Current Report Filing (8-k)

May 27 2015 - 4:40PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 21, 2015

MannKind Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

000-50865 |

|

13-3607736 |

| (State or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

| 28903 North Avenue Paine

Valencia, California |

|

91355 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (661) 775-5300

N/A

(Former name or

former address, if changed since last report.)

Check the appropriate box below

if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

(d)

On May 21, 2015, our Board of Directors elected James

S. Shannon, M.D., MRCP (UK), as a director of MannKind Corporation (“MannKind”), effective immediately. Dr. Shannon previously served as one of our directors from February 2010 through April 2012. Concurrently with his appointment to

the Board of Directors, Dr. Shannon was also appointed to the Compensation Committee of our Board of Directors (the “Compensation Committee”).

Dr. Shannon will be entitled to receive annual retainers and equity awards for his service as a director of MannKind and as a Compensation Committee

member in accordance with our amended non-employee director compensation program. On May 21, 2015, the Compensation Committee amended our non-employee director compensation program to, among other things, (i) increase the annual retainer

payable to all non-employee directors from $40,000 to $50,000, (ii) increase the additional annual retainer payable to the chair of the Audit Committee from $20,000 to $25,000, (iii) increase the additional annual retainer payable to the

chair of the Compensation Committee from $20,000 to $25,000, and (iv) increase the additional annual retainer payable to the lead independent director from $20,000 to $25,000. Each non-chair member of the Compensation Committee, including

Dr. Shannon, will continue to be eligible to receive an additional annual retainer of $7,500 for his service on the Compensation Committee. The Compensation Committee also amended our non-employee director compensation program to provide that

each of our non-employee directors will automatically receive, on the date of each of our annual stockholder meetings, an equity award determined by dividing $150,000 (increased from $85,000) by the 20-day trailing average closing price of our

common stock reported on The NASDAQ Global Market as of the trading day immediately preceding the date of the applicable annual meeting of stockholders.

Pursuant to our amended non-employee director compensation program, each person who is elected or appointed for the first time to be a non-employee director

will automatically receive, on the date of his or her initial election or appointment to our Board of Directors, an option to purchase 50,000 shares (increased from 30,000 shares) of our common stock as an initial grant. Because Dr. Shannon

previously served as a non-employee director of MannKind, he did not receive this initial grant. However, on May 21, 2015 the Compensation Committee granted Dr. Shannon an option under our 2013 Equity Incentive Plan (the “Plan”)

to purchase 10,000 shares of our common stock, which vests in equal monthly installments over a period of three years and has an exercise price per share of $4.63, which is equal to the closing price of our common stock as reported on The NASDAQ

Global Market on the grant date. The foregoing stock option is evidenced by a Stock Option Grant Notice and Option Agreement (collectively, the “Grant Documents”), which, together with the Plan, set forth the terms and conditions of the

stock option.

The foregoing description of the stock option granted to Dr. Shannon does not purport to be complete and is qualified in its entirety

by reference to the Plan and the forms of Grant Documents under the Plan, which we have previously filed with the Securities and Exchange Commission (“SEC”). The foregoing description of our amended non-employee director compensation

program does not purport to be complete and is qualified in its entirety by reference to the full text of the amended non-employee director compensation program, which we intend to file as an exhibit to our quarterly report on Form 10-Q for the

quarter ending June 30, 2015.

| Item 5.07 |

Submission of Matters to a Vote of Security Holders. |

The following is a brief description of each

matter voted upon at our 2015 Annual Meeting of Stockholders held on May 21, 2015 (the “Annual Meeting”), as well as the number of votes with respect to each matter.

| |

• |

|

Our stockholders elected each of the seven individuals nominated by our Board of Directors to serve as directors until the next annual meeting of stockholders. The tabulation of votes in the election was as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Shares |

|

|

Shares |

|

|

Broker |

|

| Nominee |

|

Voted For |

|

|

Withheld |

|

|

Non-Votes |

|

| Alfred E. Mann |

|

|

202,137,398 |

|

|

|

1,545,422 |

|

|

|

145,552,587 |

|

| Hakan S. Edstrom |

|

|

200,991,275 |

|

|

|

2,691,545 |

|

|

|

145,552,587 |

|

| Ronald Consiglio |

|

|

200,669,338 |

|

|

|

3,013,482 |

|

|

|

145,552,587 |

|

| Michael Friedman, M.D. |

|

|

200,389,277 |

|

|

|

3,293,543 |

|

|

|

145,552,587 |

|

| Kent Kresa |

|

|

200,721,177 |

|

|

|

2,961,643 |

|

|

|

145,552,587 |

|

| David H. MacCallum |

|

|

201,156,260 |

|

|

|

2,526,560 |

|

|

|

145,552,587 |

|

| Henry L. Nordhoff |

|

|

201,174,707 |

|

|

|

2,508,113 |

|

|

|

145,552,587 |

|

| |

• |

|

Our stockholders approved, on an advisory basis, the compensation of our named executive officers, as disclosed in our definitive proxy statement for the Annual Meeting filed with the SEC on April 10, 2015.

The tabulation of votes on this matter was as follows: shares voted for: 197,137,686; shares voted against: 5,413,865; shares abstaining: 1,131,268; and broker non-votes: 145,552,588. |

| |

• |

|

Our stockholders ratified the selection of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2015. The tabulation of votes on this

matter was as follows: shares voted for: 339,829,742; shares voted against: 7,889,916; shares abstaining: 1,515,749; and broker non-votes: 0. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

| Date: May 27, 2015 |

|

|

|

MANNKIND CORPORATION |

|

|

|

|

|

|

|

|

By: |

|

/s/ David Thomson |

|

|

|

|

|

|

David Thomson, Ph.D., J.D. |

|

|

|

|

|

|

Corporate Vice President, General Counsel and Secretary |

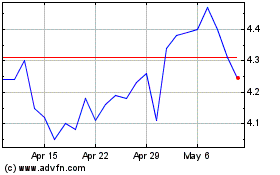

MannKind (NASDAQ:MNKD)

Historical Stock Chart

From Mar 2024 to Apr 2024

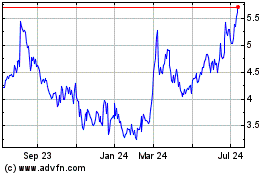

MannKind (NASDAQ:MNKD)

Historical Stock Chart

From Apr 2023 to Apr 2024