Strong growth in organic sales:

+2.9%

ROI growth for the eighth consecutive half:

+5.3% at constant exchange rates

Adjusted net income, Group share up

+0.6%

Regulatory News:

Carrefour (Paris:CA):

Sales inc. VAT of €40.6bn in H1 (€20.5bn in Q2): Further

growth in organic sales

- Resilient sales in France and Europe in

a more difficult consumption environment, notably marked by

unfavorable weather conditions

- Very strong growth in emerging markets,

driven by Latin America and Taiwan

Recurring Operating Income of €706m in H1: Strong operational

performance

- Operating margin held up well in

France, stable at 1.8%

- Strong growth in Other European

countries, with a 30bp rise in operating margin

- Growth in profitability in Latin

America, with a 12.3% rise in ROI

Investments to support the multiformat and omnichannel

model

- Openings of 305 convenience stores, 97

supermarkets, 5 cash & carry stores and 3 integrated

hypermarkets in H1

- Digital-channel development in all the

Group’s countries

- First contribution of Rue du Commerce

in France

- Creation of Cargo, a real estate

company dedicated to logistics controlled by Carrefour and

co-financed with third parties

- Accelerated pace of DIA store

conversions in France with 260 stores converted in H1. 412 stores

are now under Carrefour banners; the conversion of the 648 stores

will be completed as planned at end-2016

2016 objectives

- Investments1 of between €2.5bn and

€2.6bn

- Increased free cash flow1 and stable

year-end net debt vs. end-2015

- Continued strict financial discipline:

maintain BBB+ rating

1 Ex. Cargo

H1 2016 sales and results

Key H1 2016 figures

€m

H12016

Variationatconstantexchangerates

Sales inc. VAT 40,552 +2.0% Net sales 36,289

+2.2% Organic growth +2.9% Recurring

Operating Income before D&A (EBITDA) 1,448 +3.4%

Recurring

Operating Income (ROI) 706

+5.3% Adjusted net income, Group share

235

H1 2016 sales and Recurring Operating Income

(€m)

Sales inc. VAT Net sales

Organicgrowth

RecurringOperatingIncome

Variation at constant

exchange rates

Europe 29,714 26,607 -0.3% 467 +5.0% Emerging markets 10,838

9,682 +10.1% 266 -6.0% Global functions

-26

Total 40,552

36,289 +2.9% 706

+5.3%

H1 2016 sales inc. VAT: Solid first-half sales

Sales inc. VAT stood at €40,552m. In the first half, currencies

had an adverse effect (-6.1%), as did petrol prices (-1.0%).

In the first half, Carrefour recorded further sales growth, up

+2.9% on an organic basis. Emerging markets posted double-digit

growth while sales in Europe were stable, impacted by a sluggish

consumption environment.

In H1 2016, France posted sales inc. VAT of €19,196m,

slightly down on a like-for-like basis, but on the back of three

consecutive years of LFL growth in H1.

Sales in international markets stood at €21,356m in H1

2016, up +5.3% like-for-like. Sales in Other European countries

were up +2.2% on a like-for-like basis. Latin America continued its

strong momentum and posted further LFL sales growth of +14.5% in

the half. In Asia, LFL sales were down 5.4%.

First-half 2016 results: Further growth in ROI (+5.3% at

constant exchange rates) and adjusted net income (+0.6%)

Income statement

The Group’s Recurring Operating Income (ROI) stood at

€706m, up +5.3% at constant exchange rates.

In Europe, ROI was up +5.0% to €467m. Operating margin in France

was stable at 1.8% of sales. In Other European countries, ROI

posted double-digit growth and operating margin increased by 30

basis points, driven notably by strong performances in Spain and

Italy.

Latin America turned in another strong performance, with its ROI

up +12.3% at constant exchange rates to €273m. Brazil’s

profitability continued to improve, driven by strong LFL sales

growth.

In Asia, ROI was impacted by the transformation of our model in

China in a context marked by the rapid evolution of consumer

expectations. In Taiwan, sales growth continued and operating

margin improved.

In the first half of 2016, non-recurring income was a net

expense of €114m, principally attributable to reorganization costs

in various countries. This compares to an expense of €16m in H1

2015. Net income from continuing operations, Group share,

stood at €158m, including the following elements:

- A decrease in financial expenses

for €16m,

- An effective tax rate of 31.3%

vs. 34.3% in H1 2015.

Net income, Group share, stood at €129m. When adjusted mainly

for non-recurring income, the Group share of net income is €235m,

up +0.6%.

Cash flow and debt

In H1 2016, gross cash flow stood at €1,088m vs. €1,180m

in H1 2015. Working capital requirements improved by €179m,

from -€2,232m in H1 2015 to -€2,052m in H1 2016.

Total capex reached €1,057m, up vs. H1 2015. Excluding

Cargo, capex was €968m, reflecting a better distribution over the

year between the two halves. These investments included the planned

acceleration of the conversion of DIA stores to Carrefour

banners.

Free cash flow stood at -€2,259m, reflecting the seasonality of

our business. Excluding Cargo and exceptional items, free cash

flow stood at -€2,106m.

Dividend payments in cash amounted to €121m in H1 2016.

In 2015, the dividend had been paid in H2. The creation of

Cargo resulted in an inflow in the “Capital increase” line

and accounts for most of it.

In total, net financial debt at June 30, 2016 stood at

€7.4bn, reflecting once again the seasonality of our activity. Net

debt at end-2016 is expected to be globally stable vs. its level at

31 December 2015.

2016 roadmap

Carrefour is continuing its transformation, with strong

ambitions for its multiformat and omnichannel model, offering its

clients a shopping experience adapted to evolving consumption

habits.

Carrefour, the world’s most multiformat retailer, continues to

expand. In 2016, the Group will continue opening stores in its

different formats. In France, the conversion of the DIA store

network is proceeding according to plan.

Carrefour, to grow sustainably, continues to modernize its

stores in all countries and to enhance the attractiveness of its

sites by capitalizing on Carmila, a company dedicated to the

revitalization of Carrefour shopping malls in France, Spain and

Italy. Carrefour is making further headway in the revamp of its

supply-chain and IT rationalization in several countries.

The transformation of its model in China continues and is well

advanced.

Carrefour continues its digital evolution, supported by its

physical store network and the development of e-commerce services

in all Group countries.

Agenda

- Q3 2016 sales: October 19, 2016

APPENDIX

First-half 2016 sales inc. VAT

The Group posted sales of €40,552m. In the half, currencies had

an unfavorable impact of 6.1%. Petrol prices had an impact of -1.0%

overall and -1.5% in France. Calendar impact was estimated at

+0.3%.

Total salesinc.

VAT(€m)

Change

atcurrentexchangerates

inc.petrol

Change

atconstantexchangerates

inc.petrol

LFL ex petrolex calendar

Organic growthex petrolex

calendar

France 19,196 -2.4%

-0.9% -1.5%

-0.5% Hypermarkets 9,857 -3.5% -1.7%

-2.1% -1.9% Supermarkets 6,267 -2.4% +1.4% -1.1% +1.6%

International 21,356

-5.7% +6.0%

+6.2% +5.3%

Other European

countries 10,518 0.0%

+1.3% +1.5%

+2.2% Spain 4,129 +0.3% +1.8% +1.6% +2.0%

Italy 2,666 -0.5% +0.2% +2.0% +2.9% Belgium 2,132 +0.4% +0.3% -0.1%

+0.2%

Latin America 7,234

-11.3% +17.8%

+17.9% +14.5% Brazil

5,619 -6.8% +15.9% +15.9% +11.5%

Asia 3,605

-9.3% -5.4%

-5.3% -5.4% China 2,708

-12.8% -9.0% -8.9% -8.8%

Group total 40,552

-4.2% +3.0%

+2.9% +2.9%

Total sales under banners including petrol stood at €49.6bn in

the first half of 2016, up +1.7% at constant exchange rates.

Second-quarter 2016 sales inc. VAT

The Group posted sales of €20,499m. In the second quarter,

currencies had an unfavorable impact of 5.4%. Petrol prices had an

impact of -1.0% overall and -1.2% in France. Calendar impact was

estimated at -0.1%.

Total salesinc.

VAT(m€)

Change

atcurrentexchangerates

inc.petrol

Change

atconstantexchangerates

inc.petrol

LFL ex petrolex calendar

Organic growthex petrolex

canlendar

France 9,861 -3.0%

-1.8% -2.1%

-0.9% Hypermarkets 4,970 -4.8% -3.2% -3.5%

-3.1% Supermarkets 3,275 -2.0% +1.9% -0.5% +2.5%

International 10,638

-5.0% +5.6%

+6.3% +5.3%

Other European

countries 5,322 -0.8%

+0.4% +0.7%

+1.2% Spain 2,105 0.0% +1.1% +0.9% +0.7% Italy

1,334 -2.3% -1.6% -0.1% +1.4% Belgium 1,077 -0.5% -0.5% -0.7% -0.5%

Latin America 3,783 -7.5%

+17.3%

+18.7% +15.5% Brazil 2,954 -1.0%

+15.7% +17.3% +13.1%

Asia 1,533

-12.2% -5.6%

-5.3% -6.0% China 1,127

-15.5% -9.2% -8.7% -9.3%

Group total 20,499

-4.1% +2.3%

+2.6% +2.7%

Total sales under banners including petrol stood at €25.0bn in

the second quarter of 2016, up +0.8% at constant exchange

rates.

First-half 2016 net sales and Recurring Operating Income by

region

Net sales Recurring

Operating Income

(€m)

H12015

H12016

Organicgrowth1

Variationat currentexchangerates

H12015

H12016

Variationat constantexchangerates

Variationatcurrentexchange rates

France

17,587 17,179 -1.5% -2.3%

321 312 -3.0% -3.0% Other Europe

9,356

9,428 +1.5% +0.8%

122 155 +26.0% +26.6%

Europe 26,944 26,607 -0.3% -1.2%

444 467 +5.0% +5.2% Latin America

7,257 6,453 +17.9% -11.1%

296

273 +12.3% -7.8% Asia

3,538 3,229 -5.3%

-8.7%

50 -7 n/a n/a

Emerging markets

10,796 9,682 +10.1% -10.3% 346

266 -6.0% -23.2% Global functions

-63

-26 TOTAL

37,739 36,289 +2.9%

-3.8% 726 706

+5.3% -2.8%

1Ex petrol, ex calendar.

First-half 2016 consolidated P&L

(€m) H1 2015

H1

2016 Net sales 37,739

36,289 Net sales, net of loyalty program costs

37,470 36,017 Other revenue

1,247 1,275

Total revenue 38,718

37,292 Cost of goods sold -30,024 -28,860

Gross margin 8,694 8,432 SG&A

-7,227 -7,006

Recurring operating income before

D&A (EBITDA) 1,488 1,448

Depreciation and amortization -740 -720

Recurring operating income (ROI) 726

706 Recurring operating income including income

from associates and joint ventures 761

686 Non-recurring income and expenses

-16 -114 Operating income

745

572 Financial expense -264 -248 Income before taxes

481 324 Income tax expense -165

-101

Net income from continuing operations 316

222 Net income from discontinued operations

-12 -28

Net income 304

194 Of which Net income – Group share

218 129 Of which Net income from continuing

operations, Group share 230 158 Of which Net income from

discontinued operations, Group share -12 -28

Of which Net income – Non-Controlling Interests (NCI)

85 65 Of which Net income from continuing operations,

NCI 85 65 Of which Net income from discontinued operations, NCI

- -

Adjusted net income, Group share

233 235

First-half 2016 consolidated balance sheet

(€m) June 30, 2015

June 30, 2016 ASSETS Intangible assets 9,607 9,719

Tangible assets 12,162 12,676 Financial investments 2,793 3,018

Deferred tax assets 816 880 Investment properties 307 357 Consumer

credit from financial-services companies – long term 2,579

2,261

Non-current assets 28,263

28,911 Inventories 6,503 6,553 Trade

receivables 2,379 2,159 Consumer credit from financial-services

companies – short term 3,396 3,789 Tax receivables 1,108 1,287

Other receivables 929 1,052 Current financial assets 410 218 Cash

and cash equivalents 1,800 1,688

Current

assets 16,524 16,745

Assets held for sale 78

43 TOTAL 44,865

45,700 LIABILITIES Shareholders equity, Group share

9,249 9,745 Minority interests in consolidated companies

1,095 1,549

Shareholders’ equity

10,344 11,294 Deferred tax liabilities

509 533 Provisions for contingencies 3,435 3,188 Borrowing – long

term 7,288 7,161 Bank loans refinancing – long term 1,569

2,091

Non-current liabilities

12,802 12,974 Borrowings – short term

1,575 2,112 Trade payables 12,096 12,198 Bank loans refinancing –

short term 3,630 3,179 Tax payables & others 1,138 1,188 Other

debts 3,229 2,732

Current liabilities

21,668

21,408 Liabilities related to assets held

for sale 51 23 TOTAL

44,865 45,700

First-half 2016 consolidated cash-flow statement

(€m) H1 2015

H1

2016 NET DEBT OPENING -4,954

-4,546 Gross cash flow 1,180 1,088 Change in working capital

-2,232 -2,052 Impact of discontinued activities 21

-11

Cash Flow from operations (ex. financial

services) -1,031 -975

Capital expenditures (ex Cargo) -804 -968 Capital expenditures

(Cargo) - -89 Change in net payables to fixed asset suppliers -261

-295 Asset disposals (business related) 53 69 Impact of

discontinued activities 0 0

Free Cash

Flow -2,044 -2,259 Free

Cash Flow from continuing operations, excluding Cargo and

exceptional items -1,930

-2,106 Financial investments -57 -136 Proceeds from

disposals of subsidiaries 1 7 Others 1 19 Impact of discontinued

activities 0 5

Cash Flow after

investments -2,098 -2,363

Capital increase 8 140 Dividends paid by parents company 0 -121

Dividends paid to non-controlling interests -70 -60 Acquisition/

disposal of investments without change of control 208 0 Treasury

shares 369 -4 Cost of net financial debt -185 -181 Others 68 -233

Impact of discontinued activities 0 0

NET

DEBT AT CLOSE -6,654 -7,367

Changes in shareholders’ equity

(€m)

Total shareholders’

equity

Shareholders’ equityGroup

share

Minorityinterests

At December 31, 2015 10,672

9,633 1,039 Total comprehensive income

for H1 2016 194 129 65 2015

dividend -181 -121 -60 Impact of

scope changes and others 609 104

505

At June 30, 2016 11,294

9,745 1,549

First-half 2016 net income, Group share, adjusted for

exceptional items

(€m) H1 2015

H1

2016 Net income from continuing operations, Group share

230 158 Restatement for non

recurring income and expenses (before tax) 16 114 Restatement for

exceptional items in net financial expenses 31 7

Tax impact 1

-28 -48

Restatement on share of income from

minorities and companies consolidatedby the equity method

-16 4

Adjusted net income, Group share

233 235

1 Tax impact of restated items (non-recurring income and

expenses and financial expenses) and non recurring tax items.

EXPANSION UNDER BANNERS – Second-quarter 2016

In Q2 2016, Carrefour opened or acquired 145,000 gross sq.

m.

Thousands of sq.

m.

Dec 31, 2015

March 31,2016

Openings/Storeenlargements

Acquisitions

Closures/Storereductions

Total Q22016 change

June 30,2016

France 5,668 5,676 23 6 -5 24 5,700 Europe (ex France) 6,039 5,959

37 -651 -615 5,344 Latin America 2,258 2,262 19 -4 16 2,278 Asia

2,734 2,708 28 -9 19 2,728 Others2 828 862 32

-7 25 887

Group

17,526 17,466 139

6

-6751

-530 16,936

NETWORK UNDER BANNERS – Second-quarter 2016

In Q2 2016, Carrefour opened or acquired 227 stores, mainly

convenience stores (183).

No. of stores

Dec 31, 2015

March 31,2016

Openings

Acquisitions

Closures/Disposals

Transfers

Total Q22016 change

June30,2016

Hypermarkets 1,481 1,480

12

-50

-38 1,442 France 242 242

242 Europe (ex France) 489 484 -49 -49 435 Latin America 304 304 3

3 307 Asia 369 369 4 -1 3 372

Others2

77 81 5

5 86

Supermarkets 3,462 3,455

29 3

-347 16

-299 3,156 France

1,003 1,016 1 3 16 20 1,036 Europe (ex France) 2,096 2,067 24 -346

-322 1,745 Latin America 168 168 0 168 Asia 29 31 2 -1 1 32 Others2

166 173 2

2 175

Convenience 7,181 7,042

183

-288 -16

-121 6,921 France

4,263 4,241 58 -36 -16 6 4,247 Europe (ex France) 2,464 2,336 109

-249 -140 2,196 Latin America 404 414 11 -3 8 422 Asia 8 8 5 5 13

Others2 42 43

0 43

Cash & carry 172 174

-6

-6 168 France 142 143 0

143 Europe (ex France) 18 19 -6 -6 13 Others2 12

12

0 12

Group

12,296 12,151

224 3

-6911

-464 11,687 France 5,650

5,642 59 3 -36 26 5,668 Europe (ex France) 5,067 4,906 133 -650

-517 4,389 Latin America 876 886 14 -3 11 897 Asia 406 408 11 -2 9

417 Others2 297 309 7

7

316

1 The termination of the franchise contract in Greece has led to

the removal of 538 stores and 568,000 sq.m. from the perimeter.2

Maghreb, Middle East and Dominican Republic

Definitions

Like for like sales growth

Sales generated by stores opened for at least twelve months,

excluding temporary store closures, at constant exchange rates.

Organic sales growth

Like for like sales growth plus net openings over the past

twelve months, including temporary store closures, at constant

exchange rates.

Sales under banners

Total sales under banners including sales by franchisees and

international partnerships.

Gross margin

Gross margin is the difference between the sum of net sales,

other income, reduced by loyalty program costs and the cost of

goods sold. Cost of sales comprises purchase costs, changes in

inventory, the cost of products sold by the financial-services

companies, discounting revenue and exchange-rate gains and losses

on goods purchased.

Recurring Operating Income (ROI)

Recurring Operating Income is defined as the difference between

gross margin and sales, general and administrative expenses,

depreciation and amortization.

Recurring Operating Income Before Depreciation and

Amortization (EBITDA)

Recurring Operating Income Before Depreciation and Amortization

(EBITDA) excludes depreciation from supply chain activities which

is booked in cost of goods sold and excludes non-recurring items as

defined below.

Operating Income (EBIT)

Operating Income (EBIT) is defined as the difference between

gross margin and sales, general and administrative expenses,

depreciation, amortization and non-recurring items

Non-recurring income and expenses are certain material items

that are unusual in terms of their nature and frequency, such as

impairment, restructuring costs and expenses related to the

revaluation of preexisting risks on the basis of information that

the Group became aware of during the accounting period.

Free cash flow

Free cash flow is defined as the difference between funds

generated by operations (before net interest costs), the variation

of working capital requirements and capital expenditures.

Disclaimer

This press release contains both historical and forward-looking

statements. These forward-looking statements are based on Carrefour

management's current views and assumptions. Such statements are not

guarantees of future performance of the Group. Actual results or

performances may differ materially from those in such

forward-looking statements as a result of a number of risks and

uncertainties, including but not limited to the risks described in

the documents filed with the Autorité des Marchés Financiers as

part of the regulated information disclosure requirements and

available on Carrefour's website (www.carrefour.com), and in

particular the Annual Report (Document de Référence). These

documents are also available in English on the company's website.

Investors may obtain a copy of these documents from Carrefour free

of charge. Carrefour does not assume any obligation to update or

revise any of these forward-looking statements in the future.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160727006687/en/

Investor RelationsAlessandra Girolami and Mathilde

RodiéTel: +33 (0)1 41 04 28 83orShareholder RelationsTel: 0

805 902 902 (toll-free in France)orGroup CommunicationTel:

+33 (0)1 41 04 26 17

Xtrackers California Mun... (NASDAQ:CA)

Historical Stock Chart

From Mar 2024 to Apr 2024

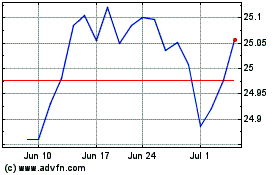

Xtrackers California Mun... (NASDAQ:CA)

Historical Stock Chart

From Apr 2023 to Apr 2024