Innovative Solutions & Support, Inc. (NASDAQ:ISSC) today

announced its financial results for the second quarter of fiscal

2015, ended March 31, 2015.

For the second quarter of fiscal 2015, the Company reported

sales of $5.3 million, compared to sales of $12.5 million for the

second quarter of fiscal 2014. The Company reported a second

quarter 2015 net loss of $0.4 million, or $0.02 per share, compared

to second quarter 2014 net income of $0.8 million, or $0.05 per

share.

Geoffrey Hedrick, Chairman and Chief Executive Officer of

Innovative Solutions & Support, Inc. (“ISSC”), said, “Although

the Company reported a loss in the quarter, we generated positive

cash flow and began to see our marketing efforts result in a

pick-up in proposal activity, which we are optimistic should lead

to an increase in new orders consistent with our past

product/marketing cycle experience. Revenues and earnings in the

second quarter reflect the quarterly variability we anticipate this

entire year. We also sustained our commitment to research and

development in the quarter, which, on a relative basis, was double

that of a year ago. Nevertheless, as a result of strong cost

controls and an improvement in margins relative to a year ago,

second quarter performance enabled us to remain profitable over the

first half of the year. It was a quarter of consolidation during

which we streamlined the organization and solidified our foundation

to move forward with an aggressive sales and marketing effort. As

our contractual engineering commitments to individual customers

begin to wind down, we can increasingly shift resources to new

programs that expand our market and leverage our technological

innovation and price-for-performance value proposition.”

At March 31, 2015, the Company had $15.6 million of cash on hand

and remained debt free. Cash provided by operating activities was

$1.5 million for the quarter, a significant turnaround from cash

used in operating activities of $0.6 million in the second quarter

of fiscal 2014.

Net orders for the quarter were $5.7 million, and backlog at

March 31, 2015 was $6.3 million, up modestly on a sequential basis

from December 31, 2014. Backlog excludes potential future

sole-source production orders from products in development under

the Company’s engineering development contracts, including the

Eclipse 550, the Pilatus PC-24, and the KC-46A, all of which the

Company expects to remain in production for a decade following

completion of their development phases. The Company expects that

these sole-source contracts will add to production sales already in

backlog.

Six Months Results

Total sales for the six months ended March 31, 2015 were $12.0

million compared to sales of $23.6 million for the six months ended

March 31, 2014. Gross margin for the first half of fiscal 2015 were

up from the year ago period, despite an unfavorable product mix

that dropped second quarter margins below those of the first

quarter. Net income for the six months ended March 31, 2015 was

$0.2 million compared to $1.8 million in the comparable year

earlier period. Earnings per share on a diluted basis for the six

months ended March 31, 2015 were $0.01 per share compared to $0.10

per share for the first half of the last fiscal year.

Shahram Askarpour, President of ISSC, commented, "During the

second quarter we continued to appropriately size the organization

for existing and anticipated engineering and production

requirements with the resulting reduction in ongoing operating

expenses. Engineering programs are progressing on schedule, with

the first flight test of the new Pilatus airframe scheduled for

May. We are also aggressively pursuing new programs and

opportunities especially for existing technologies like Flat Panel

Displays, Flight Management Systems and Standby Instruments, which

significantly shorten the production and deployment schedule,

reduce custom engineering requirements, yield attractive margins

and grow the backlog. Together with new opportunities arising from

changing macroeconomic conditions, such as reduced fuel costs, our

goal is to leverage our proprietary price-for-performance

advantages across the military, commercial air transport, and

general aviation markets to optimize returns and build value for

shareholders."

Conference Call

The Company will be hosting a conference call May 7, 2015 at

10:00 AM ET to discuss these results and its business outlook.

Those planning to dial in to the call should dial the following

number and register their names and company affiliations:

1-877-883-0383 and enter the PIN Number 8551127. The call will also

be carried live on the Investor Relations page of the Company web

site at www.innovative-ss.com.

About Innovative Solutions &

Support, Inc.

Headquartered in Exton, Pa., Innovative Solutions & Support,

Inc. (www.innovative-ss.com) is a systems integrator that designs

and manufactures flight guidance and cockpit display systems for

Original Equipment Manufacturers (OEM’s) and retrofit applications.

The company supplies integrated Flight Management Systems (FMS) and

advanced GPS receivers for precision low carbon footprint

navigation.

Certain matters contained herein that are not descriptions of

historical facts are “forward-looking” (as such term is defined in

the Private Securities Litigation Reform Act of 1995). Because such

statements include risks and uncertainties, actual results may

differ materially from those expressed or implied by such

forward-looking statements. Factors that could cause results to

differ materially from those expressed or implied by such

forward-looking statements include, but are not limited to, those

discussed in filings made by the Company with the Securities and

Exchange Commission. Many of the factors that will determine the

Company’s future results are beyond the ability of management to

control or predict. Readers should not place undue reliance on

forward-looking statements, which reflect management’s views only

as of the date hereof. The Company undertakes no obligation to

revise or update any forward-looking statements, or to make any

other forward-looking statements, whether as a result of new

information, future events or otherwise.

Innovative Solutions and Support, Inc.

Consolidated Balance Sheets

March 31, September 30, 2015 2014 (unaudited)

ASSETS

Current assets Cash and cash equivalents $ 15,568,221 $ 15,214,584

Accounts receivable 3,390,952 4,419,863 Unbilled receivables, net

5,859,955 7,425,728 Inventories 4,619,241 5,470,786 Deferred income

taxes 2,871,417 3,245,223 Prepaid expenses and other current assets

875,890 750,108 Total current assets 33,185,676

36,526,292 Property and equipment, net 7,363,487 7,467,663

Non-current deferred income taxes 1,007,361 57,707 Other assets

170,248 110,848 Total assets $ 41,726,772 $

44,162,510

LIABILITIES AND

SHAREHOLDERS' EQUITY

Current liabilities Accounts payable $ 1,039,583 $ 2,402,652

Accrued expenses 2,491,242 4,077,290 Deferred revenue 760,847

526,320 Total current liabilities 4,291,672 7,006,262

Deferred income taxes 133,233 132,999 Other liabilities

11,902 11,725 Total liabilities 4,436,807

7,150,986 Commitments and contingencies

- - Shareholders' equity Preferred stock, 10,000,000

shares authorized, $.001 par value, of which 200,000 shares are

authorized as Class A Convertible stock. No shares issued issued

and outstanding at March 31, 2015 and September 30, 2014 - -

Common stock, $.001 par value: 75,000,000 shares authorized,

18,736,089 and 18,714,449 issued at March 31, 2015 and September

30, 2014, respectively 18,736 18,715 Additional paid-in

capital 51,000,436 50,697,497 Retained earnings 6,914,553 6,684,902

Treasury stock, at cost, 1,846,451 shares at March 31, 2015 and

1,756,807 at September 30, 2014 (20,643,760 )

(20,389,590 ) Total shareholders' equity 37,289,965

37,011,524 Total liabilities and

shareholders' equity $ 41,726,772 $ 44,162,510

Innovative Solutions and Support, Inc.

Consolidated Statements of Operations (unaudited)

Three months ended Six

months ended March 31, March 31, 2015 2014 2015 2014 Net

sales $ 5,286,050 $ 12,495,016 12,010,306 23,600,827 Cost of

sales 3,702,654 8,709,891 7,665,105

16,035,266 Gross profit 1,583,396 3,785,125

4,345,201 7,565,561 Operating expenses: Research and

development 647,473 660,876 1,302,472 1,287,797 Selling, general

and administrative 1,573,888 2,034,609

3,514,379 3,779,500 Total operating expenses

2,221,361 2,695,485 4,816,851 5,067,297 Operating income

(loss) (637,965 ) 1,089,640 (471,650 ) 2,498,264 Interest

income 6,013 5,299 11,898 10,965 Other income 9,407

8,901 20,229 19,368 Income (loss)

before income taxes (622,545 ) 1,103,840 (439,523 ) 2,528,597

Income tax expense (benefit) (258,454 )

319,623 (669,174 ) 735,784 Net income (loss) $

(364,091 ) $ 784,217 $ 229,651 $ 1,792,813 Net income

(loss) per common share: Basic $ (0.02 ) $ 0.05 $ 0.01 $

0.11 Diluted $ (0.02 ) $ 0.05 $ 0.01 $ 0.10 Weighted

average shares outstanding: Basic

16,925,028

16,915,823

16,940,377 16,901,955

Diluted

16,925,028

17,152,678 17,043,735

17,123,512

Innovative Solutions & Support, Inc.Relland Winand,

610-646-0350Chief Financial Officer

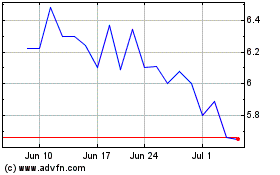

Innovative Solutions and... (NASDAQ:ISSC)

Historical Stock Chart

From Mar 2024 to Apr 2024

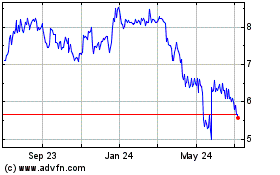

Innovative Solutions and... (NASDAQ:ISSC)

Historical Stock Chart

From Apr 2023 to Apr 2024