Table of Contents

|

|

|

UNITED STATES |

|

SECURITIES AND EXCHANGE COMMISSION |

|

Washington, D.C. 20549 |

|

|

|

SCHEDULE 14A |

|

|

|

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. ) |

|

|

|

Filed by the Registrant þ |

|

|

|

Filed by a Party other than the Registrant o |

|

|

|

Check the appropriate box: |

|

o |

Preliminary Proxy Statement |

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

þ |

Definitive Proxy Statement |

|

o |

Definitive Additional Materials |

|

o |

Soliciting Material under §240.14a-12 |

|

|

|

|

|

(Name of Registrant as Specified in its Charter) |

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

|

|

Payment of Filing Fee (Check the appropriate box): |

|

þ |

No fee required |

|

o |

Fee computed on table below per Exchange Act Rules 14a-6(i) (1) and 0-11. |

|

|

(1) |

Title of each class of securities to which transaction applies: |

|

|

|

|

|

|

(2) |

Aggregate number of securities to which transaction applies: |

|

|

|

|

|

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

|

|

|

|

(4) |

Proposed maximum aggregate value of transaction: |

|

|

|

|

|

|

(5) |

Total fee paid: |

|

|

|

|

|

|

|

|

o |

Fee paid previously with preliminary materials. |

|

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

Amount Previously Paid: |

|

|

|

|

|

|

(2) |

Form, Schedule or Registration Statement No.: |

|

|

|

|

|

|

(3) |

Filing Party: |

|

|

|

|

|

|

(4) |

Date Filed: |

|

|

|

|

|

|

|

|

|

|

|

|

Table of Contents

HELEN OF TROY LIMITED

Clarendon House

2 Church Street

Hamilton, Bermuda

July 15, 2015

Dear Shareholders:

It is my pleasure to invite you to the 2015 Annual General Meeting of the Shareholders of Helen of Troy Limited. The meeting will be held at 1:00 p.m., Mountain Daylight Time, on Wednesday, August 19, 2015, in the Seminar Room at the El Paso Museum of History at 510 N. Santa Fe, El Paso, Texas 79901. In addition to the business to be transacted at the meeting, members of management will present information about the Company’s operations and will be available to respond to your questions.

We encourage you to help us reduce printing and mailing costs and conserve natural resources by signing up for electronic delivery of our shareholder communications. For more information, see “Electronic Delivery of Shareholder Communications” in the enclosed proxy statement.

At our meeting, we will vote on proposals (1) to set the number of Director positions at eight (or such lower number as shall equal the number of nominees elected as Directors) and elect the eight nominees to our Board of Directors, (2) to provide advisory approval of the Company’s executive compensation, (3) approve the Helen of Troy Limited Amended and Restated 2008 Stock Incentive Plan, (4) to appoint Grant Thornton LLP as the Company’s auditor and independent registered public accounting firm and to authorize the Audit Committee of the Board of Directors to set the auditor’s remuneration, and (5) to transact such other business as may properly come before the meeting. The accompanying Notice of Annual General Meeting of Shareholders and proxy statement contains information that you should consider when you vote your shares. Also, for your convenience, you can appoint your proxy via touch-tone telephone or the internet at:

1-800-690-6903 or WWW.PROXYVOTE.COM

It is important that you vote your shares whether or not you plan to attend the meeting. Please complete, sign, date and return the enclosed proxy card in the accompanying envelope as soon as possible, or appoint your proxy by telephone or on the Internet as set forth above. If you plan to attend the meeting and wish to vote in person, you may revoke your proxy and vote in person at that time. I look forward to seeing you at the meeting. On behalf of the management and directors of Helen of Troy Limited, I want to thank you for your continued support and confidence.

|

|

Sincerely, |

|

|

|

|

|

/s/ Julien R. Mininberg |

|

|

|

|

|

Julien R. Mininberg |

|

|

Chief Executive Officer |

Table of Contents

HELEN OF TROY LIMITED

Clarendon House

2 Church Street

Hamilton, Bermuda

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD AUGUST 19, 2015

Notice is hereby given that the 2015 Annual General Meeting of the Shareholders (the “Annual Meeting”) of Helen of Troy Limited, a Bermuda company (the “Company”), will be held in the Seminar Room at the El Paso Museum of History at 510 N. Santa Fe, El Paso, Texas 79901, on Wednesday, August 19, 2015, at 1:00 p.m., Mountain Daylight Time, for the following purposes:

1. To set the number of Director positions at eight (or such lower number as shall equal the number of nominees elected as Directors) and elect the eight nominees to our Board of Directors;

2. To provide advisory approval of the Company’s executive compensation;

3. To approve the Helen of Troy Limited Amended and Restated 2008 Stock Incentive Plan;

4. To appoint Grant Thornton LLP as the Company’s auditor and independent registered public accounting firm and to authorize the Audit Committee of the Board of Directors to set the auditor’s remuneration; and

5. To transact such other business as may properly come before the Annual Meeting or any adjournment thereof.

The record date for determining shareholders entitled to receive notice of and to vote at the Annual Meeting is June 26, 2015. You are urged to read carefully the attached proxy statement for additional information concerning the matters to be considered at the Annual Meeting.

If you do not expect to be present in person at the Annual Meeting, please complete, sign and date the enclosed proxy and return it promptly in the enclosed postage-paid envelope that has been provided for your convenience. The prompt return of proxies will help ensure the presence of a quorum and save the Company the expense of further solicitation. Also, for your convenience, you can appoint your proxy via touch-tone telephone or internet at:

1-800-690-6903 or WWW.PROXYVOTE.COM

The proxy statement and the Company’s 2015 Annual Report to Shareholders are also available on our hosted website at HTTP://MATERIALS.PROXYVOTE.COM/G4388N. For additional related information, please refer to the “Important Notice Regarding Internet Availability of Proxy Materials” in the enclosed proxy statement.

You are cordially invited and encouraged to attend the Annual Meeting in person.

|

|

/s/ Vincent D. Carson |

|

|

Vincent D. Carson |

|

|

Chief Legal Officer and Secretary |

El Paso, Texas

July 15, 2015

IMPORTANT

WHETHER OR NOT YOU EXPECT TO BE PRESENT AT THE ANNUAL MEETING, PLEASE SUBMIT YOUR PROXY AS SOON AS POSSIBLE. IF YOU DO ATTEND THE ANNUAL MEETING, YOU MAY REVOKE YOUR PROXY AND VOTE IN PERSON. MOST SHAREHOLDERS HAVE THREE OPTIONS FOR SUBMITTING THEIR PROXIES PRIOR TO THE ANNUAL MEETING: (1) VIA THE INTERNET, (2) BY PHONE OR (3) BY MARKING, DATING AND SIGNING THE ENCLOSED PROXY AND RETURNING IT IN THE ENVELOPE PROVIDED. IF YOU HAVE INTERNET ACCESS, WE ENCOURAGE YOU TO APPOINT YOUR PROXY ON THE INTERNET. IT IS CONVENIENT, AND IT SAVES THE COMPANY SIGNIFICANT POSTAGE AND PROCESSING COSTS.

Table of Contents

Proxy Statement Summary

Below are the highlights of important information you will find in this proxy statement. As it is only a summary, please review the complete proxy statement before you vote.

|

Helen of Troy Fiscal Year 2015 Proxy Statement Highlights

|

|

|

HOW TO VOTE:

You can vote by any of the following methods:

· Via the internet by going to WWW.PROXYVOTE.COM and following the instructions at that website.

· Via touch-tone telephone at 1-800-690-6903.

· If you received a proxy card or voting instruction in the mail, by completing, signing, dating and returning the enclosed proxy card in the accompanying envelope as soon as possible.

· If you plan to attend the meeting and wish to vote in person, you may revoke your proxy and vote in person at that time.

|

|

ANNUAL MEETING INFORMATION: |

|

|

|

Date and Time: |

August 19, 2015, at 1:00 PM,

Mountain Daylight Time |

|

|

|

|

|

|

|

|

|

|

Record Date: |

June 26, 2015 |

|

|

|

|

|

|

|

|

|

|

Location: |

El Paso Museum of History

Seminar Room

510 N. Santa Fe

El Paso, Texas 79901 |

|

|

|

VOTING MATTERS:

Proposal |

Voting

Recommendation

of the Board |

|

· Set the number of Director positions at eight (or such lower number as shall equal the number of nominees elected as Directors) and elect the eight nominees to our Board of Directors

|

FOR |

|

· Provide advisory approval of the Company’s executive compensation

|

FOR |

|

· Approve the Helen of Troy Limited Amended and Restated 2008 Stock Incentive Plan

|

FOR |

|

· Appoint Grant Thornton LLP as the Company’s auditor and independent registered public accounting firm and to authorize the Audit Committee of the Board of Directors to set the auditor’s remuneration

|

FOR |

|

· Transact such other business as may properly come before the meeting

|

FOR |

1

Table of Contents

|

BOARD NOMINEES: |

|

Name |

Age |

Director

Since |

Independent

Director |

Compensation

Committee |

Audit

Committee |

Nominating

Committee |

Corporate

Governance

Committee |

|

Julien R. Mininberg

Chief Executive Officer of Helen of Troy |

50 |

2014 |

|

|

|

|

|

|

Timothy F. Meeker

Chairman |

68 |

2004 |

ü |

ü |

|

Chair |

|

|

Gary B. Abromovitz

Deputy Chairman |

72 |

1990 |

ü |

ü |

ü |

ü |

ü |

|

John B. Butterworth |

63 |

2002 |

ü |

|

ü |

|

|

|

Alexander M. Davern |

48 |

2014 |

ü |

|

Chair |

|

ü |

|

Beryl B. Raff |

64 |

2014 |

ü |

ü |

ü |

|

|

|

William F. Susetka |

62 |

2009 |

ü |

Chair |

|

ü |

|

|

Darren G. Woody |

55 |

2004 |

ü |

ü |

|

ü |

Chair |

|

PERFORMANCE HIGHLIGHTS:

The following events summarize our performance highlights for fiscal year 2015:

|

|

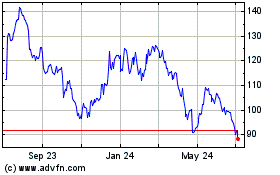

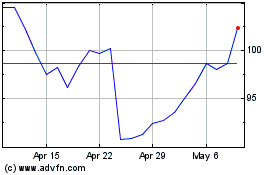

· We had cumulative total shareholder returns of 136 percent and 217 percent over the past three and five fiscal years, respectively, that exceeded our Compensation Peer Group (as described on page 25), the NASDAQ Market Index (the “NASDAQ Market”) and the Dow Jones-U.S. Personal Products, Broad Market Cap, Yearly, and Total Return Index (the “Industry Group”).

|

|

· Following the appointment of Mr. Mininberg as our new Chief Executive Officer, we implemented a new global shared services management structure to increase the level of collaboration across the enterprise, implement best practices across divisions and departments and better leverage our scale.

|

|

· Our return on average equity for fiscal year 2015 was 15 percent, which includes after tax non-cash asset impairment charges of $8.16 million and after tax acquisition-related expenses of $2.31 million.

|

2

Table of Contents

|

CORPORATE GOVERNANCE:

We are committed to a corporate governance approach that ensures mutually beneficial results for the Company and its shareholders. In pursuit of this approach, we have implemented the following policies:

· We maintain separate roles for Chairman and Chief Executive Officer.

· We require majority voting for all Directors.

· We require annual election for all Directors.

· Our Nominating Committee’s policy is to review director qualifications and skill sets in order to maintain a balance between refreshed and seasoned Directors with knowledge of the Company’s business. Consistent with that objective, our Board nominated two directors for election at the 2014 annual general meeting, Ms. Beryl Raff and Mr. Alexander Davern, who had not previously served on the Board.

· We maintain stock retention guidelines for both our directors and executive officers further aligning them with our shareholders.

· We require independent directors to meet in executive session without management present at every regular Board meeting and throughout the year as needed.

· The Board of Directors periodically evaluates the rotation of committee chairs.

|

|

EXECUTIVE COMPENSATION FEATURES:

Overall, our executive compensation program emphasizes performance- and equity-based compensation to align it with shareholder interests and includes other practices that we believe serve shareholder interests such as paying for performance, not providing tax “gross-up” payments and maintaining policies relating to clawbacks of incentive awards and prohibitions on hedging or pledging Company stock. Important features of our executive compensation program include the following: |

|

|

|

Feature |

Terms |

|

Benchmarking; Market Compensation Levels |

· Set the compensation of our Chief Executive Officer at what the Compensation Committee believes is a market level using a benchmark peer group of similarly situated companies against which to compare and assess the Company’s compensation program and performance.

|

|

Rigorous Performance Metrics |

· Established rigorous performance goals based on multiple metrics that are not duplicative between short-term and long-term incentive awards.

|

|

Long-Term Incentives |

· Established multi-year performance periods for long-term incentive awards, with minimum vesting periods for Company equity grants.

|

|

Limited Severance Payments |

· Established limited severance payments to our named executive officers.

|

|

Flexibility to Address Shareholder Feedback |

· Maintained the flexibility to modify our Chief Executive Officer’s compensation package to reflect changes in market trends.

|

3

Table of Contents

HELEN OF TROY LIMITED

Clarendon House

2 Church Street

Hamilton, Bermuda

PROXY STATEMENT

FOR

ANNUAL GENERAL MEETING OF SHAREHOLDERS

August 19, 2015

SOLICITATION OF PROXIES

The accompanying proxy is solicited by the Board of Directors of Helen of Troy Limited (the “Company”) for use at its Annual General Meeting of Shareholders (the “Annual Meeting”) to be held in the Seminar Room at the El Paso Museum of History at 510 N. Santa Fe, El Paso, Texas 79901 on Wednesday, August 19, 2015, at 1:00 p.m., Mountain Daylight Time, and at any adjournment thereof, for the purposes set forth in the accompanying Notice of Annual General Meeting of Shareholders. A proxy may be revoked by filing a written notice of revocation or an executed proxy bearing a later date with the Secretary of our Company any time before exercise of the proxy or by attending the Annual Meeting and voting in person. The proxy statements and form of proxy cards are to be distributed to shareholders on or about July 15, 2015.

If you complete and submit your proxy, the persons named as proxies will vote the shares represented by your proxy in accordance with your instructions. If you submit a proxy card but do not fill out the voting instructions on the proxy card, the persons named as proxies will vote the shares represented by your proxy as follows:

· FOR setting the number of Director positions at eight (or such lower number as shall equal the number of nominees elected as Directors) and electing the eight nominees to the Board of Directors, as set forth in Proposal 1.

· FOR the advisory approval of the Company’s executive compensation, as set forth in Proposal 2.

· FOR, the approval of the Helen of Troy Limited Amended and Restated 2008 Stock Incentive Plan, as set forth in Proposal 3.

· FOR the appointment of Grant Thornton LLP as the auditor and independent registered public accounting firm of the Company and to authorize the Audit Committee of the Board of Directors to set the auditor’s remuneration, as set forth in Proposal 4.

In addition, if other matters are properly presented for voting at the Annual Meeting or any adjournment thereof, the persons named as proxies will vote on such matters in accordance with their judgment. We have not received notice of other matters that may properly be presented for voting at the Annual Meeting. Your vote is important. If you do not vote your shares, you will not have a say in the important issues to be voted upon at the Annual Meeting. To pass, each proposal included in this year’s proxy statement requires an affirmative vote of a majority of the votes cast on such proposal at the Annual Meeting. To ensure that your vote is recorded promptly, please submit your proxy as soon as possible, even if you plan to attend the Annual Meeting in person.

The Annual Report to Shareholders for the year ended February 28, 2015 (“fiscal year 2015”), including financial statements, is enclosed. It does not form any part of the material provided for the solicitation of proxies.

The cost of solicitation of proxies will be borne by the Company. In addition to solicitation by mail, officers and employees of the Company may solicit the return of proxies by telephone, facsimile, electronic mail, personal interview, and other methods of communication.

We will request brokerage houses and other nominees, fiduciaries and custodians to forward soliciting materials to beneficial owners of the Company’s common shares, par value $0.10 per share (the “Common Stock”), for which we will, upon request, reimburse the forwarding expense.

4

Table of Contents

VOTING SECURITIES AND RECORD DATE

The close of business on June 26, 2015, is the record date for determination of shareholders entitled to notice of, and to vote at, the Annual Meeting. As of June 26, 2015, there were 28,616,395 shares of Common Stock issued and outstanding, each entitled to one vote per share.

QUORUM; VOTING

Shareholders may hold their shares either as a “shareholder of record” or as a “street name” holder. If your shares are registered directly in your name with our transfer agent, you are considered the shareholder of record with respect to those shares and this proxy statement is being sent directly to you by the Company. If your shares are held in a brokerage account or by another nominee, you are considered to be the beneficial owner of shares held in “street name,” and these proxy materials, together with a voting instruction card, are being forwarded to you by your broker, trustee or other nominee. As the beneficial owner of the shares, you have the right to direct your broker, trustee or other nominee how to vote.

The presence in person of two or more persons, representing throughout the Annual Meeting, in person or by proxy, at least a majority of the issued shares of Common Stock entitled to vote is necessary to constitute a quorum at the Annual Meeting. Proxies marked as “Withhold Authority” on the election of Directors will be treated as present at the Annual Meeting for purposes of determining the quorum.

Abstentions and broker non-votes are also counted for purposes of determining whether a quorum is present. “Broker non-votes” occur when shares held in street name by a broker or nominee are represented at the Annual Meeting, but such broker or nominee is not empowered to vote those shares on a particular proposal because the broker has not received voting instructions from the beneficial owner.

Under the rules that govern brokers who are voting with respect to shares held by them in a street name, if the broker has not been furnished with voting instructions by its client at least ten days before the meeting, those brokers have the discretion to vote such shares on routine matters, but not on non-routine matters. Routine matters include the appointment of the auditor and related matters, submitted to the shareholders in Proposal 4. Non-routine matters include the election of Directors submitted to shareholders in Proposal 1, the advisory approval of the Company’s executive compensation submitted to shareholders in Proposal 2, and the approval of the Helen of Troy Limited Amended and Restated 2008 Stock Incentive Plan submitted to the shareholders in Proposal 3. As a result, with regard to Proposals 1, 2 and 3, brokers have no discretion to vote shares where no voting instructions are received, and no vote will be cast if you do not vote on that proposal. We therefore urge you to vote on ALL voting items.

If a quorum is present, each nominee for Director receiving a majority of the votes cast (the number of shares voted “for” a director nominee must exceed the number of votes cast “against” that nominee) at the Annual Meeting in person or by proxy shall be elected. The affirmative vote of the majority of the votes cast at the Annual Meeting in person or by proxy shall also be the act of the shareholders with respect to Proposals 3 and 4. Abstentions and broker non-votes are not counted in determining the total number of votes cast and will have no effect with respect to any of the proposals because abstentions and broker non-votes are not considered to be votes cast under the applicable laws of Bermuda.

The advisory vote on executive compensation is non-binding. Although the vote is non-binding, the Compensation Committee and the Board of Directors will review and carefully consider the outcome of the advisory vote to approve the Company’s executive compensation and those opinions when making future decisions regarding executive compensation programs. Notwithstanding the advisory nature of the vote, the resolution in Proposal 2 will be considered passed with the affirmative vote of a majority of the votes cast at the Annual Meeting in person or by proxy.

If within half an hour from the time appointed for the Annual Meeting a quorum is not present in person or by proxy, the Annual Meeting shall stand adjourned to the same day one week later, at the same time and place or to such other day, time or place the Board of Directors may determine, provided that at least two persons are present at such adjourned meeting, representing throughout the meeting, in person or by proxy, at least a majority of the issued shares of Common Stock entitled to vote. At any such adjourned meeting at which a quorum is present or represented, any business may be transacted that might have been transacted at the Annual Meeting as originally called.

5

Table of Contents

ATTENDING THE ANNUAL MEETING

A person is entitled to attend the Annual Meeting only if that person was a shareholder or joint shareholder as of the close of business on the record date or that person holds a valid proxy for the Annual Meeting. If you hold your shares in street name and desire to vote your shares at the Annual Meeting, you must provide a signed proxy directly from the holder of record giving you the right to vote the shares or a letter from the broker or nominee appointing you as their proxy. The proxy card enclosed with this proxy statement is not sufficient to satisfy this requirement. If you hold your shares in street name and desire to attend the Annual Meeting, you must also provide proof of beneficial ownership on the record date, such as your most recent account statement prior to the record date or other similar evidence of ownership. If you are the shareholder of record or hold a valid proxy for the Annual Meeting, your name or the name of the person on whose behalf you are proxy must be verified against the Company’s list of shareholders of record on the record date prior to being admitted to and prior to voting at the Annual Meeting. All shareholders must, if requested by representatives of the Company, present photo identification for admittance. If you do not provide photo identification or comply with the other procedures outlined above upon request, you will not be admitted to the Annual Meeting and/or will not be permitted to vote, as applicable.

PROPOSAL 1: ELECTION OF DIRECTORS

The bye-laws of the Company state that the number of our Directors shall be established by the shareholders from time to time but shall not be less than two. The Company currently has eight members who serve on the Board of Directors. The Nominating Committee has nominated eight candidates for election to the Board of Directors. Accordingly, the Board of Directors recommends that the number of Director positions be set at eight. In the event that less than eight Directors are elected, then the number of Director positions set shall not be eight, but instead shall equal the number of Directors actually elected.

The eight persons named below are the nominees for election as Directors. Each nominee has consented to serve as a Director if elected. One of the eight candidates, Julien R. Mininberg, is the Company’s Chief Executive Officer. The Board of Directors has determined that the remaining seven candidates, Gary B. Abromovitz, John B. Butterworth, Alexander M. Davern, Timothy F. Meeker, Beryl B. Raff, William F. Susetka, and Darren G. Woody are independent Directors as defined in the applicable listing standards for companies traded on the NASDAQ Stock Market LLC (“NASDAQ”). Therefore, the majority of persons nominated to serve on our Board of Directors are independent as so defined. Each Director elected shall serve as a Director until the next annual general meeting of shareholders or until his or her successor is elected or appointed.

Nominees for the Election of Directors

Set forth below are descriptions of the business experience of the nominees for election to our Board of Directors as well as their qualifications:

GARY B. ABROMOVITZ, age 72, has been a Director of the Company since 1990. He is Deputy Chairman of the Board and during his tenure has served as Chair of the Compensation, Nominating, Governance, and Audit Committees. He currently serves as a member of each of those Committees and chairs the executive sessions of the independent Directors. Mr. Abromovitz is an attorney and continues to act as a consultant to several law firms in business related matters. He also has been active for more than thirty years in various real estate development and acquisition transactions. Until August 10, 2012, Mr. Abromovitz served as a Director of Cardio Vascular Bio Therapeutics, Inc.

Mr. Abromovitz provides the Board with a significant leadership role as Deputy Chairman and an in-depth knowledge of the history and operations of the Company. He has a deep understanding of corporate governance and compensation guidelines, as well as experience managing board affairs. Further, Mr. Abromovitz’s background and skill sets as an attorney and his practical business experience provides a unique perspective to the Board.

6

Table of Contents

JOHN B. BUTTERWORTH, age 63, has been a Director of the Company since 2002. Mr. Butterworth is a Certified Public Accountant and a shareholder in the public accounting firm of Weatherley, Butterworth, Macias & Graves P.C. located in El Paso, Texas. Mr. Butterworth has thirty-six years of certified public accounting experience and has been a member of the Company’s Audit Committee for the last thirteen years.

Mr. Butterworth has valuable accounting and tax expertise. Additionally, Mr. Butterworth has gained a deep understanding of the Company’s business that enables him to provide significant insights regarding the Company’s financial and accounting related matters. He brings strategic focus to our Board of Directors and has provided leadership and guidance that have helped drive the Company’s growth.

ALEXANDER M. DAVERN, age 48, was elected to our Board of Directors in August 2014 and chairs the Audit Committee. He also serves as a member of the Corporate Governance Committee. Mr. Davern joined National Instruments Corp., a producer of automated test equipment and application software, in February 1994. Since 2010, he has served as Chief Operating Officer, Chief Financial Officer and Executive Vice President. From 2002 to 2010, he served as Chief Financial Officer and Senior Vice President, Information Technology and Manufacturing Operations. From 1997 to 2002, he was the Chief Financial Officer of National Instruments. Prior to joining National Instruments, Mr. Davern worked both in Europe and in the United States for the international accounting firm of Price Waterhouse, LLP. From 2003 to 2008, Mr. Davern also served on the Board of Directors and as Audit Committee Chairman of Sigma Tel, Inc., a semiconductor manufacturer. In March 2015, Mr. Davern joined the Board of Directors of Cirrus Logic, Inc., a publically traded semiconductor manufacturer. Mr. Davern received a Bachelor’s of Commerce degree and a postgraduate diploma in professional accounting from University College in Dublin, Ireland.

Mr. Davern brings broad experience in business strategy, operations, global accounting, information technology, auditing, and SEC reporting matters. In addition, his experience as a public company executive contributes to his knowledge of corporate governance and public company matters.

TIMOTHY F. MEEKER, age 68, has been a Director of the Company since 2004. In January 2014, Mr. Meeker was appointed as Chairman of the Board. Mr. Meeker is also Chairman of the Nominating Committee and serves as a member of the Compensation Committee. Since 2002, Mr. Meeker has served as President and principal in Meeker and Associates, a privately-held management consulting firm. Mr. Meeker served as Senior Vice President, Sales & Customer Development for Bristol-Myers Squibb, a consumer products and pharmaceutical company, from 1996 through 2002. From 1989 to 1996, Mr. Meeker served as Vice President of Sales for Bristol-Myers’ Clairol Division.

Mr. Meeker has over thirty-seven years of experience in the consumer products industry resulting in extensive general management experience with responsibilities for sales, distribution, finance, human resources, customer service and facilities. In addition, he has a valued perspective on operational matters that is an asset to the Board of Directors. Mr. Meeker has served as a chairman of the National Association of Chain Drug Stores advisory committee, which allows him to bring an extensive understanding of retail mass market sales and marketing to our Board of Directors.

JULIEN R. MININBERG, age 50, has served as our Chief Executive Officer and a member of the Board since March 2014. Prior to his appointment as CEO, Mr. Mininberg had served as the Chief Executive Officer of Kaz Inc. (“Kaz”), a wholly-owned subsidiary of the Company since December 2010. Kaz comprises the Healthcare/Home Environment segment of the Company, which is the Company’s largest and most global business segment. Mr. Mininberg joined Kaz in 2006 serving as Chief Marketing Officer and was appointed President in September 2007, where he served until he was appointed Chief Executive Officer of Kaz in September 2010. Before joining Kaz, Mr. Mininberg worked 15 years at Procter & Gamble Co. (“P&G”), where he spent an equal amount of time in the United States and Latin America serving in a variety of marketing and general management capacities. In the U.S., he worked in brand management, serving as Brand Manager in P&G’s Health Care division. He was promoted to Marketing Director in 1997 and transferred to Latin America, where he served in the Fabric & Home Care division before being promoted to Country Manager for P&G’s Home Care business in Latin America. In 2003, he became Country Manager for Central America overseeing all P&G business in that region. Mr. Mininberg earned his Bachelor’s degree and MBA from Yale University. He currently serves on the Board of Advisors for Yale School of Management and serves as Past President of its global Alumni Association Board of Directors.

Mr. Mininberg brings a 26-year track record of building market-leading multinational brands and organizations, a strategic mindset, operational expertise, and seasoned leadership skills. As our Chief Executive Officer, Mr. Mininberg provides essential oversight of the business and organization, and a link between management and the Board. Mr. Mininberg has extensive experience in global brand building, general management and leading multi-national organizations. He plays a key role in communication with shareholders and leading the Company’s acquisition activities. Additionally, he provides crucial insight to the Board on the Company’s strategic planning and operations.

7

Table of Contents

BERYL B. RAFF, age 64, was elected to our Board of Directors in August 2014 and serves as a member of the Audit and Compensation Committees. Since April 2009, Ms. Raff has served as Chairman and Chief Executive Officer at Helzberg Diamond Shops Inc., a jewelry retailer and a wholly owned subsidiary of Berkshire Hathaway Inc. From 2005 through April 2009, she served as Executive Vice President-General Merchandise Manager for the fine jewelry division of J.C. Penney Company, Inc., a retailer of apparel and home furnishings. From 2001 through 2005, Ms. Raff served as Senior Vice President-General Merchandise Manager for the fine jewelry division of J.C. Penney. Prior to joining J.C. Penney, Beryl served in various leadership roles of Zale Corporation, a national retail jewelry chain, last serving as its Chairman and Chief Executive Officer. Ms. Raff served on the Board of Directors of Group 1 Automotive, Inc., an automotive retail operator, as a member of its Compensation Committee and Chairman of the Governance/Nomination Committee from 2007 to 2015. Since September 2014, Ms. Raff has served on the Board of Directors of The Michaels Stores, Inc., a national retail chain of arts and crafts specialty stores, and is a member of its Audit Committee. Ms. Raff serves on the Advisory Board of Jewelers Circular Keystone, a trade publication and industry authority, and as Chairman of the Board of the Jewelers Vigilance Committee, a non-profit organization focused on legal and regulatory issues facing the jewelry industry. Ms. Raff is also a Director of the NACD Heartland Chapter, a non-profit organization dedicated to excellence in board leadership. From 2001 through February 2011, Ms. Raff served on the Board of Directors, the Corporate Governance Committee and the Compensation Committee (which she chaired from 2008 to 2011) of Jo-Ann Stores, Inc., a national specialty retailer of craft, sewing and decorating products. Ms. Raff graduated from Boston University with a Bachelor of Business Administration degree and from Drexel University with a Masters of Business Administration.

Ms. Raff is well known throughout the retail industry and brings to the Board of Directors her experience and perspective as an outstanding merchant and multi-store retail executive. The Board expects to benefit from Ms. Raff’s extensive knowledge of the retail industry and her valuable insight on how we can best serve our retail partners. Ms. Raff’s current and previous service on other boards also provides important perspectives on key corporate governance matters.

WILLIAM F. SUSETKA, age 62, has been a Director of the Company since 2009. In August 2014, Mr. Susetka was appointed as Chairman of the Compensation Committee. He also serves as a member of the Nominating Committee. Mr. Susetka spent thirty years in marketing and senior management for Clairol, Inc. and Avon Products, Inc. From 1999 to 2001, Mr. Susetka was President of the Clairol U.S. Retail Division, with additional responsibility for worldwide research and development and manufacturing. From 2002 through 2005, Mr. Susetka was President of Global Marketing at Avon Products, Inc. where he led worldwide marketing, advertising and research and development and served on Avon’s Executive Committee. Prior to 1999, he held positions as President of the Clairol International Division and Vice President/General Manager for the Clairol Professional Products Division. He served as a Board Member of the Cosmetics, Toiletry and Fragrance Association from 1999 to 2005 and as a member of the Avon Foundation Board from 2004 to 2005. From October 2005 to January 2006, Mr. Susetka was Chief Operating Officer of Nice Pak Products, Inc., a manufacturer of private labeled pre-moistened wipes and other antiseptic wipes. From 2007 through May 2009, he served as Chief Marketing Officer for the LPGA (Ladies Professional Golf Association). Mr. Susetka currently serves on the LPGA Board of Directors.

Mr. Susetka provides a wealth of global consumer products industry experience and valuable insight to the Board of Directors. Mr. Susetka is also instrumental in helping to monitor and adjust the strategic direction of the Company’s Grooming, Skin Care, and Hair Care products category, provides general guidance regarding consumer brand strategy to the Company’s other product categories, and consulting on related matters to senior management.

DARREN G. WOODY, age 55, has been a Director of the Company since 2004. Mr. Woody chairs the Corporate Governance Committee and also serves as a member of the Compensation and Nominating Committees. Mr. Woody is President and Chief Executive Officer of Jordan Foster Construction, LLC, a construction firm with offices in Austin, Dallas, El Paso, Houston, and San Antonio, Texas and field operations throughout the United States. The firm specializes in military, commercial, multi-family, and highway construction. He has served in this capacity since August of 2000. Previously, Mr. Woody was a partner in the law firm of Krafsur, Gordon, Mott, Davis and Woody P.C., where he specialized in real estate, business acquisitions and complex financing arrangements.

Mr. Woody brings a multi-disciplined perspective to our Board of Directors given his executive leadership and legal experience. This background enables him to provide oversight with regard to many of the Company’s legal matters, significant transactional negotiations and the management of challenging complex projects.

8

Table of Contents

The receipt of a majority of the votes cast (the number of shares voted “for” a director nominee exceeding the number of votes cast “against” that nominee) at the Annual Meeting is required to set the number of Director positions at eight (or such lower number as shall equal the number of nominees elected as Directors) and to elect each of the eight nominees for Director. In the event that any of the Company’s nominees are unable to serve, proxies will be voted for the substitute nominee or nominees designated by our Board of Directors, or will be voted to fix the number of Directors at fewer than eight and for fewer than eight nominees, as the Board may deem advisable in its discretion.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE SHAREHOLDERS VOTE “FOR” EACH OF THE EIGHT NOMINEES NAMED ABOVE.

CORPORATE GOVERNANCE

Corporate Governance. Corporate governance is typically defined as the system that allocates duties and authority among a company’s shareholders, Board of Directors and management. The shareholders elect the Board and vote on extraordinary matters.

Our Corporate Governance Guidelines, as well as our Code of Ethics, and the charters of the Audit Committee, Compensation Committee, Nominating Committee, and Corporate Governance Committee are available under the “Corporate Governance” heading of the investor relations page of our website at the following address: WWW.HOTUS.COM.

Our Company believes that it is in compliance with the corporate governance requirements of the NASDAQ listing standards. The principal elements of these governance requirements as implemented by our Company are:

· affirmative determination by the Board of Directors that a majority of the Directors are independent;

· regularly scheduled executive sessions of independent Directors;

· Audit Committee, Nominating Committee and Compensation Committee comprised of independent Directors and having the purposes and charters described below under the separate committee headings; and

· specific Audit Committee responsibility, authority and procedures outlined in the charter of the Audit Committee.

Independence. The Board of Directors has determined that the following directors and nominees for election at the Annual Meeting are independent Directors as defined in the NASDAQ listing standards: Gary B. Abromovitz, John B. Butterworth, Alexander M. Davern, Timothy F. Meeker, Beryl B. Raff, William F. Susetka and Darren G. Woody. Other than Julien R. Miniberg, the Company’s Chief Executive Officer, each member of the Board, including all the persons nominated to serve on our Company’s Board of Directors, are independent as so defined. The foregoing independence determination of our Board of Directors included the determination that each of these seven nominated Board members, if elected and appointed to the Audit Committee, Compensation Committee or Nominating Committee, or as discussed above, respectively, is:

· independent for purposes of membership on the Audit Committee under Rule 5605(c)(2) of the NASDAQ listing standards, that includes the independence requirements of Rule 5605(a)(2) and additional independence requirements under SEC Rule 10A-3(b);

· independent under the NASDAQ listing standards for purposes of membership on the Nominating Committee; and

· independent under the NASDAQ listing standards for purposes of membership on the Compensation Committee, as a “non-employee director” under SEC Rule 16b-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and an “outside director” as defined in regulations under Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”).

9

Table of Contents

BOARD LEADERSHIP AND THE BOARD’S ROLE IN RISK OVERSIGHT

Separation of Chairman and Chief Executive Officer Roles.

In January 2014, the Board separated the roles of the Chairman and the Chief Executive Officer in order to further diversify and strengthen its leadership structure. We separated these roles in recognition of the differences between the two roles and the value to our Company of having the distinct and different perspectives and experiences of a separate Chairman and Chief Executive Officer. Our Chief Executive Officer is responsible for the day-to-day management and supervision of the business and affairs of our Company (such as reviewing performance and allocating resources as the Company’s chief operating decision maker) and for ensuring that the directives of the Board are carried into effect. Our Chairman, on the other hand, is charged with presiding over all meetings of the Board and our shareholders, and providing advice and counsel to the Chief Executive Officer and our Company’s other officers regarding our business and operations, as well as focusing on oversight and governance matters.

By separating the roles of Chief Executive Officer and Chairman, our Chief Executive Officer is able to focus his time and energy on managing the Company’s complex daily operations, while our Chairman can devote his time and attention to addressing matters relating to the responsibilities of our Board. Our Chief Executive Officer and Chairman have an excellent working relationship, and, with more than 37 years of experience in the consumer products industry, our Chairman is well positioned to provide our Chief Executive Officer with guidance, advice, and counsel regarding our Company’s business, operations and strategy. Moreover, we believe that having a separate Chairman focused on oversight and governance matters allows the Board to more effectively perform its risk oversight role as described below. In connection with the Board’s self-evaluation process, as required by our Corporate Governance Guidelines, the Board evaluates its organization and processes to ensure that the Board is functioning effectively. For the foregoing reasons, we believe that our separate Chief Executive Officer/Chairman structure is the most appropriate and effective leadership structure for our Company and our shareholders.

Deputy Chairman

The Deputy Chairman’s authority and responsibilities include presiding at all meetings of the Board when the Chairman is not present, presiding over all executive sessions of the independent Directors and interacting with committee Chairs to efficiently address Board issues for presentation at Board meetings. The Deputy Chairman also consults with the Chairman regarding Board agendas and outreach to shareholders.

Executive Sessions

Independent Directors regularly meet without management present. In regard to executive sessions, any independent Director has the authority to call meetings of independent Directors.

The Board’s Role on Risk Oversight

The Company’s management is responsible for the ongoing assessment and management of the risks the Company faces, including risks relating to capital structure, strategy, liquidity and credit, financial reporting and public disclosure, operations, and governance. The Board oversees management’s policies and procedures in addressing these and other risks. Additionally, each of the Board’s four committees (the Audit Committee, Compensation Committee, Nominating Committee, and Corporate Governance Committee) monitor and report to the Board those risks that fall within the scope of such committees’ area of oversight responsibility. For example, the full Board directly oversees strategic risks. The Nominating Committee directly oversees risk management relating to Director nomination and independence. The Corporate Governance Committee directly oversees risk management regarding corporate governance. The Compensation Committee directly oversees risk management relating to employee compensation, including any risks of compensation programs encouraging excessive risk-taking. Finally, the Audit Committee directly oversees risk management relating to financial reporting, public disclosure and legal and regulatory compliance. The Audit Committee is also responsible for assessing the steps management has taken to monitor and control these risks and exposures and discussing guidelines and policies with respect to the Company’s risk assessment and risk management.

10

Table of Contents

Management has identified risks, designated associated “risk owners” within the organization and receives appropriate reports from the various risk owners as conditions change. Management works with the Board to communicate risk factors to the Board and to enable the Board to understand the Company’s risk identification, risk management and risk mitigation measures relating to strategic matters. Additional review or reporting of risks is conducted by management as needed or when requested by the Board or a committee. Additionally, the Chairman and Deputy Chairman, working with the Audit Committee and the Corporate Governance Committee, assess corporate governance practices and risks. The Corporate Governance Committee periodically assesses the effectiveness of the Company’s corporate governance policies in light of the applicable listing standards and laws and reports their findings to the Board.

BOARD COMMITTEES AND MEETINGS

Our Board of Directors has four committees: the Audit Committee, the Nominating Committee, the Corporate Governance Committee, and the Compensation Committee. The Independent Directors listed in the table below also meet in executive sessions without management present. The following table shows the composition of these committees as of February 28, 2015 and the number of meetings held during fiscal year 2015:

|

Director |

Executive

Sessions of

Independent

Directors |

Compensation

Committee |

Audit

Committee |

Nominating

Committee |

Corporate

Governance

Committee |

|

Gary B. Abromovitz |

Chair |

M |

M |

M |

M |

|

John B. Butterworth |

M |

|

M |

|

|

|

Alexander M. Davern |

M |

|

Chair |

|

M |

|

Timothy F. Meeker |

M |

M |

|

Chair |

|

|

Beryl B. Raff |

M |

M |

M |

|

|

|

William F. Susetka |

M |

Chair |

|

M |

|

|

Darren G. Woody |

M |

M |

|

M |

Chair |

|

Number of Meetings Held in Fiscal Year 2015 |

4 |

7 |

6 |

4 |

2 |

M = Member as of February 28, 2015

Audit Committee. Our Audit Committee is established in accordance with Section 3(a)(58)(A) of the Exchange Act. The Audit Committee operates under a written charter that has been adopted by the Board of Directors. The primary purposes of this committee are to oversee, on behalf of the Company’s Board of Directors: (1) the accounting and financial reporting processes and integrity of our Company’s financial statements, (2) the audits of our Company’s financial statements and the appointment, compensation, qualifications, independence, and performance of our independent registered public accounting firm, (3) our compliance with legal and regulatory requirements, and (4) the staffing and ongoing operation of our internal audit function. The Audit Committee meets periodically with our Chief Financial Officer and other appropriate officers in the discharge of its duties. The Audit Committee also reviews the content and enforcement of the Company’s Code of Ethics, consults with legal counsel on various legal compliance matters and on other legal matters if those matters could materially affect our financial statements.

The Board of Directors has determined that each of the members of the Audit Committee is independent as previously described. In addition, the Board of Directors determined that Alexander M. Davern qualifies as an “audit committee financial expert” as defined by the SEC in Item 407(d)(5) of Regulation S-K promulgated by the SEC. Additionally, the Board of Directors determined that all of the members of the Audit Committee meet the requirement of the NASDAQ listing standards that each member be able to read and understand fundamental financial statements, including a company’s balance sheet, income statement and cash flow statement.

11

Table of Contents

Compensation Committee. The Compensation Committee operates under a written charter that has been adopted by the Board of Directors. The primary purposes of the committee are to (1) evaluate and approve the corporate goals and objectives set by the Chief Executive Officer (the “CEO”), (2) evaluate the CEO’s performance in light of those goals and objectives, (3) make recommendations to the Board of Directors with respect to non-CEO compensation, incentive compensation plans and equity-based plans, (4) oversee the administration of our incentive compensation plans and equity-based plans, and (5) produce an annual report on executive compensation for inclusion in the Company’s proxy statement. The Board of Directors has determined that the members of this committee are independent as previously described. In addition to formal meetings, the committee also conducted numerous informal telephonic discussions and consulted its legal advisors throughout the year. The Compensation Committee has the independent authority to hire compensation, accounting, legal, or other advisors. For fiscal year 2015, the Compensation Committee retained Pearl Meyer & Partners (“Pearl Meyer”) as its independent compensation consultant. Pearl Meyer works directly with the Compensation Committee (and not on behalf of management) to assist the Compensation Committee in meeting its responsibilities. During fiscal year 2015, Pearl Meyer assisted the Compensation Committee in connection with an analysis of the compensation received by our executive officers, including implementation and evaluation of fiscal year 2015 compensation packages for our Chief Executive Officer, other executive officers and selected senior management. The Compensation Committee has determined that Pearl Meyer has no conflicts of interest relating to its engagement by the Compensation Committee.

Nominating Committee. The Nominating Committee operates under a written charter that has been adopted by the Board of Directors. The primary purposes of the Nominating committee are to (1) recommend to our Board of Directors individuals qualified to serve on our Board of Directors for election by shareholders at each annual general meeting of shareholders and to fill vacancies on the Board of Directors, and (2) implement the Board’s criteria for selecting new Directors. The Nominating Committee also oversees the evaluation of the Board members and seeks to annually review Director qualifications and skill sets with the goal of maintaining fresh perspectives on the Board. The Nominating Committee receives recommendations from its members, other members of the Board of Directors, outside advisors, and consultants for candidates to be considered for the Board. The Nominating Committee receives recommendations from its members or other members of the Board of Directors for candidates to be appointed to committee positions, reviews and evaluates such candidates and makes recommendations to the Board of Directors for nominations to fill or add committee positions.

The Nominating Committee’s current process for identifying and evaluating nominees for Director positions consists of general periodic evaluations of the size and composition of the Board of Directors, applicable listing standards and laws, and other appropriate factors with a goal of maintaining continuity of appropriate industry expertise and knowledge of our Company. The Nominating Committee looks for a number of personal attributes in selecting candidates as specified in the Company’s Corporate Governance Guidelines including: sound reputation and ethical conduct; business and professional activities that are complementary to those of the Company; the availability of time and a willingness to carry out their duties and responsibilities effectively; an active awareness of changes in the social, political and economic landscape; an absence of any conflicts of interest; a level of health that allows for attendance and active contribution to most Board and committee meetings; limited service on other boards; and a commitment to contribute to the Company’s overall performance, placing it above personal interests. The Nominating Committee does not have a diversity policy regarding its selection criteria for determining Director nominees. However, as specified in the Company’s Corporate Governance Guidelines, the Nominating Committee makes efforts to maintain members on the Board who have substantial and direct experience in areas of importance to the Company. Additionally, the Nominating Committee seeks independent Directors who represent a mix of backgrounds and experiences that will enhance the quality of the Board’s deliberations and decisions. The Nominating Committee considers all attributes, business diversity, professional qualifications, and experience of all candidates the committee believes will benefit the Company and increase shareholder value, without regard to gender, race or ethnic background. The Nominating Committee does not assign specific weights to particular criteria, and no particular criterion is necessarily applicable to all prospective nominees.

The Nominating Committee will consider candidates recommended by shareholders. Written suggestions for candidates by shareholders should be delivered for consideration by the Nominating Committee to the Secretary of the Company, Clarendon House, 2 Church Street, Hamilton, Bermuda. Written suggestions for candidates should be accompanied by a written consent of the proposed candidate to serve as a Director if nominated and elected, a description of his or her qualifications and other relevant biographical information. The Nominating Committee may request that the shareholder submitting the proposed nominee furnish additional information to determine the eligibility and qualifications of such candidate. Additionally, any candidate recommended by shareholders must meet the same general requirements outlined in the previous paragraph to be considered for election. Any shareholder recommendation will be considered for nomination as

12

Table of Contents

a Director at the sole discretion of the Nominating Committee. Neither the Board of Directors nor the Nominating Committee is required to include any shareholder nominee recommendation as a proposal in the proxy statement and proxy card mailed to shareholders. Our Company did not receive any such Director nominee recommendations for the Annual Meeting.

In addition, Section 79 of the Companies Act 1981 provides that (i) any number of shareholders representing not less than 5 percent of the total voting power of the shares eligible to vote at a general meeting of shareholders, or (ii) not less than 100 shareholders may propose any resolution which may properly be moved at the next annual general meeting of shareholders. Upon timely receipt of a requisition and compliance with Section 79, we will, at the expense of such shareholder(s), give our other shareholders entitled to receive notice of the next annual general meeting of shareholders notice of the proposed resolution. To be timely, the requisition requiring notice of a resolution must be deposited at our registered office at least six weeks before the next annual general meeting of shareholders. Shareholders satisfying the criteria of Section 79 may also require us to circulate a statement in respect of any matter to come before an annual general meeting of shareholders by requisition deposited at our registered office not less than one week prior to the annual general meeting of shareholders.

Corporate Governance Committee. The primary purposes of the Corporate Governance Committee are to (1) develop, assess and recommend to the Board our corporate governance policies, and (2) evaluate, develop and recommend to the Board succession plans for all of the Company’s senior management. The Corporate Governance Committee works with the Compensation Committee to develop and recommend succession plans to the Board of Directors.

Meetings of Board of Directors and its Committees. The Board of Directors held four regularly scheduled meetings and six other meetings (five of which were telephonic) during fiscal year 2015. Each Board member attended at least 75 percent of the meetings of our Board of Directors and the committee meetings for which they were members. We encourage, but do not require, the members of the Board of Directors to attend annual general meetings. Last year, all of our Directors attended the annual general meeting of shareholders. We expect that all Board members and Director nominees will attend the Annual Meeting.

Committee Rotation

The Board will consider the rotation of committee assignments and of committee chairs at such intervals as the Board determines on the recommendation of the Corporate Governance Committee. Consideration of rotation will seek to balance the benefits derived from continuity and experience, on the one hand, and the benefits derived from gaining fresh perspectives and enhancing Directors’ understanding of different aspects of the Company’s business and enabling functions. The Board approved the rotation of each of the committee chairs in fiscal year 2015.

SHAREHOLDER COMMUNICATIONS TO THE BOARD OF DIRECTORS

Any record or beneficial owner of our shares of Common Stock who has concerns about accounting, internal accounting controls or auditing matters relating to our Company may contact the Audit Committee directly. Any record or beneficial owner of our Common Stock who wishes to communicate with the Board of Directors on any other matter should also contact the Audit Committee. The Audit Committee has undertaken on behalf of the Board of Directors to be the recipient of communications from shareholders relating to our Company. If particular communications are directed to the full Board, independent Directors as a group, or individual Directors, the Audit Committee will route these communications to the appropriate Directors or committees so long as the intended recipients are clearly stated.

Communications intended to be anonymous may be made by calling our national hotline service at 866-210-7649 or 866-210-7650. When calling, please identify yourself as a shareholder of our Company intending to communicate with the Audit Committee. This third party service undertakes to forward the communications to the Audit Committee if so requested and clearly stated. You may also send communications intended to be anonymous by mail, without indicating your name or address, to Helen of Troy, 1 Helen of Troy Plaza, El Paso, Texas, 79912, USA, Attention: Chairman of the Audit Committee. Communications not intended to be made anonymously may be made by calling the hotline number or by mail to that address, including whatever identifying or other information you wish to communicate.

Communications from employees or agents of our Company will not be treated as communications from our shareholders unless the employee or agent clearly indicates that the communication is made solely in the person’s capacity as a shareholder.

13

Table of Contents

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

During fiscal year 2015, none of the members of the Compensation Committee was an officer (or former officer) or employee of the Company, and no executive officer of the Company served on the Compensation Committee (or equivalent), or the Board of Directors of another entity whose executive officer(s) served on the Company’s Compensation Committee or Board.

DIRECTOR COMPENSATION

The following table summarizes the total compensation earned by all non-employee Directors during fiscal year 2015:

|

Director Compensation for Fiscal Year 2015 |

|

|

|

|

|

|

Fees Earned |

|

|

|

|

|

|

|

|

|

|

or Paid |

|

|

Stock |

|

|

|

|

|

|

|

in Cash |

|

|

Awards |

|

|

Total |

|

Name |

|

|

($) |

|

|

($) (3) |

|

|

($) |

|

Gary B. Abromovitz |

|

|

127,500 |

|

|

127,606 |

|

|

255,106 |

|

John B. Butterworth |

|

|

96,000 |

|

|

127,606 |

|

|

223,606 |

|

Alexander M. Davern (1) |

|

|

86,250 |

|

|

50,000 |

|

|

136,250 |

|

Timothy F. Meeker |

|

|

181,750 |

|

|

127,606 |

|

|

309,356 |

|

Beryl B. Raff (1) |

|

|

75,000 |

|

|

50,000 |

|

|

125,000 |

|

William F. Susetka |

|

|

110,250 |

|

|

127,606 |

|

|

237,856 |

|

Adolpho R. Telles (2) |

|

|

50,000 |

|

|

77,606 |

|

|

127,606 |

|

Darren G. Woody |

|

|

98,250 |

|

|

127,606 |

|

|

225,856 |

(1) Joined the Board of Directors on August 26, 2014.

(2) Served on the Board of Directors for the first two fiscal quarters of fiscal year 2015 through August 26, 2014.

(3) The amounts in this column are based on the grant date fair values of $65.99, $58.18, $58.22 and $64.57 per share on March 3, June 2, September 1, and December 1, 2014, respectively, computed in accordance with FASB ASC Topic 718. Each of the restricted stock awards vested on the grant date. With respect to stock awards, approximately 30 percent of the value of the grant is settled with cash in order for the Directors to satisfy any tax liabilities associated with the grant. Further information regarding the awards is included in “Non-Employee Director Equity Compensation Plan.”

During the fiscal year ended February 28, 2015, Julien R. Mininberg, our Chief Executive Officer, was our only Director who was also an employee of the Company. He did not receive any remuneration for his service as a member of the Board of Directors. In August 2014, the Board of Directors adopted new director compensation guidelines effective June 1, 2014 (the “2015 Director Compensation Guidelines”). Because Mr. Telles’ service as a director ended at the 2014 annual general meeting, his compensation was paid under the previous director compensation guidelines, as described below. Under the new general guidelines, Board members received annual compensation for their services in the form of a cash retainer equal to $100,000 and Common Stock valued at $100,000. The grants of Common Stock are made in quarterly equal value installments on the first business day of each fiscal quarter based on fair market value of the Common Stock as of the close of business of the grant date. The Chairman of the Board of Directors will receive an additional $70,000 annually in cash compensation, the Deputy Chairman will receive an additional $20,000 annually in cash compensation, and the Chairperson of each committee of the Board of Directors will receive the following annual cash compensation:

|

Audit Committee |

$15,000 |

|

Compensation Committee |

$15,000 |

|

Nominating Committee |

$5,000 |

|

Governance Committee |

$5,000 |

14

Table of Contents

All other meeting attendance and committee service fees were eliminated.

Prior to the adoption of the 2015 Director Compensation Guidelines, the director compensation guidelines provided that all non-employee Directors receive a quarterly cash retainer of $6,000, a quarterly cash fee of $3,000 for each regular meeting of the Board of Directors attended and a quarterly cash fee of $6,000 for participation in executive sessions. In addition, the previous director compensation guidelines provided that the Deputy Chairman and lead Director each receive a quarterly cash fee of $10,000, each non-chair member of the Audit Committee receive a quarterly cash fee of $6,000, each non-chair member of the Compensation Committee receive a quarterly cash fee of $3,000, each non-chair member of the Corporate Governance Committee receive a quarterly cash fee of $1,500, the Compensation Committee Chairman receive a quarterly cash fee of $5,000, the Corporate Governance Committee Chairman receive a quarterly cash fee of $2,500 and the Audit Committee Chairman receive a quarterly cash fee of $10,000.

In fiscal year 2015, the following cash compensation was paid to our non-employee Directors. Payments for the first quarter of fiscal year 2015 were made under the director compensation guidelines then in effect. Unless otherwise noted, payments for the last three quarters of fiscal year 2015 were made pursuant to the new 2015 Director Compensation Guidelines.

|

Directors Fees Earned or Paid in Cash for Fiscal Year 2015 |

|

|

|

|

|

Chairman |

|

|

|

|

|

|

Board |

Executive |

And Deputy |

Committee |

Committee |

|

|

|

Board |

Meeting |

Session |

Chairman |

Chair |

Member |

|

|

|

Retainers |

Fees |

Fees |

Fees |

Fees |

Fees |

Total |

|

Name |

($) (1) |

($) (2) |

($) (3) |

($) |

($) |

($) (10) |

($) |

|

Gary B. Abromovitz |

81,000 |

3,000 |

6,000 |

25,000 |

(4) |

5,000 |

(6) |

7,500 |

127,500 |

|

John B. Butterworth |

81,000 |

3,000 |

6,000 |

- |

|

- |

|

6,000 |

96,000 |

|

Alexander M. Davern |

75,000 |

- |

- |

- |

|

11,250 |

(7) |

- |

86,250 |

|

Timothy F. Meeker |

81,000 |

3,000 |

6,000 |

86,250 |

(5) |

2,500 |

(8) |

3,000 |

181,750 |

|

Beryl B. Raff |

75,000 |

- |

- |

- |

|

- |

|

- |

75,000 |

|

William F. Susetka |

81,000 |

3,000 |

6,000 |

- |

|

11,250 |

(6) |

9,000 |

110,250 |

|

Adolpho R. Telles |

12,000 |

6,000 |

12,000 |

- |

|

20,000 |

(7) |

- |

50,000 |

|

Darren G. Woody |

81,000 |

3,000 |

6,000 |

- |

|

3,750 |

(9) |

4,500 |

98,250 |

(1) Mr. Telles received retainer payments under the previous director compensation guidelines for his two quarters of service in fiscal year 2015 through the 2014 annual general meeting. All other non-employee Directors received a quarterly cash retainer of $6,000 for the first quarter of fiscal year 2015 and a quarterly cash retainer of $25,000 for all remaining fiscal quarters.

(2) Mr. Telles received cash fees under the previous director compensation guidelines for his two quarters of service in fiscal year 2015 through the 2014 annual general meeting. All other non-employee Directors received a quarterly cash fee of $3,000 for attending the regular meeting of the Board of Directors in the first quarter of fiscal year 2015. Thereafter, they received no cash fees for all remaining quarters of fiscal year 2015.

(3) Mr. Telles received cash fees under the previous director compensation guidelines for his two fiscal quarters of service through the 2014 annual general meeting. All continuing non-employee Directors received a quarterly cash fee of $6,000 for their participation in executive sessions during the first fiscal quarter of fiscal year 2015. Thereafter, they received no cash fees for all remaining quarters of fiscal year 2015.

(4) For his services as Deputy Chairman, Mr. Abromovitz received a quarterly cash fee of $10,000 during the first quarter of fiscal year 2015 and quarterly cash fees of $5,000 for all remaining quarters of fiscal year 2015.

(5) For his services as Chairman of the Board, Mr. Meeker received a quarterly cash fee of $30,000 for the first quarter of fiscal year 2015 and quarterly cash fees of $17,500 for all remaining quarters of fiscal year 2015.

(6) For his services as Chairman of the Compensation Committee, Mr. Abromovitz received a quarterly cash fee of $5,000 during the first quarter of fiscal year 2015. Mr. Susetka succeeded Mr. Abromovitz as Chairman of the Compensation Committee, and received quarterly cash fees of $3,750 for all remaining quarters of fiscal year 2015.

15

Table of Contents

(7) For his services as Chairman of the Audit Committee, Mr. Davern received quarterly cash retainers of $3,750 for the last three quarters of fiscal year 2015. Mr. Telles received cash fees under the previous director compensation guidelines totaling $20,000 for his two quarters of service in fiscal year 2015 as Chairman of the Audit Committee through the 2014 annual general meeting.

(8) For his services as Chairman of the Corporate Governance Committee, Mr. Meeker received a quarterly cash fee of $2,500 during the first quarter of fiscal year 2015. For his services as Chairman of the Nominating Committee, Mr. Meeker received quarterly cash fees of $1,250 for the last three quarters of fiscal year 2015.

(9) For his services as Chairman of the Corporate Governance Committee, Mr. Woody received quarterly cash fees of $1,250 for the last three quarters of fiscal year 2015.

(10) Represents fees paid for the first quarter of service in fiscal year 2015 to each non-chair committee member under the director compensation guidelines then in effect. Each non-chair Audit Committee member received a quarterly cash fee of $6,000, each non-chair Compensation Committee member received a quarterly cash fee of $3,000 and each non-chair Corporate Governance Committee member received a quarterly cash fee of $1,500.

Director Stock Ownership and Compensation Guidelines

The Compensation Committee and the Board of Directors believe that Directors should own and hold Common Stock to further align their interests and actions with the interests of the Company’s shareholders. Accordingly, in June 2008, the Board of Directors adopted stock ownership and compensation guidelines for the Directors. Under the guidelines, the Directors were required to hold shares of the Company’s Common Stock equal in value to at least three times the annual cash retainer for the Directors. The guidelines provided that the stock ownership levels should be achieved by each Director within five years of his or her first appointment to the Board of Directors. To further encourage equity participation, the guidelines provide that equity awards to non-employee Directors either vest over a period of at least three years or are required to be held by the Director until his or her service with the Company ends. Through the date of the 2014 annual general meeting, each then- active Director’s stock ownership in the Company exceeded the guidelines.

In June 2014, upon the recommendation of the Compensation Committee, the Board of Directors adopted revised stock ownership and compensation guidelines for the Directors, which replaced the guidelines described above. These revised guidelines took effect after the 2014 annual general meeting and now require that Directors hold shares of the Common Stock equal in value to at least twice the annual cash retainer for Directors. Because of the increase in the annual cash retainer received by the Directors beginning with the 2014 annual general meeting, these revised guidelines will require higher ownership threshold than under the previously effective guidelines. The revised guidelines provide that equity awards to non-employee Directors vest when granted. Because the effectiveness of the revised guidelines took effect concurrent with the increases in the Director annual cash retainers, the Directors were given five years from the date of the increase to acquire any additional shares needed to comply with the revised guidelines. The Compensation Committee will review stock ownership levels on the first trading day of the calendar year based on the fair market value of the shares on such date.

The Board of Directors also believes that compensation arrangements should be flexible enough to allow the Directors to receive a balanced mix of equity and cash keeping in mind the Board’s guidelines for achieving and maintaining stock ownership. In this respect, the Board of Directors will seek to target Director average compensation at a mix of approximately 50 percent cash and 50 percent equity, not including any annual cash chair fees paid to the chairpersons of the Board committees. Each Director receives approximately 30 percent of the value of the stock grant award in cash in order to pay any tax liabilities associated with the grant.

Non-Employee Director Equity Compensation Plan

At the 2008 annual general meeting of shareholders, the Company’s shareholders approved the Helen of Troy Limited 2008 Non-Employee Directors Stock Incentive Plan (the “2008 Director Plan”). The purpose of the 2008 Director Plan is to (1) aid the Company in attracting, securing, and retaining Directors of outstanding ability and (2) motivate such persons to exert their best efforts on behalf of the Company and its subsidiaries and its affiliates by providing incentives through the granting of awards under the plan. Only non-employee Directors of the Company are eligible to participate in the 2008 Director Plan. Because Julien Mininberg is an employee of the Company, he is not eligible to participate in the 2008 Director Plan.

The 2008 Director Plan is administered by the Compensation Committee of the Board of Directors. The 2008 Director Plan permits grants of restricted stock, restricted stock units and other stock-based

16

Table of Contents