not reflect current or future capital expenditures or the cost of capital. The Company

compensates for these limitations by using adjusted EBITDA and adjusted property EBITDA as only two of several comparative tools, together with U.S. GAAP measurements, to assist in the evaluation of operating performance. |

Such U.S. GAAP measurements include operating income, net income, cash flows from operations and cash flow data. The Company has significant

uses of cash flows, including capital expenditures, interest payments, debt principal repayments, taxes and other recurring and nonrecurring charges, which are not reflected in adjusted EBITDA or adjusted property EBITDA. Also, the Company’s

calculation of adjusted EBITDA and adjusted property EBITDA may be different from the calculation methods used by other companies and, therefore, comparability may be limited. Reconciliations of adjusted EBITDA and adjusted property EBITDA with the

most comparable financial measures calculated and presented in accordance with U.S. GAAP are provided herein immediately following the financial statements included in this announcement.

7

| (2) |

“Adjusted net income” is net income before pre-opening costs, development costs and property charges and others. Adjusted net income attributable to Melco Crown Entertainment and adjusted net income

attributable to Melco Crown Entertainment per share (“EPS”) are presented as supplemental disclosures because management believes that they are widely used to measure the performance, and as a basis for valuation, of gaming

companies. These measures are used by management and/or evaluated by some investors, in addition to income and EPS computed in accordance with U.S. GAAP, as an additional basis for assessing period-to-period results of our business. Adjusted net

income attributable to Melco Crown Entertainment and adjusted net income attributable to Melco Crown Entertainment per share may be different from the calculation methods used by other companies and, therefore, comparability may be limited.

Reconciliations of adjusted net income attributable to Melco Crown Entertainment with the most comparable financial measures calculated and presented in accordance with U.S. GAAP are provided herein immediately following the financial statements

included in this announcement. |

About Melco Crown Entertainment Limited

Melco Crown Entertainment, with its shares listed on the Main Board of The Stock Exchange of Hong Kong Limited (the “Stock Exchange”) (SEHK:

6883) and its American depositary shares listed on the NASDAQ Global Select Market (NASDAQ: MPEL), is a developer, owner and operator of casino gaming and entertainment casino resort facilities in Asia. Melco Crown Entertainment currently operates

Altira Macau (www.altiramacau.com), a casino hotel located at Taipa, Macau and City of Dreams (www.cityofdreamsmacau.com), an integrated urban casino resort located in Cotai, Macau. Melco Crown Entertainment’s business also

includes the Mocha Clubs (www.mochaclubs.com), which comprise the largest non-casino based operations of electronic gaming machines in Macau. The Company is also developing the planned Studio City (www.studiocity-macau.com), a

cinematically-themed integrated entertainment, retail and gaming resort in Cotai, Macau. In the Philippines, Melco Crown (Philippines) Resorts Corporation’s subsidiary, MCE Leisure (Philippines) Corporation, currently operates and manages City

of Dreams Manila (www.cityofdreams.com.ph), a casino, hotel, retail and entertainment integrated resort in the Entertainment City complex in Manila. For more information about Melco Crown Entertainment, please visit www.melco-crown.com.

Melco Crown Entertainment has strong support from both of its major shareholders, Melco

International Development Limited (“Melco”) and Crown Resorts Limited (“Crown”). Melco is a listed company on the Stock Exchange and is substantially owned and led by Mr. Lawrence Ho, who is Co-Chairman, an

Executive Director and the Chief Executive Officer of Melco Crown Entertainment. Crown is a top-50 company listed on the Australian Securities Exchange and led by Chairman Mr. James Packer, who is also Co-Chairman and a Non-executive Director

of Melco Crown Entertainment.

8

For investment community, please contact:

Ross Dunwoody

Vice President, Investor Relations

Tel: +853 8868 7575 or +852 2598 3689

Email:

rossdunwoody@melco-crown.com

For media enquiry, please contact:

Maggie Ma

Head of Corporate Communications

Tel: +853 8868 3767 or +852 3151 3767

Email:

maggiema@melco-crown.com

|

| By order of the Board |

| Melco Crown Entertainment Limited |

| Lawrence Yau Lung Ho |

| Co-Chairman and Chief Executive Officer |

Macau, May 7, 2015

As at the date of this announcement, the board of directors comprises one executive director, namely Mr. Lawrence Yau Lung Ho (Co-Chairman and Chief

Executive Officer); five non-executive directors, namely Mr. James Douglas Packer (Co-Chairman), Mr. John Peter Ben Wang, Mr. Clarence Yuk Man Chung, Mr. William Todd Nisbet, and Mr. Rowen Bruce Craigie; and four independent

non-executive directors, namely Mr. James Andrew Charles MacKenzie, Mr. Thomas Jefferson Wu, Mr. Alec Yiu Wa Tsui, and Mr. Robert Wason Mactier.

This announcement is prepared in both English and Chinese and in the event of inconsistency, the English text of this announcement shall prevail over the

Chinese text.

9

Melco Crown Entertainment Limited and Subsidiaries

Condensed Consolidated Statements of Operations

(In thousands of U.S. dollars, except share and per share data)

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

March 31, |

|

| |

|

2015 |

|

|

2014 |

|

| |

|

(Unaudited) |

|

|

(Unaudited) |

|

| OPERATING REVENUES |

|

|

|

|

|

|

|

|

| Casino |

|

$ |

1,011,242 |

|

|

$ |

1,320,139 |

|

| Rooms |

|

|

44,563 |

|

|

|

33,434 |

|

| Food and beverage |

|

|

29,507 |

|

|

|

21,344 |

|

| Entertainment, retail and others |

|

|

23,217 |

|

|

|

27,315 |

|

|

|

|

|

|

|

|

|

|

| Gross revenues |

|

|

1,108,529 |

|

|

|

1,402,232 |

|

| Less: promotional allowances |

|

|

(54,277 |

) |

|

|

(44,913 |

) |

|

|

|

|

|

|

|

|

|

| Net revenues |

|

|

1,054,252 |

|

|

|

1,357,319 |

|

|

|

|

|

|

|

|

|

|

| OPERATING COSTS AND EXPENSES |

|

|

|

|

|

|

|

|

| Casino |

|

|

(716,794 |

) |

|

|

(913,630 |

) |

| Rooms |

|

|

(5,255 |

) |

|

|

(3,126 |

) |

| Food and beverage |

|

|

(8,001 |

) |

|

|

(5,732 |

) |

| Entertainment, retail and others |

|

|

(15,122 |

) |

|

|

(14,294 |

) |

| General and administrative |

|

|

(93,430 |

) |

|

|

(66,465 |

) |

| Payments to the Philippine Parties |

|

|

(3,136 |

) |

|

|

— |

|

| Pre-opening costs |

|

|

(41,278 |

) |

|

|

(8,531 |

) |

| Development costs |

|

|

(20 |

) |

|

|

(1,525 |

) |

| Amortization of gaming subconcession |

|

|

(14,309 |

) |

|

|

(14,309 |

) |

| Amortization of land use rights |

|

|

(16,118 |

) |

|

|

(16,118 |

) |

| Depreciation and amortization |

|

|

(80,277 |

) |

|

|

(64,402 |

) |

| Property charges and others |

|

|

(301 |

) |

|

|

(1,692 |

) |

| Gain on disposal of assets held for sale |

|

|

— |

|

|

|

22,072 |

|

|

|

|

|

|

|

|

|

|

| Total operating costs and expenses |

|

|

(994,041 |

) |

|

|

(1,087,752 |

) |

|

|

|

|

|

|

|

|

|

| OPERATING INCOME |

|

|

60,211 |

|

|

|

269,567 |

|

|

|

|

|

|

|

|

|

|

| NON-OPERATING INCOME (EXPENSES) |

|

|

|

|

|

|

|

|

| Interest income |

|

|

1,820 |

|

|

|

3,875 |

|

| Interest expenses, net of capitalized interest |

|

|

(27,039 |

) |

|

|

(31,868 |

) |

| Other finance costs |

|

|

(12,382 |

) |

|

|

(11,657 |

) |

| Foreign exchange gain (loss), net |

|

|

1,254 |

|

|

|

(2,228 |

) |

| Other income, net |

|

|

548 |

|

|

|

558 |

|

|

|

|

|

|

|

|

|

|

| Total non-operating expenses, net |

|

|

(35,799 |

) |

|

|

(41,320 |

) |

|

|

|

|

|

|

|

|

|

| INCOME BEFORE INCOME TAX |

|

|

24,412 |

|

|

|

228,247 |

|

| INCOME TAX EXPENSE |

|

|

(574 |

) |

|

|

(2,689 |

) |

|

|

|

|

|

|

|

|

|

| NET INCOME |

|

|

23,838 |

|

|

|

225,558 |

|

| NET LOSS ATTRIBUTABLE TO NONCONTROLLING INTERESTS |

|

|

36,791 |

|

|

|

13,985 |

|

|

|

|

|

|

|

|

|

|

| NET INCOME ATTRIBUTABLE TO MELCO CROWN ENTERTAINMENT LIMITED |

|

$ |

60,629 |

|

|

$ |

239,543 |

|

|

|

|

|

|

|

|

|

|

| NET INCOME ATTRIBUTABLE TO MELCO CROWN ENTERTAINMENT LIMITED PER SHARE: |

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.038 |

|

|

$ |

0.145 |

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

$ |

0.037 |

|

|

$ |

0.144 |

|

|

|

|

|

|

|

|

|

|

| NET INCOME ATTRIBUTABLE TO MELCO CROWN ENTERTAINMENT LIMITED PER ADS: |

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.113 |

|

|

$ |

0.435 |

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

$ |

0.112 |

|

|

$ |

0.431 |

|

|

|

|

|

|

|

|

|

|

| WEIGHTED AVERAGE SHARES USED IN NET INCOME ATTRIBUTABLE TO MELCO CROWN ENTERTAINMENT LIMITED PER SHARE CALCULATION: |

|

|

|

|

|

|

|

|

| Basic |

|

|

1,616,031,719 |

|

|

|

1,651,289,415 |

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

|

1,627,484,296 |

|

|

|

1,666,365,474 |

|

|

|

|

|

|

|

|

|

|

10

Melco Crown Entertainment Limited and Subsidiaries

Condensed Consolidated Balance Sheets

(In thousands of U.S. dollars)

|

|

|

|

|

|

|

|

|

| |

|

March 31, |

|

|

December 31, |

|

| |

|

2015 |

|

|

2014 |

|

| |

|

(Unaudited) |

|

|

(Audited) |

|

| ASSETS |

|

|

|

|

|

|

|

|

|

|

|

| CURRENT ASSETS |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

1,498,907 |

|

|

$ |

1,597,655 |

|

| Bank deposits with original maturity over three months |

|

|

123,469 |

|

|

|

110,616 |

|

| Restricted cash |

|

|

1,201,307 |

|

|

|

1,447,034 |

|

| Accounts receivable, net |

|

|

235,346 |

|

|

|

253,665 |

|

| Amounts due from affiliated companies |

|

|

927 |

|

|

|

1,079 |

|

| Deferred tax assets |

|

|

8 |

|

|

|

532 |

|

| Income tax receivable |

|

|

4 |

|

|

|

15 |

|

| Inventories |

|

|

22,293 |

|

|

|

23,111 |

|

| Prepaid expenses and other current assets |

|

|

65,292 |

|

|

|

69,254 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

3,147,553 |

|

|

|

3,502,961 |

|

|

|

|

|

|

|

|

|

|

| PROPERTY AND EQUIPMENT, NET |

|

|

5,071,043 |

|

|

|

4,696,391 |

|

| GAMING SUBCONCESSION, NET |

|

|

413,485 |

|

|

|

427,794 |

|

| INTANGIBLE ASSETS, NET |

|

|

4,220 |

|

|

|

4,220 |

|

| GOODWILL |

|

|

81,915 |

|

|

|

81,915 |

|

| LONG-TERM PREPAYMENTS, DEPOSITS AND OTHER ASSETS |

|

|

237,752 |

|

|

|

287,558 |

|

| RESTRICTED CASH |

|

|

360,785 |

|

|

|

369,549 |

|

| DEFERRED TAX ASSETS |

|

|

92 |

|

|

|

115 |

|

| DEFERRED FINANCING COSTS, NET |

|

|

163,875 |

|

|

|

174,872 |

|

| LAND USE RIGHTS, NET |

|

|

871,070 |

|

|

|

887,188 |

|

|

|

|

|

|

|

|

|

|

| TOTAL ASSETS |

|

$ |

10,351,790 |

|

|

$ |

10,432,563 |

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

| CURRENT LIABILITIES |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

15,737 |

|

|

$ |

14,428 |

|

| Accrued expenses and other current liabilities |

|

|

977,050 |

|

|

|

1,005,720 |

|

| Income tax payable |

|

|

4,871 |

|

|

|

6,621 |

|

| Capital lease obligations, due within one year |

|

|

25,865 |

|

|

|

23,512 |

|

| Current portion of long-term debt |

|

|

301,659 |

|

|

|

262,750 |

|

| Amounts due to affiliated companies |

|

|

1,759 |

|

|

|

3,626 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

1,326,941 |

|

|

|

1,316,657 |

|

|

|

|

|

|

|

|

|

|

| LONG-TERM DEBT |

|

|

3,534,101 |

|

|

|

3,640,031 |

|

| OTHER LONG-TERM LIABILITIES |

|

|

112,288 |

|

|

|

93,441 |

|

| DEFERRED TAX LIABILITIES |

|

|

57,917 |

|

|

|

58,949 |

|

| CAPITAL LEASE OBLIGATIONS, DUE AFTER ONE YEAR |

|

|

278,412 |

|

|

|

278,027 |

|

| LAND USE RIGHTS PAYABLE |

|

|

— |

|

|

|

3,788 |

|

|

|

|

| SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Ordinary shares |

|

|

16,309 |

|

|

|

16,337 |

|

| Treasury shares |

|

|

(1,083 |

) |

|

|

(33,167 |

) |

| Additional paid-in capital |

|

|

3,064,343 |

|

|

|

3,092,943 |

|

| Accumulated other comprehensive losses |

|

|

(17,399 |

) |

|

|

(17,149 |

) |

| Retained earnings |

|

|

1,260,172 |

|

|

|

1,227,177 |

|

|

|

|

|

|

|

|

|

|

| Total Melco Crown Entertainment Limited shareholders’ equity |

|

|

4,322,342 |

|

|

|

4,286,141 |

|

| Noncontrolling interests |

|

|

719,789 |

|

|

|

755,529 |

|

|

|

|

|

|

|

|

|

|

| Total equity |

|

|

5,042,131 |

|

|

|

5,041,670 |

|

|

|

|

|

|

|

|

|

|

| TOTAL LIABILITIES AND EQUITY |

|

$ |

10,351,790 |

|

|

$ |

10,432,563 |

|

|

|

|

|

|

|

|

|

|

11

Melco Crown Entertainment Limited and Subsidiaries

Reconciliation of Net Income Attributable to Melco Crown Entertainment Limited to

Adjusted Net Income Attributable to Melco Crown Entertainment Limited

(In thousands of U.S. dollars, except share and per share data)

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

March 31, |

|

| |

|

2015 |

|

|

2014 |

|

| |

|

(Unaudited) |

|

|

(Unaudited) |

|

| Net Income Attributable to Melco Crown Entertainment Limited |

|

$ |

60,629 |

|

|

$ |

239,543 |

|

| Pre-opening Costs, Net |

|

|

26,157 |

|

|

|

6,548 |

|

| Development Costs, Net |

|

|

20 |

|

|

|

1,525 |

|

| Property Charges and Others, Net |

|

|

301 |

|

|

|

1,692 |

|

|

|

|

|

|

|

|

|

|

| Adjusted Net Income Attributable to Melco Crown Entertainment Limited |

|

$ |

87,107 |

|

|

$ |

249,308 |

|

|

|

|

|

|

|

|

|

|

| ADJUSTED NET INCOME ATTRIBUTABLE TO MELCO CROWN ENTERTAINMENT LIMITED PER SHARE: |

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.054 |

|

|

$ |

0.151 |

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

$ |

0.054 |

|

|

$ |

0.150 |

|

|

|

|

|

|

|

|

|

|

| ADJUSTED NET INCOME ATTRIBUTABLE TO MELCO CROWN ENTERTAINMENT LIMITED PER ADS: |

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.162 |

|

|

$ |

0.453 |

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

$ |

0.161 |

|

|

$ |

0.449 |

|

|

|

|

|

|

|

|

|

|

| WEIGHTED AVERAGE SHARES USED IN ADJUSTED NET INCOME ATTRIBUTABLE TO MELCO CROWN ENTERTAINMENT LIMITED PER SHARE CALCULATION: |

|

|

|

|

|

|

|

|

| Basic |

|

|

1,616,031,719 |

|

|

|

1,651,289,415 |

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

|

1,627,484,296 |

|

|

|

1,666,365,474 |

|

|

|

|

|

|

|

|

|

|

12

Melco Crown Entertainment Limited and Subsidiaries

Reconciliation of Operating Income (Loss) to

Adjusted EBITDA and Adjusted Property EBITDA

(In thousands of U.S. dollars)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Three Months Ended March 31, 2015 |

|

|

|

|

| |

|

Altira Macau |

|

|

Mocha |

|

|

City of

Dreams |

|

|

Studio

City |

|

|

City of

Dreams

Manila |

|

|

Corporate

and Others |

|

|

Total |

|

| |

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

| Operating (Loss) Income |

|

$ |

(59 |

) |

|

$ |

5,128 |

|

|

$ |

182,719 |

|

|

$ |

(23,718 |

) |

|

$ |

(50,363 |

) |

|

$ |

(53,496 |

) |

|

$ |

60,211 |

|

|

|

|

|

|

|

|

|

| Payments to the Philippine Parties |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3,136 |

|

|

|

— |

|

|

|

3,136 |

|

| Land Rent to Belle Corporation |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

894 |

|

|

|

— |

|

|

|

894 |

|

| Pre-opening Costs |

|

|

— |

|

|

|

— |

|

|

|

361 |

|

|

|

12,334 |

|

|

|

26,201 |

|

|

|

2,382 |

|

|

|

41,278 |

|

| Development Costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

20 |

|

|

|

20 |

|

| Depreciation and Amortization |

|

|

6,862 |

|

|

|

3,132 |

|

|

|

52,156 |

|

|

|

10,893 |

|

|

|

21,305 |

|

|

|

16,356 |

|

|

|

110,704 |

|

| Share-based Compensation |

|

|

30 |

|

|

|

21 |

|

|

|

262 |

|

|

|

29 |

|

|

|

1,703 |

|

|

|

2,766 |

|

|

|

4,811 |

|

| Property Charges and Others |

|

|

— |

|

|

|

— |

|

|

|

301 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

301 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

|

6,833 |

|

|

|

8,281 |

|

|

|

235,799 |

|

|

|

(462 |

) |

|

|

2,876 |

|

|

|

(31,972 |

) |

|

|

221,355 |

|

| Corporate and Others Expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

31,972 |

|

|

|

31,972 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Property EBITDA |

|

$ |

6,833 |

|

|

$ |

8,281 |

|

|

$ |

235,799 |

|

|

$ |

(462 |

) |

|

$ |

2,876 |

|

|

$ |

— |

|

|

$ |

253,327 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Three Months Ended March 31, 2014 |

|

|

|

|

| |

|

Altira Macau |

|

|

Mocha |

|

|

City of

Dreams |

|

|

Studio

City |

|

|

City of

Dreams

Manila |

|

|

Corporate

and Others |

|

|

Total |

|

| |

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

| Operating Income (Loss) |

|

$ |

26,915 |

|

|

$ |

6,727 |

|

|

$ |

283,415 |

|

|

$ |

(12,039 |

) |

|

$ |

(8,794 |

) |

|

$ |

(26,657 |

) |

|

$ |

269,567 |

|

|

|

|

|

|

|

|

|

| Land Rent to Belle Corporation |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

880 |

|

|

|

— |

|

|

|

880 |

|

| Pre-opening Costs |

|

|

— |

|

|

|

614 |

|

|

|

117 |

|

|

|

855 |

|

|

|

6,065 |

|

|

|

— |

|

|

|

7,651 |

|

| Development Costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,525 |

|

|

|

1,525 |

|

| Depreciation and Amortization |

|

|

7,820 |

|

|

|

2,959 |

|

|

|

56,848 |

|

|

|

10,883 |

|

|

|

446 |

|

|

|

15,873 |

|

|

|

94,829 |

|

| Share-based Compensation |

|

|

32 |

|

|

|

46 |

|

|

|

228 |

|

|

|

— |

|

|

|

1,792 |

|

|

|

2,567 |

|

|

|

4,665 |

|

| Property Charges and Others |

|

|

— |

|

|

|

935 |

|

|

|

757 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,692 |

|

| Gain on Disposal of Assets Held For Sale |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(22,072 |

) |

|

|

(22,072 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

|

34,767 |

|

|

|

11,281 |

|

|

|

341,365 |

|

|

|

(301 |

) |

|

|

389 |

|

|

|

(28,764 |

) |

|

|

358,737 |

|

| Corporate and Others Expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

28,764 |

|

|

|

28,764 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Property EBITDA |

|

$ |

34,767 |

|

|

$ |

11,281 |

|

|

$ |

341,365 |

|

|

$ |

(301 |

) |

|

$ |

389 |

|

|

$ |

— |

|

|

$ |

387,501 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13

Melco Crown Entertainment Limited and Subsidiaries

Reconciliation of Adjusted EBITDA and Adjusted Property EBITDA to

Net Income Attributable to Melco Crown Entertainment Limited

(In thousands of U.S. dollars)

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

| |

|

March 31, |

|

| |

|

2015 |

|

|

2014 |

|

| |

|

(Unaudited) |

|

|

(Unaudited) |

|

| Adjusted Property EBITDA |

|

$ |

253,327 |

|

|

$ |

387,501 |

|

| Corporate and Others Expenses |

|

|

(31,972 |

) |

|

|

(28,764 |

) |

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

|

221,355 |

|

|

|

358,737 |

|

| Payments to the Philippine Parties |

|

|

(3,136 |

) |

|

|

— |

|

| Land Rent to Belle Corporation |

|

|

(894 |

) |

|

|

(880 |

) |

| Pre-opening Costs |

|

|

(41,278 |

) |

|

|

(7,651 |

) |

| Development Costs |

|

|

(20 |

) |

|

|

(1,525 |

) |

| Depreciation and Amortization |

|

|

(110,704 |

) |

|

|

(94,829 |

) |

| Share-based Compensation |

|

|

(4,811 |

) |

|

|

(4,665 |

) |

| Property Charges and Others |

|

|

(301 |

) |

|

|

(1,692 |

) |

| Gain on Disposal of Assets Held For Sale |

|

|

— |

|

|

|

22,072 |

|

| Interest and Other Non-Operating Expenses, Net |

|

|

(35,799 |

) |

|

|

(41,320 |

) |

| Income Tax Expense |

|

|

(574 |

) |

|

|

(2,689 |

) |

|

|

|

|

|

|

|

|

|

| Net Income |

|

|

23,838 |

|

|

|

225,558 |

|

| Net Loss Attributable to Noncontrolling Interests |

|

|

36,791 |

|

|

|

13,985 |

|

|

|

|

|

|

|

|

|

|

| Net Income Attributable to Melco Crown Entertainment Limited |

|

$ |

60,629 |

|

|

$ |

239,543 |

|

|

|

|

|

|

|

|

|

|

14

Melco Crown Entertainment Limited and Subsidiaries

Supplemental Data Schedule

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

March 31, |

|

| |

|

2015 |

|

|

2014 |

|

| Room Statistics: |

|

|

|

|

|

|

|

|

| Altira Macau |

|

|

|

|

|

|

|

|

| Average daily rate(3) |

|

$ |

228 |

|

|

$ |

236 |

|

| Occupancy per available room |

|

|

99 |

% |

|

|

99 |

% |

| Revenue per available room(4) |

|

$ |

225 |

|

|

$ |

233 |

|

|

|

|

| City of Dreams |

|

|

|

|

|

|

|

|

| Average daily rate(3) |

|

$ |

206 |

|

|

$ |

197 |

|

| Occupancy per available room |

|

|

99 |

% |

|

|

98 |

% |

| Revenue per available room(4) |

|

$ |

203 |

|

|

$ |

194 |

|

|

|

|

| City of Dreams Manila |

|

|

|

|

|

|

|

|

| Average daily rate(3) |

|

$ |

227 |

|

|

|

N/A |

|

| Occupancy per available room |

|

|

76 |

% |

|

|

N/A |

|

| Revenue per available room(4) |

|

$ |

173 |

|

|

|

N/A |

|

|

|

|

| Other Information: |

|

|

|

|

|

|

|

|

| Altira Macau |

|

|

|

|

|

|

|

|

| Average number of table games |

|

|

121 |

|

|

|

142 |

|

| Average number of gaming machines |

|

|

59 |

|

|

|

N/A |

|

| Table games win per unit per day(5) |

|

$ |

19,470 |

|

|

$ |

25,217 |

|

| Gaming machines win per unit per day(6) |

|

$ |

81 |

|

|

|

N/A |

|

|

|

|

| City of Dreams |

|

|

|

|

|

|

|

|

| Average number of table games |

|

|

506 |

|

|

|

484 |

|

| Average number of gaming machines |

|

|

1,265 |

|

|

|

1,183 |

|

| Table games win per unit per day(5) |

|

$ |

19,021 |

|

|

$ |

28,244 |

|

| Gaming machines win per unit per day(6) |

|

$ |

380 |

|

|

$ |

536 |

|

|

|

|

| City of Dreams Manila |

|

|

|

|

|

|

|

|

| Average number of table games |

|

|

231 |

|

|

|

N/A |

|

| Average number of gaming machines |

|

|

1,745 |

|

|

|

N/A |

|

| Table games win per unit per day(5) |

|

$ |

1,241 |

|

|

|

N/A |

|

| Gaming machines win per unit per day(6) |

|

$ |

145 |

|

|

|

N/A |

|

| (3) |

Average daily rate is calculated by dividing total room revenue including the retail value of promotional allowances by total occupied rooms including complimentary rooms |

| (4) |

Revenue per available room is calculated by dividing total room revenue including the retail value of promotional allowances by total rooms available |

| (5) |

Table games win per unit per day is shown before discounts and commissions |

| (6) |

Gaming machines win per unit per day is shown before deducting cost for slot points |

15

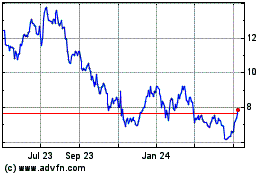

Melco Resorts and Entert... (NASDAQ:MLCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

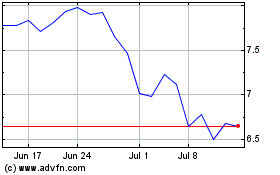

Melco Resorts and Entert... (NASDAQ:MLCO)

Historical Stock Chart

From Apr 2023 to Apr 2024