UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the

Registrant x Filed by

a Party other than the Registrant ¨

Check the appropriate box:

|

|

|

| ¨ |

|

Preliminary Proxy Statement |

|

|

| ¨ |

|

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

| ¨ |

|

Definitive Proxy Statement |

|

|

| ¨ |

|

Definitive Additional Materials |

|

|

| x |

|

Soliciting Material Pursuant to §240.14a-12 |

CASELLA

WASTE SYSTEMS, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Copies to:

|

|

|

| Jeffrey A. Stein

Wilmer Cutler Pickering Hale and Dorr LLP

60 State Street Boston,

Massachusetts 02109 (617) 526-6000 |

|

Keith E. Gottfried, Esq.

Morgan, Lewis & Bockius LLP

1111 Pennsylvania Avenue, N.W.

Washington, DC 20004-2541

(202) 739-5947 |

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

| x |

|

No fee required. |

|

|

| ¨ |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

|

|

|

(1) |

|

Title of each class of securities to which transaction applies:

|

|

|

(2) |

|

Aggregate number of securities to which transaction applies:

|

|

|

(3) |

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing

fee is calculated and state how it was determined):

|

|

|

(4) |

|

Proposed maximum aggregate value of transaction:

|

|

|

(5) |

|

Total fee paid:

|

|

|

| ¨ |

|

Fee paid previously with preliminary materials: |

|

|

| ¨ |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing. |

|

|

|

|

|

(1) |

|

Amount previously paid:

|

|

|

(2) |

|

Form, Schedule or Registration Statement No.:

|

|

|

(3) |

|

Filing Party:

|

|

|

(4) |

|

Date Filed:

|

Casella Waste Systems, Inc., a Delaware corporation (“Casella” or the

“Company”), is filing materials contained in this Schedule 14A with the U.S. Securities and Exchange Commission (“SEC”) in connection with the solicitation of proxies from its stockholders in connection with its

2015 Annual Meeting of Stockholders to be held on Friday, November 6, 2015 and at any and all adjournments or postponements thereof (the “2015 Annual Meeting”). Casella has not yet filed a preliminary or definitive proxy

statement with the SEC in connection with its solicitation of proxies to be used at the 2015 Annual Meeting.

Excerpts from Casella’s Quarterly

Report on Form 10-Q for the Quarter Ended June 30, 2015

Attached hereto as Exhibit 1 are excerpts from Casella’s Quarterly Report on Form

10-Q for the quarter ended June 30, 2015 (the “Form 10-Q”) that was filed with the SEC on July 30, 2015. These excerpts from the Form 10-Q are being filed herewith because they reference the potential solicitation of

proxies from Casella’s stockholders that may be conducted by JCP Investment Management, LLC and its affiliates in an effort to have our stockholders elect their three proposed candidates to our board of directors at the 2015 Annual Meeting.

Important Additional Information And Where To Find It

Casella, its directors and certain of its executive officers are deemed to be participants in the solicitation of proxies from the Company’s stockholders

in connection with the matters to be considered at the Company’s 2015 Annual Meeting of Stockholders. Information regarding the names of the Company’s directors and executive officers and their respective interests in the Company by

security holdings or otherwise can be found in the Company’s Form 10-KT/A for the transition period from May 1, 2014 to December 31, 2014, filed with the SEC on April 30, 2015. To the extent holdings of the Company’s

securities have changed since the amounts set forth in the Company’s Form 10-KT/A for the transition period from May 1, 2014 to December 31, 2014, such changes have been reflected on Initial Statements of Beneficial Ownership on Form

3 or Statements of Change in Ownership on Form 4 filed with the SEC. These documents are available free of charge at the SEC’s website at www.sec.gov. Casella intends to file a proxy statement and

accompanying WHITE proxy card with the SEC in connection with the solicitation of proxies from Casella stockholders in connection with the matters to be considered at the Company’s 2015 Annual Meeting of Stockholders.

Additional information regarding the identity of participants, and their direct or indirect interests, by security holdings or otherwise, will be set forth in the Company’s proxy statement for its 2015 Annual Meeting, including the schedules

and appendices thereto. INVESTORS AND STOCKHOLDERS ARE STRONGLY ENCOURAGED TO READ ANY SUCH PROXY STATEMENT AND THE ACCOMPANYING PROXY CARD AND OTHER DOCUMENTS FILED BY CASELLA WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME

AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION. Stockholders will be able to obtain the Proxy Statement, any amendments or supplements to the Proxy Statement, the accompanying WHITE proxy card, and other

documents filed by Casella with the SEC for no charge at the SEC’s website at www.sec.gov. Copies will also be available at no charge at the Investor Relations section of the Company’s corporate website at www.casella.com, by writing to

the Company’s Corporate Secretary at Casella Waste Systems, Inc., 25 Greens Hill Lane, Rutland, VT 05701, or by calling the Company’s Corporate Secretary at (802) 772-2257.

EXHIBIT 1

Excerpts from Quarterly Report on Form 10-Q of

Casella Waste Systems, Inc. for the Three Months Ended June 30, 2015

Commenting on Contested Solicitation at 2015 Annual Meeting by

JCP Investment Management, LLC and other members of its investor group

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

. . .

Recent Stockholder Events

On April 7, 2015, JCP

Investment Partnership, LP notified us of its intention to nominate Brett W. Frazier, James C. Pappas and Joseph B. Swinbank for election as directors at our 2015 Annual Meeting of Stockholders in opposition to the three candidates that will be

recommended for election by our Board of Directors. According to the Schedule 13D filed with the SEC by JCP Investment Partnership, LP, JCP Single-Asset Partnership, LP, JCP Investment Partners, LP, JCP Investment Holdings, LLC, JCP Investment

Management, LLC and James C. Pappas (collectively, the “JCP Group”) on April 28, 2015, the JCP Group beneficially owns approximately 5.0% of our outstanding Class A common stock. On April 29, 2015, the JCP Group filed

with the SEC soliciting material under Rule 14a-12 of the Exchange Act confirming its intention to file a preliminary proxy statement and an accompanying proxy card with the SEC to solicit votes for the election of the JCP Group’s slate of

three director nominees to our Board of Directors, at our 2015 Annual Meeting of Stockholders. On May 29, 2015, the JCP Group filed with the SEC soliciting material under Rule 14a-12 of the Exchange Act reconfirming such intention.

Risk Factor Related To Possible Proxy Contest

Proxy contests threatened or commenced against us could be disruptive and costly and the possibility that activist shareholders may wage proxy contests

or gain representation on or control of our Board of Directors could cause uncertainty about the strategic direction of our business.

On

April 7, 2015, JCP Investment Partnership, LP notified us of its intention to nominate Brett W. Frazier, James C. Pappas and Joseph B. Swinbank for election as directors at our 2015 Annual Meeting of Stockholders in opposition to the three

candidates that will be recommended for election by our Board of Directors. According to the Schedule 13D filed with the SEC by JCP Investment Partnership, LP, JCP Single-Asset Partnership, LP, JCP Investment Partners, LP, JCP Investment Holdings,

LLC, JCP Investment Management, LLC and James C. Pappas (collectively, the “JCP Group”) on April 28, 2015, the JCP Group beneficially owns approximately 5.0% of our outstanding Class A common stock. On April 29, 2015, the

JCP Group filed with the SEC soliciting material under Rule 14a-12 of the Exchange Act confirming its intention to file a preliminary proxy statement and an accompanying proxy card with the SEC to solicit votes for the election of the JCP

Group’s slate of three director nominees to our Board of Directors, at our 2015 Annual Meeting of Stockholders. On May 29, 2015, the JCP Group filed with the SEC soliciting material under Rule 14a-12 of the Exchange Act reconfirming such

intention.

If the JCP Group pursues a proxy contest or other actions at the 2015 Annual Meeting of Stockholders to elect directors other than those

recommended by our Board of Directors, or takes other actions that contest or conflict with our strategic direction, any such actions could have an adverse effect on us because:

| |

• |

|

responding to proxy contests and other actions by activist shareholders such as the JCP Group can be costly and time-consuming, disrupt our operations, and divert the attention of our management and employees away from

their regular duties and the pursuit of our business strategies; |

| |

• |

|

perceived uncertainties as to our future direction as a result of changes to composition of our board may lead to the perception of a change in the direction of the business, instability or lack of continuity which may

be exploited by our competitors, cause concern to our current or potential customers, may result in the loss of potential business opportunities and make it more difficult to attract and retain qualified personnel and business partners and may

affect our relationships with vendors, customers and other third parties; |

| |

• |

|

these types of actions could cause significant fluctuations in our stock price based on temporary or speculative market perceptions or other factors that do not necessarily reflect the underlying fundamentals and

prospects of our business; and |

| |

• |

|

if individuals are elected to our Board of Directors with a specific agenda, it may adversely affect our ability to effectively implement our business strategy and create additional value for our shareholders.

|

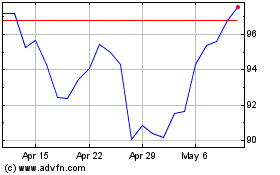

Casella Waste Systems (NASDAQ:CWST)

Historical Stock Chart

From Mar 2024 to Apr 2024

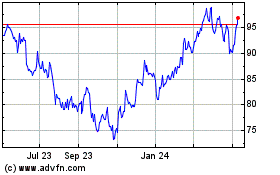

Casella Waste Systems (NASDAQ:CWST)

Historical Stock Chart

From Apr 2023 to Apr 2024