Current Report Filing (8-k)

October 03 2014 - 5:15PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

|

|

Date of Report (Date of Earliest Event Reported): |

|

September 29, 2014 |

Corinthian Colleges, Inc.

__________________________________________

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware |

0-25283 |

33-0717312 |

|

_____________________

(State or other jurisdiction |

_____________

(Commission |

______________

(I.R.S. Employer |

|

of incorporation) |

File Number) |

Identification No.) |

|

|

|

|

|

6 Hutton Centre Drive, Suite 400, Santa Ana, California |

|

92707 |

|

_________________________________

(Address of principal executive offices) |

|

___________

(Zip Code) |

|

|

|

|

|

Registrant’s telephone number, including area code: |

|

(714) 427-3000 |

Not Applicable

______________________________________________

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 3.01. Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On September 29, 2014, Corinthian Colleges, Inc. (the “Company”) received a letter from The NASDAQ Stock Market (“Nasdaq”) stating that the Company is not in compliance with Nasdaq Listing Rule 5250(c)(1) because its Annual Report on Form 10-K for the period ended June 30, 2014 was not filed on a timely basis with the Securities and Exchange Commission. The Company issued a press release on October 3, 2014 disclosing its receipt of the notification from Nasdaq pursuant to Nasdaq Listing Rule 5810(b). A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

|

99.1 |

Press Release issued by the Company on October 3, 2014. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

CORINTHIAN COLLEGES, INC. |

|

|

|

|

|

|

|

|

|

October 3, 2014 |

|

/s/ Stan A. Mortensen |

|

|

|

Stan A. Mortensen |

|

|

|

Executive Vice President and |

|

|

|

General Counsel |

3

Exhibit 99.1

|

CONTACTS: |

Investors: |

|

|

Anna Marie Dunlap |

|

|

SVP Investor Relations |

|

|

714-424-2678 |

|

|

|

|

|

Media: |

|

|

Kent Jenkins Jr. |

|

|

VP Public Affairs Communications |

|

|

(202) 682-9494 |

Corinthian Colleges Receives Nasdaq Notice Regarding Late Form 10-K Filing

SANTA ANA, Calif., October 3, 2014 (GLOBE NEWSWIRE) — Corinthian Colleges, Inc. (Nasdaq: COCO) has received a letter from The NASDAQ Stock Market (“Nasdaq”) notifying the Company that it is not in compliance with Nasdaq Listing Rule 5250(c)(1). The Rule requires timely filing of reports with the U.S. Securities and Exchange Commission (the “SEC”). Nasdaq sent the notice, dated September 29, 2014, as a result of the Company’s failure to timely file its Annual Report on Form 10-K for the fiscal year ended June 30, 2014 (“10-K”).

The Nasdaq notice has no immediate effect on the listing or trading of the Company’s common stock on the Nasdaq Global Select Market. Under the Nasdaq rules, the Company has 60 days to submit a plan to regain compliance. If the plan is accepted, the Company could be granted up to 180 days from the 10-K’s due date to regain compliance.

As previously disclosed in a Report on Form 8-K filed with the SEC on July 7, 2014, the Company entered into an Operating Agreement (the “Operating Agreement”) with the U.S. Department of Education which became effective on July 8, 2014, and which, among other things, required the Company to produce certain documents within certain time periods, teach out and close 12 of its schools, and pursue selling the remainder of its Title IV-eligible schools. The efforts required to comply with the terms of the Operating Agreement have put significant constraints on the Company’s resources, preventing it from obtaining and compiling the information required to complete and file its 10-K. The Company could not eliminate the delay without unreasonable effort and expense. In addition, the uncertain outcome of the school sales that the Company is pursuing creates uncertainties regarding the valuation of the Company’s assets, as well as its financial condition and results of operations as of and for the fiscal year ended June 30, 2014.

About Corinthian

Corinthian offers post-secondary career education through its Everest, Heald and WyoTech campuses, as well as online. Program areas include health care, business, criminal justice, transportation technology and maintenance, construction trades and information technology.

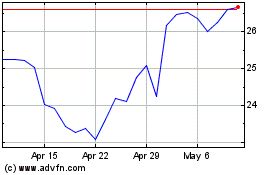

Vita Coco (NASDAQ:COCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

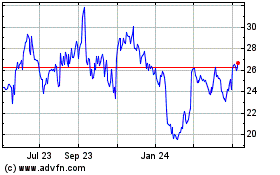

Vita Coco (NASDAQ:COCO)

Historical Stock Chart

From Apr 2023 to Apr 2024