UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 24, 2015

LINCOLN ELECTRIC HOLDINGS, INC.

(Exact name of registrant as specified in charter)

|

|

|

|

|

| Ohio |

|

0-1402 |

|

34-1860551 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

22801 St. Clair Avenue

Cleveland, Ohio 44117

(Address of principal executive offices) (Zip Code)

(216) 481-8100

(Registrant’s telephone number, including area code)

Not applicable

(Former

name and former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain

Officers; Compensatory Arrangements of Certain Officers.

Geoffrey P. Allman Designated as Chief Accounting Officer

On July 24, 2015, the Board of Directors (the “Board”) of Lincoln Electric Holdings, Inc. (the “Company”) designated

Geoffrey P. Allman as its Chief Accounting Officer. Mr. Allman, age 45, has served as Senior Vice President since January 1, 2014. Mr. Allman has also served as Corporate Controller since July 2012. Prior to his service as

Corporate Controller, Mr. Allman was Regional Finance Director, North America, a position he held from October 2009 through July 2012.

Vincent K. Petrella, who was the Company’s Principal Accounting Officer prior to Mr. Allman’s appointment, continues to serve

as Executive Vice President, Chief Financial Officer and Treasurer and the Company’s Principal Financial Officer.

Michael F.

Hilton Elected to the Company’s Board of Directors

On July 27, 2015, the Board elected Michael F. Hilton as a member of

the Board in the class of Directors that will stand for re-election at the Company’s 2016 Annual Meeting of Shareholders. Mr. Hilton was also appointed to the Audit and Nominating and Corporate Governance Committees of the Board.

Mr. Hilton is President, Chief Executive Officer and Director of Nordson Corporation, which engineers, manufactures and markets differentiated products and systems used for the precision dispensing of adhesives, coatings, sealants,

biomaterials, polymers, plastics and other materials, fluid management, test and inspection, UV curing and plasma surface treatment, and a director of Ryder System, Inc., a provider of transportation, logistics and supply chain management solutions.

The Board has determined that Mr. Hilton is independent under the listing standards of the Nasdaq stock market. There is no

arrangement or understanding between Mr. Hilton and any other persons pursuant to which Mr. Hilton was elected as a Director.

As a non-employee Director, Mr. Hilton will receive compensation in the same manner as the Company’s other non-employee Directors,

which compensation was previously disclosed in its definitive proxy statement on Schedule 14A, filed with the Securities and Exchange Commission (the “SEC”) on March 18, 2015. Mr. Hilton received 586 shares of restricted stock

under the Company’s 2015 Stock Plan for Non-Employee Directors in connection with his election to the Board. The form of restricted stock agreement is attached hereto as Exhibit 10.1.

The Company will enter into its standard indemnification agreement with Mr. Hilton (the “Indemnification Agreement”). The form

of the Indemnification Agreement is filed as Exhibit 10.2 to the Company’s Current Report on Form 8-K filed with the SEC on February 29, 2012 and is incorporated herein by reference. The Indemnification Agreement supplements the

indemnification coverage afforded by the Company’s Amended and Restated Code of Regulations under Ohio law.

A copy of the press

release announcing Mr. Hilton’s election is attached hereto as Exhibit 99.1 and incorporated herein by reference.

Item 9.01. Financial

Statements and Exhibits.

(d) Exhibits

|

|

|

| 10.1 |

|

Form of Restricted Share Agreement for Non-Employee Directors |

|

|

| 99.1 |

|

Press Release announcing the election of Michael F. Hilton to the Board |

- 2 -

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

LINCOLN ELECTRIC HOLDINGS, INC. |

|

|

|

| Date: July 29, 2015 |

|

By: |

|

/s/ Frederick G. Stueber |

|

|

|

|

Frederick G. Stueber |

|

|

|

|

Executive Vice President, General Counsel & Secretary |

- 3 -

LINCOLN ELECTRIC HOLDINGS, INC.

INDEX TO EXHIBITS

|

|

|

| Exhibit

No. |

|

Exhibit |

|

|

| 10.1 |

|

Form of Restricted Share Agreement for Non-Employee Directors |

|

|

| 99.1 |

|

Press Release announcing the election of Michael F. Hilton to the Board of Directors of Lincoln Electric Holdings, Inc. |

Exhibit 10.1

LINCOLN ELECTRIC HOLDINGS, INC.

2015 STOCK PLAN FOR NON-EMPLOYEE DIRECTORS

Restricted Shares Agreement

WHEREAS, Lincoln Electric Holdings, Inc. (the “Company”) maintains the Company’s 2015 Stock Plan for Non-Employee Directors, as may be

amended from time to time (the “Plan”), pursuant to which the Company may award Restricted Shares to non-employee Directors of the Company;

WHEREAS, (the

“Grantee”) is an non-employee Director of the Company;

WHEREAS, the Grantee was awarded Restricted Shares under the Plan by the

Nominating and Corporate Governance Committee (the “Committee”) of the Board of Directors (the “Board”) of the Company on

(the “Date of Grant”) and the execution of an award agreement substantially in the form hereof (the

“Agreement”) has been authorized by a resolution of the Committee duly adopted on such date.

NOW, THEREFORE, pursuant to the Plan

and subject to the terms and conditions thereof and the terms and conditions hereinafter set forth, the Company hereby confirms to the Grantee the award of

Restricted Shares.

| 1. |

Definitions. Unless otherwise defined in this Agreement, terms used in this Agreement with initial capital letters will have the meanings assigned to them in the Plan. |

| |

(a) |

“Cause”: A termination for “Cause” shall mean that, prior to termination of service as a Director of the Company, the Grantee shall have: |

| |

(i) |

been convicted of, or pleaded nolo contendere to, a criminal violation, in each case, involving fraud, embezzlement or theft in connection with the Grantee’s duties or in the course of the Grantee’s service as

a Director of the Company (or the Successor, if applicable); |

| |

(ii) |

committed intentional wrongful damage to property of the Company (or the Successor, if applicable); |

| |

(iii) |

committed intentional wrongful disclosure of secret processes or confidential information of the Company or any Company subsidiary (or the Successor, if applicable); or |

| |

(iv) |

committed intentional wrongful engagement in any of the activities set forth in any confidentiality, non-competition or non-solicitation arrangement with the Company or any Company subsidiary (or the Successor, if

applicable) to which the Grantee is a party; |

and, in each case, any such act shall have been demonstrably and materially harmful to the

Company (or the Successor, if applicable). For purposes of this Agreement, no act or failure to act on the part of the Grantee will be deemed “intentional” if it was due primarily to an error in judgment or negligence, but will be deemed

“intentional” only if done or omitted to be done by the Grantee not in good faith and without reasonable belief that the Grantee’s action or omission was in the best interest of the Company (or the Successor, if applicable).

| |

(b) |

“Replacement Award” means an award: (i) of the same type (e.g., time-based restricted shares) as the Replaced Award; (ii) that has a value at least equal to the value of the Replaced Award;

(iii) that relates to publicly traded equity securities of the Company or its successor in the Change in Control or another entity that is affiliated with the Company or its successor following the Change in Control; (iv) if the Grantee

holding the Replaced Award is subject to U.S. federal income tax under the Code, the tax consequences of which to such Grantee under the Code are not less favorable to such Grantee than the tax consequences of the Replaced Award; and (v) the

other terms and conditions of which are not less favorable to the Grantee holding the Replaced Award than the terms and conditions of the Replaced Award (including the provisions that would apply in the event of a subsequent Change in Control). A

Replacement Award may be granted only to the extent it does not result in the Replaced Award or Replacement Award failing to comply with or be exempt from Section 409A of the Code. Without limiting the generality of the foregoing, the

Replacement Award may take the form of a continuation of the Replaced Award if the requirements of the two preceding sentences are satisfied. The determination of whether the conditions of this Section 1(b) are satisfied will be made by the

Committee, as constituted immediately before the Change in Control, in its sole discretion. |

| 2. |

Issuance of Restricted Shares. The Restricted Shares covered by this Agreement shall be issued to the Grantee effective upon the Date of Grant. |

| 3. |

Restrictions on Transfer of Shares. Subject to Section 14 of the Plan, the Common Shares subject to this grant of Restricted Shares may not be sold, exchanged, assigned, transferred, pledged, encumbered or

otherwise disposed of by the Grantee, except to the Company, until the Restricted Shares have vested as provided in Section 4, 5 or 6 hereof; provided, however, that the Grantee’s rights with respect to such Common Shares may

be transferred by will or pursuant to the laws of descent and distribution. Any purported transfer or encumbrance in violation of the provisions of this Section 3 shall be void, and the other party to any such purported transaction shall not

obtain any rights to or interest in such Common Shares. The Company in its sole discretion, when and as permitted by the Plan, may waive the restrictions on transferability with respect to all or a portion of the Common Shares subject to this grant

of Restricted Shares. |

| 4. |

Vesting of Restricted Shares. Subject to the terms and conditions of Sections 5, 6 and 7 hereof, all of the Restricted Shares covered by this Agreement shall vest after three full years from the Date of Grant;

provided, however, that the Grantee shall have served continuously as a Director for that entire period. |

- 2 -

| 5. |

Effect of Change in Control. In the event a Change in Control occurs after the Date of Grant but before the Restricted Shares vest pursuant to Section 4 or 6 of this Agreement, the Restricted Shares covered

by this Agreement shall vest to the extent provided in this Section 5: |

| |

(a) |

If the Grantee serves as an Eligible Director of the Company throughout the period beginning on the Date of Grant and ending on the date of the Change in Control, the Restricted Shares covered by this Agreement will

vest in full immediately prior to the Change in Control, except to the extent that a Replacement Award is provided to the Grantee in accordance with Section 1(b) to replace, adjust or continue the award of Restricted Shares covered by this

Agreement (the “Replaced Award”). If a Replacement Award is provided, references to Restricted Shares in this Agreement shall be deemed to refer to the Replacement Award after the Change in Control. |

| |

(b) |

If, upon or after receiving a Replacement Award, the Grantee experiences a termination of service as an Eligible Director of the Company (or its successor) (as applicable, the “Successor”) by reason of the

Successor terminating Grantee’s employment other than for Cause within a period of two years after the Change in Control and during the remaining vesting period for the Replacement Award, the Replacement Award shall immediately vest in full

upon such termination. |

| 6. |

Effect of Death, Disability or Retirement. |

| |

(a) |

If the Grantee’s service as a Director of the Company should terminate because of the Grantee’s death or Disability, prior to the vesting otherwise provided in Section 4, 5 or 6 hereof, the Restricted

Shares subject to this Agreement shall immediately vest in full. |

| |

(b) |

If the Grantee’s service as a Director of the Company should terminate because of the Grantee’s Retirement, prior to the end of vesting period provided in Section 4, 5 or 6 hereof, a pro rata

portion of the Restricted Shares subject to this Agreement shall immediately vest. The pro rata portion that shall vest shall be determined by multiplying the total number of Restricted Shares covered by this Agreement by the number of days

the Grantee has served as a Director of the Company from the Date of Grant through the date of Retirement, divided by 1,095 (rounded down to the nearest whole Common Share). Any Restricted Shares subject to this Agreement that do not so vest in

connection with the Grantee’s Retirement will be forfeited. |

| 7. |

Retention of Stock Certificate(s) by the Corporation. Unless otherwise determined by the Committee, all Restricted Shares covered by this Agreement will be held at the Company’s transfer agent in book entry

form with appropriate restrictions relating to the transfer of such Restricted Shares as set forth herein, until those shares have vested in accordance with Section 4, 5 or 6 hereof. |

| 8. |

Dividends and Voting Rights. The Grantee shall have all of the rights of a shareholder with respect to the Restricted Shares covered by this

Agreement, including the right to vote such Restricted Shares and receive any dividends that may be paid thereon; provided, however, that any additional Common Shares or other securities that the Grantee may become entitled

|

- 3 -

| |

to receive pursuant to a stock dividend, stock split, combination of shares, recapitalization, merger, consolidation, separation or reorganization or any other change in the capital structure of

the Company shall be subject to the same restrictions as the Restricted Shares covered by this Agreement. |

| 9. |

No Right to Continued Service. The Plan and this Agreement will not confer upon the Grantee any right with respect to the continuance of service as a Director of the Company. |

| 10. |

Agreement Subject to the Plan. The Restricted Shares granted under this Agreement and all of the terms and conditions hereof are subject to all of the terms and conditions of the Plan. In the event of any

inconsistency between this Agreement and the Plan, the terms of the Plan will govern. In addition, the terms and conditions of Section 10 of the Plan shall apply to this award of Restricted Shares as if Restricted Shares were specifically

included in the list of award vehicles included in the first sentence thereof. |

| 11. |

Amendments. Any amendment to the Plan shall be deemed to be an amendment to this Agreement to the extent that the amendment is applicable hereto; provided, however, that no amendment shall adversely

affect the rights of the Grantee with respect to Restricted Shares without the Grantee’s consent. |

| 12. |

Severability. In the event that one or more of the provisions of this Agreement shall be invalidated for any reason by a court of competent jurisdiction, any provision so invalidated will be deemed to be

separable from the other provisions hereof, and the remaining provisions hereof will continue to be valid and fully enforceable. |

| 13. |

Governing Law. This Agreement is made under, and will be construed in accordance with, the internal substantive laws of the State of Ohio. |

| 14. |

Restricted Shares Subject to the Company’s Recovery of Funds Policy. Notwithstanding anything in this Agreement to the contrary, the Restricted Shares covered by this Agreement shall be subject to the

Company’s Recovery of Funds Policy (or similar clawback policy), as it may be in effect from time to time, including, without limitation, to implement Section 10D of the Exchange Act and any applicable rules or regulations issued by the

U.S. Securities and Exchange Commission or any national securities exchange or national securities association on which the Common Shares may be traded. |

- 4 -

The undersigned Grantee hereby acknowledges receipt of an executed original of this Restricted

Shares Agreement and accepts the right to receive the Restricted Shares granted hereunder subject to the terms and conditions of the Plan and the terms and conditions herein above set forth.

THIS AGREEMENT is executed in the name and on behalf of the Company on this day of

, 201 .

|

|

|

| LINCOLN ELECTRIC HOLDINGS, INC. |

|

| |

| Christopher L. Mapes Chairman,

President and Chief Executive Officer |

Exhibit 99.1

LINCOLN ELECTRIC HOLDINGS, INC.

22801 Saint Clair Avenue ● Cleveland, Ohio 44117 ● U.S.A

NEWS

● RELEASE

MICHAEL F. HILTON ELECTED TO LINCOLN ELECTRIC BOARD

CLEVELAND, OH, Wednesday, July 29, 2015 – Lincoln Electric Holdings, Inc., (“Company,” “Lincoln Electric”)

(Nasdaq: LECO) today announced that Michael F. Hilton, 61, President and Chief Executive Officer of Nordson Corporation (Nasdaq: NDSN), has been elected to Lincoln Electric’s Board of Directors, effective July 27, 2015.

Mr. Hilton’s appointment expands Lincoln Electric’s Board to 11 directors, 10 of whom are non-employee directors.

“Mike brings the Board valuable perspective and over forty-years of hands-on experience in the global industrial sector, said Christopher

L. Mapes, Chairman, President and Chief Executive Officer. “We appreciate his willingness to join the Board and we will benefit from his track record of developing strong and profitable businesses in both developed and emerging markets as

Lincoln Electric executes on its ‘2020 Vision and Strategy’ goals.”

Mr. Hilton is President and Chief Executive

Officer of Nordson Corporation, a diversified industrial manufacturer of precision equipment for dispensing adhesives, coatings, sealants and other materials. The company serves global customers in consumer durable, non-durable, industrial,

electronics and medical end markets. Since joining Nordson in 2010, Mr. Hilton has led the company to record results through a deepened focus on innovative new products, emerging markets, continuous improvement and strategic

acquisitions. Prior to joining Nordson, Mr. Hilton held a variety of executive roles at Air Products & Chemicals, Inc. over his thirty-three year tenure with the organization. He last served as Senior Vice President and General

Manager of Air Products & Chemicals, Inc.’s Electronics and Performance Materials segment.

Mr. Hilton is a member of

the board of directors of Nordson Corporation and Ryder System, Inc., and serves on the board of trustees and the executive council of the Manufacturers Alliance for Productivity and Innovation (MAPI). He is a graduate of Lehigh University

where he earned a bachelors of science degree in chemical engineering and an MBA.

Business

Lincoln Electric is the world leader in the design, development and manufacture of arc welding products, robotic arc welding systems, plasma

and oxyfuel cutting equipment and has a leading global position in the brazing and soldering alloys market. Headquartered in Cleveland, Ohio, Lincoln has 47 manufacturing locations, including operations and joint ventures in 19 countries and a

worldwide network of distributors and sales offices covering more than 160 countries. For more information about Lincoln Electric and its products and services, visit the Company’s website at www.lincolnelectric.com.

Contact

Amanda Butler

Director, Investor Relations

Tel: 216.383.2534

Email: Amanda_Butler@lincolnelectric.com

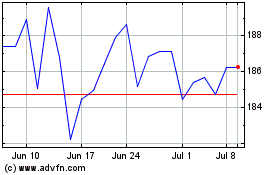

Lincoln Electric (NASDAQ:LECO)

Historical Stock Chart

From Mar 2024 to Apr 2024

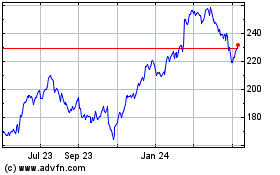

Lincoln Electric (NASDAQ:LECO)

Historical Stock Chart

From Apr 2023 to Apr 2024