Liberty Global to Buy Cable & Wireless Communications for $5.3 Billion

November 16 2015 - 2:20PM

Dow Jones News

Cable tycoon John Malone's Liberty Global PLC agreed to buy

Caribbean cable operator Cable & Wireless Communications PLC

for $5.3 billion, strengthening the acquisitive company's foothold

in an emerging market ripe for additional consolidation.

The companies said in a statement Monday that the stock offer is

valued at 78.04 pence a share—a 6% premium to Cable &

Wireless's Monday closing price of 73.54 pence in London, where it

trades.

The deal also includes a special dividend of 3 pence a share

that will be paid when the transaction closes, bringing the total

consideration to 81.04 pence per share. Liberty Global said the

full offer represents a 40% premium to Cable & Wireless'

closing share price on Oct. 21, the day before The Wall Street

Journal first reported that the companies were in talks. Including

net debt, the deal is valued at $8 billion.

Cable & Wireless, which has more than 6 million subscribers,

offers pay-television, Internet, landline phone and wireless

service—the so-called "quad play"—in the Caribbean, Panama, Monaco

and the Seychelles, according to its website. Liberty Global

executives have been keenly focused on the need to offer a "quad

play" eventually in all the company's territories, which stretch

across Europe, Latin America and the Caribbean. The combined

company will have 10 million subscribers in the Caribbean and Latin

America.

In an interview, Liberty Global Chief Executive Mike Fries

touted the deal as a "unique platform to start looking at

additional consolidation" of cable assets in the Latin American and

Caribbean region, which he described as "fragmented" and

"underpenetrated."

Mr. Fries highlighted Cable & Wireless' valuable and

sprawling network of undersea cables in the region, which will

allow Liberty Global to capitalize on exploding broadband data

consumption.

The pending deal, which offers Cable & Wireless shareholders

a mix of several Liberty shares, is subject to regulatory approval

by several smaller and bigger government entities in the Caribbean.

The companies expect the transaction to close in the second

quarter.

Liberty Global recently created a separate tracking stock dubbed

LiLAC to track its Latin American and Caribbean holdings, which

also include cable companies in Puerto Rico and Chile. The stock

has dropped since its debut in July, though it has rebounded

somewhat since The Wall Street Journal reported on the talks with

Cable & Wireless. Cable & Wireless will be attributed to

the LiLAC stock.

The deal will personally benefit Mr. Malone, Liberty Global's

chairman and largest voting shareholder with a 24% stake. About a

year ago, Cable & Wireless had struck a deal to buy Columbus

International Inc., in which Mr. Malone owned a stake. The deal

gave Mr. Malone a 13% voting stake in Cable & Wireless. As a

result, Mr. Malone had recused himself from the talks between

Liberty Global and Cable & Wireless.

Liberty Global has been on an acquisition spree over the past

few years as it seeks to build an international media and cable

powerhouse. A series of large acquisitions in recent years,

including buying the U.K.'s Virgin Media Inc. and Dutch cable

operator Ziggo NV, have made Liberty Global the largest cable

operator in the world by subscribers, with 27 million customers

across 14 countries.

Of late, Liberty Global has been snapping up stakes in content

companies. In the past year, it has agreed to acquire Irish

broadcaster TV3 and taken stakes in All3Media, British broadcaster

ITV and Lions Gate Entertainment Corp.

Liberty Global is separate from Mr. Malone's Liberty Broadband

Corp., which backs U.S.-based Charter Communications Inc., the

company buying Time Warner Cable Inc. and Bright House

Networks.

Write to Shalini Ramachandran at

shalini.ramachandran@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 16, 2015 14:05 ET (19:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

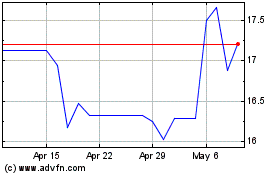

Liberty Global (NASDAQ:LBTYB)

Historical Stock Chart

From Mar 2024 to Apr 2024

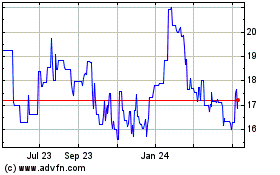

Liberty Global (NASDAQ:LBTYB)

Historical Stock Chart

From Apr 2023 to Apr 2024