|

|

UNITED STATES |

|

|

|

SECURITIES AND EXCHANGE COMMISSION |

|

|

|

Washington, D.C. 20549 |

|

|

|

|

|

|

|

SCHEDULE 13D |

|

Under the Securities Exchange Act of 1934

(Amendment No. 11)*

CA, Inc. (formerly known as Computer Associates International, Inc.)

(Name of Issuer)

Common Stock, par value $0.10 per share

(Title of Class of Securities)

(CUSIP Number)

Mr. Roger Rotach

Careal Holding AG

Utoquai 49

8022 Zurich, Switzerland

Telephone Number 41-44-269-53-16

Copy to:

Alan M. Klein, Esq.

Simpson Thacher & Bartlett LLP

425 Lexington Avenue

New York, New York 10017

(212) 455-2000

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. o

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to be sent.

* The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934 ("Act") or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

CUSIP No. 12673P105 |

|

|

|

|

1 |

Names of Reporting Persons

Careal Holding AG |

|

|

|

|

2 |

Check the Appropriate Box if a Member of a Group (See Instructions) |

|

|

|

(a) |

o |

|

|

|

(b) |

x |

|

|

|

|

3 |

SEC Use Only |

|

|

|

|

4 |

Source of Funds (See Instructions)

WC |

|

|

|

|

5 |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Item 2(d) or 2(e) o |

|

|

|

|

6 |

Citizenship or Place of Organization

Switzerland |

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7 |

Sole Voting Power

103,813,380 |

|

|

|

8 |

Shared Voting Power

0 |

|

|

|

9 |

Sole Dispositive Power

103,813,380 |

|

|

|

10 |

Shared Dispositive Power

0 |

|

|

|

|

11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

103,813,380 |

|

|

|

|

12 |

Check if the Aggregate Amount in Row 11 Excludes Certain Shares (See Instructions) o |

|

|

|

|

13 |

Percent of Class Represented by Amount in Row 11

23.7%(1) |

|

|

|

|

14 |

Type of Reporting Person (See Instructions)

CO |

|

|

|

|

|

|

(1) The percentage of Common Stock beneficially owned is based on 438,726,208 shares of Common Stock outstanding as of October 31, 2015, as provided by CA, Inc. (the “Company”).

2

|

CUSIP No. 12673P105 |

|

|

|

|

1 |

Names of Reporting Persons

Martin Haefner |

|

|

|

|

2 |

Check the Appropriate Box if a Member of a Group (See Instructions) |

|

|

|

(a) |

o |

|

|

|

(b) |

x |

|

|

|

|

3 |

SEC Use Only |

|

|

|

|

4 |

Source of Funds (See Instructions)

WC OF CAREAL HOLDING AG |

|

|

|

|

5 |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Item 2(d) or 2(e) o |

|

|

|

|

6 |

Citizenship or Place of Organization

Switzerland |

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7 |

Sole Voting Power

20,000(2) |

|

|

|

8 |

Shared Voting Power

103,816,580(3) |

|

|

|

9 |

Sole Dispositive Power

0 |

|

|

|

10 |

Shared Dispositive Power

103,816,580 |

|

|

|

|

11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

103,836,580 |

|

|

|

|

12 |

Check if the Aggregate Amount in Row 11 Excludes Certain Shares (See Instructions) o |

|

|

|

|

13 |

Percent of Class Represented by Amount in Row 11

23.7%(4) |

|

|

|

|

14 |

Type of Reporting Person (See Instructions)

IN |

|

|

|

|

|

|

(2) 20,000 shares of Common Stock are held by Mr. Haefner.

(3) 103,813,380 shares of Common Stock are held by Careal Holding AG and 3,200 shares of Common Stock are held by the spouse of Mr. Haefner.

(4) The percentage of Common Stock beneficially owned is based on 438,726,208 shares of Common Stock outstanding as of October 31, 2015, as provided by the Company.

3

|

CUSIP No. 12673P105 |

|

|

|

|

1 |

Names of Reporting Persons

Eva Maria Bucher-Haefner |

|

|

|

|

2 |

Check the Appropriate Box if a Member of a Group (See Instructions) |

|

|

|

(a) |

o |

|

|

|

(b) |

x |

|

|

|

|

3 |

SEC Use Only |

|

|

|

|

4 |

Source of Funds (See Instructions)

WC OF CAREAL HOLDING AG |

|

|

|

|

5 |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Item 2(d) or 2(e) o |

|

|

|

|

6 |

Citizenship or Place of Organization

Switzerland |

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7 |

Sole Voting Power

0 |

|

|

|

8 |

Shared Voting Power

103,813,380(5) |

|

|

|

9 |

Sole Dispositive Power

0 |

|

|

|

10 |

Shared Dispositive Power

103,813,380 |

|

|

|

|

11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

103,813,380 |

|

|

|

|

12 |

Check if the Aggregate Amount in Row 11 Excludes Certain Shares (See Instructions) o |

|

|

|

|

13 |

Percent of Class Represented by Amount in Row 11

23.7%(6) |

|

|

|

|

14 |

Type of Reporting Person (See Instructions)

IN |

|

|

|

|

|

|

(5) 103,813,380 shares of Common Stock are held by Careal Holdings AG.

(6) The percentage of Common Stock beneficially owned is based on 438,726,208 shares of Common Stock outstanding as of October 31, 2015, as provided by the Company.

4

This Amendment No. 11 (this “Amendment”) to the Statement on Schedule 13D, filed on August 24, 1987, by Careal Holding AG, a Swiss corporation (“Careal”) and Mr. Walter H. Haefner, a national and resident of Switzerland, as amended on July 21, 1988, February 22, 1989, June 14, 1989, August 3, 1989, December 1, 1989, September 16, 1998, November 14, 2001, December 28, 2001 and October 30, 2003 and as further amended by a filing by Careal, Mr. Martin Haefner and Ms. Eva Maria Bucher-Haefner on July 10, 2012 (the “Statement”), further amends and supplements such Statement with respect to the Common Stock, par value $.10 per share (“Common Stock”), of CA, Inc. (formerly known as Computer Associates International, Inc.), a Delaware corporation (the “Company”). All items not described herein remain as previously reported in the Statement. Except as otherwise specified in this Amendment, all previous Items are unchanged. Capitalized terms used herein which are not defined herein have the meanings given to them in the Statement, as previously amended, filed with the Securities and Exchange Commission.

Item 4. Purpose of Transaction.

Item 4 of the Schedule 13D is hereby amended by the following:

Share Repurchase Agreement

On November 17, 2015, Careal entered into a share purchase agreement (the “Share Purchase Agreement”) with the Company, pursuant to which the Company agreed to purchase from Careal 22,000,000 shares Common Stock (the “Repurchased Shares”) for an aggregate purchase price of $584,388,200.00 The purchase by the Company of the Repurchased Shares closed on November 20, 2015.

After the closing of the purchase of the Repurchased Shares, the Company will not cancel the Repurchased Shares by way of a capital reduction or otherwise, will continue to hold the Repurchased Shares in a separate account pending their sale or other transfer and will use commercially reasonable efforts to sell or otherwise transfer the Repurchased Shares to one or more third-parties until all the Repurchased Shares have been so sold or otherwise transferred. Upon request by Careal, the Company will document and confirm such position to Careal.

The foregoing description of the Share Purchase Agreement is qualified in its entirety by reference to the Share Purchase Agreement, a copy of which is filed herewith as Exhibit 8 and is incorporated by reference herein.

Careal intends, on or before December 31, 2015, to (i) transfer an additional 37,050,000 shares of Company Stock to BigPoint Holding AG, a Swiss company wholly owned by Mr. Haefner and (ii) use the cash proceeds from the Repurchased Shares in connection with a purchase of shares of Careal owned by Ms. Bucher-Haefner. These actions are part of a transaction to allow Mr. Haefner and Ms. Bucher-Haefner to maintain their respective 50% ownership interest in Careal.

Item 5. Interest in Securities of the Issuer.

Item 5 of the Schedule 13D is hereby amended and restated in its entirety as follows:

(a)-(b) As of the date hereof, Careal is the owner of record of 103,813,380 shares of Common Stock, representing approximately 23.7% of the Common Stock outstanding. The percentage of Common Stock is based on 438,726,208 shares of Common Stock outstanding as of October 31, 2015, as provided by the Company. As the owner of 50% of the shares of Careal, each of Mr. Haefner and Ms. Bucher-Haefner may be deemed to be the beneficial owner of such 103,813,380 shares of Common Stock and each may be deemed to have shared voting and dispositive power with respect thereto.

Other than the 103,813,380 shares of Common Stock owned of record by Careal and that may be deemed to be beneficially owned by Mr. Haefner and Ms. Bucher-Haefner, the 20,000 shares of Common Stock owned of record by Mr. Haefner and the 3,200 shares of Common Stock owned of record by the spouse of Mr. Haefner (which may be deemed to be beneficially owned by Mr. Haefner), to the best knowledge of Careal, none of its other

5

directors or executive officers are the beneficial owners of, nor do any of them have a right to acquire, directly or indirectly, shares of Common Stock.

(c) Other than the transactions described in Item 4, none of Careal, Martin Haefner or Ms. Bucher-Haefner has effected any transactions in shares of Common Stock in the past 60 days.

(d) Other than Careal, Martin Haefner and Ms. Bucher-Haefner, no person is known to have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the 103,813,380 shares of Common Stock owned of record by Careal.

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

Item 6 of the Schedule 13D is amended and supplemented with the information contained in Item 4 of this Amendment, which is hereby incorporated by reference.

Item 7. Material to be Filed as Exhibits.

Item 7 of the Schedule 13D is hereby amended by adding the exhibit listed below:

The following exhibit is filed as an exhibit hereto:

|

Exhibit |

|

Description of Exhibit |

|

8 |

|

Share Repurchase Agreement, dated November 17, 2015, by and between Careal Holding AG and CA, Inc. |

6

SIGNATURE

After reasonable inquiry and to the best of their knowledge and belief, the undersigned certify that the information set forth in this statement is true, complete and correct.

November 20, 2015

|

|

CAREAL HOLDING AG |

|

|

|

|

|

|

|

By: Martin Haefner, Chairman and President |

|

|

|

|

|

|

|

|

By: |

/s/ Claude Lambert |

|

|

|

|

Claude Lambert |

|

|

|

|

Attorney-in-fact for Martin Haefner |

|

|

|

|

|

|

|

|

|

|

|

|

MARTIN HAEFNER |

|

|

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Claude Lambert |

|

|

|

Claude Lambert, attorney-in-fact |

|

|

|

|

|

|

|

|

|

|

|

|

EVA MARIA BUCHER-HAEFNER |

|

|

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Claude Lambert |

|

|

|

Claude Lambert, attorney-in-fact |

7

Exhibit 8

EXECUTION VERSION

SHARE REPURCHASE AGREEMENT

THIS SHARE REPURCHASE AGREEMENT (this “Agreement”) is made and entered into as of November 17, 2015, by and among Careal Holding AG, a Swiss corporation (the “Seller”) and CA, Inc., a Delaware corporation (the “Purchaser” and, together with the Seller, the “Parties”).

RECITALS

WHEREAS, the Seller desires to sell to the Purchaser, and the Purchaser desires to purchase from the Seller, 22,000,000 shares (the “Shares”) of Common Stock, par value $0.10 per share, of the Purchaser (“Common Stock”), on the terms and conditions set forth in this Agreement (the “Repurchase Transaction”).

WHEREAS, the Purchaser has determined that it is in the best interests of the Purchaser and its stockholders to enter into the Repurchase Transaction.

NOW, THEREFORE, in consideration of the premises and the agreements set forth below, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

ARTICLE I

CERTAIN DEFINITIONS AND CONSTRUCTION

Section 1.1 Certain Definitions. As used in this Agreement, the following terms have the meanings set forth below:

(a) “Agreement” has the meaning set forth in the Preamble.

(b) “Closing” has the meaning set forth in Section 2.2.

(c) “Closing Date” has the meaning set forth in Section 2.2.

(d) “Common Stock” has the meaning set forth in the Recitals.

(e) “Contract” means any agreement, obligation, contract, license, commitment, indenture or instrument, whether written or oral.

(f) “Custodian” means UBS Switzerland AG.

(g) “Order” has the meaning set forth in Section 6.1.

(h) “Parties” has the meaning set forth in the Preamble.

(i) “Person” means an individual, a corporation, a general or limited partnership, an association, a limited liability company, a governmental entity, a trust or other entity or organization.

(j) “Proceeding” means any suit, action, proceeding, arbitration, mediation, audit, hearing, inquiry or, to the knowledge of the Person in question, investigation (in each case, whether civil, criminal, administrative, investigative, formal or informal) commenced, brought, conducted or heard by or before, or otherwise involving, any governmental entity.

(k) “Purchase Price” has the meaning set forth in Section 2.1(b).

(l) “Purchaser” has the meaning set forth in the Preamble.

(m) “Repurchase Transaction” has the meaning set forth in the Recitals.

(n) “Seller” has the meaning set forth in the Preamble.

(o) “Shares” has the meaning set forth in the Recitals.

(p) “Transfer Agent” means Computershare Trust Company, N.A.

Section 1.2 Headings. The section headings contained in this Agreement are for reference purposes only and shall not affect in any way the meaning or interpretation of this Agreement.

Section 1.3 Interpretation. Unless the express content otherwise requires, (i) terms herein defined in the singular shall have a comparable meaning when used in the plural, and vice versa; (ii) the term “$” means United States Dollars; (iii) the word “or” shall not be exclusive; (iv) references to “written” or “in writing” include in electronic form; (v) references herein to any contract or agreement (including this Agreement) mean such contract or agreement, as amended, restated, supplemented or modified from time to time in accordance with the terms thereof; (vi) “including” and its variants mean “including, without limitation” and its variants; (vii) the term “Section” refers to the specified Section of this Agreement and the term “Article” refers to the specified Article of this Agreement; and (viii) the word “extent” in the phrase “to the extent” shall mean the degree to which a subject or other thing extends and such phrase shall not mean simply “if.”

ARTICLE II

SALE AND PURCHASE OF SHARES

Section 2.1 Purchase.

(a) Subject to the terms and conditions of this Agreement, at the Closing (as defined below), the Seller shall sell, assign, transfer, convey and deliver to the Purchaser, and the Purchaser shall purchase, acquire and accept from the Seller, the Shares, in consideration of the payment by the Purchaser to the Seller by wire transfer of immediately available funds in the amount of the Purchase Price.

2

(b) The purchase price for each Share shall be equal to $26.8131. The aggregate amount payable for the Shares shall be $589,888,200.00; provided, however, that if the Closing occurs on or after November 19, 2015, which is the record date for the dividend that the Purchaser will pay to its shareholders during the quarterly period ending on December 31, 2015, the aggregate amount payable for the Shares shall be reduced by $5,500,000.00, which is the aggregate amount of such dividend on the Shares (the amount payable at the Closing being referred to herein as the “Purchase Price”). The purchase price of $26.8131 for each Share equals a 3.00% discount to the arithmetic average of each daily volume weighted average price of $27.6424 according to Bloomberg for the period of 10 trading days preceding and including November 5th, 2015.

Section 2.2 Closing. The closing of the Repurchase Transaction (the “Closing”) will take place at 9:00 am New York City time on November 20, 2015 or at such other time and place as the Parties may mutually agree. The date on which the Closing occurs is called the “Closing Date”. At the Closing, the Seller shall cause the Custodian, which is holding the Shares in custody for the Seller, to deliver the Shares to the Transfer Agent with instructions to register the Shares in the name of the Purchaser against payment of the Purchase Price to the Custodian for the account of the Seller by wire transfer of immediately available funds.

ARTICLE III

REPRESENTATIONS AND WARRANTIES OF THE SELLER

The Seller hereby makes the following representations and warranties to the Purchaser that:

Section 3.1 Power; Authorization and Enforceability.

(a) The Seller is a corporation duly formed and validly existing under the laws of Switzerland. The Seller has the power, authority and capacity to execute and deliver this Agreement, to perform its obligations hereunder, and to consummate the transactions contemplated by this Agreement. All consents, Orders, approvals and other authorizations, whether governmental, corporate or otherwise, necessary for such execution, delivery and performance by the Seller of this Agreement and the transactions contemplated by this Agreement have been obtained and are in full force and effect.

(b) This Agreement has been duly executed and delivered by the Seller and constitutes a legal, valid and binding obligation of the Seller, enforceable against the Seller in accordance with its terms, except as limited by applicable bankruptcy, insolvency, reorganization and other similar laws of general applicability relating to or affecting the enforcement of creditors’ rights generally and to general principles of equity.

Section 3.2 No Conflicts. The execution and delivery of this Agreement by the Seller and the consummation by the Seller of the transactions contemplated by this Agreement does not and will not constitute or result in a breach, violation or default under (i) any agreement or instrument, whether written or oral, express or implied, to which the Seller is a party, (ii) the organizational documents of the Seller or (iii) any statute, law, ordinance, decree, order,

3

injunction, rule, directive, judgment or regulation of any court, administrative or regulatory body, governmental entity, arbitrator, mediator or similar body on the part of the Seller, except, in each case, as would not reasonably be expected to (x) adversely affect the ability to deliver the Shares free and clear of any lien, pledge, charge, security interest, mortgage or other encumbrance or adverse claim or (y) materially impact the Seller’s ability to perform its obligations under this Agreement.

Section 3.3 Title to Shares. The Seller is the sole legal owner of, and has good and valid title to, the Shares and upon delivery to the Purchaser of the Shares to be sold by the Seller to the Purchaser, against payment made pursuant to this Agreement, good and valid title to such Shares, free and clear of any lien, pledge, charge, security interest, mortgage, or other encumbrance or adverse claim, will pass to the Purchaser (it being understood that resale of the Shares by the Purchaser is subject to applicable securities laws). There are no outstanding rights, options, warrants, conversion rights, repurchase rights, agreements, arrangements, calls, commitments or rights of any kind that obligate the Seller to sell the Shares or any securities or obligations convertible or exchangeable into or exercisable for, or giving any Person a right to subscribe for or acquire the Shares.

Section 3.4 Legal Proceedings. As of the date hereof, there are no legal, governmental or regulatory Proceedings pending or, to the knowledge of the Seller, threatened against the Seller which, individually or in the aggregate, would materially and adversely affect the ability of the Seller to perform its obligations under this Agreement.

Section 3.5 No Broker’s Fees. As of the date hereof, the Seller is not a party to any Contract with any Person that would require the Purchaser or its subsidiaries to pay any investment banking fee or commission, finder’s fee or similar payment in connection with the Repurchase Transaction.

Section 3.6 No Other Representations or Warranties. Except for the representations and warranties made by the Seller in this Article III, the Seller makes no representations or warranties to the Purchaser in connection with this Agreement.

Section 3.7 Acknowledgment. The Seller acknowledges that neither the Purchaser nor any Person on behalf of the Purchaser is making any representations, warranties or covenants whatsoever, express or implied, beyond those expressly made by the Purchaser in Article IV and V and the Seller has not been induced by, or relied upon, any representations, warranties, covenants or statements (written or oral), whether express or implied, made by any Person, other than those that are expressly set forth in Article IV and Article V.

4

ARTICLE IV

REPRESENTATIONS AND WARRANTIES OF THE PURCHASER

The Purchaser hereby makes the following representations and warranties to the Seller that:

Section 4.1 Power; Authorization and Enforceability.

(a) The Purchaser is a corporation duly organized, validly existing and in good standing under the laws of the State of Delaware and has the power, authority and capacity to execute and deliver this Agreement, to perform the Purchaser’s obligations hereunder, and to consummate the transactions contemplated hereby. All consents, Orders, approvals and other authorizations, whether governmental, corporate or otherwise, necessary for such execution, delivery and performance by the Purchaser of this Agreement and the transactions contemplated hereby have been obtained and are in full force and effect.

(b) This Agreement has been duly executed and delivered by the Purchaser and constitutes a legal, valid and binding obligation of the Purchaser, enforceable against the Purchaser in accordance with its terms, except as limited by applicable bankruptcy, insolvency, reorganization and other similar laws of general applicability relating to or affecting the enforcement of creditors’ rights generally and to general principles of equity.

Section 4.2 No Conflicts. The execution and delivery of this Agreement by the Purchaser and the consummation by the Purchaser of the transactions contemplated by this Agreement does not and will not constitute or result in a breach, violation or default under (i) any agreement or instrument, whether written or oral, express or implied, to which the Purchaser is a party, (ii) the organizational documents of the Purchaser or (iii) any statute, law, ordinance, decree, order, injunction, rule, directive, judgment or regulation of any court, administrative or regulatory body, governmental entity, arbitrator, mediator or similar body on the part of the Purchaser, except, in each case, as would not reasonably be expected to (x) affect the ability to receive the Shares free and clear of any lien, pledge, charge, security interest, mortgage or other encumbrance or adverse claim or (y) materially impact the Purchaser’s ability to perform its obligations under this Agreement.

Section 4.3 Sufficiency of Funds. The Purchaser has access to funds sufficient to consummate the transactions contemplated by this Agreement.

Section 4.4 Capitalization. The authorized capital stock of the Purchaser consists of (i) 1,100,000,000 shares of Common Stock and (ii) 10,000,000 shares of Class A preferred stock, without par value (the “Preferred Stock”). As of the close of business on September 30, 2015, the Purchaser had issued a total of 589,695,081 shares of Common Stock and zero shares of Preferred Stock. Of the 589,695,081 issued shares of Common Stock, 438,761,847 shares were outstanding (which number includes 4,455,617 shares awarded to employees subject to restrictions on transfer and forfeiture until vesting) and 150,933,233 shares were held by the Purchaser in its treasury, and the Purchaser had reserved for issuance out of the shares held in its treasury (i) 3,877,313 shares upon exercise of outstanding stock options, (ii) 1,417,514 shares for

5

restricted stock units, (iii) 3,184,210 shares for performance share awards and (iv) 621,799 shares to be issued to directors. From the close of business on September 30, 2015 until December 31, 2015, the Purchaser has not issued and will not issue any shares of Common Stock that are not already outstanding except out of the shares held in its treasury, so that the total number of issued shares will remain the same until December 31, 2015.

Section 4.5 Legal Proceedings. As of the date hereof, there are no legal, governmental or regulatory Proceedings pending or, to the knowledge of the Purchaser, threatened against the Purchaser which, individually or in the aggregate, would materially and adversely affect the ability of the Purchaser to perform its obligations under this Agreement.

Section 4.6 No Broker’s Fees. As of the date hereof, the Purchaser is not a party to any Contract with any Person that would require the Seller to pay any investment banking fee or commission, finder’s fee or similar payment in connection with the Repurchase Transaction.

Section 4.7 No Other Representations or Warranties. Except for the representations and warranties made by the Purchaser in this Article IV, the Purchaser makes no representations or warranties to the Seller in connection with this Agreement.

Section 4.8 Acknowledgment. The Purchaser acknowledges that neither the Seller nor any Person on behalf of the Seller is making any representations, warranties or covenants whatsoever, express or implied, beyond those expressly made by the Seller in Article III and Article V and the Purchaser has not been induced by, or relied upon, any representations, warranties, covenants or statements (written or oral), whether express or implied, made by any Person, other than those that are expressly set forth in Article III and Article V.

ARTICLE V

COVENANTS AND INDEMNIFICATION

Section 5.1 Further Assurances. The parties agree to use reasonable best efforts to execute and deliver, or cause to be executed and delivered, further instruments or documents or take such other actions as may be reasonably necessary (or as reasonably requested by another party) to consummate the Repurchase Transaction.

Section 5.2 Filings and Announcements. The Purchaser will issue a press release, in the form attached hereto as Exhibit A, and will file a Current Report on Form 8-K with the U.S. Securities and Exchange Commission, to announce this Agreement and the purchase by the Purchaser of the Shares and will include a copy of this Agreement as an exhibit to such Form 8-K. The Seller will issue a press release, in the form attached hereto as Exhibit B, to announce this Agreement, and the Seller will, to the extent required by law, file a Form 4 and an appropriate amendment to its Schedule 13D regarding the sale of the Shares. Except as required by applicable law, none of the Parties shall issue a subsequent press release or public announcement or otherwise make any disclosure concerning this Agreement or the transactions contemplated hereby without consulting with the other Party and providing such other Party a reasonable opportunity to comment thereon. The Parties acknowledge and agree that, notwithstanding the foregoing, nothing in this Agreement shall limit the Parties’ or their affiliates’ ability to file this

6

Agreement as required by applicable law or disclose the terms and provisions of this Agreement and the transactions contemplated hereby in any reports that they file with regulators or in any teleconference or webcast hosted by or on behalf of the Parties or their respective affiliates to discuss financial results or related matters.

Section 5.3 Post-Closing Shares Treatment. After the Closing, the Purchaser shall not cancel the Shares by way of a capital reduction or otherwise, shall continue to hold the Shares in a separate account pending their sale or other transfer and shall use commercially reasonable efforts to sell or otherwise transfer the Shares to one or more Persons (other than one of the Parties) after the Closing Date until all the Shares have been so sold or otherwise transferred. Upon request by the Seller, Purchaser shall document and confirm such position to the Seller.

Section 5.4 Indemnification.

(a) Indemnification by the Purchaser. If the Purchaser breaches any of the covenants set forth in Section 5.3 and, solely as a result of such breach, the Seller is required to pay, and does in fact pay, Swiss federal corporate income taxes arising out of the Repurchase Transaction and/or out of the transfer of 37,050,000 shares of Common Stock of the Purchaser to BigPoint Holding AG, the private holding company of Mr. Haefner, which, for the avoidance of doubt, shall be reduced by any deduction, loss, credit or other tax attribute that may be utilized to reduce such corporate income taxes, then the Purchaser shall pay to the Seller an amount such that, taking into account reasonable expenses incurred by the Seller with respect to such breach and the Swiss federal corporate income taxes (including interest and penalties) imposed on the Seller as the result of the payment received from the Purchaser pursuant to this Section 5.4(a), the Seller is in the same after-tax position in which the Seller would have been in the absence of the Purchaser’s breach of such covenants; provided that the Seller shall, at the Purchaser’s request, contest any imposition of such Swiss federal corporate income taxes in good faith to the fullest extent permitted by applicable law and; provided, further, that the Purchaser shall not be obligated to make any payment under this Section 5.4(a) until a final tax bill or decision, which can no longer be legally contested, will have been rendered, confirming that Swiss federal corporate income taxes arising out of the Repurchase Transaction and/or out of the transfer of the 37,050,000 shares of Common Stock of the Purchaser to BigPoint Holding AG are due, except that, if Seller has made a good faith determination that Purchaser is likely to have an obligation to make a payment under this Section 5.4(a), Purchaser shall advance to the Seller the amount of any tax payment or deposit of tax reasonably required to contest any imposition of such Swiss federal corporate income taxes, provided that any refund of such tax payment or deposit of tax shall be for the account of the Purchaser. The Purchaser will in any event not be liable for any consequential, incidental or indirect damages suffered by the Seller as a result of the Purchaser’s breach of such covenants. The Seller shall promptly notify the Purchaser in writing upon receipt of notice of any tax audits, examinations or assessments that could give rise to a liability for which the Purchaser may be responsible under this Section 5.4(a). The Seller shall also (i) notify the Purchaser of significant developments with respect to such tax audit, examination or assessment, (ii) give to the Purchaser a copy of any tax adjustment proposed in writing with respect to such tax audit, examination or proceeding and copies of any other written correspondence with the relevant taxing authority related to such tax audit, examination or proceeding, (iii) not settle or compromise any issue without the consent of the Purchaser, which consent shall not be unreasonably withheld, conditioned or delayed, (iv) otherwise permit the

7

Purchaser to participate in all aspects of such tax audit, examination or proceeding (including, but not limited to, appeal proceeding) at the Purchaser’s own expense. A certificate delivered by the Seller to the Purchaser after such payment of Swiss federal corporate income taxes shall, absent manifest error, be conclusive as to the amount owed by the Purchaser to the Seller. The Purchaser shall make a payment in cash to the Seller in the amount presented in such certificate within ten (10) business days of the receipt of such certificate. The Parties agree that, from and after the Closing, the remedies provided for in this Section 5.4(a) shall constitute the sole and exclusive remedy for any and all loss or damage that the Seller may suffer or incur arising from, or directly or indirectly relating to, a breach by the Purchaser of such covenants.

(b) Indemnification by the Seller. If the United States Internal Revenue Service (“IRS”) asserts that the deduction or withholding of taxes was required by applicable law with respect to the payment of the Purchase Price made by the Purchaser to the Seller pursuant to this Agreement, the Seller shall pay to the Purchaser an amount such that, taking into account reasonable expenses incurred by the Purchaser with respect to any such assertion and all taxes (including interest and penalties) imposed on the Purchaser as the result of the payment received from the Seller pursuant to this Section 5.4(b), the Purchaser is in the same after-tax position in which the Purchaser would have been if the IRS had not asserted that any deduction or withholding of taxes was so required; provided that the Purchaser shall, at the Seller’s request, contest any such assertion in good faith to the fullest extent permitted by applicable law and; provided, further, that the Seller shall not be obligated to make any payment under this Section 5.4(b) until there has been a final “determination” within the meaning of Section 1313(a) of the United States Internal Revenue Code of 1986, as amended, as to the amount of tax, if any, that is due by reason of the failure to so deduct or withhold, except that, if Purchaser has made a good faith determination that Seller is likely to have an obligation to make a payment under this Section 5.4(b), the Seller shall advance to the Purchaser the amount of any tax payment or deposit of tax reasonably required to contest any such assertion, provided that any refund of such tax payment or deposit of tax shall be for the account of the Seller. The Seller will in any event not be liable for any consequential, incidental or indirect damages suffered by the Purchaser as a result of the IRS’s assertion that any deduction or withholding of taxes was required. The Purchaser shall promptly notify the Seller in writing upon receipt of notice of any tax audits, examinations or assessments that could give rise to a liability for which the Seller may be responsible under this Section 5.4(b). The Purchaser shall also (i) notify the Seller of significant developments with respect to such tax audit, examination or assessment, (ii) give to the Seller a copy of any tax adjustment proposed in writing with respect to such tax audit, examination or proceeding and copies of any other written correspondence with the relevant taxing authority related to such tax audit, examination or proceeding, (iii) not settle or compromise any issue without the consent of the Seller, which consent shall not be unreasonably withheld, conditioned or delayed, (iv) otherwise permit the Seller to participate in all aspects of such tax audit, examination or proceeding at the Seller’s own expense. A certificate delivered by the Purchaser to the Seller after a final determination shall, absent manifest error, be conclusive as to the amount owed by the Seller to the Purchaser. The Seller shall make a payment in cash to the Purchaser in the amount presented in such certificate within ten (10) business days of the receipt of such certificate. The Parties agree that, from and after the Closing, the remedies provided for in this Section 5.4(b) shall constitute the sole and exclusive remedy for any and all loss or damage that the Purchaser may suffer or incur arising from, or directly or indirectly relating to, the IRS’s assertion that any deduction or withholding of taxes was required by applicable law

8

with respect to the payment of the Purchase Price made by the Purchaser to the Seller pursuant to this Agreement.

Section 5.5 Survival. Section 5.3, Section 5.4 and this Section 5.5 shall survive the Closing.

Section 5.6 Tax Treatment. The Parties agree to treat any indemnity payment under Section 5.4 as an adjustment to the Purchase Price, which interpretation shall be followed for United States federal income tax and Swiss tax purposes to the fullest extent permitted by applicable law.

ARTICLE VI

CONDITIONS TO CLOSING

Section 6.1 Conditions to Each Party’s Obligations to Consummate the Repurchase Transaction. The respective obligation of each party hereto to consummate the Repurchase Transaction is subject to the satisfaction or waiver of the following condition:

(a) No Injunction. No judgment, injunction, decree or other legal restraint (each, an “Order”) prohibiting the consummation of the Repurchase Transaction shall have been issued by any governmental entity and be continuing in effect, there shall be no pending Proceeding commenced by a governmental entity seeking an Order that would prohibit the Repurchase Transaction, and the consummation of the Repurchase Transaction shall not have been prohibited or rendered illegal under any applicable law.

Section 6.2 Conditions to the Seller’s Obligation to Consummate the Repurchase Transaction. The obligations of the Seller to consummate the Repurchase Transaction are subject to the satisfaction or waiver of each of the following conditions:

(a) Representations and Warranties. The representations and warranties of the Purchaser set forth in Article IV shall be true and correct in all material respects as of the Closing Date as if made on and as of the Closing Date (except to the extent that any such representation and warranty expressly speaks as of an earlier date, in which case such representation and warranty shall be true and correct in all material respects as of such earlier date).

(b) Covenants. Each of the covenants and agreements of the Purchaser contained in this Agreement that are to be performed at or prior to the Closing shall have been duly performed in all material respects.

Section 6.3 Conditions to the Purchaser’s Obligation to Consummate the Repurchase Transaction. The obligation of the Purchaser to consummate the Repurchase Transaction is subject to the satisfaction or waiver of each of the following conditions:

(a) Representations and Warranties. The representations and warranties of the Seller set forth in Article III shall be true and correct in all material respects as of the Closing Date as if made on and as of the Closing Date (except to the extent that any such representation

9

and warranty expressly speaks as of an earlier date, in which case such representation and warranty shall be true and correct in all material respects as of such earlier date).

(b) Covenants. Each of the covenants and agreements of the Seller contained in this Agreement that are to be performed at or prior to the Closing shall have been duly performed in all material respects.

ARTICLE VII

MISCELLANEOUS PROVISIONS

Section 7.1 Termination. Any Party may terminate this Agreement in its entirety and be of no further force or effect with the exception of the provisions set forth in this Article VII if the Closing has not occurred on or before December 31, 2015.

Section 7.2 Notice. All notices, requests, certificates and other communications to any party hereunder shall be in writing and given to each other party hereto and shall be deemed given or made (i) as of the date delivered, if delivered personally, (ii) on the date the delivering party receives confirmation, if delivered by facsimile or electronic mail, (iii) three business days after being mailed by registered or certified mail (postage prepaid, return receipt requested) or (iv) one business day after being sent by overnight courier (providing proof of delivery), to the parties at the following addresses (or at such other address for a party as shall be specified in a notice given in accordance with this Section 7.2).

If delivered to the Purchaser, to:

CA, Inc.

520 Madison Avenue

New York, NY 10022

Attention: Michael C. Bisignano

Executive Vice President, General Counsel and Corporate Secretary

Facsimile: +1 631 342 4866

E-mail: Michael.Bisignano@ca.com

with a copy to:

Sullivan & Cromwell LLP

125 Broad Street

New York, NY 10004

Attention: Keith A. Pagnani

Facsimile No.: +1 212 291 9110

E-mail: pagnanik@sullcrom.com

10

if to the Seller, to:

Careal Holding AG

Utoquai 49

8008 Zürich

Attention: Roger Rotach

Facsimile: +41 44 269 53 63

E-mail: roger.rotach@amag.ch

with a copy to:

Homburger AG

Primetower

Hardstrasse 201

8005 Zürich

Attention: Claude Lambert

Facsimile No.:+41 43 222 15 00

E-mail: claude.lambert@homburger.ch

Section 7.3 Entire Agreement. This Agreement (including the exhibits hereto and the documents and instruments referred to in this Agreement) shall constitute the entire agreement between the parties with respect to the subject matter hereof and shall supersede all prior agreements and understandings, both written and oral, between the parties with respect to the subject matter of this Agreement.

Section 7.4 Assignment; Binding Agreement. Neither this Agreement nor any of the rights, interests or obligations hereunder shall be assigned, in whole or in part, by any of the Parties without the prior written consent of the other party. Subject to preceding sentence, this Agreement shall be binding upon, inure to the benefit of, and be enforceable by, the parties hereto and their respective successors and permitted assigns. Any purported assignment not permitted under this Section 7.4 shall be null and void.

Section 7.5 Counterparts. This Agreement may be executed and delivered (including by facsimile or electronic mail transmission) in one or more counterparts, and by the different parties in separate counterparts, each of which when executed and delivered shall be deemed to be an original but all of which taken together shall constitute one and the same agreement. Copies of executed counterparts transmitted by telecopy, telefax or electronic transmission shall be considered original executed counterparts for purposes of this Section 7.5.

Section 7.6 Specific Performance. Each party acknowledges, stipulates and agrees that (i) irreparable injury will result to the other parties in the event that any party breaches its covenants or agreements contained in this Agreement, and (ii) in the event of any such breach or threatened breach of any of the provisions set forth in this Agreement, the other parties hereto shall be entitled, in addition to any other remedies available to it (including, without limitation, damages), to preliminary injunction, permanent injunction or other injunctive relief, without posting any bond or other security, compelling such party to comply with any and all such provisions. Nothing herein contained shall be construed as an election of remedies or as a waiver

11

or limitation of any right available to any party under this Agreement or the law, including the right to seek damages from any party for its breach of any provision of this Agreement.

Section 7.7 Forum Selection, Consent to Jurisdiction and Governing Law. THIS AGREEMENT AND ANY MATTERS RELATED TO THE TRANSACTIONS CONTEMPLATED HEREBY SHALL IN ALL RESPECTS BE CONSTRUED IN ACCORDANCE WITH AND GOVERNED BY THE SUBSTANTIVE LAWS OF THE STATE OF NEW YORK, WITHOUT GIVING EFFECT TO PRINCIPLES OF CONFLICTS OF LAWS. The Purchaser and the Seller agrees that any Proceeding arising in respect of this Agreement will be tried exclusively in the U.S. District Court for the Southern District of New York or, if that court does not have subject matter jurisdiction, in any state court located in The City and County of New York and the Purchaser and the Seller agrees to submit to the jurisdiction of, and to venue in, such courts. EACH PARTY HERETO WAIVES, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY RIGHT IT MAY HAVE TO A TRIAL BY JURY IN RESPECT OF ANY ACTION, SUIT OR PROCEEDING ARISING OUT OF OR RELATING TO THIS AGREEMENT OR THE TRANSACTIONS CONTEMPLATED HEREBY.

Section 7.8 No Third-Party Beneficiaries or Other Rights. This Agreement is for the sole benefit of the parties and their successors and permitted assigns and nothing herein express or implied shall give or shall be construed to confer any legal or equitable rights or remedies to any Person other than the parties to this Agreement and such successors and permitted assigns.

Section 7.9 Amendments; Waivers. This Agreement and its terms may not be changed, amended, waived, terminated, augmented, rescinded or discharged (other than in accordance with its terms), in whole or in part, except by a writing executed by the parties hereto.

Section 7.10 Severability. In the event any one or more of the provisions contained in this Agreement should be held invalid, illegal or unenforceable in any respect, the validity, legality and enforceability of the remaining provisions contained herein and therein shall not in any way be affected or impaired thereby. The parties shall endeavor in good faith negotiations to replace the invalid, illegal or unenforceable provisions with valid provisions, the economic effect of which comes as close as possible to that of the invalid, illegal or unenforceable provisions.

Section 7.11 Expenses and Transfer Duties. Each of the Purchaser, on the one hand, and the Seller, on the other hand, shall bear their own expenses in connection with the drafting, negotiation, execution and delivery of this Agreement and the consummation of the transactions contemplated hereby. Swiss duties, if any, applicable on the transfer of the Shares (such as the Swiss federal transfer stamp tax) shall be exclusively borne by the Seller.

12

IN WITNESS WHEREOF, each of the parties hereto has caused this Agreement to be executed as of the date first above written.

THE PURCHASER:

CA, Inc.

|

By: |

/s/ Michael Bisignano |

|

|

|

|

|

Name: Michael Bisignano |

|

|

Title: General Counsel & Executive Vice President |

|

THE SELLER:

Careal Holding AG

|

By: |

/s/ Martin Haefner |

|

|

|

|

|

Name: Martin Haefner |

|

|

Title: Director |

|

|

By: |

/s/ Peter Widmer |

|

|

|

|

|

Name: Peter Widmer |

|

|

Title: Director |

|

Exhibit A

[Purchaser press release]

CA Technologies Increases Dividend, Accelerates Stock Repurchase Program, and Announces Additional $750M Stock Repurchase Authorization

· Increases Dividend to $1.02 per share in FY17

· Accelerates Stock Repurchase Program

· Announces Additional $750M Stock Repurchase Authorization

· Increases FY16 EPS by Approximately $0.03 GAAP and $0.04 non-GAAP

NEW YORK, November 18, 2015 — CA Technologies (NASDAQ: CA) announced today that it intends to increase the dividend per share in Fiscal Year 2017, subject to quarterly board approval, to $1.02 per share for the year, or $0.255 per share on a quarterly basis. This is up from the current $1.00 per share annual dividend, or $0.25 per share on a quarterly basis.

The company has accelerated its Common Stock Repurchase Program, having agreed to repurchase 22 million shares of its Common Stock from Careal Holding AG, its largest shareholder, in a private transaction valued at $590 million (with an effective share repurchase price of $26.81 per share).

The per share purchase price represents a 3% discount to the 10-trading day volume weighted average price for CA stock using a reference date of November 5, 2015. The closing price of CA stock on November 17, 2015 was $26.90. The transaction, which is expected to close in the third quarter of Fiscal Year 2016, will be funded from US cash on hand.

Careal Holding AG has disclosed that Martin Haefner, one of Careal’s co-principals, will obtain approximately 37 million shares of CA common stock from Careal to add to his personal investment holdings.

This deal effectively concludes CA’s prior $1 billion stock repurchase program, through which CA had repurchased approximately 11 million shares as of September 30, 2015. As a result, as part of the company’s capital allocation strategy, CA’s board of directors has authorized a new $750 million share repurchase program.

The impact of the accelerated share repurchase is expected to benefit GAAP EPS by $0.03 and non-GAAP EPS by $0.04 in FY16.

“Our capital allocation strategy, which includes a new $750 million share buy-back authorization as well as an increasing dividend, reflects our improved confidence in our business as we look to the coming years,” said Rich Beckert, CFO, CA Technologies. “The transaction with Careal provided us with the opportunity to accelerate our share repurchase program at favorable prices, and highlights our long-term strategy of returning capital to shareholders.”

Careal used CA’s share buyback program as an opportunity to rebalance Careal’s assets as part of an overall reallocation. Careal issued a statement today that “Careal Holding AG and its shareholders remain the principal shareholders of CA Technologies… they believe that CA Technologies will continue to grow and intend to keep hold of their investments for the long term.”

About CA Technologies

CA Technologies (NASDAQ: CA) creates software that fuels transformation for companies and enables them to seize the opportunities of the application economy. Software is at the heart of every business in every industry. From planning, to development, to management and security, CA is working with companies worldwide to change the way we live, transact, and communicate - across mobile, private and public cloud, distributed and mainframe environments. Learn more at www.ca.com.

Follow CA Technologies

· Twitter

· Social Media Page

· Press Releases

· Blogs

Non-GAAP Financial Measures

This news release includes certain financial measures that exclude the impact of certain items and therefore have not been calculated in accordance with U.S. generally accepted accounting principles (GAAP). Non-GAAP metrics for diluted earnings per share exclude the following items: share-based compensation expense; non-cash amortization of purchased software and other intangible assets; charges relating to rebalancing initiatives that are large enough to require approval from the Company’s Board of Directors, and certain other gains and losses. The Company began expensing costs for internally developed software where development efforts commenced in the first quarter of fiscal 2014. Due to this change, the Company also adds back capitalized internal software costs and excludes amortization of internally developed software costs previously capitalized from these non-GAAP metrics. These non-GAAP financial measures may be different from non-GAAP financial measures used by other companies. Non-GAAP financial measures should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. By excluding these items, non-GAAP financial measures facilitate management’s internal comparisons to the Company’s historical operating results and cash flows, to competitors’ operating results and cash flows, and to estimates made by securities analysts. Management uses these non-GAAP financial measures internally to evaluate its performance and they are key variables in determining management incentive compensation. The Company believes these non-GAAP financial measures are useful to investors in allowing for greater transparency of supplemental information used by management in its financial and operational decision-making. In addition, the Company has historically reported similar non-GAAP financial measures to its investors and believes that the inclusion of comparative numbers provides consistency in its financial reporting.

Cautionary Statement Regarding Forward-Looking Statements

The declaration and payment of future dividends is subject to the determination of the Company’s Board of Directors, in its sole discretion, after considering various factors, including the Company’s financial condition, historical and forecast operating results, and available cash flow, as well as any applicable laws and contractual covenants and any other relevant factors. The Company’s practice regarding payment of dividends may be modified at any time and from time to time.

Repurchases under the Company’s stock repurchase program may be made from time to time, subject to market conditions and other factors, in the open market, through solicited or unsolicited privately negotiated transactions or otherwise. The program does not obligate the Company to acquire any particular amount of common stock, and it may be modified or suspended at any time at the Company’s discretion. Certain statements in this communication

(such as statements containing the words “believes,” “plans,” “anticipates,” “expects,” “estimates,” “targets” and similar expressions relating to the future) constitute “forward-looking statements” that are based upon the beliefs of, and assumptions made by, the Company’s management, as well as information currently available to management. These forward-looking statements reflect the Company’s current views with respect to future events and are subject to certain risks, uncertainties, and assumptions. A number of important factors could cause actual results or events to differ materially from those indicated by such forward-looking statements, including: the ability to achieve success in the Company’s strategy by, among other things, enabling the Company’s sales force to accelerate growth of new product sales (at levels sufficient to offset any decline in revenue in the Company’s Mainframe Solutions segment), improving the Company’s brand, technology and innovation awareness in the marketplace, ensuring the Company’s offerings for cloud computing, application development and IT operations (DevOps), Software-as-a-Service (SaaS), and mobile device management, as well as other new offerings, address the needs of a rapidly changing market, while not adversely affecting the demand for the Company’s traditional products or its profitability to an extent greater than anticipated, and effectively managing the strategic shift in the Company’s business model to develop more easily installed software, provide additional SaaS offerings and refocus the Company’s professional services and education engagements on those engagements that are connected to new product sales, without affecting the Company’s performance to an extent greater than anticipated; the failure to innovate or adapt to technological changes and introduce new software products and services in a timely manner; competition in product and service offerings and pricing; the ability of the Company’s products to remain compatible with ever-changing operating environments, platforms or third party products; global economic factors or political events beyond the Company’s control and other business and legal risks associated with non-U.S. operations; the failure to expand partner programs; the ability to retain and attract qualified professionals; general economic conditions and credit constraints, or unfavorable economic conditions in a particular region, industry or business sector; the ability to successfully integrate acquired companies and products into the Company’s existing business; risks associated with sales to government customers; breaches of the Company’s data center, network, as well as the Company’s software products, and the IT environments of the Company’s vendors and customers; the ability to adequately manage, evolve and protect the Company’s information systems, infrastructure and processes; fluctuations in foreign exchange rates; discovery of errors or omissions in the Company’s software products or documentation and potential product liability claims; the failure to protect the Company’s intellectual property rights and source code; the failure to renew large license transactions on a satisfactory basis; access to software licensed from third parties; risks associated with the use of software from open source code sources; third-party claims of intellectual property infringement or royalty payments; fluctuations in the number, terms and duration of the Company’s license agreements, as well as the timing of orders from customers and channel partners; events or circumstances that would require the Company to record an impairment charge relating to the Company’s goodwill or capitalized software and other intangible assets balances; potential tax liabilities; changes in market conditions or the Company’s credit ratings; the failure to effectively execute the Company’s workforce reductions, workforce rebalancing and facilities consolidations; successful and secure outsourcing of various functions to third parties; changes in generally accepted accounting principles; and other factors described more fully in the Company’s filings with the Securities and Exchange Commission. Should one or more of these risks or uncertainties occur, or should the Company’s assumptions prove incorrect, actual results may vary materially from those described herein as believed, planned, anticipated, expected, estimated, targeted or similarly expressed in a forward-looking manner. The Company assumes no obligation to update the information in this communication, except as otherwise required by law. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof.

Copyright © 2015 CA, Inc. All Rights Reserved. All other trademarks, trade names, service marks, and logos referenced herein belong to their respective companies.

Contacts:

Saswato Das

Corporate Communications

(646) 710 6690 – US ET

Saswato.Das@ca.com

Traci Tsuchiguchi

Investor Relations

(650) 534 9814 – US PT

Traci.Tsuchiguchi@ca.com

Exhibit B

[Seller press release]

Medienmitteilung

Careal Holding AG passt im Rahmen ihrer Portfolio-Strategie ihre Beteiligung an der CA Technologies an

Z ü r i c h, 18. November 2015 — Die Careal Holding AG, Zürich, eine Familienholding im Besitz von Martin Haefner und Eva Maria Bucher-Haefner, hat in Umsetzung ihrer Portfolio-Strategie und im Rahmen eines Aktienrückkaufprogramms der CA Technologies, New York, 22 Millionen Aktien der CA Technologies im Gesamtwert von rund USD 590 Mio. verkauft. Gleichzeitig wird die Careal Holding AG 37 Millionen Aktien der CA Technologies an die Privatholding von Martin Haefner übertragen. Die Careal Holding AG und ihre Aktionäre bleiben mit rund 24% der ausstehenden Aktien Hauptaktionäre der CA Technologies, einer der weltweit grössten unabhängigen Software-Unternehmungen. Sie sind überzeugt vom weiteren Wachstum der CA Technologies und beabsichtigen, ihre Beteiligungen langfristig zu halten.

Kontakt

Im Auftrag der Careal Holding AG:

Hirzel.Neef.Schmid.Konsulenten

Sarah Antenore

Telefon +41 344 42 55

sarah.antenore@konsulenten.ch

Über Careal Holding AG

Die 1941 gegründete Careal Holding AG befindet sich vollständig im Besitz der Familien Martin Haefner und Eva Maria Bucher-Haefner, der Nachkommen des Firmengründers Walter Haefner. Das Unternehmen ist Eigentümerin der AMAG Automobil- und Motoren AG, des bedeutendsten Unternehmens der schweizerischen Automobilwirtschaft, und hält massgebliche Beteiligungen an weiteren schweizerischen und internationalen Industrie- und Immobilienunternehmungen.

Press release

Careal Holding AG adjusts stake in CA Technologies as part of its portfolio strategy

Z u r i c h, November 18, 2015 — Careal Holding AG, Zurich, a family holding company owned by Martin Haefner and Eva Maria Bucher-Haefner, has sold 22 million shares in CA Technologies, New York, worth around USD 590 million, as part of its portfolio strategy and in response to a stock repurchase program by CA Technologies. At the same time, Careal Holding AG will transfer 37 million shares in CA Technologies to Martin Haefner’s private holding company. Careal Holding AG and its shareholders remain the principal shareholders in CA Technologies, one of the world’s largest independent software companies, with a stake of around 24% of outstanding shares. They believe that CA Technologies will continue to grow and intend to keep hold of their investments for the long term.

Contact

On behalf of Careal Holding AG:

Hirzel.Neef.Schmid.Counselors

Sarah Antenore.

Phone +41 344 42 55

sarah.antenore@konsulenten.ch

About Careal Holding AG

Careal Holding AG, founded in 1941, is wholly owned by the families of Martin Haefner and Eva Maria Bucher-Haefner, the descendants of the company’s founder Walter Haefner. The company owns Amag Automobil- und Motoren AG, the leading firm in the Swiss automotive industry, and holds significant shareholdings in other Swiss and international industrial and real estate companies.

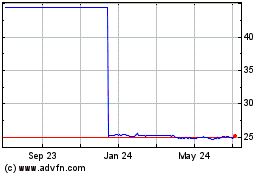

Xtrackers California Mun... (NASDAQ:CA)

Historical Stock Chart

From Mar 2024 to Apr 2024

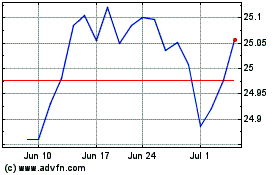

Xtrackers California Mun... (NASDAQ:CA)

Historical Stock Chart

From Apr 2023 to Apr 2024