Amended Statement of Ownership (sc 13g/a)

February 09 2016 - 3:47PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13G

Under the Securities Exchange Act of 1934

(Amendment No. 4)

Horizon Bancorp

(Name of Issuer)

Common Stock, no par value

(Title of Class of Securities)

440407104

(CUSIP Number)

December 31, 2015

(Date of Event Which Requires Filing of this Statement)

Check the appropriate box to designate the rule pursuant to which this Schedule is filed:

¨ Rule 13d-1(b)

S Rule 13d-1(c)

¨ Rule 13d-1(d)

|

1

|

NAME OF REPORTING PERSONS

Financial Edge Fund, L.P.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

Not Applicable

|

(a) T

(b) o

|

|

3

|

SEC USE ONLY

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

5

|

SOLE VOTING POWER

0

|

|

6

|

SHARED VOTING POWER

292,313

|

|

7

|

SOLE DISPOSITIVE POWER

0

|

|

8

|

SHARED DISPOSITIVE POWER

292,313

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

292,313

|

|

10

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

T

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

2.4%

|

|

12

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

PN

|

|

1

|

NAME OF REPORTING PERSONS

Financial Edge–Strategic Fund, L.P.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

Not Applicable

|

(a) T

(b) o

|

|

3

|

SEC USE ONLY

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

5

|

SOLE VOTING POWER

0

|

|

6

|

SHARED VOTING POWER

118,146

|

|

7

|

SOLE DISPOSITIVE POWER

0

|

|

8

|

SHARED DISPOSITIVE POWER

118,146

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

118,146

|

|

10

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

T

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

1.0%

|

|

12

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

PN

|

|

1

|

NAME OF REPORTING PERSONS

Goodbody/PL Capital, L.P.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

Not Applicable

|

(a) T

(b) o

|

|

3

|

SEC USE ONLY

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

5

|

SOLE VOTING POWER

0

|

|

6

|

SHARED VOTING POWER

103,695

|

|

7

|

SOLE DISPOSITIVE POWER

0

|

|

8

|

SHARED DISPOSITIVE POWER

103,695

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

103,695

|

|

10

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

T

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

0.9%

|

|

12

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

PN

|

|

1

|

NAME OF REPORTING PERSONS

PL Capital/Focused Fund, L.P.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

Not Applicable

|

(a) T

(b) o

|

|

3

|

SEC USE ONLY

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

5

|

SOLE VOTING POWER

0

|

|

6

|

SHARED VOTING POWER

58,438

|

|

7

|

SOLE DISPOSITIVE POWER

0

|

|

8

|

SHARED DISPOSITIVE POWER

58,438

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

58,438

|

|

10

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

T

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

0.5%

|

|

12

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

PN

|

|

1

|

NAME OF REPORTING PERSONS

PL Capital, LLC

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

Not Applicable

|

(a) T

(b) o

|

|

3

|

SEC USE ONLY

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

5

|

SOLE VOTING POWER

0

|

|

6

|

SHARED VOTING POWER

468,897

|

|

7

|

SOLE DISPOSITIVE POWER

0

|

|

8

|

SHARED DISPOSITIVE POWER

468,897

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

468,897

|

|

10

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

T

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

3.9%

|

|

12

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

PN

|

|

1

|

NAME OF REPORTING PERSONS

PL Capital Advisors, LLC

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

Not Applicable

|

(a) T

(b) o

|

|

3

|

SEC USE ONLY

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

5

|

SOLE VOTING POWER

0

|

|

6

|

SHARED VOTING POWER

572,592

|

|

7

|

SOLE DISPOSITIVE POWER

0

|

|

8

|

SHARED DISPOSITIVE POWER

572,592

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

572,592

|

|

10

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

T

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

4.8%

|

|

12

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

PN

|

|

1

|

NAME OF REPORTING PERSONS

Goodbody/PL Capital, LLC

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

Not Applicable

|

(a) T

(b) o

|

|

3

|

SEC USE ONLY

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

5

|

SOLE VOTING POWER

0

|

|

6

|

SHARED VOTING POWER

103,695

|

|

7

|

SOLE DISPOSITIVE POWER

0

|

|

8

|

SHARED DISPOSITIVE POWER

103,695

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

103,695

|

|

10

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

T

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

0.9%

|

|

12

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

PN

|

|

1

|

NAME OF REPORTING PERSONS

John W. Palmer

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

Not Applicable

|

(a) T

(b) o

|

|

3

|

SEC USE ONLY

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

USA

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

5

|

SOLE VOTING POWER

125

|

|

6

|

SHARED VOTING POWER

572,592

|

|

7

|

SOLE DISPOSITIVE POWER

125

|

|

8

|

SHARED DISPOSITIVE POWER

572,592

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

572,717

|

|

10

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

T

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

4.8%

|

|

12

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

IN

|

|

1

|

NAME OF REPORTING PERSONS

Richard J. Lashley

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

Not Applicable

|

(a) T

(b) o

|

|

3

|

SEC USE ONLY

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

USA

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

5

|

SOLE VOTING POWER

0

|

|

6

|

SHARED VOTING POWER

572,592

|

|

7

|

SOLE DISPOSITIVE POWER

0

|

|

8

|

SHARED DISPOSITIVE POWER

572,592

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

572,592

|

|

10

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

T

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

4.8%

|

|

12

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

IN

|

|

Item 1(a).

|

Name of Issuer:

|

Horizon Bancorp

|

Item 1(b).

|

Address of Issuer’s Principal Executive Offices:

|

515 Franklin Square, Michigan City, Indiana 46360.

|

Item 2(a).

|

Name of Persons Filing:

|

|

|

The parties identified in the list below constitute the “PL Capital Group.”

|

|

●

|

Financial Edge Fund, L.P., a Delaware limited partnership (“Financial Edge Fund”).

|

|

●

|

Financial Edge-Strategic Fund, L.P., a Delaware limited partnership (“Financial Edge Strategic”).

|

|

●

|

PL Capital/Focused Fund, L.P., a Delaware limited partnership (“Focused Fund”).

|

|

●

|

PL Capital, LLC, a Delaware limited liability company and General Partner of Financial Edge Fund, Financial Edge Strategic and Focused Fund (“PL Capital”).

|

|

●

|

PL Capital Advisors, LLC, a Delaware limited liability company and investment advisor to Financial Edge Fund, Financial Edge Strategic, Focused Fund and Goodbody/PL Capital, L.P. (“PL Capital Advisors”).

|

|

●

|

Goodbody/PL Capital, L.P., a Delaware limited partnership (“Goodbody/PL LP”).

|

|

●

|

Goodbody/PL Capital, LLC, a Delaware limited liability company and General Partner of Goodbody/PL LP (“Goodbody/PL LLC”).

|

|

●

|

Richard J. Lashley, as a Managing Member of PL Capital, PL Capital Advisors and Goodbody/PL LLC, and

|

|

●

|

John W. Palmer, as (1) Managing Member of PL Capital, PL Capital Advisors and Goodbody/PL LLC and (2) as an individual, in his inherited IRA.

|

|

|

The joint filing agreement of the members of the PL Capital Group is attached as Exhibit 1 to Amendment No. 1 to the Amended Schedule 13G filed on February 12, 2013.

|

|

Item 2(b).

|

Address of Principal Business Office or, if none, Residence:

|

|

|

The business address of Financial Edge Fund, Financial Edge Strategic, Focused Fund, PL Capital, PL Capital Advisors, Goodbody/PL LP, Goodbody/PL LLC, Mr. Palmer and Mr. Lashley is: c/o PL Capital, 47 E. Chicago Avenue, Suite 328, Naperville, Illinois 60540. Each of Financial Edge Fund, Financial Edge Strategic, Focused Fund, PL Capital, PL Capital Advisors, Goodbody/PL LP and Goodbody/PL LLC are engaged in various interests, including investments.

|

The principal employment of Messrs. Palmer and Lashley is investment management with each of PL Capital, PL Capital Advisors and Goodbody/PL LLC, whose principal business is investments.

|

|

All of the individuals who are members of the PL Capital Group are citizens of the United States.

|

|

Item 2(d).

|

Title of Class of Securities:

|

Common Stock

440407104

|

Item 3.

|

If this statement is filed pursuant to sections 240.13d-1(b), or 240.13d-2(b) or (c), check whether the person filing is a:

|

Item 4. Ownership:

|

|

The following list sets forth the aggregate number and percentage (based on 11,932,887 shares of Common Stock outstanding as reported in the Issuer’s Form 10-Q, as filed on November 9, 2015) of outstanding shares of Common Stock owned beneficially by each reporting person named in Item 2(a):

|

|

Name

|

Shares of Common Stock

Beneficially Owned (Shared Voting and Investment Power for all Shares, Except as Noted)

|

Percentage of Shares of Common Stock Beneficially Owned

|

|

Financial Edge Fund

|

292,313

|

2.4%

|

|

Financial Edge Strategic

|

118,146

|

1.0%

|

|

Focused Fund

|

58,438

|

0.5%

|

|

PL Capital

|

468,897

|

3.9%

(indirect beneficial ownership as general partner of Financial Edge Fund, Financial Edge Strategic and Focused Fund)

|

|

PL Capital Advisors

|

572,592

|

4.8%

(indirect beneficial ownership as investment adviser to Financial Edge Fund, Financial Edge Strategic, Focused Fund and Goodbody/PL LP)

|

|

Goodbody/PL LP

|

103,695

|

0.9%

|

|

Goodbody/PL LLC

|

103,695

|

0.9%

(indirect beneficial ownership as general partner of Goodbody/PL LP)

|

|

John W. Palmer

|

572,717

(has sole voting and investment power over 125 shares that he holds in his own name)

|

4.8%

(indirect beneficial ownership as managing member of PL Capital, PL Capital Advisors and Goodbody/PL LLC; and individual ownership of 125 shares)

|

|

Richard J. Lashley

|

572,592

|

4.8%

(indirect beneficial ownership as managing member of PL Capital, PL Capital Advisors and Goodbody/PL LLC)

|

|

|

PL Capital is the General Partner of Financial Edge Fund, Financial Edge Strategic and Focused Fund. Because Mr. Palmer and Mr. Lashley are the Managing Members of PL Capital, they have the power to direct the affairs of PL Capital. Therefore, PL Capital may be deemed to share with Mr. Palmer and Mr. Lashley voting and dispositive power with regard to the shares of Common Stock held by Financial Edge Fund, Financial Edge Strategic and Focused Fund.

|

|

|

Goodbody/PL LLC is the general partner of Goodbody/PL LP. Because Mr. Palmer and Mr. Lashley are the Managing Members of Goodbody/PL LLC, they have the power to direct the affairs of Goodbody/PL LP. Therefore, Goodbody/PL LLC may be deemed to share with Messrs. Palmer and Lashley voting and dispositive power with regard to the shares of Common Stock held by Goodbody/PL LP.

|

|

|

PL Capital Advisors is the investment advisor to Financial Edge Fund, Financial Edge Strategic, Goodbody/PL LP and Focused Fund. Because Mr. Palmer and Mr. Lashley are the Managing Members of PL Capital Advisors, they have the power to direct the affairs of PL Capital Advisors. Therefore, PL Capital Advisors may be deemed to share with Mr. Palmer and Mr. Lashley voting and dispositive power with regard to the shares of Common Stock held by Financial Edge Fund, Financial Edge Strategic, Goodbody/PL LP, and Focused Fund.

|

|

|

Mr. Palmer has sole voting and investment power over the 125 shares held in his own name.

|

Item 5. Ownership of Five Percent or Less of a Class:

|

|

If this statement is being filed to report the fact that as of the date hereof the reporting person has ceased to be the beneficial owner of more than five percent of the class of securities, check the following T

|

Item 6. Ownership of More than Five Percent on Behalf of Another Person:

|

Item 7.

|

Identification and Classification of the Subsidiary Which Acquired the Security Being Reported on by the Parent Holding Company or Control Person:

|

Item 8. Identification and Classification of Members of the Group:

Item 9. Notice of Dissolution of Group:

Item 10. Certification:

|

|

By signing below I certify that, to the best of my knowledge and belief, the securities referred to above were not acquired and are not held for the purpose of or with the effect of changing or influencing the control of the issuer of the securities and were not acquired and are not held in connection with or as a participant in any transaction having that purpose or effect, other than activities solely in connection with a nomination under Rule 14a-11.

|

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: February 9, 2016

|

FINANCIAL EDGE FUND, L.P.

By: PL CAPITAL, LLC

General Partner

By: /s/ John W. Palmer

John W. Palmer

Managing Member

|

By: /s/ Richard J. Lashley

Richard J. Lashley

Managing Member

|

|

FINANCIAL EDGE-STRATEGIC FUND, L.P.

By: PL CAPITAL, LLC

General Partner

By: /s/ John W. Palmer

John W. Palmer

Managing Member

|

By: /s/ Richard J. Lashley

Richard J. Lashley

Managing Member

|

|

PL CAPITAL/FOCUSED FUND, L.P.

By: PL CAPITAL, LLC

General Partner

By: /s/ John W. Palmer

John W. Palmer

Managing Member

|

By: /s/ Richard J. Lashley

Richard J. Lashley

Managing Member

|

|

GOODBODY/PL CAPITAL, L.P.

By: GOODBODY/PL CAPITAL, LLC

General Partner

By: /s/ John W. Palmer

John W. Palmer

Managing Member

|

By: /s/ Richard J. Lashley

Richard J. Lashley

Managing Member

|

|

GOODBODY/PL CAPITAL, LLC

By: /s/ John W. Palmer

John W. Palmer

Managing Member

|

By: /s/ Richard J. Lashley

Richard J. Lashley

Managing Member

|

|

PL CAPITAL, LLC

By: /s/ John W. Palmer

John W. Palmer

Managing Member

|

By: /s/ Richard J. Lashley

Richard J. Lashley

Managing Member

|

|

PL CAPITAL ADVISORS, LLC

By: /s/ John W. Palmer

John W. Palmer

Managing Member

|

By: /s/ Richard J. Lashley

Richard J. Lashley

Managing Member

|

|

/s/ John W. Palmer

John W. Palmer

|

|

/s/ Richard J. Lashley

Richard J. Lashley

|

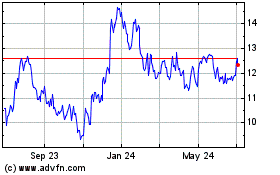

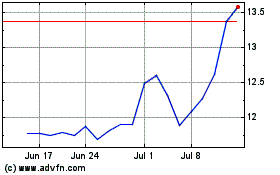

Horizon Bancorp (NASDAQ:HBNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Horizon Bancorp (NASDAQ:HBNC)

Historical Stock Chart

From Apr 2023 to Apr 2024