FORM

6-K

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a–16 OR 15d–16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of April 2015

Commission File Number: 001-33178

MELCO CROWN ENTERTAINMENT LIMITED

36th Floor, The Centrium

60 Wyndham Street

Central

Hong Kong

(Address of principal executive offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20–F or Form 40–F. Form

20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the

Commission pursuant to Rule 12g3–2(b) under the Securities Exchange Act of

1934. Yes ¨ No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3–2(b): 82– N/A

MELCO CROWN ENTERTAINMENT LIMITED

Form 6–K

TABLE OF

CONTENTS

Signature

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

| MELCO CROWN ENTERTAINMENT LIMITED |

|

|

| By: |

|

/s/ Geoffrey Davis |

| Name: |

|

Geoffrey Davis, CFA |

| Title: |

|

Chief Financial Officer |

Date: April 15, 2015

3

EXHIBIT INDEX

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 20.1 |

|

Depositary’s Notice of Annual General Meeting of the Registrant |

|

|

| 20.2 |

|

Registrant’s Notice of Annual General Meeting |

|

|

| 20.3 |

|

Voting Card |

Exhibit 20.1

Deutsche Bank Trust Company Americas

Trust &

Securities Services

Global Equity Services

April 8, 2015

DEPOSITARY RECEIPTS

Depositary’s Notice of Annual General Meeting of Shareholders of Melco Crown Entertainment Limited (the

“Company”):

|

|

|

| Issuer: |

|

Melco Crown Entertainment Limited / Cusip 585464100 |

|

|

| Country: |

|

Incorporated in the Cayman Islands |

|

|

| Meeting Details: |

|

Annual General Meeting of Shareholders of the Company on May 20, 2015 – 4:00 p.m. (HK Time) at Salon VI, Level 2, Grand Hyatt Macau, City of Dreams, Estrada do Istmo, Cotai, Macau |

|

|

| Meeting Agenda: |

|

The Company’s Notice of Meeting including the Agenda is attached |

|

|

| Voting Deadline: |

|

On or before May 11, 2015 at 3:00 p.m. (New York City Time) |

|

|

| ADR Record Date: |

|

April 2, 2015 |

|

|

| Ordinary Shares: ADR ratio |

|

3 ordinary shares: 1 ADR |

Holders of American Depositary Receipts (“ADRs”) representing ordinary shares, par value US$0.01 per share (the

“Deposited Securities”) of the Company are hereby notified of the Company’s Annual General Meeting of shareholders. A copy of the Notice of Meeting from the Company, which includes the agenda for such meeting, is attached.

Holders of record of ADRs as of the close of business on the ADR Record Date (the “Holders”) will be entitled, subject to any applicable law, the

deposit agreement entered into on 22 December 2006, as amended from time to time, between the Company, Deutsche Bank Trust Company Americas as depositary (the “Depositary”) and the Holders and beneficial owners of American Depositary

Shares (“ADSs”) (the “Deposit Agreement”), the Company’s Memorandum and Articles of Association and the provisions of or governing the Deposited Securities, to instruct the Depositary as to the exercise of voting rights, if

any, pertaining to the Deposited Securities represented by their respective ADRs. Voting instructions may be given only in respect of a number of ADSs representing an integral number of ordinary shares or other Deposited Securities. Upon the timely

receipt of written instructions of a Holder of ADRs on the ADR Record Date of voting instructions in the manner specified by the Depositary, the Depositary shall endeavor, insofar as practicable and permitted under applicable law, the provisions of

the Deposit Agreement, the Company’s Memorandum and Articles of Association and the provisions of or governing the Deposited Securities, to vote or cause the Custodian (as defined in the Deposit Agreement) to vote the ordinary shares and/or

other Deposited Securities (in person or by proxy) represented by ADSs evidenced by such ADR in accordance with such voting instructions. Neither the Depositary nor the Custodian shall, under any circumstances exercise any discretion as to voting,

and neither the Depositary nor the Custodian shall vote, or attempt to exercise the right to vote, or in any way make use of for purposes of establishing a quorum or otherwise, the ordinary shares or other Deposited Securities represented by ADRs

except pursuant to and in accordance with such written instructions from the Holders. Notwithstanding the above, save for applicable provisions of the law of the Cayman Islands, and in accordance with the terms of Section 5.3 of the Deposit

Agreement, the Depositary shall not be liable for any failure to carry out any instructions to vote any of the Deposited Securities or for the manner in which such vote is cast or the effect of any such vote.

Deutsche Bank - Depositary Receipts

Exhibit 20.2

MELCO CROWN ENTERTAINMENT LIMITED

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 20, 2015

Dear

Shareholders,

You are cordially invited to attend the Annual General Meeting of Shareholders of Melco Crown Entertainment Limited

(the “Company”), which will be held at Salon VI, Level 2, Grand Hyatt Macau, City of Dreams, Estrada do Istmo, Cotai, Macau on Wednesday, May 20, 2015 at 4:00 p.m. (Hong Kong time). The meeting is being held for the

following purposes:

| 1. |

To ratify the annual report on Form 20-F filed with the U.S. Securities and Exchange Commission, and to receive and adopt the audited consolidated financial statements and the directors’ and auditors’ reports,

for the year ended December 31, 2014. |

| 2. |

To re-elect each of the following directors: |

| |

(a) |

Mr. Lawrence Yau Lung Ho as the executive director of the Company; |

| |

(b) |

Mr. James Douglas Packer as a non-executive director of the Company; and |

| |

(c) |

Mr. John Peter Ben Wang as a non-executive director of the Company. |

| 3. |

To appoint Mr. Robert Rankin as a non-executive director of the Company. |

| 4. |

To authorize the board of directors of the Company (the “Directors”) to fix the remuneration of each Director. |

| 5. |

To ratify the appointment of and re-appoint the independent auditors of the Company, Deloitte Touche Tohmatsu, and to authorize the Directors to fix their remuneration. |

| 6. |

To grant a general and unconditional mandate to the Directors to issue new shares of the Company not exceeding 20% of the issued share capital of the Company as at the date of passing this resolution, valid for a period

commencing from this resolution date until the earliest of (i) the conclusion of the next annual general meeting; (ii) the expiration of the period within which the next annual general meeting is required to be held by Articles, Cayman Islands laws

or any other applicable law; and (iii) the revocation of such mandate by shareholders (the “Relevant Period”). |

| 7. |

|

(A) |

To grant a general and unconditional mandate to the Directors to repurchase shares of the Company not exceeding 10% of the issued share

capital of the Company as at the date of passing this resolution, valid for a period commencing from this resolution date until the earliest of (i) the Relevant Period; and (ii) the effective date and time of the proposed voluntary withdrawal of the

listing of the Company’s shares on the Main Board of The Stock Exchange of Hong Kong Limited (the “Proposed De-Listing”). |

| |

(B) |

To grant a general and unconditional mandate to the Directors to repurchase shares of the Company, valid for a period immediately following the effective date and time of the Proposed De-Listing until the end of the

Relevant Period. |

| 8. |

To extend the general mandate granted to the Directors to issue new shares of the Company under Resolution No. 6 by the aggregate nominal amount of shares repurchased by the Company pursuant to the general mandates

granted to the Directors to repurchase shares of the Company under Resolutions 7A and 7B. |

| 9. |

To (a) approve certain amendments to the Company’s 2011 Share Incentive Plan, including removing references to, and provisions required by Hong Kong laws and the Rules Governing the Listing of Securities on The

Stock Exchange of Hong Kong Limited (the “Listing Rules”), adding clarifications and modifying and updating certain provisions, to be implemented as of the effective date and time of the Proposed De-Listing, and (b) authorize any

one Director and officer of the Company, including the Chief Executive Officer, Chief Financial Officer, Chief Legal Officer and Company Secretary (collectively, the “Authorized Representatives”) to execute such documents, make

such applications and submissions and do all such acts, deeds or things incidental thereto or arising in connection therewith as such Authorized Representative might deem appropriate, and approve all such actions by any Authorized Representative on

behalf of the Company in connection with the foregoing resolution. |

| 10. |

To (a) approve certain amendments to the Share Incentive Plan of Melco Crown (Philippines) Resorts Corporation (“MCP”), including removing references to Hong Kong laws and Listing Rules, adding

clarifications and modifying and updating certain provisions, to be implemented upon the occurrence of the following events: (i) the effective date and time of the Proposed De-Listing; (ii) the passing of the necessary resolutions by the directors

and shareholders of MCP; and (iii) the Philippine Securities and Exchange Commission approving the amendments, and (b) authorize any one director and officer of the Company and MCP (collectively, the “MCP Authorized Representatives”) to

execute such documents, make such applications and submissions and do all such acts, deeds or things incidental thereto or arising in connection therewith as such MCP Authorized Representative might deem appropriate, and approve all such actions by

any MCP Authorized Representative on behalf of the Company in connection with the foregoing resolution. |

Only shareholders of record in the

books of the Company at the close of business on 2 April 2015 will be entitled to vote at the meeting or any adjournment that may take place.

A

shareholder entitled to attend and vote at the meeting is entitled to appoint a proxy to attend and vote in his/her/its place. A proxy need not be a shareholder of the Company. A form of proxy is enclosed.

Shareholders are requested to complete, date, sign and return the enclosed proxy form to reach the Company as promptly as possible but not later than 48 hours

prior to the Annual General Meeting or adjourned meeting at which the proxy is to be used. The giving of such proxy will not affect your right to vote in person should you decide to attend the Annual General Meeting or adjourned meeting.

Shareholders or their proxies are responsible for their own expenses for attending the meeting, including, but not limited to, transportation and

accommodation expenses.

Please note that copies of the annual reports of the Company are available for shareholders. Should you want to obtain a copy,

you can (1) send your request for a physical copy by e-mail to ir@melco-crown.com; (2) notify the Company of your e-mail address by sending your request to Investor Relations, Melco Crown Entertainment Limited, 36th Floor, The Centrium, 60

Wyndham Street, Central, Hong Kong and a soft copy will be sent to your e-mail address provided; (3) you may also view the annual report and the Annual General Meeting related materials at the Company’s website at www.melco-crown.com.

By Order of the Board of Directors,

|

| /s/ Stephanie Cheung |

|

| Stephanie Cheung Company

Secretary |

Exhibit 20.3

Annual General Meeting of Shareholders

|

| (Name of ADR

holder) |

| (Number of ADRs held) |

Resolutions presented for consideration by the Annual General Meeting of Shareholders of Melco Crown Entertainment Limited

(the “Company”) on May 20, 2015.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Affirmative |

|

|

Negative |

|

|

Abstained |

|

|

ORDINARY RESOLUTIONS |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

| 1) |

|

To ratify the annual report on Form 20-F filed with the U.S. Securities and Exchange Commission, and to receive and adopt the audited consolidated financial statements and the

directors’ and auditors’ reports, for the year ended December 31, 2014. |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

| 2) |

|

To re-elect each of the following directors: |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

| |

|

(a) Mr. Lawrence Yau Lung Ho as the executive

director of the Company; |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

| |

|

(b) Mr. James Douglas Packer as a non-executive

director of the Company; and |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

| |

|

(c) Mr. John Peter Ben Wang as a non-executive

director of the Company. |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

| 3) |

|

To appoint Mr. Robert Rankin as a non-executive director of the Company. |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

| 4) |

|

To authorize the board of directors of the Company (the “Directors”) to fix the remuneration of each Director. |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

| 5) |

|

To ratify the appointment of and re-appoint the independent auditors of the Company, Deloitte Touche Tohmatsu, and to authorize the Directors to fix their remuneration. |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

| 6) |

|

To grant a general and unconditional mandate to the Directors to issue new shares of the Company not exceeding 20% of the issued share capital of the Company as at the date of

passing this resolution, valid for a period commencing from this resolution date until the earliest of (i) the conclusion of the next annual general meeting; (ii) the expiration of the period within which the next annual general meeting is

required to be held by Articles, Cayman Islands laws or any other applicable law; and (iii) the revocation of such mandate by shareholders (the “Relevant Period”). |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

| 7) |

|

(A) To grant a general and unconditional mandate to the Directors

to repurchase shares of the Company not exceeding 10% of the issued share capital of the Company as at the date of passing this resolution, valid for a period commencing from this resolution date until the earliest of (i) the Relevant Period;

and (ii) the effective date and time of the proposed voluntary withdrawal of the listing of the Company’s shares on the Main Board of The Stock Exchange of Hong Kong Limited (the “Proposed

De-Listing”). |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

| |

|

(B) To grant a general and unconditional mandate to the Directors

to repurchase shares of the Company, valid for a period immediately following the effective date and time of the Proposed De-Listing until the end of the Relevant Period. |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

| 8) |

|

To extend the general mandate granted to the Directors to issue new shares of the Company under Resolution No. 6 by the aggregate nominal amount of shares repurchased by

the Company pursuant to the general mandates granted to the Directors to repurchase shares of the Company under Resolutions 7A and 7B. |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

| 9) |

|

To (a) approve certain amendments to the Company’s 2011 Share Incentive Plan, including removing references to, and provisions required by Hong Kong laws and the

Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited (the “Listing Rules”), adding clarifications and modifying and updating certain provisions, to be implemented as of the effective date and time of

the Proposed De-Listing, and (b) authorize any one Director and officer of the Company, including the Chief Executive Officer, Chief Financial Officer, Chief Legal Officer and Company Secretary (collectively, the “Authorized

Representatives”) to execute such documents, make such applications and submissions and do all such acts, deeds or things incidental thereto or arising in connection therewith as such Authorized Representative might deem appropriate, and

approve all such actions by any Authorized Representative on behalf of the Company in connection with the foregoing resolution. |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

| 10) |

|

To (a) approve certain amendments to the Share Incentive Plan of Melco Crown (Philippines) Resorts Corporation (“MCP”), including removing references to

Hong Kong laws and Listing Rules, adding clarifications and modifying and updating certain provisions, to be implemented upon the occurrence of the following events: (i) the effective date and time of the Proposed De-Listing; (ii) the passing of the

necessary resolutions by the directors and shareholders of MCP; and (iii) the Philippine Securities and Exchange Commission approving the amendments, and (b) authorize any one director and officer of the Company and MCP (collectively, the

“MCP Authorized Representatives”) to execute such documents, make such applications and submissions and do all such acts, deeds or things incidental thereto or arising in connection therewith as such MCP Authorized Representative

might deem appropriate, and approve all such actions by any MCP Authorized Representative on behalf of the Company in connection with the foregoing resolution. |

|

|

|

|

|

|

|

|

|

|

|

|

(Signature)

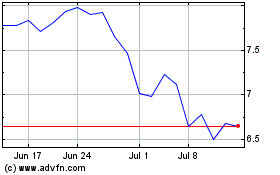

Melco Resorts and Entert... (NASDAQ:MLCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

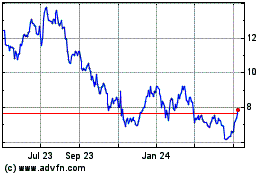

Melco Resorts and Entert... (NASDAQ:MLCO)

Historical Stock Chart

From Apr 2023 to Apr 2024