Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS 2

Table of Contents

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-192640

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

Title of each class of securities

to be registered

|

|

Amount to be

registered |

|

Proposed maximum

offering price per

unit |

|

Proposed maximum

aggregate offering

price |

|

Amount of

registration fee |

Common Stock, par value $0.001 per share |

|

8,337,500(1) |

|

$24.00 |

|

$200,100,000 |

|

$23,251.62(2) |

- (1)

- Includes

1,087,500 shares that the underwriters have the option to purchase, exercisable for 30 days from the date of this prospectus

supplement.

- (2)

- This

filing fee is calculated in accordance with Rule 457(r) under the Securities Act of 1933, as amended. This "Calculation of

Registration Fee" table shall be deemed to update the "Calculation of Registration Fee" table in the registrant's Registration Statement on Form S-3 (File No. 333-192640) in accordance

with Rules 456(b) and 457(r) under the Securities Act of 1933, as amended.

Prospectus Supplement

(To prospectus dated December 3, 2013)

7,250,000 Shares

Celldex Therapeutics, Inc.

Common Stock

We are offering 7,250,000 shares of our common stock. Our common stock is listed on the Nasdaq Global Market under the symbol "CLDX." On February 25,

2015, the last reported sale price of our common stock on the Nasdaq Global Market was $24.96 per share.

Investing in our common stock involves a high degree of risk. Please read the "Risk Factors" beginning on page S-9 of this prospectus supplement, on page 5 of the

accompanying prospectus and the "Risk Factors" sections in our Annual Report on Form 10-K for the year ended December 31, 2014 and in the other documents incorporated by reference into

this prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or

the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

|

|

|

|

|

|

|

|

|

PER SHARE |

|

TOTAL |

|

Public Offering Price |

|

$ |

24.00 |

|

$ |

174,000,000 |

|

Underwriting Discounts and Commissions(1) |

|

$ |

1.32 |

|

$ |

9,570,000 |

|

Proceeds to Celldex before expenses |

|

$ |

22.68 |

|

$ |

164,430,000 |

|

- (1)

- The

underwriters will also be reimbursed for certain expenses incurred in this offering. See "Underwriting" for details.

Delivery of the shares of common stock is expected to be made on or about March 3, 2015. We have granted the underwriters an option for a period of

30 days to purchase an additional 1,087,500 shares of our common stock. If the underwriters exercise the option in full, the total underwriting discounts and commissions payable will be

$11,005,500 and the total proceeds, before expenses, will be $189,094,500.

Joint Book-Running Managers

|

|

|

|

|

|

| Jefferies |

|

Leerink Partners |

Lead Manager

Guggenheim Securities

Co-Managers

|

|

|

|

|

|

| Oppenheimer & Co. |

|

Brean Capital |

Cantor Fitzgerald & Co. |

|

Roth Capital Partners |

Prospectus

Supplement dated February 25, 2015

Table of Contents

TABLE OF CONTENTS

Table of Contents

ABOUT THIS PROSPECTUS SUPPLEMENT

In this prospectus supplement, "Celldex," "we," "us," "our" or "ours" refers to Celldex Therapeutics, Inc.

This

prospectus supplement and the accompanying prospectus relate to the offering of shares of our common stock. Before buying any of the shares of common stock offered hereby, we urge you to

carefully read this prospectus supplement and the accompanying prospectus, together with the information incorporated herein by reference as described under the headings "Where You Can Find More

Information" and "Incorporation of Documents by Reference." These documents contain important information that you should consider when making your investment decision. This prospectus supplement

contains information about the common stock offered hereby and may add, update or change information in the accompanying prospectus.

You

should rely only on the information that we have provided or incorporated by reference in this prospectus supplement and the accompanying prospectus. We have not authorized any other person to

provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it.

We

are not making offers to sell or solicitations to buy our common stock in any jurisdiction in which an offer or solicitation is not authorized or in which the person making that offer or

solicitation is not qualified to do so or to anyone to whom it is unlawful to make an offer or solicitation. You should assume that the information in this prospectus supplement and the accompanying

prospectus or any related free writing prospectus is accurate only as of the date on the front of the document and that any information that we have incorporated by reference is accurate only as of

the date of the document incorporated by reference, regardless of the time of delivery of this prospectus supplement, the accompanying prospectus or any related free writing prospectus, or any sale of

a security.

This

document is in two parts. The first part is this prospectus supplement, which adds to and updates information contained in the accompanying prospectus. The second part, the prospectus, provides

more general information, some of which may not apply to this offering. Generally, when we refer to this prospectus, we are referring to both parts of this document combined. To the extent there is a

conflict between the information contained in this prospectus supplement and the information contained in the accompanying prospectus, you should rely on the information in this prospectus supplement.

This

prospectus supplement and the accompanying prospectus contain summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents

for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been or will be filed as exhibits to the

registration statement of which this prospectus is a part or as exhibits to documents incorporated by reference herein, and you may obtain copies of those documents as described below under the

headings "Where You Can Find More Information" and "Incorporation of Documents by Reference."

S-1

Table of Contents

PROSPECTUS SUPPLEMENT SUMMARY

The following summary of our business highlights some of the information contained elsewhere in or incorporated by reference

into this prospectus supplement. Because this is only a summary, however, it does not contain all of the information that may be important to you. You should carefully read this prospectus supplement

and the accompanying prospectus, including the documents incorporated by reference, which are described under "Incorporation of Documents by Reference" and "Where You Can Find More Information" in

this prospectus supplement. You should also carefully consider the matters discussed in the section titled "Risk Factors" in this prospectus supplement and in the accompanying prospectus and in other

periodic reports incorporated by reference herein.

Our Company

We are a biopharmaceutical company focused on the development and commercialization of several immunotherapy technologies for the treatment of cancer

and other difficult-to-treat diseases. Our lead drug candidates include rindopepimut (also referred to as Rintega® and CDX-110) and glembatumumab vedotin (also referred to as CDX-011).

Rindopepimut is a targeted immunotherapeutic in a pivotal Phase 3 study for the treatment of front-line glioblastoma and a Phase 2 study for the treatment of recurrent glioblastoma.

Glembatumumab vedotin is a targeted antibody-drug conjugate in a randomized, Phase 2b study for the treatment of triple negative breast cancer and a Phase 2 study for the treatment of

metastatic melanoma. We also have a number of earlier stage drug candidates in clinical development, including varlilumab (also referred to as CDX-1127), a fully human therapeutic monoclonal antibody

for cancer indications, CDX-1401, a targeted immunotherapeutic aimed at antigen presenting cells, or APC, for cancer indications and CDX-301, an immune cell mobilizing agent and dendritic cell growth

factor. Our drug candidates address market opportunities for which we believe current therapies are inadequate or non-existent.

We

are building a fully integrated, commercial-stage biopharmaceutical company that develops important therapies for patients with unmet medical needs. Our program assets provide us with the strategic

options to either retain full economic rights to our innovative therapies or seek favorable economic terms through advantageous commercial partnerships. This approach allows us to maximize the overall

value of our technology and product portfolio while best ensuring the expeditious development of each individual product.

Rindopepimut (Rintega®; CDX-110)

Rindopepimut is an experimental immunotherapeutic drug that targets the tumor-specific molecule epidermal growth factor receptor variant III, or

EGFRvIII. EGFRvIII is a mutated form of the epidermal growth factor receptor, or EGFR, that is only expressed in cancer cells and not in normal tissue and can directly contribute to cancer cell

growth. EGFRvIII is expressed in approximately 30% of glioblastoma, or GBM, tumors, the most common and aggressive form of brain cancer. Rindopepimut is composed of the EGFRvIII peptide linked to a

carrier protein called Keyhole Limpet Hemocyanin, or KLH, and administered together with the adjuvant GM-CSF. The Food and Drug Administration, or FDA, has granted rindopepimut Breakthrough Therapy

designation for the treatment of adult patients with EGFRvIII-positive glioblastoma and has also granted Fast Track designation. Breakthrough Therapy and Fast Track designation do not change the

standards for approval but may expedite the development or approval process. The FDA and the European Medicines Agency, or EMA, have both granted orphan drug designation for rindopepimut for the

treatment of EGFRvIII expressing GBM.

In

December 2011, we initiated ACT IV, a pivotal, randomized, double-blind, controlled Phase 3 study of rindopepimut in patients with surgically resected, EGFRvIII-positive GBM. Patients were

randomized after the completion of surgery and standard chemotherapy (temozolomide, or TMZ) and radiation treatment. The treatment regimen includes a rindopepimut priming phase post-radiation followed

by an adjuvant TMZ

S-2

Table of Contents

phase

and a rindopepimut maintenance therapy phase. Patients are treated until disease progression or intolerance to therapy. The primary objective of the study is to determine whether rindopepimut

plus adjuvant GM-CSF improves the overall survival of patients with newly diagnosed EGFRvIII-positive GBM with minimal residual disease post resection and traditional chemo-radiation when compared to

treatment with TMZ and a control injection of KLH. KLH is a component of rindopepimut and was selected due to its ability to generate a similar injection site reaction to that observed with

rindopepimut.

In

December 2014, ACT IV completed enrollment. In total, over 4,800 GBM patients were screened for EGFRvIII status from more than 200 clinical trial sites across 22 countries and, consistent with

prior studies, 30% were positive for the EGFRvIII mutation. The study enrolled 745 patients to reach the required 374 patients with minimal residual disease (assessed by central review) needed for

analysis of the primary overall survival endpoint. All patients, including patients with disease that exceed this threshold, will be included in a secondary analysis of overall survival as well as

analyses of progression-free survival, safety and tolerability, and quality of life. The timing of the overall survival primary endpoint data is event-driven. Interim analyses will be conducted by an

independent Data Safety and Monitoring Board at 50% and 75% of events (deaths). The first interim analysis is expected in mid-2015. The second interim analysis is currently expected in late 2015 or

early 2016 and the final data is currently expected by the end of 2016, although our expectations regarding timing for the second interim analysis and final data read out may change based on event

rates.

In

December 2011, we also initiated ReACT, a Phase 2 study of rindopepimut in combination with bevacizumab in patients with recurrent EGFRvIII-positive GBM. This study completed enrollment in

2014 and includes 3 groups. Group 1 consists of 72 patients who had not previously received Avastin and were randomized to receive either rindopepimut and Avastin or a control injection of KLH and

Avastin in a blinded fashion. Group 2 includes 25 patients who are refractory to Avastin having received Avastin in either the frontline or recurrent setting with subsequent progression and who

received rindopepimut plus Avastin in a single treatment arm. In August 2013, we announced the addition of an expansion cohort of up to 75 patients, called Group 2C, to better characterize the

potential activity of rindopepimut in this refractory patient population. This decision was based on early evidence of anti-tumor activity, including stable disease, tumor shrinkage and

investigator-reported response. In total, Group 2C enrolled 28 patients. The primary endpoint is six month progression-free survival rate, or PFS-6, for groups 1 and 2 and objective response rate

(ORR) for group 2C. Other study endpoints include PFS-6, ORR, progression-free survival, or PFS, overall survival, or OS and safety and tolerability.

In

November 2014, we reported interim data from our ongoing Phase 2 ReACT study. Rindopepimut plus Avastin was very well tolerated (dosing up to 26+ months) and the results demonstrated clear

signs of clinical activity in advanced patient populations, including evidence of anti-tumor activity (tumor shrinkage, objective response and stable disease). Strong immune response correlated with

improved outcome. In Avastin-naïve patients treated with both rindopepimut and Avastin, a statistically significant survival benefit was seen compared to the control patients. Final

data is anticipated by mid-year 2015 and we intend to present this data at a peer reviewed medical meeting in that same time frame.

Group 1 Interim Data

- §

- PFS-6: PFS-6 by investigator read was 27% for patients treated with rindopepimut

compared to 11% for control patients (p=0.048)

- §

- Survival: The OS demonstrated a statistically significant benefit (p=0.0208) with a

hazard ratio of 0.47 (0.25, 0.91) in favor of the rindopepimut treated patients. Median OS was 12.0 months for patients treated with rindopepimut compared to 8.8 months for control

patients.

- §

- Response

Rate: 7 out of 29 patients (24%) evaluable for response on the rindopepimut arm experienced a confirmed objective response versus 5 out

of 30 patients (17%) evaluable for response on the control arm. Assessments of response were conducted by study investigators according to RANO criteria.

S-3

Table of Contents

- §

- Other: All subgroup analyses, including performance status, steroid use and recent

resection, show a hazard ratio in favor of rindopepimut treatment.

Group 2/2C Interim Data

- §

- Survival: Median OS was 5.1 months (95% CI 3.2, 6.5) for these heavily

pretreated, refractory EGFRvIII-positive patients. 46% of patients in Group 2/2C were alive at 6 months.

- §

- Response

Rate: Based on investigator assessment, two patients experienced complete response, of which one was unconfirmed, and two patients

experienced partial response, of which one was unconfirmed, in Group 2. Two of these four patients did not meet the protocol defined definition of refractory in Group 2, the only two such patients

enrolled. No additional objective responses were observed in Group 2C and the study did not meet the criteria (defined as two responses in the first 23 patients enrolled in Group 2C) for continued

enrollment. Ten patients with measurable disease experienced objective tumor shrinkage across Group 2/2C.

In

February 2015, the FDA granted rindopepimut Breakthrough Therapy designation for the treatment of adult patients with EGFRvIII-positive glioblastoma. The FDA's Breakthrough Therapy designation is

intended to expedite the development and review of a drug candidate that is intended to treat a serious or life-threatening disease or condition when preliminary clinical evidence demonstrates that

such drug may have substantial improvement on one or more clinically significant endpoints over existing therapies. Breakthrough Therapy designation does not change the standards for approval but may

expedite the development or approval process.

Glembatumumab Vedotin (CDX-011)

CDX-011 is an antibody-drug conjugate for the treatment of patients with glycoprotein NMB, referred to as gpNMB, expressing advanced, refractory

breast cancer. CDX-011 targets the protein gpNMB, which is over-expressed in a variety of cancers, including breast cancer and melanoma. The FDA has granted Fast Track designation to CDX-011 for the

treatment of advanced, refractory/resistant gpNMB-expressing breast cancer.

In

December 2012, we announced final results from the EMERGE study, a randomized, multi-center Phase 2b study of glembatumumab vedotin in 122 patients with heavily pre-treated, advanced, gpNMB

positive breast

cancer. Patients were randomized (2:1) to receive either glembatumumab vedotin or single-agent Investigator's Choice, or IC, chemotherapy. Patients randomized to receive IC were allowed to cross over

to receive glembatumumab vedotin following disease progression. Activity endpoints included response rate, PFS and OS. The final results suggested that glembatumumab vedotin induces significant

response rates compared to currently available therapies in patient subsets with advanced, refractory breast cancers with gpNMB over-expression (expression in greater than or equal to 25% of tumor

cells) and in patients with triple negative breast cancer. The OS and PFS of patients treated with glembatumumab vedotin was also observed to be greatest in patients with triple negative breast cancer

who also over-express gpNMB and all patients with gpNMB over-expression.

S-4

Table of Contents

EMERGE: Overall Response Rate and Disease Control Data

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

gpNMB Over-Expression |

|

Triple Negative and

gpNMB Over-Expression |

|

|

|

glembatumumab

vedotin |

|

Investigator

Choice |

|

glembatumumab

vedotin |

|

Investigator

Choice |

|

|

|

(n=25)

|

|

(n=8)

|

|

(n=12)

|

|

(n=4)

|

|

Response |

|

|

32 |

% |

|

13 |

% |

|

33 |

% |

|

0 |

% |

Disease Control Rate |

|

|

64 |

% |

|

38 |

% |

|

75 |

% |

|

25 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Responses per RECIST 1.1; IC = Investigator's Choice; glembatumumab vedotin arm includes 15 patients who crossed over to receive glembatumumab vedotin treatment after

progression on IC. Analysis of best response excludes patients who discontinued from study without evaluable post-baseline radiographic imaging (n=15 for glembatumumab vedotin arm; n=5 for IC

arm).

EMERGE: Progression Free Survival (PFS) and Overall Survival (OS) Data

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

gpNMB

Over-Expression |

|

Triple Negative

and gpNMB

Over-Expression |

|

|

|

glembatumumab

vedotin |

|

Investigator

Choice |

|

glembatumumab

vedotin |

|

Investigator

Choice |

|

Median PFS (months) |

|

|

2.7 |

|

|

1.5 |

|

|

3.0 |

|

|

1.5 |

|

|

|

|

p=0.14 |

|

|

p=0.008 |

|

Median OS (months) |

|

|

10.0 |

|

|

5.7 |

|

|

10.0 |

|

|

5.5 |

|

|

|

|

p=0.18 |

|

|

p=0.003 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

When cross over patients are removed, median OS in patients with gpNMB over-expression is 10.0 months for glembatumumab vedotin vs 5.2 months for IC (p=0.05) and

median OS in triple negative patients with gpNMB over- expression is 10.0 months for glembatumumab vedotin vs 5.2 months for IC (p=0.009).

In

December 2013, we initiated METRIC, a randomized, controlled, Phase 2b study of glembatumumab vedotin in patients with triple negative breast cancer that over-express gpNMB. To-date, 95

sites are open to enrollment across the United States, Canada and Australia. The study was originally designed to obtain accelerated approval. Feedback from clinical investigators conducting the study

indicated that the eligibility criteria for study entry were limiting their ability to enroll patients they felt were clinically appropriate for study. In addition, we had spoken to country-specific

members of the European Medicines Agency, or EMA, and believed a significant opportunity existed to expand the study into the EU. Based on these factors, in the fourth quarter of 2014, we amended the

METRIC study and expanded patient entry criteria to position it for full marketing approval with global regulators, including the EMA, and to support improved enrollment in the study. The primary

endpoint of the study is PFS as PFS is an established endpoint for full approval registration studies in this patient population in both the US and the EU. The sample size of 300 patients and the

secondary endpoint of OS remained unchanged. We implemented these changes in parallel to regulatory discussions to maintain momentum at open clinical trial sites. Since implementation, both the FDA

and central European regulatory authorities have reviewed the protocol design and we believe the METRIC study could support marketing approval in both the US and Europe dependent upon data review.

Based on current projections, we believe enrollment will be completed in 2016.

S-5

Table of Contents

CDX-1127

CDX-1127 is a human monoclonal antibody that targets CD27, a potentially important target for immunotherapy of various cancers. CD27 acts downstream

from CD40 and may provide a novel way to regulate the immune responses. CD27 is a co-stimulatory molecule on T cells and is over-expressed in certain lymphomas and leukemias. CDX-1127 is an agonist

antibody designed to have two potential therapeutic mechanisms. CDX-1127 has been shown to activate immune cells that can target and eliminate cancerous cells in tumor-bearing mice and to directly

kill or inhibit the growth of CD27-expressing lymphomas and leukemias in vitro and in vivo. Both mechanisms have been seen even at low doses in preclinical models.

We

are conducting an open label Phase 1 study of varlilumab in patients with selected malignant solid tumors or hematologic cancers at multiple clinical sites in the United States. Initial dose

escalation cohorts were conducted to determine an optimal dose for future study and, to date, no maximum tolerated dose has been reached. The lymphoid malignancies dose escalation arm has completed

enrollment of 24 patients and a new cohort has been added to include evaluation of T cell malignancies. An expansion cohort with 15 patients has also been added at 0.3mg/kg dosed once every three

weeks in patients with Hodgkin Lymphoma. The solid tumor arm, which included patients with various solid tumors, completed dose escalation in 2013. Two expansion cohorts were subsequently added at 3

mg/kg dosed weekly in metastatic melanoma for 16 patients and renal cell carcinoma for 15 patients to better characterize clinical activity and further define the safety profile in preparation for

combination studies.

We

presented updated data from this Phase 1 study in November 2014. Varlilumab was very well tolerated and induced immunologic activity in patients that is consistent with both its mechanism of

action and preclinical models. A total of 86 patients have been dosed in the study. Fifty-five patients have been dosed in dose escalation cohorts (various solid and hematologic B-cell tumors) and 31

patients have been dosed in the expansion cohorts (melanoma and RCC) at 3 mg/kg. In both the solid tumor and hematologic dose-escalations, the pre-specified maximum dose level (10 mg/kg) was reached

without identification of a maximum tolerated dose. The majority of adverse events related to treatment have been mild to moderate (Grade 1/2) in severity, with only three serious adverse events

related to treatment reported. No significant immune-mediated adverse events (colitis, hepatitis, etc.) typically associated with check-point blockade have been observed. Two patients experienced

objective responses including a complete response in Hodgkin Lymphoma and a partial response in renal cell carcinoma. Thirteen patients experienced stable disease with a range of 3-30.7+ months

to-date. Based on the results observed in hematologic malignancies, an expansion cohort has been added to enroll up to 15 patients with Hodgkin Lymphoma and an abbreviated dose escalation in T cell

hematologic malignancies is ongoing.

In

May 2014, we entered into a clinical trial collaboration with Bristol-Myers Squibb Company, or BMS, to evaluate the safety, tolerability and preliminary efficacy of varlilumab and

Opdivo®, BMS's PD-1 immune checkpoint inhibitor, in a Phase 1/2 study. This study was initiated in January 2015 and is being conducted in adult patients with advanced non-small cell lung

cancer, metastatic melanoma, colorectal cancer, ovarian cancer, and head and neck squamous cell carcinoma. The Phase 1 dose-escalation portion of the study will assess the safety and

tolerability of varlilumab at varying doses when administered with Opdivo. Following dose escalation, a Phase 2 portion of the study will include five disease specific cohorts. The primary

objective of the Phase 2 study is overall response rate. Secondary objectives include pharmacokinetics assessments, determining

the immunogenicity of varlilumab when given in combination with Opdivo and further assessing the anti-tumor activity of combination treatment.

Multiple

efforts are underway to finalize designs and plans for additional Phase 2 combination studies of varlilumab, including but not limited to: a Phase 1/2 study of varlilumab and

ipilumumab in patients with metastatic melanoma (plus CDX-1401 in NY-ESO positive patients); a Phase 1/2 of varlilumab plus sunitinib in renal cell carcinoma; and a Phase 1/2 study of varlilumab plus

a mek pathway agent (followed sequentially by a checkpoint inhibitor) for patients with B-raf mutated metastatic melanoma. In addition to

S-6

Table of Contents

our

sponsored studies and clinical trial collaborations, we anticipate that varlilumab's potential activity will also be explored in investigator sponsored studies at various academic institutions.

Other Clinical and Pre-Clinical Programs

We have several other programs in clinical and pre-clinical development. The status of the other programs that we currently believe are significant to

our business is summarized in the table below:

|

|

|

|

|

| |

Product Candidate

|

|

Indication/Field |

|

Stage of Clinical

Development |

CDX-1401 |

|

Multiple solid tumors |

|

Phase 1 |

CDX-301 |

|

Allogeneic Hematopoietic Stem Cell Transplantation |

|

Phase 1 |

CDX-014 |

|

Ovarian and renal cancer |

|

Preclinical |

|

|

|

|

|

|

Corporate Information

We are a Delaware corporation organized in 1983. On October 1, 2009, a wholly-owned subsidiary of Celldex merged with and into CuraGen

Corporation. On December 31, 2009, CuraGen Corporation was merged with and into Celldex and the separate existence of CuraGen ceased.

Our

principal executive offices are located at Perryville III Building, 53 Frontage Road, Suite 220, Hampton, New Jersey 08827 and our telephone number is (908) 200-7500. Our corporate

website is www.celldex.com. The information on our website is not incorporated by reference into this prospectus.

S-7

Table of Contents

THE OFFERING

|

|

|

| Common stock offered by us |

|

7,250,000 shares |

Common stock to be outstanding immediately after this offering |

|

96,842,779 shares |

Underwriters' Option to Purchase Additional Shares

We have granted the underwriters an option to purchase up to 1,087,500 additional shares of our common stock. This option is exercisable, in whole or

in part, for a period of 30 days from the date of this prospectus supplement.

Use of Proceeds

We intend to use the net proceeds received by us in this offering to fund clinical trials of our product candidates, expansion of our pipeline,

expansion of our commercial team and for working capital and other general corporate purposes. See "Use of Proceeds."

Risk Factors

An investment in our common stock involves a high degree of risk. See the information contained in or incorporated under "Risk Factors" beginning on

page S-9 of this prospectus supplement, page 5 of the accompanying prospectus, our Annual Report on Form 10-K for the year ended December 31, 2014 and in the other

documents incorporated by reference into this prospectus supplement.

NASDAQ Global Market Symbol

Our common stock is listed on The NASDAQ Global Market under the symbol "CLDX."

The

total number of shares of common stock to be outstanding immediately after this offering assumes no exercise of the underwriters' option to purchase additional shares and is based on 89,592,779

shares of common stock issued and outstanding as of December 31, 2014, which does not include the following, all as of December 31,

2014:

- §

- 7,015,350 shares issuable upon the exercise of outstanding stock options with

a weighted-average exercise price of $9.34 per share; and

- §

- 828,485 shares available for future issuance under our equity compensation

plans.

Unless

otherwise stated, all information in this prospectus supplement:

- §

- assumes no exercise of outstanding options to purchase common stock and no

issuance of shares available for future issuance under our equity compensation plans;

- §

- assumes no exercise of the underwriters' option to purchase additional shares;

and

- §

- reflects all currency in U.S. dollars.

S-8

Table of Contents

RISK FACTORS

An investment in our securities involves a high degree of risk. You should carefully consider the risks described under "Risk Factors" in the accompanying prospectus and our

Annual Report on Form 10-K for the year ended December 31, 2014, respectively, as updated by any other document that we subsequently file with the Securities and Exchange Commission and

that is incorporated by reference into this prospectus supplement and the accompanying prospectus, as well as the risks described below and all of the other information contained in this prospectus

supplement and the accompanying prospectus, and incorporated by reference into this prospectus supplement and the accompanying prospectus, including our financial statements and related notes, before

investing in our securities. These risks and uncertainties are not the only ones facing us and there may be additional matters that we are unaware of or that we currently consider immaterial. All of

these could adversely affect our business, business prospects, cash flow, results of operations and financial condition. In such case, the trading price of our common stock could decline, and you

could lose all or part of your investment in our common stock.

Risks Related to this Offering

Management will have broad discretion as to the use of the proceeds from this offering, and we may

not use the proceeds effectively.

Because we have not designated the amount of net proceeds received by us from this offering to be used for any particular purpose, our management will

have broad discretion as to the application of the net proceeds from this offering and could use them for purposes other than those contemplated at the time of the offering. Our management may use the

net proceeds for corporate purposes that may not improve our financial condition or market value.

You will experience immediate and substantial dilution in the book value per share of the common

stock you purchase.

Because the price per share of our common stock being offered will be higher than the book value per share of our common stock, you will suffer

substantial dilution in the net tangible book value of the common stock you purchase in this offering. See the section entitled "Dilution" below for a more detailed discussion of the dilution you will

incur if you purchase common stock in this offering. In addition, we have a significant number of options and restricted stock outstanding. If the holders of these securities exercise them or become

vested in them, as applicable, you may incur further dilution.

Sales of a significant number of shares of our common stock in the public markets could depress the

market price of our common stock.

Sales of a substantial number of shares of our common stock or other equity-related securities in the public markets could depress the market price of

our common stock and impair our ability to raise capital through the sale of additional equity securities. We cannot predict the effect that future sales of our common stock or other equity-related

securities would have on the market price of our common stock.

Our share price has been and could remain volatile.

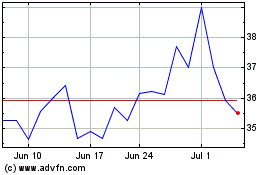

The market price of our common stock has historically experienced and may continue to experience significant volatility. From January 2014 through

December 2014, the market price of our common stock has fluctuated from a high of $33.33 per share in the first quarter of 2014, to a low of $10.76 per share in the second quarter of 2014. Our

progress in developing and commercializing our products, the impact of government regulations on our products and industry, the potential sale of a large volume of our common stock by stockholders,

our quarterly operating results, changes in general conditions in the economy or the financial markets and other developments affecting us or our competitors could cause the market price of

S-9

Table of Contents

our

common stock to fluctuate substantially with significant market losses. If our stockholders sell a substantial number of shares of common stock, especially if those sales are made during a short

period of time, those sales could adversely affect the market price of our common stock and could impair our ability to raise capital. In addition, in recent years, the stock market has experienced

significant price and volume fluctuations. This volatility has affected the market prices of securities issued by many companies for reasons unrelated to their operating performance and may adversely

affect the price of our common stock. In addition, we could be subject to a securities class action litigation as a result of volatility in the price of our stock, which could result in substantial

costs and diversion of management's attention and resources and could harm our stock price, business, prospects, results of operations and financial condition.

S-10

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein contain forward-looking statements made

pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements represent our management's judgment regarding future events. In many cases,

you can identify forward- looking statements by terminology such as "may," "will," "should," "plan," "expect," "anticipate," "estimate," "predict," "intend," "potential" or "continue" or the negative

of these terms or other words of similar import, although some forward-looking statements are expressed differently. All statements other than statements of historical fact included in this prospectus

supplement, the accompanying prospectus and the documents incorporated by reference herein regarding our financial position, business strategy and plans or objectives for future operations are

forward-looking statements. Without limiting the broader description of forward-looking statements above, we specifically note that statements regarding potential drug candidates, their potential

therapeutic effect, the possibility of obtaining regulatory approval, our expected timing for completing clinical trials and clinical trial milestones for our drug candidates, our ability or the

ability of our collaborators to manufacture and sell any products, market acceptance or our ability to earn a profit from sales or licenses of any drug candidate or to discover new drugs in the future

are all forward-looking in nature. We cannot guarantee the accuracy of forward-looking statements, and you should be aware that results and events could differ materially and adversely from those

described in the forward-looking statements due to a number of factors, including:

There

are a number of important factors that could cause the actual results to differ materially from those expressed in any forward-looking statement made by us. These factors include, but are not

limited to:

- §

- our ability to successfully complete research and further development,

including animal, preclinical and clinical studies, and, if we obtain regulatory approval, commercialization of rindopepimut (also referred to as Rintega® and CDX-110), glembatumumab

vedotin (also referred to as CDX-011), and other drug candidates and the growth of the markets for those drug candidates;

- §

- our ability to raise sufficient capital to fund our clinical studies and to

meet our long-term liquidity needs, on terms acceptable to us, or at all. If we are unable to raise the funds necessary to meet our long-term liquidity needs, we may have to delay or discontinue the

development of one or more programs, discontinue or delay on-going or anticipated clinical trials, license out programs earlier than expected, raise funds at a significant discount or on other

unfavorable terms, if at all, or sell all or part of our business;

- §

- our ability to manage multiple clinical trials for a variety of drug candidates

at different stages of development, including ACT IV and ReACT for rindopepimut and METRIC for glembatumumab vedotin;

- §

- the cost, timing, scope and results of ongoing safety and efficacy trials of

rindopepimut, glembatumumab vedotin, and other preclinical and clinical testing;

- §

- our ability to fund and complete the development and, if we obtain regulatory

approval, to commercialize rindopepimut in North America and Europe ourselves;

- §

- the availability, cost, delivery and quality of clinical and commercial grade

materials produced by our own manufacturing facility or supplied by contract manufacturers, suppliers and partners, who may be the sole source of supply;

- §

- the timing, cost and uncertainty of obtaining regulatory approvals for our drug

candidates;

- §

- our ability to maintain breakthrough therapy designation for rindopepimut,

which designation may be revoked by the FDA in the future, and even if the designation is not revoked, the designation does not change the standards for approval of rindopepimut or guarantee approval

or expedited approval of rindopepimut;

S-11

Table of Contents

- §

- our ability to develop and commercialize products before competitors that are

superior to the alternatives developed by such competitors;

- §

- our ability to negotiate strategic partnerships, where appropriate, for our

programs, which may include, rindopepimut outside of North America and Europe, glembatumumab vedotin and varlilumab (also referred to as CDX-1127);

- §

- our ability to develop technological capabilities, including identification of

novel and clinically important targets, exploiting our existing technology platforms to develop new product candidates and expand our focus to broader markets for our existing targeted

immunotherapeutics;

- §

- our ability to adapt our proprietary antibody-targeted technology, or APC

Targeting Technology™, to develop new, safe and effective therapeutics for oncology and infectious disease indications;

- §

- the availability, cost, delivery and quality of clinical management services

provided by our clinical research organization partners;

- §

- our ability to protect our intellectual property rights, including the ability

to successfully defend patent oppositions filed against a European patent related to technology we use in varlilumab, and our ability to avoid intellectual property litigation, which can be costly and

divert management time and attention.

You

should also consider carefully the statements set forth in the section entitled "Risk Factors" in this prospectus supplement and in our Annual Report on Form 10-K for the year ended

December 31, 2014, respectively, as updated by any other document that we subsequently filed with the Securities and Exchange Commission and that is incorporated by reference into this

prospectus supplement, which address various factors that could cause results or events to differ from those described in the forward-looking statements. All subsequent written and oral

forward-looking statements attributable to us or to persons acting on our behalf are expressly qualified in their entirety by the applicable cautionary statements. We have no plans to update these

forward-looking statements.

S-12

Table of Contents

USE OF PROCEEDS

We estimate that the net proceeds received by us from this offering, after deducting the underwriting discounts and commissions and estimated offering

expenses payable by us, will be approximately $164.2 million, or approximately $188.9 million, if the underwriters exercise their option to purchase additional shares in full.

We

currently expect to use the net proceeds from this offering to fund clinical trials of our product candidates, expansion of our pipeline, expansion of commercial team and for working capital and

other general corporate purposes. Until we use the net proceeds of this offering, we intend to invest the funds in short-term, investment grade, interest-bearing securities.

The

amount and timing of actual expenditures for the purposes set forth above may vary based on several factors, and our management will retain broad discretion as to the ultimate allocation of the

proceeds.

S-13

Table of Contents

DILUTION

If you invest in our common stock in this offering, your ownership interest will be diluted to the extent of the difference between the public

offering price per share and our pro forma net tangible book value per share after this offering. We calculate net tangible book value per share by dividing our net tangible book value, which is

tangible assets less total liabilities, by the number of outstanding shares of our common stock.

Our

net tangible book value as of December 31, 2014 was approximately $180.9 million, or $2.02 per share. After giving effect to the sale by us of 7,250,000 shares of common stock

offered by this prospectus supplement at a public offering price of $24.00 per share, and after deducting the underwriting discounts and commissions and estimated offering expenses payable by us, our

pro forma net tangible book value as of December 31, 2014 would have been approximately $345.1 million, or $3.56 per share. This represents an immediate increase in pro forma

net tangible book value of $1.54 per share to existing stockholders and an immediate dilution of $20.44 per share to new investors purchasing our common stock in this offering. The following table

illustrates the per share dilution:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Public offering price per share |

|

|

|

|

$ |

24.00 |

|

Net tangible book value per share as of December 31, 2014 |

|

$ |

2.02 |

|

|

|

|

Increase in net tangible book value per share after this offering |

|

$ |

1.54 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Pro forma net tangible book value per share as of December 31, 2014, after giving effect to this offering |

|

|

|

|

$ |

3.56 |

|

|

|

|

|

|

|

|

|

|

Dilution per share to new investors in this offering |

|

|

|

|

$ |

20.44 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The

information above assumes that the underwriters do not exercise their option to purchase additional shares. If the underwriters exercise their option to purchase additional shares in full, our pro

forma net tangible book value per share at December 31, 2014 after giving effect to this offering would have been $3.78 per share, and the dilution in pro forma net tangible book value per

share to investors in this offering would have been $20.22 per share.

The

above table is based on 89,592,779 shares of our common stock issued and outstanding as of December 31, 2014, which does not include the

following:

- §

- 7,015,350 shares issuable upon the exercise of outstanding stock options as of

December 31, 2014 with a weighted-average exercise price of $9.34 per share; and

- §

- 828,485 shares available for future issuance under our equity compensation

plans as of December 31, 2014.

S-14

Table of Contents

UNDERWRITING

Subject to the terms and conditions set forth in the underwriting agreement, dated February 25, 2015, among us and Jefferies LLC and

Leerink Partners LLC, as the representatives of the underwriters named below and the joint book-running managers of this offering, we have agreed to sell to the underwriters, and each of the

underwriters has agreed, severally and not jointly, to purchase from us, the respective number of shares of common stock shown opposite its name below:

|

|

|

| |

Underwriters

|

|

NUMBER OF

SHARES |

Jefferies LLC |

|

2,827,500 |

Leerink Partners LLC |

|

2,537,500 |

Guggenheim Securities, LLC |

|

725,000 |

Oppenheimer & Co. Inc. |

|

290,000 |

Brean Capital, LLC |

|

290,000 |

Cantor Fitzgerald & Co. |

|

290,000 |

Roth Capital Partners, LLC |

|

290,000 |

|

|

|

|

Total |

|

7,250,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The

underwriting agreement provides that the obligations of the several underwriters are subject to certain conditions precedent such as the receipt by the underwriters of officers' certificates and

legal opinions and approval of certain legal matters by their counsel. The underwriting agreement provides that the underwriters will purchase all of the shares of common stock if any of them are

purchased. If an underwriter defaults, the underwriting agreement provides that the purchase commitments of the nondefaulting underwriters may be increased or the underwriting agreement may be

terminated. We have agreed to indemnify the underwriters and certain of their controlling persons against certain liabilities, including liabilities under the Securities Act, and to contribute to

payments that the underwriters may be required to make in respect of those liabilities. We have granted to the underwriters an option to purchase additional shares of common stock as described below.

See "—Option to Purchase Additional Shares."

The

underwriters have advised us that, following the completion of this offering, they currently intend to make a market in the common stock as permitted by applicable laws and regulations. However,

the underwriters are not obligated to do so, and the underwriters may discontinue any market-making activities at any time without notice in their sole discretion. Accordingly, no assurance can be

given as to the liquidity of the trading market for the common stock, that you will be able to sell any of the common stock held by you at a particular time or that the prices that you receive when

you sell will be favorable.

The

underwriters are offering the shares of common stock subject to their acceptance of the shares of common stock from us and subject to prior sale. The underwriters reserve the right to withdraw,

cancel or modify offers to the public and to reject orders in whole or in part. In addition, the underwriters have advised us that they do not intend to confirm sales to any account over which they

exercise discretionary authority.

Commission and Expenses

The underwriters have advised us that they propose to offer the shares of common stock to the public at the initial public offering price set forth on

the cover page of this prospectus and to certain dealers, which may include the underwriters, at that price less a concession not in excess of $0.792 per share of common stock. After the offering, the

initial public offering price and concession to dealers may be reduced by the representatives. No such reduction will change the amount of proceeds to be received by us as set forth on the cover page

of this prospectus.

S-15

Table of Contents

The

following table shows the public offering price, the underwriting discounts and commissions that we are to pay the underwriters and the proceeds, before expenses, to us in connection with this

offering. Such amounts are shown assuming both no exercise and full exercise of the underwriters' option to purchase additional shares.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

PER SHARE |

|

TOTAL |

|

|

|

WITHOUT OPTION

TO PURCHASE

ADDITIONAL

SHARES |

|

WITH OPTION

TO PURCHASE

ADDITIONAL

SHARES |

|

WITHOUT OPTION

TO PURCHASE

ADDITIONAL

SHARES |

|

WITH OPTION

TO PURCHASE

ADDITIONAL

SHARES |

|

Public offering price |

|

$ |

24.00 |

|

$ |

24.00 |

|

$ |

174,000,000 |

|

$ |

200,100,000 |

|

Underwriting discounts and commissions |

|

$ |

1.32 |

|

$ |

1.32 |

|

$ |

9,570,000 |

|

$ |

11,005,500 |

|

Proceeds to us, before expenses |

|

$ |

22.68 |

|

$ |

22.68 |

|

$ |

164,430,000 |

|

$ |

189,094,500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

We

estimate expenses payable by us in connection with this offering, other than the underwriting discounts and commissions referred to above, will be approximately $200,000. We also have agreed to

reimburse the underwriters for up to $10,000 for their FINRA counsel fee. In accordance with FINRA Rule 5110, this reimbursed fee is deemed underwriting compensation for this offering.

Listing

Our common stock is listed on The Nasdaq Global Market under the trading symbol "CLDX".

Stamp Taxes

If you purchase shares of common stock offered in this prospectus, you may be required to pay stamp taxes and other charges under the laws and

practices of the country of purchase, in addition to the offering price listed on the cover page of this prospectus.

Option to Purchase Additional Shares

We have granted to the underwriters an option, exercisable for 30 days from the date of this prospectus, to purchase, from time to time, in

whole or in part, up to an aggregate of 1,087,500 shares from us at the public offering price set forth on the cover page of this prospectus, less underwriting

discounts and commissions. If the underwriters exercise this option, each underwriter will be obligated, subject to specified conditions, to purchase a number of additional shares proportionate to

that underwriter's initial purchase commitment as indicated in the table above. This option may be exercised only if the underwriters sell more shares than the total number set forth on the cover page

of this prospectus.

No Sales of Similar Securities

We, our officers, directors and holders of all or substantially all our outstanding capital stock have agreed, subject to specified exceptions, not to

directly or indirectly:

- §

- sell, offer, contract or grant any option to sell (including any short sale),

pledge, transfer, establish an open "put equivalent position" within the meaning of Rule 16a-l(h) under the Securities Exchange Act of 1934, as amended, or

- §

- otherwise dispose of any shares of common stock, options or warrants to

acquire shares of common stock, or securities exchangeable or exercisable for or convertible into shares of common stock currently or hereafter owned either of record or beneficially, or

- §

- publicly announce an intention to do any of the foregoing for a period of

90 days after the date of this prospectus without the prior written consent of Jefferies LLC and Leerink Partners LLC.

S-16

Table of Contents

This

restriction terminates after the close of trading of the common stock on and including the 90th day after the date of this prospectus. Further, subject to certain exceptions,

in the event that either:

- §

- during the last 17 days of the 90-day restricted period, we issue an

earnings release or material news or a material event relating to us occurs, or

- §

- prior to the expiration of the 90-day restricted period, we announce that we

will release earnings results during the 16-day period beginning on the last day of the 90-day restricted period,

then

in either case the expiration of the 90-day restricted period will be extended until the expiration of the 18-day period beginning on the date of the issuance of an earnings release or the

occurrence of the material news or event, as applicable, unless Jefferies LLC and Leerink Partners LLC waive, in writing, such an extension.

Jefferies LLC

and Leerink Partners LLC may, in their sole discretion and at any time or from time to time before the termination of the 90-day period release all or any portion of the

securities subject to lock-up agreements. There are no existing agreements between the underwriters and any of our stockholders who will execute a lock-up agreement, providing consent to the sale of

shares prior to the expiration of the lock-up period.

Stabilization

The underwriters have advised us that they, pursuant to Regulation M under the Securities Exchange Act of 1934, as amended, certain persons

participating in the offering may engage in short sale transactions, stabilizing transactions, syndicate covering transactions or the imposition of penalty bids in connection with this offering. These

activities may have the effect of stabilizing or maintaining the market price of the common stock at a level above that which might otherwise prevail in the open market. Establishing short sales

positions may involve either "covered" short sales or "naked" short sales.

"Covered"

short sales are sales made in an amount not greater than the underwriters' option to purchase additional shares of our common stock in this offering. The underwriters may close out any

covered short position by either exercising their option to purchase additional shares of our common stock or purchasing shares of our

common stock in the open market. In determining the source of shares to close out the covered short position, the underwriters will consider, among other things, the price of shares available for

purchase in the open market as compared to the price at which they may purchase shares through the option to purchase additional shares.

"Naked"

short sales are sales in excess of the option to purchase additional shares of our common stock. The underwriters must close out any naked short position by purchasing shares in the open

market. A naked short position is more likely to be created if the underwriters are concerned that there may be downward pressure on the price of the shares of our common stock in the open market

after pricing that could adversely affect investors who purchase in this offering.

A

stabilizing bid is a bid for the purchase of shares of common stock on behalf of the underwriters for the purpose of fixing or maintaining the price of the common stock. A syndicate covering

transaction is the bid for or the purchase of shares of common stock on behalf of the underwriters to reduce a short position incurred by the underwriters in connection with the offering. Similar to

other purchase transactions, the underwriter's purchases to cover the syndicate short sales may have the effect of raising or maintaining the market price of our common stock or preventing or

retarding a decline in the market price of our common stock. As a result, the price of our common stock may be higher than the price that might otherwise exist in the open market. A penalty bid is an

arrangement permitting the underwriters to reclaim the selling concession otherwise accruing to a syndicate member in connection with the offering if the common stock originally sold by such syndicate

member are purchased in a syndicate covering transaction and therefore have not been effectively placed by such syndicate member.

S-17

Table of Contents

Neither

we nor any of the underwriters make any representation or prediction as to the direction or magnitude of any effect that the transactions described above may have on the price of our common

stock. The underwriters are not obligated to engage in these activities and, if commenced, any of the activities may be discontinued at any time.

The

underwriters may also engage in passive market making transactions in our common stock on The NASDAQ Global Select Market in accordance with Rule 103 of Regulation M during a period

before the commencement of offers or sales of shares of our common stock in this offering and extending through the completion of distribution. A passive market maker must display its bid at a price

not in excess of the highest independent bid of that security. However, if all independent bids are lowered below the passive market maker's bid, that bid must then be lowered when specified purchase

limits are exceeded.

Electronic Distribution

A prospectus in electronic format may be made available by e-mail or on the web sites or through online services maintained by one or more of the

underwriters or their affiliates. In those cases, prospective investors may view offering terms online and may be allowed to place orders online. The underwriters may agree with us to allocate a

specific number of shares of common stock for sale to online brokerage account holders. Any such allocation for online distributions will be made by the underwriters on the same basis as other

allocations. Other than the prospectus in electronic format, the information on the underwriters' web sites and any information contained in any other web site maintained by any of the underwriters is

not part of this prospectus, has not been approved and/or endorsed by us or the underwriters and should not be relied upon by investors.

Other Activities and Relationships

The underwriters and certain of their affiliates are full service financial institutions engaged in various activities, which may include securities

trading, commercial and investment banking, financial advisory, investment management, investment research, principal investment, hedging, financing and brokerage activities. The underwriters and

certain of their affiliates have, from time to time, performed, and may in the future perform, various commercial and investment banking and financial advisory services for us and our affiliates, for

which they received or will receive customary fees and expenses.

In

the ordinary course of their various business activities, the underwriters and certain of their affiliates may make or hold a broad array of investments and actively trade debt and equity

securities (or related derivative securities) and financial instruments (including bank loans) for their own account and for the accounts of their customers, and such investment and securities

activities may involve securities and/or instruments issued by us and our affiliates. If the underwriters or their respective affiliates have a lending relationship with us, they routinely hedge their

credit exposure to us consistent with their customary risk management policies. The underwriters and their respective affiliates may hedge such exposure by entering into transactions which consist of

either the purchase of credit default swaps or the creation of short positions in our securities or the securities of our affiliates, including potentially the common stock offered hereby. Any such

short positions could adversely affect future trading prices of the common stock offered hereby. The underwriters and certain of their respective affiliates may also communicate independent investment

recommendations, market color or trading ideas and/or publish or express independent research views in respect of such securities or instruments and may at any time hold, or recommend to clients that

they acquire, long and/or short positions in such securities and instruments.

S-18

Table of Contents

NOTICE TO INVESTORS

Australia

This prospectus is not a disclosure document for the purposes of Australia's Corporations Act 2001 (Cth) of Australia, or Corporations Act, has not

been lodged with the Australian Securities & Investments Commission and is only directed to the categories of exempt persons set out below. Accordingly, if you receive this prospectus in

Australia:

You

confirm and warrant that you are either:

- §

- a "sophisticated investor" under section 708(8)(a) or (b) of the

Corporations Act;

- §

- a "sophisticated investor" under section 708(8)(c) or (d) of the

Corporations Act and that you have provided an accountant's certificate to the company which complies with the requirements of section 708(8)(c)(i) or (ii) of the Corporations Act and

related regulations before the offer has been made;

- §

- "professional investor" within the meaning of section 708(11)(a) or

(b) of the Corporations Act.

To

the extent that you are unable to confirm or warrant that you are an exempt sophisticated investor or professional investor under the Corporations Act any offer made to you under this prospectus is

void and incapable of acceptance.

You

warrant and agree that you will not offer any of the shares issued to you pursuant to this prospectus for resale in Australia within 12 months of those shares being issued unless any such

resale offer is exempt from the requirement to issue a disclosure document under section 708 of the Corporations Act.

European Economic Area

In relation to each member state of the European Economic Area which has implemented the Prospectus Directive (each, a

"Relevant Member State"), with effect from and including the date on which the Prospectus Directive is implemented in that Relevant Member State (the

"Relevant Implementation Date"), no offer of any securities which are the subject of the offering contemplated by this prospectus has been or will be made

to the public in that Relevant Member State other than any offer where a prospectus has been or will be published in relation to such securities that has been approved by the competent authority in

that Relevant Member State or, where appropriate, approved in another Relevant Member State and notified to the relevant competent authority in that Relevant Member State in accordance with the

Prospectus Directive, except

that with effect from and including the Relevant Implementation Date, an offer of such securities may be made to the public in that Relevant Member

State:

- §

- to any legal entity which is a "qualified investor" as defined in the

Prospectus Directive;

- §

- to fewer than 100 or, if the Relevant Member State has implemented the relevant

provision of the 2010 PD Amending Directive, 150, natural or legal persons (other than qualified investors as defined in the Prospectus Directive), as permitted under the Prospectus Directive, subject

to obtaining the prior consent of the representatives of the underwriters for any such offer; or

- §

- in any other circumstances falling within Article 3(2) of the Prospectus

Directive,

provided

that no such offer of securities shall require the Company or any of the underwriters to publish a prospectus pursuant to Article 3 of the Prospectus Directive or supplement a

prospectus pursuant to Article 16 of the Prospectus Directive.

For

the purposes of this provision, the expression an "offer to the public" in relation to any securities in any Relevant Member State means the communication in any form and by any means of

sufficient information on the terms of the offer and the securities to be offered so as to enable an investor to decide to purchase or subscribe the securities, as the same may be varied in that

Relevant Member State by any measure implementing the Prospectus Directive in that Relevant Member State and the expression "Prospectus

S-19

Table of Contents

Directive"

means Directive 2003/71/EC (and amendments thereto, including the 2010 PD Amending Directive, to the extent implemented in the Relevant Member State), and includes any relevant implementing

measure in the Relevant Member State and the expression "2010 PD Amending Directive" means Directive 2010/73/EU.

Hong Kong

No securities have been offered or sold, and no securities may be offered or sold, in Hong Kong, by means of any document, other than to persons whose

ordinary business is to buy or sell shares or debentures, whether as principal or agent; or to "professional investors" as defined in the Securities and Futures Ordinance (Cap. 571) of Hong Kong and

any rules made under that Ordinance; or in other circumstances which do not result in the document being a "prospectus" as defined in the Companies Ordinance (Cap. 32) of Hong Kong or

which do not constitute an offer to the public within the meaning of the Companies Ordinance (Cap. 32) of Hong Kong. No document, invitation or advertisement relating to the securities has been

issued or may be issued or may be in the possession of any person for the purpose of issue (in each case whether in Hong Kong or elsewhere), which is directed at, or the contents of which are likely

to be accessed or read by, the public of Hong Kong (except if permitted under the securities laws of Hong Kong) other than with respect to securities which are or are intended to be disposed of only

to persons outside Hong Kong or only to "professional investors" as defined in the Securities and Futures Ordinance (Cap. 571) of Hong Kong and any rules made under that Ordinance.

This

prospectus has not been registered with the Registrar of Companies in Hong Kong. Accordingly, this prospectus may not be issued, circulated or distributed in Hong Kong, and the securities may not

be offered for subscription to members of the public in Hong Kong. Each person acquiring the securities will be required, and is deemed by the acquisition of the securities, to confirm that he is

aware of the restriction on offers of the securities described in this prospectus and the relevant offering documents and that he is not acquiring, and has not been offered any securities in

circumstances that contravene any such restrictions.

Japan

The offering has not been and will not be registered under the Financial Instruments and Exchange Law of Japan (Law No. 25 of 1948 of Japan, as

amended), or FIEL, and the Initial Purchaser will not offer or sell any securities, directly or indirectly, in Japan or to, or for the benefit of, any resident of Japan (which term as used herein

means, unless otherwise provided herein, any person resident in Japan, including any corporation or other entity organized under the laws of Japan), or to others for re-offering or resale, directly or

indirectly, in Japan or to a resident of Japan, except pursuant to an exemption from the registration requirements of, and otherwise in compliance with, the FIEL and any other applicable laws,

regulations and ministerial guidelines of Japan.

Singapore

This prospectus has not been and will not be lodged or registered with the Monetary Authority of Singapore. Accordingly, this prospectus and any other

document or material in connection with the offer or sale, or the invitation for subscription or purchase of the securities may not be issued, circulated or distributed, nor may the securities be

offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to the public or any member of the public in Singapore other than (i) to

an institutional investor under Section 274 of the Securities and Futures Act, Chapter 289 of Singapore (the "SFA"), (ii) to a

relevant person as defined under Section 275(2), or any person pursuant to Section 275(1A) of the SFA, and in accordance with the conditions, specified in Section 275 of the SFA,

or (iii) otherwise pursuant to, and in accordance with the conditions of any other applicable provision of the SFA.

S-20

Table of Contents

Where

the securities are subscribed or purchased under Section 275 of the SFA by a relevant person which is:

- §

- a corporation (which is not an accredited investor as defined under

Section 4A of the SFA) the sole business of which is to hold investments and the entire share capital of which is owned by one or more individuals, each of whom is an accredited investor; or

- §

- a trust (where the trustee is not an accredited investor) whose sole purpose is

to hold investments and each beneficiary is an accredited investor,

shares,

debentures and units of shares and debentures of that corporation or the beneficiaries' rights and interest in that trust shall not be transferable for six months after that corporation or

that trust has acquired the Offer Shares under Section 275 of the SFA except:

- §

- to an institutional investor under Section 274 of the SFA or to a

relevant person defined in Section 275(2) of the SFA, or to any person pursuant to an offer that is made on terms that such shares, debentures and units of shares and debentures of that

corporation or such rights and interest in that trust are acquired at a consideration of not less than $200,000 (or its equivalent in a foreign currency) for each transaction, whether such amount is

to be paid for in cash or by exchange of securities or other assets, and further for corporations, in accordance with the conditions, specified in Section 275 of the SFA;

- §

- where no consideration is given for the transfer; or

- §

- where the transfer is by operation of law.

Switzerland

The securities may not be publicly offered in Switzerland and will not be listed on the SIX Swiss Exchange

("SIX") or on any other stock exchange or regulated trading facility in Switzerland. This prospectus has been prepared without regard to the disclosure

standards for issuance prospectuses under art. 652a or art. 1156 of the Swiss Code of Obligations or the disclosure standards for listing prospectuses under art. 27 ff. of the SIX Listing Rules or the

listing rules of any other stock exchange or regulated trading facility in Switzerland. Neither this prospectus nor any other offering or marketing material relating to the securities or the offering

may be publicly distributed or otherwise made publicly available in Switzerland.

Neither

this prospectus nor any other offering or marketing material relating to the offering, the Company or the securities have been or will be filed with or approved by any Swiss regulatory

authority. In particular, this prospectus will not be filed with, and the offer of securities will not be supervised by, the Swiss Financial Market Supervisory Authority FINMA

("FINMA"), and the offer of securities has not been and will not be authorized under the Swiss Federal Act on Collective Investment Schemes

("CISA"). The investor protection afforded to acquirers of interests in collective investment schemes under the CISA does not extend to acquirers of

securities.

United Kingdom

This prospectus is only being distributed to, and is only directed at, persons in the United Kingdom that are qualified investors within the meaning

of Article 2(1)(e) of the Prospectus Directive that are also (i) investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial

Promotion) Order 2005, as amended (the "Order") and/or (ii) high net worth entities falling within Article 49(2)(a) to (d) of the

Order and other persons to whom it may lawfully be communicated (each such person being referred to as a "relevant person").

This

prospectus and its contents are confidential and should not be distributed, published or reproduced (in whole or in part) or disclosed by recipients to any other persons in the United Kingdom.

Any person in the United Kingdom that is not a relevant person should not act or rely on this document or any of its contents.

S-21

Table of Contents

LEGAL MATTERS

Lowenstein Sandler LLP, New York, New York, will provide us with an opinion as to the validity of the shares of common stock offered by this

prospectus supplement and the accompanying prospectus. This opinion may be conditioned upon and may be subject to assumptions regarding future actions required to be taken by us and any underwriters,