Good Start to the Year, Accelerating Growth

in International Markets

Reported Growth of +3.8% Ex Petrol, +3.1%

Like-for-Like

Regulatory News:

Carrefour (Paris:CA)

- International: Reported growth

of +6.4% ex petrol and ex currencies, +5.3% on a like-for-like

basis

- Accelerating growth in Europe; all

countries posted like-for-like sales growth

- Continued excellent performance in

Latin America

- Very good momentum in Taiwan; in China,

like-for-like sales improved sequentially versus Q4 2015

- France: Stable reported sales ex

petrol on a strong comparable base (+7.9% in Q1 2015)

- Further growth in food sales

- Acceleration of conversion of stores

acquired from Dia, as previously announced; 115 stores converted in

Q1

- Roll-out of omni-channel including the

contribution of Rue du Commerce

First quarter 2016 consolidated sales inc. VAT

The Group posted sales of €20,053m. In the quarter, currencies

and petrol prices had unfavourable impacts of 6.9% and 1.2%

respectively. The calendar effect was +0.6%.

Sales inc. VAT (€m)

LFL ex petrol and ex

calendar

Total growth ex petrol at

constant exch. rates

International

France

10,718

9,335

+5.3%

0.0%

+6.4%

+0.1%

Group 20,053 +3.1%

+3.8%

Total sales under banners including petrol stood at €24.6bn in

the first quarter of 2016, up 2.5% at constant exchange rates.

FIRST QUARTER 2016 INC. VAT

Sales inc. VAT (€m)

LFL ex petrol and ex

calendar

Total growth ex petrol at

constant exch. rates

France 9,335 0.0% +0.1%

International 10,718 +5.3% +6.4%

Other European countries 5,196 +3.2% +2.3% Latin America 3,451

+13.5% +18.3% Asia 2,071 -4.9% -5.2%

In the first quarter, France recorded stable sales ex

petrol (+0.1%), a good performance over the strong +7.9% growth

posted in the first quarter of 2015. Food sales grew in the first

quarter for the fourth consecutive year. The evolution of petrol

prices had an unfavourable impact of 1.9% this quarter.

Like-for-like sales at hypermarkets were down 0.6% on a

strong comparable base of +2.1%. Like-for-like sales at

supermarkets were up by +0.7%, with an equally strong

comparable base of +2.5%, marking the sixth consecutive quarterly

growth in sales.

Like-for-like sales in convenience and other formats were

up +1.1%.

The transformation of stores acquired from Dia has gained pace

since the start of the year: 115 stores were reopened in Q1 2016,

bringing to 267 the number of stores converted to Carrefour banners

since the start of the program.

Like-for-like sales in international activities rose by

5.3%. The calendar effect was +0.6% in the quarter. The currency

impact is strong at -12.6%.

In other European countries, like-for-like sales were up

+3.2%. Every country posted like-for-like growth in the

quarter.

Like-for-like sales in Spain continued to grow, with a

rise of +3.4% in the first quarter. Trends also improved in

Italy, where like-for-like sales were up by +4.5%. Sales in

Belgium were up by +1.0% on a like-for-like basis. They were

also up in Poland and sharply up in Romania.

In Latin America, like-for-like sales were up by +13.5%

(+17.1% on an organic basis). The currency effect was -34.0%.

In Brazil, like-for-like sales were up by +9.9% (+14.3%

on an organic basis) on a strong comparable base of +8.4% in the

first quarter of 2015. All formats posted continued growth.

Like-for-like sales in Argentina rose by +23.6%.

Like-for-like sales in Asia were down 4.9%. China

posted a sequential improvement with like-for-like sales down 8.4%.

In Taiwan, where trends accelerated, sales grew for the

fifth consecutive quarter with like-for-like sales up +8.4%.

VARIATION OF FIRST QUARTER 2016 SALES INC. VAT

Total sales inc. VAT

(€m)

Change at current

exchange rates inc. petrol

Change at constant

exchange rates inc. petrol

LFL inc. petrol

LFL ex petrol ex

calendar

Organic growth ex petrol

ex calendar

France 9,335 -1.8% -1.8%

-1.2% 0.0% -0.8% Hypermarkets

4,887 -2.1% -2.1% -2.1% -0.6% -0.6%

Supermarkets 2,991 -2.8% -2,8% -1.7% +0.7% -1.7% Convenience/ other

formats 1,456 +1.4% +1.4% +4.4% +1.1% +0.5%

International 10,718 -6.4% +6.2%

+5.7% +5.3% +6.1%

Other European countries 5,196 +0.9%

+1.3% +2.7% +3.2%

+2.5% Spain 2,024 +0.6% +0.6% +1.9% +3.4% +2.4% Italy 1,332

+1.3% +1.3% +3.9% +4.5% +4.2% Belgium 1,055 +1.2% +1.2% +1.6% +1.0%

+0.6%

Latin America 3,451

-15.2% +18.7% +15.0%

+13.5% +17.1% Brazil 2,665 -12.5% +16.7%

+12.2% +9.9% +14.3%

Asia 2,071

-7.1% -5.2% -4.8%

-4.9% -5.2% China 1,582 -10.8% -8.8% -8.1%

-8.4% -9.1%

Group total 20,053 -4.3%

+2.6% +2.7% +3.1%

+3.2%

EXPANSION UNDER BANNERS – First quarter 2016

Thousands of sq. m.

Dec. 31, 2015

Openings/Store

enlargements

Acquisitions

Closures/ Store

reductions

Total Q1 2016 change

March 31, 2016

France 5,668 14 1 -7 8

5,676 Europe (ex France) 6,039 65 -144 -80 5,959 Latin America

2,258 8 -4 4 2,262 Asia 2,734 22 -47 -25 2,708 Others1 828

37 -3 34 862

Group

17,526 145 1

-205 -60 17,466

STORE NETWORK UNDER BANNERS – First quarter 2016

No. of stores

Dec. 31, 2015

Openings Acquisitions

Closures/ Disposals

Transfers

Total Q1 2016 change

March 31, 2016

Hypermarkets 1,481 7

-8 -1

1,480 France 242 0

242 Europe (ex France) 489 -5 -5 484 Latin America 304 1 -1

0 304 Asia 369 2 -2 0 369

Others1

77 4

4 81

Supermarkets 3,462

68 1 -87 11

-7 3,455 France 1,003 3 1 -2 11 13 1,016

Europe (ex France) 2,096 53 -82 -29 2,067 Latin America 168 0 168

Asia 29 2 2 31 Others1 166 10 -3

7 173

Convenience

7,181 122 -249

-12 -139 7,042 France

4,263 29 -39 -12 -22 4, 241 Europe (ex France) 2,464 78 -206 -128

2, 336 Latin America 404 12 -2 10 414 Asia 8 0 8 Others1 42

3 -2 1 43

Cash & carry 172 1

1 2

174 France 142 1 1 143 Europe (ex France) 18 1 1 19 Others1

12

0 12

Group 12,296

198 1 -344

-145 12,151 France 5,650 32 1 -41 -8 5,642

Europe (ex France) 5,067 132 -293 -161 4,906 Latin America 876 13

-3 10 886 Asia 406 4 -2 2 408 Others1 297 17

-5 12 309

DEFINITIONS

LFL sales growth: Sales generated by stores opened for at

least twelve months, excluding temporary store closures, at

constant exchange rates.

Organic growth: LFL sales plus net openings over the past

twelve months, including temporary store closures, at constant

exchange rates.

Sales under banners: Total sales under banners including

sales by franchisees and international partnerships.

1Africa, Middle East and Dominican Republic.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160414006641/en/

CarrefourInvestor Relations:Alessandra Girolami, Matthew Mellin,

Mathilde Rodié, +33 (0)1 41 04 28 83orShareholders Relations, +33

(0)805 902 902 (toll-free in France)orGroup Communication, +33

(0)1 41 04 26 17

Xtrackers California Mun... (NASDAQ:CA)

Historical Stock Chart

From Mar 2024 to Apr 2024

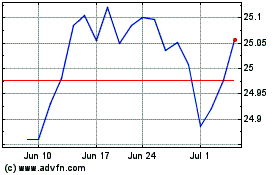

Xtrackers California Mun... (NASDAQ:CA)

Historical Stock Chart

From Apr 2023 to Apr 2024