Sam Wyly Gets a $1.1 Billion Tax Bill

June 28 2016 - 4:40PM

Dow Jones News

A federal judge has ordered Texas entrepreneur Sam Wyly to pay

$1.1 billion in taxes and penalties for committing tax fraud using

offshore accounts, even though the former billionaire's net worth

has fallen to a fraction of that amount.

The payment demand from Judge Barbara Houser on Monday was made

for federal taxes due as far back as 1992. In a court opinion filed

last month, she admitted that the money "may now be more difficult

for the government to collect given the passage of time and the

dissipation of Sam's wealth."

Financial statements filed with the U.S. Bankruptcy Court in

Dallas in November 2014 declared that Mr. Wyly's assets were worth

$382.83 million. His spokesman didn't return requests for comment

on the order.

In a May 10 opinion, Judge Houser ruled that Mr. Wyly, 81 years

old, and his lawyers created a complex network of offshore accounts

to conceal trading profits and "amass tremendous untaxed

wealth."

Specifically, Judge Houser said Mr. Wyly transferred stock

options he earned, as compensation for serving as a director of

business for software maker Sterling Software Inc. and

arts-and-crafts chain Michaels Stores Inc., into the offshore

trusts in exchange for a private annuity.

The network enabled Mr. Wyly to "escape his obligation to pay

tax on the annuity income he was contractually entitled to

receive," wrote Judge Houser, who called the offshore system

"nothing short of mind-numbing…with identically named domestic and

foreign corporations, and layers upon layers of foreign

entities."

Mr. Wyly's lawyers, during a three-week trial, blamed his hired

financial professionals. Mr. Wyly testified that he hasn't prepared

his own tax returns since the 1960s.

Judge Houser was not convinced.

"To accept [his] explanation requires the court to be satisfied

that it is appropriate for extraordinarily wealthy individuals to

hire middlemen to do their bidding in order to insulate themselves

from wrongdoing so that, when the fraud is ultimately exposed, they

have plausible deniability," she wrote.

Judge Houser also found that Mr. Wyly's brother Charles, who

died in a 2011 car accident, was also part of the "deceptive and

fraudulent" scheme.

In her 459-page opinion, Judge Houser traced Mr. Wyly's transfer

strategy to a 1991 asset protection and tax deferral seminar held

in New Orleans by trust promoter David Tedder, who later visited

the Wylys at Sam Wyly's Malibu, Calif., home.

The Wyly family used offshore money to buy art and jewelry and

to build homes in Texas and Colorado in a way that Mr. Wyly

"believed prevented them from being taxed as gifts or other

distributions from offshore," the opinion said.

U.S. Securities and Exchange regulators later sued Mr. Wyly for

securities fraud, a dispute that led to a $198.1 million judgment.

He filed for chapter 11 protection in October 2014, saying he

couldn't afford such a steep penalty.

The payment breakdown in Monday's court order shows that roughly

$745 million is owed for penalties. Judge Houser ordered him to pay

about $135 million for federal taxes due from 1992 to 2013 and

about $227.1 million in interest.

In her opinion, Judge Houser pointed out that the tax bill

sharply escalated after Mr. Wyly, who learned of the Internal

Revenue Service's audit in early 2004, opted not to cooperate with

tax investigators. She added that Mr. Wyly was "uncooperative"

during the trial and "had to be impeached frequently to get him to

admit to fairly obvious facts."

He "simply waited for the IRS to come after him, all the while

continuing his offshore activities," she wrote. "Such a cavalier

attitude toward his reporting obligations for 20-plus years

reflects, at a minimum, reckless indifference."

Peg Brickley contributed to this article.

Write to Katy Stech at

katy.stech@wsj.com<mailto:katy.stech@wsj.com>

(END) Dow Jones Newswires

June 28, 2016 16:25 ET (20:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

Xtrackers California Mun... (NASDAQ:CA)

Historical Stock Chart

From Mar 2024 to Apr 2024

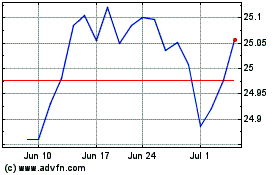

Xtrackers California Mun... (NASDAQ:CA)

Historical Stock Chart

From Apr 2023 to Apr 2024