ADR Report: Shares Fall Slightly On Continued Greece Worries

May 24 2012 - 5:17PM

Dow Jones News

International companies trading in New York traded slightly

lower Thursday amid continued speculation over whether Greece may

exit the euro zone.

The Bank of New York index of ADRs slipped 0.2% to 113.24.

Greece's leftist Syriza party, which opposes the country's

austerity measures, maintained its lead over the conservative New

Democracy party, according to the latest public opinion poll.

Shares of some European banks shifted lower, with the National

Bank of Greece SA (NBG, ETE.AT) losing 5.1% to $1.50, BNP Paribas

SA (BNPQY, BNP.FR) tumbling 5.6% to $16.02, and Societe Generale SA

(SCGLY, GLE.FR) declining 1.2% to $4.05.

The Asian index declined 0.6% to 112.63 and the emerging index

shed 0.6% to 259.88.

The chief executives of four major Chinese solar-power equipment

producers said at a press conference in Shanghai that they formed

an alliance to fight Washington's allegations against Chinese

solar-panel companies and fight efforts to impose tariffs on the

industry, saying their industry is beneficial to the U.S.

The newly created Solar Energy Promotion Alliance includes

Yingli Green Energy Holding Co. (YGE), Suntech Power Holdings Co.

(STP, K3ND.SG), Trina Solar Ltd. (TSL, K3KD.SG) and Canadian Solar

Inc. (CSIQ).

Still, shares of Yingli Green tumbled 6.1% to $2.63, Suntech's

stock dropped 4.5% to $1.93.

Shares of LDK Solar Co. (LDK) slumped 15% to $2.59.

The Latin American index fell 0.5% to 302.13.

Brazilian flat steel inventories fell to 1.018 million metric

tons in April, 17% below the levels in the same month in 2011,

steel distributors' association Sindisider said Wednesday.

Companhia Siderurgica Nacional (SID, CSNA3.BR) fell 2% to

$6.50.

The European index edged up 0.04% to 104.67.

Repsol YPF SA (REPYY, REP.MC) said Thursday that some of the

areas it is exploring off the coast of Brazil contain more than

more than a billion barrels of oil and gas, a development that

highlights the potential of the operations there to drive Repsol's

growth. Repsol YPF rose 1.7% to $17.28.

Partially offsetting those gains was computer peripherals maker

Logitech International SA (LOGI, LOGN.VX), whose shares fell 2.1%

to $10.56. The company said it will cut its Swiss workforce by 16%

as part of its restructuring program.

-By Corrie Driebusch, Dow Jones Newswires; 212-416-2143;

corrie.driebusch@dowjones.com

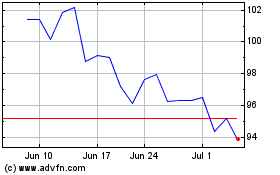

Logitech (NASDAQ:LOGI)

Historical Stock Chart

From Mar 2024 to Apr 2024

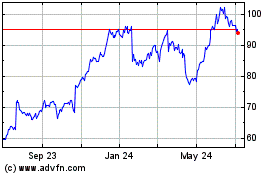

Logitech (NASDAQ:LOGI)

Historical Stock Chart

From Apr 2023 to Apr 2024