SEC Blesses CBOE Stock Exchange's Deal For National Stock Exchange

January 05 2012 - 3:28PM

Dow Jones News

The Securities and Exchange Commission has approved the planned

takeover of the National Stock Exchange Inc. by the CBOE Stock

Exchange LLC, which is partly owned by the Chicago Board Options

Exchange.

Regulators' approval gives a green light for the union of two of

the smallest U.S. stock-trading platforms, which together represent

about 0.6% of daily turnover in domestic securities, according to

data from BATS Global Markets.

The all-electronic CBOE Stock Exchange, or CBSX, had agreed in

late September to buy the NSX, another automated market once known

as the Cincinnati Stock Exchange. Their deal was patterned on the

structure of larger rivals like Nasdaq OMX Group Inc. (NDAQ) and

NYSE Euronext (NYX), both of which run multiple stock exchanges

offering various market models and pricing schemes in a bid to lure

different types of trading.

SEC officials approved rule changes related to the deal in a

letter dated Dec. 29. The approval was the only major regulatory

sign-off needed, according to a spokeswoman for CBOE.

Alongside the Chicago Board Options Exchange, CBSX is owned by a

consortium of brokers and trading firms, including Interactive

Brokers Group Inc. (IBKR), Cowen Group Inc. (COWN), Lime Brokerage

Holdings LLC, Susquehanna International Group LLP, Wolverine

Trading LLC, IMC Group, Allston Trading and Blue Fire Capital LLC.

The CBOE is owned by CBOE Holdings Inc. (CBOE).

The NSX in recent years has worked to develop a specialty in

supplying data on exchange-traded funds and notes, following a

partnership deal in 2006 that saw six Wall Street banks and trading

firms, including Credit Suisse (CS) and Citigroup Inc. (C), take

equity stakes in the company.

-By Jacob Bunge, Dow Jones Newswires; 312 750 4117;

jacob.bunge@dowjones.com

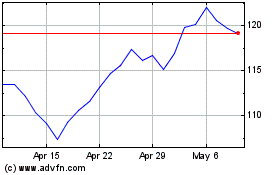

Interactive Brokers (NASDAQ:IBKR)

Historical Stock Chart

From Mar 2024 to Apr 2024

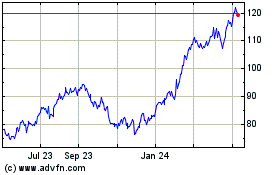

Interactive Brokers (NASDAQ:IBKR)

Historical Stock Chart

From Apr 2023 to Apr 2024