UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): November 19, 2014

Corinthian Colleges, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

0-25283 |

|

33-0717312 |

|

(State or other jurisdiction |

|

(Commission |

|

(I.R.S. Employer |

|

of incorporation) |

|

File Number) |

|

Identification No.) |

|

6 Hutton Centre Drive, Suite 400, Santa

Ana, California |

|

92707 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (714) 427-3000

Not Applicable

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01. Entry into a Material Definitive Agreement.

As previously disclosed in a Current Report on Form 8-K filed with the U.S. Securities and Exchange Commission on July 7, 2014, Corinthian Colleges, Inc. (the “Company”) entered into an Operating Agreement (the “Operating Agreement”) with the U.S. Department of Education (“ED”) that became effective on July 8, 2014, and that, among other things, required the Company to teach out and close 12 of its schools and pursue selling the remainder of its Title IV-eligible schools.

On November 19, 2014, the Company and various of the Company’s direct and indirect subsidiaries (together with the Company, the “Sellers”) entered into an Asset Purchase Agreement (the “Purchase Agreement”) with Zenith Education Group, Inc., a nonprofit Delaware corporation (“Purchaser”), whose sole member is ECMC Group, Inc., a nonprofit Delaware corporation (“ECMC”), and ECMC, as a guarantor of Purchaser’s obligations under the Purchase Agreement.

Pursuant to the terms of the Purchase Agreement, Purchaser has agreed to purchase certain assets (the “Purchased Assets”) used in the Everest Plus Business (as defined below) and assume certain liabilities (the “Assumed Liabilities”) for total cash consideration of $24 million, subject to certain closing adjustments, including for working capital and deferred revenue. At the closing of the acquisition and after the closing adjustments relating to working capital and deferred revenue, the purchase price will be distributed as follows: (1) $8 million will be placed in escrow in order to secure potential indemnification obligations of the Sellers to Purchaser, (2) $0.5 million will be placed in escrow in order to secure potential working capital adjustment obligations of the Sellers to Purchaser, (3) a total of $12 million will be paid to ED, and (4) any remainder will be paid to the Company.

The Purchased Assets include, subject to certain limitations, all of the Sellers’ right, title and interest in and to all of the assets, properties, and rights of the Sellers that are used in the operation of 56 of the Sellers’ Everest and WyoTech campuses as well as Everest online programs. In addition, Purchaser has agreed to continue and conclude the teach-out process at the 12 schools that are in the process of being taught out and closed pursuant to the Operating Agreement. Collectively, the 56 schools and the 12 teach-out schools (collectively, the “Everest Plus Business”) constitute all of the Sellers’ U.S.-based Everest and WyoTech campuses located outside of California and serve more than 39,000 students. Excluded from the Purchased Assets, among other things, are the Everest and WyoTech schools operated by the Sellers in the state of California.

The Assumed Liabilities include, subject to certain limitations, the ordinary course operating liabilities of the Sellers that relate to the operation of the Everest Plus Business. Excluded from the Assumed Liabilities, among other things, are the Sellers’ liabilities relating to private student loans, litigation, and indebtedness.

2

The Purchase Agreement includes customary representations and warranties of the Sellers and Purchaser. The Purchase Agreement also includes certain covenants of the Sellers and Purchaser, including: (1) that the Sellers operate the Everest Plus Business in the ordinary course of business as presently conducted until the closing of the acquisition; (2) that the Sellers and Purchaser cooperate and use their respective commercially reasonable best efforts to negotiate with the lessors under the Assumed Leases and counterparties to the Assumed Contracts the terms by which Purchaser would assume those Assumed Leases and Assumed Contracts (and permitting Purchaser to exclude contracts from the transaction if so requested by Purchaser, subject to certain limitations); (3) that, at Purchaser’s request, the Sellers change the name of any Seller entity (other than the Company); (4) that Purchaser replace certain letters of credit and surety bonds held by the Sellers in connection with the Sellers’ operation of the Everest Plus Business and the Purchased Assets; (5) that the Company provide Purchaser with cash flow projections on a weekly basis between signing and closing of the Purchase Agreement; (6) that the Sellers terminate the employment of, and Purchaser offer employment to, the Sellers’ employees who work in or provide services with respect to the Everest Plus Business (subject to a limited right of Purchaser to exclude certain employees), for substantially equivalent positions and on substantially equivalent base compensation; and (7) that Purchaser provide a repository for the books and records of certain current and former institutions of the Sellers.

The closing of the acquisition is conditioned upon certain closing conditions, including: (1) confirmation that stockholder approval is not required to consummate the acquisition, or the occurrence of a foreclosure on the Purchased Assets by the Sellers’ lenders that allows Purchaser to acquire the Purchased Assets without impairing Title IV eligibility; (2) the receipt of specified educational regulatory approvals and consents, including receipt of pre-acquisition review notices from ED; (3) that the IRS has approved Purchaser’s request for tax-exempt status; (4) that Purchaser receive assurances satisfactory to it from each of ED, the United States Department of Justice, the Consumer Financial Protection Bureau (“CFPB”), and the Office of the Attorney General for the State of Iowa that Purchaser will not be held responsible for or be made subject to any claims or liabilities for any pre-closing obligations of the Company or its subsidiaries with respect to Purchaser’s proposed post-closing operation of the Everest Plus Business; (5) that the Sellers withdraw accreditation by the Accrediting Council for Independent Colleges and Schools with respect to any schools operated by the Sellers outside of the United States that are accredited as branch campuses or additional campuses of any school to be acquired by Purchaser; (6) in the case of Purchaser, the absence of any change or event that would reasonably be expected to result in a material adverse effect with respect to the Everest Plus Business, including any change or proposed change in any educational law (including Title IV); (7) in the case of Purchaser, the receipt of certain third-party consents; (8) in the case of Purchaser, that there be no actions that allege a violation of any educational law, any law for the protection of consumers, or the federal False Claims Act that would increase the Assumed Liabilities by $5 million or more or that otherwise could reasonably be expected to materially increase the potential liability of Purchaser from the consummation of the acquisition; (9) in the case of Purchaser, that the Sellers have completed, and each applicable educational agency shall have approved, a reorganization of the designations of certain of the schools to be acquired by Purchaser as main campuses, branch campuses or additional locations (including revised OPEID

3

numbers from ED); (10) in the case of Purchaser, in the event that the purchase price calculation, after adjustments for working capital and deferred revenue, results in a negative amount, that the Sellers have taken steps to assure that the Sellers will pay such amount to Purchaser at closing; and (11) in the case of the Sellers, that the Sellers have received any required consent of the lenders under its credit agreement.

The Purchase Agreement provides for the option of Purchaser to consummate the acquisition by means of multiple closings to the extent applicable pre-closing educational consents have not been obtained for 10 or fewer of the schools to be acquired by Purchaser. In the event this option is exercised, the full purchase price would be paid at the initial closing, and, subject to continued satisfaction of the closing conditions, subsequent closings would occur for any additional schools for which applicable pre-closing educational consents are obtained within 90 days after the initial closing.

Subject to certain exceptions and other provisions, each party has agreed to indemnify the other for breaches of representations and warranties, breaches of covenants and certain other matters. The indemnification period for representations and warranties is 18 months following the closing, with the exception of certain specified representations and warranties that survive for longer periods or indefinitely. With certain exceptions, the Sellers’ aggregate liability for claims relating to representations and warranties is capped at $8 million.

Concurrent with the closing of the acquisition, Purchaser and the Sellers will enter into certain ancillary agreements, including an escrow agreement, a transition services agreement pursuant to which Purchaser will provide certain services to the Sellers, and license agreements relating to the Sellers’ continued use for a period of time of the Everest and WyoTech names and related trademarks and the curriculum owned by the Sellers and included in the Purchased Assets.

The Purchase Agreement contains certain termination rights of the Sellers and Purchaser, including: (1) by mutual written consent of Purchaser and the Sellers; (2) by the Sellers or Purchaser if the acquisition is not consummated by January 5, 2015, if the terminating party is not in material breach of the Purchase Agreement; (3) by the Sellers or, in certain instances, Purchaser, if one or more of the closing conditions will not be satisfied or waived prior to January 5, 2015; (4) by the Sellers, if the Company’s board of directors determines in good faith after consultation with counsel that an insolvency proceeding of one or more of the Sellers is advisable and in the best interests of the Company; (5) by the Sellers and Purchaser, if the Higher Education Act is amended on or before December 31, 2014 such that the Sellers may file for Chapter 11 bankruptcy without resulting in the schools operated by the Company or its subsidiaries losing eligibility for Title IV program participation (in which event, subject to the Sellers’ and Purchaser’s respective fiduciary obligations to their entities, the Sellers and Purchaser would seek expedited consummation of a transaction in form and substance substantially similar (and no less economically beneficial to the Sellers) to that contained in the Purchase Agreement for the Sellers to sell the Purchased Assets to Purchaser pursuant to sections 363(b) and 365 of the bankruptcy code); (6) by Purchaser, if the Sellers have not provided Purchaser on or before December 8, 2014 with a written plan that is reasonably achievable by the Sellers pursuant to which the Sellers will be able to continue to operate the Everest Plus Business outside of Chapter 11 bankruptcy until January 5, 2015 and pay to Purchaser any amounts payable by the Sellers at the closing, or (7) by Purchaser, upon entry of an order for relief in any Chapter 11 bankruptcy of any Seller (other than in the event described in item (5) of this sentence).

4

The foregoing description of the Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Purchase Agreement.

Safe Harbor

Certain statements in this Current Report on Form 8-K may be deemed to be forward-looking statements under the Private Securities Litigation Reform Act of 1995. The Company intends that all such statements be subject to the “safe-harbor” provisions of that Act. Such statements include, but are not limited to, those regarding the closing of the transactions contemplated by the Purchase Agreement. Many factors may cause the Company’s actual results to differ materially from those discussed in any such forward-looking statements or elsewhere, including: delays in or failure to satisfy required closing conditions in the Purchase Agreement, including the receipt of required regulatory approvals; failure to consummate or delay in consummating the transactions contemplated by the Purchase Agreement for other reasons, including the failure by the Company to obtain and maintain the necessary liquidity to operate its business until the closing of the transactions contemplated by the Purchase Agreement; the potential for further action by ED to limit the Company’s ability to receive regular disbursements of Title IV to fund its operations; the Company’s possible inability to comply with the terms of the Operating Agreement; the Company’s effectiveness in its regulatory and accreditation compliance efforts; the outcome of ongoing reviews and inquiries by accrediting, state and federal agencies, including ED, various attorneys general, and the CFPB; the outcome of pending litigation against the Company, including the civil complaints filed by the CFPB and by certain state attorneys general; the uncertainty of counterparty decisions in the waiver of events of default in the Company’s credit agreement; and the other risks and uncertainties described in the Company’s filings with the U.S. Securities and Exchange Commission. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Item 8.01. Other Events.

On November 20, 2014, the Company issued a press release announcing its entry into the Purchase Agreement. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit No. |

|

Description |

|

99.1 |

|

Press Release of Corinthian Colleges, Inc. dated November 20, 2014. |

5

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

CORINTHIAN COLLEGES, INC. |

|

|

|

|

|

|

|

Date: November 20, 2014 |

By: |

/s/ Stan A. Mortensen |

|

|

|

Stan A. Mortensen |

|

|

|

Executive Vice President and |

|

|

|

General Counsel |

6

Exhibit 99.1

Contacts:

|

Investors: |

Anna Marie Dunlap |

|

|

SVP, Corporate Communications/Investor Relations |

|

|

714-424-2678 |

|

|

|

|

Media: |

Kent Jenkins Jr. |

|

|

Vice President, Public Affairs Communications |

|

|

202-682-9494 |

Corinthian Colleges Enters into Agreement to Sell 56 Everest and WyoTech Campuses to Nonprofit ECMC Group

SANTA ANA, Calif., November 20, 2014 (Globe Newswire) — Corinthian Colleges Inc. (Nasdaq: COCO) today announced that it has signed a definitive agreement with Zenith Education Group, Inc. (Zenith), an affiliate of ECMC Group, Inc. (ECMC Group) under which Zenith will acquire 56 Everest and WyoTech campuses in 17 states as well as online programs. Under the agreement Zenith will also acquire 12 schools that are currently being taught out and closed, and will continue the teach-out process until complete. In total, the schools being purchased represent all of Corinthian’s U.S.-based Everest and WyoTech campuses located outside of California, serving more than 39,000 students.

The acquisition is expected to close in January 2015, subject to regulatory approvals and other conditions. For more detail about the agreement, please refer to the Company’s 8-K filed today with the Securities and Exchange Commission. [http://investors.cci.edu/sec.cfm]

ECMC Group is a nonprofit corporation with a mission to help students succeed. All ECMC Group companies work to fulfill this mission through product and service support and through the philanthropic activities of the ECMC Foundation. Educational Credit Management Corporation, a nonprofit affiliate of ECMC Group, is one of the largest student loan guaranty agencies in the United States. With Zenith’s purchase of Everest and WyoTech schools, ECMC Group plans to create the largest system of nonprofit career schools in the country.

“Everest and WyoTech students will benefit greatly from ECMC Group’s commitment to students and its goal of making a positive difference in career education,” said Jack Massimino, Chairman and CEO of Corinthian Colleges. “ECMC will focus significant resources on student programs and services and enhance the future prospects of Everest and WyoTech.”

Corinthian entered into an Operating Agreement with the Department effective on July 8, 2014, under which Corinthian agreed to wind down and close 12 schools and offered to sell the rest of its U.S. schools, including online programs.

Corinthian also owns Heald College, which has 12 campuses in three Western states; 13 Everest and WyoTech campuses in California; and 14 Everest campuses in Ontario, Canada. Collectively, these 39 schools serve approximately 20,000 students. Corinthian expects to continue to operate these schools until it finds suitable buyers for them.

“We are grateful to the thousands of Corinthian employees who in recent months have done remarkable work during extremely challenging circumstances,” Massimino said. “Their commitment to our students has been nothing short of inspiring.”

About Corinthian

Corinthian offers post-secondary education through its Everest, Heald College and WyoTech campuses, as well as online. Program areas include healthcare, business, criminal justice, transportation technology and maintenance, construction trades and information technology.

Safe Harbor

Certain statements in this press release may be deemed to be forward-looking statements under the Private Securities Litigation Reform Act of 1995. Corinthian intends that all such statements be subject to the “safe-harbor” provisions of that Act. Such statements include, but are not limited to, those regarding the closing of the transactions contemplated by the purchase agreement entered into with Zenith. Many factors may cause Corinthian’s actual results to differ materially from those discussed in any such forward-looking statements or elsewhere, including: delays in or failure to satisfy required closing conditions in the purchase agreement, including the receipt of required regulatory approvals; failure to consummate or delay in consummating the transactions contemplated by the purchase agreement for other reasons, including the failure by Corinthian to obtain and maintain the necessary liquidity to operate its business until the closing of the transactions contemplated by the purchase agreement; the potential for further action by the Department to limit Corinthian’s ability to receive regular disbursements of Title IV to fund its operations; Corinthian’s possible inability to comply with the terms of the Operating Agreement; Corinthian’s effectiveness in its regulatory and accreditation compliance efforts; the outcome of ongoing reviews and inquiries by accrediting, state and federal agencies, including the Department, various attorneys general, and the Consumer Financial Protection Bureau (CFPB); the outcome of pending litigation against Corinthian, including the civil complaints filed by the CFPB and by certain state attorneys general; the uncertainty of counterparty decisions in the waiver of events of default in Corinthian’s credit agreement; and the other risks and uncertainties described in Corinthian’s filings with the U.S. Securities and Exchange Commission. Corinthian undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

###

LIST OF CAMPUSES BEING SOLD TO ECMC

|

State |

|

Campuses |

|

Teach-out

Campuses |

|

Arizona |

|

Mesa

Phoenix |

|

|

|

Colorado |

|

Aurora

Colorado Springs Thornton |

|

|

|

Florida |

|

Brandon

Daytona

Jacksonville

Lakeland

Melbourne

Orlando N

Orlando S

Orange Park

Pinellas (Largo)

Pompano Beach

Tampa |

|

|

|

Georgia |

|

Atlanta Greenbriar

Jonesboro

Marietta

Norcross |

|

|

|

Illinois |

|

Burr Ridge

Bedford Park

Melrose Park

Merrionette Park

Skokie |

|

|

|

Indiana |

|

|

|

Merrillville |

|

Maryland |

|

|

|

Silver Spring |

|

Massachusetts |

|

|

|

Chelsea |

|

Michigan |

|

Dearborn

Detroit

Southfield |

|

Grand Rapids

Kalamazoo |

|

Minnesota |

|

|

|

Eagan |

|

Missouri |

|

Kansas City

Springfield |

|

St. Louis |

|

Nevada |

|

Henderson |

|

|

|

New Jersey |

|

South Plainfield |

|

|

|

New York |

|

Rochester |

|

|

|

Ohio |

|

Columbus |

|

|

|

Oregon |

|

Portland

Tigard |

|

|

|

Pennsylvania |

|

Blairsville

Pittsburgh |

|

Bensalem |

|

Texas |

|

Arlington (Mid Cities)

Austin

Bissonnet

Dallas

Fort Worth South

Greenspoint

Houston Hobby

San Antonio |

|

Fort Worth North |

|

Utah |

|

|

|

Salt Lake City |

|

Virginia |

|

Chesapeake

Newport News

Woodbridge |

|

Tysons Corner |

|

Washington |

|

Bremerton

Everett

Renton

Seattle

Tacoma

Vancouver |

|

|

|

West Virginia |

|

|

|

Cross Lanes |

|

Wyoming |

|

Laramie |

|

|

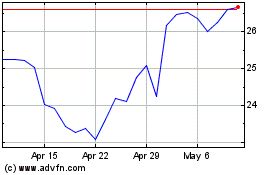

Vita Coco (NASDAQ:COCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

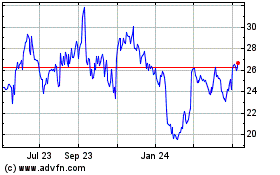

Vita Coco (NASDAQ:COCO)

Historical Stock Chart

From Apr 2023 to Apr 2024