Interactive Brokers' Peterffy Warns On MF Global Customer Transfers

November 03 2011 - 5:04PM

Dow Jones News

Former customers of MF Global Holdings Ltd. (MFGLQ) and the

firms that on Thursday agreed to take on their business face a

potentially messy process, according to the chief executive of

Interactive Brokers Group (IBKR), which nearly bought the

struggling broker-dealer earlier this week.

Interactive Brokers "reluctantly" declined to join in a plan

developed by CME Group Inc. (CME) to divide up MF Global's customer

base and move them over to other firms, due to potential market

exposure and legal risks that could come along with the business,

Peterffy said.

"MF Global put the exchanges and regulators in a very tough

position," Peterffy said in an email.

Regulators and exchanges had held out hope Sunday that MF Global

and its bankers could negotiate a last-ditch sale of the troubled

firm to Interactive Brokers, which operates in similar markets but

has a different clientele. Interactive Brokers early Monday broke

off those discussions after a discrepancy arose in the amount of

customer assets held by MF Global, assets that are required by law

to remain separate from a clearing firm's own funds.

The Commodity Futures Trading Commission on Wednesday figured

the shortfall at $633 million. MF Global has declined comment this

week.

The transfer project was put together in an effort to free up

clients that had trades and collateral stuck with the collapsed

firm since Monday.

"Interactive Brokers was interested in purchasing MF Global

before the issues arose that have been reported in the media, but

we reluctantly decided not to participate in this transfer of the

customer accounts from the futures exchanges," Peterffy said in an

email.

The main issue is that customer positions will be transferred

with "minimum margin" to cover outstanding trades, and without an

extra cash buffer, market movements could soon render the trades

without enough collateral to cover the exposure. That would put the

clearing firm accepting the customer account at "potentially large

risk," Peterffy said.

The group of about 10 firms that have agreed to receive MF

Global customers Thursday will either have to immediately ask their

new clients for more money to cover the trades -- if these

investors can be reached -- or else liquidate the accounts, unless

the firms choose to take on the risk themselves, according to

Peterffy.

"These brokers thus potentially face big market risks,

litigation risk, confusion, complaints and unhappy customers," he

said.

A better solution would have been to liquidate all MF Global

customers' positions to cash on Monday, following the bankruptcy

filing, Peterffy said, though this would have "created its own

problems."

-By Jacob Bunge, Dow Jones Newswires; 312 750 4117;

jacob.bunge@dowjones.com

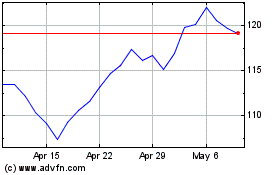

Interactive Brokers (NASDAQ:IBKR)

Historical Stock Chart

From Mar 2024 to Apr 2024

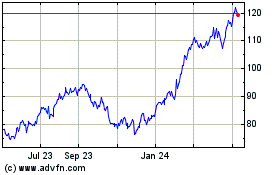

Interactive Brokers (NASDAQ:IBKR)

Historical Stock Chart

From Apr 2023 to Apr 2024