UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): September 22, 2015

|

| | |

| JACK IN THE BOX INC. | |

| (Exact name of registrant as specified in its charter) | |

|

| | | | |

DELAWARE | | 1-9390 | | 95-2698708 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

|

| | |

9330 BALBOA AVENUE, SAN DIEGO, CA | | 92123 |

(Address of principal executive offices) | | (Zip Code) |

(858) 571-2121

(Registrant’s telephone number, including area code)

NOT APPLICABLE

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

⃞ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

⃞ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

⃞ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

⃞ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

ITEM 5.02 DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS

(d)

Changes to Deferred Compensation Programs. Jack in the Box Inc. (the “Company”) sponsors both qualified and non-qualified deferred compensation plans. The Jack in the Box Inc. Easy$aver Plus Plan (the “401(k) Plan”) is a qualified defined contribution plan, from which most of our highly compensated employees have been excluded from participation. Effective as of January 1, 2016, the qualified 401(k) Plan was amended to (a) expand the group of employees eligible to participate in the 401(k) Plan to include all restaurant employees and any highly compensated employees previously excluded from the plan; (b) adopt “safe harbor” provisions (as defined pursuant to the Internal Revenue Code (the “Code”)) including a matching contribution formula equal to 100% of the first four percent of compensation deferred by participants; and immediately vest company matching contributions at 100%.

The Jack in the Box Inc. Executive Deferred Compensation Plan (“EDCP”) is an unfunded, non-qualified deferred compensation plan available to certain key employees, intended to be exempt from the vesting, funding and fiduciary requirements set forth in Title I of ERISA. The EDCP provides eligible participants the opportunity to defer up to 50% of their base salary and up to 85% of their annual cash incentive compensation. Deferral and distribution elections are made by participants in accordance with the EDCP and Code Section 409A. Deferrals are payable in cash in either lump sums or installments at certain future dates as specified by participants in accordance with the EDCP or upon the occurrence of certain events, such as death, termination of employment, or in the event of a financial hardship, as defined in the EDCP. The Company will require a six month delay in the payment of EDCP benefits if the participant is a “specified employee” pursuant to Code Section 409A. Deferred amounts are credited with earnings, gains and losses in accordance with investment crediting options established by the Company from time to time, and with employer contributions including “matching contributions,” “discretionary contributions,” and “supplemental contributions” made by the Company to participants’ accounts in accordance with the EDCP. A participant will be 100% vested at all times in his or her elective contributions to the EDCP. Employer contributions to the EDCP are subject to the vesting schedules contained in the EDCP.

On September 17, 2015, the Compensation Committee of the Company’s Board of Directors (the “Committee”) approved replacing the current company matching contribution formula -- equal to 100% of the first three percent of compensation deferred by participants -- with a restoration matching contribution intended to coordinate the EDCP with the changes to the 401(k) Plan and likewise effective for compensation deferred after January 1, 2016. This restoration matching contribution is intended to “restore” up to the full four percent potential company matching contribution for participants whose elective deferrals to the 401(k) plan (and related company matching contributions) were limited due to Code limits applicable to qualified plans. Under the restoration matching contribution, beginning January 1, 2016, a participant employed on the last day of the plan year shall receive a credit in his or her restoration matching contribution account equal to (i) the maximum matching contribution that would be available under the qualified 401(k) Plan if his or her compensation under that plan was not reduced by deferrals to the EDCP and/or the limits of Code Section 401(a)(17), less (ii) the maximum matching contribution that could be credited to the participant under the 401(k) Plan given applicable Code limits; provided, however, the credit shall not exceed 100% of deferrals to the EDCP in the plan year to which it relates. Participants will be 100% vested in their restoration matching contribution at all times. The restoration matching contribution will be credited with earnings, gains, and losses in accordance with the EDCP. All of our fiscal 2014 NEOs participate in the EDCP and will be eligible for the restoration matching contribution.

The Committee also approved other non-material, minor changes to the EDCP in order to clarify compliance with 409A or for other non-material administrative purposes.

The foregoing descriptions of the EDCP amendments are qualified in their entirety by reference to the terms of the plan, a copy of which has been filed as Exhibit 10.4.1 hereto.

Clarifying Amendment to Jack in the Box Inc. Supplemental Executive Retirement Plan (SERP).

On September 17, 2015, the Committee approved a technical amendment to the SERP. The SERP was closed to new participants in 2007. The SERP is an unfunded non-qualified defined benefit plan available to select key employees of the Company who are designated by management, intended to be exempt from the vesting, funding and fiduciary requirements set forth in Title I of ERISA. The SERP provides retirement income, on a defined-benefit basis, without regard to Code limitations,

with a participant’s benefit amount increasing for each year of service up to 20 years. The Company also maintains a tax-qualified defined benefit pension plan (the “Retirement Plan”), in which our Jack in the Box employees hired prior to 2011 participate. The Retirement Plan was closed to new employees hired on or after January 1, 2011 and will “sunset” on December 31, 2015, such that our participating employees will no longer accrue additional benefits based on additional pay and service after December 31, 2015. The SERP was amended to clarify and confirm that the definition of “Years of Service” in the SERP is not affected by the Retirement Plan sunset, such that participants in the SERP will continue to accrue Years of Service in the SERP after December 31, 2015. Two fiscal 2014 NEOs are participants in the SERP as they were hired or promoted to an eligible position prior to 2007.

The foregoing description of the SERP amendment is qualified in its entirety by reference to the terms of the amendment, a copy of which has been filed as Exhibit 10.3.1 hereto.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits.

|

| | |

Exhibit No. | | Title |

10.3.1 | | First Amendment to Jack in the Box Inc. Supplemental Executive Retirement Plan, As Amended and Restated Effective January 1, 2009

|

10.4.1 | | Jack in the Box Inc. Executive Deferred Compensation Plan, As Amended and Restated Effective January 1, 2016

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| | JACK IN THE BOX INC. |

| | |

| | |

| By: | /s/ Jerry P. Rebel |

| | Jerry P. Rebel |

| | Executive Vice President |

| | Chief Financial Officer |

| | (Principal Financial Officer) |

| | (Duly Authorized Signatory) |

| | Date: September 22, 2015 |

Exhibit 10.3.1

FIRST AMENDMENT

TO THE

JACK IN THE BOX INC.

SUPPLEMENTAL EXECUTIVE RETIREMENT PLAN

(As Amended and Restated Effective January 1, 2009)

| |

1. | Section 2.23, “Years of Service” is hereby amended and restated in its entirety as follows: |

’Years of Service’ means the number of years of service determined in accordance with the provisions of the Retirement Plan as in effect on September 17, 2015, whether or not the Participant is a participant in such plan, and without reference to Section 5.16 of the Retirement Plan.

Exhibit 10.4.1

JACK IN THE BOX INC.

EXECUTIVE DEFERRED COMPENSATION PLAN

As Amended and Restated Effective January 1, 2016

TABLE OF CONTENTS

|

| | | |

| | |

ARTICLE I - PURPOSE | 1 |

|

| | |

ARTICLE II - DEFINITIONS | 1 |

|

| | |

2.1 | Account | 1 |

|

2.2 | Administrative Committee | 1 |

|

2.3 | Beneficiary | 1 |

|

2.4 | Board | 1 |

|

2.5 | Change in Control | 1 |

|

2.6 | Code | 2 |

|

2.7 | Company | 2 |

|

2.8 | Compensation | 2 |

|

2.9 | Deferral Election | 3 |

|

2.10 | Discretionary Contribution | 3 |

|

2.11 | Easy$aver Plus Plan | 3 |

|

2.12 | Effective Date | 3 |

|

2.13 | Elected Deferred Compensation | 3 |

|

2.14 | Employer | 3 |

|

2.15 | Financial Hardship | 3 |

|

2.16 | Hardship Distribution | 3 |

|

2.17 | In-Service Withdrawal | 4 |

|

2.18 | Matching Contribution | 4 |

|

2.19 | Participant | 4 |

|

2.20 | Plan | 4 |

|

2.21 | Plan Year | 4 |

|

2.22 | Restoration Matching Contribution | 4 |

|

2.23 | Supplemental Contribution | 4 |

|

2.24 | Transfer Contribution | 4 |

|

2.25 | Year of Service | 4 |

|

| | |

ARTICLE III - PARTICIPATION AND DEFERRAL ELECTIONS | 4 |

|

| | |

3.1 | Eligibility and Participation | 4 |

|

3.2 | Deferral Elections | 5 |

|

3.3 | Commencement, Duration and Modification of Deferral Election | 5 |

|

| | |

ARTICLE IV - DEFERRED COMPENSATION ACCOUNTS | 6 |

|

| | |

4.1 | Accounts | 6 |

|

4.2 | Crediting of Deferrals | 6 |

|

4.3 | Termination Account | 6 |

|

4.4 | In-Service Withdrawal Accounts | 6 |

|

|

| | | |

4.5 | Matching Contribution Account (Prior to January 1, 2016) | 6 |

|

4.6 | Restoration Matching Contribution Account (Effective January 1, 2016) | 7 |

|

4.7 | Discretionary Contribution Account | 7 |

|

4.8 | Supplemental Contribution Account | 7 |

|

4.9 | Transfer Contribution | 7 |

|

4.10 | Vesting of Accounts | 8 |

|

4.11 | Statement of Accounts | 8 |

|

| | |

ARTICLE V - INVESTMENT AND EARNINGS | 8 |

|

| | |

5.1 | Plan Investments | 8 |

|

5.2 | Crediting Investment Gains and Losses | 9 |

|

| | |

ARTICLE VI - PLAN BENEFITS | 9 |

|

| | |

6.1 | Distribution Options | 9 |

|

6.2 | Commencement of Benefits | 10 |

|

6.3 | Termination Benefits | 10 |

|

6.4 | Death Benefits | 10 |

|

6.5 | In-Service Withdrawal | 10 |

|

6.6 | Hardship Distribution | 11 |

|

6.7 | Withholding and Payroll Taxes | 11 |

|

6.8 | Payment to Guardian | 12 |

|

6.9 | Change of Control | 12 |

|

| | |

ARTICLE VII - BENEFICIARY DESIGNATION | 12 |

|

| | |

7.1 | Beneficiary Designation | 12 |

|

7.2 | Changing Beneficiary | 12 |

|

7.3 | No Beneficiary Designation | 13 |

|

7.4 | Effect of Payment | 13 |

|

| | |

ARTICLE VIII - ADMINISTRATION | 13 |

|

| | |

8.1 | Committee; Duties | 13 |

|

8.2 | Agents | 13 |

|

8.3 | Binding Effect of Decisions | 13 |

|

8.4 | Indemnity of Committee | 13 |

|

8.5 | Election of Committee After Change in Control | 14 |

|

| | |

ARTICLE IX - CLAIMS PROCEDURE | 14 |

|

| | |

9.1 | Claim | 14 |

|

9.2 | Denial of Claim | 14 |

|

9.3 | Review of Claim | 14 |

|

9.4 | Final Decision | 14 |

|

|

| | | |

| | |

ARTICLE X - AMENDMENT AND TERMINATION OF PLAN | 15 |

|

| | |

10.1 | Amendment | 15 |

|

10.2 | Company's Right to Terminate | 16 |

|

| | |

ARTICLE XI - MISCELLANEOUS | 16 |

|

| | |

11.1 | Unfunded Plan | 16 |

|

11.2 | Unsecured General Creditor | 16 |

|

11.3 | Trust Fund | 16 |

|

11.4 | Nonassignability | 17 |

|

11.5 | Not a Contract of Employment | 17 |

|

11.6 | Protective Provisions | 17 |

|

11.7 | Governing Law | 17 |

|

11.8 | Validity | 17 |

|

11.9 | Gender | 17 |

|

11.10 | Notice | 17 |

|

11.11 | Successors | 17 |

|

| | |

APPENDIX A GRANDFATHERED PRE-2005 PLAN PROVISIONS | 18 |

|

| | |

JACK IN THE BOX INC.

EXECUTIVE DEFERRED COMPENSATION PLAN

ARTICLE I - PURPOSE

The Jack in the Box Executive Deferred Compensation Plan (the “Plan”) is hereby amended and restated, effective January 1, 2016, to incorporate the First through Fifth Amendments to the January 1, 2009 restatement and to make certain other specified changes as set forth herein. The purpose of the Plan is to provide current tax planning opportunities as well as supplemental funds upon the retirement or death of certain key employees of Employer. It is intended that the Plan will aid in attracting and retaining key employees of exceptional ability by providing them with these benefits.

ARTICLE II - DEFINITIONS

For the purposes of this Plan, the following terms shall have the meanings indicated, unless the content clearly indicates otherwise:

"Account" means the interest of a Participant in the Plan as represented by the hypothetical bookkeeping entries kept by Employer. A separate Account shall be established for each Participant and as may otherwise be required.

| |

2.2 | Administrative Committee |

"Administrative Committee" means the committee appointed by the Board to administer the Plan pursuant to Article VIII.

"Beneficiary" means the person, persons or entity (including, without limitation, any trustee) last designated by a Participant to receive the benefits specified hereunder, in the event of the Participant’s death.

"Board" means the Board of Directors of the Company.

2.5 Change in Control

"Change in Control" of the Company means, and shall be deemed to have occurred upon, the first to occur of any of the following events:

a.Any "Person" (other than those Persons in control of the Company as of the original Effective Date, or other than a trustee or other fiduciary holding securities under an employee benefit plan of the Company, or a corporation owned directly or indirectly by the stockholders of the Company in substantially the same proportions as their ownership of stock of the Company) becomes the "Beneficial Owner" of securities of the Company representing fifty percent (50%) or more of (i) the then outstanding shares of the securities of the Company, or (ii) the combined voting power of the then outstanding securities of the Company entitled to vote generally in the election of directors ("Company Voting Stock"); or

b.The majority of members of the Company's Board of Directors is replaced during any 12- month period by directors whose appointment or election is not endorsed by a majority of the members of the Company's Board of Directors before the date of the appointment; or

c.The stockholders of the Company approve: (i) a plan of complete liquidation of the Company; or (ii)

an agreement for the sale or disposition of all or substantially all of the Company's assets; or (iii) a merger, consolidation, or reorganization of the Company with or involving any other corporation, if immediately after such transaction persons who hold a majority of the outstanding voting securities entitled to vote generally in the election of directors of the surviving entity (or the entity owning 100% of such surviving entity) are not persons who, immediately prior to such transaction, held the Company Voting Stock.

However, in no event shall a "Change in Control" be deemed to have occurred, with respect to the Participant, if the Participant is part of a purchasing group which consummates the Change in Control transaction. The Participant shall be deemed "part of a purchasing group" for purposes of the preceding sentence if the Participant is an equity participant in the purchasing company or group (except for: (i) passive ownership of less than two percent (2%) of the stock of the purchasing company; or (ii) ownership of equity participation in the purchasing company or group which is otherwise not significant, as determined prior to the Change in Control by a majority of the nonemployee continuing Directors).

For purposes of this Section, the terms "Person" and "Beneficial Owner" shall have the meanings given those terms in Sections 13(d) and 14(d) of the Securities Exchange Act of 1934, and Rule 13d-3 under that Act.

Notwithstanding anything to the contrary herein, with respect to amounts deferred for services performed for periods commencing on or after January 1, 2012, for purposes of Section 6.9, a Change in Control shall be deemed to have occurred only to the extent the event constitutes a change in the ownership or effective control of the corporation, or a change in the ownership of a substantial portion of the assets of the corporation, as defined under Code Section 409A and the regulations issued thereunder.

2.6 Code

"Code" means the Internal Revenue Code of 1986, as amended.

2.7 Company

"Company" means Jack in the Box Inc., a Delaware corporation or any successor to the business thereof.

2.8 Compensation

"Compensation" means the base salary payable to and annual cash incentive compensation earned by a Participant for services performed for the Employer and considered to be wages for purposes of federal income tax withholding. Inclusion of any other forms of compensation is subject to Committee approval. Compensation shall be calculated before reduction for any amounts deferred by the Participant pursuant to the Employer's tax qualified plans which may be maintained under Code Section 401(a) or a plan maintained under Code Section 125, or under this Plan.

2.9 Deferral Election

"Deferral Election" means a commitment by a Participant to defer a portion of Compensation to this Plan and for which the commitment has been submitted by the Participant to the Administrative Committee.

2.10 Discretionary Contribution

"Discretionary Contribution" means an Employer contribution credited to a Participant's Account pursuant to Section 4.7 of this Plan.

2.11 Easy$aver Plus Plan

“Easy$aver Plus Plan” means the Jack in the Box Inc. Easy$aver Plus Plan, a qualified 401(k) retirement plan, as currently in effect or as hereafter amended from time to time, and any successor thereto.

2.12 Effective Date

“Effective Date” of this Amended and Restated Plan means January 1, 2016. The Plan was originally effective as of January 1, 2003, was thereafter amended and restated effective January 1, 2009, and was thereafter amended from time to time.

2.13 Elected Deferred Compensation

"Elected Deferred Compensation" means the amount of Compensation that a Participant elects to defer pursuant to a Deferral Election.

2.14 Employer

"Employer" means the Company and any affiliate or subsidiary entities designated by the Board as participating in this Plan.

2.15 Financial Hardship

"Financial Hardship" means an unforeseeable emergency due to an illness or accident of the Participant, the Participant's spouse, the Participant's Beneficiary or the Participant 's dependent (as defined in Section 152 of the Code without regard to Sections 152(b)(1), (b)(2), and (d)(1)(B))); loss of the Participant's property due to casualty (including the need to rebuild a home not otherwise covered by insurance); or other similar extraordinary and unforeseeable circumstances arising as a result of events beyond the control of the Participant that would result in severe financial hardship to the Participant if early withdrawal were not permitted. Financial Hardship will not exist if the financial need can be relieved through reimbursement or compensation from insurance or otherwise; by liquidation of the Participant's assets, to the extent the liquidation of such assets would not itself cause severe financial hardship; or by cessation of deferrals under the Plan. Notwithstanding anything to the contrary herein, a Financial Hardship shall be deemed to have occurred only to the extent the event constitutes an Unforeseeable Emergency as defined under Code Section 409A and the regulations issued thereunder.

2.16 Hardship Distribution

"Hardship Distribution" means a distribution pursuant to Section 6.6 of the Plan made on account of the Participant’s Financial Hardship. Such distribution must be limited to the amount reasonably necessary to satisfy the Financial Hardship (which may include any amounts necessary to pay any federal, state, or local income taxes or penalties reasonably anticipated to result from the distribution).

2.17 In-Service Withdrawal

"In-Service Withdrawal" means a distribution to a Participant prior to termination of employment pursuant to Sections 4.4 and 6.5 of this Plan.

2.18 Matching Contribution

"Matching Contribution" means an Employer contribution credited to a Participant's Account pursuant to Section 4.5 of this Plan. Matching Contributions shall not be credited to the Plan after December 31, 2015.

2.19 Participant

"Participant" means any individual who is participating in this Plan as provided in Article III.

2.20 Plan

"Plan" means this Jack in the Box Inc. Executive Deferred Compensation Plan as set forth in this document and as the same may be amended from time to time.

2.21 Plan Year

"Plan Year" means each calendar year beginning on January 1 and ending on December 31.

2.22 Restoration Matching Contribution

“Restoration Matching Contribution” means an Employer Contribution credited to a Participant’s Account pursuant to Section 4.6. Restoration Matching Contributions were not available prior to January 1, 2016.

2.23 Supplemental Contribution

"Supplemental Contribution” means an Employer Contribution credited to a Participant's Account pursuant to Section 4.8 of the Plan.

2.24 Transfer Contribution

"Transfer Contribution" means a Participant's contribution credited to a Participant’s Account pursuant to Section 4.9 of the Plan.

2.25 Year of Service

“Year of Service” shall have the same meaning as provided in the Easy$aver Plus Plan, whether or not the Participant is a participant in such plan.

ARTICLE III - PARTICIPATION AND DEFERRAL ELECTIONS

3.1 Eligibility and Participation

(a)Eligibility. Any select key employee designated by the Employer and approved by the Administrative Committee shall be eligible to participate in the Plan.

(b)Participation. An eligible employee may elect to participate in the Plan by submitting a Deferral Election to the Administrative Committee prior to the beginning of the Plan Year in which the employee is eligible to participate.

(c)Part-Year Participation. In the event an employee first becomes eligible to participate in the Plan on other than the first day of a Plan Year, a Deferral Election may be submitted to the Administrative Committee within 30 days after the employee becomes eligible to participate in the Plan, provided, however, that an employee will not be considered newly eligible to participate in the Plan for purposes of this provision if the employee has ever been eligible to participate in another plan maintained by the Employer considered to be the same type of plan under Code Section 409A. The Deferral Election shall be effective only with regard to Compensation attributable to base salary earned following submission of the Deferral Election to the Administrative Committee.

3.2 Deferral Elections

A Participant may file with the Administrative Committee, in accordance with procedures established by the Administrative Committee, a Deferral Election to defer any or all of the following:

(d)Salary Deferrals. A Participant may elect to defer up to fifty percent (50%) of base salary. The amount to be deferred shall be stated as a whole percentage of base salary.

(e)Annual Cash Incentive Compensation Deferrals. A Participant may elect to defer up to 85% of any annual cash incentive compensation to be paid by the Employer, provided, however, that such an election must be made before the beginning of the Plan Year or other performance period in which the annual cash incentive compensation is earned, unless the annual cash incentive compensation qualifies as "performance-based compensation " under Code section 409A, in which case a Participant may elect to defer such annual cash incentive compensation in accordance with the rules set out in Treasury Regulation section 1.409A-2(a)(8). The amount to be deferred shall be stated as a whole percentage of each annual cash incentive compensation payment.

(f)Changes to Deferral Elections. The Administrative Committee may change the maximum amount of salary and/or annual cash incentive compensation that may be deferred by giving written notice to all Participants. No such change may affect a Deferral Election entered into prior to the Administrative Committee's action.

3.3 Commencement, Duration and Modification of Deferral Election

(g)Commencement. A Deferral Election shall become effective on the first day of the Plan Year

immediately following the date such Deferral Election is filed with the Administrative Committee. In the case when an employee first becomes eligible to participate in the Plan on other than the first day of a Plan Year, the Deferral Election will be effective only with regard to Compensation attributable to base salary earned following the date such Deferral Election is timely submitted per Section 3.l(c).

(h)Duration. A Deferral Election shall remain in effect for all future Plan Years unless revoked or amended in writing or through electronic means by the Participant. Any such revocation or amendment shall become effective as of the first day of the Plan Year immediately following the receipt of the revocation or amendment by the Administrative Committee.

(i)Modification. A Deferral Election shall terminate on the date a Participant terminates employment (except with respect to Compensation earned while the Deferral Election was in effect) or receives a Hardship Distribution pursuant to Section 6.6 of the Plan, provided, however, that if a Participant is rehired during the same Plan Year as the Plan Year in which the Participant terminates employment, a Deferral Election applicable to such Plan Year shall be reinstated for the balance of the Plan Year. A Deferral Election shall also terminate as of December 31 following a demotion during the Plan Year to a position not eligible to participate in the Plan.

ARTICLE IV - DEFERRED COMPENSATION ACCOUNTS

4.1 Accounts

For recordkeeping purposes only, the Employer shall maintain such Accounts as are necessary to reflect the Participant’s interest in the Plan. The Accounts shall include up to two (2) Termination Accounts, up to five (5) In-Service Withdrawal Accounts, a Matching Contribution Account, a Restoration Matching Contribution Account, a Discretionary Contribution Account, and a Supplemental Contribution Account.

4.2 Crediting of Deferrals

Beginning January 1 of each Plan Year, a Participant’s Elected Deferred Compensation which consists of deferred base salary shall be credited to the Participant 's Accounts as soon as administratively feasible following the date when the corresponding non-deferred portion of the Participant's base salary is paid or would have been paid but for the Deferral Election. Beginning January l of each Plan Year, a Participant's Elected Deferred Compensation which consists of deferred annual cash incentive compensation shall be credited to the Participant 's Accounts as soon as administratively feasible following the date of each year on which the annual cash incentive compensation is paid or would have been paid but for the Deferral Election applicable to such annual cash incentive compensation; provided, however, that the deferred annual cash incentive compensation shall be credited no later than the last day of the Plan Year in which the annual cash incentive compensation is paid or would have been paid but for the Deferral Election applicable to such annual cash incentive compensation.

4.3 Termination Account

A Termination Account shall be established for each Participant upon his or her initial participation in the Plan, to be known as the Participant’s Primary Termination Account. A Participant may establish one additional Termination Account during any enrollment window by directing the establishment of the account on his or her Deferral Election (the Secondary Termination Account). Amounts credited to a Termination Account will be distributed following termination of employment and in the form elected pursuant to Section 6.1 of the Plan. A Participant may elect to defer Compensation into the Primary Termination Account and/or a Secondary Termination Account.

4.4 In-Service Withdrawal Accounts

A Participant may establish one or more In-Service Withdrawal Accounts on his or her Deferral Election. The Deferral Election shall specify a future date on which amounts allocated to the Account(s), and any earnings attributable thereto, are to be distributed, and the percentage of Compensation to be allocated to such Account(s).

4.5 Matching Contribution Account (Prior to January 1, 2016)

Prior to January 1, 2016, there shall be credited to each Participant's Matching Contribution Account an amount equal to one hundred percent (l00%) of the first three percent (3%) of a Participant's Compensation that is

deferred into this Plan for the Plan Year. The amount shall be credited as of the date employee deferrals are credited pursuant to Section 4.2 of the Plan. No further amounts shall be credited to the Matching Contribution Account after January 1, 2016. Amounts credited to a Participant's Matching Contribution Account for a Plan Year shall be allocated to the Participant’s Primary Termination Account or, if so provided on the Participant’s Deferral Election for the Plan Year, to the Participant’s Secondary Termination Account or to both the Primary Termination Account and the Secondary Termination Account.

4.6 Restoration Matching Contribution Account (Effective January 1, 2016)

Effective January 1, 2016, each Participant who is actively employed on the last day of a Plan Year shall receive a credit in his or her Restoration Matching Contribution Account equal to (i) the maximum matching contribution that would be available to Participant under the Easy$aver Plus Plan if his or her compensation under that plan was not reduced by deferrals to this Plan and/or the limits of Code Section 401(a)(17), less (ii) the maximum matching contribution that could be credited to the Participant under the Easy$aver Plus Plan given applicable Code limits; provided, however, the credit shall not exceed 100% of deferrals to this Plan for the Plan Year to which it relates. The Restoration Matching Contribution amount shall be credited as soon as administratively feasible following the end of the Plan Year to which it relates. Amounts credited to a Participant's Restoration Matching Contribution Account for a Plan Year shall be allocated to the Participant’s Primary Termination Account or, if so provided on the Participant’s Deferral Election for the Plan Year, to the Participant’s Secondary Termination Account or to both the Primary Termination Account and the Secondary Termination Account.

4.7 Discretionary Contribution Account

The Employer may make contributions in such amount and at such times as recommended by the Administrative Committee and approved by the Compensation Committee of the Board, or as the Board, in its sole discretion, shall determine. Such amount shall be credited to the Participant’s Discretionary Contribution Account as of the date designated by the Administrative Committee. Unless otherwise specified by the Administrative Committee, amounts credited to a Participant's Discretionary Contribution Account for a Plan Year shall be allocated to the Participant’s Primary Termination Account or, if so provided on the Participant’s Deferral Election for the Plan Year, to the Participant’s Secondary Termination Account or to both the Primary Termination Account and the Secondary Termination Account.

4.8 Supplemental Contribution Account

The Employer shall make a Supplemental Contribution equal to four percent (4%) of Compensation to the Plan Account of each officer newly promoted or newly hired on or before May 7, 2015, which shall include a position of Corporate Vice President or above as approved by the Board as eligible for Supplemental Contributions, for each of the first ten (10) years in which the Participant serves in such position. Such Supplemental Contribution amounts shall be credited to the Participant's Supplemental Contribution Account as soon as administratively possible following the date when the Participant's corresponding Compensation is paid (or would have been paid, if such Compensation had not been deferred under a Deferral Election). Amounts credited to a Participant's Supplemental Contribution Account for a Plan Year shall be allocated to the Participant’s Primary Termination Account.

4.9 Transfer Contribution

A Participant may make an irrevocable election, in accordance with the procedures promulgated by the Administrative Committee, to transfer all of his or her accumulated account balance under the Capital Accumulation Plan for Executives (the "CAPE") into this Plan. Any transfer to this Plan from the CAPE shall include the vested and non-vested portions of the Participant's account under the CAPE and such amounts shall be allocated among the Participant’s Termination Account, Matching Contribution Account and Discretionary Contribution Account respectively. A Participant who elected to withdraw amounts attributable to a specific deferral commitment prior to termination of employment under the CAPE shall have such sums credited in this Plan to one or more In-Service Withdrawal Accounts. Amounts transferred from the CAPE to this Plan pursuant to this Section 4.9 may not be transferred from this Plan to the CAPE. Transfer Contributions are not permitted after December 31, 2007.

4.10 Vesting of Accounts

Each Participant shall be vested in the amounts credited to such Participant's Account as follows:

(a)Elected Deferred Compensation. A Participant shall be one hundred percent (100%) vested at all times in his or her Elected Deferred Compensation and any gains or losses thereon.

(b)Matching Contributions. Matching Contributions made for years commencing prior to January 1, 2016, and any gains or losses thereon, shall become vested at the rate of twenty-five percent (25%) for each completed Year of Service; except, a Participant shall become one hundred percent (100%) vested in such amounts at death or upon a Change in Control.

(c)Restoration Matching Contributions. Restoration Matching Contributions made for years commencing on or after January 1, 2016, and any gains or losses thereon, shall be 100% vested at all times.

(d)Discretionary Contributions. A Participant’s Discretionary Contribution Account, and any gains or losses thereon, shall become vested as determined by the Compensation Committee of the Board, or by the Board. The Participant shall become one hundred percent (100%) vested in such amounts at death or upon a Change of Control.

(e)Supplemental Contributions. A Participant's Supplemental Contribution Account, and any gains or losses thereon, shall become vested at the rate of twenty-five percent (25%) for each completed Year of Service; except, a participant shall become one hundred percent (100%) vested in such amounts at death or upon a Change in Control.

4.11 Statement of Accounts

From time to time, but not less frequently than annually, each Participant shall be provided with a benefit statement setting forth the balance of the Accounts maintained for the Participant. Such statements shall be provided electronically, unless otherwise determined by the Administrative Committee.

ARTICLE V - INVESTMENT AND EARNINGS

A Participant shall complete a portfolio allocation form electing from among a series of hypothetical investment options designated by the Administrative Committee into which the Participant's Elected Deferred Compensation and all Employer contributions shall be credited. The performance of the Participant’s Accounts shall be measured based upon the investment options selected. The Participant's Accounts shall be credited with such hypothetical crediting rates calculated after the investment managers' expenses and any insurance-related or other expenses as designated by the Administrative Committee have been deducted. Investment options may be changed daily by following such procedures as may be determined by the Administrative Committee. A revised or changed investment allocation shall be effective on the first business day following the Participant’s request for a change.

| |

5.2 | Crediting Investment Gains and Losses |

Participant Accounts shall be credited daily with investment gains and losses as if such Account(s) were invested in one (1) or more of the Plan’s investment options, as selected by the Participant, less administrative charges applied against the particular investment options.

ARTICLE VI - PLAN BENEFITS

6.1 Distribution Options

(a)Distribution Election. Pursuant to Article III - Participation and Deferral Elections, a Participant’s distribution election must be made at the same time as the deferral election with respect to Compensation deferred for that Plan Year.

(b)Form of Payment. Benefits payable due to termination of employment or the death of the Participant shall be paid in one of the following forms elected by the Participant for the Termination Account to which amounts are credited:

(i)Lump Sum. One (1) lump-sum payment.

(ii)Installment Payments. Annual installment payments over a period of up to ten (10) years, as elected by the Participant. The first installment payment shall be paid as soon as is administratively feasible after the Participant’s date of termination or death. Subsequent installments shall be paid at the beginning of each subsequent Plan Year. The initial installment shall be based on the vested Account balance as of the end of the month in which termination or death occurs, and each subsequent installment shall be based on the remaining vested Account balance as of the immediately preceding December 31, multiplied by a fraction, the numerator of which is 1 and the denominator of which is the number of remaining installment payments. Adjustments for investment gains and losses shall continue on unpaid vested Account balances.

(iii)If a Participant fails to elect a form of distribution for amounts payable from his or her Primary Termination Account, benefit payments shall be paid in a single lump sum. Notwithstanding the preceding sentence, amounts payable from the Primary Termination Account that relate to service periods commencing prior to January 1, 2013, with respect to which no form of distribution election has been made, will be paid in annual installments over ten (10) years.

(iv)Notwithstanding any election made by the Participant, if, on the Participant's date of termination or date of death, his or her vested Account balance is less than fifty thousand dollars ($50,000), such Account shall be paid to the Participant or Beneficiary in a single lump sum.

(c)Change in Form of Payment. A Participant's election as to the form of distribution upon termination of employment or death shall be irrevocable; except that a Participant may file a new form of payment election which shall supersede his or her most recent prior election, provided (i) the new election will not take effect until 12 months after the date on which the election is made, and (ii) in the case of an election related to a payment upon termination of employment for reasons other than death, the payment (or commencement of payment) with respect to which such election is made will be paid (or payments will commence) five years after the date such payment would otherwise have been paid (or commenced). Installment payments will be treated as a single payment for this purpose. A Participant may file a new form of payment election with respect to each Termination Account no more than two (2) times. An election filed within the twelve (12) months preceding termination of employment or death shall be null and void and the next preceding timely election filed by the Participant shall be controlling.

6.2 Commencement of Benefits

A benefit payment in a single lump sum and the first payment of a series of installment payments shall be paid to the Participant (or Beneficiary, if applicable) as soon as administratively feasible but in no event more than sixty (60) days after the event giving rise to the distribution.

Notwithstanding the foregoing, if the Participant is identified as a "specified employee" under Code section 409A, as determined by the Company using an identification method described in the regulations or other guidance issued under Code section 409A and documented in a duly authorized resolution of the committee of the Company authorized to make such determination, then, to the extent that a payment amount is required to be delayed for six months in order to comply with Code section 409A, such payment amount shall be paid as soon as administratively feasible, but in no event more than 60 days, after the end of the six-month waiting period required under Code section 409A.

6.3 Termination Benefits

Upon termination of employment, a Participant shall receive all vested Termination Account balances in the form elected pursuant to Section 6.1 of the Plan. If the Participant terminates before the initial payment date of any In-Service Withdrawal Accounts, the balance in such In-Service Withdrawal Accounts shall be paid on termination in a single lump sum.

6.4 Death Benefits

(d)Pre-termination. If a Participant dies prior to commencement of benefit payments, the Employer shall pay to the Beneficiary all of the Participant's vested Account balances in the form elected by the Participant pursuant to Section 6.1 of the Plan, including any balance in one or more In-Service Withdrawal Accounts.

(e)Post-termination. If a Participant dies following the commencement of benefit payments, the Employer shall pay to the Beneficiary any remaining installment payments that would have been paid to the Participant had the Participant survived.

(f)Account balances completely distributed. If a Participant dies after all vested Account balances have been completely distributed, no death benefit shall be payable to the Beneficiary under the Plan.

(g)Investment Direction. The Beneficiary shall succeed to the Participant's right to direct investments pursuant to Section 5.1 of the Plan following the Participant's death.

(h)Subsequent Beneficiaries. If a Beneficiary who is receiving payments dies before all payments have been paid, any subsequent Beneficiary (as determined and provided for in Article VII) shall be paid any remaining vested Account balances in a lump sum as soon as practical after the death of the first Beneficiary.

6.5 In-Service Withdrawal

(i)Distribution Election. Pursuant to Article III - Participation and Deferral Elections, a Participant’s distribution election for an In-Service Withdrawal must be made at the same time as the deferral election with respect to Compensation deferred for that Plan Year.

(j)Commencement and Form of In-Service Withdrawal. For amounts deferred with respect to services performed for periods commencing on or after January 1, 2012, the balance of an In-Service Withdrawal Account shall be paid on the date and in the form elected by the Participant in the Deferral Election with which the applicable Account was established, except as otherwise provided in paragraph (c) hereof. The available forms of payment shall be a single lump sum or up to five (5) annual installments. In no event shall the elected payment date be prior to the completion of two (2) Plan Years from the date the applicable Account is established. Amounts deferred with respect to services performed for periods commencing prior to January 1, 2012 are payable in a single lump sum on the date elected by the Participant in the Deferral Election with which the Account was established, except to the extent modified in accordance with paragraph (c) hereof.

(k)Changing the Payment Date or Form of Payment. A Participant’s election indicating the date and/or form of distribution of an In-Service Withdrawal Account may be modified one time by filing a new election, provided (i) the election is made no later than twelve (12) months prior to the date the Account would otherwise be payable and (ii) the Participant selects a new date of distribution that is at least five (5) years after the originally scheduled date of distribution. A Participant may file a new election no more than once with regard to the distribution of an In-Service Withdrawal Account. Installment payments will be treated as a single payment for this purpose. An election filed within the twelve (12) months preceding the date of distribution shall be null and void and the next preceding timely election filed by the Participant shall be controlling.

(l)Termination of Employment Prior to Commencement of Payments from an In-Service Withdrawal Account. If a Participant terminates employment or dies prior to commencement of payments from such Participant's In-Service Withdrawal Account(s), such Account shall be paid pursuant to Section 6.3 or 6.4, as applicable.

6.6 Hardship Distribution

Upon finding that a Participant or Beneficiary has suffered a Financial Hardship, the Administrative Committee may, in its sole discretion, make distributions from the Participant 's Account prior to the time specified for payment of benefits under the Plan. The Hardship Distribution shall be made ratably from all vested Accounts. The amount of such distribution shall be limited to the amount reasonably necessary to meet the Participant's or Beneficiary's requirements during the Financial Hardship.

Applications for a Hardship Distribution and determinations thereon by the Administrative Committee shall be in writing, and a Participant or Beneficiary may be required to furnish written proof of the Financial Hardship, as determined by the Administrative Committee in its sole discretion.

Upon receiving a Hardship Distribution from this Plan, or a hardship distribution from a qualified plan maintained by the Employer under Code Section 401(k), a Participant's Deferral Election shall cease and such

Participant shall not participate in the Plan until the first day of the Plan Year following twelve (12) months from the date of the distribution.

6.7 Withholding and Payroll Taxes

The Employer shall withhold from Plan payments any taxes required to be withheld from such payments under federal, state or local law. Such taxes shall be withheld from the Participant’s non-deferred base salary or annual cash incentive compensation to the maximum extent possible with any excess being withheld from the Participant’s Elected Deferred Compensation. Each Participant shall bear the ultimate responsibility for payment of all taxes owed under this Plan.

6.8 Payment to Guardian

If a Plan benefit is payable to a minor or a person declared incompetent or to a person incapable of handling the disposition of his or her property, the Administrative Committee may direct payment to the guardian, conservator, legal representative, or person having the care and custody of such minor, incompetent or incapacitated person. The Administrative Committee may require proof of minority, incompetency, incapacity, conservatorship or guardianship as it may deem appropriate prior to distribution. Such distribution shall completely discharge the Administrative Committee from all liability with respect to such benefit.

6.9 Change of Control

Notwithstanding anything to the contrary in this Article VI, and subject to Section 6.2, with respect to amounts deferred for services performed for periods commencing on or after January 1, 2012, a Participant will receive a single lump sum payment equal to the unpaid balance of all of his or her Accounts attributable to such post-2011 deferrals if termination of employment occurs within 24 months following a Change in Control. A Participant or Beneficiary receiving installment payments when a Change in Control occurs will receive the remaining account balances attributable to such post-2011 deferrals in a single lump sum within 90 days following the Change in Control.

ARTICLE VII - BENEFICIARY DESIGNATION

| |

7.1 | Beneficiary Designation |

Each Participant shall have the right, at any time, to designate one (1) or more persons or entities as Beneficiary (both primary as well as secondary) to whom benefits under this Plan shall be paid in the event of the Participant's death prior to complete distribution of the Participant's vested Account Balance. Each Beneficiary designation shall be made in writing or through electronic means as permitted by the Administrative Committee and shall be effective only when filed with the Administrative Committee during the Participant's lifetime.

A married Participant’s spouse shall be entitled to fifty percent (50%) interest in any benefit due the Participant unless such spouse waives the right to receive such benefit by executing a written consent acknowledging the effect of the Beneficiary designation, or it is established that such consent cannot be obtained because the spouse cannot be located.

Any Beneficiary designation may be changed by an unmarried Participant without the consent of the previously named Beneficiary by the filing of a new Beneficiary designation with the Administrative Committee.

A married Participant’s Beneficiary designation may be changed by a Participant by the filing of a new Beneficiary designation with the Administrative Committee with the consent of the Participant’s spouse as provided for in Section 7.1 above. The filing of a new designation shall supersede all designations previously filed.

| |

7.3 | No Beneficiary Designation |

If any Participant fails to designate a Beneficiary in the manner provided above, if the designation is void, or if the Beneficiary dies before the Participant or before complete distribution of the Participant's benefits, the Participant's

Beneficiary shall be the person in the first of the following classes in which there is a survivor:

(a)The Participant's surviving spouse;

(b)The Participant's children in equal shares, except that if any of the children predecease the Participant with surviving issue, then such issue shall take by right of representation;

(c)The Participant's estate.

Payment to the Beneficiary shall completely discharge the Employer's obligations under this Plan.

ARTICLE VIII - ADMINISTRATION

This Plan shall be administered by the Administrative Committee, consisting of three (3) members as may be appointed by the Board or, except after a Change in Control, as provided in Section 8.5 below. The Administrative Committee shall have the authority to make, amend, interpret and enforce all appropriate rules and regulations for the administration of the Plan and decide or resolve any and all questions, including interpretations of the Plan, as may arise in such administration. A majority vote of the Administrative Committee members in office at the time of the vote shall control any decision. Members of the Administrative Committee may be Participants under this Plan.

The Administrative Committee may employ agents and delegate to them such administrative duties as it sees fit, and may consult with counsel who may be counsel to the Company.

| |

8.3 | Binding Effect of Decisions |

The decision or action of the Administrative Committee with respect to any question arising out of or in connection with the administration, interpretation and application of the Plan and the rules and regulations promulgated hereunder shall be final, conclusive and binding upon all persons having any interest in the Plan.

| |

8.4 | Indemnity of Committee |

The Company shall indemnify and hold harmless the members of the Administrative Committee against any and all claims, loss, damage, expense or liability arising from any action or failure to act with respect to this Plan on account of such person's service on the Administrative Committee, except in the case of gross negligence or willful misconduct.

| |

8.5 | Election of Committee After Change in Control |

After a Change in Control, vacancies on the Administrative Committee shall be filled by majority vote of the remaining Administrative Committee members and Administrative Committee members may be removed only by such a vote. If no Administrative Committee members remain, a new Administrative Committee shall be elected by majority vote of the Participants in the Plan immediately preceding such Change in Control. No amendment shall be made to Article VIII or other Plan provisions regarding Administrative Committee authority with respect to the Plan without prior approval by the Administrative Committee.

ARTICLE IX - CLAIMS PROCEDURE

Any person claiming a benefit, requesting an interpretation or ruling under the Plan, or requesting information under the Plan shall present the request in writing to the Administrative Committee, which shall respond in writing within ninety (90) days, unless the Administrative Committee determines that special circumstances prevent

it from ruling within that period, in which case the Administrative Committee shall respond within one hundred eighty (180) days, provided the claimant is provided written notice within the initial ninety day (90) day period of the extension, the reasons it is necessary, and when a decision can be expected.

If the claim or request is denied, the written notice of denial shall state:

(a)The reason for denial, with specific reference to the Plan provisions on which the denial is based.

(b)A description of any additional material or information required and an explanation of why it is necessary.

(c)An explanation of the Plan's claim review procedure, the time limits for submitting and appealing claims, and a statement of the claimant’s right to bring a civil action under ERISA.

Any person whose claim or request is denied may request review by notice given in writing to the Administrative Committee. Such notice must be received by the Administrative Committee within sixty (60) days following the receipt of the denial. The claim or request shall be reviewed by the Administrative Committee which may, but shall not be required to, grant the claimant a hearing. On review, the claimant may have representation, examine pertinent documents, and submit issues and comments in writing.

The decision on review shall normally be made within sixty (60) days after the claim or request is received by the Administrative Committee and shall take into account all comments, documents, records and other information submitted by the claimant, whether or not submitted in connection with the initial claim. If an extension of time (not exceeding an additional 60 days) is required for a hearing or other special circumstances, the claimant shall be notified within the initial sixty day (60) day period of the extension, the reasons it is necessary, and when a decision can be expected.

If the claim or request is denied upon review, the Administrative Committee shall provide the claimant with written notice of denial that includes:

(a)The reason for denial, with specific reference to the Plan provisions on which the denial is based.

(b)A statement that the claimant may access and obtain copies of documents and other relevant information regarding the claim.

(c)A statement of the claimant’s right to bring a civil action under ERISA.

The decision shall be in writing and shall state the reasons and the relevant Plan provisions. All decisions on review shall be final and bind all parties concerned.

ARTICLE X - AMENDMENT AND TERMINATION OF PLAN

10.1 Amendment

(a)The Board may at any time amend the Plan by written instrument subject to subsection (e) below.

(b)The Administrative Committee may adopt any technical, clerical, conforming or clarifying amendment or other amendment or change, provided:

(i)The Administrative Committee deems it necessary or advisable to:

(A)Correct any defect, supply any omission or reconcile any inconsistency in order to carry out

the intent and purposes of the Plan;

(B)Maintain the Plan's status as a "top-hat" plan for purposes of ERISA; or

(C)Facilitate the administration of the Plan;

(ii)The amendment or change does not, without the consent of the Board (or any authorized committee thereof), substantially change the nature or design of the Plan; and

(iii)The amendment or change does not, without the consent of the Board (or any authorized committee thereof), materially increase the cost to the Employer of maintaining the Plan; and

(iv)Any formal amendment adopted by the Administrative Committee shall be in writing, signed by a member of the Committee and promptly reported to the Board.

(c)To the extent permitted under subsection (e) below, amendments may have an immediate, prospective or retroactive effective date.

| |

(d) | Amendments do not require the consent of any Participant or Beneficiary. |

| |

(e) | Amendments are subject to the following limitations: |

(i)Preservation of Account Balance. No amendment shall reduce the amount credited or to be credited to any Account as of the date notice of the amendment is given to Participants.

(ii)Changes in Earnings Rate. If the Plan is amended so that a series of investment options is not used to calculate the Participants' investment gains or losses under the Plan, the rate of earnings to be credited to the Participant's Account shall not be less than the monthly equivalent of the average nominal annual yield on three (3) month Treasury bills for the applicable period.

10.2 Company's Right to Terminate

The Board may at any time partially or completely terminate the Plan if, in its judgment, the tax, accounting or other effects of the continuance of the Plan, or potential payments thereunder would not be in the best interests of Company.

(a)Partial Termination. The Board may partially terminate the Plan by instructing the Administrative Committee not to permit future Deferral Elections. If such a partial termination occurs, the Plan shall continue to operate and be effective with regard to amounts credited prior to the effective date of such partial termination.

(b)Complete Termination. The Board may completely terminate the Plan at any time. If such a complete termination occurs, the Employer shall pay out each Account on termination of the Plan to the extent permitted by Code section 409A. Earnings shall continue to be credited on any unpaid Account balances.

ARTICLE XI - MISCELLANEOUS

11.1 Unfunded Plan

This plan is an unfunded plan maintained primarily to provide deferred compensation benefits for a select group of "management or highly-compensated employees" within the meaning of Sections 20l, 30l and 401 of the Employee Retirement Income Security Act of 1974, as amended ("ERISA"), and therefore is exempt from the provisions of Parts 2, 3 and 4 of Title I of ERISA.

11.2 Unsecured General Creditor

Participants and Beneficiaries shall be unsecured general creditors, with no secured or preferential right to any assets of Employer or any other party for payment of benefits under this Plan. Any property held by Employer for the purpose of generating the cash flow for benefit payments shall remain its general, unpledged and unrestricted

assets. Employer's obligation under the Plan shall be an unfunded and unsecured promise to pay money in the future.

11.3 Trust Fund

At its discretion, the Company may establish one (1) or more trusts, with such trustees as the Board may approve, for the purpose of providing for the payment of benefits owed under the Plan. Although such a trust shall be irrevocable, its assets shall be held for payment to Employer's general creditors in the event of insolvency or bankruptcy. To the extent any benefits provided under the Plan with respect to an Employer's Participants are paid from any such trust, that Employer shall have no further obligation to pay them. If not paid from the trust, such benefits shall remain the obligation solely of that Employer.

11.4 Nonassignability

Neither a Participant nor any other person shall have any right to commute, sell, assign, transfer, pledge, anticipate, mortgage or otherwise encumber, transfer, hypothecate or convey in advance of actual receipt the amounts, if any, payable hereunder, or any part thereof, which are, and all rights to which are, expressly declared to be unassignable and non-transferable. No part of the amounts payable shall, prior to actual payment, be subject to seizure or sequestration for the payment of any debts, judgments, alimony or separate maintenance owed by a Participant or any other person, nor be transferable by operation of law in the event of a Participant's or any other person's bankruptcy or insolvency.

11.5 Not a Contract of Employment

This Plan shall not constitute a contract of employment between Employer and the Participant. Nothing in this Plan shall give a Participant the right to be retained in the service of Employer or to interfere with the right of Employer to discipline or discharge a Participant at any time.

11.6 Protective Provisions

A Participant shall cooperate with Employer by furnishing any and all information requested by Employer in order to facilitate the payment of benefits hereunder, and by taking such physical examinations as Employer may deem necessary and taking such other action as may be requested by Employer.

11.7 Governing Law

The provisions of this Plan shall be construed and interpreted according to the laws of the State of California, except as preempted by federal law.

11.8 Validity

In case any provision of this Plan shall be held illegal or invalid for any reason, said illegality

or invalidity shall not affect the remaining parts hereof, but this Plan shall be construed and enforced as if such illegal and invalid provision had never been inserted herein.

11.9 Gender

The masculine gender shall include the feminine and the singular shall include the plural, except where the context expressly dictates otherwise.

11.10 Notice

Any notice required or permitted under the Plan shall be sufficient if in writing and sent by first-class mail. Such notice shall be deemed as given as of the date of delivery or, if delivery is made by mail, as of the date that is three (3) business days after the mailing date. Mailed notice to the Administrative Committee shall be directed to the Company’s address. Mailed notice to a Participant or Beneficiary shall be directed to the individual’s last known address in Employer's records.

11.11 Successors

The provisions of this Plan shall bind and inure to the benefit of Company and its successors and assigns. The term successors as used herein shall include any corporate or other business entity which shall, whether by merger, consolidation, purchase or otherwise acquire all or substantially all of the business and assets of Company, and successors of any such corporation or other business entity.

APPENDIX A GRANDFATHERED PRE-2005 PLAN PROVISIONS

In accordance with the provisions of Code section 409A, all Account balances that were accrued and vested before January 1, 2005 shall continue to be subject to the terms of the pre-2005 plan provisions, as shown in the attached pre-2005 Plan document, which is incorporated by reference herein and made a part hereof.

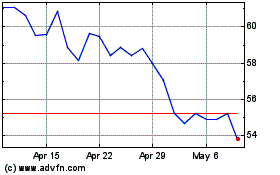

Jack in the Box (NASDAQ:JACK)

Historical Stock Chart

From Mar 2024 to Apr 2024

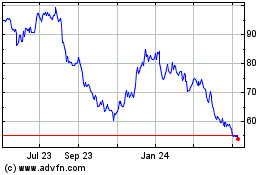

Jack in the Box (NASDAQ:JACK)

Historical Stock Chart

From Apr 2023 to Apr 2024