University Group Operating Income Increases

more than 200%

Career Education Corporation (NASDAQ: CECO) today reported

operating and financial results for the third quarter of 2015.

Business Highlights:

- Increased University Group revenue by

1.4 percent year-over-year; excluding adjustments related to

changes in accounting for withdrawn students, revenue would have

increased 3.0 percent year-over-year

- Improved rate of cash burn

year-over-year by generating $5.6 million of positive cash flow

from operations during the quarter; first positive cash flow from

operations in a third quarter since 2012

- Increased University Group operating

income by 212.3 percent year-over-year to $20.3 million, driven by

ongoing cost discipline and modest total student enrollment

growth

- Third quarter 2015 operating expenses

for continuing operations remain in-line with the Company’s

expectations and were lowered by $41.7 million

- Adjusted EBITDA was $16.6 million for

the University Group and Corporate, an improvement of 157.6 percent

or $10.2 million as compared to the prior year quarter

- Adjusted EBITDA for the Transitional

Group and discontinued operations improved to ($13.4) million,

compared to ($36.9) million in the same quarter last year, as a

result of continued progress in executing legacy teach-outs,

reducing lease obligations and benefits from the accretive nature

of the Career College teach-outs announced in early May

- New leadership structure within the

University Group provides leadership for CTU and AIU with unique

skill sets intended to address specific needs of each

institution

“During the third quarter we saw a continuation of positive

trends in our operating performance that have resulted from the

successful implementation of our transformation initiatives. Cost

reductions and previously announced restructuring actions are

meeting our expectations and continue to position the Company to

achieve sustained long-term profitability. I have confidence in the

path that we are on as an organization and believe the strategy we

are pursuing is in the best interest of students and shareholders

alike,” said Todd Nelson, President and Chief Executive Officer.

“At this point in our transformation, it is critical that we not

take our eye off the ball with respect to our cost reduction,

performance and student outcome improvement initiatives, but we

must also enhance our focus on responsible growth to fulfill our

long-term objectives.”

Nelson continued, “Our recent announcement of the appointments

of John Kline and Andrew Hurst as Senior Vice Presidents

responsible for AIU and CTU are an indication of that transition in

our plan at the University Group level, and having them report

directly to me will increase our speed and effectiveness as we seek

to improve the long-term performance of each of their institutions.

We have a great team in place here, and I have been impressed with

the caliber of talent that I have encountered thus far in my tenure

as CEO. We have a significant opportunity to build a best-in-class

organization and I am confident that we can be successful. One of

the biggest milestones on our path to success is the completion of

divestitures and teach-outs of our former Career Colleges segment.

At this point in time, we are progressing in exclusive discussions

with one buyer for our Le Cordon Bleu campuses and we expect to

execute a definitive agreement by the end of the year.”

REVENUE

For the third quarter of 2015, total revenue was $162.1 million,

an 11.4 percent decrease from $182.8 million for the third quarter

of 2014. Total revenue for the University Group was $136.1 million

for the third quarter of 2015 compared to $134.3 million for the

third quarter of 2014, an increase of 1.4 percent. Adjusting for

changes related to accounting for withdrawn students, revenue

increased 3.0 percent for the current quarter as compared to the

prior year quarter for the University Group.

Revenue ($ in

thousands)

Q3 2015 (3)

Q2 2015 (3) Q1 2015 (3)

Q4 2014 (3) Q3

2014 CTU $ 85,433 $ 86,174 $ 85,127 $ 82,202 $ 82,410 AIU

50,688 52,024 53,066 44,749

51,889 Total University Group 136,121 138,198

138,193 126,951 134,299 Corporate and Other 39 39 39

40 52 Transitional Group (1) 25,914 36,543

44,070 47,216 48,474 Total (2) $ 162,074 $ 174,780 $

182,302 $ 174,207 $ 182,825 (1)

Teach-out campuses included in the

Transitional Group are in the process of being taught out and

therefore no longer enroll new students. Additionally, campuses

which have ceased operations subsequent to December 31, 2014 and no

longer qualify for discontinued operations treatment under

Financial Accounting Standards Board (“FASB”) Accounting Standards

Codification (“ASC”) Topic 360 – Property, Plant & Equipment or

campuses that were announced for sale subsequent to December 31,

2014 are also included in the Transitional Group.

(2) Excludes discontinued operations, which consists of the

results of operations for campuses that have ceased operations

prior to 2015 and the LCB campuses which are held for sale.

(3) Fourth quarter of 2014 total revenue was negatively impacted by

approximately $9.4 million due to the change in how the Company

accounts for revenue for students who withdrew from one of its

institutions prior to completion of their programs. This cumulative

adjustment was recorded during the fourth quarter of 2014. First

quarter, second quarter, and third quarter of 2015 were negatively

impacted by approximately $1.9 million, $2.2 million and $2.4

million, respectively, related to this change in accounting.

TOTAL AND NEW STUDENT ENROLLMENTS

For the third quarter of 2015, total student enrollments for the

University Group were 31,400, which remained relatively flat to the

prior year quarter. New student enrollments for the University

Group were 8,450, a decrease of 3.5 percent as compared to the

prior year quarter primarily due to the decline in enrollments at

AIU, while CTU remained relatively flat as compared to the prior

year quarter.

Total Student

Enrollment

Q3 2015 Q2

2015 Q1 2015 Q4 2014

Q3 2014 CTU 20,600 20,600

20,300 20,400 19,800 AIU 10,800 10,700

13,500 11,600 11,500 Total University Group

31,400 31,300 33,800 32,000

31,300 Transitional Group 5,200 7,000 9,500

9,400 11,300 Total 36,600 38,300

43,300 41,400 42,600

New Student

Enrollments

Q3 2015 Q2

2015 Q1 2015 Q4 2014

Q3 2014 CTU 5,470 5,670

5,040 5,670 5,460 AIU 2,980 2,280

5,090 3,370 3,300 Total University Group

8,450 7,950 10,130 9,040 8,760

Transitional Group (1) 510 830 1,830

1,150 3,290 Total 8,960 8,780 11,960

10,190 12,050 (1) Teach-out campuses within

the Transitional Group no longer enroll new students; students who

re-enter after 365 days are reported as new student enrollments.

OPERATING (LOSS) INCOME

For the third quarter of 2015, operating loss of $10.8 million

improved 66.0 percent compared to an operating loss of $31.7

million in the prior year quarter. Total University Group operating

income increased to $20.3 million from $6.5 million in the prior

year quarter, an increase of 212.3 percent. This increase in

operating income was primarily driven by ongoing cost improvement

initiatives and increased revenues.

Operating (Loss)

Income ($ in thousands)

Q3 2015 Q2 2015

Q1 2015 Q4 2014 Q3 2014

CTU $ 18,616 $ 24,263 $ 14,616 $ 23,356 $ 10,698 AIU 1,695

5,174 (2,887 ) (304 ) (4,194 ) Total

University Group 20,311 29,437 11,729

23,052 6,504 Corporate and Other (1) (8,040 ) (7,036 )

(5,860 ) (7,048 ) 2,528 Transitional Group (2) (23,065 )

(31,733 ) (30,470 ) (23,788 ) (40,764 )

Total (3) $ (10,794 ) $ (9,332 ) $ (24,601 ) $ (7,784 ) $ (31,732 )

(1) Income related to a net insurance recovery of $8.6

million was recorded during the third quarter of 2014. (2)

Asset impairment charges of $1.7 million, $6.0 million, $3.9

million and $12.9 million were recorded during the second quarter

of 2015, first quarter of 2015, fourth quarter of 2014 and third

quarter of 2014, respectively. (3) Excludes discontinued

operations, which consists of the results of operations for

campuses that have ceased operations prior to 2015 and the LCB

campuses which are held for sale.

ADJUSTED EBITDA

The Company believes it is useful to present non-GAAP financial

measures, which exclude certain significant items, as a means to

understand the performance of its operations. (See tables below and

the GAAP to non-GAAP reconciliation attached to this press release

for further details.)

For the third quarter of 2015, Adjusted EBITDA for the

University Group and Corporate increased $10.2 million to $16.6

million compared to the prior year quarter, driven by increased

revenue and continued cost reduction initiatives. Adjusted EBITDA

for the Transitional Group and discontinued operations was ($13.4)

million for the third quarter of 2015, compared to ($36.9) million

in the prior year quarter. This favorability is a result of the

completion of teach-out campus operations and continued focus on

reducing lease obligations.

Adjusted EBITDA

($ in thousands)

Q3 2015 Q2 2015

Q1 2015 Q4 2014 Q3 2014

University Group

and Corporate:

Pre-tax loss from continuing operations $ (11,485 ) $ (10,218 ) $

(24,990 ) $ (7,747 ) $ (31,651 ) Transitional Group pre-tax loss

23,724 32,624 30,470 23,788 40,764 Interest expense (income), net 7

(52 ) 2 (38 ) (120 ) Depreciation and amortization (1) 3,454 3,956

4,361 5,170 5,402 Stock-based compensation (1) 983 530 940 966 950

Legal settlements (1) (2) — — — — — Asset impairments (1) — — — —

73 Unused space charges (1) (3) (385 ) (348 ) 556 (373 ) (368 )

Insurance recovery — — — — (8,588 ) Adjustment related to revenue

recognition (1) (5) 348 94 93 1,354

—

Adjusted EBITDA--University Group and

Corporate

$ 16,646 $ 26,586 $

11,432 $ 23,120 $ 6,462

Memo: Advertising Expenses $ 46,194 $

34,258 $ 50,587 $ 36,731

$ 50,410

Transitional

Group and Discontinued Operations:

Pre-tax loss from discontinued operations $ (33,715 ) $ (11,252 ) $

(102 ) $ (17,195 ) $ (15,201 ) Transitional Group pre-tax loss

(23,724 ) (32,624 ) (30,470 ) (23,788 ) (40,764 ) Loss on sale of

business (4) 715 917 — — — Depreciation and amortization (4) 2,508

3,231 2,351 7,319 7,739 Legal settlements (4) — (166 ) 1,485 — 225

Asset impairments (4) 33,446 11,372 6,019 14,203 14,412 Unused

space charges (3) (4) 7,174 (2,305 ) (2,424 ) (2,063 ) (3,343 )

Adjustment related to revenue recognition (4) (5) 173

13 (67 ) 1,029 —

Adjusted

EBITDA--Transitional and

Discontinued Operations

$ (13,423 ) $ (30,814 )

$ (23,208 ) $ (20,495 )

$ (36,932 ) Consolidated Adjusted

EBITDA $ 3,223 $ (4,228 )

$ (11,776 ) $ 2,625 $

(30,470 ) (1) Quarterly amounts relate to the

University Group and Corporate (2) Legal settlement amounts

are net of insurance recoveries (3) Unused space charges

include initial charge and subsequent accretion (4)

Quarterly amounts relate to Transitional Group and discontinued

operations (5) Q4 2014 amounts are cumulative for the full

year 2014 recorded during the fourth quarter of 2014

BALANCE SHEET AND CASH FLOW

Net cash provided by operating activities improved to $5.6

million for the third quarter of 2015, compared to a net cash usage

of $19.9 million in the prior year quarter. The continued focus on

operating margin improvements and the completion of teach-outs

drove the improvement in cash usage for the current year quarter as

compared to the prior year quarter. The Company continues to expect

to end 2015 with approximately $190 million in total cash, cash

equivalents, restricted cash and short-term and long-term

investments, excluding the timing differences related to

outstanding checks, deposits and other transfers.

As of September 30, 2015 and September 30, 2014, cash,

cash equivalents, restricted cash and short-term and long-term

investments totaled $206.8 million and $258.3 million,

respectively.

Cash and Cash

Flow from Operations ($ in thousands)

Q3 2015 Q2

2015 Q1 2015 (3) Q4 2014

(3) Q3 2014 Consolidated Cash, Cash

Equivalents, Restricted Cash

and Short-Term and Long-Term Investments

(1)

$ 206,792 $ 204,104 $ 213,739 $ 247,002 $ 258,274 Cash Flow from

Operations (2) $ 5,592 $ (6,419 ) $ (20,176 ) $ (17,479 ) $ (19,860

) (1) Consolidated cash, cash equivalents, restricted cash

and short-term and long-term investment balances are quarter end

balances and include both continuing and discontinued operations.

Long-term investment balances of $7.4 million for each of the

periods disclosed are reflected within other non-current assets on

our consolidated balance sheets. (2) Cash flow from

operations includes payments of legal settlements of $2.4 million

and $1.3 million during the first quarter of 2015 and fourth

quarter of 2014, respectively. (3) The fourth quarter of

2014 ending cash, cash equivalents, restricted cash and investment

balance includes $10.0 million of restricted cash related to

borrowings under the Credit Agreement. The $10.0 million of

outstanding borrowings was repaid during the first quarter of 2015.

CONFERENCE CALL INFORMATION

Career Education Corporation will host a conference call on

Wednesday, November 4, 2015 at 9:00 a.m. Eastern time.

Interested parties can access the live webcast of the conference

call and the related presentation materials at www.careered.com in the Investor Relations section

of the website. Participants can also listen to the conference call

by dialing 844-378-6484 (domestic) or 412-542-4179 (international).

Please log-in or dial-in at least 10 minutes prior to the start

time to ensure a connection. An archived version of the webcast

will be accessible for 90 days at www.careered.com in the Investor Relations section

of the website.

ABOUT CAREER EDUCATION CORPORATION

Career Education’s academic institutions offer a quality

education to a diverse student population in a variety of

disciplines through online, on-ground and hybrid learning programs.

Our two universities – American InterContinental University (“AIU”)

and Colorado Technical University (“CTU”) – provide degree programs

through the master’s or doctoral level as well as associate and

bachelor’s levels. Both universities predominantly serve students

online with career-focused degree programs that are designed to

meet the educational demands of today’s busy adults. AIU and CTU

continue to show innovation in higher education, advancing new

personalized learning technologies like their intellipath™

adaptive learning platform that allow students to more efficiently

pursue earning a degree by receiving course credit for knowledge

they can already demonstrate. Career Education is committed to

providing quality education that closes the gap between learners

who seek to advance their careers and employers needing a qualified

workforce.

A listing of individual campus locations and web links to Career

Education’s institutions can be found at www.careered.com.

Except for the historical and present factual information

contained herein, the matters set forth in this release, including

statements identified by words such as “expect,” “intend,”

“believe,” “will,” “anticipate,” “continue,” “seek,” “position us”

and similar expressions, are forward-looking statements as defined

in Section 21E of the Securities Exchange Act of 1934, as

amended. These statements are based on information currently

available to us and are subject to various assumptions, risks,

uncertainties and other factors that could cause our results of

operations, financial condition, cash flows, performance, business

prospects and opportunities to differ materially from those

expressed in, or implied by, these statements. Except as expressly

required by the federal securities laws, we undertake no obligation

to update or revise such factors or any of the forward-looking

statements contained herein to reflect future events, developments

or changed circumstances, or for any other reason. These risks and

uncertainties, the outcomes of which could materially and adversely

affect our financial condition and operations, include, but are not

limited to, the following: declines in enrollment; the success of

our initiatives to divest our LCB culinary arts campuses and

remaining Career College institutions, which could be impacted by

the level of buyer interest and related valuations, required

regulatory approvals, and the various factors noted in this

paragraph, among other things; negative trends in the real estate

market which could impact the costs related to teaching out

campuses and the success of our initiatives to reduce our real

estate obligations; our ability to achieve anticipated cost savings

and business efficiencies; rulemaking by the U.S. Department of

Education or any state and increased focus by Congress, the

President and governmental agencies on for-profit education

institutions; our continued compliance with and eligibility to

participate in Title IV Programs under the Higher Education Act of

1965, as amended, and the regulations thereunder (including the

gainful employment and financial responsibility standards

prescribed by the U.S. Department of Education), as well as

national and regional accreditation standards and state regulatory

requirements; the impact of management changes; our ability to

successfully defend litigation and other claims brought against us;

and changes in the overall U.S. or global economy. Further

information about these and other relevant risks and uncertainties

may be found in the Company’s Annual Report on Form 10-K for the

fiscal year ended December 31, 2014 and its subsequent filings

with the Securities and Exchange Commission.

CAREER EDUCATION CORPORATION AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands)

September 30,

2015

December 31,

2014

(unaudited)

ASSETS CURRENT ASSETS: Cash and cash equivalents,

unrestricted $ 68,940 $ 93,832 Restricted cash 13,688 22,938

Short-term investments 116,790 122,858 Total cash and

cash equivalents, restricted cash and short-term investments

199,418 239,628 Student receivables, net 27,696 24,564

Receivables, other, net 4,415 18,925 Prepaid expenses 13,360 14,679

Inventories 2,353 3,305 Other current assets 1,565 2,384 Assets

held for sale 29,239 76,846 Assets of discontinued operations

347 473 Total current assets 278,393

380,804

NON-CURRENT ASSETS: Property and equipment,

net 54,680 73,083 Goodwill 87,356 87,356 Intangible assets, net

7,900 9,819 Student receivables, net 2,874 2,926 Other assets

16,901 18,571 Assets of discontinued operations 780

975

TOTAL ASSETS $ 448,884 $

573,534 LIABILITIES AND STOCKHOLDERS' EQUITY

CURRENT LIABILITIES: Short-term borrowings $ — $ 10,000

Accounts payable 28,293 21,968 Accrued expenses: Payroll and

related benefits 31,208 29,545 Advertising and production costs

15,026 13,162 Income taxes 1,717 1,633 Other 22,295 21,440 Deferred

tuition revenue 31,004 37,572 Liabilities held for sale 45,187

50,357 Liabilities of discontinued operations 12,355

15,506 Total current liabilities 187,085 201,183

NON-CURRENT LIABILITIES: Deferred rent obligations

34,999 48,381 Other liabilities 19,760 19,178 Liabilities of

discontinued operations 12,597 22,859 Total

non-current liabilities 67,356 90,418

STOCKHOLDERS' EQUITY: Preferred stock — — Common stock 829

823 Additional paid-in capital 610,063 606,531 Accumulated other

comprehensive loss (620 ) (853 ) Retained deficit (200,242 )

(109,403 ) Cost of shares in treasury (215,587 )

(215,165 ) Total stockholders' equity 194,443 281,933

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $

448,884 $ 573,534

CAREER EDUCATION CORPORATION AND

SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF LOSS AND COMPREHENSIVE LOSS

(In thousands, except per share amounts

and percentages)

For the Quarter Ended September 30,

2015 % of

Total

Revenue

2014 % of

Total

Revenue

REVENUE: Tuition and registration fees $

161,358 99.6 % $ 181,761 99.4 % Other 716 0.4 % 1,064

0.6 % Total revenue 162,074 182,825

OPERATING

EXPENSES: Educational services and facilities 54,201 33.4 %

60,790 33.3 % General and administrative 112,705 69.5 % 132,090

72.2 % Depreciation and amortization 5,962 3.7 % 8,739 4.8 % Asset

impairment — 0.0 % 12,938 7.1 % Total operating expenses

172,868 106.7 % 214,557 117.4 % Operating loss

(10,794 ) -6.7 % (31,732 ) -17.4 %

OTHER (EXPENSE)

INCOME: Interest income 163 0.1 % 223 0.1 % Interest expense

(170 ) -0.1 % (103 ) -0.1 % Loss on sale of business (715 ) -0.4 %

— 0.0 % Miscellaneous income (expense) 31 0.0 % (39 )

0.0 % Total other (expense) income (691 ) -0.4 % 81

0.0 %

PRETAX LOSS (11,485 ) -7.1 % (31,651 ) -17.3 %

Provision for income taxes 35 0.0 % 1,116 0.6 %

LOSS FROM CONTINUING OPERATIONS (11,520 ) -7.1 %

(32,767 ) -17.9 % Loss from discontinued operations, net of tax

(33,715 ) -20.8 % (15,201 ) -8.3 %

NET LOSS

(45,235 ) -27.9 % (47,968 ) -26.2 %

OTHER

COMPREHENSIVE LOSS, net of tax: Unrealized gain (loss) on

investments 81 (108 )

COMPREHENSIVE LOSS

$ (45,154 ) $ (48,076 )

NET LOSS PER SHARE - DILUTED: Loss from continuing

operations $ (0.17 ) $ (0.49 ) Loss from discontinued operations

(0.50 ) (0.22 ) Net loss per share $ (0.67 ) $ (0.71

)

DILUTED WEIGHTED AVERAGE SHARES

OUTSTANDING

67,961 67,209

CAREER EDUCATION CORPORATION AND

SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF LOSS AND COMPREHENSIVE LOSS

(In thousands, except per share amounts

and percentages)

For the Year to Date Ended September

30, 2015 % of

Total

Revenue

2014 % of

Total

Revenue

REVENUE: Tuition and registration fees $

516,722 99.5 % $ 563,806 99.4 % Other 2,434 0.5 %

3,345 0.6 % Total revenue 519,156 567,151

OPERATING EXPENSES: Educational services and facilities

163,101 31.4 % 181,429 32.0 % General and administrative 373,218

71.9 % 409,587 72.2 % Depreciation and amortization 19,860 3.8 %

28,052 4.9 % Asset impairment 7,704 1.5 % 13,015 2.3

% Total operating expenses 563,883 108.6 % 632,083

111.4 % Operating loss (44,727 ) -8.6 % (64,932 )

-11.4 %

OTHER (EXPENSE) INCOME: Interest income 545 0.1 %

614 0.1 % Interest expense (502 ) -0.1 % (292 ) -0.1 % Loss on sale

of business (1,632 ) -0.3 % — 0.0 % Miscellaneous expense

(377 ) -0.1 % (147 ) 0.0 % Total other (expense) income

(1,966 ) -0.4 % 175 0.0 %

PRETAX LOSS (46,693

) -9.0 % (64,757 ) -11.4 % (Benefit from) provision for income

taxes (923 ) -0.2 % 3,190 0.6 %

LOSS FROM

CONTINUING OPERATIONS (45,770 ) -8.8 % (67,947 ) -12.0 % Loss

from discontinued operations, net of tax (45,069 ) -8.7 %

(84,728 ) -14.9 %

NET LOSS (90,839 ) -17.5 %

(152,675 ) -26.9 %

OTHER COMPREHENSIVE INCOME (LOSS), net

of tax:

Unrealized income (loss) on investments 233 (243 )

COMPREHENSIVE LOSS $ (90,606 ) $

(152,918 ) NET LOSS PER SHARE -

DILUTED: Loss from continuing operations $ (0.68 ) $ (1.01 )

Loss from discontinued operations (0.66 ) (1.26 ) Net

loss per share $ (1.34 ) $ (2.27 )

DILUTED WEIGHTED

AVERAGE SHARES

OUTSTANDING:

67,798 67,121

CAREER EDUCATION CORPORATION AND

SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In thousands)

For the Year to date

Ended September 30,

2015 2014 CASH FLOWS FROM OPERATING

ACTIVITIES: Net loss $ (90,839 ) $ (152,675 ) Adjustments to

reconcile net loss to net cash used in operating activities: Asset

impairment 50,837 22,006 Depreciation and amortization expense

19,861 42,966 Bad debt expense 15,526 19,107 Compensation expense

related to share-based awards 2,453 3,311 Loss on sale of

businesses, net 1,632 311 (Gain) loss on disposition of property

and equipment (10 ) 32 Changes in operating assets and liabilities

(20,463 ) (36,203 ) Net cash used in operating

activities (21,003 ) (101,145 )

CASH FLOWS

FROM INVESTING ACTIVITIES: Purchases of available-for-sale

investments (64,056 ) (131,487 ) Sales of available-for-sale

investments 69,436 51,540 Purchases of property and equipment

(7,926 ) (10,558 ) Proceeds on the sale of assets 2,272 — Payments

of cash upon sale of businesses (4,125 ) (387 ) Net

cash used in investing activities (4,399 ) (90,892 )

CASH FLOWS FROM FINANCING ACTIVITIES: Issuance of

common stock 1,082 575 Payment on borrowings (10,000 ) — Change in

restricted cash 9,250 (674 ) Net cash provided by

(used in) financing activities 332 (99 )

EFFECT OF FOREIGN CURRENCY EXCHANGE RATE CHANGES ON CASH

AND CASH EQUIVALENTS:

178 121

NET DECREASE IN CASH AND CASH

EQUIVALENTS (24,892 ) (192,015 )

DISCONTINUED OPERATIONS

CASH ACTIVITY INCLUDED ABOVE: Add: Cash balance of discontinued

operations, beginning of the period — 475 Less: Cash balance of

discontinued operations, end of the period — —

CASH AND CASH

EQUIVALENTS, beginning of the period 93,832

318,468

CASH AND CASH EQUIVALENTS, end of the period $

68,940 $ 126,928

CAREER EDUCATION CORPORATION AND

SUBSIDIARIES

UNAUDITED SELECTED SEGMENT

INFORMATION

(In thousands, except percentages)

For the Quarter Ended

September 30, 2015 2014 REVENUE:

CTU $ 85,433 $ 82,410 AIU 50,688 51,889 Total

University Group 136,121 134,299 Corporate and Other

39 52 Transitional Group 25,914 48,474 Total $

162,074 $ 182,825

OPERATING (LOSS) INCOME: CTU $

18,616 $ 10,698 AIU 1,695 (4,194 ) Total University

Group 20,311 6,504 Corporate and Other (8,040 ) 2,528

Transitional Group (23,065 ) (40,764 ) Total $

(10,794 ) $ (31,732 )

OPERATING (LOSS) MARGIN: CTU

21.8 % 13.0 % AIU 3.3 % -8.1 % Total University Group 14.9 % 4.8 %

Corporate and Other NM NM Transitional Group NM NM Total -6.7 %

-17.4 %

CAREER EDUCATION CORPORATION AND

SUBSIDIARIES

UNAUDITED SELECTED SEGMENT

INFORMATION

(In thousands, except percentages)

For the Year to Date Ended

September 30, 2015 2014 REVENUE:

CTU $ 256,734 $ 254,371 AIU 155,778 154,147 Total

University Group 412,512 408,518 Corporate and Other

117 190 Transitional Group 106,527 158,443 Total $

519,156 $ 567,151

OPERATING (LOSS) INCOME: CTU $ 57,495 $

46,136 AIU 3,982 (9,108 ) Total University Group

61,477 37,028 Corporate and Other (20,936 ) (14,121 )

Transitional Group (85,268 ) (87,839 ) Total $

(44,727 ) $ (64,932 )

OPERATING (LOSS) MARGIN: CTU 22.4 %

18.1 % AIU 2.6 % -5.9 % Total University Group 14.9 % 9.1 %

Corporate and Other NM NM Transitional Group NM NM Total -8.6 %

-11.4 %

CAREER EDUCATION CORPORATION AND

SUBSIDIARIES

UNAUDITED RECONCILIATION OF GAAP TO

NON-GAAP ITEMS (1)

(In thousands)

Adjusted

EBITDA

Q3 2015 Q2 2015 Q1 2015 Q4 2014 Q3

2014

University Group

and Corporate:

Pre-tax loss from continuing operations $ (11,485 ) $ (10,218 ) $

(24,990 ) $ (7,747 ) $ (31,651 ) Transitional Group pre-tax loss

23,724 32,624 30,470 23,788 40,764 Interest expense (income), net 7

(52 ) 2 (38 ) (120 ) Depreciation and amortization (3) 3,454 3,956

4,361 5,170 5,402 Stock-based compensation (3) 983 530 940 966 950

Legal settlements (3) (5) — — — — — Asset impairments (3) — — — —

73 Unused space charges (3) (6) (385 ) (348 ) 556 (373 ) (368 )

Insurance recovery — — — — (8,588 ) Adjustment related to revenue

recognition (3) (7)

348 94 93 1,354 —

Adjusted

EBITDA--University Group and

Corporate (2)

$ 16,646 $ 26,586 $

11,432 $ 23,120 $ 6,462

Memo: Advertising Expenses (3) $ 46,194

$ 34,258 $ 50,587 $

36,731 $ 50,410

Transitional

Group and Discontinued Operations (4):

Pre-tax loss from discontinued operations $ (33,715 ) $ (11,252 ) $

(102 ) $ (17,195 ) $ (15,201 ) Transitional Group pre-tax loss

(23,724 ) (32,624 ) (30,470 ) (23,788 ) (40,764 ) Loss on sale of

business (8) 715 917 — — — Depreciation and amortization (8) 2,508

3,231 2,351 7,319 7,739 Legal settlements (5) (8) — (166 ) 1,485 —

225 Asset impairments (8) 33,446 11,372 6,019 14,203 14,412 Unused

space charges (6) (8) 7,174 (2,305 ) (2,424 ) (2,063 ) (3,343 )

Adjustment related to revenue

recognition (7) (8)

173 13 (67 ) 1,029 —

Adjusted

EBITDA--Transitional and

Discontinued Operations

(2)

$ (13,423 ) $ (30,814 )

$ (23,208 ) $ (20,495 )

$ (36,932 ) Consolidated Adjusted

EBITDA $ 3,223 $ (4,228 )

$ (11,776 ) $ 2,625 $

(30,470 ) (1) The Company believes it is

useful to present non-GAAP financial measures which exclude certain

significant items as a means to understand the performance of its

operations. As a general matter, the company uses non-GAAP

financial measures in conjunction with results presented in

accordance with GAAP to help analyze the performance of its

operations, assist with preparing the annual operating plan, and

measure performance for some forms of compensation. In addition,

the company believes that non-GAAP financial information is used by

analysts and others in the investment community to analyze the

company’s historical results and to provide estimates of future

performance and that failure to report non-GAAP measures could

result in a misplaced perception that the company’s results have

underperformed or exceeded expectations. We believe adjusted

EBITDA allows us to compare our current operating results with

corresponding historical periods and with the operational

performance of other companies in our industry because it does not

give effect to potential differences caused by items we do not

consider reflective of underlying operating performance. We also

present adjusted EBITDA because we believe it is frequently used by

securities analysts, investors and other interested parties as a

measure of performance. In evaluating adjusted EBITDA, investors

should be aware that in the future we may incur expenses similar to

the adjustments presented above. Our presentation of adjusted

EBITDA should not be construed as an inference that our future

results will be unaffected by expenses that are unusual,

non-routine or non-recurring. Adjusted EBITDA has limitations as an

analytical tool, and you should not consider it in isolation, or as

a substitute for net income (loss), operating income (loss), or any

other performance measure derived in accordance and reported under

GAAP or as an alternative to cash flow from operating activities or

as a measure of our liquidity. Non-GAAP financial measures,

when viewed in a reconciliation to corresponding GAAP financial

measures, provide an additional way of viewing the company’s

results of operations and the factors and trends affecting the

company’s business. Non-GAAP financial measures should be

considered as a supplement to, and not as a substitute for, or

superior to, the corresponding financial results presented in

accordance with GAAP. (2) Management assesses results of

operations for the University Group and Corporate separately from

the Transitional Group. As a result, management views adjusted

EBITDA from the University Group and Corporate separately from the

remainder of the organization, to assess results and make

decisions. Accordingly, the Transitional Group pre-tax losses are

added back to pre-tax loss from continuing operations and

subtracted from pre-tax loss from discontinued operations.

(3) Quarterly amounts relate to the University Group and Corporate.

(4) The Company announced the Culinary Arts segment as held

for sale during the fourth quarter of 2014 and it is therefore now

reported within discontinued operations. Quarterly adjusted EBITDA

amounts for Culinary Arts include:

Q3 2015 Q2 2015 Q1 2015

Q4 2014 Q3 2014 Pre-tax (loss) income $

(33,171 ) $ (10,532 ) $ 250 $ (15,927 ) $ (12,602 ) Depreciation

and amortization — — — 4,504 4,282 Legal settlements — — 775 — —

Asset impairments 33,446 9,687 — 10,320 1,523 Unused space charges

209 (982 ) (377 ) 65 213 Cumulative adjustment related to revenue

recognition 150 5 54 514 —

Total $ 634 $ (1,822 )

$ 702 $ (524 ) $

(6,584 ) (5) Legal settlement amounts are net

of insurance recoveries. (6) Unused space charges represent

the net present value of remaining lease obligations less an

estimated amount for sublease income as well as the subsequent

accretion of these charges. (7) Revenue recognition

adjustment relates to the accounting for students who withdraw from

one of our institutions prior to completion of their program. This

adjustment now reflects revenue earned on a cash-basis of

accounting beginning in the fourth quarter of 2014 for these

students. Q4 2014 amounts are cumulative for the full year 2014

recorded during the fourth quarter of 2014. (8) Quarterly

amounts relate to the Transitional Group and discontinued

operations.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20151104005383/en/

Investors:Alpha IR GroupSam Gibbons or Chris Hodges(312)

445-2870CECO@alpha-ir.comOrMedia:Career Education

Corporation(847) 585-2600media@careered.com

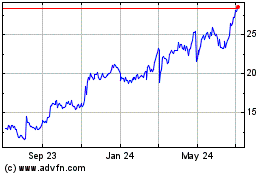

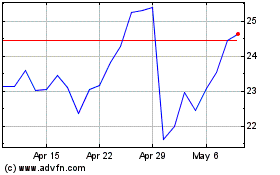

CECO Environmental (NASDAQ:CECO)

Historical Stock Chart

From Mar 2024 to Apr 2024

CECO Environmental (NASDAQ:CECO)

Historical Stock Chart

From Apr 2023 to Apr 2024